Académique Documents

Professionnel Documents

Culture Documents

CheatSheet (Finance)

Transféré par

Guan Yu LimCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

CheatSheet (Finance)

Transféré par

Guan Yu LimDroits d'auteur :

Formats disponibles

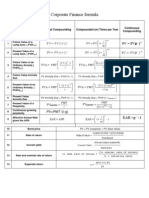

FIN2004X Cheat Sheet Capital Gain Yield = Cap Gain/Initial Price Corporate Finance Investment Returns Dollar :Amt

Recd - Amt invst Dividend Yield = Div/Initial Share Price Capital budgeting (invest) % rtd :(Amt Recd-Amt invst)/Amt invst Total return = div yield + cap gain yield Capital structure (fund) 1 + real return = (1 + nominal return)/(1 + inflation rate) Working capital mgt (liquid) Accting Standards Expected Returns Mkt Cap = Share Price x No. of Outstding Shares Expected r^ = Summation(riPi) Mkt Value of Assets = Mkt Cap + Mkt Val of Debt (same as book) Arithmetic average return = Sum of (rt)/t Enterprise Value = Mkt Value (Equity + Debt) Excess Cash Volatility=Sqrt[Sum of(ri-Expected r)^2(Pi)] Est Volatility=Sqrt[Sum of(rt-Avg r)^2/n-1] Sources of cash (Use of Cash): decreases(increase) in assets (other than cash) CV = Standard Deviation/Expt r (risk/unit of rtd) increases(decrease) in equity and liabilities. risk premium=excess return over the risk-free rate Weighted r=Sum of (wir^i) w must add up to 1 Portfolio r=Sum of(port ri*Pi) stock Portf Volatility = Sqrt[Sum of(ri-Expected r)^2(Pi)] Cash Flow From Assets = Operating Cash Flow (OCF) Alt Portf Risk= sqrt[w^2(risk1^2)+(1-w)(risk2^2)+2w(1-w)Cov(risk1)(risk2)] Net Capital Spending (NCS) Changes in NOWC OCF = EBIT + Depreciation (EBIT*Tax Rate) Cash Flow From Assets (CFFA)* + Interest Tax Shield = NCS = Ending Net Fix Assets Begin Net Fix Assets + Depreciation Cash Flow to Creditors + Cash Flow to Stockholders Changes in NOWC = Ending NOWC Beginning NOWC Cash Flow to Creditors (B/S and I/S) = interest paid net new borrowing (LT Debt and Notes Payable) Cash Flow to Stockholders (B/S and I/S) = dividends paid net new equity raised Cap line=rp=rf+(rm-rf)/std m *std p Liquidity Ratio Expected Returns Covariance=Sum of [Prob(s)*(Ri-E(ri))*(Rj-E(rj))] Cash Ratio = Cash / CL Total Risk(Volatility)=Co. Spec risk(UnSystem)+Mket Risk(System) NWC to Total Assets = NWC / TA Interval Measure = CA / average daily operating costs Beta(market risk)=Covariance of invstment rtd with rtds of Financial Leverage Ratio mkt/mkt portf variance Required ri=rrf+(rm-rrf)betai Total Debt Ratio = Total Debt / Total Assets Debt/Equity Ratio = (total assets total equity) / total equity (Compound rtd)Geometric Equity Multiplier = total assets/total equity mean=[(1+r1)(1+r2)(1+r3)..(1+rn)]^n - 1 Long-Term Debt Ratio = long-term debt / (long-term debt + total equity) Risk to Rewards - (Rm-Rf) is the market Times Interest Earned Ratio = EBIT / interest premium for each unit of beta Portf Beta=Sum of (Wi*betai) Cash Coverage Ratio = (EBIT + depreciation) / interest Inflation Increase the Required Return by the same amount - rrf is affected Asset Mgt Ratio When investors are more risk adverse, the risk premium increase - (rm-rrf) Inventory Turnover = COGS / Inventory Days Sales in Inventory = 365 / Inventory Turnover Portf that gives the greatest rtd for a given risk is called efficient Rec. turnover = Sales / Receivables Any asset combo is efficient as long as it is above the Mini Days Sales Outstanding = Account Receivable/Average Daily Sales (Sale/365) Variance Portf, this is Efficient Frontier FA Turnover = Sales / Net fixed assets Type of Loans Profitability Ratio Pure Discount Loans No interest Profit margin = Net income / Sales Interest Only Loans - Principal paid at end BEP (Basic Earning Power) = EBIT/Total assets Loans with Fixed Principal Payments ROE = Net income*(if there's preferred, remove it) / Total common equity Amortized Loans - Varying Portion of Mkt Ratio principal paid at end P/E = Price / Earnings per share Time Value of Money M/B = Mkt price per share / Book value per share APR = period rate * the number of periods per year The Dupont System EAR = [1+APR/m]^m -1 where m is compounding ROE = PM * TA TO * EM ((NI / Sales) (Sales / TA) (TA / TE)) frequency per year Time Value of Money FVn = PV(1 + i)n i = (FV / PV)1/n 1 t = ln(FV / PV) / ln(1 + r) PV of Perpetuity = Constant CF/r Ordinary Annuity (1+i) = Annuity Due PV of growing Perpetuity = C1/r-g Ordinary Annuity PV = PMT*(1/r*(1-1/(1+r)^n)) FV= PMT * [1/r*[(1+r)^n-1]]

Lecture 1-5

Vous aimerez peut-être aussi

- Corporate Finance Formula SheetDocument4 pagesCorporate Finance Formula Sheetogsunny100% (3)

- Corporate Finance - FormulasDocument3 pagesCorporate Finance - FormulasAbhijit Pandit100% (1)

- Kelly's Finance Cheat Sheet V6Document2 pagesKelly's Finance Cheat Sheet V6Kelly Koh100% (4)

- Fnce 100 Final Cheat SheetDocument2 pagesFnce 100 Final Cheat SheetToby Arriaga100% (2)

- CFA Formula Cheat SheetDocument9 pagesCFA Formula Cheat SheetChingWa ChanPas encore d'évaluation

- CorpFinance Cheat Sheet v2.2Document2 pagesCorpFinance Cheat Sheet v2.2subtle69100% (4)

- Corporate Finance Math SheetDocument19 pagesCorporate Finance Math Sheetmweaveruga100% (3)

- Finance Cheat SheetDocument2 pagesFinance Cheat SheetMarc MPas encore d'évaluation

- Corporate Finance FormulasDocument3 pagesCorporate Finance FormulasMustafa Yavuzcan83% (12)

- Accounting Cheat SheetsDocument4 pagesAccounting Cheat SheetsGreg BealPas encore d'évaluation

- Accounting Cheat SheetDocument7 pagesAccounting Cheat Sheetopty100% (15)

- Overview of Financial Management Concepts and ToolsDocument4 pagesOverview of Financial Management Concepts and ToolsPeixuan Zhuang100% (1)

- Accounting Cheat SheetDocument2 pagesAccounting Cheat Sheetanoushes1100% (2)

- Dividend Discount and Residual Income Models ExplainedDocument2 pagesDividend Discount and Residual Income Models ExplainedMohammad DaulehPas encore d'évaluation

- Cheat Sheet For AccountingDocument4 pagesCheat Sheet For AccountingshihuiPas encore d'évaluation

- FIN6215-Cheat Sheet BigDocument3 pagesFIN6215-Cheat Sheet BigJojo Kittiya100% (1)

- CheatDocument1 pageCheatIshmo KueedPas encore d'évaluation

- Cheat Sheet Corporate - FinanceDocument2 pagesCheat Sheet Corporate - FinanceAnna BudaevaPas encore d'évaluation

- Finance Cheat SheetDocument4 pagesFinance Cheat SheetRudolf Jansen van RensburgPas encore d'évaluation

- BF2201 Cheat Sheet FinalsDocument2 pagesBF2201 Cheat Sheet Finalssiewhong93100% (1)

- General Accounting Cheat SheetDocument35 pagesGeneral Accounting Cheat SheetZee Drake100% (5)

- Cheat Sheet - AccountingDocument2 pagesCheat Sheet - AccountingJeffery KaoPas encore d'évaluation

- Cheat Sheet Exam 1Document1 pageCheat Sheet Exam 1Shashi Gavini Keil100% (2)

- Fin Cheat SheetDocument3 pagesFin Cheat SheetChristina RomanoPas encore d'évaluation

- Cheat Sheet For Financial AccountingDocument1 pageCheat Sheet For Financial Accountingmikewu101Pas encore d'évaluation

- Maximise Firm Value with Corporate Finance PrinciplesDocument4 pagesMaximise Firm Value with Corporate Finance PrinciplesLynettePas encore d'évaluation

- Defining Heads of Charge and Deductions S10(1Document2 pagesDefining Heads of Charge and Deductions S10(1Jean Pingfang Koh100% (3)

- Cheat Sheet Final - FMVDocument3 pagesCheat Sheet Final - FMVhanifakih100% (2)

- Bf2207 Final CheatsheetDocument2 pagesBf2207 Final CheatsheetBryan 林裕强Pas encore d'évaluation

- Cfa Level I - Us Gaap Vs IfrsDocument4 pagesCfa Level I - Us Gaap Vs IfrsSanjay RathiPas encore d'évaluation

- Accounting Cheat Sheet FinalsDocument5 pagesAccounting Cheat Sheet FinalsRahel CharikarPas encore d'évaluation

- ACC1002X Cheat Sheet 2Document1 pageACC1002X Cheat Sheet 2jieboPas encore d'évaluation

- Corporate FinanceDocument96 pagesCorporate FinanceRohit Kumar80% (5)

- Corporate Finance Cheatsheet Zhiwei NewDocument2 pagesCorporate Finance Cheatsheet Zhiwei NewZaggie NgPas encore d'évaluation

- Midsem Cheat Sheet (Finance)Document2 pagesMidsem Cheat Sheet (Finance)lalaran123Pas encore d'évaluation

- Cheat Sheet - EXAM Version - BARBARADocument2 pagesCheat Sheet - EXAM Version - BARBARAJosé António Cardoso RodriguesPas encore d'évaluation

- ACC3601 Finals CheatsheetDocument3 pagesACC3601 Finals CheatsheetKerry TranPas encore d'évaluation

- Corporate Finance Cheat SheetDocument3 pagesCorporate Finance Cheat Sheetdiscreetmike50Pas encore d'évaluation

- Financial Accounting: Tools For Business Decision-Making, Third Canadian EditionDocument6 pagesFinancial Accounting: Tools For Business Decision-Making, Third Canadian Editionapi-19743565100% (1)

- Formule Corporate FinanceDocument6 pagesFormule Corporate FinanceБота Омарова100% (1)

- FORMULA SHEET GUIDEDocument3 pagesFORMULA SHEET GUIDEnatlyhPas encore d'évaluation

- Wealth Management: (Page 1 of 2) (Printed Only On One Side)Document2 pagesWealth Management: (Page 1 of 2) (Printed Only On One Side)mohakbhutaPas encore d'évaluation

- Formula Sheet FIN 300Document3 pagesFormula Sheet FIN 300Stephanie NaamaniPas encore d'évaluation

- Formulas - All Chapters - Corporate Finance Formulas - All Chapters - Corporate FinanceDocument6 pagesFormulas - All Chapters - Corporate Finance Formulas - All Chapters - Corporate FinanceNaeemPas encore d'évaluation

- Formula SheetDocument4 pagesFormula SheetAdil AliPas encore d'évaluation

- O o o o o Total Costs Q X V + FC o Accounting Break-Even: Q (FC + D) / (P-V)Document3 pagesO o o o o Total Costs Q X V + FC o Accounting Break-Even: Q (FC + D) / (P-V)Ana C. RichiezPas encore d'évaluation

- List of Formulas Used in Different Financial CalculationsDocument2 pagesList of Formulas Used in Different Financial CalculationsRaja Muaz Ahmad KhanPas encore d'évaluation

- Corporate Finance: RF M ErDocument3 pagesCorporate Finance: RF M ErFarin KaziPas encore d'évaluation

- R) (1 CF ...... R) (1 CF R) (1 CF CF NPV: Invesment Initial NPV 1 Invesments Initial Flows Cash Future of PVDocument9 pagesR) (1 CF ...... R) (1 CF R) (1 CF CF NPV: Invesment Initial NPV 1 Invesments Initial Flows Cash Future of PVAgnes LoPas encore d'évaluation

- Fin 3101Document5 pagesFin 3101Park JiyeonPas encore d'évaluation

- CFA Level I Formula SheetDocument27 pagesCFA Level I Formula SheetAnonymous P1xUTHstHT100% (4)

- RecipeDocument4 pagesRecipesasyedaPas encore d'évaluation

- 25th Aug 2014 Lect: Current Time InvestDocument3 pages25th Aug 2014 Lect: Current Time InvestGaurav SomaniPas encore d'évaluation

- Strategic Financial Management Formula and Concept KitDocument84 pagesStrategic Financial Management Formula and Concept KitNirmal ShresthaPas encore d'évaluation

- Formula SheetDocument5 pagesFormula SheetherculesPas encore d'évaluation

- FINA 2201 and 2209 Final Exam ReviewDocument5 pagesFINA 2201 and 2209 Final Exam Reviewsxzhou23Pas encore d'évaluation

- Corporate Finance Formulas: A Simple IntroductionD'EverandCorporate Finance Formulas: A Simple IntroductionÉvaluation : 4 sur 5 étoiles4/5 (8)

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)D'EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Évaluation : 3.5 sur 5 étoiles3.5/5 (17)

- Accounting and Finance Formulas: A Simple IntroductionD'EverandAccounting and Finance Formulas: A Simple IntroductionÉvaluation : 4 sur 5 étoiles4/5 (8)

- Week 2Document1 pageWeek 2Guan Yu LimPas encore d'évaluation

- Introduction To InvestmentDocument16 pagesIntroduction To InvestmentGuan Yu LimPas encore d'évaluation

- Assignment 1Document33 pagesAssignment 1Guan Yu LimPas encore d'évaluation

- Finance Case 2Document26 pagesFinance Case 2Guan Yu LimPas encore d'évaluation

- Lecture 23Document6 pagesLecture 23Guan Yu LimPas encore d'évaluation

- Pricing Fixed-Income SecuritiesDocument50 pagesPricing Fixed-Income SecuritiesyeehawwwwPas encore d'évaluation

- Closing Summary Sep 28 2022 EN - tcm10-29086 - tcm10-29086Document2 pagesClosing Summary Sep 28 2022 EN - tcm10-29086 - tcm10-29086indraseenayya chilakalaPas encore d'évaluation

- 6 Months Statement Axis BankDocument34 pages6 Months Statement Axis Bankhariomsingh.karnisenaPas encore d'évaluation

- 19 Chart-Patterns PDFDocument25 pages19 Chart-Patterns PDFMahid HasanPas encore d'évaluation

- Corporation: Issuance: JPIA Mentor's CircleDocument18 pagesCorporation: Issuance: JPIA Mentor's CircleartPas encore d'évaluation

- Stock ValuationDocument16 pagesStock ValuationHassaan NasirPas encore d'évaluation

- Case Study Virgin AmericaDocument3 pagesCase Study Virgin Americaareeshatajani100% (1)

- Wachovia Securities DatabookDocument44 pagesWachovia Securities DatabookanshulsahibPas encore d'évaluation

- Value Investor Insight-3-17-Causeway Capital, WydenDocument21 pagesValue Investor Insight-3-17-Causeway Capital, WydenWei HuPas encore d'évaluation

- Strategy Name Number of Option Legs Direction: Short Straddle 2 Market NeutralDocument4 pagesStrategy Name Number of Option Legs Direction: Short Straddle 2 Market NeutralGupta JeePas encore d'évaluation

- B 20170522Document94 pagesB 20170522larryPas encore d'évaluation

- Tejaswini More: ObjectivesDocument2 pagesTejaswini More: ObjectivesChrisPas encore d'évaluation

- Future ContractDocument24 pagesFuture ContractKhyaati SharmaPas encore d'évaluation

- Dow Jones Aiding Islamic InvestingDocument3 pagesDow Jones Aiding Islamic InvestingRory CoenPas encore d'évaluation

- SM Chapter 11Document91 pagesSM Chapter 11mas aziz100% (1)

- Commodities Reading List ScheduleDocument5 pagesCommodities Reading List Schedulelaozi222Pas encore d'évaluation

- Vitrox - IPO Prospectus CompiledDocument204 pagesVitrox - IPO Prospectus CompiledEugene Teo100% (1)

- How to Become a Stock Market Genius by Investing in Underfollowed SituationsDocument2 pagesHow to Become a Stock Market Genius by Investing in Underfollowed SituationsRyan ReitzPas encore d'évaluation

- Lecture 2 Financial System and InstrumentsDocument44 pagesLecture 2 Financial System and InstrumentsLuisLoPas encore d'évaluation

- 01 - The Truth About Support and Resistance PDFDocument11 pages01 - The Truth About Support and Resistance PDFVard Raj75% (4)

- Fin 2101 Module 4 - Analyses of Financial Ratios and Their Implications To ManagementDocument7 pagesFin 2101 Module 4 - Analyses of Financial Ratios and Their Implications To ManagementSamantha Nicoleigh TuasonPas encore d'évaluation

- Investor Perceptions of Mutual FundsDocument81 pagesInvestor Perceptions of Mutual FundsHanu DonPas encore d'évaluation

- 2014 Nvca Yearbook PDFDocument127 pages2014 Nvca Yearbook PDFDeepa DevanathanPas encore d'évaluation

- Which Statement Regarding The Risk of Investment in Variable Life Is TRUEDocument2 pagesWhich Statement Regarding The Risk of Investment in Variable Life Is TRUEFranz JosephPas encore d'évaluation

- Shaikh, A. S., Et Al (2017)Document25 pagesShaikh, A. S., Et Al (2017)Irza RayhanPas encore d'évaluation

- Problem Set 1 Fundamentals of ValuationDocument3 pagesProblem Set 1 Fundamentals of ValuationSerin SiluéPas encore d'évaluation

- Mar3023 Exam 1 Review-1Document31 pagesMar3023 Exam 1 Review-1Anish SubramanianPas encore d'évaluation

- Account Number Currency Int Amt CR Int Amt DR: End of ReportDocument2 pagesAccount Number Currency Int Amt CR Int Amt DR: End of ReportshivaprasadssPas encore d'évaluation

- Investment Analysis & Portfolio ManagementDocument22 pagesInvestment Analysis & Portfolio ManagementJyoti YadavPas encore d'évaluation

- 18ardennes RulesDocument20 pages18ardennes RulestobymaoPas encore d'évaluation