Académique Documents

Professionnel Documents

Culture Documents

Transpo Cases VIII - Breach of Contract of Carriage

Transféré par

Ayen T. DupraDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Transpo Cases VIII - Breach of Contract of Carriage

Transféré par

Ayen T. DupraDroits d'auteur :

Formats disponibles

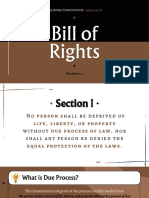

Republic of the Philippines SUPREME COURT Manila SECOND DIVISION G.R. No.

168433 February 10, 2009

UCPB GENERAL INSURANCE CO., INC., Petitioner, vs. ABOITIZ SHIPPING CORP. EAGLE EXPRESS LINES, DAMCO INTERMODAL SERVICES, INC., and PIMENTEL CUSTOMS BROKERAGE CO., Respondents. DECISION TINGA, J.: UCPB General Insurance Co., Inc. (UCPB) assails the Decision1 of the Court of Appeals dated October 29, 2004, which reversed the Decision2 dated November 29, 1999 of the Regional Trial Court of Makati City, Branch 146, and its Resolution3 dated June 14, 2005, which denied UCPBs motion for reconsideration. The undisputed facts, culled from the assailed Decision, are as follows: On June 18, 1991, three (3) units of waste water treatment plant with accessories were purchased by San Miguel Corporation (SMC for brevity) from Super Max Engineering Enterprises, Co., Ltd. of Taipei, Taiwan. The goods came from Charleston, U.S.A. and arrived at the port of Manila on board MV "SCANDUTCH STAR". The same were then transported to Cebu on board MV "ABOITIZ SUPERCON II". After its arrival at the port of Cebu and clearance from the Bureau of Customs, the goods were delivered to and received by SMC at its plant site on August 2, 1991. It was then discovered that one electrical motor of DBS Drive Unit Model DE-30-7 was damaged. Pursuant to an insurance agreement, plaintiff-appellee paid SMC the amount of P1,703,381.40 representing the value of the damaged unit. In turn, SMC executed a Subrogation Form dated March 31, 1992 in favor of plaintiff-appellee. Consequently, plaintiff-appellee filed a Complaint on July 21, 1992 as subrogee of SMC seeking to recover from defendants the amount it had paid SMC. On September 20, 1994, plaintiff-appellee moved to admit its Amended Complaint whereby it impleaded East Asiatic Co. Ltd. (EAST for brevity) as among the defendants for being the "general agent" of DAMCO. In its Order dated September 23, 1994, the lower court admitted the said amended complaint. Upon plaintiff-appellees motion, defendant DAMCO was declared in default by the lower court in its Order dated January 6, 1995. In the meantime, on January 25, 1995, defendant EAST filed a Motion for Preliminary Hearing on its affirmative defenses seeking the dismissal of the complaint against it on the ground of prescription, which motion was however denied by the court a quo in its Order dated September 1, 1995. Such denial was elevated by defendant EAST to this Court through a Petition for Certiorari on October 30, 1995 in CA G.R. SP No. 38840. Eventually, this Court issued its Decision dated February 14, 1996 setting aside the lower courts assailed order of denial and further ordering the dismissal of the complaint against defendant EAST. Plaintiff-appellee moved for reconsideration thereof but the same was denied by this Court in its Resolution dated November 8, 1996. As per Entry of Judgment, this Courts decision ordering the dismissal of the complaint against defendant EAST became final and executory on December 5, 1996.

Accordingly, the court a quo noted the dismissal of the complaint against defendant EAST in its Order dated December 5, 1997. Thus, trial ensued with respect to the remaining defendants. On November 29, 1999, the lower court rendered its assailed Decision, the dispositive portion of which reads: WHEREFORE, all the foregoing premises considered, judgment is hereby rendered declaring DAMCO Intermodal Systems, Inc., Eagle Express Lines, Inc. and defendant Aboitiz Shipping solidarily liable to plaintiff-subrogee for the damaged shipment and orders them to pay plaintiff jointly and severally the sum of P1,703,381.40. No costs. SO ORDERED. Not convinced, defendants-appellants EAGLE and ABOITIZ now come to this Court through their respective appeals x x x4 The appellate court, as previously mentioned, reversed the decision of the trial court and ruled that UCPBs right of action against respondents did not accrue because UCPB failed to file a formal notice of claim within 24 hours from (SMCs) receipt of the damaged merchandise as required under Art. 366 of the Code of Commerce. According to the Court of Appeals, the filing of a claim within the time limitation in Art. 366 is a condition precedent to the accrual of a right of action against the carrier for the damages caused to the merchandise. In its Memorandum5 dated February 8, 2007, UCPB asserts that the claim requirement under Art. 366 of the Code of Commerce does not apply to this case because the damage to the merchandise had already been known to the carrier. Interestingly, UCPB makes this revelation: "x x x damage to the cargo was found upon discharge from the foreign carrier onto the International Container Terminal Services, Inc. (ICTSI) in the presence of the carriers representative who signed the Request for Bad Order Survey6 and the Turn Over of Bad Order Cargoes.7 On transshipment, the cargo was already damaged when loaded on board the inter-island carrier."8 This knowledge, UCPB argues, dispenses with the need to give the carrier a formal notice of claim. Incidentally, the carriers representative mentioned by UCPB as present at the time the merchandise was unloaded was in fact a representative of respondent Eagle Express Lines (Eagle Express). UCPB claims that under the Carriage of Goods by Sea Act (COGSA), notice of loss need not be given if the condition of the cargo has been the subject of joint inspection such as, in this case, the inspection in the presence of the Eagle Express representative at the time the cargo was opened at the ICTSI. UCPB further claims that the issue of the applicability of Art. 366 of the Code of Commerce was never raised before the trial court and should, therefore, not have been considered by the Court of Appeals. Eagle Express, in its Memorandum9 dated February 7, 2007, asserts that it cannot be held liable for the damage to the merchandise as it acted merely as a freight forwarders agent in the transaction. It allegedly facilitated the transshipment of the cargo from Manila to Cebu but represented the interest of the cargo owner, and not the carriers. The only reason why the name of the Eagle Express representative appeared on the Permit to Deliver Imported Goods was that the form did not have a space for the freight forwarders agent, but only for the agent of the shipping line. Moreover, UCPB had previously judicially admitted that upon verification from the Bureau of Customs, it was East Asiatic Co., Ltd. (East Asiatic), regarding whom the original complaint was dismissed on the ground of prescription, which was the real agent of DAMCO Intermodal Services, Inc. (DAMCO), the ship owner. Eagle Express argues that the applicability of Art. 366 of the Code of Commerce was properly raised as an issue before the trial court as it mentioned this issue as a defense in its Answer to UCPBs Amended Complaint. Hence, UCPBs contention that the question was raised for the first time on appeal is incorrect. Aboitiz Shipping Corporation (Aboitiz), on the other hand, points out, in its Memorandum10 dated March 29, 2007, that it obviously cannot be held liable for the damage to the cargo which, by UCPBs admission, was incurred not during transshipment to Cebu on

board one of Aboitizs vessels, but was already existent at the time of unloading in Manila. Aboitiz also argues that Art. 366 of the Code of Commerce is applicable and serves as a condition precedent to the accrual of UCPBs cause of action against it.lawphil.net The Memorandum11 dated June 3, 2008, filed by Pimentel Customs Brokerage Co. (Pimentel Customs), is also a reiteration of the applicability of Art. 366 of the Code of Commerce. It should be stated at the outset that the issue of whether a claim should have been made by SMC, or UCPB as SMCs subrogee, within the 24-hour period prescribed by Art. 366 of the Code of Commerce was squarely raised before the trial court. In its Answer to Amended Complaint12 dated May 10, 1993, Eagle Express averred, thus: The amended complaint states no cause of action under the provisions of the Code of Commerce and the terms of the bill of lading; consignee made no claim against herein defendant within twenty four (24) hours following the receipt of the alleged cargo regarding the condition in which said cargo was delivered; however, assuming arguendo that the damage or loss, if any, could not be ascertained from the outside part of the shipment, consignee never made any claim against herein defendant at the time of receipt of said cargo; herein defendant learned of the alleged claim only upon receipt of the complaint.13 Likewise, in its Answer14 dated September 21, 1992, Aboitiz raised the defense that UCPB did not file a claim with it and that the complaint states no cause of action. UCPB obviously made a gross misrepresentation to the Court when it claimed that the issue regarding the applicability of the Code of Commerce, particularly the 24-hour formal claim rule, was not raised as an issue before the trial court. The appellate court, therefore, correctly looked into the validity of the arguments raised by Eagle Express, Aboitiz and Pimentel Customs on this point after the trial court had so ill-advisedly centered its decision merely on the matter of extraordinary diligence. Interestingly enough, UCPB itself has revealed that when the shipment was discharged and opened at the ICTSI in Manila in the presence of an Eagle Express representative, the cargo had already been found damaged. In fact, a request for bad order survey was then made and a turnover survey of bad order cargoes was issued, pursuant to the procedure in the discharge of bad order cargo. The shipment was then repacked and transshipped from Manila to Cebu on board MV Aboitiz Supercon II. When the cargo was finally received by SMC at its Mandaue City warehouse, it was found in bad order, thereby confirming the damage already uncovered in Manila.15 In charging Aboitiz with liability for the damaged cargo, the trial court condoned UCPBs wrongful suit against Aboitiz to whom the damage could not have been attributable since there was no evidence presented that the cargo was further damaged during its transshipment to Cebu. Even by the exercise of extraordinary diligence, Aboitiz could not have undone the damage to the cargo that had already been there when the same was shipped on board its vessel. That said, it is nonetheless necessary to ascertain whether any of the remaining parties may still be held liable by UCPB. The provisions of the Code of Commerce, which apply to overland, river and maritime transportation, come into play. Art. 366 of the Code of Commerce states: Art. 366. Within twenty-four hours following the receipt of the merchandise, the claim against the carrier for damage or average which may be found therein upon opening the packages, may be made, provided that the indications of the damage or average which gives rise to the claim cannot be ascertained from the outside part of such packages, in which case the claim shall be admitted only at the time of receipt. After the periods mentioned have elapsed, or the transportation charges have been paid, no claim shall be admitted against the carrier with regard to the condition in which the goods transported were delivered.1avvphi1

The law clearly requires that the claim for damage or average must be made within 24 hours from receipt of the merchandise if, as in this case, damage cannot be ascertained merely from the outside packaging of the cargo. In Philippine Charter Insurance Corporation v. Chemoil Lighterage Corporation,16 petitioner, as subrogee of Plastic Group Phil., Inc. (PGP), filed suit against respondent therein for the damage found on a shipment of chemicals loaded on board respondents barge. Respondent claimed that no timely notice in accordance with Art. 366 of the Code of Commerce was made by petitioner because an employee of PGP merely made a phone call to respondents Vice President, informing the latter of the contamination of the cargo. The Court ruled that the notice of claim was not timely made or relayed to respondent in accordance with Art. 366 of the Code of Commerce. The requirement to give notice of loss or damage to the goods is not an empty formalism. The fundamental reason or purpose of such a stipulation is not to relieve the carrier from just liability, but reasonably to inform it that the shipment has been damaged and that it is charged with liability therefor, and to give it an opportunity to examine the nature and extent of the injury. This protects the carrier by affording it an opportunity to make an investigation of a claim while the matter is still fresh and easily investigated so as to safeguard itself from false and fraudulent claims.17 We have construed the 24-hour claim requirement as a condition precedent to the accrual of a right of action against a carrier for loss of, or damage to, the goods. The shipper or consignee must allege and prove the fulfillment of the condition. Otherwise, no right of action against the carrier can accrue in favor of the former.18 The shipment in this case was received by SMC on August 2, 1991. However, as found by the Court of Appeals, the claims were dated October 30, 1991, more than three (3) months from receipt of the shipment and, at that, even after the extent of the loss had already been determined by SMCs surveyor. The claim was, therefore, clearly filed beyond the 24-hour time frame prescribed by Art. 366 of the Code of Commerce. But what of the damage already discovered in the presence of Eagle Expresss representative at the time the shipment was discharged in Manila? The Request for Bad Order Survey and Turn Over Survey of Bad Order Cargoes, respectively dated June 17, 1999 and June 28, 1991, evince the fact that the damage to the cargo was already made known to Eagle Express and, possibly, SMC, as of those dates. Sec. 3(6) of the COGSA provides a similar claim mechanism as the Code of Commerce but prescribes a period of three (3) days within which notice of claim must be given if the loss or damage is not apparent. It states: Sec. 3(6). Unless notice of loss or damage and the general nature of such loss or damage be given in writing to the carrier or his agent at the port of discharge or at the time of the removal of the goods into the custody of the person entitled to delivery thereof under the contract of carriage, such removal shall be prima facie evidence of the delivery by the carrier of the goods as descibed in the bill of lading. If the loss or damage is not apparent, the notice must be given within three days of the delivery. Said notice of loss or damage may be endorsed upon the receipt of the goods given by the person taking delivery thereof. The notice in writing need not be given if the state of the goods has at the time of their receipt been the subject of joint survey or inspection. UCPB seizes upon the last paragraph which dispenses with the written notice if the state of the goods has been the subject of a joint survey which, in this case, was the opening of the shipment in the presence of an Eagle Express representative. It should be noted at this point that the applicability of the above-quoted provision of the COGSA was not raised as an issue by UCPB before the trial court and was only cited by UCPB in its Memorandum in this case. UCPB, however, is ambivalent as to which party Eagle Express represented in the transaction. By its own manifestation, East Asiatic, and not Eagle Express, acted as the agent through which summons

and court notices may be served on DAMCO. It would be unjust to hold that Eagle Expresss knowledge of the damage to the cargo is such that it served to preclude or dispense with the 24-hour notice to the carrier required by Art. 366 of the Code of Commerce. Neither did the inspection of the cargo in which Eagle Expresss representative had participated lead to the waiver of the written notice under the Sec. 3(6) of the COGSA. Eagle Express, after all, had acted as the agent of the freight consolidator, not that of the carrier to whom the notice should have been made. At any rate, the notion that the request for bad order survey and turn over survey of bad cargoes signed by Eagle Expresss representative is construable as compliant with the notice requirement under Art. 366 of the Code of Commerce was foreclosed by the dismissal of the complaint against DAMCOs representative, East Asiatic. As regards respondent Pimentel Customs, it is sufficient to acknowledge that it had no participation in the physical handling, loading and delivery of the damaged cargo and should, therefore, be absolved of liability. Finally, UCPBs misrepresentation that the applicability of the Code of Commerce was not raised as an issue before the trial court warrants the assessment of double costs of suit against it. WHEREFORE, the petition is DENIED. The Decision of the Court of Appeals in CA-G.R. CV No. 68168, dated October 29, 2004 and its Resolution dated June 14, 2005 are AFFIRMED. Double costs against petitioner. SO ORDERED. DANTE O. TINGAM Associate Justice WE CONCUR: LEONARDO A. QUISUMBING Associate Justice Chairperson CONCHITA CARPIO MORALES Associate Justice ARTURO D. BRION Associate Justice ATTESTATION I attest that the conclusions in the above Decision had been reached in consultation before the case was assigned to the writer of the opinion of the Courts Division. LEONARDO A. QUISUMBING Associate Justice Chairperson, Second Division PRESBITERO J. VELASCO, JR. Associate Justice

Republic of the Philippines SUPREME COURT Manila SECOND DIVISION G.R. No. 136888 June 29, 2005

PHILIPPINE CHARTER INSURANCE CORPORATION, petitioner, vs. CHEMOIL LIGHTERAGE CORPORATION, respondent. DECISION CHICO-NAZARIO, J.: Before Us is a petition for review on certiorari which assails the Decision of the Court of Appeals1 in CA-G.R. CV No. 56209, dated 18 December 1998. The Decision reversed and set aside the decision of the Regional Trial Court (RTC),2 Branch 16, City of Manila, which ordered herein respondent to pay the petitioners claim in the amount of P5,000,000.00 with legal interest from the date of the filing of the complaint. THE FACTS Petitioner Philippine Charter Insurance Corporation is a domestic corporation engaged in the business of non-life insurance. Respondent Chemoil Lighterage Corporation is also a domestic corporation engaged in the transport of goods. On 24 January 1991, Samkyung Chemical Company, Ltd., based in Ulsan, South Korea, shipped 62.06 metric tons of the liquid chemical DIOCTYL PHTHALATE (DOP) on board MT "TACHIBANA" which was valued at US$90,201.57 under Bill of Lading No. ULS/MNL-13 and another 436.70 metric tons of DOP valued at US$634,724.89 under Bill of Lading No. ULS/MNL-24 to the Philippines. The consignee was Plastic Group Phils., Inc. (PGP) in Manila. PGP insured the cargo with herein petitioner Philippine Charter Insurance Corporation against all risks. The insurance was under Marine Policies No. MRN-307215 dated 06 February 1991 for P31,757,969.19 and No. MRN307226 for P4,514,881.00. Marine Endorsement No. 27867 dated 11 May 1991 was attached and formed part of MRN30721, amending the latters insured value to P24,667,422.03, and reduced the premium accordingly. The ocean tanker MT "TACHIBANA" unloaded the cargo to Tanker Barge LB-1011 of respondent Chemoil Lighterage Corporation, which shall transport the same to Del Pan Bridge in Pasig River. Tanker Barge LB-1011 would unload the cargo to tanker trucks, also owned by the respondent, and haul it by land to PGPs storage tanks in Calamba, Laguna. Upon inspection by PGP, the samples taken from the shipment showed discoloration from yellowish to amber, demonstrating that it was damaged, as DOP is colorless and water clear. PGP then sent a letter to the petitioner dated 18 February 19918 where it formally made an insurance claim for the loss it sustained due to the contamination. The petitioner requested an independent insurance adjuster, the GIT Insurance Adjusters, Inc. (GIT), to conduct a Quantity and Condition Survey of the shipment. On 22 February 1991, GIT issued a Report,9 part of which states: As unloading progressed, it was observed on February 14, 1991 that DOP samples taken were discolored from yellowish to amber. Inspection of cargo tanks showed manhole covers of ballast tanks ceilings loosely secured. Furthermore, it was noted that the rubber gaskets of the manhole covers of the ballast tanks re-acted to the chemical causing shrinkage thus, loosening the covers and cargo ingress to the rusty ballast tanks10

On 13 May 1991, the petitioner paid PGP the amount of P5,000,000.0011 as full and final payment for the loss. PGP issued a Subrogation Receipt to the petitioner. Meanwhile, on 03 April 1991, PGP paid the respondent the amount of P301,909.50 as full payment for the latters services, as evidenced by Official Receipt No. 1274.12 On 15 July 1991, an action for damages was instituted by the petitioner-insurer against respondent-carrier before the RTC, Branch 16, City of Manila, docketed as Civil Case No. 91-57923.13 The petitioner prayed for actual damages in the amount of P5,000,000.00, attorneys fees in the amount of no less than P1,000,000.00, and costs of suit. An Answer with Compulsory Counterclaim14 was filed by the respondent on 05 September 1991. The respondent admitted it undertook to transport the consignees shipment from MT "TACHIBANA" to the Del Pan Bridge, Pasig River, where it was transferred to its tanker trucks for hauling to PGPs storage tanks in Calamba, Laguna. The respondent alleged that before the DOP was loaded into its barge (LB-1011), the surveyor/representative of PGP, Adjustment Standard Corporation, inspected it and found the same clean, dry, and fit for loading. The entire loading and unloading of the shipment were also done under the control and supervision of PGPs surveyor/representative. It was also mentioned by the respondent that the contract between it and PGP expressly stipulated that it shall be free from any and all claims arising from contamination, loss of cargo or part thereof; that the consignee accepted the cargo without any protest or notice; and that the cargo shall be insured by its ownersans recourse against all risks. As subrogee, the petitioner was bound by this stipulation. As carrier, no fault and negligence can be attributed against respondent as it exercised extraordinary diligence in handling the cargo.15 After due hearing, the trial court rendered a Decision on 06 January 1997, the dispositive portion of which reads: WHEREFORE, PREMISES CONSIDERED, judgment is hereby rendered in favor of plaintiff ordering defendant to pay plaintiffs claim of P5,000,000.00 with legal interest from the date of the filing of the complaint. The counterclaims are DISMISSED.16 Aggrieved by the trial courts decision, the respondent sought relief with the Court of Appeals where it alleged in the main that PGP failed to file any notice, claim or protest within the period required by Article 366 of the Code of Commerce, which is a condition precedent to the accrual of a right of action against the carrier.17 A telephone call which was supposedly made by a certain Alfred Chan, an employee of PGP, to one of the Vice Presidents of the respondent, informing the latter of the discoloration, is not the notice required by Article 366 of the Code of Commerce.18 On 18 December 1998, the Court of Appeals promulgated its Decision reversing the trial court, the dispositive portion of which reads: WHEREFORE, the decision appealed from is hereby REVERSED AND SET ASIDE and a new one is entered dismissing the complaint.19 A petition for review on certiorari20 was filed by the petitioner with this Court, praying that the decision of the trial court be affirmed. After the respondent filed its Comment21 and the petitioner filed its Reply22 thereto, this Court issued a Resolution23 on 18 August 1999, giving due course to the petition. ASSIGNMENT OF ERRORS The petitioner assigns as errors the following: I

THE APPELLATE COURT GRAVELY ERRED IN FINDING THAT THE NOTICE OF CLAIM WAS NOT FILED WITHIN THE REQUIRED PERIOD. II THE APPELLATE COURT GRAVELY ERRED IN NOT HOLDING THAT DAMAGE TO THE CARGO WAS DUE TO THE FAULT OR NEGLIGENCE OF RESPONDENT CHEMOIL. III THE APPELLATE COURT GRAVELY ERRED IN SETTING ASIDE THE TRIAL COURTS DECISION AND IN DISMISSING THE COMPLAINT.24 ISSUES Synthesized, the issues that must be addressed by this Court are: I WHETHER OR NOT THE NOTICE OF CLAIM WAS FILED WITHIN THE REQUIRED PERIOD. If the answer is in the affirmative, II WHETHER OR NOT THE DAMAGE TO THE CARGO WAS DUE TO THE FAULT OR NEGLIGENCE OF THE RESPONDENT. THE COURTS RULINGS Article 366 of the Code of Commerce has profound application in the case at bar. This provision of law imparts: Art. 366. Within twenty-four hours following the receipt of the merchandise a claim may be made against the carrier on account of damage or average found upon opening the packages, provided that the indications of the damage or average giving rise to the claim cannot be ascertained from the exterior of said packages, in which case said claim shall only be admitted at the time of the receipt of the packages. After the periods mentioned have elapsed, or after the transportation charges have been paid, no claim whatsoever shall be admitted against the carrier with regard to the condition in which the goods transported were delivered. As to the first issue, the petitioner contends that the notice of contamination was given by Alfredo Chan, an employee of PGP, to Ms. Encarnacion Abastillas, Vice President for Administration and Operations of the respondent, at the time of the delivery of the cargo, and therefore, within the required period.25 This was done by telephone. The respondent, however, claims that the supposed notice given by PGP over the telephone was denied by Ms. Abastillas. Between the testimonies of Alfredo Chan and Encarnacion Abastillas, the latters testimony is purportedly more credible because it would be quite unbelievable and contrary to business practice for Alfredo Chan to merely make a verbal notice of claim that involves millions of pesos.26 On this point, the Court of Appeals declared: . . . We are inclined to sustain the view that a telephone call made to defendant-company could constitute substantial compliance with the requirement of notice considering that the notice was given to a responsible official, the VicePresident, who promptly replied that she will look into the matter. However, it must be pointed out that compliance with the period for filing notice is an essential part of the requirement, i.e.. immediately if the damage is apparent, or

otherwise within twenty-four hours from receipt of the goods, the clear import being that prompt examination of the goods must be made to ascertain damage if this is not immediately apparent. We have examined the evidence, and We are unable to find any proof of compliance with the required period, which is fatal to the accrual of the right of action against the carrier.27 The petitioner is of the view that there was an incongruity in the findings of facts of the trial court and the Court of Appeals, the former allegedly holding that the period to file the notice had been complied with, while the latter held otherwise. We do not agree. On the matter concerning the giving of the notice of claim as required by Article 366 of the Code of Commerce, the finding of fact of the Court of Appeals does not actually contradict the finding of fact of the trial court. Both courts held that, indeed, a telephone call was made by Alfredo Chan to Encarnacion Abastillas, informing the latter of the contamination. However, nothing in the trial courts decision stated that the notice of claim was relayed or filed with the respondent-carrier immediately or within a period of twenty-four hours from the time the goods were received. The Court of Appeals made the same finding. Having examined the entire records of the case, we cannot find a shred of evidence that will precisely and ultimately point to the conclusion that the notice of claim was timely relayed or filed. The allegation of the petitioner that not only the Vice President of the respondent was informed, but also its drivers, as testified by Alfredo Chan, during the time that the delivery was actually being made, cannot be given great weight as no driver was presented to the witness stand to prove this. Part of the testimony of Alfredo Chan is revealing: Q: Mr. Witness, were you in your plant site at the time these various cargoes were delivered? A: No, sir. Q: So, do you have a first hand knowledge that your plant representative informed the driver of the alleged contamination? A: What do you mean by that? Q: Personal knowledge [that] you yourself heard or saw them [notify] the driver? A: No, sir.28 From the preceding testimony, it is quite palpable that the witness Alfredo Chan had no personal knowledge that the drivers of the respondent were informed of the contamination. The requirement that a notice of claim should be filed within the period stated by Article 366 of the Code of Commerce is not an empty or worthless proviso. In a case, we held: The object sought to be attained by the requirement of the submission of claims in pursuance of this article is to compel the consignee of goods entrusted to a carrier to make prompt demand for settlement of alleged damages suffered by the goods while in transport, so that the carrier will be enabled to verify all such claims at the time of delivery or within twenty-four hours thereafter, and if necessary fix responsibility and secure evidence as to the nature and extent of the alleged damages to the goods while the matter is still fresh in the minds of the parties.29 In another case, we ruled, thus:

More particularly, where the contract of shipment contains a reasonable requirement of giving notice of loss of or injury to the goods, the giving of such notice is a condition precedent to the action for loss or injury or the right to enforce the carriers liability. Such requirement is not an empty formalism. The fundamental reason or purpose of such a stipulation is not to relieve the carrier from just liability, but reasonably to inform it that the shipment has been damaged and that it is charged with liability therefore, and to give it an opportunity to examine the nature and extent of the injury. This protects the carrier by affording it an opportunity to make an investigation of a claim while the matter is fresh and easily investigated so as to safeguard itself from false and fraudulent claims.30 The filing of a claim with the carrier within the time limitation therefore actually constitutes a condition precedent to the accrual of a right of action against a carrier for loss of, or damage to, the goods. The shipper or consignee must allege and prove the fulfillment of the condition. If it fails to do so, no right of action against the carrier can accrue in favor of the former. The aforementioned requirement is a reasonable condition precedent; it does not constitute a limitation of action.31 The second paragraph of Article 366 of the Code of Commerce is also edifying. It is not only when the period to make a claim has elapsed that no claim whatsoever shall be admitted, as no claim may similarly be admitted after the transportation charges have been paid. In this case, there is no question that the transportation charges have been paid, as admitted by the petitioner, and the corresponding official receipt32 duly issued. But the petitioner is of the view that the payment for services does not invalidate its claim. It contends that under the second paragraph of Article 366 of the Code of Commerce, it is clear that if notice or protest has been made prior to payment of services, claim against the bad order condition of the cargo is allowed. We do not believe so. As discussed at length above, there is no evidence to confirm that the notice of claim was filed within the period provided for under Article 366 of the Code of Commerce. Petitioners contention proceeds from a false presupposition that the notice of claim was timely filed. Considering that we have resolved the first issue in the negative, it is therefore unnecessary to make a resolution on the second issue. WHEREFORE, in view of all the foregoing, the Decision of the Court of Appeals dated 18 December 1998, which reversed and set aside the decision of the trial court, is hereby AFFIRMED in toto. No pronouncement as to costs. SO ORDERED. Puno, (Chairman), Austria-Martinez, Callejo, Sr., and Tinga, JJ., concur.

Republic of the Philippines Supreme Court Manila THIRD DIVISION

ABOITIZ SHIPPING CORPORATION, Petitioner,

G.R. No. 168402 Present: YNARES-SANTIAGO, J., Chairperson,

- versus -

AUSTRIA-MARTINEZ, CHICO-NAZARIO, NACHURA, and REYES, JJ.

INSURANCE COMPANY OF Promulgated: NORTH AMERICA, Respondent.

August 6, 2008

x--------------------------------------------------x DECISION

REYES, R.T., J.:

THE RIGHT of subrogation attaches upon payment by the insurer of the insurance claims by the assured. As subrogee, the insurer steps into the shoes of the assured and may exercise only those rights that the assured may have against the wrongdoer who caused the damage. Before Us is a petition for review on certiorari of the Decision[1] of the Court of Appeals (CA) which reversed the Decision[2] of the Regional Trial Court (RTC). The CA ordered petitioner Aboitiz Shipping Corporation to pay the sum of P280,176.92 plus interest and attorneys fees in favor of respondent Insurance Company of North America (ICNA). The Facts Culled from the records, the facts are as follows: On June 20, 1993, MSAS Cargo International Limited and/or Associated and/or Subsidiary Companies (MSAS) procured a marine insurance policy from respondent ICNA UK Limited of London. The insurance was for a transshipment of certain wooden work tools and workbenches purchased for the consignee Science Teaching Improvement Project (STIP), Ecotech Center, Sudlon Lahug, Cebu City, Philippines.[3] ICNA issued an all-risk open marine policy,[4] stating:

This Company, in consideration of a premium as agreed and subject to the terms and conditions printed hereon, does insure for MSAS Cargo International Limited &/or Associated &/or Subsidiary Companies on behalf of the title holder: Loss, if any, payable to the Assured or order.[5] The cargo, packed inside one container van, was shipped freight prepaid from Hamburg, Germany on board M/S Katsuragi. A clean bill of lading[6] was issued by Hapag-Lloyd which stated the consignee to be STIP, Ecotech Center, Sudlon Lahug, Cebu City. The container van was then off-loaded at Singapore and transshipped on board M/S Vigour Singapore. On July 18, 1993, the ship arrived and docked at the Manila International Container Port where the container van was again offloaded. On July 26, 1993, the cargo was received by petitioner Aboitiz Shipping Corporation (Aboitiz) through its duly authorized booking representative, Aboitiz Transport System. The bill of lading[7] issued by Aboitiz contained the notation grounded outside warehouse. The container van was stripped and transferred to another crate/container van without any notation on the condition of the cargo on the Stuffing/Stripping Report.[8] OnAugust 1, 1993, the container van was loaded on board petitioners vessel, MV Super Concarrier I. The vessel left Manila en route to Cebu City on August 2, 1993. On August 3, 1993, the shipment arrived in Cebu City and discharged onto a receiving apron of the Cebu International Port. It was then brought to the Cebu Bonded Warehousing Corporation pending clearance from the Customs authorities. In the Stripping Report[9] dated August 5, 1993, petitioners checker noted that the crates were slightly broken or cracked at the bottom. On August 11, 1993, the cargo was withdrawn by the representative of the consignee, Science Teaching Improvement Project (STIP) and delivered to Don Bosco TechnicalHigh School, Punta Princesa, Cebu City. It was received by Mr. Bernhard Willig. On August 13, 1993, Mayo B. Perez, then Claims Head of petitioner, received a telephone call from Willig informing him that the cargo sustained water damage. Perez, upon receiving the call, immediately went to the bonded warehouse and checked the condition of the container and other cargoes stuffed in the same container. He found that the container van and other cargoes stuffed there were completely dry and showed no sign of wetness.[10] Perez found that except for the bottom of the crate which was slightly broken, the crate itself appeared to be completely dry and had no water marks. But he confirmed that the tools which were stored inside the crate were already corroded. He further explained that the grounded outside warehouse notation in the bill of lading referred only to the container van bearing the cargo.[11] In a letter dated August 15, 1993, Willig informed Aboitiz of the damage noticed upon opening of the cargo.[12] The letter stated that the crate was broken at its bottom part such that the contents were exposed. The work tools and workbenches were found to have been completely soaked in water with most of the packing cartons already disintegrating. The crate was properly sealed off from the inside with tarpaper sheets. On the outside, galvanized metal

bands were nailed onto all the edges. The letter concluded that apparently, the damage was caused by water entering through the broken parts of the crate. The consignee contacted the Philippine office of ICNA for insurance claims. On August 21, 1993, the Claimsmen Adjustment Corporation (CAC) conducted an ocular inspection and survey of the damage. CAC reported to ICNA that the goods sustained water damage, molds, and corrosion which were discovered upon delivery to consignee.[13] On September 21, 1993, the consignee filed a formal claim[14] with Aboitiz in the amount of P276,540.00 for the damaged condition of the following goods: ten (10) wooden workbenches three (3) carbide-tipped saw blades one (1) set of ball-bearing guides one (1) set of overarm router bits twenty (20) rolls of sandpaper for stroke sander In a Supplemental Report dated October 20, 1993,[15] CAC reported to ICNA that based on official weather report from the Philippine Atmospheric, Geophysical and Astronomical Services Administration, it would appear that heavy rains on July 28 and 29, 1993 caused water damage to the shipment. CAC noted that the shipment was placed outside the warehouse of Pier No. 4, North Harbor, Manila when it was delivered on July 26, 1993. The shipment was placed outside the warehouse as can be gleaned from the bill of lading issued by Aboitiz which contained the notation grounded outside warehouse. It was only on July 31, 1993 when the shipment was stuffed inside another container van for shipment to Cebu. Aboitiz refused to settle the claim. On October 4, 1993, ICNA paid the amount of P280,176.92 to consignee. A subrogation receipt was duly signed by Willig. ICNA formally advised Aboitiz of the claim and subrogation receipt executed in its favor. Despite follow-ups, however, no reply was received from Aboitiz. RTC Disposition ICNA filed a civil complaint against Aboitiz for collection of actual damages in the sum of P280,176.92, plus interest and attorneys fees.[16] ICNA alleged that the damage sustained by the shipment was exclusively and solely brought about by the fault and negligence of Aboitiz when the shipment was left grounded outside its warehouse prior to delivery. Aboitiz disavowed any liability and asserted that the claim had no factual and legal bases. It countered that the complaint stated no cause of action, plaintiff ICNA had no personality to institute the suit, the cause of action was barred, and the suit was premature there being no claim made upon Aboitiz. On November 14, 2003, the RTC rendered judgment against ICNA. The dispositive portion of the decision[17] states:

WHEREFORE, premises considered, the court holds that plaintiff is not entitled to the relief claimed in the complaint for being baseless and without merit. The complaint is hereby DISMISSED. The defendants counterclaims are, likewise, DISMISSED for lack of basis.[18] The RTC ruled that ICNA failed to prove that it is the real party-in-interest to pursue the claim against Aboitiz. The trial court noted that Marine Policy No. 87GB 4475 was issued by ICNA UK Limited with address at Cigna House, 8 Lime Street, London EC3M 7NA. However, complainant ICNA Phils. did not present any evidence to show that ICNA UK is its predecessor-in-interest, or that ICNA UK assigned the insurance policy to ICNA Phils. Moreover, ICNA Phils. claim that it had been subrogated to the rights of the consignee must fail because the subrogatio n receipt had no probative value for being hearsay evidence. The RTC reasoned: While it is clear that Marine Policy No. 87GB 4475 was issued by Insurance Company of North America (U.K.) Limited (ICNA UK) with address at Cigna House, 8 Lime Street, London EC3M 7NA, no evidence has been adduced which would show that ICNA UK is the same as or the predecessor-in-interest of plaintiff Insurance Company of North America ICNA with office address at Cigna-Monarch Bldg., dela Rosa cor. Herrera Sts., Legaspi Village, Makati, Metro Manila or that ICNA UK assigned the Marine Policy to ICNA. Second, the assured in the Marine Policy appears to be MSAS Cargo International Limited &/or Associated &/or Subsidiary Companies. Plaintiffs witness, Francisco B. Francisco, claims that the signature below the name MSAS Cargo International is an endorsement of the marine policy in favor of Science Teaching Improvement Project. Plaintiffs witness, however, failed to identify whose signature it was and plaintiff did not present on the witness stand or took (sic) the deposition of the person who made that signature. Hence, the claim that there was an endorsement of the marine policy has no probative value as it is hearsay. Plaintiff, further, claims that it has been subrogated to the rights and interest of Science Teaching Improvement Project as shown by the Subrogation Form (Exhibit K) allegedly signed by a representative of Science Teaching Improvement Project. Such representative, however, was not presented on the witness stand. Hence, the Subrogation Form is self-serving and has no probative value.[19] (Emphasis supplied) The trial court also found that ICNA failed to produce evidence that it was a foreign corporation duly licensed to do business in the Philippines. Thus, it lacked the capacity to sue before Philippine Courts, to wit: Prescinding from the foregoing, plaintiff alleged in its complaint that it is a foreign insurance company duly authorized to do business in the Philippines. This allegation was, however, denied by the defendant. In fact, in the Pre-Trial Order of 12 March 1996, one of the issues defined by the court is whether or not the plaintiff has legal capacity to sue and be sued. Under Philippine law, the condition is that a foreign insurance company must obtain licenses/authority to do business in the Philippines. These licenses/authority are obtained from the Securities and Exchange Commission, the Board of Investments and the Insurance Commission. If it fails to obtain these licenses/authority, such foreign corporation doing business in the Philippinescannot sue before Philippine courts. Mentholatum Co., Inc. v. Mangaliman, 72 Phil. 524. (Emphasis supplied)

CA Disposition ICNA appealed to the CA. It contended that the trial court failed to consider that its cause of action is anchored on the right of subrogation under Article 2207 of the Civil Code. ICNA said it is one and the same as the ICNA UK Limited as made known in the dorsal portion of the Open Policy.[20] On the other hand, Aboitiz reiterated that ICNA lacked a cause of action. It argued that the formal claim was not filed within the period required under Article 366 of the Code of Commerce; that ICNA had no right of subrogation because the subrogation receipt should have been signed by MSAS, the assured in the open policy, and not Willig, who is merely the representative of the consignee. On March 29, 2005, the CA reversed and set aside the RTC ruling, disposing as follows: WHEREFORE, premises considered, the present appeal is hereby GRANTED. The appealed decision of the Regional Trial Court of Makati City in Civil Case No. 94-1590 is hereby REVERSED and SET ASIDE. A new judgment is hereby rendered ordering defendant-appellee Aboitiz Shipping Corporation to pay the plaintiff-appellant Insurance Company of North America the sum ofP280,176.92 with interest thereon at the legal rate from the date of the institution of this case until fully paid, and attorneys fees in the sum of P50,000, plus the costs of suit.[21] The CA opined that the right of subrogation accrues simply upon payment by the insurance company of the insurance claim. As subrogee, ICNA is entitled to reimbursement from Aboitiz, even assuming that it is an unlicensed foreign corporation. The CA ruled: At any rate, We find the ground invoked for the dismissal of the complaint as legally untenable. Even assuming arguendo that the plaintiff-insurer in this case is an unlicensed foreign corporation, such circumstance will not bar it from claiming reimbursement from the defendant carrier by virtue of subrogation under the contract of insurance and as recognized by Philippine courts. x x x xxxx Plaintiff insurer, whether the foreign company or its duly authorized Agent/Representative in the country, as subrogee of the claim of the insured under the subject marine policy, is therefore the real party in interest to bring this suit and recover the full amount of loss of the subject cargo shipped by it from Manila to the consignee in Cebu City. x x x[22] The CA ruled that the presumption that the carrier was at fault or that it acted negligently was not overcome by any countervailing evidence. Hence, the trial court erred in dismissing the complaint and in not finding that based on the evidence on record and relevant provisions of law, Aboitiz is liable for the loss or damage sustained by the subject cargo.

Issues The following issues are up for Our consideration: (1) THE HONORABLE COURT OF APPEALS COMMITTED A REVERSIBLE ERROR IN RULING THAT ICNA HAS A CAUSE OF ACTION AGAINST ABOITIZ BY VIRTUE OF THE RIGHT OF SUBROGATION BUT WITHOUT CONSIDERING THE ISSUE CONSISTENTLY RAISED BY ABOITIZ THAT THE FORMAL CLAIM OF STIP WAS NOT MADE WITHIN THE PERIOD PRESCRIBED BY ARTICLE 366 OF THE CODE OF COMMERCE; AND, MORE SO, THAT THE CLAIM WAS MADE BY A WRONG CLAIMANT. THE HONORABLE COURT OF APPEALS COMMITTED A REVERSIBLE ERROR IN RULING THAT THE SUIT FOR REIMBURSEMENT AGAINST ABOITIZ WAS PROPERLY FILED BY ICNA AS THE LATTER WAS AN AUTHORIZED AGENT OF THE INSURANCE COMPANY OF NORTH AMERICA (U.K.) (ICNA UK). THE HONORABLE COURT OF APPEALS COMMITTED A REVERSIBLE ERROR IN RULING THAT THERE WAS PROPER INDORSEMENT OF THE INSURANCE POLICY FROM THE ORIGINAL ASSURED MSAS CARGO INTERNATIONAL LIMITED (MSAS) IN FAVOR OF THE CONSIGNEE STIP, AND THAT THE SUBROGATION RECEIPT ISSUED BY STIP IN FAVOR OF ICNA IS VALID NOTWITHSTANDING THE FACT THAT IT HAS NO PROBATIVE VALUE AND IS MERELY HEARSAY AND A SELF-SERVING DOCUMENT FOR FAILURE OF ICNA TO PRESENT A REPRESENTATIVE OF STIP TO IDENTIFY AND AUTHENTICATE THE SAME. THE HONORABLE COURT OF APPEALS COMMITTED A REVERSIBLE ERROR IN RULING THAT THE EXTENT AND KIND OF DAMAGE SUSTAINED BY THE SUBJECT CARGO WAS CAUSED BY THE FAULT OR NEGLIGENCE OF ABOITIZ.[23] (Underscoring supplied)

(2)

(3)

(4)

Elsewise stated, the controversy rotates on three (3) central questions: (a) Is respondent ICNA the real party-ininterest that possesses the right of subrogation to claim reimbursement from petitioner Aboitiz? (b) Was there a timely filing of the notice of claim as required under Article 366 of the Code of Commerce? (c) If so, can petitioner be held liable on the claim for damages? Our Ruling We answer the triple questions in the affirmative. A foreign corporation not licensed to do business in the Philippines is not absolutely incapacitated from filing a suit in local courts. Only when that foreign corporation is transacting or doing business in the country will a license be necessary before it can institute suits.[24] It may, however, bring suits on isolated business transactions, which is not prohibited under Philippine law.[25] Thus, this Court has held that a foreign insurance company may sue in Philippine courts upon the marine insurance policies issued by it abroad to cover international-bound cargoes shipped by a Philippine carrier, even if it has no license to do business in this country. It is the act of engaging in business without the prescribed license, and not the lack of license per se, which bars a foreign corporation from access to our courts.[26]

In any case, We uphold the CA observation that while it was the ICNA UK Limited which issued the subject marine policy, the present suit was filed by the said companys authorized agent in Manila. It was the domestic corporation that brought the suit and not the foreign company. Its authority is expressly provided for in the open policy which includes the ICNA office in the Philippines as one of the foreign companys agents. As found by the CA, the RTC erred when it ruled that there was no proper indorsement of the insurance policy by MSAS, the shipper, in favor of STIP of Don Bosco Technical High School, the consignee. The terms of the Open Policy authorize the filing of any claim on the insured goods, to be brought against ICNA UK, the company who issued the insurance, or against any of its listed agents worldwide.[27] MSAS accepted said provision when it signed and accepted the policy. The acceptance operated as an acceptance of the authority of the agents. Hence, a formal indorsement of the policy to the agent in the Philippines was unnecessary for the latter to exercise the rights of the insurer. Likewise, the Open Policy expressly provides that: The Company, in consideration of a premium as agreed and subject to the terms and conditions printed hereon, does insure MSAS Cargo International Limited &/or Associates &/or Subsidiary Companies in behalf of the title holder: Loss, if any, payable to the Assured or Order. The policy benefits any subsequent assignee, or holder, including the consignee, who may file claims on behalf of the assured. This is in keeping with Section 57 of the Insurance Code which states: A policy may be so framed that it will inure to the benefit of whosoever, during the continuance of the risk, may become the owner of the interest insured. (Emphasis added) Respondents cause of action is founded on it being subrogated to the rights of the consigne e of the damaged shipment. The right of subrogation springs from Article 2207 of the Civil Code, which states: Article 2207. If the plaintiffs property has been insured, and he has received indemnity from the insurance company for the injury or loss arising out of the wrong or breach of contract complained of,the insurance company shall be subrogated to the rights of the insured against the wrongdoer or the person who has violated the contract. If the amount paid by the insurance company does not fully cover the injury or loss, the aggrieved party shall be entitled to recover the deficiency from the person causing the loss or injury. (Emphasis added)

As this Court held in the case of Pan Malayan Insurance Corporation v. Court of Appeals,[28] payment by the insurer to the assured operates as an equitable assignment of all remedies the assured may have against the third party who caused the damage. Subrogation is not dependent upon, nor does it grow out of, any privity of contract or upon written assignment of claim. It accrues simply upon payment of the insurance claim by the insurer.[29]

Upon payment to the consignee of indemnity for damage to the insured goods, ICNAs entitlement to subrogation equipped it with a cause of action against petitioner in case of a contractual breach or negligence.[30] This right of subrogation, however, has its limitations. First, both the insurer and the consignee are bound by the contractual stipulations under the bill of lading.[31] Second, the insurer can be subrogated only to the rights as the insured may have against the wrongdoer. If by its own acts after receiving payment from the insurer, the insured releases the wrongdoer who caused the loss from liability, the insurer loses its claim against the latter.[32] The giving of notice of loss or injury is a condition precedent to the action for loss or injury or the right to enforce the carriers liability. Circumstances peculiar to this case lead Us to conclude that the notice requirement was complied with. As held in the case of Philippine American General Insurance Co., Inc. v. Sweet Lines, Inc.,[33] this notice requirement protects the carrier by affording it an opportunity to make an investigation of the claim while the matter is still fresh and easily investigated. It is meant to safeguard the carrier from false and fraudulent claims.

Under the Code of Commerce, the notice of claim must be made within twenty four (24) hours from receipt of the cargo if the damage is not apparent from the outside of the package. For damages that are visible from the outside of the package, the claim must be made immediately. The law provides: Article 366. Within twenty four hours following the receipt of the merchandise, the claim against the carrier for damages or average which may be found therein upon opening the packages, may be made, provided that the indications of the damage or average which give rise to the claim cannot be ascertained from the outside part of such packages, in which case the claim shall be admitted only at the time of receipt. After the periods mentioned have elapsed, or the transportation charges have been paid, no claim shall be admitted against the carrier with regard to the condition in which the goods transported were delivered. (Emphasis supplied) The periods above, as well as the manner of giving notice may be modified in the terms of the bill of lading, which is the contract between the parties. Notably, neither of the parties in this case presented the terms for giving notices of claim under the bill of lading issued by petitioner for the goods. The shipment was delivered on August 11, 1993. Although the letter informing the carrier of the damage was dated August 15, 1993, that letter, together with the notice of claim, was received by petitioner only on September 21, 1993. But petitioner admits that even before it received the written notice of claim, Mr. Mayo B. Perez, Claims Head of the company, was informed by telephone sometime in August 13, 1993. Mr. Perez then immediately went to the warehouse and to the delivery site to inspect the goods in behalf of petitioner.[34]

In the case of Philippine Charter Insurance Corporation (PCIC) v. Chemoil Lighterage Corporation,[35] the notice was allegedly made by the consignee through telephone. The claim for damages was denied. This Court ruled that such a notice did not comply with the notice requirement under the law. There was no evidence presented that the notice was timely given. Neither was there evidence presented that the notice was relayed to the responsible authority of the carrier. As adverted to earlier, there are peculiar circumstances in the instant case that constrain Us to rule differently from the PCIC case, albeit this ruling is being made pro hac vice, not to be made a precedent for other cases. Stipulations requiring notice of loss or claim for damage as a condition precedent to the right of recovery from a carrier must be given a reasonable and practical construction, adapted to the circumstances of the case under adjudication, and their application is limited to cases falling fairly within their object and purpose.[36] Bernhard Willig, the representative of consignee who received the shipment, relayed the information that the delivered goods were discovered to have sustained water damage to no less than the Claims Head of petitioner, Mayo B. Perez. Immediately, Perez was able to investigate the claims himself and he confirmed that the goods were, indeed, already corroded. Provisions specifying a time to give notice of damage to common carriers are ordinarily to be given a reasonable and practical, rather than a strict construction.[37] We give due consideration to the fact that the final destination of the damaged cargo was a school institution where authorities are bound by rules and regulations governing their actions. Understandably, when the goods were delivered, the necessary clearance had to be made before the package was opened. Upon opening and discovery of the damaged condition of the goods, a report to this effect had to pass through the proper channels before it could be finalized and endorsed by the institution to the claims department of the shipping company. The call to petitioner was made two days from delivery, a reasonable period considering that the goods could not have corroded instantly overnight such that it could only have sustained the damage during transit. Moreover, petitioner was able to immediately inspect the damage while the matter was still fresh. In so doing, the main objective of the prescribed time period was fulfilled. Thus, there was substantial compliance with the notice requirement in this case. To recapitulate, We have found that respondent, as subrogee of the consignee, is the real party in interest to institute the claim for damages against petitioner; and pro hac vice, that a valid notice of claim was made by respondent. We now discuss petitioners liability for the damages sustained by the shipment. The rule as stated in Article 1735 of the Civil Code is that in cases where the goods are lost, destroyed or deteriorated, common carriers are presumed to have been at fault or to have acted negligently, unless they prove that they observed extraordinary diligence required by law.[38] Extraordinary diligence is that extreme measure of care and caution which persons of unusual prudence and circumspection use for securing and preserving their own property rights.[39] This standard is

intended to grant favor to the shipper who is at the mercy of the common carrier once the goods have been entrusted to the latter for shipment.[40] Here, the shipment delivered to the consignee sustained water damage. We agree with the findings of the CA that petitioner failed to overturn this presumption: x x x upon delivery of the cargo to the consignee Don Bosco Technical High School by a representative from Trabajo Arrastre, and the crates opened, it was discovered that the workbenches and work tools suffered damage due to wettage although by then they were already physically dry. Appellee carrier having failed to discharge the burden of proving that it exercised extraordinary diligence in the vigilance over such goods it contracted for carriage, the presumption of fault or negligence on its part from the time the goods were unconditionally placed in its possession (July 26, 1993) up to the time the same were delivered to the consignee (August 11, 1993), therefore stands. The presumption that the carrier was at fault or that it acted negligently was not overcome by any countervailing evidence. x x x[41] (Emphasis added) The shipment arrived in the port of Manila and was received by petitioner for carriage on July 26, 1993. On the same day, it was stripped from the container van. Five days later, on July 31, 1993, it was re-stuffed inside another container van. On August 1, 1993, it was loaded onto another vessel bound for Cebu. During the period between July 26 to 31, 1993, the shipment was outside a container van and kept in storage by petitioner. The bill of lading issued by petitioner on July 31, 1993 contains the notation grounded outside warehouse, suggesting that from July 26 to 31, the goods were kept outside the warehouse. And since evidence showed that rain fell over Manila during the same period, We can conclude that this was when the shipment sustained water damage. To prove the exercise of extraordinary diligence, petitioner must do more than merely show the possibility that some other party could be responsible for the damage. It must prove that it used all reasonable means to ascertain the nature and characteristic of the goods tendered for transport and that it exercised due care in handling them.[42] Extraordinary diligence must include safeguarding the shipment from damage coming from natural elements such as rainfall. Aside from denying that the grounded outside warehouse notation referred not to the crate for shipment but only to the carrier van, petitioner failed to mention where exactly the goods were stored during the period in question. It failed to show that the crate was properly stored indoors during the time when it exercised custody before shipment to Cebu. As amply explained by the CA: On the other hand, the supplemental report submitted by the surveyor has confirmed that it was rainwater that seeped into the cargo based on official data from the PAGASA that there was, indeed, rainfall in the Port Area of Manila from July 26 to 31, 1993. The Surveyor specifically noted that the subject cargo was under the custody of appellee carrier from the time it was delivered by the shipper onJuly 26, 1993 until it was stuffed inside Container No. ACCU-213798-4 on July 31, 1993. No other inevitable conclusion can be deduced from the foregoing established facts that damage from wettage suffered by the subject cargo was caused by the negligence of appellee carrier in grounding the shipment outside causing rainwater to seep into the cargoes.

Appellees witness, Mr. Mayo tried to disavow any responsibility for causing wettage to the subject goods by claiming that the notation GROUNDED OUTSIDE WHSE. actually refers to the container and not the contents thereof or the cargoes. And yet it presented no evidence to explain where did they place or store the subject goods from the time it accepted the same for shipment on July 26, 1993 up to the time the goods were stripped or transferred from the container van to another container and loaded into the vessel M/V Supercon Carrier I on August 1, 1993 and left Manila for Cebu City on August 2, 1993. x x x If the subject cargo was not grounded outside prior to shipment to Cebu City, appellee provided no explanation as to where said cargo was stored from July 26, 1993 to July 31, 1993. What the records showed is that the subject cargo was stripped from the container van of the shipper and transferred to the container on August 1, 1993 and finally loaded into the appellees vessel bound for Cebu City on August 2, 1993. The Stuffing/Stripping Report (Exhibit D) at the Manila port did not indicate any such defect or damage, but when the container was stripped upon arrival in Cebu City port after being discharged from appellees vessel, it was noted that only one (1) slab was slightly broken at the bottom allegedly hit by a forklift blade (Exhibit F).[43] (Emphasis added)

Petitioner is thus liable for the water damage sustained by the goods due to its failure to satisfactorily prove that it exercised the extraordinary diligence required of common carriers. WHEREFORE, the petition is DENIED and the appealed Decision AFFIRMED. SO ORDERED.

RUBEN T. REYES Associate Justice

WE CONCUR:

CONSUELO YNARES-SANTIAGO Associate Justice Chairperson

MA. ALICIA AUSTRIA-MARTINEZ Associate Justice

MINITA V. CHICO-NAZARIO Associate Justice

ANTONIO EDUARDO B. NACHURA Associate Justice

SECOND DIVISION

[G.R. No. 119571. March 11, 1998]

MITSUI O.S.K. LINES LTD., represented by MAGSAYSAY AGENCIES, INC., petitioner, vs. COURT OF APPEALS and LAVINE LOUNGEWEAR MFG. CORP., respondents. DECISION MENDOZA, J.: This is a petition for review on certiorari of the January 25, 1995 decision of the Court of Appeals[1] and its resolution of March 22, 1995 denying petitioners motion for reconsideration. The appellate court upheld orders of Branch 68 (Pasig) of the Regional Trial Court, National Capital Judicial Region, denying petitioners motion to dismiss in the original action filed against petitioner by private respondent. The facts are not in dispute.[2] Petitioner Mitsui O.S.K. Lines Ltd. is a foreign corporation represented in the Philippines by its agent, Magsaysay Agencies. It entered into a contract of carriage through Meister Transport, Inc., an international freight forwarder, with private respondent Lavine Loungewear Manufacturing Corporation to transport goods of the latter from Manila to Le Havre, France. Petitioner undertook to deliver the goods to France 28 days from initial loading. On July 24, 1991, petitioners vessel loaded private respondents container van for carriage at the said port of origin. However, in Kaoshiung, Taiwan the goods were not transshipped immediately, with the result that the shipment arrived in Le Havre only on November 14, 1991. The consignee allegedly paid only half the value of the said goods on the ground that they did not arrive in France until the off season in that country. The remaining half was allegedly charged to the account of private respondent which in turn demanded payment from petitioner through its agent. As petitioner denied private respondents claim, the latter filed a case in the Regional Trial Court on April 14, 1992. In the original complaint, private respondent impleaded as defendants Meister Transport, Inc. and Magsaysay Agencies, Inc., the latter as agent of petitioner Mitsui O.S.K. Lines Ltd. On May 20, 1993, it amended its complaint by impleading petitioner as defendant in lieu of its agent. The parties to the case thus became private respondent as plaintiff, on one side, and Meister Transport Inc. and petitioner Mitsui O.S.K. Lines Ltd. as represented by Magsaysay Agencies, Inc., as defendants on the other. Petitioner filed a motion to dismiss alleging that the claim against it had prescribed under the Carriage of Goods by Sea Act. The Regional Trial Court, as aforesaid, denied petitioners motion as well as its subsequent motion for reconsideration. On petition for certiorari, the Court of Appeals sustained the trial courts orders. Hence this petition containing one assignment of error: THE RESPONDENT COURT OF APPEALS COMMITTED A SERIOUS ERROR OF LAW IN RULING THAT PRIVATE RESPONDENTS AMENDED COMPLAINT IS (sic) NOT PRESCRIBED PURSUANT TO SECTION 3(6) OF THE CARRIAGE OF GOODS BY SEA ACT.

The issue raised by the instant petition is whether private respondents action is for loss or damage to goods shipped, within the meaning of 3(6) of the Carriage of Goods by Sea Act (COGSA). Section 3 provides: (6) Unless notice of loss or damage and the general nature of such loss or damage be given in writing to the carrier or his agent at the port of discharge or at the time of the removal of the goods into the custody of the person entitled to delivery thereof under the contract of carriage, such removal shall be prima facie evidence of the delivery by the carrier of the goods as described in the bill of lading. If the loss or damage is not apparent, the notice must be given within three days of the delivery. Said notice of loss or damage may be endorsed upon the receipt for the goods given by the person taking delivery thereof. The notice in writing need not be given if the state of the goods has at the time of their receipt been the subject of joint survey or inspection. In any event the carrier and the ship shall be discharged from all liability in respect of loss or damage unless suit is brought within one year after delivery of the goods or the date when the goods should have been delivered: Provided, that, if a notice of loss or damage, either apparent or concealed, is not given as provided for in this section, that fact shall not affect or prejudice the right of the shipper to bring suit within one year after the delivery of the goods or the date when the goods should have been delivered. In the case of any actual or apprehended loss or damage, the carrier and the receiver shall give all reasonable facilities to each other for inspecting and tallying the goods. In Ang v. American Steamship Agencies, Inc., the question was whether an action for the value of goods which had been delivered to a party other than the consignee is for loss or damage within the meaning of 3(6) of the COGSA. It was held that there was no loss because the goods had simply been misdelivered. Loss refers to the deterioration or disappearance of goods.[3] As defined in the Civil Code and as applied to Section 3(6), paragraph 4 of the Carriage of Goods by Sea Act, loss contemplates merely a situation where no delivery at all was made by the shipper of the goods because the same had perished, gone out of commerce, or disappeared in such a way that their existence is unknown or they cannot be recovered.[4] Conformably with this concept of what constitutes loss or damage, this Court held in another case[5] that the deterioration of goods due to delay in their transportation constitutes loss or damage within the meaning of 3(6), so that as suit was not brought within one year the action was barred: Whatever damage or injury is suffered by the goods while in transit would result in loss or damage to either the shipper or the consignee. As long as it is claimed, therefore, as it is done here, that the losses or damages suffered by the shipper or consignee were due to the arrival of the goods in damaged or deteriorated condition, the action is still basically one for damage to the goods, and must be filed within the period of one year from delivery or receipt, under the above-quoted provision of the Carriage of Goods by Sea Act.[6] But the Court allowed that There would be some merit in appellants insistence that the damages suffered by him as a result of the delay in the shipment of his cargo are not covered by the prescriptive provision of the Carriage of Goods by Sea Act above referred to, if such damages were due, not to the deterioration and decay of the goods while in transit, but to other causes independent of the condition of the cargo upon arrival, like a drop in their market value. . . .[7]

The rationale behind limiting the said definitions to such parameters is not hard to find or fathom. As this Court held in Ang: Said one-year period of limitation is designed to meet the exigencies of maritime hazards. In a case where the goods shipped were neither lost nor damaged in transit but were, on the contrary, delivered in port to someone who claimed to be entitled thereto, the situation is different, and the special need for the short period of limitation in cases of loss or damage caused by maritime perils does not obtain.[8] In the case at bar, there is neither deterioration nor disappearance nor destruction of goods caused by the carriers breach of contract. Whatever reduction there may have been in the value of the goods is not due to their deterioration or disappearance because they had been damaged in transit. Petitioner contends: Although we agree that there are places in the section (Article III) in which the phrase need have no broader meaning than loss or physical damage to the goods, we disagree with the conclusion that it must so be limited wherever it is used. We take it that the phrase has a uniform meaning, not merely in Section 3, but throughout the Act; and there are a number of places in which the restricted interpretation suggested would be inappropriate. For example Section 4(2) [Article IV(2) (sic) exempts exempts (sic) the carrier, the ship (sic), from liability loss or damage (sic)resulting from certain courses beyond their control.[9] Indeed, what is in issue in this petition is not the liability of petitioner for its handling of goods as provided by 3(6) of the COGSA, but its liability under its contract of carriage with private respondent as covered by laws of more general application. Precisely, the question before the trial court is not the particular sense of damages as it refers to the physical loss or damage of a shippers goods as specifically covered by 3(6) of COGSA but petitioners potential liability for the damages it has caused in the general sense and, as such, the matter is governed by the Civil Code, the Code of Commerce and COGSA, for the breach of its contract of carriage with private respondent. We conclude by holding that as the suit below is not for loss or damage to goods contemplated in 3(6), the question of prescription of action is governed not by the COGSA but by Art. 1144 of the Civil Code which provides for a prescriptive period of ten years. WHEREFORE, the decision of the Court of Appeals is AFFIRMED. SO ORDERED. Regalado (Chairman), Melo, Puno and Martinez, JJ., concur.

Republic of the Philippines SUPREME COURT Manila SECOND DIVISION G.R. No. L-54140 October 14, 1986 FILIPINO MERCHANTS INSURANCE COMPANY, INC., petitioner, vs. HONORABLE JOSE ALEJANDRO, Presiding Judge of Branch XXVI of the Court of First Instance of Manila and FROTA OCEANICA BRASILIERA, respondents. G.R. No. L-62001 October 14, 1986 FILIPINO MERCHANTS INSURANCE COMPANY, INC., petitioner, vs. HONORABLE ALFREDO BENIPAYO, Presiding Judge of Branch XVI of the Court of First Instance of Manila and AUSTRALIA-WEST PACIFIC LINE, respondents.

GUTIERREZ, JR., J.: These consolidated petitions raise the issue of whether or not the one-year period within which to file a suit against the carrier and theship, in case of damage or loss as provided for in the Carriage of Goods by Sea Act applies to the insurer of the goods. On August 3, 1977, plaintiff Choa Tiek Seng filed a complaint, docketed as Civil Case No. 109911, against the petitioner before the then Court of First Instance of Manila for recovery of a sum of money under the marine insurance policy on cargo. Mr. Choa alleged that the goods he insured with the petitioner sustained loss and damage in the amount of P35,987.26. The vessel SS Frotario which was owned and operated by private respondent Frota Oceanica Brasiliera, (Frota) discharged the goods at the port of Manila on December 13, 1976. The said goods were delivered to the arrastre operator E. Razon, Inc., on December 17, 1976 and on the same date were received by the consignee-plaintiff. On December 19, 1977, the petitioner filed its amended answer disclaiming liability, imputing against the plaintiff the commission of fraud and counterclaiming for damages. On January 9, 1978, the petitioner filed a third-party complaint against the carrier, private respondent Frota and the arrastre contractor, E. Razon, Inc. for indemnity, subrogation, or reimbursement in the event that it is held liable to the plaintiff. Meanwhile, on August 10, 1977, Joseph Benzon Chua filed a similar complaint against the petitioner which was docketed as Civil Case No. 110061, for recovery under the marine insurance policy for cargo alleging that the goods insured with the petitioner sustained loss and damage in the sum of P55,996.49. The goods were delivered to the plaintiff-consignee on or about January 25-28, 1977.