Académique Documents

Professionnel Documents

Culture Documents

General Knowledge Today - 61

Transféré par

niranjan_meharTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

General Knowledge Today - 61

Transféré par

niranjan_meharDroits d'auteur :

Formats disponibles

Articles from General Knowledge Today

Current Targets in Priority Sector Lending

2011-04-23 04:04:21 GKToday

At present the domestic banks have to disburse 40% of the Net Bank Credit to Total Priority sector, out of which 18% should be total agricultural advances. The Foreign banks have been given a target of 32% of the Net Bank Credit to priority sector, however, there is no lower limit fixed for agriculture.

Domestic banks (both public sector and private sector banks)

Total Priority Sector advances Total agricultural advances SSI advances Export credit Advances to weaker sections

40 percent of NBC 18 percent of NBC No target Export credit does not form part of priority sector 10 percent of NBC

Foreign banks operating in India 32 percent of NBC No target 10 percent of NBC 12 percent of NBC No target

Please note this important point: Net Bank Credit is the figure reported in the fortnightly return submitted to RBI by the Banks. But, the outstanding deposits under the FCNR (B) and NRNR (Non-Resident Non-Reptriable Term Deposit Account) Schemes are excluded from net bank credit for computation of priority sector lending target/ subtargets. Weaker sections: Under the above, the following have been defined by RBI have weaker sections of the society: 1. Small and marginal farmers with land holding of 5 acres and less and landless laborers, tenant farmers and share croppers. 2. Artisans, village and cottage industries where individual credit limits do not exceed Rs. 50,000/3. Beneficiaries of Swarnjayanti Gram Swarojgar Yojana (SGSY) 4. Scheduled Castes and Scheduled Tribes 5. Beneficiaries of Differential Rate of Interest (DRI) scheme 6. Beneficiaries under Swarna Jayanti Shahari Rojgar Yojana (SJSRY) 7. Beneficiaries under the Scheme for Liberation and Rehabilitation of

Scavangers (SLRS). 8. Self Help Groups (SHGs) RBI Guidelines: RBI keeps issuing guidelines for the Priority sector lending. Here are a few important points: The overall target set by the RBI for the priority sector lending is 40% of the adjusted net bank credit (ANBC) out of which 18% is fixed for agriculture sector and 10% for weaker sections of the society. Target Credit to women beneficiaries is 5%. Banks are supposed to give acknowledgement for loan applications received from weaker sections. The application should be disposed off as follows: Loans up to ` 25000 2 weeks Loans above ` 25000 8-9 weeks For SSI Loans up to ` 25000 2 weeks 25000 up to 5,00,000 4 weeks Above ` 5 Lakh 8-9 weeks The loans applications of the priority sector can be rejected by the branch manager provided the rejection is later verified by the Divisional Manager / regional manager However, in case of SC/ ST, a branch manager can not reject the application. In this case, only a divisional manager / regional manager can do so. Commercial banks have been advised to link the tenor of loans to Housing Finance Companies (HFCs) in line with the average portfolio maturity of housing loans up to ` 20 lakh extended by HFCs to individual borrowers, otherwise such loans would not be eligible for classification under priority sector. Banks have been advised to ensure the end-use of funds strictly as per the guidelines on lending to priority sector.

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Wand Hare 2015Document11 pagesWand Hare 2015niranjan_meharPas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Rls AlgorithmDocument15 pagesRls Algorithmniranjan_meharPas encore d'évaluation

- Multiple Nutrient Deficiency Detection in Paddy Leaf Images Using Color and Pattern AnalysisDocument4 pagesMultiple Nutrient Deficiency Detection in Paddy Leaf Images Using Color and Pattern Analysisniranjan_meharPas encore d'évaluation

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Multiple Nutrient Deficiency Detection in Paddy Leaf Images Using Color and Pattern AnalysisDocument4 pagesMultiple Nutrient Deficiency Detection in Paddy Leaf Images Using Color and Pattern Analysisniranjan_meharPas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- 09 Chapter4Document23 pages09 Chapter4niranjan_meharPas encore d'évaluation

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- InitiateSingleEntryPaymentSummary17 06 2017 PDFDocument1 pageInitiateSingleEntryPaymentSummary17 06 2017 PDFniranjan_meharPas encore d'évaluation

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Without Applying Induction Motor Voltage SagDocument4 pagesWithout Applying Induction Motor Voltage Sagniranjan_meharPas encore d'évaluation

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Example16 SIMULINK PDFDocument11 pagesExample16 SIMULINK PDFgomgomPas encore d'évaluation

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- NSS 3-Reliable Low-Power Multiplier PDFDocument10 pagesNSS 3-Reliable Low-Power Multiplier PDFThahsin ThahirPas encore d'évaluation

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- No ThanksDocument5 pagesNo Thanksniranjan_meharPas encore d'évaluation

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Simulationlab EE0405 PDFDocument78 pagesSimulationlab EE0405 PDFDhondiram KakrePas encore d'évaluation

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Detailed Project Report Solar PVDocument19 pagesDetailed Project Report Solar PVbakoolk100% (3)

- 05676476Document8 pages05676476niranjan_meharPas encore d'évaluation

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- Brahma Kadi GinaDocument4 pagesBrahma Kadi GinaAswith R ShenoyPas encore d'évaluation

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Original Image To Be SelectedDocument5 pagesOriginal Image To Be Selectedniranjan_meharPas encore d'évaluation

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Aes Encryption: Encrypti ONDocument12 pagesAes Encryption: Encrypti ONniranjan_meharPas encore d'évaluation

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Admission Schedule 201401132015Document2 pagesAdmission Schedule 201401132015niranjan_meharPas encore d'évaluation

- The Importance of Hard Work in SuccessDocument1 pageThe Importance of Hard Work in Successniranjan_meharPas encore d'évaluation

- Stores - ObsDocument4 pagesStores - Obsniranjan_meharPas encore d'évaluation

- Research Activities Published Paper ICPS04Document6 pagesResearch Activities Published Paper ICPS04Luiza DraghiciPas encore d'évaluation

- PTC Corporate Presentation-30!09!2012Document25 pagesPTC Corporate Presentation-30!09!2012niranjan_meharPas encore d'évaluation

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- PTC - Sustainability ReportDocument4 pagesPTC - Sustainability ReportgavinilaaPas encore d'évaluation

- Mysteries of The Sacred Universe - An OverviewDocument11 pagesMysteries of The Sacred Universe - An Overviewniranjan_mehar100% (2)

- RasdfsDocument39 pagesRasdfsKeyur GajjarPas encore d'évaluation

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- 2013 2013 1 PB PDFDocument28 pages2013 2013 1 PB PDFImran ShahzadPas encore d'évaluation

- Sri Yantra A DESTINEYDocument14 pagesSri Yantra A DESTINEYsssmouPas encore d'évaluation

- RulesDocument39 pagesRulesniranjan_meharPas encore d'évaluation

- TeluguvDocument1 pageTeluguvniranjan_meharPas encore d'évaluation

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (120)

- FFS & CFSDocument25 pagesFFS & CFSGovindPas encore d'évaluation

- Petitioners - versus-BONNIE BAUTISTA LAO, Respondent. G.R. NoDocument3 pagesPetitioners - versus-BONNIE BAUTISTA LAO, Respondent. G.R. Nobb yattyPas encore d'évaluation

- Review 105 - Day 6 SAINT LOUIS UNIVERSITY Theory of AccountsDocument11 pagesReview 105 - Day 6 SAINT LOUIS UNIVERSITY Theory of AccountsrandyPas encore d'évaluation

- Pagcor Vs BirDocument5 pagesPagcor Vs BirClarisse Ann MirandaPas encore d'évaluation

- Why The Poor Actually Tend To Make Rational Decisions?Document1 pageWhy The Poor Actually Tend To Make Rational Decisions?Olga WłodarczykPas encore d'évaluation

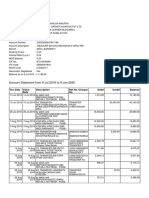

- Account Statement From 9 Jul 2019 To 9 Jan 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument4 pagesAccount Statement From 9 Jul 2019 To 9 Jan 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalancemauryapiaePas encore d'évaluation

- Banking VocabularyDocument13 pagesBanking VocabularyLiz RamosPas encore d'évaluation

- Response To Motion For Summary JudgmentDocument10 pagesResponse To Motion For Summary Judgmentdalawman1781100% (1)

- CCDC Documents DescriptionsDocument6 pagesCCDC Documents Descriptionsmynalawal100% (1)

- 01 Mar 2020 Bill PDFDocument5 pages01 Mar 2020 Bill PDFChanel PhangPas encore d'évaluation

- List PDFDocument4 pagesList PDFPam Welch HeulePas encore d'évaluation

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Structure of Indian Financial SystemDocument24 pagesStructure of Indian Financial SystemRaj SodhaPas encore d'évaluation

- A Guide To Commercial Mortgage-Backed SecuritiesDocument50 pagesA Guide To Commercial Mortgage-Backed SecuritiesJay Kab100% (1)

- Yes Bank - "What's Behind The Crisis": Master of Business Administration Work Integrated Learning Project 3Rd SemesterDocument12 pagesYes Bank - "What's Behind The Crisis": Master of Business Administration Work Integrated Learning Project 3Rd SemestervaisakhgokulPas encore d'évaluation

- Doing Business in Kuwait 2019Document30 pagesDoing Business in Kuwait 2019munaftPas encore d'évaluation

- Manufacturing Accounts FormatDocument7 pagesManufacturing Accounts Formatlaguda babajide100% (10)

- Current Ratio & Cash RatioDocument1 pageCurrent Ratio & Cash RatioNoman Khosa100% (1)

- Procedure CFVDocument13 pagesProcedure CFVNDTInstructorPas encore d'évaluation

- Your Statement: Smart AccessDocument4 pagesYour Statement: Smart AccessDeep GrewalPas encore d'évaluation

- Property Dispositions Solutions Manual Discussion QuestionsDocument55 pagesProperty Dispositions Solutions Manual Discussion Questionstrenn1100% (5)

- Job OrderDocument2 pagesJob OrderaliPas encore d'évaluation

- WHFITDocument3 pagesWHFITjpes100% (2)

- SHELLDocument6 pagesSHELLAbdullah QureshiPas encore d'évaluation

- WEEK 4 Inggris THE SABBATH CONTAINER COMPANYDocument3 pagesWEEK 4 Inggris THE SABBATH CONTAINER COMPANYRennya Lily KharismaPas encore d'évaluation

- FY19 - QBDT Client - Lesson-11 - Track and Pay Sales Tax - BDB - v2Document22 pagesFY19 - QBDT Client - Lesson-11 - Track and Pay Sales Tax - BDB - v2Nyasha MakorePas encore d'évaluation

- Tutorial 9 Questions Mfrs 112 Income Taxes (Part 1) - Lazar and HuangDocument4 pagesTutorial 9 Questions Mfrs 112 Income Taxes (Part 1) - Lazar and HuangLee HansPas encore d'évaluation

- Challenges Faced by Microfinance InstitutionsDocument20 pagesChallenges Faced by Microfinance InstitutionsPrince Kumar Singh100% (2)

- Form 24QDocument1 pageForm 24QASANTA SWAINPas encore d'évaluation

- Subway Bankrupcy 1Document34 pagesSubway Bankrupcy 1Kate TaylorPas encore d'évaluation

- Business Math Midterm Reviewer Session 8 Introduction To Salaries and WagesDocument8 pagesBusiness Math Midterm Reviewer Session 8 Introduction To Salaries and WagesJwyneth Royce DenolanPas encore d'évaluation

- CDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsD'EverandCDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsÉvaluation : 4 sur 5 étoiles4/5 (4)

- Money Made Easy: How to Budget, Pay Off Debt, and Save MoneyD'EverandMoney Made Easy: How to Budget, Pay Off Debt, and Save MoneyÉvaluation : 5 sur 5 étoiles5/5 (1)

- You Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantD'EverandYou Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantÉvaluation : 4 sur 5 étoiles4/5 (104)

- How to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsD'EverandHow to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsPas encore d'évaluation

- Financial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassD'EverandFinancial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassPas encore d'évaluation

- The 30-Day Money Cleanse: Take Control of Your Finances, Manage Your Spending, and De-Stress Your Money for Good (Personal Finance and Budgeting Self-Help Book)D'EverandThe 30-Day Money Cleanse: Take Control of Your Finances, Manage Your Spending, and De-Stress Your Money for Good (Personal Finance and Budgeting Self-Help Book)Évaluation : 3.5 sur 5 étoiles3.5/5 (9)