Académique Documents

Professionnel Documents

Culture Documents

Bill of Exchange

Transféré par

Nisot IhdnagCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Bill of Exchange

Transféré par

Nisot IhdnagDroits d'auteur :

Formats disponibles

Bill of Exchange

A non-interest-bearing written order used primarily in international trade that binds one party to pay a fixed sum of money to another party at a predetermined future date.

Bills of exchange are similar to checks and promissory notes. They can be drawn by individuals or banks and are generally transferable by endorsements. The difference between a promissory note and a bill of exchange is that this product is transferable and can bind one party to pay a third party that was not involved in its creation. If these bills are issued by a bank, they can be referred to as bank drafts. If they are issued by individuals, they can be referred to as trade drafts.

A bill of exchange is usually defined as:

An unconditional order in writing Addressed by one person (the drawer) to another (the drawee) Signed by the person giving it (the drawer) Requiring the person to whom it is addressed To pay on demand, or at a fixed or determinable future time A sum certain in money To, or to the order of, a specified person or to bearer (the payee)

The bill of exchange, commonly referred to as the draft or the bill, is an unconditional order in writing, signed and addressed by the drawer (the exporter usually) to the drawee (the confirming bank or the issuing bank usually), requiring the drawee to pay the drawer a certain sum of money at sight or at a fixed or determinable future time. The draft is widely used in international trade, most frequently in the payment against a letter of credit (L/C). It is also used in the open account without any L/C involved. Drafts Drawn On the Bank In the L/C sample, the draft is drawn on the confirming bank, which is The Moon Bank. The UVW Exports may issue a draft drawn on The Moon Bank as follows:

Sample Instrument: Draft

The "No." (number) in the above sample draft may be used for the exporter's reference number. Blank drafts are available at the paying bank.

First of Exchange (Second Unpaid) and Second of Exchange (First Unpaid) In practice, it is not uncommon that two drafts are drawn on the drawee bank in a letter of credit (L/C) to ensure that at least one draft reaches the drawee when they are dispatched separately. The issuance of more than one draft in a letter of credit follows the same logic as in the issuance of bill of lading in more than one original. At times even three drafts may be drawn on the drawee bank, this practice was not uncommon before in certain countries. In contrast, normally one draft (sola bill) is issued in a documentary collection where the draft is drawn on the importer.

Vous aimerez peut-être aussi

- Ion of Bill of ExchangeDocument11 pagesIon of Bill of Exchangeshami00992100% (1)

- Bill of ExchangeDocument4 pagesBill of ExchangeChetan SapraPas encore d'évaluation

- 5 Bill of ExchangeDocument0 page5 Bill of Exchangemy hoangPas encore d'évaluation

- Letter of AdviceDocument2 pagesLetter of AdviceAndrew100% (6)

- Bills of ExchangeDocument31 pagesBills of ExchangeViransh Coaching ClassesPas encore d'évaluation

- Bill of Exchange SampleDocument11 pagesBill of Exchange SampleInter_vivos56% (9)

- Bill of ExchangeDocument4 pagesBill of Exchangemmmprasajanu100% (1)

- 8281 2010 PIMCO ExDocument1 page8281 2010 PIMCO ExBunny Fontaine100% (1)

- Bills of Exchange Cases - Sec 126 To 183Document13 pagesBills of Exchange Cases - Sec 126 To 183iicaiiPas encore d'évaluation

- WCSM Notice of Document Certification 2 3Document2 pagesWCSM Notice of Document Certification 2 3douglas jonesPas encore d'évaluation

- Preauthorzed Letter of CreditDocument1 pagePreauthorzed Letter of Creditlakeshia1lovinglife10% (1)

- Bill of ExchangeDocument13 pagesBill of ExchangeShiwaniSharmaPas encore d'évaluation

- Bills of Exchange (I) - NADT PDFDocument8 pagesBills of Exchange (I) - NADT PDFbonnie.barma2831Pas encore d'évaluation

- Bankers AcceptanceDocument3 pagesBankers AcceptanceGilner PomarPas encore d'évaluation

- Bank DepositsDocument15 pagesBank DepositsSamuel BaulaPas encore d'évaluation

- Report Promissory NoteDocument4 pagesReport Promissory NoteSaiyidah syafiqahPas encore d'évaluation

- Letter of CreditDocument2 pagesLetter of CreditLuke Cooper100% (3)

- 10-Amended True Bill 1Document2 pages10-Amended True Bill 1Kristin Cantley SnellPas encore d'évaluation

- 04-02-12 OUR Style Money Order For WebDocument1 page04-02-12 OUR Style Money Order For WebSaleem Alhakim84% (19)

- Bill of ExchangeDocument12 pagesBill of ExchangeSandesh Jadhav89% (18)

- Letter of CreditDocument6 pagesLetter of Creditappyworld121100% (1)

- Void Where Prohibited by Law: Private Issue Private IssueDocument1 pageVoid Where Prohibited by Law: Private Issue Private IssueMikeDouglas89% (18)

- Bank Letter AffidavitDocument1 pageBank Letter AffidavitYarod ELPas encore d'évaluation

- Commercial PaperDocument2 pagesCommercial PaperKaren Laccay100% (2)

- F 8281Document3 pagesF 8281Madeline JohnsonPas encore d'évaluation

- Cover Letter 2Document1 pageCover Letter 2MikeDouglasPas encore d'évaluation

- Bankers AcceptanceDocument1 pageBankers AcceptanceVarad LaghatePas encore d'évaluation

- 1Document6 pages1cha chaPas encore d'évaluation

- Promissory Note Template 05Document2 pagesPromissory Note Template 05Smith Siva100% (2)

- US Treasury Address Puerto RicoDocument1 pageUS Treasury Address Puerto RicoFreeman Lawyer75% (4)

- Pay System ChecklistDocument8 pagesPay System ChecklistAshley FryPas encore d'évaluation

- Presentment of InstrumentDocument12 pagesPresentment of Instrumentefaf007Pas encore d'évaluation

- 7-2 Affidavit of Mailing Notice - Shareholders Special MeetingDocument1 page7-2 Affidavit of Mailing Notice - Shareholders Special MeetingDaniel100% (3)

- Fiduciary Appointment and Authorization: Respondent / Fiduciary Trustee Principal / BeneficiaryDocument6 pagesFiduciary Appointment and Authorization: Respondent / Fiduciary Trustee Principal / Beneficiarytony100% (21)

- Bills of ExchangeDocument5 pagesBills of Exchangesara24391100% (3)

- Accepted Offer Addendum-CounterDocument16 pagesAccepted Offer Addendum-Counterrealestate6199Pas encore d'évaluation

- Information Return For Publicly Offered Original Issue Discount InstrumentsDocument4 pagesInformation Return For Publicly Offered Original Issue Discount InstrumentsShawn60% (5)

- CFPB Mortgage Request-Error-ResolutionDocument4 pagesCFPB Mortgage Request-Error-Resolutionmptacly9152Pas encore d'évaluation

- Promissory NoteDocument19 pagesPromissory NoteUndra Watkins100% (2)

- The Treasury Group: Inverse Relationship of Price of Bond and YTMDocument8 pagesThe Treasury Group: Inverse Relationship of Price of Bond and YTMMichelle T100% (1)

- Negotiable Instruments Act 1881Document16 pagesNegotiable Instruments Act 1881Sunil Shaw100% (2)

- Bill of ConveyanceDocument3 pagesBill of Conveyance:Lawiy-Zodok:Shamu:-El80% (5)

- Form 3575Document1 pageForm 3575c100% (1)

- PS-bill of Exchange ActDocument35 pagesPS-bill of Exchange ActPhani Kiran MangipudiPas encore d'évaluation

- 04-2013 b10 Form Court VersionDocument3 pages04-2013 b10 Form Court Versionjmaglich1100% (1)

- Tender of PaymentDocument1 pageTender of PaymentPatrick Long100% (2)

- Payment Voucher Form 1040v WEBDocument1 pagePayment Voucher Form 1040v WEBWil100% (4)

- RemittanceDocument3 pagesRemittanceSalman Abrar100% (2)

- Bill of ExchangeDocument15 pagesBill of Exchangedcsshit100% (2)

- Bill of Exchange Case StudyDocument5 pagesBill of Exchange Case StudySudhir Kochhar Fema Author100% (2)

- Letter of Credit GenericDocument1 pageLetter of Credit GenericJoe SkeltonPas encore d'évaluation

- H H I A: OLD Armless AND Ndemnity Greement No. 05091989QNWHHIA Non Negotiable Between The PartiesDocument4 pagesH H I A: OLD Armless AND Ndemnity Greement No. 05091989QNWHHIA Non Negotiable Between The PartiesQueenNicole WilliamsPas encore d'évaluation

- 2.2-Notice of TenderDocument6 pages2.2-Notice of TenderAkil Bey100% (1)

- Tom Clayton, MD 1998 1040x CompleteDocument15 pagesTom Clayton, MD 1998 1040x CompleteTom Clayton100% (3)

- Validity of AFV 7Document31 pagesValidity of AFV 7universalparallax100% (4)

- DRAWEEDocument4 pagesDRAWEEranticccPas encore d'évaluation

- Unit-Ii Negotiable InstrumentsDocument65 pagesUnit-Ii Negotiable InstrumentsRAYSPEAR0% (1)

- Bill of ExchangeDocument4 pagesBill of ExchangeSara SanamPas encore d'évaluation

- Credit InstrumentsDocument18 pagesCredit InstrumentsRichard100% (2)

- Statement MAR2022 760347549Document60 pagesStatement MAR2022 760347549Nehal JajuPas encore d'évaluation

- Cognizant Cognizant Infosys Infosys Wipro Future Focus Infotech Accenture Accenture Robert Bosch Rig TechnologiesDocument1 pageCognizant Cognizant Infosys Infosys Wipro Future Focus Infotech Accenture Accenture Robert Bosch Rig TechnologiesVikky VikramPas encore d'évaluation

- Voucher-BqZ WiFi-Perhari-vc-429-06.29.20Document1 pageVoucher-BqZ WiFi-Perhari-vc-429-06.29.20angga13Pas encore d'évaluation

- Token Manual June 2017 FinalDocument6 pagesToken Manual June 2017 Finalvarun singhPas encore d'évaluation

- Statement 20220501 20220517Document5 pagesStatement 20220501 20220517Mrr Roth OfficialPas encore d'évaluation

- Indus Business Account SOC 30.07.2020Document1 pageIndus Business Account SOC 30.07.2020Rameshchandra SolankiPas encore d'évaluation

- Kucoin Incoming Transactions History - Google Search PDFDocument1 pageKucoin Incoming Transactions History - Google Search PDFBen SavagePas encore d'évaluation

- Pocket Rocket PayTmDocument16 pagesPocket Rocket PayTmNikhil Negi100% (1)

- A Comparative Study On Adoption and Usage of Paytm With Phonepe - A Case Study in Bangalore, Karnataka.Document74 pagesA Comparative Study On Adoption and Usage of Paytm With Phonepe - A Case Study in Bangalore, Karnataka.Gns Harish100% (2)

- 1.FIN508 Global Trends and Developments in International BankingDocument183 pages1.FIN508 Global Trends and Developments in International BankingDhawal RajPas encore d'évaluation

- Statement FormatDocument11 pagesStatement Formatanmol gillPas encore d'évaluation

- Demonetization: Impact On Cashless Payemnt System: Manpreet KaurDocument6 pagesDemonetization: Impact On Cashless Payemnt System: Manpreet KaurKiran SoniPas encore d'évaluation

- Ogl20201202 PDFDocument1 pageOgl20201202 PDFaktaruzzaman bethuPas encore d'évaluation

- E-Commerce in IndiaDocument4 pagesE-Commerce in IndiaSohail AhmadPas encore d'évaluation

- Positive Pay SystemDocument6 pagesPositive Pay SystemSoham ChatterjeePas encore d'évaluation

- Perjanjian Kerjasama ESPAY Payment Gateway (Indo - Eng Version) With Newest ChannelDocument23 pagesPerjanjian Kerjasama ESPAY Payment Gateway (Indo - Eng Version) With Newest ChannelZaynull Abideen NoahPas encore d'évaluation

- Penyata Kad / Card Statement: Yap Foot Kean 11A JALAN SS2/28 47300 Petaling Jaya 12 SEP 2023 RM 10,000 02 OCT 2023Document4 pagesPenyata Kad / Card Statement: Yap Foot Kean 11A JALAN SS2/28 47300 Petaling Jaya 12 SEP 2023 RM 10,000 02 OCT 2023waiwahphinPas encore d'évaluation

- Electronic Banking: Electromagnetic CardsDocument13 pagesElectronic Banking: Electromagnetic CardsNikhilrajsingh ShekhawatPas encore d'évaluation

- Splactd PDFDocument1 pageSplactd PDFHelina DikePas encore d'évaluation

- Banks & FintechDocument25 pagesBanks & FintechzamanbdPas encore d'évaluation

- Course Registration Form: Sayyedha Sidrah Nisar Muhammad Nisar KhanDocument2 pagesCourse Registration Form: Sayyedha Sidrah Nisar Muhammad Nisar KhanAli SyedPas encore d'évaluation

- France La Banque PostaleDocument1 pageFrance La Banque PostaleDRISS TAZIPas encore d'évaluation

- MIT Sloan - Finance Track - Course ListingDocument3 pagesMIT Sloan - Finance Track - Course ListingPeter Aguar100% (2)

- (ACV-S06) Week 6 - Pre-Task - Quiz - What Do You Do - (PA) - INGLES II (35973)Document5 pages(ACV-S06) Week 6 - Pre-Task - Quiz - What Do You Do - (PA) - INGLES II (35973)Augusto Aparicio AcostaPas encore d'évaluation

- Direct Debit Authorization Agreement (EFT)Document1 pageDirect Debit Authorization Agreement (EFT)Luis Meza100% (1)

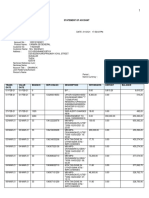

- Statement of AccountDocument5 pagesStatement of Accountmutaia pandian100% (1)

- Benifits of TBL Credit CardDocument3 pagesBenifits of TBL Credit Cardherodataherculis2172Pas encore d'évaluation

- Account Number Customer Id Account Currency Opening Balance Closing BalanceDocument1 pageAccount Number Customer Id Account Currency Opening Balance Closing Balancemohammad1jamalPas encore d'évaluation

- 6 Best Mobile Credit Card Processing Options 2019Document21 pages6 Best Mobile Credit Card Processing Options 2019Ana Marie SuganobPas encore d'évaluation

- Debit Card SkimmingDocument2 pagesDebit Card SkimmingBeldon GonsalvesPas encore d'évaluation