Académique Documents

Professionnel Documents

Culture Documents

Business - Outlookindia - Repco Home Loans

Transféré par

Venkat Narayan RavuriTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Business - Outlookindia - Repco Home Loans

Transféré par

Venkat Narayan RavuriDroits d'auteur :

Formats disponibles

2/23/2014

business.outlookindia.com | Basant Maheshwari

Markets

MAGAZINE|JAN04,2014

MYBESTPICK

BasantMaheshwari

Founder & CEO, equitydesk is bullish on Tamil Nadu home loan major Repco Home Finance

BASANTMAHESHWARI

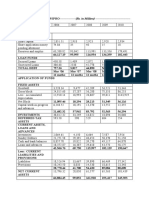

RepcoHome WellcapitalisedTNfocusedhomeloanplayerhasenoughheadroomtogrow CY13return 99% StockpriceRs320 P/B(FY15)2.1X Marketcap Rs1,989cr NetincomeRs406cr NetprofitRs80cr ROE17.06% RoCE13.49% *** Kolkataisdullandboringforinvestors.ThelandofTagoreandTeresadoesnthavemuchtoshow whenitcomestogroomingworldclasscompanies,withtheexceptionofITC,whichhasamarketcap ofRs250,000crore .Happily,though,asafulltimeinvestor,myworktakesmefarandwide togetasenseofthecompaniesinwhichIdecidetoinvest. Companyvisitsformanimportantpartofmyvacationsaswell.Ona holidaytoSikkim,myreturnwasdelayedbyadayandIgottovisitthe

http://business.outlookindia.com/printarticle.aspx?288878

Repco Home operates with very little competition in

1/3

2/23/2014

business.outlookindia.com | Basant Maheshwari

upcomingZydusWellnessfacilitylocatedadjacenttotheTeestariveron thewayfromGangtoktoSiliguri.Thediversionfromthenationalhighway isjustafewkilometres,andthevisitwasthehighlightoftheholiday,for meatleast.MyvisitstoKeralahavealsobeeninterruptedbyastopover atBengaluruforasneakpeekintoPageIndustries,themanufacturerof theJockeybrandofinnerwearandacompanyIhaveheldforthepast fiveyears.Holidayandworkisadeadlycombination,butoneIhave neversucceededinavoiding.

the Rs 515 lakh home loan space, mostly to self employed borrowers

ItwasonatriptoKeralalastyearthatIcameacrossanewsbriefaboutRepcoHomeFinance

Repco sources customers on its own, keeping operating costs low, which helps a branch achieve breakeven in the first year

.Thearticlewasquitebrief,statingacompanyengagedinthe businessofprovidinglowticketmortgageloanshasfileditsprospectus withSebitoraiseuptoRs200crore.Downloadingtheredherring prospectusnowseemedmoreinterestingthancheckingthefamed backwaters.IthencalledRepcosChennaiofficefromthenumberson theprospectus,wherethecompanysecretaryinformedmethatthedate fortheIPOwasundecided.OverthenextfewmonthsIfollowedupwith thecompanyforitsIPO,whichiteventuallydidatacutoffpriceofRs 172.

Repcoseemedapromising investment,giventhestrong tailwindforcompanies cateringtosemiurbanand ruralareas.Theseareas haveseenastrongand steadyincreaseindisposable incomeinrecentyears,led bythefarmloanwaiverof 2008implementationofthe SixthPayCommission NREGAincreaseinpricesof foodsandvegetables,which hastransferredmoneyto semiurbanandruralIndia fromthemetrosandrisein priceoflandandgold,which createsawealtheffectinthe ruralpopulation.Almost64% ofRepcosloanbook originatesinTamilNadu.Itoperateswithverylittlecompetitioninitsspace,sincecompaniessuchas HDFCandLICHousingofferloanswithaminimumticketsizeofRs15lakh,whileShriramandM&M FinanciallookatlessthanRs5lakh,leavingtheRs515lakhmarketforRepco.Notsurprisingly,over thepast10years,thecompanyhasgrownitsloanbookatabove40%andlookssettogrowatan annualisedrateofmorethan30%forthenextfewyearsaswell. However,sinceselfemployedborrowersconstitute54%ofRepcosloanbookandthesecustomers haveerraticincomeflowsunliketheirsalariedcounterparts,thecompanysnonperformingasset (NPA)levelkeepsswingingfromquartertoquarterbeforenormalisingbytheMarchquartereach year.TheseNPAsaretechnicalinnatureas,inspiteofthehighgrowth,theloanlossatRs3.71crore isonly0.08%ofitstotallendingofoverRs4,000crore.Thecompanyhasrecentlycreatedan incentiveschemewherebybranchmanagerswillbeevaluatedbothforlendingaswellasforrecovery. Theideaistocompelemployeesdownthelinetofocusonrecoverybasedonquarterlytimelines. TheseinitiativesshouldhelpstreamlineNPAswings,ashasbeenevidentfromthequarterlyresults.

http://business.outlookindia.com/printarticle.aspx?288878

2/3

2/23/2014

business.outlookindia.com | Basant Maheshwari

Diggingdeeper Idecidedtomeetthemanagementearlierthisyear andshotoffanemailtothecompanyrequestinga meeting.WhenIreachedRepcosofficeinChennai,I wastakenrightawaytoVRaghu,executivedirector. Heknowshisworkandseemstobefocusedonjust onething:makingloansatreasonableratesandthen recoveringitwithinterest.Raghuemphasisedthat growingfastisnotaproblemasthetargetsegment remainslargelyuntapped.Hebuttressedhispointby statingthatTNconstitutes18%ofIndiasmortgage marketandifRepcofocusesonlyonthisstateitis possibletogenerateagrowthof25%to30%forthe nextfiveyearsatleast. WhenaskedaboutthelittleheadwaythatRepcohas madeintootherstates,themanagementsaidthe strategybehindventuringintootherstatesisthat whenTamilNadubecomessaturatedinafewyears, thecompanywouldalreadyhavetheinfrastructure readytoscaleupitsbusinessfromotherareas.K Ashok,thechiefgeneralmanagerandanoldhand, pointedoutthatRepcohadnottakenanyrateincreaseforthepasttwoyearsbecausegrowthwas profitableandthecompanywasmorefocusedondistributionandpenetration. IlatermetRVaradarajan,MD,whoinformedmethatRepcoBank,theparentofRepcoHome, maintainsazeroNPA.Healsoagreedwithmysuggestionofretainingthemoneyinthebusinessand growingitratherthandistributeitasdividends.Repcosourcescustomersonitsown,thuskeeping operatingcostslowat6%andhelpsabranchachievebreakeveninthefirstyearofoperation.The companyintendstoadd12to15branchestoitsexistingnetworkof102brancheswithastresson expandingtwothirdsofthenewonesinnicheoruntappedareas. ItscreditratingwasrecentlyupgradedbyIcratoAA(stable).Thisenhancedratingwillbeusedto diversifyitsliabilitysidebyissuingdebenturesandcommercialpaperandshouldresultinlowering borrowingcostsby25to30basispoints.Thecompanyscostofborrowinghasbeenconstantaround 9.3%,enablingittoenjoyaspreadof34%.ThankstotheIPOfundinfusion,thenetinterestmargin shotupto4.9%inQ2FY14,translatingtoaspreadof3.1%.ThenetNPAforthequarterwasat0.92% andisgettingsmoothenedoutforquarterlyaberrations.Areturnonassetsofaround2.7%without takinganypriceincreaseoverthepasttwoyearsleavesthecompanywithenoughfirepowerto weatheranystormandacapitaladequacyof24%indicatesthatitsreturnonequitycouldmove aheadfromthecurrent18%. AgainstitsissuepriceofRs172,thestockiscurrentlytradingatRs292,translatingto12times estimatedFY15earningspershareofRs25andataround2.1timesprojectedFY15bookofaround Rs140.Giventhereasonablevaluationandenoughroomforgrowth,thestockshoulddowellin2014 andappearstobeapotentialmultibagger. Thewriterholdsthestockinhispersonalcapacity

Clickheretoseethearticleinitsstandardwebformat

http://business.outlookindia.com/printarticle.aspx?288878

3/3

Vous aimerez peut-être aussi

- Pevc Outline Spring 2018Document14 pagesPevc Outline Spring 2018Venkat Narayan RavuriPas encore d'évaluation

- Agro PagesDocument72 pagesAgro PagesVenkat Narayan RavuriPas encore d'évaluation

- Annual Report 12-13Document55 pagesAnnual Report 12-13Venkat Narayan RavuriPas encore d'évaluation

- Capital Market-15th MarchDocument28 pagesCapital Market-15th MarchVenkat Narayan RavuriPas encore d'évaluation

- Project Summary-Madurai TuticorinDocument2 pagesProject Summary-Madurai TuticorinVenkat Narayan RavuriPas encore d'évaluation

- Capital Market-15th MarchDocument28 pagesCapital Market-15th MarchVenkat Narayan RavuriPas encore d'évaluation

- Simhapuri Energy R 11042014Document2 pagesSimhapuri Energy R 11042014Venkat Narayan RavuriPas encore d'évaluation

- Claris Lifesciences Sunidhi 150515Document5 pagesClaris Lifesciences Sunidhi 150515Venkat Narayan RavuriPas encore d'évaluation

- CCL Products 2013Document82 pagesCCL Products 2013Venkat Narayan Ravuri100% (1)

- CCL Products (India) LTD SHP M151Document6 pagesCCL Products (India) LTD SHP M151Venkat Narayan RavuriPas encore d'évaluation

- Capital MarketDocument28 pagesCapital MarketVenkat Narayan RavuriPas encore d'évaluation

- Offer LetterDocument1 pageOffer LetterVenkat Narayan RavuriPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- MR Javed Mohammad Monis B295, Chattarpur Enclave, PHASE 2, NEW DELHI-110074Document1 pageMR Javed Mohammad Monis B295, Chattarpur Enclave, PHASE 2, NEW DELHI-110074javedmonis07Pas encore d'évaluation

- CH 3Document15 pagesCH 3Gizaw BelayPas encore d'évaluation

- 2008 HSBC Annual Report and Accounts EnglishDocument34 pages2008 HSBC Annual Report and Accounts EnglishigharieebPas encore d'évaluation

- The Role of SHG Federation in The Promotion of Livelihoods and The Community Enterprises: A Case of MahakalasamDocument28 pagesThe Role of SHG Federation in The Promotion of Livelihoods and The Community Enterprises: A Case of MahakalasampmanikPas encore d'évaluation

- qm350 ch03Document26 pagesqm350 ch03johnPas encore d'évaluation

- RR 13-00Document2 pagesRR 13-00saintkarri100% (2)

- CHAPTER 6 Module Financial ManagementDocument20 pagesCHAPTER 6 Module Financial ManagementAdoree RamosPas encore d'évaluation

- IIBF Certified Credit Professionals 2018 PDFDocument277 pagesIIBF Certified Credit Professionals 2018 PDFRahul Kashyap75% (12)

- Ratio Analysis. Corporate FinanceDocument46 pagesRatio Analysis. Corporate FinanceRadwa MohammedPas encore d'évaluation

- Ece Realty and Development, Inc., PetitionerDocument3 pagesEce Realty and Development, Inc., PetitionerTiff DizonPas encore d'évaluation

- Subprime Mortgage CrisisDocument50 pagesSubprime Mortgage CrisisAli HabibPas encore d'évaluation

- Balance Sheet of WiproDocument3 pagesBalance Sheet of WiproRinni JainPas encore d'évaluation

- Why You Just Can't Withdraw A Bounce Back Loan From Company?Document2 pagesWhy You Just Can't Withdraw A Bounce Back Loan From Company?kainat fatimaPas encore d'évaluation

- Guidelines On Late Payment Charges For Islamic Banking Institutions and Moratorium (Loan Repayment Assistance)Document12 pagesGuidelines On Late Payment Charges For Islamic Banking Institutions and Moratorium (Loan Repayment Assistance)Muhammad Nur Akmal BachokPas encore d'évaluation

- Reliance Mutual Funds ProjectDocument58 pagesReliance Mutual Funds ProjectShivangi SinghPas encore d'évaluation

- Presentation Access To EducationDocument50 pagesPresentation Access To EducationAngeline DyPas encore d'évaluation

- Myanmar Business Today Vol 2, Issue 38Document32 pagesMyanmar Business Today Vol 2, Issue 38Thit Htoo LwinPas encore d'évaluation

- ICICI Bank I Finals PPT - MTDocument25 pagesICICI Bank I Finals PPT - MTaditya100% (1)

- Ashika DCCDocument64 pagesAshika DCCUDayPas encore d'évaluation

- HUD Settlement Statement For 09-1102-EDocument3 pagesHUD Settlement Statement For 09-1102-Esgv_1939Pas encore d'évaluation

- Kanisa Sacco Information BookletDocument24 pagesKanisa Sacco Information BookletGideon M Kimari0% (1)

- E BankingDocument77 pagesE BankingDEEPAKPas encore d'évaluation

- ICAAPDocument84 pagesICAAPjugokrst4246100% (1)

- A Practical Guide To Capitalisation of Borrowing Costs: November 2008Document23 pagesA Practical Guide To Capitalisation of Borrowing Costs: November 2008adi darmawanPas encore d'évaluation

- E BankingDocument87 pagesE BankingMailaram BheemreddyPas encore d'évaluation

- SWIFT MessagesDocument521 pagesSWIFT Messagesashish_scribd_23Pas encore d'évaluation

- ReportPdfResponseServlet 2Document4 pagesReportPdfResponseServlet 2UTKALGRAMEEN BANKPas encore d'évaluation

- Financial Planning and Analysis: The Master Budget: Solutions To ExercisesDocument12 pagesFinancial Planning and Analysis: The Master Budget: Solutions To ExercisesBlackBunny103Pas encore d'évaluation

- Laxmi Priya - Credit ManagementDocument39 pagesLaxmi Priya - Credit Managementmoongem infocityPas encore d'évaluation

- Evaluating Consumer Loans: William Chittenden Edited and Updated The Powerpoint Slides For This EditionDocument61 pagesEvaluating Consumer Loans: William Chittenden Edited and Updated The Powerpoint Slides For This Edition分享区Pas encore d'évaluation