Académique Documents

Professionnel Documents

Culture Documents

Chapter 8

Transféré par

Aminul Haque RusselCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Chapter 8

Transféré par

Aminul Haque RusselDroits d'auteur :

Formats disponibles

Capital Asset Pricing Model (CAPM) A model that describes the relationship between risk and expected return

and that is used in the pricing of risky securities.If this expected return does not meet or beat the required return, then the investment should not be undertaken.

The general idea behind CA ! is that investors need to be compensated in two ways" time value of money and risk. The time value of money is represented by the risk#free $r f% rate in the formula and compensates the investors for placing money in any investment over a period of time. The other half of the formula represents risk and calculates the amount of compensation the investor needs for taking on additional risk. This is calculated by taking a risk measure $beta% that compares the returns of the asset to the market over a period of time and to the market premium $&m#rf%. Assumptions of Capital Asset Pricing Model (CAPM) '. All investors think in terms of a single period, and they choose among alternative portfolios on the basis of each portfolios expected return and standard deviation over that period. (. All investors can borrow or lend an unlimited amount of money at a given risk free rate of interest and there are no restrictions on short sales of any asset. ). All investors have homogeneous expectations. *. All assts are perfectly divisible and are perfectly marketable at the going price. +. There are no transaction costs. ,. There are no taxes. -. All investors are price taker. .. The quantities of all assets are given and fixed.

Limitation of the CAPM

The model assumes that asset returns are $/ointly% normally distributed random variables. The model assumes that the variance of returns is an adequate measurement of risk. The model assumes that all investors have access to the same information and agree about the risk and expected return of all assets

The model assumes that the probability beliefs of investors match the true distribution of returns.

The model does not appear to adequately explain the variation in stock returns. 0mpirical studies show that low beta stocks may offer higher returns than the model would predict.

The model assumes that given a certain expected return investors will prefer lower risk $lower variance% to higher risk and conversely given a certain level of risk will prefer higher returns to lower ones

The model assumes that there are no taxes or transaction costs, The market portfolio consists of all assets in all markets, where each asset is weighted by its market capitali1ation. This assumes no preference between markets and assets for individual investors, and that investors choose assets solely as a function of their risk# return profile

The market portfolio should in theory include all types of assets that are held by anyone as an investment $including works of art, real estate, human capital.

Capital Market line (CML) The capital market line $C!2% is a line used in the capital asset pricing model to show the rates of return for efficient portfolios depending on the risk#free rate of return and the level of risk $standard deviation% for a particular portfolio. All combinations of the risk#free asset and risky portfolio ! are on C!2, and in equilibrium, all investors will end up with portfolios somewhere on the C!2.

The C!2 is considered to be superior to the efficient frontier since it takes into account the inclusion of a risk#free asset in the portfolio.

Security Market Line (SML) The security market line is a line that graphs the systematic, or market, risk versus return of the whole market at a certain time and shows all risky marketable securities.

The 3!2 essentially graphs the results from the capital asset pricing model $CA !% formula. The x#axis represents the risk $beta%, and the y#axis represents the expected return. The market risk premium is determined from the slope of the 3!2. The security market line is a useful tool in determining whether an asset being considered for a portfolio offers a reasonable expected return for risk. Individual securities are plotted on the 3!2 graph. If the security4s risk versus expected return is plotted above the 3!2, it is undervalued because the investor can expect a greater return for the inherent risk. A security plotted below the 3!2 is overvalued because the investor would be accepting less return for the amount of risk assumed.

Difference between CML and SML Capital Market Line (CML) Security Market Line (SML)

The C!2 is a line that is used to show the 3!2, which is also called a Characteristic rates of return, which depends on risk#free 2ine, is a graphical representation of the rates of return and levels of risk for a specific market4s risk and return at a given time. portfolio. 5hile standard deviation is the measure of risk 6eta coefficient determines the risk factors of in C!2. the 3!2. 5hile the Capital !arket 2ine graphs define The 3ecurity !arket 2ine graphs define both efficient portfolios. efficient and non#efficient portfolios. C!2 is the basis of the capital market theory. The equation of Capital !arket 2ine" 3!2 is the basis of the CA ! The equation of 3ecurity !arket 2ine"

Arbitrage Pricing heory 3tephen &oss has proposed an approach called the arbitrage pricing theory $A T% n which many factors are required to specify the equilibrium risk7return relationship rather than /ust one or two. The A T can include any number of risk factors, so the required return could be a function of three, four or even more factors. The equation of A T #

!" !rf# $%f% # $&f&''''''''''''# $nfn

Assumptions of Arbitrage Pricing heory (AP ) '. The A T can include any number of risk factors, so the required return could be a function of three, four or even more factors. (. A T is based on complex mathematical and statistical theory.

). A T concept depends on only three risk factors, inflation, industrial production and the aggregate degree of risk aversion. *. A T does not identify the relevant factors beforehand. +. A T does not require that all investors hold the market portfolio. Difference between CAPM and AP (

)*+S ,-.S %( 6riefly describe the similarities and difference between CA ! and A T. &( 3hort notes" 3ecurity !arket 2ine $3!2%, Capital !arket 2ine $C!2%. /( 8escribe both CA ! and the A T and identify the factors determines return in each. 0( 5hat is CA !9 :ow is the A T model consistent with the CA !9 1( 3how the ma/or differences between 3!2 and C!2.

Vous aimerez peut-être aussi

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- ECO402 Solved MCQs in One FileDocument47 pagesECO402 Solved MCQs in One FileAb DulPas encore d'évaluation

- 206 HW6 BneDocument9 pages206 HW6 Bneamit_singhal_110% (1)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- 11 May 2020 EconomicsDocument32 pages11 May 2020 EconomicsErkin GasimzadePas encore d'évaluation

- Microeconomics I - Module-1-1 PDFDocument242 pagesMicroeconomics I - Module-1-1 PDFGisha100% (3)

- 7 Chart Patterns That Consistently Make Money - Ed Downs - Page 16 To 30Document15 pages7 Chart Patterns That Consistently Make Money - Ed Downs - Page 16 To 30YapKJPas encore d'évaluation

- Extensive Guide On How To Scalp Forex-Web&print Vers - by Bfree (GeorgiaStyle) PDFDocument27 pagesExtensive Guide On How To Scalp Forex-Web&print Vers - by Bfree (GeorgiaStyle) PDFkalelenikhl100% (1)

- Marketing Analysis Toolkit - Market Size and MarketDocument14 pagesMarketing Analysis Toolkit - Market Size and MarketMathewPas encore d'évaluation

- Staple GoodsDocument1 pageStaple GoodsAminul Haque RusselPas encore d'évaluation

- PLSDocument1 pagePLSAminul Haque RusselPas encore d'évaluation

- Business ResearchDocument1 pageBusiness ResearchAminul Haque RusselPas encore d'évaluation

- Production & Operations Management: Group ListDocument2 pagesProduction & Operations Management: Group ListAminul Haque RusselPas encore d'évaluation

- Financial LeverageDocument1 pageFinancial LeverageAminul Haque RusselPas encore d'évaluation

- Bank Job General KnowledgeDocument6 pagesBank Job General KnowledgeAminul Haque RusselPas encore d'évaluation

- Chapter Insurance CompaniesDocument22 pagesChapter Insurance CompaniesAminul Haque RusselPas encore d'évaluation

- Chapter - Investment CompaniesDocument16 pagesChapter - Investment CompaniesAminul Haque RusselPas encore d'évaluation

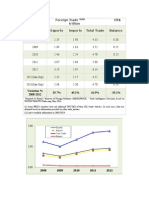

- Foreign TradeDocument4 pagesForeign TradeAminul Haque RusselPas encore d'évaluation

- Financial System of BangladeshDocument2 pagesFinancial System of BangladeshAminul Haque Russel100% (1)

- E-Cmrc AssignmentDocument34 pagesE-Cmrc AssignmentAminul Haque RusselPas encore d'évaluation

- RiskDocument2 pagesRiskAminul Haque RusselPas encore d'évaluation

- Question PaperDocument6 pagesQuestion PaperAminul Haque RusselPas encore d'évaluation

- SMLDocument1 pageSMLAminul Haque RusselPas encore d'évaluation

- Question PaperDocument6 pagesQuestion PaperAminul Haque RusselPas encore d'évaluation

- Topics of Project ReportDocument1 pageTopics of Project ReportAminul Haque RusselPas encore d'évaluation

- InsuranceDocument3 pagesInsuranceAminul Haque Russel100% (1)

- Business, Management, Economics, Finance Submission EmailDocument1 pageBusiness, Management, Economics, Finance Submission EmailAminul Haque RusselPas encore d'évaluation

- Short Notes MGTDocument9 pagesShort Notes MGTAminul Haque RusselPas encore d'évaluation

- Inventory Policy SystemDocument3 pagesInventory Policy SystemAminul Haque Russel0% (1)

- Growth in India: InfrastructureDocument2 pagesGrowth in India: InfrastructureAminul Haque RusselPas encore d'évaluation

- DifferenceDocument2 pagesDifferenceAminul Haque RusselPas encore d'évaluation

- Project Appraisal: The First Step of Project Appraisal Is To Estimate The Potential Size ofDocument3 pagesProject Appraisal: The First Step of Project Appraisal Is To Estimate The Potential Size ofAminul Haque RusselPas encore d'évaluation

- Question ListDocument5 pagesQuestion ListAminul Haque RusselPas encore d'évaluation

- Syllabus BankingDocument1 pageSyllabus BankingAminul Haque RusselPas encore d'évaluation

- Main Characteristics of ManagementDocument3 pagesMain Characteristics of ManagementAminul Haque RusselPas encore d'évaluation

- Insurance Company RatingDocument2 pagesInsurance Company RatingAminul Haque RusselPas encore d'évaluation

- Operational IssuesDocument4 pagesOperational IssuesAminul Haque RusselPas encore d'évaluation

- Principles of ManagementDocument3 pagesPrinciples of ManagementAminul Haque RusselPas encore d'évaluation

- EMH Market EfficiencyDocument46 pagesEMH Market EfficiencyDevyansh GuptaPas encore d'évaluation

- Pengertian AkadDocument92 pagesPengertian AkadFaizal NurmatiasPas encore d'évaluation

- Lecture - 7 17 July 2023Document12 pagesLecture - 7 17 July 2023vanshikaPas encore d'évaluation

- Marketing StrategyDocument2 pagesMarketing StrategyMiriam Zavala GutierrezPas encore d'évaluation

- Cosatu Growth Path and Economic Transformation - Chris MalikaneDocument46 pagesCosatu Growth Path and Economic Transformation - Chris MalikanepiyushiiPas encore d'évaluation

- Is LM Model Class LectureDocument35 pagesIs LM Model Class LectureRamaranjan Chatterjee100% (3)

- Updated Business Information SystemDocument10 pagesUpdated Business Information Systemashfaq50% (2)

- Revenue ManagementDocument3 pagesRevenue ManagementMichael FabonPas encore d'évaluation

- b2b Presentation 2.PDF - DRDocument78 pagesb2b Presentation 2.PDF - DRGagan GhaiPas encore d'évaluation

- Strategies in Action: Strategic Management: Concepts & Cases 13 Edition Fred DavidDocument17 pagesStrategies in Action: Strategic Management: Concepts & Cases 13 Edition Fred DavidChris Nicole LaiguePas encore d'évaluation

- A.E ReviewerDocument2 pagesA.E ReviewerRenmar BartolomePas encore d'évaluation

- Rangkuman Bab 12 Market EfficiencyDocument4 pagesRangkuman Bab 12 Market Efficiencyindah oliviaPas encore d'évaluation

- Five Axioms 1Document2 pagesFive Axioms 1Heart BukkabiPas encore d'évaluation

- MKT 521Document158 pagesMKT 521Adeniyi AlesePas encore d'évaluation

- 3 S.R. Vishwanath 13 Chandrasekhar KrishnamurtiDocument4 pages3 S.R. Vishwanath 13 Chandrasekhar KrishnamurtiAlesso RossiPas encore d'évaluation

- Economics Questionnaire SampleDocument2 pagesEconomics Questionnaire SamplekinikinayyPas encore d'évaluation

- Marketing Management: 12 EditionDocument21 pagesMarketing Management: 12 EditionMaybelle VelhoPas encore d'évaluation

- TwsDdeBeginners RanDocument129 pagesTwsDdeBeginners Ranapi-3856957Pas encore d'évaluation

- Debt ExerciseDocument5 pagesDebt ExerciseGiang Truong ThuyPas encore d'évaluation

- 02Document16 pages02Paran GuptaPas encore d'évaluation

- Rosal Business Curriculum FinalDocument2 pagesRosal Business Curriculum FinalJames Martin RosalPas encore d'évaluation

- Group Chapter MCQ AnswersDocument45 pagesGroup Chapter MCQ Answersfiza akhterPas encore d'évaluation

- A Theory of Demand For Products PDFDocument21 pagesA Theory of Demand For Products PDFSoukunPas encore d'évaluation