Académique Documents

Professionnel Documents

Culture Documents

Assessement Procedure in Indian Income Tax

Transféré par

earthanskyfriendsCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Assessement Procedure in Indian Income Tax

Transféré par

earthanskyfriendsDroits d'auteur :

Formats disponibles

by

Dr Vinay Kumar Singh

Additional Director (Faculty),

NATIONAL ACADEMY OF DIRECT

TAXES, NA!"R

. . . . , N \ D T Nupur

, lllR|\RY ?O!O

l\RT !

3

LAW

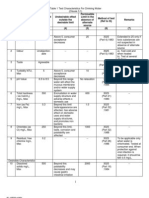

- Tn!rcduc!!cn !c Tnccmc - Tn!rcduc!!cn !c Tnccmc

!ux !ux . .

llGTSl\T|Rl

Ol TNDT\

lOlTCY l\" GO\l \DMTNTSTR\TTON

CTTT/lNS Ol TNDT\

l!cc!!c

ns

Tn!cns!cn c

!c!s!u!urc

ST\T|Tl

- Cc!!cc!!cn c rcvcnuc

cr l|llTC GOODS

- Rcd!s!r!bu!!cn c

!nccmc

- lchuv!cur

mcd!!cu!!cn

-lO|TTY

-Nl|TR\lTTY

-lllTCTlNCY

-lRlDTCT\lTlTTY

-\DlO|\CY

- S!undurd !cx!

- Ccnvcvs

!n!cn!!cn c

!c!s!u!urc !c

& \dm!n!s!ru!crs

ccmp!!crs

-R|llS

-lROClD|Rl

-CON\lNTTONS

. . . M O l

. . . . C l D T

. . . . C C s T T

. . . C s T T

./ . . \dd! J! C s

. . T T

/ . \ss!! Dcp Cs

. . T T

. . . T T O s

. . . T T T s

. . / . . S C H C

Tn!crprc!u!!cn

c

!n!cn!!cn c

!c!s!u!urc

. . . ( ) C s T T \ppcu!

\SSl

SSTN

G

OllT

ClR

\c!un!urv

ccmp!!unc

c

C\Sl

l\"S

ORDlRS

. . . . T T \ T

4

LAW is in the form of text, which in turn is composed of

words & phrases

Words (& phrases) can often mean different things in

different contexts

Different persons can claim different meaning or

interpretation of words (& phrases)

Words (& phrases) can e defined within the rele!ant law

(Act)

Definitions themsel!es are composed of words (& phrases), and so

ma" ecome su#ect to interpretational disputes

Words (& phrases) not defined in the law (Act) ha!e to e

understood as there are used in common parlance (so far

as the" do not lead to asurdit")

$he %&W'( &) *+$'(%('$A$*&+ &) *+$'+$*&+ &)

L',*-LA$.(' in use of particular words (& phrases) in law

!ests with the /igher #udiciar" (/0 1 -0)

*+$'(%('$A$*&+ &) -$A$.$'

- Tn!rcduc!!cn !c Tnccmc - Tn!rcduc!!cn !c Tnccmc

!ux !ux . .

2

Law is made " the

representati!es of the

citi3ens

All pulic ser!ants wor4 for the

citi3ens of the countr"

'xecuti!e has the responsiilit"

of ensuring compliance of the

Law

*ncome tax authorities are

5.A-*-6.D*0*AL in nature

While exercising this

responsiilit", and while

dealing with citi3ens, the"

must follow the asic

principles of natural #ustice7

A!!RECIATION OF

E#IDENCE

O!!ORT"NITY OF $EIN

%EARD

S!EA&IN ORDER

A!!LICATION OF MIND

%(*+0*%L'- &) +A$.(AL

6.-$*0'

- Tn!rcduc!!cn !c Tnccmc - Tn!rcduc!!cn !c Tnccmc

!ux !ux . .

llGTSl\T|R

l

J|DTCT\

RY

l\lC|TT\l

8

L*9*$A$*&+ &) %&W'(

+o action can e ta4en " an executi!e

that impinges upon an" of the rights of

the citi3ens, unless the Law authori3es

such action

Action can onl" e ta4en " the authorit"

to whom the power is delegated, &+L:

within his 6.(*-D*0$*&+

$here must e application of mind " that

authorit"

Action must e ;&+A-)*D' & +&+-

D*-0(*9*+A$&(: (+'.$(AL*$:)

L*9*$A$*&+ &) $*9'

$ime limits often defined in the Act for

certain actions

+o action possile once ;A(('D ;: $*9'

L*9*$A$*&+

L*9*$A$*&+ &) *+$'(%('$A$*&+

Words (& phrases) defined in the statute

0ase laws interpreting the meaning of

certain terms

0ommon parlance (in 4eeping with o!erall

o#ecti!e)

L*9*$A$*&+- &+ A.$/&(*$: &)

'<'0.$*='

- Tn!rcduc!!cn !c Tnccmc - Tn!rcduc!!cn !c Tnccmc

!ux !ux . .

l\lC|TT\l

>

%.;L*0 -'(=A+$

- Tn!rcduc!!cn !c Tnccmc - Tn!rcduc!!cn !c Tnccmc

!ux !ux . .

l\lC|TT\l

. ( ) Scc ? 8 c

TT \c!

l|llTC

SlR\\NT

. Scc ?! c

TlC

?

%.;L*0 -'(=A+$

- Tn!rcduc!!cn !c Tnccmc - Tn!rcduc!!cn !c Tnccmc

!ux !ux . .

l\lC|TT\l

Sec '( o) INDIAN !ENAL CODE

Nint*- '!er" officer whose dut" it is, as such officer, to

ta4e, recei!e, 4eep or expend an" propert" on ehalf of

the ,o!ernment, or to ma4e an" sur!e", assessment or

contract on ehalf of the ,o!ernment, or to execute

an" re!enue process, or to in!estigate, or to report, on

an" matter affecting the pecuniar" interests of the

,o!ernment, or to ma4e, authenticate or 4eep an"

document relating to the pecuniar" interests of the

,o!ernment, or to pre!ent the infraction of an" law for

the protection of the pecuniar" interests of the

,o!ernment@

Tent*- '!er" officer whose dut" it is, as such officer, to

ta4e, recei!e, 4eep or expend an" propert", to ma4e

an" sur!e" or assessment or to le!" an" rate or tax for

an" secular common purpose of an" !illage, town or

district, or to ma4e, authenticate or 4eep an"

document for the ascertaining of the rights of the

people of an" !illage, town or district@

T+el)t*- E,ery -er.on/

(a) in t*e .er,ice or -ay o) t*e o,ern0ent or

re0unerated 1y )ee. or co00i..ion )or t*e

-er)or0ance o) any -u1lic duty 1y t*e

o,ern0ent2

lub!!c scrvun! hus !hc sum c m cun!n us !n

( scc!!cn ?! c !hc Tnd!un lcnu!C cdc 45 c

) !8GO

S c c ?

( ) 8 c

. T T \ c!

A

*+0&9'-$A< A.$/&(*$*'-

- Tn!rcduc!!cn !c Tnccmc - Tn!rcduc!!cn !c Tnccmc

!ux !ux . .

. . Scc !!G - Thcrc shu!! bc !hc c!!c!n c!usscs c !nccmc !ux

, : uu!hcr!!!cs cr !hc purpcscs c !h!s \c! numc!v

(u) !hc Ccn!ru! lcurd c D!rcc! Tuxcs ccns!!!u!cd undcr !hc

, ( ), Ccn!ru! lcurds c Rcvcnuc \c! !OG8 54 c !OG8

(b) - - D!rcc!crs Gcncru! c Tnccmc !ux cr Ch!c Ccmm!ss!cncrs c

- , Tnccmc !ux

(c) - - D!rcc!crs c Tnccmc !ux cr Ccmm!ss!cncrs c Tnccmc !ux cr

- ( ), Ccmm!ss!cncrs c Tnccmc !ux \ppcu!s

(cc) - \dd!!!cnu! D!rcc!crs c Tnccmc !ux cr \dd!!!cnu!

- Ccmm!ss!cncrs c Tnccmc !ux cr \dd!!!cnu! Ccmm!ss!cncrs c

- ( ), Tnccmc !ux \ppcu!s

(ccu) - Jc!n! D!rcc!crs c Tnccmc !ux cr Jc!n! Ccmm!ss!cncrs c

- , Tnccmc !ux

(d) - Dcpu!v D!rcc!crs c Tnccmc !ux cr Dcpu!v Ccmm!ss!cncrs c

- - ( ), Tnccmc !ux cr Dcpu!v Ccmm!ss!cncrs c Tnccmc !ux \ppcu!s

(c) - \ss!s!un! D!rcc!crs c Tnccmc !ux cr \ss!s!un!

- , Ccmm!ss!cncrs c Tnccmc !ux

() - , Tnccmc !ux O!ccrs

() , Tux Rcccvcrv O!ccrs

(h) - . Tnspcc!crs c Tnccmc !ux

BC

*+0&9'-$A< A.$/&(*$*'-

- Tn!rcduc!!cn !c Tnccmc - Tn!rcduc!!cn !c Tnccmc

!ux !ux . .

l\lC|TT\l

. Scc ?

( ) ?8

. Scc ?

( ) !?

. Scc ?

( ) !5\

. Scc ?

( ) !G

. ( ) / ( ) / ( )/ Scc ? !C ? !D ? ?8C

( ) ? ?8D

. ( ) / ( ) / ( )/ Scc ? O\ ? Ol ? !O\

( ) ? !OC

. Scc ?

( ) ?5

. Scc ?

( ) \

. Scc !!

( ) !

BB

A--'--*+, &))*0'(

- Tn!rcduc!!cn !c Tnccmc - Tn!rcduc!!cn !c Tnccmc

!ux !ux . .

Sec3 ' (4A) A..e..in5 O))icer means

the Assistant 0ommissioner or Deput"

0ommissioner or Assistant Director or

Deput" Director or the *ncome-tax

&fficer who is !ested with the rele!ant

#urisdiction " !irtue of directions or

orders issued under su-section (B) or

su-section (D) of section BDC or an"

other pro!ision of this Act,

and the Additional 0ommissioner or

Additional Director or 6oint

0ommissioner or 6oint Director who is

directed under clause () of su-section

(4) of that section to exercise or

perform all or an" of the powers and

functions conferred on, or assigned to,

an Assessing &fficer under this Act @

BD

A--'--*+, &))*0'(

- Tn!rcduc!!cn !c Tnccmc - Tn!rcduc!!cn !c Tnccmc

!ux !ux . .

Sec3 ('6 7uri.diction o) inco0e/ta8 aut*oritie.

(() *ncome-tax authorities shall exercise all or an" of the

powers and perform all or an" of the functions conferred

on, or, as the case ma" e, assigned to such authorities

" or under this Act in accordance with such directions as

the ;oard ma" issue for the exercise of the powers and

performance of the functions " all or an" of those

authoritiesE

Explanation. )or the remo!al of douts, it is here"

declared that an" income-tax authorit", eing an

authorit" higher in ran4, ma", if so directed " the ;oard,

exercise the powers and perform the functions of the

income-tax authorit" lower in ran4 and an" such direction

issued " the ;oard shall e deemed to e a direction

issued under su-section (B)E

(') $he directions of the ;oard under su-section (B) ma"

authorise an" other income-tax authorit" to issue orders

in writing for the exercise of the powers and performance

of the functions " all or an" of the other income-tax

authorities who are suordinate to itE

. ( ) S c c ? \ \ ssc ss!n

O !cc r

B3

A--'--*+, &))*0'(

- Tn!rcduc!!cn !c Tnccmc - Tn!rcduc!!cn !c Tnccmc

!ux !ux . .

Sec3 ('6 7uri.diction o) inco0e/ta8 aut*oritie.

9) Without pre#udice to the pro!isions of su-sections (B) and (D), the

;oard ma", " general or special order, and su#ect to such

conditions, restrictions or limitations as ma" e specified therein,

(a) authorise an" Director ,eneral or Director to perform such

functionsof an" other income-tax authorit" as ma" e assigned to

him " the ;oard@

(b) empower the Director ,eneral or 0hief 0ommissioner or

0ommissioner to issue orders in writing that the powers and

functions conferred on, or as the case ma" e, assigned to, the

Assessing &fficer " or under this Act in respect of an" specified

area or persons or classes of persons or incomes or classes of

income or cases or classes of cases, shall e exercised or

performed " an Additional 0ommissioner or an Additional

Director or a 6oint 0ommissioner or a 6oint Director, and, where

an" order is made under this clause, references in an" other

pro!ision of this Act, or in an" rule made thereunder to the

Assessing &fficer shall e deemed to e references to such

Additional 0ommissioner or Additional Director or 6oint

0ommissioner or 6oint Director " whom the powers and functions

are to e exercised or performed under such order, and an"

pro!ision of this Act reGuiring appro!al or sanction of the 6oint

0ommissioner shall not appl"E

. ( ) S c c ? \ \ ssc ss!n

O !cc r

B4

A--'--*+, &))*0'(

- Tn!rcduc!!cn !c Tnccmc - Tn!rcduc!!cn !c Tnccmc

!ux !ux . .

*E$E Authorit" !sE AE&E

-ec BDC t or s

su s t on( (

vs susection (4)()

What is the impact of secE BDC (D)

0an there e more than one AE&E for the same

assessee

0an a 6tE 0*$ e made an A& " appl"ing secE

BDC (D)

When will an AddlE 0*$ ecome an AE&E

0an a 0*$ ecome an AE&E rele!ance of secE

BDC (D)

B2

A--'--*+, &))*0'( H A 0A-' -$.D:

- Tn!rcduc!!cn !c Tnccmc - Tn!rcduc!!cn !c Tnccmc

!ux !ux . .

%rior to restructuring of our DepttE, AddlE 1

6tE 0*$s were designated DepE0*$ -ecE D

(D?0) existed ut not secE D (B0).

(FY 2007, w.r.e.f. 1.6.1994)

;oardIs letter dt >-D-CD stated that AddlE

0*$160*$ is entitled to exercise all the

powers and functions of an Assessing

&fficer wor4ing under himE /e can also

finalise the assessment under his

signaturesE

0*$ forwarded the ;oardJs letter to all

AddlE0*$160*$

*n case of ;indal Apparels, the AddlE 0*$

made the assessment orderE

Assessee challenged efore the *$A$, Delhi

that AddlE 0*$ was not an A&, so the order

is in!alidE

::::

B8

A--'--*+, &))*0'( H A 0A-' -$.D:

- Tn!rcduc!!cn !c Tnccmc - Tn!rcduc!!cn !c Tnccmc

!ux !ux . .

Held

T*e Additional CIT +a. not t*e

;A..e..in5 O))icer< to i..ue a notice

under .3(9= o) t*e Inco0e Ta8 Act

(>?( and 0a@e t*e a..e..0ent

-articularly +*en *e +a. not .o

a--ointed 1y a .-eci)ic order under

.3('6(9)(1) o) t*e Act3 T*ere)ore,

t*e a..e..0ent 0ade 1y t*e

Additional CIT +a. in,alid3 T*e

de)inition o) 7oint CIT under .3'('AC)

o) t*e Act, +*ic* included an

Additional CIT, +a. irrele,ant )or

t*at -ur-o.e3

-Delhi *$A$, in case of ;indal Apparel !sE A0*$, *$ Appeal +oE 2C>

(Delhi) of DCC3

B>

KD*('0$&( ,'+'(AL &( D*('0$&(L

- Tn!rcduc!!cn !c Tnccmc - Tn!rcduc!!cn !c Tnccmc

!ux !ux . .

( r tor

n r l or

r tor m ns

p rson ppo nt to

r tor

n r l o n om

t x or s t s

m r tor

o n om t x un r

su s t on ( o

s t on n

n lu s p rson

ppo nt un r

t t su s t on to

n t on l

r tor o n om

t x or Jo nt

r tor o n om

t x or n ss st nt

r tor or put

r tor o n om

t x

. . . M O l

. . . . C l D T

. . . . C C s T T

. . . C s T T

./ . . \dd! J! C s

. . T T

/ . \ss!! Dcp Cs

. . T T

. . . T T O s

. . . T T T s

\SSl

SSTN

G

OllT

ClR

. . . . D G s T T

. . . D s T T

./ . . \dd! J! D s

. . T T

/ . \ss!! Dcp Ds

. . T T

. ( ) Scc !8? ! Scurch und sc!zurc "hcrc !hc D!rcc!cr Gcncru! cr

D!rcc!cr cr !hc Ch!c Ccmm!ss!cncr cr Ccmm!ss!cncr cr unv such Jc!n!

D!rcc!cr cr Jc!n! Ccmm!ss!cncr us muv bc cmpccrcd !n !h!s bchu! bv

!hc lcurd, .. , ( ) !hcn \ Thc D!rcc!cr Gcncru! cr D!rcc!cr cr !hc

, , Ch!c Ccmm!ss!cncr cr Ccmm!ss!cncr us !hc cusc muv bc muv uu!hcr!sc

, , unv Jc!n! D!rcc!cr Jc!n! Ccmm!ss!cncr \ss!s!un! D!rcc!cr cr Dcpu!v

, - D!rcc!cr \ss!s!un! Ccmm!ss!cncr cr Dcpu!v Ccmm!ss!cncr cr Tnccmc !ux

, ( ) O!ccr cr l , such Jc!n! D!rcc!cr cr Jc!n! Ccmm!ss!cncr, us !hc cusc

, , muv bc muv uu!hcr!sc unv \ss!s!un! D!rcc!cr cr Dcpu!v D!rcc!cr

- , \ss!s!un! Ccmm!ss!cncr cr Dcpu!v Ccmm!ss!cncr cr Tnccmc !ux O!ccr

..

B?

KD*('0$&( ,'+'(AL &( D*('0$&(L

- Tn!rcduc!!cn !c Tnccmc - Tn!rcduc!!cn !c Tnccmc

!ux !ux . .

. . Cun un \dd! DTT !ssuc u scurch urrun! undcr scc

. . ( ) !8? r scc ? ?!

. . - [ ] Tn !hc cusc c Dr Nu!!n! Muhu]un v D!rcc!cr c Tnccmc !ux ?OO?

, ?5 TTR !?8 Dc!h! H!h Ccur! nc!cd !hu!

, Scc ? bc!ns !!h !hc crds un!css !hc ccn!cx! c!hcr!sc

rcqu!rcs

, "hcrc !hc ccn!cx! sc rcqu!rcs mcun!n muv bc d!crcn!

. !hun !hc !!!cru! mcun!n prcv!dcd !n !hc dc!n!!!cn Scc

. !8? dc!ncs h!crurchv c c!ccrs T \dd! D!rcc!cr us

, u!rcudv !nc!udcd !n !hc D!rcc!cr Gcncru! cr D!rcc!cr

!hcn !! cu!d nc! bc rcqu!rcd !c rccr !c !! scpuru!c!v

. ( ) !n scc !8? !

, Tn!crprc!u!!cn c!uusc !s nc! u pcs!!!vc cnuc!mcn! hus u

, . !!m!!cd mcun!n und !!m!!cd cpcru!!cn "h!!c !v!n

, ccc! !c !! Ccur! mus! nc! crc! !hu! sccpc und

cb]cc! c such u prcv!s!cn !s sub]cc! !c !!s

upp!!cub!!!!v und !hc ccn!cx!

Hc!d

\dd!!!cnu! D!rcc!cr us nc! cmpccrcd !c !ssuc !hc scurch

urrun!

BA

A%%'LLA$' A.$/&(*$*'-

- Tn!rcduc!!cn !c Tnccmc - Tn!rcduc!!cn !c Tnccmc

!ux !ux . .

J|DTCT\RY

. Scc ?

( ) 4

. Scc ?

( ) !G\

. . . Scc ?5? c T T

\c!

( ). Scc ? ?OD Nu!!cnu! Tux

Tr!bunu! mcuns !hc Nu!!cnu!

Tux Tr!bunu! cs!ub!!shcd undcr

scc!!cn 8 c !hc Nu!!cnu! Tux

, Tr!bunu! \c! ?OO5

( ) - ( ) / Scc ? !Ol DCTT \

. ( ) \dd! CTT \

DC

A%%'LLA$' A.$/&(*$*'-

- Tn!rcduc!!cn !c Tnccmc - Tn!rcduc!!cn !c Tnccmc

!ux !ux . .

J|DTCT\RY

. ( ) \RT !?4 ! Thcrc shu!! bc u Suprcmc Ccur! c

Tnd!u

, ccns!s!!n c u Ch!c Jus!!cc c Tnd!u und un!!!

, lur!!umcn! bv !u prcscr!bcs u !urcr numbcr c nc!

. mcrc !hun scvcn c!hcr Judcs

- , ( ) Nc !cn!v !vc v!dc !hc Suprcmc Ccur! Numbcr c Judcs

, \mcndmcn! \c! ( ), . . !O8G ?? c !O8G s ?

. . \RT !4! Thc !u dcc!urcd bv !hc Suprcmc Ccur! shu!!

bc b!nd!n cn u!! ccur!s !!h!n !hc !crr!!crv c

. Tnd!u

. \RT 8GG ( ) ! ! !4 H!h Ccur! mcuns unv Ccur! h!ch !s

dccmcd cr !hc purpcscs c !h!s Ccns!!!u!!cn !c bc u

- H!h Ccur! cr unv S!u!c und !nc!udcs ( ) u unv Ccur!

!n !hc !crr!!crv c Tnd!u ccns!!!u!cd cr

rcccns!!!u!cd undcr !h!s Ccns!!!u!!cn us u H!h

, Ccur! und ( ) b unv c!hcr Ccur! !n !hc !crr!!crv c

Tnd!u h!ch muv bc dcc!urcd bv lur!!umcn! bv !u !c

bc u H!h Ccur! cr u!! cr unv c !hc purpcscs c

" !h!s Ccns!!!u!!cn

CONSTTT|TTON Ol TNDT\ CONSTTT|TTON Ol TNDT\

DB

$A< ('0&='(: &))*0'(

- Tn!rcduc!!cn !c Tnccmc - Tn!rcduc!!cn !c Tnccmc

!ux !ux . .

( ) Scc ? 44 Tux Rcccvcrv O!ccr

mcuns - unv Tnccmc !ux O!ccr hc muv bc uu!hcr!scd

bv !hc Ch!c Ccmm!ss!cncr cr Ccmm!ss!cncr, bv cncru! cr

, spcc!u! crdcr !n r!!!n !c cxcrc!sc !hc pccrs c u

Tux Rcccvcrv O!ccr und u!sc !c cxcrc!sc cr pcrcrm

, such pccrs und unc!!cns h!ch urc ccncrrcd cn cr

, uss!ncd !c un \sscss!n O!ccr undcr !h!s \c! und

" h!ch muv bc prcscr!bcd

- Scc Scccnd Schcdu!c lrcccdurc cr rcccvcrv c !ux

- Cun un \CTT bc u TRO '

( ) . . ( ) rc scc !?O ? r ? 44

- Cun u TTO bc u TRO und un \O u! !hc sumc !!mc '

DD

Sec3 '('BA) India means the territor" of

*ndia as referred to in article B of the

0onstitution, its territorial waters, seaed

and susoil underl"ing such waters,

continental shelf, exclusi!e economic 3one

or an" other maritime 3one as referred to in

the $erritorial Waters, 0ontinental -helf,

'xclusi!e 'conomic Mone and other

9aritime Mones Act, BA>8 (?C of BA>8), and

the air space ao!e its territor" and

territorial waters

*+D*A

- Tn!rcduc!!cn !c Tnccmc - Tn!rcduc!!cn !c Tnccmc

!ux !ux . .

CONSTTT|TTON Ol TNDT\ CONSTTT|TTON Ol TNDT\

. . .- \RT ! Numc und !crr!!crv c !hc |n!cn

( ) ! , , Tnd!u !hu! !s lhuru! shu!! bc u |n!cn c

. S!u!cs

( ) ? Thc S!u!cs und !hc !crr!!cr!cs !hcrcc

. shu!! bc us spcc!!cd !n !hc l!rs! Schcdu!c

( ) 8 - Thc !crr!!crv c Tnd!u shu!! ccmpr!sc

) u " !hc !crr!!cr!cs c !hc S!u!cs

) b !hc |n!cn !crr!!cr!cs spcc!!cd

" !n !hc l!rs! Schcdu!c und

) c such c!hcr !crr!!cr!cs us muv bc

. ucqu!rcd

cu!cr cdc c !hc ccn!!ncn!u!

mur!n cr !c u d!s!uncc c !c

hundrcd nuu!!cu! m!!cs rcm

!hc busc!!nc .

D3

A--'--9'+$ &) *+0&9'

- Tn!rcduc!!cn !c Tnccmc - Tn!rcduc!!cn !c Tnccmc

!ux !ux . .

T\\

. ( ) Scc ? 48

. ( ) Scc ?

RlT|RN Ol TNCOMl

cr !hc

/ \SSlSSMlNT Yl\R lRl\TO|S Yl\R

\SSlSSll

\SSlSSMlNT

c

TNCOMl

. ( ) Scc ? ?4

. ( ) Scc ? O . ( ) Scc ? 84

. ( ) Scc ? 8

D4

A--'--''

- Tn!rcduc!!cn !c Tnccmc - Tn!rcduc!!cn !c Tnccmc

!ux !ux . .

( ss ss m ns

p rson # om n t x

or n ot r sum o

mon s p l un r

t s t n n lu s

( v r p rson n

r sp t o # om n

pro n un r t s

t s n t n or

t ss ssm nt o s

n om or ss ssm nt o

r n n ts or o

t n om o n

ot r p rson n

r sp t o # s

ss ss l or o t

loss sust n m

or su ot r

p rson or o t

mount o r un u

to m or to su

ot r p rson

( v r p rson # o s

m to n

ss ss un r n

prov s on o t s t

( v r p rson # o s

m to n

ss ss n ult

un r n prov s on o

t s t

Nc! ncccssurv !c huvc uc!uu!

prccccd!ns !n!!!!!u!cd

und pcnd!n cr bc!n

ccns!dcrcd u usscsscc

. [ ] TTO vs DD\ ?OO ?5? TTR

( ) ? SC

D2

%'(-&+

- Tn!rcduc!!cn !c Tnccmc - Tn!rcduc!!cn !c Tnccmc

!ux !ux . .

( p rson n lu s

( n n v u l

( n u un v

m l

( omp n

( v rm

(v n sso t on o

p rsons or o o

n v u ls # t r

n orpor t or not

(v lo l ut or t

n

(v v r rt l

ur l p rson not

ll n # t n n o

t pr n su

l us s

xpl n t on or t

purpos s o t s l us n

sso t on o p rsons or

o o n v u ls or

lo l ut or t or n

rt l ur l

p rson s ll m to

p rson # t r or not

su p rson or o or

ut or t or ur l

p rson # s orm or

st l s or

n orpor t # t t

o t o r v n

n om pro ts or ns

D8

|n!!v c cncrsh!p

/E.E)E

- Tn!rcduc!!cn !c Tnccmc - Tn!rcduc!!cn !c Tnccmc

!ux !ux . .

%"F %"F H not defined in *E$E Act, reference in /indu Law

Characteristics :

-indi!ided famil" of those to whom /indu Law applies NBA>DO ?3 *$( >DC (-0)

-/*+D. is a person whose parents are /indu & who is rought up a /induEENBA>8O BC4 *$( 438 (-0)

-includes 6ainsPPENBA34OD *$( 483

-co!ers oth Da"aagh & 9ita4sharaschool NBA>4O A> *$( 4A3

--ingle indi!idual not /.)NBA>4O A> *$( 4A3EEEEED male memers not reGd NBA88O8C *$(DA3(-0)

-reGuires presence of male memerPPPNDCCBO D4? *$( DCB(-0)

Nu!uru! humun bc!n . [ ] |dhum S!nh vs CTT !O88

!! TTR 4!

D\Y\l\GH\

MTT\|SH\R\

. vs

|n!!v c

pcsscss!cn

D>

0&9%A+:

- Tn!rcduc!!cn !c Tnccmc - Tn!rcduc!!cn !c Tnccmc

!ux !ux . .

Sec3 '((4 Sec3 '((4) ) compan" means compan" means

(i) an" (i) an" Indian co0-any Indian co0-any, or , or

(ii) an" od" corporate incorporated " or under (ii) an" od" corporate incorporated " or under

the laws of a countr" outside *ndia, or the laws of a countr" outside *ndia, or

(iii) an" institution, association or od" which is or (iii) an" institution, association or od" which is or

was assessale or was assessed as a compan" was assessale or was assessed as a compan"

for an" assessment "ear under the *ndian for an" assessment "ear under the *ndian

*ncome-tax Act, BADD (BB of BADD), or which is *ncome-tax Act, BADD (BB of BADD), or which is

or was assessale or was assessed under this or was assessale or was assessed under this

Act as a compan" for an" assessment "ear Act as a compan" for an" assessment "ear

commencing on or efore the Bst da" of April, commencing on or efore the Bst da" of April,

BA>C, or BA>C, or

(i!) an" institution, association or od", whether (i!) an" institution, association or od", whether

incorporated or not and whether *ndian or non- incorporated or not and whether *ndian or non-

*ndian, which is declared " general or special *ndian, which is declared " general or special

order of the ;oard to e a compan" 7 order of the ;oard to e a compan" 7

%ro!ided that such institution, association or od" %ro!ided that such institution, association or od"

shall e deemed to e a compan" onl" for such shall e deemed to e a compan" onl" for such

assessment "ear or assessment "ears (whether assessment "ear or assessment "ears (whether

commencing efore the Bst da" of April, BA>B, commencing efore the Bst da" of April, BA>B,

or on or after that date) as ma" e specified in or on or after that date) as ma" e specified in

the declaration @ the declaration @

. ( ) S c c ? ? G

D?

0&9%A+:

- Tn!rcduc!!cn !c Tnccmc - Tn!rcduc!!cn !c Tnccmc

!ux !ux . .

Sec3 '('?) Indian co0-any 0ean. a co0-any )or0ed and

re5i.tered under t*e Co0-anie. Act, (>B? (( o) (>B?), and

include.

( a co0-any )or0ed and re5i.tered under any la+ relatin5 to co0-anie.

)or0erly in )orce in any -art o) India (ot*er t*an t*e State o) 7a00u

and &a.*0ir and t*e "nion territorie. .-eci)ied in .u1/clau.e (iii) o)

t*i. clau.e) 2

(ia) a cor-oration e.ta1li.*ed 1y or under a Central, State or !ro,incial Act 2

(i1) any in.titution, a..ociation or 1ody +*ic* i. declared 1y t*e $oard to 1e

a co0-any under clau.e ((4)2

(ii) in t*e ca.e o) t*e State o) 7a00u and &a.*0ir, a co0-any )or0ed and

re5i.tered under any la+ )or t*e ti0e 1ein5 in )orce in t*at State 2

(iii) in t*e ca.e o) any o) t*e "nion territorie. o) Dadra and Na5ar %a,eli,

oa, Da0an and Diu, and !ondic*erry, a co0-any )or0ed and re5i.tered

under any la+ )or t*e ti0e 1ein5 in )orce in t*at "nion territory C

!ro,ided t*at t*e re5i.tered or, a. t*e ca.e 0ay 1e, -rinci-al o))ice

o) t*e co0-any, cor-oration, in.titution, a..ociation or 1ody in all

ca.e. i. in India 2

TNDT\N

COMl\NY

lcrc!n

. Cc

lur!!cr u

. Cc

Dcc!urcd u

. Cc

. Scc ?

( ) !

DA

0&9%A+:

- Tn!rcduc!!cn !c Tnccmc - Tn!rcduc!!cn !c Tnccmc

!ux !ux . .

Co0-anie. Act, (>B? Co0-anie. Act, (>B?

Sec =3 De)inition. o) co0-any, e8i.tin5 co0-any, !ri,ate

co0-any and -u1lic co0-any3

(() *n this Act, unless the context otherwise reGuires, the

expressions Qcompan"Q, Qexisting compan"Q, Qpri!ate compan"Q

and Qpulic compan"Q, shall, su#ect to the pro!isions of su-

section (D), ha!e the meanings specified elow 7R

(i) Qco0-anyQ means a compan" formed and registered under

this Act or an existing compan" as defined in clause (ii)7

(ii) Qe8i.tin5 co0-anyQ means a compan" formed and

registered under an" of the pre!ious companies laws specified

elow7R

(a) an" Act or Acts relating to companies in force efore the

*ndian 0ompanies Act, B?88 (BC of B?88) and repealed " that Act@

() the *ndian 0ompanies Act, B?88 (BCC8 BA88)@

(c) the *ndian 0ompanies Act, B??D ( 8 of B??D)@

(d) the *ndian 0ompanies Act, BAB3 (> of BAB3)@

(e) the (egistration of $ransferred 0ompanies &rdinance, BA4D

(24 of BA4D)@ and

(f) an" law corresponding to an" of the Act or the &rdinance

aforesaid and in force in the merged territories or in a %art ; -ate, or

an" part thereof, efore the extension thereto of the *ndian 0ompanies

Act, BAB3( > of BAB3)@

3C

0&9%A+:

- Tn!rcduc!!cn !c Tnccmc - Tn!rcduc!!cn !c Tnccmc

!ux !ux . .

Co0-anie. Act, (>B? Co0-anie. Act, (>B?

Sec =3 De)inition. o) co0-any, e8i.tin5 co0-any, !ri,ate co0-any and

-u1lic co0-any3

.subsection (1) Dcontd.

(iii) Q-ri,ate co0-anyQ means a compan" which, " its articles,

R

(a) restricts the right to transfer its shares, if an"@

() limits the numer of its memers to fift" not including

R

(i) persons who are in the emplo"ment of the compan",

and

(ii) persons who ha!ing een formerl" in the

emplo"ment of the compan", were memers of the compan"

while in that emplo"ment and ha!e continued to e memers

after the emplo"ment ceased@ and

(c) prohiits an" in!itation to the pulic to suscrie for

an" shares in, or deentures of, the compan"@

%ro!ided that where two or more persons hold one or more

shares in a compan" #ointl", the" shall, for the purposes of this

definition, e treated as a single memer@

(i!) Q-u1lic co0-anyQ means a compan" which is not a pri!ate

compan"E

3B

0&9%A+:

- Tn !rc d u c!!c n !c Tn cc m c - Tn !rc d u c!!c n !c Tn cc m c

!u x !u x . .

Co0-anie. Act, (>B? Co0-anie. Act, (>B?

Section ('3 MODE OF FORMIN INCOR!ORATED COM!ANY

(B) An" se!en or more persons, or where the compan" to e

formed will e a pri!ate compan", an" two or more persons,

associated for an" lawful purpose ma", " suscriing their

names to a memorandum of association and otherwise

compl"ing with the reGuirements of this Act in respect of

registration, form an incorporated compan", with or without

limited liailit"E

(D) -uch a compan" ma" e either R

(a) a compan" ha!ing the liailit" of its memers limited

" the memorandum to the amount, if an", unpaid on the

shares respecti!el" held " them (in its Act termed Qa

compan" limited " sharesQ)@

() a compan" ha!ing the liailit" of its memers limited

" the memorandum to such amount as the memers ma"

respecti!el" underta4e " the memorandum to contriute to

the assets of the compan" in the e!ent of its eing wound up

(in this Act termed K a compan" limited " guaranteeQ)@ or

(c) a compan" not ha!ing an" limit on the liailit" of its

memers (in this Act termed Qan unlimited compan"Q)E

3D

0&9%A+:

- Tn !rc d u c!!c n !c Tn cc m c - Tn !rc d u c!!c n !c Tn cc m c

!u x !u x . .

DOMlSTTC COMl\NY

lORlTGN COMl\NY

l|llTC SlCTOR COMl\NY

COMl\NY

!n h!ch pub!!c urc

subs!un!!u!!v !n!crcs!cd

TNDT\N

COMl\NY

. Cc c crc!n

cr!!n

. lur!!cr u Cc

. Dcc!urcd u Cc

. Scc ?

( ) !

. Scc ?

( ) ?G

. Scc ?

( ) ??\

. Scc ?

( ) ?8\

. Scc ?

( ) 8G\

. ( ) Scc ? !8

33

0&9%A+:

- Tn !rc d u c!!c n !c Tn cc m c - Tn !rc d u c!!c n !c Tn cc m c

!u x !u x . .

I3T3Act, (>?( I3T3Act, (>?(

Section ' (''A) do0e.tic co0-any means an *ndian

compan", or an" other compan" which, in respect of its

income liale to tax under this Act, has made the prescried

arrangements for the declaration and pa"ment, within *ndia,

of the di!idends (including di!idends on preference shares)

pa"ale out of such income @

Section BA4E $he principal officer of an *ndian compan" or a compan"

which has made the prescried arrangements for the declaration and

pa"ment of di!idends (including di!idends on preference shares)

within *ndia, shallPPPE

. . T T Ru!c ? . . T T Ru!c ? lrcscr!bcd urruncmcn!s cr dcc!uru!!cn und

puvmcn! c d!v!dcnds !!h!n Tnd!u.

Thc urruncm cn!s rccrrcd !c !n scc!!cns !O4 und ?8G !c bc m udc bv u ccm punv

( cr !hc dcc!uru!!cn und puvm cn! c d!v!dcnds !nc!ud!n d!v!dcnds cn

) : prccrcncc shurcs !!h!n Tnd!u shu!!bc us c!!c s

( ) ! Thc - shurc rc!s!cr c !hc ccm punv cr u!!shurchc!dcrs shu!!bc rcu!ur!v

m u!n!u!ncd u! !!s pr!nc!pu!p!ucc c bus!ncss !!h!n Tnd!u, !n rcspcc! c unv

. usscssm cn! vcur rcm u du!c nc! !u!cr !hun !hc !s! duv c \ pr!!c such vcur

( ) ? Thc cncru!m cc!!n cr puss!n !hc ucccun!s c !hc prcv!cus vcur rc!cvun! !c

!hc usscssm cn! vcur und cr dcc!ur!n unv d!v!dcnds !n rcspcc! !hcrcc shu!!

bc hc!d cn!v u! u p!ucc !!h!n Tnd!u.

( ) 8 Thc d!v!dcnds , , dcc!urcd !unv shu!!bc puvub!c cn!v !!h!n Tnd!u !c u!!

. shurchc!dcrs

34

0&9%A+:

- Tn !rc d u c!!c n !c Tn cc m c - Tn !rc d u c!!c n !c Tn cc m c

!u x !u x . .

I3T3Act, (>?( I3T3Act, (>?(

Section ('=A) )orei5n co0-any means a compan" which is not

a domestic compan"

Section (=?A) -u1lic .ector co0-any means an" corporation

estalished " or under an" 0entral, -tate or %ro!incial Act or a

,o!ernment compan" as defined in section 8B> of the

0ompanies Act, BA28 (B of BA28) @

, C cm pun!cs \ c! !O5G , C cm pun!cs \ c! !O5G

. ! ! . S c c!!c n G ! D l l TN TT TO N O l G O \ l R N M l N T C O M l\ N Y

, lcr !hc purpcscs c !h!s \ c! G cvcrnm cn! ccm punv m cuns unv ccm punv !n h!ch

- - nc! !css !hun !!v cnc pcr ccn! c !hc pu!d up shurc cup!!u!!s hc!d bv !hc C cn!ru!

, , G cvcrnm cn! cr bv unv S!u!c G cvcrnm cn! cr G cvcrnm cn!s cr pur!!v bv !hc C cn!ru!

G cvcrnm cn! und pur!!v bv cnc cr m crc S!u!c G cvcrnm cn!s und !nc!udcs u ccm punv

h!ch !s u subs!d!urv c u G cvcrnm cn! ccm punv us !hus dc!ncd.

. Scc!!cn 4 Ml\NTNG Ol HOlDTNG COMl\NY \ND S|lSTDT\RY.

( ) , , - ! lcr !hc purpcscs c !h!s \c! u ccmpunv shu!! sub]cc! !c !hc prcv!s!cns c sub

( ), , , $ scc!!cn 8 bc dccmcd !c bc u subs!d!urv c unc!hcr ! bu! cn!v !

( ) u !hu! c!hcr ccn!rc!s !hc ccmpcs!!!cns c !!s lcurd " c d!rcc!crs cr

( ) b !hu! c!hcr hc!ds mcrc !hun hu! !n ncm!nu! vu!uc c !!s cqu!!v shurc cup!!u!" cr

( ) - c !hc !rs! mcn!!cncd ccmpunv !s u subs!d!urv c unv ccmpunv h!ch !s !hu! c!hcr`s

. subs!d!urv

32

0&9%A+:

- Tn!rcduc!!cn !c Tnccmc - Tn!rcduc!!cn !c Tnccmc

!ux !ux . .

Section((A) co0-any in +*ic* t*e -u1lic are .u1.tantially

intere.ted E

A compan" is said to e a compan" in which the pulic are sustantiall"

interested

(a) if it is a compan" owned " the ,o!ernment or the (eser!e ;an4 of *ndia

or in which not less than fort" per cent of the shares are held (whether singl"

or ta4en together) " the ,o!ernment or the (eser!e ;an4 of *ndia or a

corporation owned " that an4 @ or

(aa) if it is a compan" which is registered under section D2 of the 0ompanies Act,

BA28 (B of BA28)@ or

(a) if it is a compan" ha!ing no share capital and if, ha!ing regard to its o#ects,

the nature and composition of its memership and other rele!ant

considerations, it is declared " order of the ;oard to e a compan" in which

the pulic are sustantiall" interested 7

%ro!ided that such compan" shall e deemed to e a compan" in which the

pulic are sustantiall" interested onl" for such assessment "ear or assessment

"ears (whether commencing efore the Bst da" of April, BA>B, or on or after that

date) as ma" e specified in the declaration @ or

(ac) if it is a mutual enefit finance compan", that is to sa", a compan" which

carries on, as its principal usiness, the usiness of acceptance of deposits

from its memers and which is declared " the 0entral ,o!ernment under

section 8DCA of the 0ompanies Act, BA28 (B of BA28), to e a +idhi or 9utual

;enefit -ociet" @ or

(ad) if it is a compan", wherein shares (not eing shares entitled to a fixed rate of

di!idend whether with or without a further right to participate in profits)

carr"ing not less than fift" per cent of the !oting power ha!e een allotted

unconditionall" to, or acGuired unconditionall" ", and were throughout the

rele!ant pre!ious "ear eneficiall" held ", one or more co-operati!e

societies @

. . , T T \c! . . , T T \c!

!OG! !OG!

38

0&9%A+:

- Tn!rcduc!!cn !c Tnccmc - Tn!rcduc!!cn !c Tnccmc

!ux !ux . .

Section('B) !OFER TO DIS!ENSE FIT% GLIMITEDG IN NAME

OF C%ARITA$LE OR OT%ER COM!ANY3 E

(B) Where it is pro!ed to the satisfaction of the 0entral ,o!ernment that an

association -

(a) is aout to e formed as a limited compan" for promoting

commerce, art, science, religion, charit" or an" other useful o#ect, and

() intends to appl" its profits, if an", or other income in promoting its

o#ects, and to prohiit the pa"ment of an" di!idend to its memers, the

0entral ,o!ernment ma", " licence direct, that the association ma" e

registered as a compan" with limited liailit", without the addition to its

name of the word QLimitedQ or the words Q%ri!ate LimitedQE

(D) $he association ma" thereupon e registered accordingl"@ and on registration shall

en#o" all the pri!ileges, and (su#ect to the pro!isions of this section) e su#ect to

all the oligations, of limited companiesE

(3) Where it is pro!ed to the satisfaction of the 0entral ,o!ernment -

(a) that the o#ects of a compan" registered under this Act as a limited

compan" are restricted to those specified in clause (a) of su-section (B), and

() that " its constitution the compan" is reGuired to appl" its profits, if an",

or other income in promoting its o#ects and is prohiited from pa"ing an" di!idend

to its memers, the 0entral ,o!ernment ma", " licence, authorise the compan" "

a special resolution to change its name, including or consisting of the omission of

the word QLimitedQ or the words Q%ri!ate LimitedQ@ and section D3 shall appl" to a

change of name under this su-section as it applies to a change of name under

section DBE

EEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEE-.;-'0$*&+- 4,2 &

8

, Ccmpun!cs \c! !O5G , Ccmpun!cs \c! !O5G

3>

0&9%A+:

- Tn!rcduc!!cn !c Tnccmc - Tn!rcduc!!cn !c Tnccmc

!ux !ux . .

Section((A) co0-any in +*ic* t*e -u1lic are .u1.tantially

intere.ted E

A compan" is said to e a compan" in which the pulic are sustantiall"

interested PPPEE (contdE)

(1) if it is a compan" which is not a pri!ate compan" as defined in the 0ompanies

Act, BA28 (B of BA28), and the conditions specified either in item (A) or in item

(;) are fulfilled, namel" 7

(A) shares in the compan" (not eing shares entitled to a fixed rate of

di!idend whether with or without a further right to participate in profits) were,

as on the last da" of the rele!ant pre!ious "ear, listed in a recognised stoc4

exchange in *ndia in accordance with the -ecurities 0ontracts ((egulation) Act,

BA28 (4D of BA28), and an" rules made thereunder @

(;) shares in the compan" (not eing shares entitled to a fixed rate of

di!idend whether with or without a further right to participate in profits)

carr"ing not less than fift" per cent of the !oting power ha!e een allotted

unconditionall" to, or acGuired unconditionall" ", and were throughout the

rele!ant pre!ious "ear eneficiall" held "

(a) the ,o!ernment, or () a corporation estalished " a 0entral, -tate

or %ro!incial Act, or

(c) an" compan" to which this clause applies or an" susidiar" compan"

of such compan" if the whole of the share capital of such susidiar" compan"

has een held " the parent compan" or " its nominees throughout the

pre!ious "earE

E8-lanation3 *n its application to an *ndian compan" whose usiness consists mainl"

in the con.truction o) .*i-. or in the manufacture or processing of goods or in

mining or in the generation or distriution of electricit" or an" other form of power,

item (;) shall ha!e effect as if for the words not less than fift" per cent, the words

not less than )orty -er cent had een sustituted @

. . , T T \c! . . , T T \c!

!OG! !OG!

3?

0&9%A+:

- Tn!rcduc!!cn !c Tnccmc - Tn!rcduc!!cn !c Tnccmc

!ux !ux . .

TNDT\N

COMl\NY

. Cc c crc!n

cr!!n

. lur!!cr u Cc

. Dcc!urcd u Cc

. ( ) S ? ?G rc!s!crcd undcr

ccmpun!cs \c!

YlS

DOlMSTTC

COMl\NY

. ( ) S ? ??\

NO lORlTGN

COMl\NY

. ( ) S ? ?8\

l|llTC SlCTOR

COMl\NY

. ( ) S ? ??\

COMl\NY !n h!ch

pub!!c urc

subs!un!!u!!v

!n!crcs!cd

. ( ) S ? !8

"hc!hcr lRlSCRTllD

/ \RR\NGlMlNTS | R ?

% / ) 4O O"NlRSHTl lY Gcv! RlT

. / . Ncn prc!! Cc u s ?5 c Cc

\c!

& Dcc!urcd bv lcurd nc

cup!!u!

/ . . . . NTDHT M l S u s G?O\ c Cc

\c!

% 5O vc!!n pccr cccp

scc!c!!cs

& Nc! u l\T Cc undcr Cc \c!

% 5O vc!!n pccr hc!d bv

Gcv! c!c

3A

)*(9

- Tn!rcduc!!cn !c Tnccmc - Tn!rcduc!!cn !c Tnccmc

!ux !ux . .

Sec3 '('=)(i) )ir0 Sec3 '('=)(i) )ir0 shall ha!e the

meaning assigned to it in the *ndian

%artnership Act, BA3D (A of BA3D),

and shall include a li0ited lia1ility

-artner.*i- as defined in the

Limited Liailit" %artnership Act,

DCC? (8 of DCCA)@

(ii) -artner -artner shall ha!e the meaning

assigned to it in the *ndian

%artnership Act, BA3D (A of BA3D),

and .*all include,

(a) an" person who, eing a 0inor,

has een ad0itted to t*e 1ene)it.

of partnership@ and

(1) a -artner o) a li0ited lia1ility

-artner.*i- as defined in the

Limited Liailit" %artnership Act,

DCC? (8 of DCCA)@

(iii) -artner.*i- -artner.*i- shall ha!e the

meaning assigned to it in the *ndian

%artnership Act, BA3D (A of BA3D),

and shall include a li0ited

lia1ility -artner.*i- as defined in

the Limited Liailit" %artnership Act,

DCC? (8 of DCCA)

, Tn d !u n l u r!n c rsh !p \ c! ! O 8 ? , Tn d !u n l u r!n c rsh !p \ c! ! O 8 ?

Scc!!cn 4 DllTNTTTON Ol

! , ! !, l\RTNlRSHTl l\RTNlR

! ! ! - !. lTRM \ND lTRM N\Ml

!lur!ncrsh!p! !s !hc rc!u!!cn

bc!ccn pcrscns hc huvc

urccd !c shurc !hc prc!!s c

u bus!ncss curr!cd cn bv u!!

. cr unv c !hcm uc!!n cr u!!

lcrscns hc huvc cn!crcd !n!c

pur!ncrsh!p !!h cnc unc!hcr

, urc cu!!cd !nd!v!duu!!v

!pur!ncrs! und ! cc!!cc!!vc!v u

!rm!, und !hc numc undcr

h!ch !hc!r bus!ncss !s

! - curr!cd cn !s cu!!cd !hc !rm

!. numc

4C

)*(9

- Tn!rcduc!!cn !c Tnccmc - Tn!rcduc!!cn !c Tnccmc

!ux !ux . .

Sec3 '('= Sec3 '('=(i) firm shall ha!e the (i) firm shall ha!e the

meaning assigned to it in the meaning assigned to it in the

*ndian %artnership Act, BA3D (A of *ndian %artnership Act, BA3D (A of

BA3D), and shall include a limited BA3D), and shall include a limited

liailit" partnership as defined in liailit" partnership as defined in

the Limited Liailit" %artnership the Limited Liailit" %artnership

Act, DCC? (8 of DCCA)@ Act, DCC? (8 of DCCA)@

THl THl lTMTTlD lTMTTlD lT\lTlTTY lT\lTlTTY l\RTNlRSHTl l\RTNlRSHTl , \CT, \CT ?OO8 ?OO8

Nu!urc c !!m!!cd !!ub!!!!v pur!ncrsh!p

. ( ) Scc 8 ! \ !!m!!cd !!ub!!!!v pur!ncrsh!p !s u bcdv ccrpcru!c

crmcd und !nccrpcru!cd undcr !h!s \c! und !s u !cu! cn!!!v

. scpuru!c rcm !hu! c !!s pur!ncrs

( ) ? : \ !!m!!cd !!ub!!!!v pur!ncrsh!p shu!! huvc pcrpc!uu! succcss!cn

\nv chunc !n !hc pur!ncrs c u !!m!!cd !!ub!!!!v pur!ncrsh!p shu!!

, nc! ucc! !hc cx!s!cncc r!h!s cr !!ub!!!!!cs c !hc !!m!!cd

. !!ub!!!!v pur!ncrsh!p

. Scc 4 , Suvc us c!hcr!sc prcv!dcd !hc prcv!s!cns c !hc Tnd!un

, lur!ncrsh!p \c! !O8? shu!! nc! upp!v !c u !!m!!cd !!ub!!!!v

. pur!ncrsh!p

4B

)*(9

- Tn!rcduc!!cn !c Tnccmc - Tn!rcduc!!cn !c Tnccmc

!ux !ux . .

Sec3 '('= Sec3 '('=(i) firm shall ha!e the meaning (i) firm shall ha!e the meaning

assigned to it in the *ndian %artnership Act, assigned to it in the *ndian %artnership Act,

BA3D (A of BA3D), and shall include a limited BA3D (A of BA3D), and shall include a limited

liailit" partnership as defined in the Limited liailit" partnership as defined in the Limited

Liailit" %artnership Act, DCC? (8 of DCCA)@ Liailit" %artnership Act, DCC? (8 of DCCA)@

THl THl lTMTTlD lTMTTlD lT\lTlTTY lT\lTlTTY l\RTNlRSHTl l\RTNlRSHTl , \CT, \CT ?OO8 ?OO8

& Dc!n!!!cn c lcdv Ccrpcru!c l!m!!cd l!ub!!!!v lur!ncrsh!p

. ( ) ! ! Scc ? d bcdv ccrpcru!c mcuns u ccmpunv us dc!ncd !n scc!!cn 8

, c !hc Ccmpun!cs \c! !O5G und !nc!udcs-

( ) ! u !!m!!cd !!ub!!!!v pur!ncrsh!p " rc!s!crcd undcr !h!s \c!

( ) " !! u !!m!!cd !!ub!!!!v pur!ncrsh!p !nccrpcru!cd cu!s!dc Tnd!u und

( ) , !!! u ccmpunv !nccrpcru!cd cu!s!dc Tnd!u

- bu! dccs nc! !nc!udc

( ) " ! ccrpcru!!cn sc!c

( ) - !! u cc cpcru!!vc scc!c!v rc!s!crcd undcr unv !u cr !hc !!mc bc!n !n

" crcc _und

( ) ( !!! unv c!hcr bcdv ccrpcru!c nc! bc!n u ccmpunv us dc!ncd !n scc!!cn 8

, c !hc Ccmpun!cs \c! !O5G cr u !!m!!cd !!ub!!!!v pur!ncrsh!p us dc!ncd !n

), , !h!s \c! h!ch !hc Ccn!ru! Gcvcrnmcn! muv bv nc!!!cu!!cn !n !hc O!c!u!

, Guzc!!c spcc!v !n !h!s bchu!

( ) ! ! n !!m!!cd !!ub!!!!v pur!ncrsh!p mcuns u pur!ncrsh!p crmcd und

rc!s!crcd

undcr !h!s \c!

. ( ) Scc 8 ! \ !!m!!cd !!ub!!!!v pur!ncrsh!p !s u bcdv ccrpcru!c crmcd

und !nccrpcru!cd undcr !h!s \c! und !s u !cu! cn!!!v scpuru!c rcm !hu! c

. !!s pur!ncrs

4D

)*(9

- Tn!rcduc!!cn !c Tnccmc - Tn!rcduc!!cn !c Tnccmc

!ux !ux . .

Characteristics

- D essential features7 (i) agreement to share

the profit or loss, & (ii) each partner acting

as the agent of another ..[1962] 46

I! 492 ("o#)

- &wning of propert" not reGuiredEEE [197$] 91

I! 412, 41% (&'d)

- 9ore than one firm with same partners

distinct identities . [196(]70 I! (4$

-

. lr!nc!p!cs !u!d dcn bv \l H!h Ccur! !n CTT vs G

& [ ] lur!husur!hv Nu!du scns !O8O !?! TTR O

- l!rm nc! cn!!!!cd !c cn!cr !n!c pur!ncrsh!p !!h unc!hcr !rm cr

!nd!v!duu!

- Scpuru!c !dcn!!!v !n T T \c!

- ( ) Cun bc uscd cr rcduc!n !ux !!ub!!!!v us pcr !OG4 58 TTR ?O4

- "hc!hcr u !rm !s cnu!nc cr bcus !s u mu!!cr c uc!s

-

-

l\RTNlRS OlJlCTT\l lTRM

&

'

43

)*(9

- Tn!rcduc!!cn !c Tnccmc - Tn!rcduc!!cn !c Tnccmc

!ux !ux . .

RlGTSTlRlD lTRM

( ) |NRlGTSTlRlD

lTRM

RlGTSTR\TTON

|ndcr !hc

. . , T T \c! Scc

, !84 !85

&

. . - T T Ru!cs ?? ?5

|ndcr !hc

Tnd!un

lur!ncrsh!

p \c!

Rcs!r!c!!cn cn

!!!n !u

su!!s

. . . . Scc GO T l \

Rcs!r!c!!cns cn

c!u!m!n

ccr!u!n

dcduc!!cns cn

ucccun! c

puvmcn!s mudc

!c pur!ncrs

Scc !85

RlGTSTlRlD lTRM

( ) |NRlGTSTlRlD

lTRM

|ndcr !hc

l!m!!cd

l!ub!!!!v

lur!ncrsh!p

\c!

RlGTSTlRlD lTRM

44

A&% 1 ;&*

- Tn!rcduc!!cn !c Tnccmc - Tn!rcduc!!cn !c Tnccmc

!ux !ux . .

Sec3 '(=( Sec3 '(=() ) (v n sso t on o

p rsons or o o n v u ls

# t r n orpor t or not

: Churuc!cr!s!!cs

- ..[ ] ( ) Ccmmcn purpcsc cr ccmmcn cuusc mus! cx!s! !O88 !48 TTl !G \!!

- ..[ ] ( ) l!cmcn!s c vc!!!!cn csscn!!u! !O8 88 TTR 48? SC

- ( . .. ) \cc!dcn!u! cr !cu! ccmb!nu!!cn !s nc! lOT c Hc!rs rccc!v!n !nhcr!!uncc

[ ] ( .) !O8 !G4 TTR 8G Mud

- ..[ ] ( ) l!cmcn! c ]c!n! vcn!urc mus! cx!s! !OGG 5O TTR ?8 SC

- ..[ ] ( .) lcdv cn!rus!cd !c rccc!vc !nccmc und d!spcsc !! !s lOT !O84 !45 TTR 8?8 |ur

- .[ ] ( .) Ccn!!nucus bus!ncss vcn!urc nc! csscn!!u! !OO ?? TTR 5!? Guu

Ccmpun

v

l!r

m

- \Ol !s nc! d!s!!nc! und scpuru!c rcm lOT lOT ccns!s!s c nu!uru! pcrscns cn!v

. . lOT muv !ukc !n nu!uru! us c!! us ur!!!c!u! pcrscns & . . [ ] Mccru Cc vs CTT !OO

( ) ??4 TTR G85 SC

42

A&% 1 ;&*

- Tn!rcduc!!cn !c Tnccmc - Tn!rcduc!!cn !c Tnccmc

!ux !ux . .

INSTANCES OF AOP

)irms attempted to e formed, ut not a firm due to some

in!alidit" P (BA8?) 8>*$( BC8 (-0)

9emers of erstwhile /.) continuing to run a !enture after

partition of /.) P (BA4C) ? *$( BB4 (-ind)

/eirs #ointl" running inherited usiness (not /.)) EEE (BA82)

22 *$( 8AD (9adE)

9ore than one 0ompanies #ointl" running a #oint !enture P

(BA8?) 8> *$( >>B (0al)

D persons purchasing a land in #oint names and running a

cinema on it P (BA?D)B3? *$( ?CB (All)

'rstwhile partners of a dissol!ed firm with a common

enterprise P (BA?2) B2D *$( 2>8 (9ad)

6oint acti!it" of two persons in smuggling P (BA?2) B23 *$(

38C (9ad)

%artners of a firm #ointl" running an enterprise other than that

stated in their partnership deed P (BAA4) >8 $axman BDA

(0al)

48

L&0AL A.$/&(*$:

- Tn!rcduc!!cn !c Tnccmc - Tn!rcduc!!cn !c Tnccmc

!ux !ux . .

,eneral 0lauses Act, B?A> ,eneral 0lauses Act, B?A>

Sec3 =(=() Hlocal aut*orityI shall

mean a municipal committee, district

oard, od" of port commissioners or

other authorit" legall" entitled to, or

entrusted " the ,o!ernment with,

the control or management of a

municipal or local fund@

( l\NCH\Y\TT R\J TNSTTT|TTONS '''

( ( ) , Scc 8 h c c D!sus!cr munucmcn! \c! ?OO5

(! ! !ccu! uu!hcr!!v !nc!udcs punchuvu!! ru] !ns!!!u!!cns, , mun!c!pu!!!!cs u d!s!r!c!

, , bcurd cun!cnmcn! bcurd !cn p!unn!n uu!hcr!!v cr /!!u lur!shud cr unv c!hcr bcdv

, , , cr uu!hcr!!v bv hu!cvcr numc cu!!cd cr !hc !!mc bc!n !nvcs!cd bv !u cr

, , rcndcr!n csscn!!u! scrv!ccs cr !!h !hc ccn!rc! und munucmcn! c c!v!c scrv!ccs

" !!h!n u spcc!!cd !ccu! urcu

( , Scc 8 c Cu!!!c Trcsspuss \c! !8!

(! ! !ccu! uu!hcr!!v mcuns unv bcdv c pcrscns cr !hc !!mc bc!n !nvcs!cd bv !u !!h

!hc ccn!rc! und udm!n!s!ru!!cn c unv mu!!crs !!h!n u spcc!!cd !ccu! urcu

( Dc!n!!!cn c !ccu! uu!hcr!!v !n Gcncru! C!uuscs \c! dccs nc! !nc!udc lunchuvu!!

. , , Ru] Tns!!!u!!cns \c!pur Grum lunchuvu! v \ss!! D!rcc!cr c Murkc!!n Gun!ur \TR

!OO8 \l !4?

( ) Rccrcncc !n Scc !O ?O [ ] nc dc!c!cd , ( ) & ( ) !4O d ?8? ?

( ) b

4>

A(*)*0*AL 6.(*D*0AL %'(-&+

- Tn!rcduc!!cn !c Tnccmc - Tn!rcduc!!cn !c Tnccmc

!ux !ux . .

+ot defined in *$ Act

(eference usuall" to an

aggregate of propert"

and income arising to

an identit" not co!ered

under other clauses

-

- \ H!ndu !dc! !s u ]ur!s!!c pcrscn cupub!c c hc!d!n prcpcr!v und

c bc!n !uxcd !hrcuh !!s shcbu!!s hc urc cn!rus!cd !!h !hc

pcsscss!cn und !hc munucmcn! c !hc prcpcr!v

.. . ( ( ) Jccnru Nu!h Nuskur v CTT !OGO 4 TTR 88 SC

4?

%('=*&.- :'A( 1 A--'--9'+$ :'A(

- Tn!rcduc!!cn !c Tnccmc - Tn!rcduc!!cn !c Tnccmc

!ux !ux . .

Sec = !re,iou. year

de)ined3

3E )or the purposes of this Act,

pre!ious "ear means the

financial "ear immediatel"

preceding the assessment

"ear 7

%ro!ided that, in the case of a

usiness or profession

newl" set up, or a source of

income newl" coming into

existence, in the said

financial "ear, the pre!ious

"ear shall e the period

eginning with the date of

setting up of the usiness

or profession or, as the case

ma" e, the date on which

the source of income newl"

comes into existence and

ending with the said

financial "earE

Scc ?

( ) 84

Scc 8

-

( ) Scc ? O usscssmcn! vcur

mcuns !hc pcr!cd c !c!vc

mcn!hs ccmmcnc!n cn !hc !s!

" duv c \pr!! cvcrv vcur

4A

%('=*&.- :'A( 1 A--'--9'+$ :'A(

- Tn!rcduc!!cn !c Tnccmc - Tn!rcduc!!cn !c Tnccmc

!ux !ux . .

Sec 9 C*ar5e o) inco0e/ta83

(B) Where an" 0entral Act enacts that income-tax shall e

charged for an" assessment "ear at an" rate or rates,

income-tax at that rate or those rates shall e charged

for that "ear in accordance with, and su#ect to the

pro!isions (including pro!isions for the le!" of additional

income-tax) of, this Act in respect of the total income of

the pre!ious "ear of e!er" person 7

%ro!ided that where " !irtue of an" pro!ision of this Act

income-tax is to e charged in respect of the income of

a period other than the pre!ious "ear, income-tax shall

e charged accordingl"E

(D) *n respect of income chargeale under su-section (B),

income-tax shall e deducted at the source or paid in

ad!ance, where it is so deductile or pa"ale under an"

pro!ision of this ActE

l!nunc!u!\ c!

. .. c

, Scc !58l

Scc

( ) !4 !

, lur! ! l!rs!

schcdu!c c

l!nuncc \ c!

2C

*+0&9'

- Tn!rcduc!!cn !c Tnccmc - Tn!rcduc!!cn !c Tnccmc

!ux !ux . .

Scc !4

Hl\DS Ol

TNCOMl

S\l\RTlS S\l\RTlS

HO|Sl lROllRTY HO|Sl lROllRTY

l|STNlSS OR l|STNlSS OR

lROllSSTON lROllSSTON

C\lTT\l G\TNS C\lTT\l G\TNS

OTHlR SSO|RClS OTHlR SSO|RClS

Scc !

Scc 5G

Scc 45

Scc ?8

Scc ??

( ) Scc ? ?4

2B

*+0&9'

- Tn!rcduc!!cn !c Tnccmc - Tn!rcduc!!cn !c Tnccmc

!ux !ux . .

&%'+*+, -$&0S BCC

%.(0/A-'- DCC

'L'0$(*0*$: BCC

,(&-- %(&)*$ BCC

------

2CC

------

S\ ll R lC lTlTS 8OO

C lO STN G STO C | ?OO

------

5OO

------

. Rs . Rs

S\l\RTlS 8O

RlNT ?O

TR\\lllTNG !O

OllTCl l\llNSlS !O

NlT lROlTT 4O

------

!!O

GROSS lROlTT !OO

TNTlRlST ON l\Tl l\YMlNTS !O

-------

!!O

TR TR

\D \D

TN TN

G G

/ \/ \

C C

l l

& &

l l

\C \C

CO CO

|N |N

T T

/ & Nc! prc!! us pcr ucccun!!n bccks muv bc d!crcn! rcm !hc prc!!

u!ns rccrrcd !n TT \c! us ccr!u!n cxpcnscs c!umcd muv nc! bc u!!cub!c us

. dcduc!!cn

2D

('$.(+ &) *+0&9'

- Tn!rcduc!!cn !c Tnccmc - Tn!rcduc!!cn !c Tnccmc

!ux !ux . .

Rc!urn c !nccmc

( ) Scc!!cn !8O ! , lvcrv pcrscn ! h!s !c!u! !nccmc cr !hc

!c!u! !nccmc c unv c!hcr pcrscn !n rcspcc! c h!ch hc !s

usscssub!c undcr !h!s \c! dur!n !hc prcv!cus vcur cxcccdcd !hc

- , , mux!mum umcun! h!ch !s nc! churcub!c !c !nccmc !ux shu!! cn

, cr bccrc !hc duc du!c urn!sh u rc!urn c h!s !nccmc cr !hc

!nccmc c such c!hcr pcrscn dur!n !hc prcv!cus vcur, !n !hc

prcscr!bcd crm und vcr!!cd !n !hc prcscr!bcd munncr und

. sc!!!n cr!h such c!hcr pur!!cu!urs us muv bc prcscr!bcd

- Ru!c !? Rc!urn c !nccmc

und Rc!urn c lr!nc

bcnc!!s

- TTR ! TO

8

23

A-'--9'+$

- Tn!rcduc!!cn !c Tnccmc - Tn!rcduc!!cn !c Tnccmc

!ux !ux . .

( ) Scc !8O !

Scc ?

( ) 8

24

A-'--9'+$

- Tn!rcduc!!cn !c Tnccmc - Tn!rcduc!!cn !c Tnccmc

!ux !ux . .

Sec ' (A) a..e..0ent include.

rea..e..0ent 2

( ) S c c ! 4 8 8

( ) - 8 On !hc duv spcc!!cd !n !hc nc!!cc

( ) ( ) - ( ), ! !ssucd undcr c!uusc ! c sub scc!!cn ? cr us sccn

, u!crurds us muv bc u!cr hcur!n such cv!dcncc und u!cr

!uk!n !n!c ucccun! such pur!!cu!urs us !hc usscsscc muv

, prcducc !hc \sscss!n O!ccr shu!!, bv un crdcr !n r!!!n,

u!!c cr rc]cc! !hc c!u!m cr c!u!ms spcc!!cd !n such nc!!cc

und mukc un usscssmcn! dc!crm!n!n !hc !c!u! !nccmc cr !css

, ucccrd!n!v und dc!crm!nc !hc sum puvub!c bv !hc usscsscc cn

. ................ !hc bus!s c such usscssmcn!

Scc ? ( ) 4O rcu!ur usscssmcn! mcuns !hc usscssmcn! mudc

( ) " undcr subscc!!cn 8 c scc!!cn !48 cr scc!!cn !44

22

A-'--9'+$

- Tn!rcduc!!cn !c Tnccmc - Tn!rcduc!!cn !c Tnccmc

!ux !ux . .

Sec ' (A) a..e..0ent include.

rea..e..0ent 2

. ! 4 4 l c s! ]u d m c n ! u ssc ssm c n !

Scc !44 ( ) ! - T unv pcrscn

( ) u u!!s !c mukc !hc rc!urn - ( ) rcqu!rcd undcr sub scc!!cn ! c

scc!!cn !8O und hus nc! mudc u rc!urn cr u rcv!scd rc!urn undcr

( ) - ( ) , subscc!!cn 4 cr sub scc!!cn 5 c !hu! scc!!cn cr

( ) b u!!s !c ccmp!v !!h u!! !hc !crms c u nc!!cc !ssucd undcr

subscc!!cn ( ) ! c scc!!cn !4? cr u!!s !c ccmp!v !!h u d!rcc!!cn

- ( ) , !ssucd undcr sub scc!!cn ?\ c !hu! scc!!cn cr

( ) c , huv!n mudc u rc!urn u!!s !c ccmp!v !!h u!! !hc !crms c u

nc!!cc - !ssucd undcr sub scc!!cn ( ) ? c scc!!cn !48,

Thc \sscss!n O!ccr, u!cr !uk!n !n!c ucccun! u!! rc!cvun!

, , mu!cr!u! h!ch !hc \sscss!n O!ccr hus u!hcrcd shu!! u!cr

, !v!n !hc usscsscc un cppcr!un!!v c bc!n hcurd mukc !hc

usscssmcn! c !hc !c!u! !nccmc cr !css !c !hc bcs! c h!s

]udmcn! und dc!crm!nc !hc sum puvub!c bv !hc usscsscc cn !hc

: bus!s c such usscssmcn!

28

A-'--9'+$

- Tn!rcduc!!cn !c Tnccmc - Tn!rcduc!!cn !c Tnccmc

!ux !ux . .

Sec ' (A) a..e..0ent include.

rea..e..0ent 2

Tn cc m c c scu p !n u ssc ssm c n !

S c c ! 4 . T!hc \sscss!n O!ccr hus rcuscn !c bc!!cvc !hu!

unv !nccm c churcub!c !c !ux hus cscupcd usscssm cn! cr unv

, , usscssm cn! vcur hc m uv sub]cc! !c !hc prcv!s!cns c scc!!cns

, !48 !c !58 u ssc ss c r rc u ssc ss such !nccm c und u!sc unv

c!hcr !nccm c churcub!c !c !ux h!ch hus cscupcd usscssm cn!

und h!ch ccm cs !c h!s nc!!cc subscqucn!!v !n !hc ccursc c

, !hc prccccd!ns undcr !h!s scc!!cn cr rcccm pu!c !hc !css cr

, !hc dcprcc!u!!cn u!!c uncc cr unv c!hcr u!!c uncc us !hc cusc

, ( m uv bc cr !hc usscssm cn! vcur ccnccrncd hcrcu!cr !n !h!s

scc!!cn und !n scc!!cns !48 !c !58 rccrrcd !c us !hc rc!cvun!

): usscssm cn! vcur ..

2>

A-'--9'+$

- Tn!rcduc!!cn !c Tnccmc - Tn!rcduc!!cn !c Tnccmc

!ux !ux . .

Sec ' (A) a..e..0ent include.

rea..e..0ent 2

- S c ! u ssc ssm c n !

S c c ! 4 O \ ( ) ! "hcrc unv !ux !spuvub!c cn !hc bus!s c unv

rc!urn rcqu!rcd !c bc urn!shcd undcr scc!!cn !8O cr scc!!cn

, , , !4? cr us !hc cusc m uv bc scc!!cn !48 u!cr !uk!n !n!c

, , ucccun! !hc um cun! c !ux ! unv u!rcudv pu!d undcr unv

, prcv!s!cn c !h!s \ c! !hc usscsscc shu!!bc !!ub!c !c puv such

!ux !cc!hcr !!h !n!crcs! puvub!c undcr unv prcv!s!cn c !h!s

\ c! cr unv dc!uv !n urn!sh!n !hc rc!urn cr unv dcuu!! cr

, dc!uv !n puvm cn! c udvuncc !ux bccrc urn!sh!n !hc rc!urn

und !hc rc!urn shu!!bc ucccm pun!cd bv prcc c puvm cn! c

such !ux und !n!crcs!.

2?

A-'--9'+$

- Tn!rcduc!!cn !c Tnccmc - Tn!rcduc!!cn !c Tnccmc

!ux !ux . .

Sec ' (A) a..e..0ent include.

rea..e..0ent 2

l rc cc ss!n c R c !u rn

( ) Scc !48 ! , "hcrc u rc!urn hus bccn mudc undcr scc!!cn !8O cr

- ( ) , !n rcspcnsc !c u nc!!cc undcr sub scc!!cn ! c scc!!cn !4?

:- such rc!urn shu!! bc prcccsscd !n !hc c!!c!n munncr numc!v

( ) u Thc !c!u! !nccmc cr !css shu!! bc ccmpu!cd u!cr muk!n !hc

c!!c!n ud]us!mcn!s :- numc!v

( ) " ! unv ur!!hmc!!cu! crrcr !n !hc rc!urn cr

( ) , !! un !nccrrcc! c!u!m ! such !nccrrcc! c!u!m !s

" uppurcn! rcm unv !ncrmu!!cn !n !hc rc!urn

( ) d \n !n!!mu!!cn shu!! bc prcpurcd cr cncru!cd und scn! !c

!hc usscsscc

( ) c Thc umcun! c rcund .. duc !c !hc usscsscc shu!! bc

. run!cd

2A

T\\

RlT|RN Ol TNCOMl

cr !hc

/ \SSlSSMlNT Yl\R lRl\TO|S Yl\R

\SSlSSll

\SSlSSMlNT c TNCOMl

A-'--9'+$

- Tn!rcduc!!cn !c Tnccmc !ux - Tn!rcduc!!cn !c Tnccmc !ux . .

llG\l

RllRlSlNT\TT\l

lROClSSTNG Ol RlT|RN

Rl\SSlSSMlNT c TNCOMl

lOO|S Ol

\CCO|NTS

DOC|MlNTS

Slll

\SSlSSMlN

T

Scc ?

( ) ?O

Scc ?

( ) ?O

\|THORTSlD

RllRlSlNT\TT\l

Scc ?88

( ) ?

Scc ?

( ) ??\\

8C

A-'--9'+$

- Tn!rcduc!!cn !c Tnccmc - Tn!rcduc!!cn !c Tnccmc

!ux !ux . .

Sec ' ('>) le5al re-re.entati,e has the meaning assigned

to it in clause (BB) of section D of the 0ode of 0i!il %rocedure,

BAC? (2 of BAC?)

Code o) Ci,il !rocedure, (>6A Code o) Ci,il !rocedure, (>6A

Sec ' ((() Gle5al re-re.entati,eG means a person who in law

represents the estate of a decea.ed -er.on, and includes an"

person who intermeddles with the estate of the deceased and

where a part" sues or is sued in a representati!e character the

person on whom the estate de!ol!es on the death of the part" so

suing or sued@

( ) Scc ? !?\ bccks cr bccks c ucccun! , - !nc!udcs !cdcrs duv

, , - , bccks cush bccks ucccun! bccks und c!hcr bccks hc!hcr kcp! !n

- , !hc r!!!cn crm cr us pr!n! cu!s c du!u s!crcd !n u !cppv

, - d!sc !upc cr unv c!hcr crm c c!cc!rc munc!!c du!u s!cruc

" dcv!cc

( ) Scc ? ??\\ dccumcn! !nc!udcs un c!cc!rcn!c rcccrd us dc!ncd

( ) - ( ) !n c!uusc ! 8 c sub scc!!cn ! c scc!!cn ? c !hc Tncrmu!!cn

, ( )" Tcchnc!cv \c! ?OOO ?! c ?OOO

8B

A.$/&(*-'D ('%('-'+$A$*='

- Tn!rcduc!!cn !c Tnccmc - Tn!rcduc!!cn !c Tnccmc

!ux !ux . .

Sec 'AA3 (() An" assessee who is entitled or reGuired to attend

efore an" income-tax authorit" or the Appellate $riunal in

connection with an" proceeding under this Act otherwise than

when reGuired under section B3B to attend personall" for

examination on oath or affirmation, ma", su#ect to the other

pro!isions of this section, attend " an authorised

representati!eE

(') )or the purposes of this section, Qaut*ori.ed

re-re.entati,eQ means a person authorised " the assessee in

writing to appear on his ehalf, eing-

(i) a person related to the assessee in an" manner, or a person

regularl" emplo"ed " the assessee@ or

(ii) an" officer of a scheduled an4 with which the assessee

maintains a current account or has other regular dealings@ or

(iii) an" legal practitioner who is entitled to practise in an" ci!il

court in *ndia@ or

(i!) an accountant@ or

. - lxp!unu!!cn , ! Tn !h!s scc!!cn ucccun!un!! mcuns u chur!crcd ucccun!un!

, ( ), !!h!n !hc mcun!n c !hc Chur!crcd \cccun!un!s \c! !O4O 88 c !O4O und

!nc!udcs, , !n rc!u!!cn !c unv S!u!c unv pcrscn hc bv v!r!uc c !hc prcv!s!cns

- ( ) , ( ), c sub scc!!cn ? c scc!!cn ??G c !hc Ccmpun!cs \c! !O5G ! c !O5G !s

cn!!!!cd !c bc uppc!n!cd !c uc! us un uud!!cr c ccmpun!cs rc!s!crcd !n !hu!

. S!u!c

, Chur!crcd \cccun!un!s \c! !O4O , Chur!crcd \cccun!un!s \c! !O4O

( )( ) Scc!!cn ? ! b ( )( ) Scc!!cn ? ! b ! ! chur!crcd ucccun!un! mcuns u pcrscn hc !s u mcmbcr c

"! !hc Tns!!!u!c

8D

A.$/&(*-'D ('%('-'+$A$*='

- Tn!rcduc!!cn !c Tnccmc - Tn!rcduc!!cn !c Tnccmc

!ux !ux . .

Sec 'AA3 (D) )or the purposes of this section, Qaut*ori.ed

re-re.entati,eQ meansEE

(!) an" person who has passed an" accountanc" examination

recognised in this ehalf " the ;oard-,I or

(!i) an" person who has acGuired such educational Gualifications

as the ;oard ma" prescrie for this purpose@ or

(!ia)an" person who, efore the coming into force of this Act in

the .nion territor" of Dadra and +agar /a!eli, ,oa, Daman

and Diu, or %ondicherr", attended efore an income-tax

authorit" in the said territor" on ehalf of an" assessee

otherwise than in the capacit" of an emplo"ee or relati!e of

that assessee@ orO

(!ii) an" other person who, immediatel" efore the

commencement of this Act, was an income-tax practitioner

within the meaning of clause (i!) of su-section (D) of section

8B of the *ndian *ncome-tax Act, BADD (BB of BADD), and was

actuall" practising as suchE

83

$A<

- Tn!rcduc!!cn !c Tnccmc - Tn!rcduc!!cn !c Tnccmc

!ux !ux . .

84

$A<

- Tn!rcduc!!cn !c Tnccmc - Tn!rcduc!!cn !c Tnccmc

!ux !ux . .

82

$A<

- Tn!rcduc!!cn !c Tnccmc - Tn!rcduc!!cn !c Tnccmc

!ux !ux . .

88

$A<

- Tn!rcduc!!cn !c Tnccmc - Tn!rcduc!!cn !c Tnccmc

!ux !ux . .

\SSlSSll

\SSlSSTNG

OllTClR

\Y/

l\YMlNTS

T

N

C

O

M

l

T

\

\

D

l

l

\

R

T

M

l

N

T

G

O

\

T

O

l

T

N

D

T

\

\D\\NCl T\\

Slll

\SSlSSMlNT

Slll \SSlSSMlNT

T\\

. . . T D S

[ &

] TNTlRlST

\

S

S

l

S

S

S

M

l

N

T

Y

l

\

R

l

R

l

\

T

O

|

S

Y

l

\

R

\SSlSSMlNT

T\\ DlM\ND

8>

A,(*0.L$.(AL *+0&9'

- Tn!rcduc!!cn !c Tnccmc - Tn!rcduc!!cn !c Tnccmc

!ux !ux . .

: CONDTTTONS ( ) : , , , , ! lcrscn !c hcm luru \ c lur! T upp!!cs Tnd!v!duu! H|l \Ol lOT

( ) ) - ( ) ) \Jl !! Tc!u! !nccmc !hc mux ncn !uxub!c !nccmc !!! \r! !nccmc Rs 5OOO

COMl|Tl \GRT TNCOMl lROM l\CH SO|RCl

SlllR\TllY

, TNCOMl l\RTT\llY \GRTC|lT|Rl l\RTT\llY

l|STNlSS

DllMlD \GRT TNCOMl SH\Rl TN \Ol

[ - ] R 5

\NY lOSS M\Y ll \DJ|STlD \G\TNST OTHlR

\GRT TNCOMl l\CllT THl lOSS \RTSTNG lROM

SH\Rl Ol \Ol

&

&

&

&

&

|N\lSORllD \GRT lOSS Ol \ lY Ol

( ) l\RlTlR 8 \Y

-

NlT

\GRT

TNCOM

l

, Tl TT TS \ lOSS DllMlD TO

ll NTl

S|M Ol \GRTC|lT|R\l TNCOMl lROM \ll

SO|RClS

-

Curr!cd

crurd

8?

A-'--9'+$

- Tn!rcduc!!cn !c Tnccmc - Tn!rcduc!!cn !c Tnccmc

!ux !ux . .

TOT\l TNCOMl

( ) Scc ? 45

8A

$&$AL *+0&9'

- Tn!rcduc!!cn !c Tnccmc - Tn!rcduc!!cn !c Tnccmc

!ux !ux . .

Sec '(9B) total inco0e means the total amount of income

referred to in section 2, computed in the manner laid down in

this Act

( ) S c c 5 ! , Sub]cc! !c !hc prcv!s!cns c !h!s \ c! !hc !c !u ! !n cc m c

c unv prcv!cus vcur c u pcrscn hc !s u rcs!dcn! !nc!udcs u!!

!nccm c rcm hu!cvcr scurcc dcr!vcd h!ch

( ) u !srccc!vcd cr !sdccmcd !c bc rccc!vcd !n Tnd!u !n such vcur

" bv cr cn bchu! c such pcrscn cr

( ) b uccrucs cr ur!scs cr !sdccmcd !c uccruc cr ur!sc !c h!m !n

" Tnd!u dur!n such vcur cr

( ) : c uccrucs cr ur!scs !c h!m cu!s!dc Tnd!u dur!n such vcur

, lrcv!dcd !hu! !n !hc cusc c u pcrscn nc! crd!nur!!v rcs!dcn! !n

- ( ) , Tnd!u !!h!n !hc m cun!n c sub scc!!cn G c scc!!cn G !hc

!nccm c h!ch uccrucs cr ur!scs !c h!m cu!s!dc Tnd!u shu!!nc! bc

sc !nc!udcd un!css !! !s dcr!vcd rcm u bus!ncss ccn!rc!!cd !n cr u

. prccss!cn sc! up !n Tnd!u

>C

$&$AL *+0&9'

- Tn!rcduc!!cn !c Tnccmc - Tn!rcduc!!cn !c Tnccmc

!ux !ux . .

Sec '(9B) total inco0e means the total amount of income

referred to in section 2, computed in the manner laid down in

this Act

S c c 5 ( ) ? , Sub]cc! !c !hc prcv!s!cns c !h!s\c! !hc !c !u ! !n cc m c

c unv prcv!cus vcur c u pcrscn hc !su - ncn rcs!dcn! !nc!udcs u!!

!nccm c rcm hu!cvcr scurcc dcr!vcd h!ch

( ) u !srccc!vcd cr !sdccmcd !c bc rccc!vcd !n Tnd!u !n such vcur

" bv cr cn bchu! c such pcrscn cr

( ) b uccrucs cr ur!scs cr !sdccmcd !c uccruc cr ur!sc !c h!m !n

. Tnd!u dur!n such vcur

. l xp !u n u !!c n ! Tnccm c uccru!n cr ur!s!n cu!s!dc Tnd!u shu!!nc!

bc dccm cd !c bc rccc!vcd !n Tnd!u !!h!n !hc m cun!n c !h!s

scc!!cn bv rcuscn cn!v c !hc uc! !hu! !! !s !ukcn !n!c ucccun! !n u

. bu!uncc shcc! prcpurcd !n Tnd!u

. l xp !u n u !!c n ? , lcr !hc rcm cvu!c dcub!s !! !s hcrcbv dcc!urcd

!hu! !nccm c h!ch hus bccn !nc!udcd !n !hc !c!u!!nccm c c u

pcrscn cn !hc bus!s !hu! !! hus uccrucd cr ur!scn cr !s dccm cd !c

huvc uccrucd cr ur!scn !c h!m shu!!nc! uu!n bc sc !nc!udcd cn

!hc bus!s !hu! !! !s rccc!vcd cr dccm cd !c bc rccc!vcd bv h!m !n

. Tnd!u

>B

,(&-- $&$AL *+0&9'

- Tn!rcduc!!cn !c Tnccmc - Tn!rcduc!!cn !c Tnccmc

!ux !ux . .

C%A!TER #I A DED"CTIONS IN RES!ECT OF

CERTAIN INCOME

Sec A6$ In t*i. c*a-ter /

(B) G5ro.. total inco0eG means the total income

computed in accordance with the pro!isions of this Act,

efore ma4ing an" deduction under this 0hapter

GROSS TOT\l

TNCOMl

TOT\l TNCOMl

DlD|CTTONS

|NDlR CH\lTlR

\T \

>D

$&$AL *+0&9'

- Tn!rcduc!!cn !c Tnccmc - Tn!rcduc!!cn !c Tnccmc

!ux !ux . .

S\l\RY

HO|Sl lROllRTY

& l|STNlSS lROl

OTHlR SO|RClS

lTCG

STCG

+

+

+

+

+

TNCOMl Ol OTHlR

llRSONS TNCl|DlD

TN TOT\l TNCOMl

( ) CH\lTlR \

TNCOMl ON "HTCH NO

- TNCOMl T\\ TS

l\Y\lll |NDlR

CH\lTlR \TT

+

+

+

, C\SH CRlDTTS

|Nl\ll\TNlD

, TN\lSTMlNTS

. l\llNDTT|Rl lTC

( Scc

, , , , ) G8 GO\ GOl GOC GOD

+

GROSS TOT\l

TNCOMl

TOT\l TNCOMl

DlD|CTTONS

|NDlR CH\lTlR

\T \

cr

ud]us!mcn!

, c !csscs

CH\lTlR \T

>3

('-*D'+$

- Tn!rcduc!!cn !c Tnccmc - Tn!rcduc!!cn !c Tnccmc

!ux !ux . .

Sec ' (9') re.ident means a person who is resident in

*ndia within the meaning of section 8

Sec ' (=6) non/re.ident means a person who is not a

resident , and for the purposes of sections AD, A3 and

B8?, includes a person who is not ordinaril" resident

within the meaning of clause (8) of section 8 @

>4

('-*D'+$

- Tn!rcduc!!cn !c Tnccmc - Tn!rcduc!!cn !c Tnccmc

!ux !ux . .

-

!

O

O

O

O

O

-

?

O

O

O

O

!

-

?

O

O

!

O

?

-

?

O

O

?

O

8

-

?

O

O

8

O

4

-

?

O

O

4

O

5

-

?

O

O

5

O

G

-

?

O

O

G

O

-

?

O

O

O

8

- ?OO8 OO

-

!

O

O

8

O

O

*

!8?

D\YS

R

l

S

T

D

l

N

T

* GO

D\YS

R

l

S

T

D

l

N

T

* 8G5 D\YS

.

N

.

O

.

R

- * NON RlSTDlNT TN O Yl\RS

! ? 8 4 5 G 8 O !O

.

N

.

O

.

R

+ ?O D\YS

2

2

>8

C%A!TER XI#

C%A!TER XI#

of of *+0&9' $A< *+0&9' $A<

A0$ BA8B A0$ BA8B

ASSESSMENT

ASSESSMENT

!ROCED"RE

!ROCED"RE

)ec 1$9 to 1%(

)ec 1$9 to 1%(

\SSlSSMlNT lROClD|Rl

\sscssmcn! lrcccdurc \sscssmcn! lrcccdurc

. .

l\RT TTT l\RT TTT

c c TNCOMl T\\ TNCOMl T\\

R|llS !OG? R|llS !OG?

\SSlSSMlNT \SSlSSMlNT

lROClD|Rl lROClD|Rl

Ru!c !? !c !5 Ru!c !? !c !5

FORMS

NOTIFICATIONS

CIRCULARS

CASE LAWS

>>

('$.(+ &) *+0&9'

Sec (=> (() '!er" person,

(a)eing a compan" or a firm@ or

() eing a person other than a compan" or a firm, i) his

total inco0e or the total income of an" other person

in respect of which he is assessale under this Act

durin5 t*e -re,iou. year exceeded the maximum

amount which is not chargeale to income-tax, shall,

on or efore the due date, )urni.* a return o) *i.

inco0e or the income of such other person during the

pre!ious "ear, in the -re.cri1ed )or0 and ,eri)ied

in t*e -re.cri1ed 0anner and .ettin5 )ort* .uc*

ot*er -articular. a. 0ay 1e -re.cri1ed 7

\sscssmcn! lrcccdurc \sscssmcn! lrcccdurc

. .

Sec 2 (33) prescribed means prescribed by rules made under this Act ;

>?

('$.(+ &) *+0&9'

Rule ('3 (() $he return o) inco0e reKuired to 1e )urni.*ed

under su-section (B) or su-section (3) or su-section (4A) or

su-section (4;) or su-section (40) or su-section (4D) of

section (=> or clause (i) of su-section (B) of section (9' or

su-section (B) of section (9A or section (B=A or the return of

fringe enefits reGuired to e furnished under su-section (B) or

su-section (D) of section ((BFD relating to the assessment

"ear commencing on the Bst da" of April, DCC? .*all,

(a) in the case of a person eing an indi,idual where the total

inco0e include. income chargeale to income-tax under the

head Salarie. or income in the nature of )a0ily -en.ion as

defined in the 'xplanation to clause (iia) of section 2> ut doe.

not include any ot*er inco0e e8ce-t inco0e 1y +ay o)

intere.t chargeale to income-tax under the head *ncome from

other sources, e in For0 No3 ITR/( and e *erified in t+e

#'nner indic'ted t+erein@

() in the case of a person eing an indi,idual not 1ein5 an

indi,idual to +*o0 clau.e (a) a--lie. or a %indu

undi,ided )a0ily where the total inco0e doe. not include

any inco0e c*ar5ea1le to inco0e/ta8 under t*e *ead

!ro)it. and 5ain. o) 1u.ine.. or -ro)e..ion, e in For0

No3 ITR/' and e *erified in t+e #'nner indic'ted t+erein,

\sscssmcn! lrcccdurc \sscssmcn! lrcccdurc

. .

prescribed form

>A

('$.(+ &) *+0&9'

\sscssmcn! lrcccdurc \sscssmcn! lrcccdurc

. .

A snapshot from https://incometaxindiaefiling.gov.in/portal/individual_huf.do

R

E

T

U

R

N

S

F

O

R

IN

DI

VI

D

U

A

L

S

prescribed form

?C

('$.(+ &) *+0&9'

\sscssmcn! lrcccdurc \sscssmcn! lrcccdurc

. .

A snapshot from I!"#

RULE 12 (1) (a) ...............................verified in the manner indicated therein

prescribed form

?B

('$.(+ &) *+0&9'

Sec (=> (() '!er" person,

(a) eing a compan" or a firm@ or

() eing a person other than a compan" or a firm, i) his total inco0e or t*e

total inco0e o) any ot*er -er.on in re.-ect o) +*ic* *e

i. a..e..a1le under t*i. Act durin5 t*e -re,iou. year exceeded

the maximum amount which is not chargeale to income-tax, shall, on or

efore the due date, )urni.* a return o) *i. inco0e or the income of such

other person during the pre!ious "ear, in the -re.cri1ed )or0 and ,eri)ied

in t*e -re.cri1ed 0anner and .ettin5 )ort* .uc* ot*er -articular. a.

0ay 1e -re.cri1ed 7

\sscssmcn! lrcccdurc \sscssmcn! lrcccdurc

. .

( ss ss m ns p rson # om n t x

or n ot r sum o mon s p l un r

t s t n n lu s

( v r p rson # o s m to n

ss ss un r n prov s on o t s t

, - ./ 0 0 ,1 2 0

0 0 - - 2, , /

Sec !" # RE$RESENTATIVE ASSESSEE

Sec !3 # A%ENT

Sec !& # E'E(UTOR

Sec )" # SU((ESSOR

( ) - u \cn! c u ncn rcs!dcn!

( ) / b Guurd!un Munucr c

/ / m!ncr !unu!!c !d!c!

( ) / c Ccur! c urds

/ \dm!n!s!ru!cr Gcncru!

Trus!cc uppc!n!cd bv ccur!

( ) ( d Trus!cc !rus! !!h

) !ns!rumcn!

( ) ( ) c Trus!cc cru! !rus!

?D

('$.(+ &) *+0&9'

Sec (=> (() '!er" person,

(a) eing a compan" or a firm@ or

() eing a person other than a compan" or a firm, i) his total inco0e or the total

income of an" other person in respect of which he is assessale under this Act

durin5 t*e -re,iou. year exceeded the maximum amount which is not

chargeale to income-tax, shall, on or efore the due date, )urni.*

a return o) *i. inco0e or the income of such other person during the

pre!ious "ear, in the -re.cri1ed )or0 and ,eri)ied in t*e -re.cri1ed

0anner and .ettin5 )ort* .uc* ot*er -articular. a. 0ay 1e -re.cri1ed

7

\sscssmcn! lrcccdurc \sscssmcn! lrcccdurc

. .

xpl n t on n t s su s t on u t

m ns

( # r t ss ss s ( omp n or

( p rson (ot r t n omp n # os

ounts r r 3u r to u t

un r t s t or un r n ot r l #

or t t m n n or or (

#or n p rtn r o rm # os ounts

r r 3u r to u t un r t s

t or un r n ot r l # or t t m

n n or t t o

pt m r o t ss ssm nt r

(substituted by Finance Act 2008, !e!"! #!$!2008%

(b) **+

( n t s o n ot r ss ss t

st o Jul o t ss ssm nt r

?3

('$.(+ &) *+0&9'

\sscssmcn! lrcccdurc \sscssmcn! lrcccdurc

. .

Sec 3, Sec 3,

Scc !8O Scc !8O

( ) ! ( ) !

" " "hc shcu!d !!c hcn hc

- lRO\TSO- lRO\TSO

! !

- lRO\TSO- lRO\TSO

? ?

- lRO\TSO- lRO\TSO

8 8

- lRO\TSO- lRO\TSO

4 4

One by six scheme

...u t! "# 2$$%&$'

Every c!. ( firm t! fi)e return

*i)in+ !f return re,d- i" TOTAL INCOME .ith!ut

+ivin+ effect t! Exemti!ns u(s 1$"- 1$/- 1$/"

!r deducti!n u( 0ha 12 " e&ceeds a'(unt

n(t c)a*+eab,e t( ta&

$rovided also that every person% being an individual or a &indu undivided family or

an association of persons or a body of individuals% 'hether i-corpor./ed or -o/% or

an artificial (uridical person% if 0is /o/.l i-come or the total income of any other

person in respect of 'hich he is assessable under this Act during the previous year%

1i/0ou/ 2i3i-2 effec/ /o /0e pro3isio-s of sec/io- "A or sec/io- "4 or

sec/io- "4A or (0.p/er VI5A e6ceeded /0e m.6imum .mou-/ 10ic0 is -o/

c0.r2e.ble /o i-come5/.6% shall% on or before the due date% fur-is0 . re/ur- of

his income or the income of such other person during the previous year% in the

prescribed form and verified in the prescribed manner and setting forth such other

particulars as may be prescribed.

?4

('$.(+ &) *+0&9'

\sscssmcn! lrcccdurc \sscssmcn! lrcccdurc

. .

(!\ (!\

) )

*i)in+ !f return by sa)aried em)!yees thr!u+h em)!yer

Schcmc cr bu!k

!!!n c rc!urns

bv su!ur!cd

, cmp!cvccs ?OO?

Schcmc c !!!n

c rc!urns bv

su!ur!cd cmp!cvccs

, !hrcuh cmp!cvcr

?OO4

(!l (!l

) )

E 3 fi)in+ !f return

l!cc!rcn!c urn!sh!n c rc!urns c

!nccmc schcmc ?OO

( ) 8 ( ) 8

Return t! be fi)ed f!r carryin+ f!r.ard a LO44 under 56r!fits