Académique Documents

Professionnel Documents

Culture Documents

Chap 3 Notes - Ratio Analysis

Transféré par

Ankit MaldeCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Chap 3 Notes - Ratio Analysis

Transféré par

Ankit MaldeDroits d'auteur :

Formats disponibles

Subject Financial Management

Chapter 3 Ratio Analysis

Nature of Ratio:Ratio are among the best know and most widely used tools of financial analysis. Financial ratio is relation between financial value As companys turnover ratio :- Total Asset / Sales Figure The resulting figure is also index of how many times the value of total asset was incorporated in the firm product. It is worthwhile to mention that the ratio must express relationship that has significance. The relationship between two figures of Balance Sheet is called Balance Sheet Ratio The relationship between Profit & Loss Figures is called Income Statement Ratio The relationship between figures of Profit & Loss Statement & Balance Sheet is called as Inter Statement Ratio

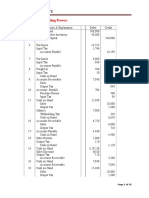

Ratio may be expressed in three firm 1. Pure Ratio 2. Rate :- Inventory turnover as so many times a year 3. As percentage :- Return on shareholders equity being 10% Significance of Ratio as Tool of Financial Analysis D.1 Liquidity Ratio :- for Short Term Obligation 1. Current Ratio :- Current Asset 2:1 Current Liabilities Higher ratio shows companys payment ability of short term obligation on maturity and vise versa for lower ratio 2. Acid Test Ratio or Quick Ratio :- Quick Current Assets ( Excluding Inventory) 1:1 Current Liabilities D.2 Leverage Ratio:- Basically relate with measuring the contribution of Owners/ Shareholder Fund, Repayment of Suppliers & repayment of Short Term & Long Term Loans 1. Debt to Total Asset :- Total Debt Total Asset This ratio indicates solvency of the company. Lower ratio greater cushion of creditors lost in liquidation. Moderate ratio which is creditors requirement & Higher ratio which is stakeholders requirement 2. Debt Equity Ratio:- Total Debt(Current & Long Term Loan) Tangible Net worth (Stock & Reserves & Surplus) Higher Ratio - Indicates more investment of creditors than an business owner, they ultimately get suffer more than owner at the time of liquidation Lower Ratio Creditors Prefer ability

Subject Financial Management

Chapter 3 Ratio Analysis

3. Long Term Debt to Total Capitalization All long term debt Net Worth Its a relationship between long term debt & capital invested. Thumb rule Is maximum 33.5% of long term debt against capital invested in manufacturing concern while 50% in public sector 4. Time Interest Earned :- Profit Before Tax & Interest ( PBIT) Interest Charge High Ratio indicates low burden of borrowing of the business & lower utilization of borrowing capacity D.3 Activity Ratio :- Reflects the efficiency of company about managing its resources. Its a relationship between the level of sales & Investment in various asset 1. Inventory Turn Over ratio : Cost of Goods Sold Average Inventory for the period High Ratio :- Higher turnover & lower blocking of funds in inventory Lower Ratio :- Slow moving inventory

2. Average Collection Period :- Receivable x 365 Days Net Sales It Indicates companies credit & collection policy & the effectiveness of collection machinery. Long Period :- Leniency of company in credit policy Shorter Period :- Aggressive Collection policy 30 days credit period is acceptable while 90 days credit period indicates three months receivable in hand 3. Total Asset Ratio : Cost of Goods Sold Average Total Asset

It indicates efficiency with which asset of the company have been utilized. Higher ratio indicates better utilization & vice versa

4. Fixed Asset Ratio :- Cost of Goods Sold Fixed Asset Lower ratio indicates poor utilization of existing plant capacity

Subject Financial Management

Chapter 3 Ratio Analysis

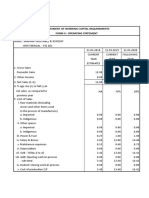

D.4 Profitability Ratio :- Are the best indicators of overall efficiency of business concern because they compare nature of return over & above the value put into business with sales & services carried by enterprises. 1. Profitability relates to Sales a. Gross Profit to Sales :- Gross Profit ( Sales Cost of Goods Sold) Sales It indicates operating efficiency of company to reflect its pricing policy b. Operating Profit to Sales :- Operating Profit Sales It indicates marginal efficiency which may not be reflected in operating income c. Net Profit to Sales Ratio :- Net Income ( After Tax) Net Sales It Indicates overall efficiency of the business. Higher ratio indicates higher overall efficiency & better utilization of all resources. Lower ratio means poor financial planning & low efficiency. 2. Profit as related to Investment :- It indicates return of total capital employed and return on net worth. a. Return on Capital Employed :Net Profit Total Capital Employed

Higher ratio indicates better utilization of funds b. Return on Net Worth :Profit Before Tax Net Worth

It means productivity of shareholders fund. Higher ratio indicates better utilization of owners fund & high productivity. D.5 Investment Ratio :- This ratio used by investors to analysis invisibility of company 1. Earnings Per Share (E.P.S.) :Earning After Tax Preferred Dividend (If Any) Common Shares Outstanding It indicates the change in the wealth of shareholders over period of one years. Year on year comparison of EPS can be very important to investors. 2. Price Earnings Ratio (P/E) :Market Price Earnings Per Share It helps in valuation of stock in future period 3. Payout Ratio :Dividend per Share Earnings Per Share

Subject Financial Management 4. Dividend Yield Ratio :-

Chapter 3 Ratio Analysis

Dividend Per Share Price Per Share It helps to potential investors who are searching for regular income. 5. Return on Investment (Du Pont Approach) :- Sales Total Assets X Earning per Share Sales

Return On Investment is one of the most successful yet simple technique aid both decision making & performance evaluation.

Vous aimerez peut-être aussi

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Salon Business Plan For Starting Your Own Beauty Salon ServiceDocument97 pagesSalon Business Plan For Starting Your Own Beauty Salon ServiceAlhaji Daramy100% (5)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- Trade Finance ProductsDocument35 pagesTrade Finance ProductsAnkit Malde100% (1)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Worldwide Paper Company Cash FlowDocument1 pageWorldwide Paper Company Cash FlowEric Silvani100% (4)

- Best Practice Talent Strategies TOCDocument9 pagesBest Practice Talent Strategies TOCAnkit MaldePas encore d'évaluation

- 122Document35 pages122De Jackela60% (5)

- MotivationDocument22 pagesMotivationAnkit MaldePas encore d'évaluation

- C V VVVV V VVV V V VVVVDocument8 pagesC V VVVV V VVV V V VVVVAnkit MaldePas encore d'évaluation

- ....Document60 pages....Ankit MaldePas encore d'évaluation

- Name: Ruchi Sukanraj Jain. ROLL NO: DPGD/AP12/1125 Company Name: A.D. Jain & Co. Designation: AuditorDocument10 pagesName: Ruchi Sukanraj Jain. ROLL NO: DPGD/AP12/1125 Company Name: A.D. Jain & Co. Designation: AuditorAnkit MaldePas encore d'évaluation

- Volume2 gv2Document702 pagesVolume2 gv2WikusPas encore d'évaluation

- Introduction To Corporate Finance - Unit 1Document21 pagesIntroduction To Corporate Finance - Unit 1VEDANT SAINIPas encore d'évaluation

- Partial - Solution - Module 2 - 6theditionDocument16 pagesPartial - Solution - Module 2 - 6theditionJenn AmaroPas encore d'évaluation

- Question BankDocument8 pagesQuestion BankSUKDEB DEYPas encore d'évaluation

- Acct602 PQ2Document4 pagesAcct602 PQ2Sweet EmmePas encore d'évaluation

- Financial Reporting and Analysis 6th Edition Revsine Test BankDocument55 pagesFinancial Reporting and Analysis 6th Edition Revsine Test Bankmrsbrianajonesmdkgzxyiatoq100% (28)

- SWGI Growth Fund - 2009 Annual ReportDocument51 pagesSWGI Growth Fund - 2009 Annual ReportThe Russia MonitorPas encore d'évaluation

- Assessment of Working Capital Requirements Form Ii: Operating StatementDocument12 pagesAssessment of Working Capital Requirements Form Ii: Operating StatementMD.SAFIKUL MONDALPas encore d'évaluation

- Learning Activity 8 BEP Sales With ProfitDocument4 pagesLearning Activity 8 BEP Sales With ProfitEnergy Trading QUEZELCO 1Pas encore d'évaluation

- 2014 IFRS Financial Statements Def CarrefourDocument80 pages2014 IFRS Financial Statements Def CarrefourawangPas encore d'évaluation

- Act Module4 Cashflow Fabm 2 5.Document11 pagesAct Module4 Cashflow Fabm 2 5.DOMDOM, NORIEL O.Pas encore d'évaluation

- Ppe ExerciseDocument8 pagesPpe ExerciseNajihah NordinPas encore d'évaluation

- CA Final AFM Q MTP 2 May 2024 Castudynotes ComDocument10 pagesCA Final AFM Q MTP 2 May 2024 Castudynotes Compabitrarijal1227Pas encore d'évaluation

- Chapter 2. Tool Kit For Financial Statements, Cash Flows, and TaxesDocument14 pagesChapter 2. Tool Kit For Financial Statements, Cash Flows, and TaxesAnshumaan SinghPas encore d'évaluation

- Accountancy MSDocument13 pagesAccountancy MSJas Singh DevganPas encore d'évaluation

- Earnings Power - Hewitt HeisermanDocument14 pagesEarnings Power - Hewitt HeisermanSivakumar GanesanPas encore d'évaluation

- OOM FINAL PresentationDocument10 pagesOOM FINAL PresentationAshutosh SharmaPas encore d'évaluation

- FAR460 - S - June 2018 - StudentsDocument6 pagesFAR460 - S - June 2018 - StudentsRuzaikha razaliPas encore d'évaluation

- BADNEWS!Document4 pagesBADNEWS!Janella CastroPas encore d'évaluation

- Guiding PrinciplesDocument39 pagesGuiding PrinciplestiwariajaykPas encore d'évaluation

- Kuis 2 AK 2 GNP 1314 - Leasing Tax - RegulerDocument4 pagesKuis 2 AK 2 GNP 1314 - Leasing Tax - RegulerBastian Nugraha SiraitPas encore d'évaluation

- IPSAS 12 - InventoriesDocument23 pagesIPSAS 12 - InventoriesKibromWeldegiyorgis0% (1)

- Conceptual Framework 1Document2 pagesConceptual Framework 1nurhanikhalilah21Pas encore d'évaluation

- (Padini) Padini Holdings Berhad - 2013Document14 pages(Padini) Padini Holdings Berhad - 2013Tung NgoPas encore d'évaluation

- Installment Sales Part 2 AND Business CombiDocument33 pagesInstallment Sales Part 2 AND Business CombiBenzon Agojo OndovillaPas encore d'évaluation

- Chapter 13 - SolutionsManual - FINAL - 050417 PDFDocument30 pagesChapter 13 - SolutionsManual - FINAL - 050417 PDFNatalie ChoiPas encore d'évaluation

- Account PaperDocument8 pagesAccount PaperAhmad SiddiquiPas encore d'évaluation