Académique Documents

Professionnel Documents

Culture Documents

NHS UK Death On Pension Factsheet

Transféré par

Amitav ShawTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

NHS UK Death On Pension Factsheet

Transféré par

Amitav ShawDroits d'auteur :

Formats disponibles

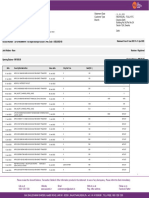

NHS Pension Scheme: Death on Pension Factsheet

If you are informed that a Scheme pensioner has died, please ask the informant to write to Paymaster as they administer death on pension benefits. Overview - Benefits payable when a pensioner dies

If a Scheme pensioner dies within 5 years of retirement a Death Gratuity Deficiency payment may be applicable. The deficiency payment is equal to 5 times the yearly rate of the pension, less the amount of pension already paid, BUT shall not exceed an amount equal to twice the members final actual pensionable or reckonable pay, LESS an amount equal to the aggregate of the members retirement lump sum and any amount which the member chose to take as a lump sum in exchange for part of their pension. Where there is a surviving partner and the pensioner was married, formed a civil partnership or had made a valid partner nomination before retirement, Paymaster will pay an initial surviving partner pension for 6 months from the day after the date of death, at the same rate of pension the member was receiving at the day they died. This will be followed by a continuing surviving partner pension. If there are dependent children a continuing child allowance may also be payable.

What happens when Paymaster are informed of the death of a Scheme pensioner?

When informed of the death of a Scheme pensioner, Paymaster may send a claim form to the informant for the survivor pension to be claimed. Paymaster will notify NHS Pensions of the death of the pensioner on form D6 so the members record can be updated. NHS Pensions will check if a Death Gratuity Deficiency payment is due. If a deficiency payment is due NHS Pensions may write to the informant for the name and address of the personal representative. NHS Pensions will authorise Paymaster to pay the deficiency payment and notify the personal representative of the amount of Life Time Allowance used. It is the responsibility of Paymaster to obtain any documentation relating to probate that may be necessary.

www.nhsbsa.nhs.uk/pensions

Death on Pension Factsheet

V2.0 06/2013

NHS Pensions will check the members record to see if there were any children dependent upon the member at retirement, and if necessary will issue a child allowance application form AW158. When the completed claim form and all necessary papers are returned we will authorise Paymaster to pay a child allowance. If the member married, formed a civil partnership, or nominated a partner after their retirement, NHS Pensions will issue the necessary claim form to be completed and returned with all necessary papers. We will then authorise Paymaster to pay the surviving partner pension. If the continuing surviving partner pension is less than 260 a year, Paymaster will ask NHS Pensions if the small pension can be commuted to a once and for all lump sum and we will then calculate the lump sum and authorise Paymaster to pay it. Paymaster: Contact Details Paymaster, Sutherland House, Russell Way Crawley, West Sussex, RH10 1UH Paymasters telephone number is 0845 1212 522 If you live outside the United Kingdom the telephone number is 0044 1293 560999

www.nhsbsa.nhs.uk/pensions

Death on Pension Factsheet

V2.0 06/2013

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Return To LibcDocument6 pagesReturn To LibcAmitav Shaw100% (1)

- Android System Development PDFDocument409 pagesAndroid System Development PDFAmitav Shaw100% (1)

- Cortex A Series ProgrGuideDocument442 pagesCortex A Series ProgrGuideAmitav ShawPas encore d'évaluation

- USB Protocol BasicsDocument34 pagesUSB Protocol BasicsAmitav Shaw100% (2)

- Rror Etection AND Orrection: Logic and Computer Design FundamentalsDocument5 pagesRror Etection AND Orrection: Logic and Computer Design FundamentalspthepronabPas encore d'évaluation

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Handicapped Form 16Document8 pagesHandicapped Form 16pranab_banerjee8630Pas encore d'évaluation

- CH 4 Brief Exercises 16th PDFDocument18 pagesCH 4 Brief Exercises 16th PDFNiken PurwantyPas encore d'évaluation

- MBA Tuition Non Res FW 2022 2023Document1 pageMBA Tuition Non Res FW 2022 2023khabiranPas encore d'évaluation

- Deductions From Gross Estate (Presentation Slides)Document24 pagesDeductions From Gross Estate (Presentation Slides)KezPas encore d'évaluation

- Global Remittance:: SGD (Singapore Dollar) Is An Eligible Currency For Wire Transfers.21Document7 pagesGlobal Remittance:: SGD (Singapore Dollar) Is An Eligible Currency For Wire Transfers.21Susmita JakkinapalliPas encore d'évaluation

- US Internal Revenue Service: I940 - 1999Document6 pagesUS Internal Revenue Service: I940 - 1999IRSPas encore d'évaluation

- 30, Vinayaka Layout, Shanthipura: House Rent ReceiptDocument5 pages30, Vinayaka Layout, Shanthipura: House Rent ReceiptmorasriPas encore d'évaluation

- LPC ReportDocument4 pagesLPC Reportaodmgmch1Pas encore d'évaluation

- BXL22 23437Document1 pageBXL22 23437zilaniPas encore d'évaluation

- Tahun 4 - Peperiksaan Pertengahan Tahun - Jawapan PDFDocument2 pagesTahun 4 - Peperiksaan Pertengahan Tahun - Jawapan PDFKanang UsopPas encore d'évaluation

- BIR Regulations On Service ChargeDocument3 pagesBIR Regulations On Service ChargeMichelle Ann S. FerriolPas encore d'évaluation

- IRA Recharacterization Request: 1. Account OwnerDocument2 pagesIRA Recharacterization Request: 1. Account OwnersaranPas encore d'évaluation

- Ocado ReceiptDocument1 pageOcado ReceiptAnonymous fgJkxm97Pas encore d'évaluation

- Comfort Inn & Suites Los Alamos: Your Reservation Is ConfirmedDocument2 pagesComfort Inn & Suites Los Alamos: Your Reservation Is ConfirmedNagendra SinghPas encore d'évaluation

- Capital GainDocument4 pagesCapital GainrichaPas encore d'évaluation

- FinMan (Common-Size Analysis)Document4 pagesFinMan (Common-Size Analysis)Lorren Graze RamiroPas encore d'évaluation

- Account Statement: Ajaz Ah MirDocument4 pagesAccount Statement: Ajaz Ah MirAjaz MirPas encore d'évaluation

- Date:29 03 2023Document1 pageDate:29 03 2023tanmay awarePas encore d'évaluation

- Online Banking TCsDocument52 pagesOnline Banking TCsmaverick_1901Pas encore d'évaluation

- Notification No. 16/2021 - Central Tax (Rate)Document2 pagesNotification No. 16/2021 - Central Tax (Rate)santanu sanyalPas encore d'évaluation

- Form PDF 457810310271221Document6 pagesForm PDF 457810310271221Pankaj GuptaPas encore d'évaluation

- Exemption From Custom DutyDocument13 pagesExemption From Custom DutyAbhinav PrasadPas encore d'évaluation

- CHAPTER 7 Conjugal PartnershipDocument15 pagesCHAPTER 7 Conjugal PartnershipClaire BarbaPas encore d'évaluation

- Gmail - Expedia Travel Confirmation - Wed, Jul 19 - (Itinerary # 72593634072884)Document4 pagesGmail - Expedia Travel Confirmation - Wed, Jul 19 - (Itinerary # 72593634072884)LUZ URREAPas encore d'évaluation

- Biaya Do Bma-2001002-1 PPJK MBS PDFDocument1 pageBiaya Do Bma-2001002-1 PPJK MBS PDFBella TanuPas encore d'évaluation

- 1575614292325Document8 pages1575614292325Kalimuddin KhanPas encore d'évaluation

- 69679716181019595Document32 pages69679716181019595logicinsidePas encore d'évaluation

- Smart CommunicationsDocument6 pagesSmart CommunicationsHaffiz AtingPas encore d'évaluation

- MCQ FA1 TenDocument12 pagesMCQ FA1 TenZeeshan BakaliPas encore d'évaluation

- Cw-Invoices Invoice 6263277 CWI1739012 3rjax6 PDFDocument1 pageCw-Invoices Invoice 6263277 CWI1739012 3rjax6 PDFBBA SNUPas encore d'évaluation