Académique Documents

Professionnel Documents

Culture Documents

Monetary Economy

Transféré par

Michael NyaongoCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Monetary Economy

Transféré par

Michael NyaongoDroits d'auteur :

Formats disponibles

MOSHI UNIVERSITY COLLEGE OF CO-OPERATIVE ABD BUSINESS STUDIES (MUCCOBS). THE CONSTITUENT COLLEGE OF SOKOINE UNIVERSITY OF AGRICULTURE.

FACULTY OF CO-OPERATIVE AND COMMUNITY DEVELOPMENT DEPARTMENT OF ECONOMICS AND STATISTICS

QUESTION Discuss the economic importance of money in the modern economies.

Qn. Discuss the economic importance of money in the modern economies. Ans Guidelines I. Introduction i. ii. iii. II. Meaning of monetary economics Economy during barter trade system and its limitations. Characteristics of monetary economy

Nature of money in Modern economy. i. ii. iii. What is money Types of money Functions of money

III. IV.

Importance of money in the modern economies Conclusion

I.

Introduction

Monetary economics is concerned with the effects of monetary institutions and policy actions on economic variables that are of importance to individuals and organizations. Such variables are commodity prices, wages, interest rates, and quantities of employment, consumption and production (McCallum, B). It is a branch of economics that historically prefigured and remains integrally linked to macroeconomics. It provides a framework for analyzing money as a medium of exchange, store of value and unit of account. In modern economy, items that people consider valuable are transferred through contractual arrangements, and thus real and real liabilities have monetary counterparts that can be ultimately settled only by delivery to a monetary claim on the sovereign state. This substantially differs from an economy where people give and receive real values either with no direct well-defined counterpart or with a collective system of real settlement- barter trade (Tobin, J). Pre-modern Monetary Economy The pre-modern monetary economy, that is, economy before the introduction of money as a medium of exchange and trade, was purely barter economy. Before the invention of modern money, it was possible for an economy to function without money. This was the Barter system economy. Barter systems were used for thousands of years. Barter trade is the direct exchange of goods and services for other goods and services. In pure barter economies, an individual who wishes to obtain goods and services must search for a second individual who is willing to provide those goods and services in exchange for goods and services that the first individual happens to be able to provide. That is, there must be what William Stanley Jevons (1835-1882) called a double coincidence of wants. Two individuals must, by coincidence, own, and desire to trade, matching goods and services (McCallum, B).

A pure barter economy has several shortcomings. Firstly, absence of a method of storing

generalized purchasing power. With money, individuals and businesses have a store of

generalized purchasing power (as opposed to specific purchasing power in the form of, say, shoes, pots, pans, and so on). Barter provides only a specific store of purchasing power. It allows individuals to store only specific goods, which may decrease in value due to physical deterioration or a change in tastes. Secondly, absence of a common unit of measure and

value. Under a barter system, we must express the price of every good or service in terms of

every other good and service. Barter therefore leads to the absence of a standardized way to state the prices of commodities. Thirdly, absence of a designated unit to use in writing

contracts requiring future payments. Many contracts deal with future activities and future

exchanges. In a barter system, it is difficult to write contracts for future payments in a unit that is readily acceptable to both parties. It is still possible to make such contracts for the future payment of goods or services, but the market value of those agreed-upon goods or services may change drastically by the time the future payment is due. Fourthly, problem of double Coincidence of Wants. Under barter system, a double coincidence of wants is required for exchange. In other words, the wants of the two persons who desire to exchange goods must coincide. For example, if person A wants to acquire shoes in exchange for wheat, then he must find another person who wants wheat for shoes. Such a double coincidence of wants involves great difficulty and wastage of time in a modern society, it rarely occurs. In the absence of a double coincidence of wants, the individuals under barter system are compelled either to hold goods for long periods of time, or to make numerous intermediary exchange' in order to get finally the goods of their choice. Fifth, Lack of divisibility. Another difficulty of barter system relates to the fact that all goods cannot be divided and subdivided. In the absence of a common medium of exchange, a problem arises, when a big indivisible commodity is to be exchanged for a smaller commodity. For example, if the price of a horse is equal to 10 shirts, then a person having one shirt cannot exchange it for the horse because it is not possible to divide the horse in small pieces without destroying its utility. Sixth, problem of portability was another difficulty of barter system in that, goods and services cannot be transported conveniently from one place to 4

another. For example, it is not easy and without risk for an individual to take heaps of wheat or herd of cattle to a distant market to exchange them for other goods. With the use of money, the inconveniences or risks of transportation are removed (Menger, K). In contrast, monetary economy later was introduced following the shortcomings of the barter economy. A monetary economy, as distinguished from a barter economy has the following characteristics:

1. Use of Money:

Unlike the barter economy in which no money exists, a monetary economy employs money to perform the following function: (a) Money is generally accepted as a medium of exchange, (b) All payments are made in terms of money, (c) Money serves as a unit of account or a numeraire, or a measure of value, (d) Money functions as a standard of deferred payments, (e) Money facilitates the transfer of value from one place to the other. 2. Money as an Asset: In a monetary economy, individuals also use money as an asset. Like other assets, wealth can be stored in the form of money. Money is considered as an asset because it is a permanent abode of purchasing power, i.e., it is a claim against all goods and services which an individual desires to have. In the barter economy, on the other hand, wealth is stored only in the form of physical goods. 3 Greater Liquidity:

Monetary economy has greater liquidity than the barter economy has. Money is the most liquid asset and is used as a link between the present and the future in a monetary economy. Such a link is absent in a barter economy. 4. Existence of Financial Institutions: Unlike the barter system, various financial institutions, such as central bank, commercial banks and other financial institutions exist in a monetary economy. These institutions deal with a variety of non-cash financial assets or near-money assets such as bills of 5

exchange, bonds, shares, etc. There exists a money market dealing with short-term credit and a capital market dealing with long-term credit. Thus, in a monetary economy, besides money (i.e., currency and coins), a number of near-money assets are also created and widely used. 5. Efficient Exchange System: As compared to the barter system, exchange activities are performed more efficiently and more conveniently in a monetary economy where money is used as a medium of exchange. All the difficulties and inconveniences of barter system, such as the problem of double coincidence of wants, the problem of divisibility, the problem of storing wealth, the problem of common measure, the problem of deferred payments, the problem of transportation, etc., are eliminated in a monetary economy.

I.

Nature of money in modern economy.

Money can be described as a token or a payment option which is used in our society to settle debts and to pay for the services and commodities which are provided to us. Money refers to any commodity which functions as medium of exchange or the settlement of a debt. In a modern economy bank notes and coins clearly form part of the money supply as they are acceptable in the settlement of all transactions. Moreover some transactions are settled by cheques drawn on bank deposits in current accounts (also known as sight or demand deposits). Thus current account deposits also form part of money supply. Deposits accounts with banks and other financial institutions are also included in the supply of money. Money can also be conceived in terms of narrow money and broad money. Narrow money refers to money balances easily available to finance day to day transactions. In other words it considers the medium of exchange function of money. Broad money refers to money held both for transactions purposes and as a form of saving. It also considers assets which can be easily converted into cash. Therefore the broad money version of money considers both the medium of exchange and store of value function of money.

Types of money There are several kinds of money varying in liability and strength. The society has modified the money at different times and in this way several types of money are introduced. When there was ample availability of metals, metal money came into existence later it was substituted by the paper money. At different times, several commodities were used as the medium of exchange. So, it can be said that according to the needs and availability of means, the kinds of money has changed. McCallun (1989) stresses on the commodity money and fiat money. He argues that a commodity-money system is one in which the medium of exchange (and medium of account) is a good that would be valuable even if it were not used as money. Such a system may be put in place by government decree or may arise naturally as the outcome of evolutionary experiments by private citizens and organizations. The government may or may not coin the designated material and mayor may not discourage the use of other potential media of exchange. The value of this kind of money comes from the value of resource used for the purpose. It is only limited by the scarcity of the resources. Value of this kind of money involves the parties associated with the exchange process. These monies have intrinsic value. Under a fiat-money system, by contrast, the circulating medium is paper or some such material that has extremely low costs of production and very low value in nonmonetary uses. Fiat currency is the kind of money which doesnt have any intrinsic value and it can't be converted into valuable resource. The value of fiat money is determined by government order which makes it a legal instrument for all transaction purposes. The fiat money need to be controlled as it may affect entire economy of a country if it is misused. The real value of fiat money is determined by the market forces of demand and supply. Representative money is another type of money. It represents a claim on commodity and it can be redeemed for that commodity at a bank. It is a token or paper money that can be exchanged for a fixed quantity of commodity. Its value depends on the commodity it backs.

Functions of money Various functions of money can be classified into two broad groups (Graham, F.D): (a) Primary functions, which include the medium of exchange and the measure of value; (b) Secondary functions which include standard of deferred payments, store of value and transfer of value These functions have been explained below: 1. Medium of Exchange: The most important function of money is to serve as a medium of exchange or as a means of payment. To be a successful medium of exchange, money must be commonly accepted by people in exchange for goods and services. While functioning as a medium of exchange, money benefits the society in a number of ways: (a) It overcomes the inconvenience of baiter system (i.e., the need for double coincidence of wants) by splitting the act of barter into two acts of exchange, i.e., sales and purchases through money. (b) It promotes transactional efficiency in exchange by facilitating the multiple exchange of goods and services with minimum effort and time, (c) It promotes allocation efficiency by facilitating specialization in production and trade, (d) It allows freedom of choice in the sense that a person can use his money to buy the things he wants most, from the people who offer the best bargain and at a time he considers the most advantageous. 2. Measure of Value: Money serves as a common measure of value in terms of which the value of all goods and services is measured and expressed. By acting as a common denominator or numeraire, money has provided a language of economic communication. It has made transactions easy and simplified the problem of measuring and comparing the prices of goods and services in the market. Prices are but values expressed in terms of money. Money also acts as a unit of account. As a unit of account, it helps in developing an efficient accounting system because the values of a variety of goods and 8

services which are physically measured in different units (e.g, quintals, metres, litres, etc.) can be added up. This makes possible the comparisons of various kinds, both over time and across regions. It provides a basis for keeping accounts, estimating national income, cost of a project, sale proceeds, profit and loss of a firm, etc. 3. Standard of Deferred Payments: When money is generally accepted as a medium of exchange and a unit of value, it naturally becomes the unit in terms of which deferred or future payments are stated. Thus, money not only helps current transactions though functions as a medium of exchange, but facilitates credit transaction (i.e., exchanging present goods on credit) through its function as a standard of deferred payments. But, to become a satisfactory standard of deferred payments, money must maintain a constant value through time; if its value increases through time (i.e., during the period of falling price level), it will benefit the creditors at the cost of debtors; if its value falls (i.e., during the period of rising price level), it will benefit the debtors at the cost of creditors. 4. Store of Value: Money, being a unit of value and a generally acceptable means of payment, provides a liquid store of value because it is so easy to spend and so easy to store. By acting as a store of value, money provides security to the individuals to meet unpredictable emergencies and to pay debts that are fixed in terms of money. It also provides assurance that attractive future buying opportunities can be exploited. Money as a liquid store of value facilitates its possessor to purchase any other asset at any time. It was Keynes who first fully realized the liquid store value of money function and regarded money as a link between the present and the future. This, however, does not mean that money is the most satisfactory liquid store of value. To become a satisfactory store of value, money must have a stable value. 5. Transfer of Value: Money also functions as a means of transferring value. Through money, value can be easily and quickly transferred from one place to another because money is acceptable everywhere and to all. II. Importance of money in the modern economy The modem economists fully recognize the economic role of money as a medium of exchange and standard of value. They regard it as an economic catalyst. They emphasize that in modern ( both command, free market and mixed) economy, money exercises a decisive influence on the volume of production, distribution of wealth and 9

income, direction and volume of exchange and on the rate of saving and investment in the country. In a capitalistic economy, money is the pivot around which all economic activities cluster. Money is an indicator as well as a surveyor of wealth. The role of money in the modern economy can be seen in the areas explained below: 1. Production Decisions. Production has been greatly facilitated by the introduction of money. Money makes possible the accumulation of wealth in those hands which are able to organize the production. Production without the use of money cannot be organized on a large scale and run efficiently and economically. The decision of what, where, when and how much to produce are all guided by the amount of money offered in exchange of goods and service. The cost of production is also estimated in terms of money. The profit or loss which is the difference between the sales proceeds and the total money cost is also expressed in terms of money. With the introduction of money, the consumption can be easily postponed and the assets can be stored for use to a future date. 2. Exchange Transactions: In a moneyless economy, exchange of goods was a very inconvenient process. People used to face the difficulties of double coincidence of wants. There was also no common measure of value. The use of money has successfully removed the awkwardness of barter. Money, by acting as a medium of exchange, has greatly stimulated the exchange of goods. It splits up exchange process into two parts, sale and purchase and thus facilitates flow of goods and services from producers to consumers. 3. Distribution of National Income: Money facilitates the division of national income between people. Total output of the country is jointly produced by a number of people as workers, land owners, capitalists, and entrepreneurs, and, in turn, will have to be distributed among them. Money helps in the distribution of national product through the system of wage, rent, interest and profit. 4. Importance in the field of public finance: - Money performs a valuable service in the field of public finance. Public Finance in recent times aims at increasing the rate of economic activities and reducing inequalities of income. It also acts as an instrument of economic and social justice in a country. Money helps the state in the achievement of these objectives. The government can easily increase the revenue through the medium of money and can spend it for the betterment of the society.

10

5. Attainment of High Level of Production and Employment: The introduction of money in the economy has facilitated exchange. It has led to high degree of specialization and interdependence of economic units; if the money is properly managed, it ensures rising level of productions employment and real income in the country. In case, money is not properly handled, it leads to decline in the prices, output and job opportunities. 6. Maximization of Satisfaction: Money helps consumers and producers to maximize their benefits. A consumer maximizes his satisfaction by equating the prices of each commodity (expressed in terms of money) with its marginal utility. Similarly, a producer maximizes his profit by equating the marginal productivity of a factor unit to its price. 7. Basis of Credit System: Credit plays an important role in the modern economic system and money constitutes the basis of credit. People deposit their money (saving) in the banks and on the basis of these deposits, the banks create credit. Ingham (2000; 2004) stresses that another key element of the role that money plays in capitalism is some sort of mechanism for credit creation, what he calls capitalist credit money. According to Ingham, this creation of credit-money by lending in the form of issued notes and bills, which exist independently of any particular level of incoming deposits. We know it very well that money serves as standard of deferred payments. The general confidence in the purchasing power of money makes it the chief farm of credit. The debtor can safely borrow money for consumption or for production purposes. This has led to the building up of a gigantic superstructure of banking and credit system. 8. Liquidity to Wealth: Money imparts liquidity to various forms of wealth. When a person holds wealth in the form of money, he makes it liquid. In fact, all forms of wealth (e.g., land, machinery, stocks, stores, etc.) can be converted into money.

Conclusion

From the above explanations, money plays an essential role in the genesis and subsistence of modern economy. The entire structure of the economy would collapse if you withdraw money. If all the money suddenly disappears from the economy the wheels of economy would halt.

11

Reference Ingham, G (2000). Babylonian Madness. In What Is Money? ed. J. Smithin (ed.),1641. London: Routledge Ingham, G (2004). The Nature of Money. Cambridge: Polity Press. Menger, K. (1892). On the Origins of Money. Economic Journal 2, no. 6:239255.

12

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Reproduction in PlantsDocument28 pagesReproduction in PlantsMichael NyaongoPas encore d'évaluation

- RESPIRATION PROCESS and ShuttleDocument10 pagesRESPIRATION PROCESS and ShuttleMichael NyaongoPas encore d'évaluation

- Fetal Developmental QuestionDocument5 pagesFetal Developmental QuestionMichael NyaongoPas encore d'évaluation

- Efficiency of ATP ProductionDocument10 pagesEfficiency of ATP ProductionMichael NyaongoPas encore d'évaluation

- Water 1Document9 pagesWater 1Michael NyaongoPas encore d'évaluation

- Reproductive SystemDocument14 pagesReproductive SystemMichael NyaongoPas encore d'évaluation

- Schedule of Cost of Goods ManufacturedDocument7 pagesSchedule of Cost of Goods ManufacturedMichael NyaongoPas encore d'évaluation

- Sub-Topic Digestion in Mammals: by Michael O. Nyaongo (BSC - Ed, MD)Document92 pagesSub-Topic Digestion in Mammals: by Michael O. Nyaongo (BSC - Ed, MD)Michael NyaongoPas encore d'évaluation

- The Small IntestineDocument16 pagesThe Small IntestineMichael NyaongoPas encore d'évaluation

- Introduction To LiteratureDocument28 pagesIntroduction To LiteratureMichael Nyaongo100% (1)

- Regulation of DigestionDocument11 pagesRegulation of DigestionMichael NyaongoPas encore d'évaluation

- A Practical Guide To Clinical MedicineDocument11 pagesA Practical Guide To Clinical MedicineMichael NyaongoPas encore d'évaluation

- Consulting ProcessDocument7 pagesConsulting ProcessMichael NyaongoPas encore d'évaluation

- What Is GlobalizationDocument9 pagesWhat Is GlobalizationMichael NyaongoPas encore d'évaluation

- Introduction To Internal Reconstruction of CompaniesDocument17 pagesIntroduction To Internal Reconstruction of CompaniesMichael NyaongoPas encore d'évaluation

- Importance of SACCOS in TanzaniaDocument16 pagesImportance of SACCOS in TanzaniaMichael Nyaongo75% (4)

- ConsultancyDocument6 pagesConsultancyMichael NyaongoPas encore d'évaluation

- Research QuestionsDocument13 pagesResearch QuestionsMichael NyaongoPas encore d'évaluation

- Research QuestionsDocument13 pagesResearch QuestionsMichael NyaongoPas encore d'évaluation

- Good Governance in CooperativesDocument7 pagesGood Governance in CooperativesMichael Nyaongo100% (3)

- Cooperatives Perspectives in TanzaniaDocument10 pagesCooperatives Perspectives in TanzaniaMichael NyaongoPas encore d'évaluation

- Antenatal Care in TanzaniaDocument32 pagesAntenatal Care in TanzaniaMichael NyaongoPas encore d'évaluation

- Barter SystemDocument20 pagesBarter SystemMichael NyaongoPas encore d'évaluation

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Khushboo Kukreja Front PageDocument4 pagesKhushboo Kukreja Front Pagejassi7nishadPas encore d'évaluation

- SAP SD Interview Questions: Rajendra BabuDocument4 pagesSAP SD Interview Questions: Rajendra Babusyed hyder ALIPas encore d'évaluation

- Multinational Accounting: Issues in Financial Reporting and Translation of Foreign Entity StatementsDocument36 pagesMultinational Accounting: Issues in Financial Reporting and Translation of Foreign Entity StatementsahmedPas encore d'évaluation

- Company Profile of Ncell Pvt. Ltd.Document22 pagesCompany Profile of Ncell Pvt. Ltd.Ayush Man Tamrakar100% (1)

- Pharmaceutical Specialty Account Manager in Springfield MA Resume Richard PielaDocument2 pagesPharmaceutical Specialty Account Manager in Springfield MA Resume Richard PielaRichardPielaPas encore d'évaluation

- Business Plan RealDocument16 pagesBusiness Plan RealAjoy JaucianPas encore d'évaluation

- SAP ISR Course ContentDocument1 pageSAP ISR Course ContentSandeep SharmaaPas encore d'évaluation

- The Basic Economic ProblemDocument44 pagesThe Basic Economic Problemmaika bategPas encore d'évaluation

- Stefan CraciunDocument9 pagesStefan CraciunRizzy PopPas encore d'évaluation

- Integrated Review Ii: Advanced Financial Accounting and Reporting Module 3: Special Revenue Recognition I. Installment SalesDocument18 pagesIntegrated Review Ii: Advanced Financial Accounting and Reporting Module 3: Special Revenue Recognition I. Installment SalesDarren Joy CoronaPas encore d'évaluation

- Lessons 1 and 2 Review IBM Coursera TestDocument6 pagesLessons 1 and 2 Review IBM Coursera TestNuePas encore d'évaluation

- CS 214 - Chapter 6: Architectural DesignDocument31 pagesCS 214 - Chapter 6: Architectural DesignAriel Anthony Fernando GaciloPas encore d'évaluation

- EngineDocument2 pagesEngineswoejaPas encore d'évaluation

- Sales SUALOGDocument21 pagesSales SUALOGEynab Perez100% (1)

- Mohan Dixit Case Study - Session - 4Document7 pagesMohan Dixit Case Study - Session - 4people creationPas encore d'évaluation

- Economics and Finance Personal StatementDocument1 pageEconomics and Finance Personal StatementNicolescu AdrianPas encore d'évaluation

- Bcom Final Year ProjectDocument65 pagesBcom Final Year ProjectSHIBIN KURIAKOSE87% (69)

- Xxxxacca Kısa ÖzzetttDocument193 pagesXxxxacca Kısa ÖzzetttkazimkorogluPas encore d'évaluation

- A Study On Customer Preference Towards Heavy Commercial Vehicle-3145 PDFDocument6 pagesA Study On Customer Preference Towards Heavy Commercial Vehicle-3145 PDFAkash DasPas encore d'évaluation

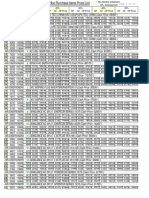

- PriceListHirePurchase Normal6thNov2019Document56 pagesPriceListHirePurchase Normal6thNov2019Jamil AhmedPas encore d'évaluation

- Know Your BSNLDocument96 pagesKnow Your BSNLFarhanAkramPas encore d'évaluation

- Lecture 4-Concrete WorksDocument24 pagesLecture 4-Concrete WorksSyakir SulaimanPas encore d'évaluation

- Rightnow Service Descriptions 1885273 PDFDocument179 pagesRightnow Service Descriptions 1885273 PDFamoussaaPas encore d'évaluation

- Ecoborder Brown L Shaped Landscape Edging (6-Pack) - The Home Depot CanadaDocument4 pagesEcoborder Brown L Shaped Landscape Edging (6-Pack) - The Home Depot Canadaming_zhu10Pas encore d'évaluation

- Six Sigma Black Belt Wk1 Define Amp MeasureDocument451 pagesSix Sigma Black Belt Wk1 Define Amp Measuremajid4uonly100% (1)

- Aileron Market Balance: Issue 19Document6 pagesAileron Market Balance: Issue 19Dan ShyPas encore d'évaluation

- 10 Steps To Starting A Business in Ho Chi Minh CityDocument5 pages10 Steps To Starting A Business in Ho Chi Minh CityRahul PatilPas encore d'évaluation

- Judith Rivera Tarea 2.2 Acco 1050Document4 pagesJudith Rivera Tarea 2.2 Acco 1050Judy RiveraPas encore d'évaluation

- Assignment For CB TechniquesDocument2 pagesAssignment For CB TechniquesRahul TirmalePas encore d'évaluation

- Gri 202 Market Presence 2016Document10 pagesGri 202 Market Presence 2016Pablo MalgesiniPas encore d'évaluation