Académique Documents

Professionnel Documents

Culture Documents

Markstrat Report - Company I - Nigel Quah - Yuanxin Gao - Zille Hussnain

Transféré par

Zillay Hussnain BasijiDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Markstrat Report - Company I - Nigel Quah - Yuanxin Gao - Zille Hussnain

Transféré par

Zillay Hussnain BasijiDroits d'auteur :

Formats disponibles

Marketing Strategy atReport Markstra Introduc ction Initially the game of f Markstrat looked very s simple butwith w every

y pe eriod it beca ame more int teresting as complex. Our journey y as team I st tarted with two t main brands named d SIBI and SIR RO. After as well a making decisions in period 0, we w landed by y default in the segment of Others with SIBI an nd in the tofSingleswith w SIRI.For rthenexttw woperiods,we w heavilyinvestedinou urbrandsand dpoured segment alotofm moneyandtargeted t constantlytoSin nglesandOt thers.Sinceteam t U,Oan ndYwereplacedina much be etter position (by the de efault setting gs of Markstr rat)so our fir rm had a kin nd of disadva antage in competi ing with them m but in terms of stock priceour te eam maintained a steady y growth. Be ecause of that init tial advantag ge to other teams, they y started to eat the part of our ma arket share in every period. Inperiod0,wehada34 4.9%sharein nthesegmen ntofSinglesand36.5%s shareinthesegment rswhilewehad h morethan18%shar reinthetota alsalesinthe emarket.In period1we ehadthe ofOther market s share of 32.5% for Singles( a decrea ase of 2.4%) and 33.3%for f others fo or Others( a decrease of 4.2%) ). In period 2 we faced more m compe etition from our competitors and we e managed to t secure 30.8 % m market share for Singles s and 30.3% market share for Other rs while our stock price grew up steadily and reached to the figu ure of 1018. . At this moment, we fe elt an urge t o modify on ne of our i closer to the custom mers deman nds. For tha at purpose we sold all the old brand to position it inventor ries and cam me up with th he changes t to modify SIRO and wait ted to see th he results of f the first modifica ationstoour rbrand.

SituationAnalysis Compan ny I started out o slow, tak king a big hit t in period 3 when we accidentally u used introd duce new brand and remove ed our old brand b instead d of modify ying them. Our O share pr rice dropped d to 596. NigelQuah YuanxinGao ZilleHussnain

MarketingStrategy MarkstratReport From there, our R&D budget had fallen behind quite significantly, and we had to divert our very limited resources to advertising our very wellpositioned new product. We adopted very aggressive strategyofborrowingheavilyandbroughtourselvesbackintothegame,bringingupourstockprice. However, our line of credit was shortened significantly, and we were unable to enter the Vodite market.

Our firm, company I is currently the 4th largest in the market according to market capitalization. Overall, our retail sales currently stands at 134,000, making us the 3rd largest player in the Sonite market. We have been gaining market share at an average of 2% per period since period 3, and our products SIGN, SICK and SIBU are wellpositioned for consumer segments others, highearners, and buffs respectively. Specifically, we hold 67.7% of the Buffs market with only one other product SYBU coming close (25.9%). Similarly, SICK is the market leader with 38.3% of the High earners segment, edging out SAKI and SOFY at 29.1% and 23.5% each. Lastly, SIGN trails SAMA in the others segment, at 12.4% compared to 64.6% of SAMA. Therefore, we believe that with the rightamountofadvertisingandlittlemodification,ourpotentialforgrowthishumongous.

The current situation is that our company is focused on removing debt and positioning ourselves to be sold. We have good feasibility studies to enter Vodites and our current Sonite markets are doing well as cash cows. Our products are gaining market share and we have two clear cash cows: SIBU andSICK.WehavecomparativelylowinvestmentsinR&D,butourROIisverysignificant.Apartfrom our mistake, resource management has been very effective. Furthermore, our company has the lowest cost prices, and this means that our eventual return will be larger than that of competitors, and we can afford to engage in lengthy price wars, giving us a comparative advantage in the long term.

SWOTanalysis Strengths We have 3 very well positioned products with good market share. They can act as cash cows for further development of other products. We have also prepared feasibility studies to produce Vodite products, which are aimed at early adopters and followers. These products have low base cost and willbeabletowrestmarketsharefromotherconsumers

Weaknesses We have historically had very low capital. This has led to low R&D investments due to the pricey nature of the ventures. Our mistake, which consequently led us to use an aggressive borrowing strategy has also led to high debt and interest payments. Lastly, we have no products launched in theVoditemarket. NigelQuah YuanxinGao ZilleHussnain

MarketingStrategy MarkstratReport

Opportunities We have the opportunity to enter vodite market using our prepared feasibility study (thereby decreasing initial investment) with increased advertising to snatch market share. Furthermore, it is possible to continue modifying our Sonite products to gain even more market share and boost our cash cow status. It is also possible for us to improve our production level management in order to preventshortageofproducts,whichhasaffectedourrevenuelevelsinthepast.

Threats Newentrantsinourexistingdominantmarkets.Shiftingconsumertastesarealsoathreat,giventhe high number of products surrounding each customer segment at the moment. The shift may favour other products and decrease our dominance in the market segment. Lastly, the possible further decrease of the market size of customer segments that we are dominant in. This is currently a small trendinthesegmentofBuffs.

StrategicMarketPlan Sinceweborrowedalotofmoneyinperiod4and5,wecouldntgrowfastbyhighinterestdebtand limited budget. However by period 8, we can pay all our debt back, therefore we have money to focusonthe R&Dandadvertising. Sowedecideto havearealaggressivemarketplan.Basically,we wantmoveourSIGNforOtherstotheStarspartandkeepour2cashcawscontinuouslybringmoney for us. At the same time, we will launch our R&D product VIVI (which is already done with the feasibility study) to Vodite market to seize the opportunities in the high growth rate market . EnteringinVoditemarket isa mustfor us, notonly becausewearetheonlyfirmwhohavent been there, but we need to have more stars . It is impossible for us to have more in crowded Sonite market, as the Buffs and High earners are decreasing, in the long run we will loss the advantages taken by SIBU and SICK. Whats more, now the Vodite market is more mature and stable, its easier for us to invest in the R&D fit for our targets ( more references database on competitors and ideal valuesevolutiononconsumers).

NigelQuah YuanxinGao ZilleHussnain

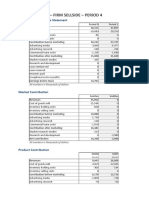

Marketing Strategy atReport Markstra Ourgrow wthsharematrix m inSonitemarketpe eriod7

In order r to reach th hese goals, we will use 4 Ps of marketing conc cept to have e a clear clu ue in our strategic cmarketplan. Brandm mapinSonite emarketper riod7

Product t As we c can see in th he brand ma ap in period d 7, we have e 3 wellpositioned prod ductsSIBU ta arget for Buffs, SI ICK target fo or High earne ers and SIGN N target for Others. Wedecide to co ontinue mod dify them with po ower and design d (whic ch are both h important t to custom mers, accord ding to Idea a Values ImportanceofChara acteristic6and4)inth henextperio odsandguaranteeourc closestpositionsnear ey in the R& &D for SICK,cause c we fee el threatene ed by our all our targets. Firstly, we will put our mone itor SAKI ( SA AKI was laun nched in per riod 5 and no ow it has mo ore purchase e intentions fro High competi NigelQuah YuanxinGao ZilleHussnain

MarketingStrategy MarkstratReport earners than SICK ). We afraid that SAKI will snatch our market share quickly with its continuous increasing brand awareness. (from the Units Market SharesSonite MarketSegment High earners, we loss some market shares in period 67 because of the highly increased market share by SAKI). Then, we decide to modify SICK with its power from 49 to 51( 60 for SAKI, however in Semantic Scales Ideal Value evolution map , High earners want lower power than before. ) and decrease our base cost in order to earn more money. Second step, we will launch our R&D of VIVI for Vodite markettargetontheearlieradopterstoseizethemarketsharewhenitsnottoolate.Lastly,wewill increase the design to 6 for SIGN to compete with SAMA, as the design is more important than before and Others want more design in the last periods, we should be the leader to invest in this characteristic. Promotion When we see the brand characteristics , we can find out that we have the same design with SAKI. However, in the brand map with design and price, our design is far from what the High earners expectpointwhereSAKIperfectlylocatedin.ForSIBU,itsthesamesituation,ourdesignisthesame withSUSI,whileinthebrandmap,SUSIsdesignisclosertoBuffsexpectation. Therefore,our mainproblemaboutourdecreasing purchaseintentiontoSICK and the disadvantage with SIBU is the consumer perceptions, so when we do the R&D for SICK , we will do the advertising more accurately at the same time. We will continuously invest in advertising research to keep the quality of our promotion. For SIGN, we should keep investing in the advertising to earn the brand awareness competing with SAMA who has been in the market from the beginning. For sales force, we did a great job and will keep this advantage by calculate the numbers in every segment refer to ConsumerSurveyShoppingHabitsandourrealdistributions.OurmainstrategyforSalesForceisto increaselittlebylittletodecreasetheriskthatwehavetofiresome. As conclusion for promotion, the most important mission for us now, is the perceptual objectives in semanticscales,wewillfocusondesign,powerandpricetogettherightcognationfromourtargets match with our real products qualities. Only in this way we can have the most efficient profit returnsbymarketing. Price We didnt have a good price strategy at first, because we only want the lowest price compared to our competitors to survive in the crowded market. It was a shortterm benefit for us, for the long term it is difficult to us to keep the pricing flexibility because we cant decrease them anymore and its also risky to increase them. Also, we cant get high revenue because of the lowest price and not so good base cost, it is part of the reason we always with low budget. So, for the next periods, we willkeepthepricereasonablefitforourtargetsandashighaspossibleforanewproductinorderto adjustitlater. NigelQuah YuanxinGao ZilleHussnain

Marketing Strategy atReport Markstra Place Inventor ryHoldingCo ostinAllmarkets

Asweca anseeinthe einventoryholding h costm map,wedidagoodman nagementab boutproduct tionunits especially for latest periods, and d also for the e distribution manageme ent. We will keep this ad dvantage with calculating sal les volume of all produ ucts sold to o our target ts times our r product consumer intentionpercentagetohavetheproduction ndecisioninordertodecreasetheh holdingcost.Also,we calculate the e numbers in n every segm ment refer to o ConsumerSurvey S Shop pping Habits s and our should c salesfor rcetodecide ethedistribu utionofeach hchannel.

Perform manceTimelineandAlloc cationofMa arketingBud dget Inviewo ofourplansandtherem movalofdebt tfromourcompanyacco ount,wefee elthatourco ompanyI has in fa act been giv ven a renewa al of capital and is relat tively wellsu uited to ente er new mark kets with security in revenues s and marke et share. Sho ould our com mpany be bo ought over (o our we could use an tal will enabl le us to putour feasibilit ty studies to o use and aggressive credit line), the injection of capit ur two vodite e products in nto the mark ket. The prod ducts havebeen b designe ed to fit theneeds of bring ou early ad dopters and followers; the two segm ments with the largest market size and growth h. In this sense,w wrestingmar rketshareof fthesetwos segmentsare eimportant.Takingthes seintoconsid deration, we have e decided to o adopt the following ac ctions and allocate our marketing m bu udget for th he next 3 periodsinthismann ner: ndofperiod7; Startingfromtheen NigelQuah YuanxinGao ZilleHussnain

MarketingStrategy MarkstratReport Period 8 Complete R&D projects for Vodite product PVIVI aimed at the early adopters segment of Vodites. Increase marketing budget for SIGN and SIBU, whilst preparing to make modifications to SICK if necessary in order to maintain our market leader position for segment High earners. We estimate that we will require approximately 7 million in loans or capital injection. We expect retail sales to increase as well, as companies will start to pull Sonite products in order to cut losses (e.g. SYBU,SYCA,SUSI).Weexpectlittlechangeinourstockprice

Period 9 Launch Vodite Product VIVI, redirect marketing budgets from Sonite products into the Vodite market so as to increase awareness and attempt to gain market share. Modifications to SICK should be done as well in order to maintain our market leader position for Highearners. Depending on whether product lines from other companies have been pulled, we would decide to raise prices to increase revenues, or remain with the status quo. We estimate that we will require no additional capital in the form of loans or capital injections. With the launch of VIVI, we expect our stock price andmarketcapitalizationtoincreasesignificantly,allowingusacorrespondingincreaseinbudgetfor the next period to consider launching another Vodite. To this end, we might consider conducting anotherfeasibilitystudysoastopositionourselvestoenteranewsegmentoftheVoditemarket.

Period 10 Depending on the performance of product VIVI, we will decide whether to reduce the advertisingbudgetoremploymoreaggressiveadvertisingtopromotebrandawareness.Wewillalso publishmodifiedSICKandadvertiseheavilyin thatarea.Similar considerationswillbegivento price increases in order to boost revenues as during period 9. Modifications to other Sonite products will alsobeconsideredatthisstagetocementourmarketposition.Ifperformanceseemsrelativelygood and we have no more pressing matters, we will start to complete a second R&D project for the Vodite market. We expect our stock price and market capitalization to remain similar for the next period. Conclusion CompanyIispositionedfairlywellintheSonitemarket,andthestepswehavetaken,andarewilling totakeinthefuturetodefendthatpositionhasbeenclearlyoutlinedinthereport.Furthermore,we have conducted feasibility studies that facilitate a speedy break into the Vodite markets. In this sense,wefeelthatcompanyIiswellpositionedtobecomeahighvalueandhighgrowthcompanyin theMarkstratworldifthegamewereallowedtocontinue. In retrospect, however, we feel that Markstrat has taught us much about classical marketing. While it is unfortunate that a misunderstanding of the mechanics of the game has caused us a severe disadvantage in capital in the very beginning of the game, it has allowed us to feel the difficulty of making hard decisions due to limited resources and the subsequent satisfaction of making the right choices. In the simplistic world of Markstrat, it is ever more important that one understands the impact of choices in marketing budget and positioning, amongst the myriad other theories that come into play here, such as the firstmover advantage. To this end, I believe that Markstrat has adequately forced us to understand the impact of classical marketing theories, and willbeusefulinthefuture. NigelQuah YuanxinGao ZilleHussnain

Vous aimerez peut-être aussi

- Markstrat ReportDocument9 pagesMarkstrat Reportsazk07Pas encore d'évaluation

- Market - Driven StrategyDocument3 pagesMarket - Driven StrategyMustafizur Rahman100% (5)

- Li Lu Top ClassDocument12 pagesLi Lu Top ClassHo Sim Lang Theophilus100% (1)

- Good Info CapsimDocument11 pagesGood Info Capsimmstephens1Pas encore d'évaluation

- Unme Jeans Case StudyDocument59 pagesUnme Jeans Case StudynarikPas encore d'évaluation

- Capstone Simulation: Strategy For Your CompanyDocument17 pagesCapstone Simulation: Strategy For Your Companyadivitya100% (6)

- Question Bank On: IndianDocument48 pagesQuestion Bank On: IndianKanak KarihalooPas encore d'évaluation

- Markstrat FinalReportExampleDocument26 pagesMarkstrat FinalReportExampleHassan Amir Khan100% (1)

- Barco Case WriteupDocument2 pagesBarco Case WriteupClare Lee Li Ting0% (1)

- Final Project Strategic Management and PolicyDocument10 pagesFinal Project Strategic Management and PolicyBushra ImranPas encore d'évaluation

- Thesis & Case Study Submit By-Submit To - Kawinder Jit Sakshi Sharma Enroll No.-5800800101Document101 pagesThesis & Case Study Submit By-Submit To - Kawinder Jit Sakshi Sharma Enroll No.-5800800101finlifecon63Pas encore d'évaluation

- Notes CapsimDocument6 pagesNotes CapsimElinorWang0% (1)

- Digby Corp 2021 Annual ReportDocument13 pagesDigby Corp 2021 Annual ReportwerfsdfssePas encore d'évaluation

- PGP 21 198 SapDocument2 pagesPGP 21 198 SapSonaliCaffreyPas encore d'évaluation

- FinalDocument32 pagesFinalSuman GadwalPas encore d'évaluation

- Welcome To The Capstone Rehearsal Tutorial!Document10 pagesWelcome To The Capstone Rehearsal Tutorial!Abhishek Singh ChauhanPas encore d'évaluation

- Mark Up Mark Down QuizDocument6 pagesMark Up Mark Down QuizEfrelyn Grethel Baraya AlejandroPas encore d'évaluation

- Stratsim AnalysisDocument12 pagesStratsim Analysisblackbirdx2_22456622100% (3)

- Management Games Andrews Industry 24Document9 pagesManagement Games Andrews Industry 24Rahul ChauhanPas encore d'évaluation

- Section 6 - AI2 - Cola Wars ContinueDocument10 pagesSection 6 - AI2 - Cola Wars ContinueBadri NarayananPas encore d'évaluation

- RTS Company AndrewsDocument26 pagesRTS Company Andrewsasia0312Pas encore d'évaluation

- A Study On Impact of Advertisement and Promotion On Consumer Purchase DecisionDocument18 pagesA Study On Impact of Advertisement and Promotion On Consumer Purchase DecisionAnonymous CwJeBCAXpPas encore d'évaluation

- Global Supply Chain Manager-Li & FungDocument33 pagesGlobal Supply Chain Manager-Li & FungnishaibsmPas encore d'évaluation

- The Fashion Channel: Section-A Group - 6Document4 pagesThe Fashion Channel: Section-A Group - 6Aviral SankhyadharPas encore d'évaluation

- Markstrat Presentation Industry 5 Firm IDocument15 pagesMarkstrat Presentation Industry 5 Firm Iprahaladhan-knight-940Pas encore d'évaluation

- Markstrat: Team O Learnings: Submitted byDocument4 pagesMarkstrat: Team O Learnings: Submitted bynevin04Pas encore d'évaluation

- Master of Business Administration (MBA-CORE)Document4 pagesMaster of Business Administration (MBA-CORE)Anish Dalmia100% (1)

- Chester Capsim Report I Professor FeedbackDocument8 pagesChester Capsim Report I Professor Feedbackparamjit badyal100% (1)

- Performance Over The Course of Simulation MarkstratDocument5 pagesPerformance Over The Course of Simulation MarkstratAnkit SutariyaPas encore d'évaluation

- ERP SIMULATION - grp4 - Sec-CDocument18 pagesERP SIMULATION - grp4 - Sec-CPrakhar DadhichPas encore d'évaluation

- UnMe Jeans - AnalysisDocument5 pagesUnMe Jeans - AnalysisAvni MisraPas encore d'évaluation

- Markstrat Questionnaire - Suggested AnswersDocument6 pagesMarkstrat Questionnaire - Suggested AnswersHafizkamranashrafPas encore d'évaluation

- Markstrat Report Round 0-3 Rubicon BravoDocument4 pagesMarkstrat Report Round 0-3 Rubicon BravoDebadatta RathaPas encore d'évaluation

- CAPSIM Capstone Strategy 2016Document21 pagesCAPSIM Capstone Strategy 2016Khanh MaiPas encore d'évaluation

- Capstone Industry - 602 Team AndrewsDocument17 pagesCapstone Industry - 602 Team AndrewsPeshwa BajiraoPas encore d'évaluation

- Markstrat ReportDocument1 pageMarkstrat Reportjipou59Pas encore d'évaluation

- Financial Report - Firm Sellside - Period 4: Company Profit & Loss StatementDocument73 pagesFinancial Report - Firm Sellside - Period 4: Company Profit & Loss StatementNancy suri100% (1)

- 500 - Capsim Team Member GuideDocument28 pages500 - Capsim Team Member GuideJaspreetPas encore d'évaluation

- SalesDocument3 pagesSalesEdgardo MartinezPas encore d'évaluation

- The Multiunit EnterpriseDocument4 pagesThe Multiunit EnterpriseRia AgustrianaPas encore d'évaluation

- Markstrat ReportDocument2 pagesMarkstrat ReportAbhi RamPas encore d'évaluation

- Group 4: Amit Sarda - Esha Sharma - Meeta Arya - Swati SachdevaDocument8 pagesGroup 4: Amit Sarda - Esha Sharma - Meeta Arya - Swati SachdevaAmit SardaPas encore d'évaluation

- Colgate Case WriteupDocument1 pageColgate Case WriteupRishit ShahPas encore d'évaluation

- ReportCapsimSavchenko PDFDocument12 pagesReportCapsimSavchenko PDFIvannaPas encore d'évaluation

- Tata Nano Marketing MixDocument4 pagesTata Nano Marketing MixRafi Uddin SharikPas encore d'évaluation

- USA Today CaseDocument10 pagesUSA Today CaseMasyitha MemesPas encore d'évaluation

- Markstrat ManualDocument50 pagesMarkstrat ManualJanet LeePas encore d'évaluation

- Individual AssignmentDocument6 pagesIndividual AssignmentPhan TitPas encore d'évaluation

- CaseDocument5 pagesCaseRj KumarPas encore d'évaluation

- Jindi EnterprisesDocument2 pagesJindi EnterprisesVvb SatyanarayanaPas encore d'évaluation

- Electronic Product DivisionDocument15 pagesElectronic Product DivisionzackyzzPas encore d'évaluation

- Capstone Situation AnalysisDocument5 pagesCapstone Situation AnalysisHerbert Ascencio0% (1)

- Argentina Team Coaching Practice Period 02Document28 pagesArgentina Team Coaching Practice Period 02qaisrani_1Pas encore d'évaluation

- How GiveIndia OperatesDocument10 pagesHow GiveIndia OperatesalvesameerPas encore d'évaluation

- Tanya: Product Life CycleDocument8 pagesTanya: Product Life CycleJoey G CirilloPas encore d'évaluation

- Honda A: Group-Karthik, Mohit, Ramya, Rishabh, Sharvani, ShouvikDocument8 pagesHonda A: Group-Karthik, Mohit, Ramya, Rishabh, Sharvani, ShouvikKarthik BhandaryPas encore d'évaluation

- 12-095Document10 pages12-095pudaynag2000Pas encore d'évaluation

- Group 15 Sport ObermeyerDocument12 pagesGroup 15 Sport ObermeyerSaurabh Pillai100% (2)

- CapsimDocument7 pagesCapsimakarsh jainPas encore d'évaluation

- Lifebuoy: Implementing The Sustainability Plan in India: Hamza Niazi - 17130Document12 pagesLifebuoy: Implementing The Sustainability Plan in India: Hamza Niazi - 17130Hassan Ullah SiddiquiPas encore d'évaluation

- Advertising Experiments at Ohio Art Company: Reshma Majumder P G P 0 9 1 6 8Document5 pagesAdvertising Experiments at Ohio Art Company: Reshma Majumder P G P 0 9 1 6 8Reshma MajumderPas encore d'évaluation

- Clean EdgeDocument9 pagesClean EdgeWajiha MansoorPas encore d'évaluation

- Product Line Management A Complete Guide - 2019 EditionD'EverandProduct Line Management A Complete Guide - 2019 EditionPas encore d'évaluation

- AOL.com (Review and Analysis of Swisher's Book)D'EverandAOL.com (Review and Analysis of Swisher's Book)Pas encore d'évaluation

- Final Strategy Evaluation - Sofia D and Antonia T-LDocument12 pagesFinal Strategy Evaluation - Sofia D and Antonia T-LSaid BelkacemPas encore d'évaluation

- Markstrat ReportDocument9 pagesMarkstrat ReportJawahir MuhammadPas encore d'évaluation

- Question 2: What Are Key Strategies Based On Your Analysis?Document2 pagesQuestion 2: What Are Key Strategies Based On Your Analysis?rakeshPas encore d'évaluation

- Me 4 (Part A)Document6 pagesMe 4 (Part A)Anuj YadavPas encore d'évaluation

- Masterlist of Position Category Updated 10.25.2021Document20 pagesMasterlist of Position Category Updated 10.25.2021johnmarcPas encore d'évaluation

- Session2 Demand v2Document61 pagesSession2 Demand v2Anyone SomeonePas encore d'évaluation

- PlannerU - 149 QuestionsDocument11 pagesPlannerU - 149 QuestionsOreoluwa AderinkomiPas encore d'évaluation

- The Photonis ProjectDocument26 pagesThe Photonis ProjectchandanPas encore d'évaluation

- Ityukta - MECCADocument31 pagesItyukta - MECCAAditi100% (1)

- 5M AdvertisingDocument3 pages5M AdvertisingNiketa Govind KhalkhoPas encore d'évaluation

- Perfect Competition in A Single Market: Essential ReadingDocument37 pagesPerfect Competition in A Single Market: Essential ReadingDương DươngPas encore d'évaluation

- Inventory 1Document5 pagesInventory 1Kim Ivy May FabunanPas encore d'évaluation

- Product ObsolescenceDocument7 pagesProduct ObsolescenceARPITA SELOTPas encore d'évaluation

- Criteria For Choosing Brand ElementsDocument11 pagesCriteria For Choosing Brand ElementsRakibZWaniPas encore d'évaluation

- Three: Gwaweru@kyu - Ac.keDocument4 pagesThree: Gwaweru@kyu - Ac.keDavidPas encore d'évaluation

- Full Download Strategic Marketing 10th Edition Cravens Test BankDocument35 pagesFull Download Strategic Marketing 10th Edition Cravens Test Banklevidelpnrr100% (35)

- IFM - Lecture NotesDocument249 pagesIFM - Lecture NotesSharath S100% (1)

- Synnex TechnologiesDocument7 pagesSynnex TechnologiesSusmitaKraletiPas encore d'évaluation

- M Javed AslamDocument35 pagesM Javed AslammukhtarPas encore d'évaluation

- MCQ Parity KeyDocument6 pagesMCQ Parity Key21070653Pas encore d'évaluation

- Chapter 4 Utility Assessment Task (Answer Key)Document3 pagesChapter 4 Utility Assessment Task (Answer Key)Jocelyn LooPas encore d'évaluation

- B. There Are Four Basic Strateg - S in Internatbnal MarketsDocument2 pagesB. There Are Four Basic Strateg - S in Internatbnal MarketsMeskat Hassan KhanPas encore d'évaluation

- Digital Marketing in COVIDDocument3 pagesDigital Marketing in COVIDDhiraj BhangalePas encore d'évaluation

- Elasticity NotesDocument4 pagesElasticity NotesAnonymousPas encore d'évaluation

- Importance of Marketing in Fashion and Apparel Industry-MahidaDocument4 pagesImportance of Marketing in Fashion and Apparel Industry-MahidasatexPas encore d'évaluation

- Summary of Principles of Economy Chapter 1Document6 pagesSummary of Principles of Economy Chapter 1Arizfa100% (1)