Académique Documents

Professionnel Documents

Culture Documents

Berkshares Accounting

Transféré par

Carl MullanCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Berkshares Accounting

Transféré par

Carl MullanDroits d'auteur :

Formats disponibles

Accounting Procedures for BerkShares

Summary of Discussion November 21, 2006 (Updated on February 6, 2009) Berkshire South Community Center with Alan Glackman, C.P.A., P.C. Robin Markey from Smith Watson & Company LLP Asa Hardcastle of Zenn New Media, President of BerkShares, welcomed the group and thanked the businesses represented reminding them that they are the heart of BerkShares. Their willingness to change billing and accounting practices to handle a new currency, created a way for the community to reimagine itself and its economy. He went on to say that the then 10% discount program was only the first stage of trade in BerkShares. In February of 2009, BerkShares, Inc. lowered the 10 percent to 5 percent. This strategic change to the exchange rate between BerkShares and federal dollars was designed to enable broader participation of the business community and to increase circulation throughout the region. In future years businesses, bankers, and citizens working in collaboration may recommend eliminating the 10% discount altogether, while still retaining the basic commitment behind the issuance of the currency which is to support local businesses. In the future the program may develop to making productive loans in BerkShares at zero percent interest to new local business initiatives. The purpose of the loans would be to build capacity to produce locally what is now being imported from outside the region. Other considerations may include a BerkShares debit card for additional convenience. As of November 21, 2006, over 250,000 BerkShares had been issued by the participating banks. of 135,000 BerkShares were in circulation at that date. A net

Asa then introduced Alan Glackman and Robin Markey who referenced the basic system for accounting with BerkShares as described on the BerkShare web site. They then took questions. Following is a summary of accounting recommendations based on the discussion.

Accounting Procedures for BerkShares Table of Contents * * * * * * * Setting up your accounting system for BerkShares Receiving payment in BerkShares Paying invoices in BerkShares Depositing BerkShares Exchanging Federal Dollars for BerkShares Supporting Non-profits with purchase of BerkShares Non-profits receiving charitable donations in BerkShares

Setting up your accounting system for BerkShares * Set up a separate current asset "BerkShares cash account" (like a petty cash account) in your Quickbooks program or other accounting programs. * Set up an expense line titled "BerkShares discount."

* BerkShares are cash, so it is also important to establish a secure place for BerkShares-on-hand. * Prepare a "Paid in BerkShares" envelope for receipts, much as you have for petty cash.

Receiving payment in BerkShares * Remember that BerkShares are cash and customers will want a receipt on payment. * Record the payment as a debit to the "BerkShares cash account" at the full amount received in BerkShares. * We recommend calculating and collecting sales tax at the full dollar amount of sale. Sales tax can be collected in BerkShares or in federal dollars. * Credit the appropriate inventory line for the full amount of the sale as you would when recording payments with checks. * The total number of "BerkShares-on-hand" in a secure place should always equal the total amount in the "BerkShares cash account." Paying invoices in BerkShares * BerkShares are cash. Payments should be made in person. Remember to have a copy of the invoice so that you can have the vendor verify payment and date. This signed receipt will go in your "Paid in BerkShares" envelope for backup purposes. * Credit the "BerkShares cash account" for the full amount of the payment.

* Debit the appropriate expense line with the same amount as you would with purchases made with checks. This practice ensures all normal inventory controls are in place. Depositing BerkShares * If you find that you have more BerkShares than can be spent with vendors, given in change to customers, or paid to employees as a percent of salaries, then BerkShares may be taken to one of the five BerkShare Exchange Banks and deposited at ninety cents on the BerkShare. * If you do not currently bank at one of the BerkShare Exchange Banks, you will need to open an account. Each of the banks is offering a no-cost checking account for new BerkShares businesses. * Prepare a separate deposit slip for your BerkShares deposit.

* The bank will then deposit federal dollars in your account at ninety cents per BerkShare or give you the funds in cash. * For your accounting purposes, if the amount of BerkShares is 100, credit the "BerkShares cash account with 100"; debit your business checking account for $95, and debit the "BerkShares discount" expense line for $5. * The "BerkShares discount" is shown as a business expense (much like a credit card fee or stock broker's fee) and the total taken from profit at the end of the year in determining your federal and state income taxes. * It is, of course, the intent of the program, that more business transactions will take place as a result of BerkShares promotion of local businesses, to make up for the discount. Exchanging Federal Dollars for BerkShares * For businesses and organizations using more BerkShares for payment of expenses than taken in as revenue, the process is the reverse of depositing BerkShares. * * Write a check to BerkShares for a multiple of $9.50, say $950 federal dollars. Take the check to one of the five BerkShare Exchange Banks. Credit your checking account for $950 to record the

* You will receive 1,000 BerkShares.* check. * *

Credit the "BerkShares discount" expense line with $50 (this is new value to your business). Debit your "BerkShares cash account" with $1,000.

* Place the 1,000 BerkShares in the secure place you have already established, waiting to pay bills! * The total number of "BerkShares-on-hand" should always equal the total amount in the "BerkShares cash account." Supporting Non-profits with purchase of BerkShares

* Several non-profits hold BerkShares acquired at the 5% discount rate from a BerkShares Exchange Bank. * Supporters of the non-profit can then purchase BerkShares one-to-one for federal dollars and the non-profit retains the 5% difference for its charitable purposes. * * * * Write a check to the non-profit for the number of BerkShares you wish to acquire. Note, this is not a charitable donation as you are receiving value in BerkShares. Arrange to take the check to the non-profit and pick up your BerkShares. Credit your checking account for the amount of the check.

* Debit your "BerkShares cash account" for the same amount which should equal BerkShares received. * Place the BerkShares in the secure place you already established, waiting to pay bills!

* The total number of "BerkShares-on-hand" should always equal the total amount in the "BerkShares cash account." Non-profits receiving charitable donations in BerkShares After discussion it was decided that since the legal exchange rate for 100 BerkShares is $95, that the charitable donation must be acknowledged at this rate. * Remember that BerkShares are cash and donors will want a receipt on payment. * Since the legal exchange rate for 100 BerkShares is $95, the charitable donation must be acknowledged at the discounted rate. * Record the payment as a debit to the "BerkShares cash account" at the full amount received in BerkShares--say 1,000 BerkShares. * Credit the appropriate donation line at .95 of the total donation--$950 using the above example. * * Credit the "BerkShares discount" expense line with $50. Place BerkShares in a secure place.

* The total number of "BerkShares-on-hand" in a secure place should always equal the total amount in the "BerkShares cash account." * There are two ways to prepare a formal thank you letter for the donation which meets IRS requirements for the donor to receive tax credit: a. Acknowledge the donation of 1,000 BerkShares. It is then the responsibility of the donor to declare the cash value, much like a stock donation. b. Acknowledge the donation of 1,000 BerkShares and then go on to say that because the

exchange rate between federal dollars and BerkShares is 9.5 to 10, the tax value of their donation is $950. Other Recommendations * * * * Issue a specific amount of BerkShares each day to each cashier. Keep BerkShares together in cash drawer in slot furthest to left. Handle sales just like cash transactions. If payment is made in BerkShares, give change in BerkShares.

* Encourage change from federal dollars transactions in BerkShares (many customers do not have time to go to the banks and like to trade in BerkShares even without the 5% discount). * Keep sufficient amount of BerkShares on hand to pay bills.

* Reference the published list of businesses accepting BerkShares to be creative about where to recirculate them. * Ask if a business will accept full or partial payment in BerkShares, even if not listed in the BerkShares directory. * Do not hesitate to place restrictions on acceptance if you need to in the short run until a wider variety of businesses are participating. * * * Pay bonuses in BerkShares. Support branding of BerkShares by adding "BerkShares Accepted" in your advertising Partially pay salary to willing employees.

* If the ten percent discount is higher than your business margin can accommodate, limit payment in BerkShares to 50% of sales price thus creating a two-and-a-half percent discount. If you have any questions about these recommendations, do not hesitate to call the BerkShares office at 528-1737, or email staff at berkshares@berkshares.org.

Vous aimerez peut-être aussi

- Case 5:09-cr-00027-RLV - DCK Document 103-2 Filed 11/17/10 Page 1 of 1Document1 pageCase 5:09-cr-00027-RLV - DCK Document 103-2 Filed 11/17/10 Page 1 of 1Carl MullanPas encore d'évaluation

- Motion in Limine To Exclude Irrelevant EvidenceDocument8 pagesMotion in Limine To Exclude Irrelevant EvidenceCarl MullanPas encore d'évaluation

- Case 5:09-cr-00027-RLV - DCK Document 158-2 Filed 03/02/11 Page 1 of 1Document1 pageCase 5:09-cr-00027-RLV - DCK Document 158-2 Filed 03/02/11 Page 1 of 1Carl MullanPas encore d'évaluation

- IndictmentDocument13 pagesIndictmentCarl MullanPas encore d'évaluation

- Motion To Compel Production of Evidence Seized at TrialDocument4 pagesMotion To Compel Production of Evidence Seized at TrialCarl MullanPas encore d'évaluation

- Fincen 2011 0003 0016Document5 pagesFincen 2011 0003 0016Carl MullanPas encore d'évaluation

- Money Laundering and Funding Terror Using Bitcoin Convertible Virtual Currency and Other Digital Currency ProductsDocument40 pagesMoney Laundering and Funding Terror Using Bitcoin Convertible Virtual Currency and Other Digital Currency ProductsCarl MullanPas encore d'évaluation

- UNITED STATES OF AMERICA, Plaintiff, vs. ROGER VER Defendant.Document21 pagesUNITED STATES OF AMERICA, Plaintiff, vs. ROGER VER Defendant.Carl MullanPas encore d'évaluation

- Crypto Retailer Magazine July 2014Document75 pagesCrypto Retailer Magazine July 2014Carl MullanPas encore d'évaluation

- Local Currencies CatalystsDocument10 pagesLocal Currencies CatalystsCarl MullanPas encore d'évaluation

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5795)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1091)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Role of e - Banking in Current ScenarioDocument5 pagesRole of e - Banking in Current ScenarioInternational Jpurnal Of Technical Research And ApplicationsPas encore d'évaluation

- PayflowGateway GuideDocument238 pagesPayflowGateway Guiderobert2370Pas encore d'évaluation

- Pivotal Payments: Total Funded ToDocument5 pagesPivotal Payments: Total Funded ToSadie BuilterPas encore d'évaluation

- Guidelines On Mobile Money Services in NigeriaDocument24 pagesGuidelines On Mobile Money Services in Nigerialine MANPas encore d'évaluation

- 14 Tybaf ProjectDocument65 pages14 Tybaf ProjectNehaPas encore d'évaluation

- Aid ListDocument8 pagesAid ListseraphinetruthPas encore d'évaluation

- Longmont Recreation Fall 2022 BrochureDocument44 pagesLongmont Recreation Fall 2022 BrochureCity of Longmont, ColoradoPas encore d'évaluation

- Landbank Iaccess Frequently Asked Questions A. Introduction 1. What Is Landbank Iaccess?Document13 pagesLandbank Iaccess Frequently Asked Questions A. Introduction 1. What Is Landbank Iaccess?allanjulesPas encore d'évaluation

- French German Spanish 2019 20Document59 pagesFrench German Spanish 2019 20cliffordjose2001Pas encore d'évaluation

- LoyaltyDocument88 pagesLoyaltymanasisohani100% (2)

- Ms Shreya Jain eMBA Student PDFDocument9 pagesMs Shreya Jain eMBA Student PDFnikki karmaPas encore d'évaluation

- Nl55ingb0537136142 - 20 06 2023 - 20 09 2023Document37 pagesNl55ingb0537136142 - 20 06 2023 - 20 09 2023ObsaharawwePas encore d'évaluation

- POS Hardware Software WhitepaperDocument11 pagesPOS Hardware Software WhitepaperIndarko WiyogoPas encore d'évaluation

- State Park RegsDocument24 pagesState Park RegsZARIEK ZENNESHIKPas encore d'évaluation

- Booking Confirmation On IRCTC, Train: 02233, 28-Sep-2021, 2A, GCT - ANVTDocument1 pageBooking Confirmation On IRCTC, Train: 02233, 28-Sep-2021, 2A, GCT - ANVTAbhimanyu SinghPas encore d'évaluation

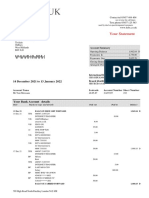

- 2022 01 13 - StatementDocument8 pages2022 01 13 - StatementToni MirosanuPas encore d'évaluation

- Axis Bank and Canara Bank ProductsDocument12 pagesAxis Bank and Canara Bank ProductsManveePas encore d'évaluation

- RAKBANK Credit Cards Terms & ConditionsDocument52 pagesRAKBANK Credit Cards Terms & ConditionsRome AdolPas encore d'évaluation

- Key Facts StatementDocument3 pagesKey Facts Statementshirine.mrouehPas encore d'évaluation

- Ent555 Digital Entrepreneurship - Case StudyDocument14 pagesEnt555 Digital Entrepreneurship - Case StudyMohd Rozi AmbranPas encore d'évaluation

- 232 Rudrapriya DiwanDocument59 pages232 Rudrapriya DiwanKashish GamrePas encore d'évaluation

- Report On Faisal MoversDocument22 pagesReport On Faisal Moversmartain maxPas encore d'évaluation

- EZYPAY PLUS - Terms & ConditionsDocument14 pagesEZYPAY PLUS - Terms & ConditionsRanmishah AmizahPas encore d'évaluation

- AllState Roadside Assistance Membership Guide FULLDocument21 pagesAllState Roadside Assistance Membership Guide FULLgod_forbidsPas encore d'évaluation

- Brand Track Report - Online Shopping July-Sept 2007Document96 pagesBrand Track Report - Online Shopping July-Sept 2007JuxtConsult Pvt. Ltd.100% (2)

- Project On HDFC BankDocument72 pagesProject On HDFC Banksunit2658Pas encore d'évaluation

- HDFC Bank Statement Apr'21 - June'21Document208 pagesHDFC Bank Statement Apr'21 - June'21Malhar LakdawalaPas encore d'évaluation

- A Starter's Guide To Customer Support On Renderforest PDFDocument27 pagesA Starter's Guide To Customer Support On Renderforest PDFLivingWorldSPas encore d'évaluation

- Unconditional Loa PDFDocument2 pagesUnconditional Loa PDFPratik PatelPas encore d'évaluation

- PhonePe Statement Feb2024 Mar2024Document7 pagesPhonePe Statement Feb2024 Mar2024jtularam15Pas encore d'évaluation