Académique Documents

Professionnel Documents

Culture Documents

Glob Cross

Transféré par

minhthuc203Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Glob Cross

Transféré par

minhthuc203Droits d'auteur :

Formats disponibles

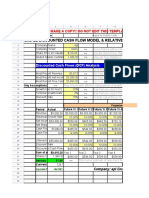

Year

1

2

3

4

5

6

7

8

9

10

FCFF

Terminal Value

Present Value

($3,526.30)

($3,098.58)

($1,761.25)

($1,359.90)

($902.69)

($612.45)

($471.71)

($281.22)

$21.87

$11.46

$391.84

$181.79

$832.27

$344.93

$948.67

$354.60

$1,407.33

$479.42

$1,461.44 $28,683.17

$9,509.89

$5,529.92

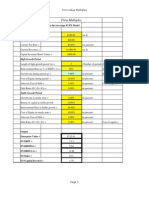

Valuing Options or Warrants when there is dilution

Enter the current stock price =

$1.86

Enter the strike price on the option =

13.375

Enter the expiration of the option =

8.4

Enter the standard deviation in stock prices =

50.00% (volatility)

Enter the annualized dividend yield on stock =

0.00%

Enter the treasury bond rate =

6.50%

Enter the number of warrants (options) outstanding =

38

Enter the number of shares outstanding =

886.47

VALUING WARRANTS WHEN THERE IS DILUTION

Stock Price=

1.86 # Warrants issued=

Strike Price=

13.375 # Shares outstanding=

Adjusted S (DO NOT ENTER)= 1.79902474 T.Bond rate=

Adjusted K (DO NOT ENTER)=

13.375 Variance=

Expiration (in years) =

8.4 Annualized dividend yield=

Div. Adj. interest rate=

d1 =

N (d1) =

-0.283025273

0.388578732

d2 =

N (d2) =

-1.732162947

0.041622277

Value of the call =

Number of Options =

Value of Options =

$0.38

38

$14.31

38

886

6.50%

0.2500

0.00%

6.50%

YearRevenues EBITDA Depreciation

1 #####

-$95

$1,580

2 #####

$0

$1,738

3 #####

$346

$1,911

4 #####

$831

$2,102

5 #####

$1,371

$1,051

6 #####

$1,809

$736

7 #####

$2,322

$773

8 #####

$2,508

$811

9 #####

$3,038

$852

10 #####

$3,589

$894

Term. Year

#####

$4,187

$939

EBIT

NOL at beginning of year

Taxes

-$1,675

$2,075

0

-$1,738

$3,750

$0

-$1,565

$5,487

$0

-$1,272

$7,052

$0

$320

$8,324

$0

$1,074

$8,004

$0

$1,550

$6,931

$0

$1,697

$5,381

$0

$2,186

$3,685

$0

$2,694

$1,498

$419

$3,248

$0

$1,137

EBIT (1-t)

-$1,675

-$1,738

-$1,565

-$1,272

$320

$1,074

$1,550

$1,697

$2,186

$2,276

$2,111

0.13

0.41666667

YearCap ExCap Ex Growth

Depreciation

Depreciation Growth

Net Cap ex

1 ##### -20.00%

$1,580

10.00%

$1,852

2 ##### -50.00%

$1,738

10.00%

-$22

3 ##### -30.00%

$1,911

10.00%

-$710

4 #####

5.00%

$2,102

10.00%

-$841

5 #####

5.00%

$1,051

-50.00%

$273

6 #####

5.00%

$736

-30.00%

$654

7 #####

5.00%

$773

5.00%

$687

8 #####

5.00%

$811

5.00%

$721

9 #####

5.00%

$852

5.00%

$758

10 #####

5.00%

$894

5.00%

$795

Term.####

Year

Capital Expenditures

$3,431

$1,716

$1,201

$1,261

$1,324

$1,390

$1,460

$1,533

$1,609

$1,690

$2,353

Depreciation Change in working

FCFFcapital Present Value

$1,580

$0

-$3,526

-$3,270.85

$1,738

$46

-$1,761

-$1,515.31

$1,911

$48

-$903

-$720.38

$2,102

$42

-$472

-$349.17

$1,051

$25

$22

$15.02

$736

$27

$392

$249.55

$773

$30

$832

$491.64

$811

$27

$949

$519.81

$852

$21

$1,407

$715.26

$894

$19

$30,145 $14,210.82

$939

$20

$677

0.7527

0.078108

$10,346.39

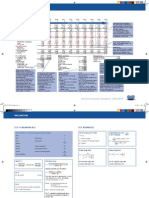

General FCFF Discount Model

A General FCFF Valuation Model

An n-stage Model

This model is designed to value a firm, with changing margins, revenue growth,

and other parameters.

Assumptions

1. The firm is expected to grow at a higher growth rate in the first period.

2. The growth rate will drop at the end of the first period to the stable growth rate.

3. The free cashflow to equity is the correct measure of expected cashflows to stockholders.

The user has to define the following inputs:

1. Length of high growth period

2. Expected growth rate in earnings during the high growth period.

3. Capital Spending, Depreciation and Working Capital needs during the high growth period.

4. Expected growth rate in earnings during the stable growth period.

5. Inputs for the cost of capital. (Cost of equity, Cost of debt, Weights on debt and equity)

Page 5

General FCFF Discount Model

Inputs to the model

Current EBIT =

($1,895.00)

(in currency)

Current Net Income =

($4,040.00)

(in currency)

Current Dividends =

( in currency)

Current Interest Expense =

$415.00

(in currency)

Current Capital Spending

$4,289.00

(in currency)

Current Depreciation =

$1,436.00

(in currency)

Tax Rate on Income =

35.00%

(in percent)

Current Revenues =

$3,804.00

( in currency)

Current Working Capital =

($110.50)

(in currency)

Chg. Working Capital =

($63.00)

(in currency)

Cash and Non-operating assets =

$2,260.00

Book Value of Debt =

$7,647.00

( in currency)

Book Value of Equity =

$6,884.00

(in currency)

NOL carried forward =

$2,075.00

Weights on Debt and Equity

Is the firm publicly traded ?

If yes, enter the market price per share =

& Number of shares outstanding =

& Market Value of Debt =

Yes

( Yes or No)

$1.86

(in currency)

886.47

(in #)

$4,922.75

( in currency)

If no, do you want to use the book value debt ratio ?

(Yes or No)

If no, enter the debt to capital ratio to be used =

(in percent)

Enter length of extraordinary growth period =

10

(in years)

No

(Yes or No)

Costs of Components

Do you want to enter cost of equity directly?

If yes, enter the cost of equity =

(in percent)

If no, enter the inputs to the cost of equity

Beta of the stock =

Page 6

General FCFF Discount Model

Riskfree rate=

4.80%

(in percent)

Risk Premium=

4.00%

(in percent)

Enter the cost of debt for cost of capital calculation

12.80%

( in percent)

Earnings Inputs

Please enter year-specific inputs for each of the following variables:

Year

Growth Rate in EBITDA/Revenue Growth Rate in Growth Rate in Working Capital

Revenue

Capital Spending Depreciation

-3%

as % of Revenue

-20%

10%

3.00%

-50%

10%

3.00%

40.00%

30.00%

5.00%

-30%

10%

3.00%

20.00%

10.00%

5%

10%

3.00%

10.00%

15.00%

5%

-50%

3.00%

10.00%

18.00%

5%

-30%

3.00%

10.00%

21.00%

5%

5%

3.00%

8.00%

24.00%

5%

5%

3.00%

6.00%

27.00%

5%

5%

3.00%

10

5.00%

30.00%

5%

5%

3.00%

Enter growth rate in stable growth period

5.00%

(in percent)

Enter EBITDA as % of Revenue in stable phase

30.00%

(in percent)

Enter Working Capital as % of Revenue in stable phase 3.00%

(in percent)

Will the beta change in the stable period?

Yes

(Yes or No)

If yes, enter the beta for stable period =

1.00

Compounded Avg

10%

Do you want to change the debt ratio in the stable growth period?

Yes

(Yes or No)

If yes, enter the debt ratio for the stable growth period =

40%

(in percent)

Will the cost of debt change in the stable period?

If yes, enter the new cost of debt =

Yes

(Yes or No)

8.00%

( in percent)

Page 7

General FCFF Discount Model

Capital Spending and Depreciation in Stable growth period

Do you want to compute the reinvestment rate in stable growth from fundamentals?

Yes

If yes, enter the return on capital in stable growth =

7.36%

Page 8

(Yes or No)

General FCFF Discount Model

If no, enter capital expenditures as % of depreciation in steady state:

110%

Output from the program

Cost of Equity =

16.80%

Equity/(Debt+Equity ) =

25.09%

After-tax Cost of debt =

8.32%

Debt/(Debt +Equity) =

74.91%

Cost of Capital =

10.45%

Page 9

(in percent: > 100%)

General FCFF Discount Model

$3,804.00

$5,325.60

$6,923.28

$8,307.94

$9,138.73

- Operating Expenses

$3,899.10

$5,325.60

$6,577.12

$7,477.14

$7,767.92

- Depreciation

$1,579.60

$1,737.56

$1,911.32

$2,102.45

$1,051.22

EBIT

($1,674.70)

($1,737.56)

($1,565.15)

($1,271.65)

$319.59

EBIT (1-t)

($1,674.70)

($1,737.56)

($1,565.15)

($1,271.65)

$319.59

+ Depreciation

$1,579.60

$1,737.56

$1,911.32

$2,102.45

$1,051.22

- Capital Spending $3,431.20

$1,715.60

$1,200.92

$1,260.97

$1,324.01

$45.65

$47.93

$41.54

$24.92

Revenues

- EBIT*t

- Chg. Working Capital

Free CF to Firm

($3,526.30)

($1,761.25)

($902.69)

($471.71)

$21.87

Present Value

($3,098.58)

($1,359.90)

($612.45)

($281.22)

$11.46

NOL

$3,749.70

$5,487.26

$7,052.41

$8,324.07

$8,004.48

3.00

3.00

3.00

3.00

3.00

Cost of Equity

16.80%

16.80%

16.80%

16.80%

16.80%

Cost of Debt

12.80%

12.80%

12.80%

12.80%

12.80%

Debt Ratio

74.91%

74.91%

74.91%

74.91%

74.91%

Cost of Capital

13.80%

13.80%

13.80%

13.80%

13.80%

Cum. WACC

1.13804

1.29513

1.47390

1.67735

1.90889

Index

Cost of Capital Computation

Tax Rate

Beta

Growth Rate in Stable Phase =

FCFF in Stable Phase =

5.00%

$676.92

Cost of Equity in Stable Phase =

8.80%

Equity/ (Equity + Debt) =

60.00%

AT Cost of Debt in Stable Phase =

5.20%

Debt/ (Equity + Debt) =

40.00%

Cost of Capital in Stable Phase =

7.36%

Value at the end of growth phase =

$28,683.17

Page 10

General FCFF Discount Model

Present Value of FCFF in high growth phase =

($3,518.92)

Present Value of Terminal Value of Firm =

$9,048.85

Value of the firm =

$5,529.92

+ Cash and Marketable Securities =

$2,260.00

Market Value of Debt =

$4,922.75

Market Value of Equity =

$2,867.17

Value of Options Outstanding (See option worksheet) =

Value of Equity in Common Stock =

1

$3,804

($95)

$1,580

($1,675)

($1,675)

$1,580

$3,431

($3,526)

$14.31

$2,852.86

Value of Equity per Share =

Revenues

EBITDA

- Depreciation

EBIT

EBIT (1-t)

+ Depreciation

- Cap Ex

- Chg WC

FCFF

4991.6447

$3.22

2

$5,326

$1,738

($1,738)

($1,738)

$1,738

$1,716

$46

($1,761)

3

$6,923

$346

$1,911

($1,565)

($1,565)

$1,911

$1,201

$48

($903)

Page 11

4

$8,308

$831

$2,102

($1,272)

($1,272)

$2,102

$1,261

$42

($472)

5

$9,139

$1,371

$1,051

$320

$320

$1,051

$1,324

$25

$22

General FCFF Discount Model

Model

margins, revenue growth,

Page 12

General FCFF Discount Model

Page 13

General FCFF Discount Model

2.548309587

Page 14

General FCFF Discount Model

Page 15

General FCFF Discount Model

ercent: > 100%)

Page 16

General FCFF Discount Model

10

Terminal Year

$10,052.60

$11,057.86

$11,942.49

$12,659.04

$13,291.99

$13,956.59

$8,243.13

$8,735.71

$9,434.57

$9,620.87

$9,703.16

$9,769.62

$735.86

$772.65

$811.28

$851.85

$894.44

$939.16

$1,073.61

$1,549.50

$1,696.64

$2,186.32

$2,694.40

$3,247.82

$418.60

$1,136.74

$1,073.61

$1,549.50

$1,696.64

$2,186.32

$2,275.80

$2,111.08

$735.86

$772.65

$811.28

$851.85

$894.44

$939.16

$1,390.22

$1,459.73

$1,532.71

$1,609.35

$1,689.82

$2,353.38

$27.42

$30.16

$26.54

$21.50

$18.99

$19.94

$391.84

$832.27

$948.67

$1,407.33

$1,461.44

$676.92

$181.79

$344.93

$354.60

$479.42

$461.05

$6,930.87

$5,381.37

$3,684.73

$1,498.40

1

16%

35%

2.60

2.20

1.80

1.40

1.00

1.00

15.20%

13.60%

12.00%

10.40%

8.80%

8.80%

11.84%

10.88%

9.92%

8.96%

6.76%

5.20%

67.93%

60.95%

53.96%

46.98%

40.00%

40.00%

12.92%

11.94%

10.88%

9.72%

7.98%

7.36%

2.15547

2.41288

2.67534

2.93548

3.16982

0.679347826

Page 17

General FCFF Discount Model

6

$10,053

$1,809

$736

$1,074

$1,074

$736

$1,390

$27

$392

7

$11,058

$2,322

$773

$1,550

$1,550

$773

$1,460

$30

$832

8

$11,942

$2,508

$811

$1,697

$1,697

$811

$1,533

$27

$949

9

$12,659

$3,038

$852

$2,186

$2,186

$852

$1,609

$21

$1,407

Page 18

10

$13,292

$3,589

$894

$2,694

$2,276

$894

$1,690

$19

$1,461

Terminal Year

$13,957

$4,187

$939

$3,248

$2,111

$939

$2,353

$20

$677

Vous aimerez peut-être aussi

- Year FCFF Terminal Value Present Value 1 2 3 4 5 6 7 8 9 10 $318.13 $60,899.33 $19,986.47 $16,041.34Document19 pagesYear FCFF Terminal Value Present Value 1 2 3 4 5 6 7 8 9 10 $318.13 $60,899.33 $19,986.47 $16,041.34api-3763138Pas encore d'évaluation

- Two-Stage FCFE Model Revenues by RegionDocument23 pagesTwo-Stage FCFE Model Revenues by Regionminhthuc203Pas encore d'évaluation

- Valuing Amazon with FCFF ModelDocument16 pagesValuing Amazon with FCFF ModelEsteban Camilo Ortiz ZambranoPas encore d'évaluation

- Two-Stage FCFE Model ValuationDocument14 pagesTwo-Stage FCFE Model ValuationAnkita HandaPas encore d'évaluation

- Two-Stage FCFF Discount ModelDocument15 pagesTwo-Stage FCFF Discount ModelCarl HsiehPas encore d'évaluation

- EuroTunnDCFDocument11 pagesEuroTunnDCFNgọc Hiền Nguyễn PhanPas encore d'évaluation

- FCFF 2 STDocument24 pagesFCFF 2 STapi-3701114Pas encore d'évaluation

- Three-Stage Fcfe Discount ModelDocument24 pagesThree-Stage Fcfe Discount Modelminhthuc203Pas encore d'évaluation

- FCFF 2 STDocument15 pagesFCFF 2 STSandeep ChowdhuryPas encore d'évaluation

- 1 - TVM Student TemplatesDocument16 pages1 - TVM Student Templatesaazad3201Pas encore d'évaluation

- A General FCFF Valuation Model An N-Stage ModelDocument17 pagesA General FCFF Valuation Model An N-Stage Modelapi-3763138Pas encore d'évaluation

- Business Analysis and Valuation - IntroductionDocument109 pagesBusiness Analysis and Valuation - IntroductioncapassoaPas encore d'évaluation

- Amazon ValuationDocument22 pagesAmazon ValuationDr Sakshi SharmaPas encore d'évaluation

- Hi GrowthDocument24 pagesHi Growthminhthuc203Pas encore d'évaluation

- DCF TakeawaysDocument2 pagesDCF TakeawaysvrkasturiPas encore d'évaluation

- Finman - Ytm & Stock ValuationDocument5 pagesFinman - Ytm & Stock ValuationnettenolascoPas encore d'évaluation

- Brand Name Value DriversDocument9 pagesBrand Name Value DriversDiego José Gómez De La Torre UribePas encore d'évaluation

- Brand Company Input Value of Brand Name Sales 21962 81724.529647631 Ebitda 7760 45823.824919442 Capital Invested 16406 71821.556358009Document9 pagesBrand Company Input Value of Brand Name Sales 21962 81724.529647631 Ebitda 7760 45823.824919442 Capital Invested 16406 71821.556358009José Manuel EstebanPas encore d'évaluation

- BrandnamevalueDocument9 pagesBrandnamevaluePro ResourcesPas encore d'évaluation

- 1244 - Roshan Kumar Sahoo - Assignment 2Document3 pages1244 - Roshan Kumar Sahoo - Assignment 2ROSHAN KUMAR SAHOOPas encore d'évaluation

- Cashflows PDFDocument40 pagesCashflows PDFABHISHEK RAJPas encore d'évaluation

- Discounted Cash FlowDocument12 pagesDiscounted Cash FlowViv BhagatPas encore d'évaluation

- Firm Multiples: Current InputsDocument2 pagesFirm Multiples: Current InputszPas encore d'évaluation

- Firm Multiples: Current InputsDocument2 pagesFirm Multiples: Current InputssambarocksPas encore d'évaluation

- FirmmultDocument2 pagesFirmmultPro ResourcesPas encore d'évaluation

- Technical Finance Prep AnswersDocument28 pagesTechnical Finance Prep Answersajaw267Pas encore d'évaluation

- Dividend Discount Model: AssumptionsDocument15 pagesDividend Discount Model: Assumptionsminhthuc203Pas encore d'évaluation

- Chapter 3 TrimmedDocument19 pagesChapter 3 Trimmedssregens82Pas encore d'évaluation

- Brand Name ValueDocument9 pagesBrand Name ValueGanapathiraju SravaniPas encore d'évaluation

- Fcfe 2 STDocument13 pagesFcfe 2 STpawankumarsahu42Pas encore d'évaluation

- Div GinzuDocument42 pagesDiv GinzujenkisanPas encore d'évaluation

- Estimating Terminal Value in Valuation ModelsDocument3 pagesEstimating Terminal Value in Valuation ModelsSandeep MishraPas encore d'évaluation

- Ch12sol PDFDocument3 pagesCh12sol PDFAmine IzamPas encore d'évaluation

- BrandnamevalueDocument9 pagesBrandnamevalueapi-3763138Pas encore d'évaluation

- Week 6 Assignment Part 2 (Empty)Document11 pagesWeek 6 Assignment Part 2 (Empty)adomahattafuahPas encore d'évaluation

- Ankush - Gupta - Financial Management and Valuation - MBA - DBF - DEC - 2020 - Word FileDocument8 pagesAnkush - Gupta - Financial Management and Valuation - MBA - DBF - DEC - 2020 - Word FileAnkush GuptaPas encore d'évaluation

- I. Income StatementDocument27 pagesI. Income StatementNidhi KaushikPas encore d'évaluation

- Axial DCF Business Valuation Calculator GuideDocument4 pagesAxial DCF Business Valuation Calculator GuideUdit AgrawalPas encore d'évaluation

- Damodaran On Valuation Lect5Document7 pagesDamodaran On Valuation Lect5Keshav KhannaPas encore d'évaluation

- Master Input Sheet: InputsDocument34 pagesMaster Input Sheet: Inputsminhthuc203Pas encore d'évaluation

- Bill French - Write Up1Document10 pagesBill French - Write Up1Nina EllyanaPas encore d'évaluation

- Master Input Sheet: InputsDocument34 pagesMaster Input Sheet: Inputsminhthuc203Pas encore d'évaluation

- 1.1 What Is Their Profit Margin? Profit MarginDocument16 pages1.1 What Is Their Profit Margin? Profit MarginVenay SahadeoPas encore d'évaluation

- Facebook IPO caseHBRDocument29 pagesFacebook IPO caseHBRCrazy Imaginations100% (1)

- Case Bill FrenchDocument3 pagesCase Bill FrenchROSHAN KUMAR SAHOOPas encore d'évaluation

- Comparing DDM and FCFE Models: Two Stage Valuation: Inputs For FCFE CalculationDocument6 pagesComparing DDM and FCFE Models: Two Stage Valuation: Inputs For FCFE Calculationapi-3763138Pas encore d'évaluation

- Chapter 3 Problems 1-30 Input and Output BoxesDocument24 pagesChapter 3 Problems 1-30 Input and Output BoxesSultan_Alali_9279Pas encore d'évaluation

- ACCA Financial Management NPVDocument150 pagesACCA Financial Management NPVحسین جلیل پورPas encore d'évaluation

- Simple Discounted Cash Flow Model & Relative ValuationDocument14 pagesSimple Discounted Cash Flow Model & Relative ValuationlearnPas encore d'évaluation

- Capital Budgeting: Making Capital Investment Decisions Risk Analysis, Scenario Analysis and Break-Even AnalysisDocument15 pagesCapital Budgeting: Making Capital Investment Decisions Risk Analysis, Scenario Analysis and Break-Even AnalysisKoey TsePas encore d'évaluation

- PP For Chapter 6 - Financial Statement Analysis - FinalDocument67 pagesPP For Chapter 6 - Financial Statement Analysis - FinalSozia TanPas encore d'évaluation

- Taos Museum of Southwestern Arts and CraftsDocument11 pagesTaos Museum of Southwestern Arts and Craftssourovkhan0% (1)

- Boeing: I. Market InformationDocument20 pagesBoeing: I. Market InformationJames ParkPas encore d'évaluation

- Higrowth Company ValuationDocument33 pagesHigrowth Company ValuationAttabik AwanPas encore d'évaluation

- DDM 3 STDocument12 pagesDDM 3 STapi-3701114Pas encore d'évaluation

- Chapter 5 Homework From LectureDocument13 pagesChapter 5 Homework From Lecturejimmy_chou1314100% (1)

- Cost Management Accounting Assignment Bill French Case StudyDocument5 pagesCost Management Accounting Assignment Bill French Case Studydeepak boraPas encore d'évaluation

- Accounting and Finance Formulas: A Simple IntroductionD'EverandAccounting and Finance Formulas: A Simple IntroductionÉvaluation : 4 sur 5 étoiles4/5 (8)

- Handbook of Capital Recovery (CR) Factors: European EditionD'EverandHandbook of Capital Recovery (CR) Factors: European EditionPas encore d'évaluation

- Receiving An Event: Guide For Tandberg Edge 95Document1 pageReceiving An Event: Guide For Tandberg Edge 95minhthuc203Pas encore d'évaluation

- FCFF VALUATION MODEL KEYDocument28 pagesFCFF VALUATION MODEL KEYshanPas encore d'évaluation

- Hi GrowthDocument24 pagesHi Growthminhthuc203Pas encore d'évaluation

- FCFF Valuation Model: Before You Start What The Model Does Inputs Master Inputs Page Earnings NormalizerDocument33 pagesFCFF Valuation Model: Before You Start What The Model Does Inputs Master Inputs Page Earnings Normalizerminhthuc203Pas encore d'évaluation

- FCFF 3 STDocument3 pagesFCFF 3 STminhthuc203Pas encore d'évaluation

- Master Input Sheet: InputsDocument34 pagesMaster Input Sheet: Inputsminhthuc203Pas encore d'évaluation

- Grossvs NetDocument4 pagesGrossvs Netapi-3763138Pas encore d'évaluation

- FCFFSTDocument10 pagesFCFFSTapi-3701114Pas encore d'évaluation

- FirmmultDocument2 pagesFirmmultapi-3763138Pas encore d'évaluation

- FcffvsfcfeDocument2 pagesFcffvsfcfePro ResourcesPas encore d'évaluation

- Inputs For Valuation Current Inputs (As A Naïve Estimate, You Can Use BV of Debt + BV of Equity)Document6 pagesInputs For Valuation Current Inputs (As A Naïve Estimate, You Can Use BV of Debt + BV of Equity)minhthuc203Pas encore d'évaluation

- Stock Risk Return Analysis and ForecastingDocument6 pagesStock Risk Return Analysis and Forecastingsumon finPas encore d'évaluation

- Fcfe Stable Growth ModelDocument5 pagesFcfe Stable Growth Modelapi-3763138Pas encore d'évaluation

- FCFF 2 STDocument15 pagesFCFF 2 STSandeep ChowdhuryPas encore d'évaluation

- LevbetaDocument2 pagesLevbetaapi-3763138Pas encore d'évaluation

- Comparing DDM and FCFE Models: Two Stage Valuation: Inputs For FCFE CalculationDocument6 pagesComparing DDM and FCFE Models: Two Stage Valuation: Inputs For FCFE Calculationapi-3763138Pas encore d'évaluation

- Implied Risk Premium Calculator: Intrinsic Value EstimateDocument3 pagesImplied Risk Premium Calculator: Intrinsic Value Estimateminhthuc203Pas encore d'évaluation

- NatresDocument3 pagesNatresapi-3701114Pas encore d'évaluation

- Sony 00Document1 pageSony 00Abhishek SinghPas encore d'évaluation

- Prima de Risc de Marime A Firmei - DamodaranDocument5 pagesPrima de Risc de Marime A Firmei - Damodarancataneor2Pas encore d'évaluation

- SP 500Document2 pagesSP 500minhthuc203Pas encore d'évaluation

- OpleaseDocument2 pagesOpleaseapi-3763138Pas encore d'évaluation

- Valaution Model - A Model For Any Valuation.Document6 pagesValaution Model - A Model For Any Valuation.kanabaramitPas encore d'évaluation

- Nestle NewDocument23 pagesNestle Newminhthuc203Pas encore d'évaluation

- Kristin KandyDocument31 pagesKristin Kandyminhthuc203Pas encore d'évaluation

- Implied Roc RoeDocument2 pagesImplied Roc RoeudelkingkongPas encore d'évaluation

- FCFF VALUATION MODEL KEYDocument28 pagesFCFF VALUATION MODEL KEYshanPas encore d'évaluation

- FIN2601 Study Unit 6 Exam QuestionsDocument6 pagesFIN2601 Study Unit 6 Exam QuestionsLungile SitholePas encore d'évaluation

- Costs of CapitalDocument80 pagesCosts of Capitalmanojben100% (1)

- Revenue and Cost StreamsDocument44 pagesRevenue and Cost StreamsAniket ChatterjeePas encore d'évaluation

- BF2 AssignmentDocument3 pagesBF2 AssignmentIbaad KhanPas encore d'évaluation

- DMS-IIT Delhi Compendium 2019-21Document55 pagesDMS-IIT Delhi Compendium 2019-21Sounak Chatterjee100% (1)

- Financial Performance & Evalution of IDLC Ltd.Document29 pagesFinancial Performance & Evalution of IDLC Ltd.Samsul ArefinPas encore d'évaluation

- Topic 1 Overview of Financial Management and Financial EnvironmentDocument68 pagesTopic 1 Overview of Financial Management and Financial EnvironmentMicaella Fevey BandejasPas encore d'évaluation

- Branding Challenges and StrategiesDocument15 pagesBranding Challenges and StrategiesAditee ZaltePas encore d'évaluation

- Roche Case Study PDFDocument10 pagesRoche Case Study PDFAbu TaherPas encore d'évaluation

- Terminal Value - Perpetuity Growth & Exit Multiple MethodDocument11 pagesTerminal Value - Perpetuity Growth & Exit Multiple MethodFahmi HaritsPas encore d'évaluation

- Equity Research Report - CiplaDocument8 pagesEquity Research Report - CiplaKrishu AgrawalPas encore d'évaluation

- Shil and DasDocument8 pagesShil and Dasbhagaban_fm8098Pas encore d'évaluation

- Managerial Fin - Midterm Cheat - Copy2Document2 pagesManagerial Fin - Midterm Cheat - Copy2JosePas encore d'évaluation

- Strategic Management Accounting by Austin SamsDocument29 pagesStrategic Management Accounting by Austin SamsSamson A Samson50% (2)

- Alok Katre Faculty ProfileDocument24 pagesAlok Katre Faculty ProfileMeghna SharmaPas encore d'évaluation

- Homework4 With Ans JDocument18 pagesHomework4 With Ans JBarakaPas encore d'évaluation

- Relevant Cash FlowDocument2 pagesRelevant Cash FlowGajendra Singh RaghavPas encore d'évaluation

- Final Assignment CMADocument21 pagesFinal Assignment CMAMahmud KaiserPas encore d'évaluation

- Interview Questions & AnswersDocument22 pagesInterview Questions & AnswersPrakashMhatre0% (1)

- UBS Training #1Document243 pagesUBS Training #1Galen Cheng100% (15)

- MANAGEMENT ADVISORY SERVICES CAPITAL BUDGETINGDocument37 pagesMANAGEMENT ADVISORY SERVICES CAPITAL BUDGETINGjoooPas encore d'évaluation

- Tutorial 1 - SolutionDocument3 pagesTutorial 1 - SolutionSuganti100% (1)

- Gagan Deep Sharma Department of Management Studies BBSB Engineering College Fatehgarh Sahib, PunjabDocument29 pagesGagan Deep Sharma Department of Management Studies BBSB Engineering College Fatehgarh Sahib, PunjabAbdul Motaleb SaikiaPas encore d'évaluation

- Corporate FinanceDocument18 pagesCorporate FinanceNishakdasPas encore d'évaluation

- Fin 439 SyllabusDocument4 pagesFin 439 Syllabuschocolatedoggy12Pas encore d'évaluation

- TN33 California Pizza KitchenDocument8 pagesTN33 California Pizza KitchenToday100% (2)

- Chapter 10 SolutionDocument27 pagesChapter 10 SolutionDiego Schneckenburger100% (1)

- Individual Case Analysis mgmt-4710-m55Document37 pagesIndividual Case Analysis mgmt-4710-m55api-658585122Pas encore d'évaluation

- Types and Costs of Financial Capital ExplainedDocument18 pagesTypes and Costs of Financial Capital ExplainedChristel YeoPas encore d'évaluation

- Working Capital Management TechniquesDocument41 pagesWorking Capital Management TechniquesMCDABCPas encore d'évaluation