Académique Documents

Professionnel Documents

Culture Documents

Chap 4 and 6

Transféré par

Russell MonroeDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Chap 4 and 6

Transféré par

Russell MonroeDroits d'auteur :

Formats disponibles

CHAPTER 4: RESULTS AND FINDINGS

This section of this partiuclar resaerch study provides an analysis of the results and findindings of the collected data. This chapter of the research study is fundamental since it provides a basis for the conclusion and recommendations with respect to the resaerch objectives provided in the later chapters of this research study. 4.1 Introduction The purpose of this particular research study had been to find out the impact of the planning of the Global Recession on the industry related to the banking sector. In order to carry out this particular research study a survey had been conducted with the help of a designed questionnaire. This research questionnaire had been prepared keeping in view the research issues and the overall research objectives. The primary data has been collected by approaching the respondents utilizing this particular designed research questionnaire. The collected data has thus been analyzed using the descriptive statistics, graphs and pie charts thus following a mix method approach. The graphical analytic approach is followed since it provides the reader with a better understanding and interpretation of the collected data and its findings. In order to carry out this particular research study four banks of the United Kingdom under the effect of the global recession had been targeted. The four targeted banks are the Bradford and Bingley Building Society, Halifax Bank of Scotland, HSBC and the Nationwide Building Society. The designed questionnaire was distributed equally in these banks. i.e. 25 questionnaires were distributed thus making the sample size equivalent to 100 for this particular research study. Thus providing the following results:

Total Received Rejected Qualified Rate Table 1 Source: Author (2012)

100 100 None 100 100%

As seen from the Table 1 provided above the response rate for this particular research study had been 100%. The respondents participated fully for this particular research study and the entire 25 questionnaire that were sent to these banks were received with 100% response rate. 4.2 Demographics of Sample

In the very first portion of the designed questionnaire related to the demographics of the respondents they were asked about the gender and the following results were obtained:

Gender

Female 39% Male 61%

Graph 4.2.1

As seen from the Graph 4.2.1 provided above 61% of the respondents that have participated in this particular research study had been male whereas 39% of the respondents taking part in this particular research study had been the females. It could be argued from the findings that since majority of participants have been male; the four targeted banks seem to have a male influence employing fewer females as compared to the male employees. In the questionnaire respondents were asked about their position and they were provided with the options like top level manager, middle level manager and other staff. Following results were obtained:

Graph 4.2.2 As seen from the Graph 4.2.2 provided above 22% of the respondents had been related to the position of the top level manager, 50% had been related to the position of the middle level manager whereas 28% had been related to other staff. It could be argued that majority of the respondents belonging to these particular banks had been related to the position of the middle

manager and this is mainly because of the flexibility of their work due to which they had accessible. The respondents were asked about their terms of employment and they were provided with the options like permanent employment, on contractual basis or other. The following results had been obtained:

Employment Type

Permanent Contract Other Specify

6% 16%

78%

Graph 4.2.3 As seen from the Graph 4.2.3 provided above it could be observed that 78% of the respondents participating in this particular research study had permanent terms of employment, 16% have contract whereas only 6% have selected other as the terms of employment. These 6% were mostly the internees and it could be observed that the targeted banks have employed the majority of the respondents on the permanent basis. Thus it could be argued that it seems convenient for the banks to hire employees on the permanent basis rather than on the contractual basis. The respondents were also asked about their work experience in the designed questionnaire and the following results were obtained:

As seen from the Graph 4 provided above it could be argued that a very small percentage of the respondents i.e. 10% have work experience ranging from none to 2 years whereas majority have work experience of 37% i.e. of 6 to 9 years. Thus it could be said that majority of the respondents participating in this particular research study had been experienced in their respective fields. 4.3 Awareness of Global Economic Recession

The respondents participating in this particular research study had been provided with the options of yes or no and were asked whether they had any idea or know how about the economic recession affecting the global village belonging to this modern era of technology and the following results were obtained:

Are you aware of the Global economic Recession (GER) and its impacts? Frequency Valid Yes No Total 86 14 100 Percent 86.0 14.0 100.0 Table 4.3 As seen from the Table 4.3 that has been provided above it could be observed that majority of the respondents i.e. 86% have been aware of the global recession whereas the remaining 14% did not have the knowledge about the global recession prevailing in the bank industry. These respondents were also asked whether they have been aware of the cause of the global recession and the following results were obtained: Valid Percent 86.0 14.0 100.0 Cumulative Percent 86.0 100.0

4.3

Causes of Global Economic Recession

Causes of Global Economic Recession

Yes No

38%

62%

Graph 4.3 As seen from the Graph 4.3 that has been provided above it could be argued that 62% of the respondents in majority have not been aware of the causes of the global recession whereas the remaining 38% have been aware of the causes. From the findings it could be observed that though majority of the respondnets have been aware of the recession of 2008 affecting the banking industry but still they had not been aware of the causes in majority.

4.4

The Impact of 2008 GER on Respective bank

In the next question of the designed questionnaire the respondents were asked to give their opinion whether the global economic recession has affected their respective banks and they were provided with the options of yes, no and dont know. Thus the following results were observed:

Graph 4.4 As seen from the Graph 4.4 provided above it could be observed that majority of the respondents that is 96% have been of the view that global recession does have an impact on their particular banks whereas 3% have given their response as dont know. The remaining 1% has given a

negative response to this particular question. In the light of the discussion provided with the help of this particular question it could be argued that it seems that those giving a positive response that global recession does affect their banks have been linked with the banks for a longer period whereas those providing the response in minority as no and dont know seem to be newly linked with their respective banks either with the job designation of the internee or recently employed students. When the respondents were asked to provide some examples as an impact of global recession in the year of 2008 which has affected their particular banks, majority of the respondents have been of the view that the most critical impact which hit their banks had been the shutdown of several bank branches. That is as a result of the global recession of 2008 the bank branches have to be closed in order to minimize the severity and the impact of global recession hitting the bank industry. Some of the respondents have also been of the view that with global recession there was an increase in the mortgage defaulters along with the mortgage securities loss. The banks also suffered huge loss in the form of losing the investors worldwide. Lending had also been terminated as a result of the recession. These respondents were also asked to give their opinion on the impact of the magnitude of the global recession affecting the banking industry in the year of 2008 and they were provided with the options ranging from very serious to less serious and the following results had been obtained: 4.5 Ranking the impact of 2008 global recession on respective bank

How can you rank impact of 2008 global recession on your bank? Frequency Percent Valid Very Serious Moderately serious Serious less serious Total 23 31 22 24 100 23.0 31.0 22.0 24.0 100.0 Valid Percent 23.0 31.0 22.0 24.0 100.0 Cumulative Percent 23.0 54.0 76.0 100.0

Table 4.5 As seen from the table 4.5 that has been provided above 23% of the respondents have given their response as very serious, 31% have given their response as moderately serious, 22% have given their response as serious whereas the remaining 24% have given their response as less serious. Thus it could be argued that majority of the respondents have been of the view that the impact of the global recession of 2008 had been moderately serious on their respective banks. The respondents belonging to this particular research study were also asked to rate the performance of their banks prior to the global recession which hit the economy in the year of 2008 and they were provided with the options like good, very good and excellent. Thus following results were obtained:

4.6

Bank performance before GER

Bank performance before GER

Series1

57% 32% 11% Excellent Very Good Good

Graph 4.6 It could be observed from the Graph 4.6 provided above that 57% of the respondents in majority have rated the performance of their respective banks prior to the global recession as excellent. It means that the banks were performing smoothly and efficiently before the global recession of 2008. 32% of the respondents have rated their bank performance as good whereas 11% have rated their bank performance as only good. It means that banking industry was in a better shape before the period of the global recession.

4.7

The Expectation that Economic Recession occur again

The respondents participating in this particular research study were also asked to provide their opinion on whether they expect a similar recession of 2008 in the future and they were provided with the options of yes and no. The following results were obtained:

Can you expect Recession to occur again

No 19%

Yes 81%

Graph 4.7 As seen from the Graph 4.7 provided above 81% of the respondents have given a positive response which means that they are of the view that a similar recession is likely to hit the banking industry whereas 19% have given a negative response depicting their confidence in favour of the strength of the banking industry. The respondents were asked about the strategies implemented by their banks in order to minimize the impact of the global recession of 2008 on short term basis and majority had been of the view that sale of the assets to the government which had been mortgage related helped in financing. Some had given a response that lending money had been adopted as the strategy from the central government.

4.8

Appropriate measures to handle this recession in future

The respondents were also asked their opinion about the measures taken by their respective banks in order to avoid the recession of a similar nature in future and they were provided the options like yes, no and dont know. The following results were obtained: Has your bank devised appropriate measures to handle this recession in future? Cumulative Frequency Valid Yes No Don't Know Total 30 64 6 100 Percent 30.0 64.0 6.0 100.0 Valid Percent 30.0 64.0 6.0 100.0 Percent 30.0 94.0 100.0

Table 4.8 As seen from the Table 4.8 provided above that 64% of the majority of the respondents have not been sure of the measure adopted by their respective banks in order to survive a similar recession in future whereas 30% have been confident however only 6% have given their response as d ont know. In the light of the response provided for this particular question it could be argued that banks are expected not to survive a similar recession provided that there are no measures taken by the banks to minimize or survive the harmful impact of the global recession.

CHAPTER 6: CONCLUSION AND RECOMMENDATIONS

The last section of this particular research study provides a conclusion of the overall research. Recommendations have also been provided in this particular section of the research study. The recommendations have been provided keeping in view the research issues and the research objectives.

6.1Conclusion The purpose of this particular research study had been to evaluate the impact of the global economic recession on the banking industry and it could be observed from the findings that there is a very strong and negative impact of the global economic recession on the banking industry. The global economic recession which hit the world economy in the year of 2008 has still left its after affects and the world leading financial institutions are under the harsh impact left behind by the global economic recession of 2008. There was a huge impact on the overall growth in the economy of different nations as a result of the effects of the global recession. The main cause of recession that had been highlighted from the findings provided section appears to be the lack of appropriate measures and strategies adopted by the banks belonging to the banking industry. One of the main reasons of failure of the banking industry was mainly because the banking system works in such a way that all the banks belonging to the banking industry depend on each other and they rely heavily on each other for their strength and weakness. The lending and borrowing within and between the banks is a part of the systematic banking process thus global recession has a huge impact on this particular banking sector working in coordination and cooperation with each other. It could be argued that researchers and analysts have provided their view regarding the strategies adopted by the banking sector which are devised in a manner affecting all the banks negatively.

Thus, there is a need to revamp these strategies in favour of the banks so that all the banks in the world could take advantage of appropriate strategies. These strategies are vital to be developed and implemented in order to minimize the impact of any sort of recession hitting the world economy and especially the banking industry. Thus there is a need to devise and take appropriate measure for minimizing the effect of global recession. It could also be observed from the findings provided in the previous section that the respondents being unaware of the global recession had also been unaware of the cause. They didnt have much knowledge about the issues related to recession prevailing in their particular baking industry. However there had been a majority of the respondents being aware of the global recession and some of these respondents had also been aware of the causes. It could be said that if the employees are unaware of the conditions prevailing in their sector they are likely to increase the level of risk in their particular banks. Such employees are likely to follow the strategies devised by the banks to minimize the impact of global recession. Therefore it could be argued that employees being negligent of their surroundings and the effect of the global recession prevailing in their particular sector are likely to have a negative impact in future on their banks. They might fail to follow the devised tools and techniques as they would be unaware of the significance of the designed strategies. 6.2 Recommendations Providing the employees with appropriate training is the ultimate responsibility of the banks as employees are the most important assets of any organization and there failure would eventually lead to the failure of the entire organization and ultimately the whole industry would be affected. It is also the responsibility of the banking sector to make their employees aware of the issues prevailing in the economy especially those issues which have a huge and negative impact on the banking sector.

As unaware of the issues many employees neglect their particular responsibilities. This information could be provided through the channels of communication and television programmes could be arranged highlighting the serious impact of recession. It is also the prime responsibility of the banking sector to hire the candidates possessing the best skills and abilities in the field of finance, account and banking such that they can meet the demand of work and job description. The banking sector should also devise strategies in a manner which should let the employees to participate in the decision making and giving their opinions to devise the strategies to such issues like for example of the global recession. The strategies should be devised in a manner that should be favourable for the overall banking industry and such that all the banks in the world would be able to follow and adopt the strategies. With the technological advancement the world has become a global village gathering all banks under one roof. The strategies are designed by the authorities in the banking sector however the implementation and following of such strategies is the responsibility of the banks working as financial institutions foe the society. It also comes under the responsibility of the government to provide the general public with appropriate safety measures. It is seen that the citizens investing in the banking sector at a huge rate are likely to play a role in improving the condition of the financial institution. The banks could therefore help the government by contributing in the overall growth of the economy. The governments devise the investment schemes and these serve as the measures and a source of attraction to the general public and they therefore invest in the banking sector.

It could also be recommended that the responsibility is not alone of the banks but also of the people and the government in order to minimize the overall harmful effect of the recession. It could be said if the banks develop appropriate strategies with the cooperation of the government and the public it is likely to minimize a similar recession from hitting the banking industry. The global recession does not only harm the banking industry it effects the overall economy and thus the general public belonging to the nation hit by the effects of the global recession.

Vous aimerez peut-être aussi

- JournalDocument199 pagesJournalVenkat GVPas encore d'évaluation

- Chapter 4Document11 pagesChapter 4Mitchie Boiser GalaboPas encore d'évaluation

- Data Analysis and Interpretation: Q. 1:-Demographic Profile of RespondentsDocument16 pagesData Analysis and Interpretation: Q. 1:-Demographic Profile of RespondentsSai PrintersPas encore d'évaluation

- Data Analysis and Interpretation: Statement 1:-Demographic Profile of RespondentsDocument16 pagesData Analysis and Interpretation: Statement 1:-Demographic Profile of RespondentsRahul VermaPas encore d'évaluation

- Discussion and Conclusion ChapterDocument14 pagesDiscussion and Conclusion ChapterChanakya ResearchPas encore d'évaluation

- Personal Finance Management: Reporter: Huynh Minh Phuong NghiDocument16 pagesPersonal Finance Management: Reporter: Huynh Minh Phuong NghiPhương Nghi HuỳnhPas encore d'évaluation

- Chapter Four Data Analysis and Presentation of FindingsDocument21 pagesChapter Four Data Analysis and Presentation of FindingsRephah KitaviPas encore d'évaluation

- Chapter 4 and 5Document19 pagesChapter 4 and 5nyasha praise mafungaPas encore d'évaluation

- Financial Issues and Millennials’ Partnered Relationships SatisfactionD'EverandFinancial Issues and Millennials’ Partnered Relationships SatisfactionPas encore d'évaluation

- Form EugeneDocument5 pagesForm EugeneAnthony Kwaw Adu-broniPas encore d'évaluation

- Rediet New 1Document11 pagesRediet New 1Reta TolesaPas encore d'évaluation

- Research in International Business and Finance: Canh Phuc Nguyen, Thai-Ha Le, Thanh Dinh Su TDocument19 pagesResearch in International Business and Finance: Canh Phuc Nguyen, Thai-Ha Le, Thanh Dinh Su TMoh Najikhul Fajri GusnansyahPas encore d'évaluation

- Journal of Personal FinanceDocument13 pagesJournal of Personal FinanceHabib SimorangkirPas encore d'évaluation

- RATIONAILEPITCHPROPOSALTREATMENT p973915 Mia Pearce-KingDocument18 pagesRATIONAILEPITCHPROPOSALTREATMENT p973915 Mia Pearce-KingMIAPas encore d'évaluation

- Factors Influencing CEOs of Publicly Traded Companies:: Deviating From Pre-Established Long-Term Strategies in Response to Short-Term ExpectationsD'EverandFactors Influencing CEOs of Publicly Traded Companies:: Deviating From Pre-Established Long-Term Strategies in Response to Short-Term ExpectationsPas encore d'évaluation

- Chapter Four Gau GabaDocument13 pagesChapter Four Gau GabaRaytone Tonnie MainaPas encore d'évaluation

- Assssement of Public RelationsDocument25 pagesAssssement of Public RelationsTilahun MikiasPas encore d'évaluation

- Neretina Et Al Paper Stress TestDocument27 pagesNeretina Et Al Paper Stress TestAbdul MongidPas encore d'évaluation

- Payers & Providers National Edition - Issue of February 2012Document8 pagesPayers & Providers National Edition - Issue of February 2012PayersandProvidersPas encore d'évaluation

- Servicequalityof Canara BankDocument49 pagesServicequalityof Canara BankRichard Lawrence50% (4)

- Dissertation MSC FinanceDocument4 pagesDissertation MSC FinanceBuyingCollegePapersOnlineAnchorage100% (1)

- Chapter Four MudiDocument21 pagesChapter Four MudiRaytone Tonnie MainaPas encore d'évaluation

- Chapter Four IssaDocument13 pagesChapter Four IssaRaytone Tonnie MainaPas encore d'évaluation

- Solutions Manual To Accompany Statistical Reasoning For Everyday Life 3rd Edition 0321286723Document37 pagesSolutions Manual To Accompany Statistical Reasoning For Everyday Life 3rd Edition 0321286723androtomyboationv7fsf100% (13)

- Main ProjectCustomer Preference Towards Titan Watches With Special Reference To Coimbatore CityDocument45 pagesMain ProjectCustomer Preference Towards Titan Watches With Special Reference To Coimbatore CityDon Rocker100% (1)

- Cover Pages of Progress ReportDocument21 pagesCover Pages of Progress ReportRiyal AnkiiPas encore d'évaluation

- (Q2) DraftDocument7 pages(Q2) DraftDuhreen Kate CastroPas encore d'évaluation

- A Study On GH Stress Among Employees Working in BPOs With Special Reference To CoimbatoreDocument18 pagesA Study On GH Stress Among Employees Working in BPOs With Special Reference To CoimbatorearunsanskritiPas encore d'évaluation

- Tomorrow's Investor - Final Pension Survey ResultsDocument6 pagesTomorrow's Investor - Final Pension Survey ResultsThe RSAPas encore d'évaluation

- Yes 60 75% No 20 25%: Respondent Awareness Towards Depository SystemDocument12 pagesYes 60 75% No 20 25%: Respondent Awareness Towards Depository SystemSaloni SharmaPas encore d'évaluation

- Mit 14.73 Essay 3Document5 pagesMit 14.73 Essay 3Emira IbrahimovićPas encore d'évaluation

- Chapter 6Document41 pagesChapter 6Rosidah MusaPas encore d'évaluation

- The Impact of Sukuk On The Insolvency Risk of Conventional and Islamic BanksDocument5 pagesThe Impact of Sukuk On The Insolvency Risk of Conventional and Islamic BanksAlinaasirPas encore d'évaluation

- Research Brief On "The Causes of The High Rate of Drop-Out Amongst Micro-Finance Borrowers"Document12 pagesResearch Brief On "The Causes of The High Rate of Drop-Out Amongst Micro-Finance Borrowers"Momal KhawajaPas encore d'évaluation

- Chapter 4Document21 pagesChapter 4ADEKUNLE MARIOPas encore d'évaluation

- Eng 105 NNRDocument25 pagesEng 105 NNRSunnyPas encore d'évaluation

- Job Satisfaction of Bank Employees after a Merger & AcquisitionD'EverandJob Satisfaction of Bank Employees after a Merger & AcquisitionPas encore d'évaluation

- RMDocument38 pagesRMDDZPas encore d'évaluation

- Wis4.1 ProposalDocument13 pagesWis4.1 ProposalZVIKOMBOREROPas encore d'évaluation

- Reshma Edited ProjectDocument9 pagesReshma Edited ProjectRESHMA RAJUPas encore d'évaluation

- 3-The Benefit of Mental Wellness and How Can We Promote It As Allied Health Students - Narrative Report PDFDocument17 pages3-The Benefit of Mental Wellness and How Can We Promote It As Allied Health Students - Narrative Report PDFOpinyon OpinionPas encore d'évaluation

- Concept TestingDocument8 pagesConcept TestingMuhd EizadPas encore d'évaluation

- SSRN Id2191606Document54 pagesSSRN Id2191606ebdscholarship2023Pas encore d'évaluation

- The Impact of Mortgage and Real Estate Finance Crisis On The United States EconomyDocument7 pagesThe Impact of Mortgage and Real Estate Finance Crisis On The United States EconomyRedlam Chitty Narain RaoPas encore d'évaluation

- Financial Close Benchmark ReportDocument26 pagesFinancial Close Benchmark ReportNam Duy VuPas encore d'évaluation

- Chapter Four GabaDocument14 pagesChapter Four GabaRaytone Tonnie MainaPas encore d'évaluation

- Online MarketingDocument18 pagesOnline MarketingManoranjan BisoyiPas encore d'évaluation

- PDFDocument5 pagesPDFBiniyam YitbarekPas encore d'évaluation

- Statistical Analysis of 2007 Call For Proposals in The Public Health ProgrammeDocument7 pagesStatistical Analysis of 2007 Call For Proposals in The Public Health ProgrammeDana ArtenePas encore d'évaluation

- 8 42720 JMTT - UnairDocument17 pages8 42720 JMTT - UnairMAURINE VALLENTEPas encore d'évaluation

- An Empirical Study On How Financial Literacy Contributes To Preparation For RetirementDocument47 pagesAn Empirical Study On How Financial Literacy Contributes To Preparation For RetirementDracule MihawkPas encore d'évaluation

- Chapter 4 DraftDocument29 pagesChapter 4 DraftMatthew DizonPas encore d'évaluation

- Topic: A Study On The Consumers Perception Towards Combo Offers Provided by Banks in Jallandhar RegionDocument31 pagesTopic: A Study On The Consumers Perception Towards Combo Offers Provided by Banks in Jallandhar Regionoureducation.inPas encore d'évaluation

- Chapter 4: Data Analysis and Interpretation: 4.1operational Definitions of Concepts Used in Research StudyDocument63 pagesChapter 4: Data Analysis and Interpretation: 4.1operational Definitions of Concepts Used in Research StudyMeenakshiPas encore d'évaluation

- ECO172Document12 pagesECO172Anonymous oXZZWHmDDCPas encore d'évaluation

- ADB Perceptions Survey: Multinational Survey of Stakeholders 2009D'EverandADB Perceptions Survey: Multinational Survey of Stakeholders 2009Pas encore d'évaluation

- Violence Against Women and Girls: Effectiveness of Intervention Programs: Gender Equality, #3D'EverandViolence Against Women and Girls: Effectiveness of Intervention Programs: Gender Equality, #3Pas encore d'évaluation

- Vidya ProjectDocument29 pagesVidya Projectyathsih24885Pas encore d'évaluation

- Payers & Providers National Edition - Issue of June 2012Document8 pagesPayers & Providers National Edition - Issue of June 2012PayersandProvidersPas encore d'évaluation

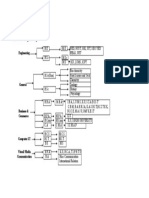

- Frequencies: Frequencies Variables Gender Ethnic /barchart Freq /order AnalysisDocument22 pagesFrequencies: Frequencies Variables Gender Ethnic /barchart Freq /order AnalysisRussell MonroePas encore d'évaluation

- Future Pathway2Document1 pageFuture Pathway2Russell MonroePas encore d'évaluation

- Future Pathway3Document1 pageFuture Pathway3Russell MonroePas encore d'évaluation

- Future Pathway: H.SC Pre-MedicalDocument1 pageFuture Pathway: H.SC Pre-MedicalRussell MonroePas encore d'évaluation

- OutputDocument2 pagesOutputYudi GinanjarPas encore d'évaluation

- Our History: Innovation. Together With Our Franchisees We Will Ignite Our Customers' Passion For TheDocument6 pagesOur History: Innovation. Together With Our Franchisees We Will Ignite Our Customers' Passion For TheRussell MonroePas encore d'évaluation

- Frequencies: Frequencies Variables Gender Ethnic /barchart Freq /order AnalysisDocument22 pagesFrequencies: Frequencies Variables Gender Ethnic /barchart Freq /order AnalysisRussell MonroePas encore d'évaluation

- Green Marketing - A Case Study of British AirwaysDocument82 pagesGreen Marketing - A Case Study of British AirwaysNogara CivPas encore d'évaluation

- Link Between Motivational Theory and Reward Business EssayDocument4 pagesLink Between Motivational Theory and Reward Business EssayRussell MonroePas encore d'évaluation

- Byaszx: The - Marketing - Process - Final-Set - 1.docx (37.63K)Document14 pagesByaszx: The - Marketing - Process - Final-Set - 1.docx (37.63K)Russell MonroePas encore d'évaluation

- CMET MBA S3 SM Assignment Feb-May 2015Document8 pagesCMET MBA S3 SM Assignment Feb-May 2015Russell MonroePas encore d'évaluation

- Barrier How To Overcome ItDocument1 pageBarrier How To Overcome ItRussell MonroePas encore d'évaluation

- What He FoundDocument5 pagesWhat He FoundRussell MonroePas encore d'évaluation

- Spss 16 ReadmeDocument20 pagesSpss 16 ReadmeAisamuddin MhPas encore d'évaluation

- PP 1Document11 pagesPP 1Russell MonroePas encore d'évaluation

- Writer Inserts Short Title of Paper: Customer Inserts His/Her NameDocument1 pageWriter Inserts Short Title of Paper: Customer Inserts His/Her NamedooymaxPas encore d'évaluation

- Disser Tai On Feedback SuDocument2 pagesDisser Tai On Feedback SuRussell MonroePas encore d'évaluation

- PP 1Document11 pagesPP 1Russell MonroePas encore d'évaluation

- Organization and Update of SchedulesDocument3 pagesOrganization and Update of SchedulesRussell MonroePas encore d'évaluation

- Spss 16 ReadmeDocument20 pagesSpss 16 ReadmeAisamuddin MhPas encore d'évaluation

- Task 2Document6 pagesTask 2Russell MonroePas encore d'évaluation

- Doc1 PhotoDocument1 pageDoc1 PhotoRussell MonroePas encore d'évaluation

- 1.0. Problem Statement: Corporate GovernanceDocument5 pages1.0. Problem Statement: Corporate GovernanceRussell MonroePas encore d'évaluation

- Assignment - Managing Organizational Change: Adrian Keys Post A Comment ShareDocument7 pagesAssignment - Managing Organizational Change: Adrian Keys Post A Comment ShareRussell MonroePas encore d'évaluation

- Case StudyDocument3 pagesCase StudyRussell MonroePas encore d'évaluation

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- IntroductionDocument12 pagesIntroductionRussell MonroePas encore d'évaluation

- DemoDocument378 pagesDemocamus__Pas encore d'évaluation

- 6.1 Consumer Behaviour 6.1.1 AttitudesDocument7 pages6.1 Consumer Behaviour 6.1.1 AttitudesRussell MonroePas encore d'évaluation

- Green Marketing - A Case Study of British AirwaysDocument82 pagesGreen Marketing - A Case Study of British AirwaysNogara CivPas encore d'évaluation

- Sksu Thesis Template AnnotatedDocument49 pagesSksu Thesis Template AnnotatedMharco Devera Dela Vega100% (1)

- Caribbean Studies Internal AssessmentDocument29 pagesCaribbean Studies Internal AssessmentJoelPas encore d'évaluation

- Module 7 Research PDFDocument8 pagesModule 7 Research PDFGirlie Castillo JimenezPas encore d'évaluation

- Ananya Assignment InternshipDocument59 pagesAnanya Assignment Internshipravi singhPas encore d'évaluation

- Rin ProjectDocument75 pagesRin ProjectAtarah NancyPas encore d'évaluation

- Bob Niemeyer QuestionnaireDocument5 pagesBob Niemeyer QuestionnaireStatesman JournalPas encore d'évaluation

- Research ProposalDocument18 pagesResearch ProposalNayomi Ekanayake100% (2)

- ICT Chapter 7Document58 pagesICT Chapter 7Aya ChoucairPas encore d'évaluation

- 7 P's of Marketing in ManufacturingDocument86 pages7 P's of Marketing in ManufacturingDeepak Haldia0% (1)

- MGT 524 - Part I - Fall 2011Document47 pagesMGT 524 - Part I - Fall 2011Osama HassanPas encore d'évaluation

- Research Paper? PDFDocument15 pagesResearch Paper? PDFChriscia Myle Rosales GegantoPas encore d'évaluation

- Practices and Challenges of Halal Restaurants in Metro Manila Lzc42Document14 pagesPractices and Challenges of Halal Restaurants in Metro Manila Lzc42Joyce TanPas encore d'évaluation

- Thrsis MdalityDocument14 pagesThrsis MdalityJayleneeePas encore d'évaluation

- Questionnaire MKTG ResearchDocument5 pagesQuestionnaire MKTG ResearchYun LauPas encore d'évaluation

- Chapter IIIDocument3 pagesChapter IIIrenan georgePas encore d'évaluation

- NCERT Class 12 Geography PracticalDocument108 pagesNCERT Class 12 Geography PracticalSudeep RanjanPas encore d'évaluation

- Motivation in Mathematics LearningDocument8 pagesMotivation in Mathematics LearningNormi Anne TuazonPas encore d'évaluation

- P V Persona Vietnam Al Facto M Natio Ors and Onal Un D Facult Niversity Tyjobs Y - Ho Satisfac Chi Mi Ction in Inh Cit N TyDocument14 pagesP V Persona Vietnam Al Facto M Natio Ors and Onal Un D Facult Niversity Tyjobs Y - Ho Satisfac Chi Mi Ction in Inh Cit N TyHLU Khoa tiếng Anh pháp lýPas encore d'évaluation

- Resarch InstrumentsDocument4 pagesResarch InstrumentsMarian de GuzmanPas encore d'évaluation

- Violence in Cartoons: The Effect of Media On Children: Alswaeer. MDocument29 pagesViolence in Cartoons: The Effect of Media On Children: Alswaeer. MMaryan AlSwaeerPas encore d'évaluation

- Survey Methods PDFDocument4 pagesSurvey Methods PDFSiva Venkata RamanaPas encore d'évaluation

- How Professional Ethics Impact Construction Quality - Abdul-Rahman Et AlDocument8 pagesHow Professional Ethics Impact Construction Quality - Abdul-Rahman Et AlJeeshan IlahiPas encore d'évaluation

- Stiff Picks Baking Needs Questionnaires Bres 301Document7 pagesStiff Picks Baking Needs Questionnaires Bres 301Tatine AvelinoPas encore d'évaluation

- PartnershipDocument195 pagesPartnershipSHAIMER CINTO100% (1)

- Factors Influencing The Early Alcohol Consumption of Teenagers in Barangay Bariquir, Naguilian, La UnionDocument18 pagesFactors Influencing The Early Alcohol Consumption of Teenagers in Barangay Bariquir, Naguilian, La UnionDonna RillortaPas encore d'évaluation

- A Study On Customer Satisfaction at Bajaj Auto LTD: Swadin Kumar MohanthyDocument9 pagesA Study On Customer Satisfaction at Bajaj Auto LTD: Swadin Kumar MohanthyAbhishek DhimanPas encore d'évaluation

- Research ProposalDocument13 pagesResearch ProposalPagla Howa100% (1)

- Sta 2100 Notes PDFDocument73 pagesSta 2100 Notes PDFBakari HamisiPas encore d'évaluation

- Chapter 3Document1 pageChapter 3Maria Del Cielo PahinagPas encore d'évaluation

- Method of Collecting DataDocument6 pagesMethod of Collecting DatazeliaPas encore d'évaluation