Académique Documents

Professionnel Documents

Culture Documents

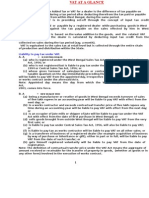

Inserted by Act No. 21 of 2011 Dated 29-12-2011 W.E.F. 1.4.2009. 2. 4% Replaced by 5% Vide Act 12 of 2012 Dated 20-0-2012 W.E.F. 15-09-2011

Transféré par

undyingTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Inserted by Act No. 21 of 2011 Dated 29-12-2011 W.E.F. 1.4.2009. 2. 4% Replaced by 5% Vide Act 12 of 2012 Dated 20-0-2012 W.E.F. 15-09-2011

Transféré par

undyingDroits d'auteur :

Formats disponibles

irrespective of the fact whether such supplies involve sale or works contract or job work subject to such condition

as may be prescribed.

1. Inserted by Act No. 21 of 2011 dated 29-12-2011 w.e.f. 1.4.2009. 2. 4% replaced by 5% vide Act 12 of 2012 dated 20-0-2012 w.e.f. 15-09-2011.

5.

Nothing contained in the Act shall be deemed to impose or authorize the imposition of a tax on the sale or purchase of any goods, where such sale or purchase takes place: a) b) outside the State; or in the course of the import of the goods into, or export of the goods out of the territory of India; or c) in the course of inter-State trade or commerce.

Explanation: - The provisions of Chapter II of the Central Sales Tax Act, 1956, shall apply for the purpose of determining when a sale or purchase takes place in the course of inter-State trade or commerce or outside a State or in the course of import or export. 6. Where goods sold or purchased are contained in containers or are packed in any packing material liable to tax under the Act, the rate of tax applicable to such containers or packing material shall, whether the price of the containers or packing material is charged for separately or not, be the same as the rate of tax applicable to such goods so contained or packed, and where such goods sold or purchased are exempt from tax under the Act, the containers or packing material shall also be exempted. 7. The goods listed in Schedule I to the Act shall be exempted from tax under the Act.

7-A Notwithstanding any thing contained in this Act, no tax under this Act shall be payable by any dealer in respect of sale of any goods made by such dealer to a registered dealer for the purpose of setting up operation, maintenance, manufacture, trading, production, processing, assembling, repairing, reconditioning, re-engineering, packaging or for use as packing material or packing accessories in an unit located in any Special Economic Zone or for development, operation and maintenance of Special Economic Zone by the developer of the Special Economic Zone, if such registered dealer has been authorized to establish such unit or to develop, operate and maintain such Special Economic Zone by the authority specified by the Central Government in this behalf.

(Section 7-A was added by Act No 28 of 2008dated 24-09-2008 w.e.f 24-09-2008)

8.

Subject to the conditions in Sections 9 and 13 of the Act, the following shall be zerorated sales for the purpose of the Act and shall be eligible for input tax credit: (a) Sale of taxable goods in the course of inter-state trade and commerce falling within the scope of Section 3 of the Central Sales Tax Act, 1956; (b) Sale of goods falling within the scope of sub sections (1) and (3) of Section 5 of the Central Sales Tax Act 1956; (c) Deleted.

(The original clause (c) Sale of goods to any unit located in Special Economic Zone. Is deleted by Act No 28 of 2008 dated 24-09-2008 w.e.f 01-06-2008)

9.

Every dealer, who is liable to pay tax on the sale of goods specified in Schedule VI, shall be eligible for input tax credit subject to the conditions in Section 13 of the Act and in the manner prescribed.

10. (1) Any dealer who is not registered or does not opt to be registered as VAT dealer shall not be entitled to claim input tax credit for any purchase, and shall not be eligible to issue a tax invoice. (2) Any dealer who is registered as a VAT dealer shall not be liable to Turnover Tax from the effective date of such registration. 11. (1) Subject to sub-section (2), the VAT payable on a sale liable to VAT shall be calculated by applying the rate of tax specified in the Schedules, on the sale price of goods. (2) Where the sale price of goods is inclusive of VAT, the amount of VAT shall be determined in accordance with the formula prescribed. (3) Where a dealer is liable to pay turnover tax under sub-section (2) of Section 4, the tax shall be calculated by applying the rate of Turnover Tax specified therein on the taxable turnover.

Vous aimerez peut-être aussi

- Sales Tax Special Withholding Rules 2010Document9 pagesSales Tax Special Withholding Rules 2010Shayan Ahmad QureshiPas encore d'évaluation

- The Uttarakhand Value Added Tax Act, 2005Document4 pagesThe Uttarakhand Value Added Tax Act, 2005sandeeep mauryaPas encore d'évaluation

- Maharashtra Value Added Tax ActDocument13 pagesMaharashtra Value Added Tax ActKaran Gandhi0% (1)

- Guidance Note On Accounting For State-Level Value Added Tax: F F Y Y I IDocument8 pagesGuidance Note On Accounting For State-Level Value Added Tax: F F Y Y I Idark lord89Pas encore d'évaluation

- Gujarat Value Added Tax ActDocument7 pagesGujarat Value Added Tax ActvikrantkapadiaPas encore d'évaluation

- VAT ReviewerDocument72 pagesVAT ReviewerJohn Kenneth AcostaPas encore d'évaluation

- VAT ActDocument16 pagesVAT ActcasarokarPas encore d'évaluation

- Feb 23 Class VATDocument58 pagesFeb 23 Class VATybun100% (1)

- Interim Regulations of The People's Republic of China On Value Added TaxDocument7 pagesInterim Regulations of The People's Republic of China On Value Added Taxstphn_maturinPas encore d'évaluation

- Sro 327 PDFDocument20 pagesSro 327 PDFOmer ToqirPas encore d'évaluation

- Sro 327-2008Document22 pagesSro 327-2008abid205Pas encore d'évaluation

- Aknowledgement: Nishikant Jha Who Gave Us The Topic of Implication of Central Sales ActDocument25 pagesAknowledgement: Nishikant Jha Who Gave Us The Topic of Implication of Central Sales ActAli ChiktePas encore d'évaluation

- Central Sales Tax ActDocument12 pagesCentral Sales Tax ActSaurabh Kumar TiwariPas encore d'évaluation

- VAT ActDocument42 pagesVAT ActJamie ReyesPas encore d'évaluation

- Serial No NoDocument27 pagesSerial No NovenkynaiduPas encore d'évaluation

- ITC Under GVat 231113Document78 pagesITC Under GVat 231113ravindra_manek123Pas encore d'évaluation

- Sales Tax Special Procedure (Withholding) Rules, PDFDocument6 pagesSales Tax Special Procedure (Withholding) Rules, PDFAli MinhasPas encore d'évaluation

- Train Law Section 32. Section 107 of The NIRC, As Amended, Is Hereby Further Amended To Read As FollowsDocument2 pagesTrain Law Section 32. Section 107 of The NIRC, As Amended, Is Hereby Further Amended To Read As FollowsReynaldo YuPas encore d'évaluation

- Notification No. 10/95-Central Excise in Exercise of The Powers Conferred by Sub-Section (1) of Section 5A of The CentralDocument5 pagesNotification No. 10/95-Central Excise in Exercise of The Powers Conferred by Sub-Section (1) of Section 5A of The Centralpatelpratik1972Pas encore d'évaluation

- Central Sales TaxDocument17 pagesCentral Sales TaxJyoti ShahPas encore d'évaluation

- Central Sales Tax Act 1956Document24 pagesCentral Sales Tax Act 1956Gunaseelan LeoPas encore d'évaluation

- VAT RulesDocument11 pagesVAT RulesamrkiplPas encore d'évaluation

- 10 42 Vat at GlanceDocument19 pages10 42 Vat at Glanceemmanuel JohnyPas encore d'évaluation

- 53 Summary On Vat CST and WCTDocument16 pages53 Summary On Vat CST and WCTYogesh DeokarPas encore d'évaluation

- Code of Fiscal BenefitsDocument19 pagesCode of Fiscal Benefitsantonior70Pas encore d'évaluation

- Sales Tax Special Procedure Rules 2007Document16 pagesSales Tax Special Procedure Rules 2007QamarAsheedPas encore d'évaluation

- Commissioner of Internal Revenue vs. Toshiba Information Equipment (Phils.), Inc., 466 SCRA 211, August 09, 2005Document4 pagesCommissioner of Internal Revenue vs. Toshiba Information Equipment (Phils.), Inc., 466 SCRA 211, August 09, 2005idolbondocPas encore d'évaluation

- VAT ModuleDocument50 pagesVAT ModuleRovi Anne IgoyPas encore d'évaluation

- Part I-FED Act 2005 (837-854)Document9 pagesPart I-FED Act 2005 (837-854)Simi SheenPas encore d'évaluation

- Nagaland Sales Tax Act 1967Document115 pagesNagaland Sales Tax Act 1967Latest Laws TeamPas encore d'évaluation

- Central Excise Act 1944, Central Excise Rule 2002 and Goods and Sales Tax (GST)Document42 pagesCentral Excise Act 1944, Central Excise Rule 2002 and Goods and Sales Tax (GST)kushal patilPas encore d'évaluation

- Tax Digest AbellanidaDocument2 pagesTax Digest AbellanidaJohn AbellanidaPas encore d'évaluation

- PVAT Rules, 2007 With Gazette NotificationDocument54 pagesPVAT Rules, 2007 With Gazette NotificationsaaisunilPas encore d'évaluation

- The Customs Tariff Act, 1975: EctionsDocument1 116 pagesThe Customs Tariff Act, 1975: EctionsAndrea RobinsonPas encore d'évaluation

- Nagaland Sales of Petroleum and Petroleum Products Including MotorDocument37 pagesNagaland Sales of Petroleum and Petroleum Products Including MotorLatest Laws TeamPas encore d'évaluation

- Compendium of Law&Regulations For-MailDocument281 pagesCompendium of Law&Regulations For-MailAmbuj SakiPas encore d'évaluation

- Types of Duty PDFDocument27 pagesTypes of Duty PDFfirastiPas encore d'évaluation

- Fort Bonifacio v. CIRDocument17 pagesFort Bonifacio v. CIRPaul Joshua SubaPas encore d'évaluation

- Cenvat Credit Rules, 2017Document9 pagesCenvat Credit Rules, 2017Latest Laws TeamPas encore d'évaluation

- Tax CorporateDocument12 pagesTax CorporateIder JanlavtsogzolPas encore d'évaluation

- Vat at A GlanceDocument19 pagesVat at A GlanceABHIJIT MONDAL100% (1)

- Vat AuditDocument46 pagesVat AuditS Dharam SinghPas encore d'évaluation

- 2 UnitDocument36 pages2 UnitIndu Prasoon GuptaPas encore d'évaluation

- VAT Codal and RegulationsDocument6 pagesVAT Codal and RegulationsVictor LimPas encore d'évaluation

- RR 3-2023 Digest FINALDocument4 pagesRR 3-2023 Digest FINALAkld D LerioPas encore d'évaluation

- The Companies Act, 1956: 211. Form and Contents of Balance-Sheet and Profit and Loss Account.Document10 pagesThe Companies Act, 1956: 211. Form and Contents of Balance-Sheet and Profit and Loss Account.Paul ArijitPas encore d'évaluation

- Entry Tax Goods Act 2001Document17 pagesEntry Tax Goods Act 2001letmelearnthisPas encore d'évaluation

- What Is TaxDocument23 pagesWhat Is TaxShah AtifPas encore d'évaluation

- PAL ActDocument8 pagesPAL ActsudumalliPas encore d'évaluation

- RMC 74-99 Treatment of Peza Sales and VatDocument4 pagesRMC 74-99 Treatment of Peza Sales and VatRester John NonatoPas encore d'évaluation

- Sro 457Document5 pagesSro 457Farhan NazirPas encore d'évaluation

- (VAT) in To: Clarifying (RR) No. The The Tax of (TaxDocument13 pages(VAT) in To: Clarifying (RR) No. The The Tax of (TaxShiela Marie Maraon100% (1)

- RMC No. 24-2022Document13 pagesRMC No. 24-2022arnulfojr hicoPas encore d'évaluation

- Procedure To Be Followed For Delhi Value Added TaxDocument6 pagesProcedure To Be Followed For Delhi Value Added TaxChirag MalhotraPas encore d'évaluation

- Frequently Asked QuestionsDocument8 pagesFrequently Asked QuestionsKrissPas encore d'évaluation

- 2007 Sro 660Document5 pages2007 Sro 660Haseeb JavidPas encore d'évaluation

- Q. Write Short Note On: Export & "Deemed Exports"Document4 pagesQ. Write Short Note On: Export & "Deemed Exports"ganeshPas encore d'évaluation

- Excise Duty-1Document11 pagesExcise Duty-1AftabKhanPas encore d'évaluation

- Rigvedic AllDocument11 pagesRigvedic AllundyingPas encore d'évaluation

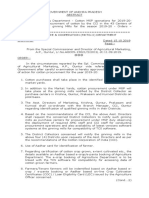

- Agricultural GODocument3 pagesAgricultural GOundyingPas encore d'évaluation

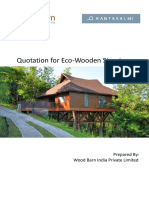

- Quotation For Eco-Wooden Structure: Prepared By: Wood Barn India Private LimitedDocument6 pagesQuotation For Eco-Wooden Structure: Prepared By: Wood Barn India Private LimitedundyingPas encore d'évaluation

- 2019aglc RT720Document1 page2019aglc RT720undyingPas encore d'évaluation

- Government of Andhra Pradesh: (RS. in Lakhs)Document1 pageGovernment of Andhra Pradesh: (RS. in Lakhs)undyingPas encore d'évaluation

- Study of The Indus Script PDFDocument39 pagesStudy of The Indus Script PDFparthibanmaniPas encore d'évaluation

- Government of Andhra PradeshDocument2 pagesGovernment of Andhra PradeshundyingPas encore d'évaluation

- Government of Andhra Pradesh: ST NDDocument1 pageGovernment of Andhra Pradesh: ST NDundyingPas encore d'évaluation

- Vedic Sarasvati-Ganga Civilisation: The Script of Indus Valley Civilisation-16Document117 pagesVedic Sarasvati-Ganga Civilisation: The Script of Indus Valley Civilisation-16undyingPas encore d'évaluation

- G.O.Ms - No.33, dt.24.1.2013 (DMDP-2031)Document26 pagesG.O.Ms - No.33, dt.24.1.2013 (DMDP-2031)srinivassukhavasiPas encore d'évaluation

- Bhirrana To Mehrgarh and Beyond in The C PDFDocument33 pagesBhirrana To Mehrgarh and Beyond in The C PDFundying100% (2)

- Green Grace HyderabadDocument36 pagesGreen Grace HyderabadundyingPas encore d'évaluation

- Telangana Records of Rights (Ror-1B) : Search Through Thousands of Indiafilings Articles and Videos..Document14 pagesTelangana Records of Rights (Ror-1B) : Search Through Thousands of Indiafilings Articles and Videos..undyingPas encore d'évaluation

- Sindhu Is The Vedic SarasvatiDocument132 pagesSindhu Is The Vedic SarasvatiundyingPas encore d'évaluation

- Revised LRS BRS Booklet-2015-2016 PDFDocument14 pagesRevised LRS BRS Booklet-2015-2016 PDFundyingPas encore d'évaluation

- Revised LRS BRS Booklet-2015-2016Document14 pagesRevised LRS BRS Booklet-2015-2016undyingPas encore d'évaluation

- Zoning Regulations and Master Plan GOsDocument146 pagesZoning Regulations and Master Plan GOsgiri_22100% (1)

- The Age of Reason 1794Document146 pagesThe Age of Reason 1794silverlightprinzessPas encore d'évaluation

- Zoning Regulations and Master Plan GOsDocument146 pagesZoning Regulations and Master Plan GOsgiri_22100% (1)

- Commercial RoadsDocument1 pageCommercial Roadsjajabor79Pas encore d'évaluation

- GST Chapter Wise RateDocument213 pagesGST Chapter Wise RateMoneycontrol News92% (280)

- Deaddiction For PornDocument21 pagesDeaddiction For PornundyingPas encore d'évaluation

- 11 - Chapter 3Document28 pages11 - Chapter 3undyingPas encore d'évaluation

- The Collapse of The Indus-Script Thesis: The Myth of A Literate Harappan CivilizationDocument39 pagesThe Collapse of The Indus-Script Thesis: The Myth of A Literate Harappan CivilizationundyingPas encore d'évaluation

- Archaeological and Anthropological StudiesDocument31 pagesArchaeological and Anthropological StudiesundyingPas encore d'évaluation

- Study of The Indus Script PDFDocument39 pagesStudy of The Indus Script PDFparthibanmaniPas encore d'évaluation

- Detailed Info Golden Visa RequirementsDocument1 pageDetailed Info Golden Visa RequirementsundyingPas encore d'évaluation

- Center For The Study of Language and InformationDocument12 pagesCenter For The Study of Language and InformationundyingPas encore d'évaluation

- Jio APN Settings For Lenovo ZUK Z2 - Jio APN SettingsDocument3 pagesJio APN Settings For Lenovo ZUK Z2 - Jio APN SettingsundyingPas encore d'évaluation

- GO Ms No 17 13 02 2019Document1 pageGO Ms No 17 13 02 2019undyingPas encore d'évaluation

- Origin of Customs DutyDocument45 pagesOrigin of Customs DutyJayagokul SaravananPas encore d'évaluation

- MBA Internship Report NEWDocument38 pagesMBA Internship Report NEWAvik ModakPas encore d'évaluation

- A Guide To UK Oil and Gas TaxationDocument172 pagesA Guide To UK Oil and Gas Taxationkalite123Pas encore d'évaluation

- R.A. No. 11976 - Ease of Paying TaxesDocument18 pagesR.A. No. 11976 - Ease of Paying TaxesBeaPas encore d'évaluation

- Chapter 5 - Exemptions From GSTDocument35 pagesChapter 5 - Exemptions From GSTkarnimasoni12Pas encore d'évaluation

- Input Tax Credit ProjectDocument14 pagesInput Tax Credit Projectratna supriyaPas encore d'évaluation

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Ch PrasadPas encore d'évaluation

- Indirect Taxes - Transformation in GSTDocument53 pagesIndirect Taxes - Transformation in GSTJogender Chauhan100% (1)

- Executive Summary: Term Paper-Licensing JaquarDocument28 pagesExecutive Summary: Term Paper-Licensing JaquarSabrina AlamPas encore d'évaluation

- Tally9 - List of LedgersDocument2 pagesTally9 - List of LedgersSubash_SaradhaPas encore d'évaluation

- QUESTIONNAIRE (Sadiq)Document3 pagesQUESTIONNAIRE (Sadiq)Favaz PgnPas encore d'évaluation

- O2 - Telefónica UK Limited PDFDocument1 pageO2 - Telefónica UK Limited PDFAgre Junior Noël0% (1)

- Income Taxation Finals ReviewerDocument10 pagesIncome Taxation Finals ReviewerMichael SanchezPas encore d'évaluation

- 10 Taxes You Should Know About - Business Standard NewsDocument8 pages10 Taxes You Should Know About - Business Standard NewsAnkaj MohindrooPas encore d'évaluation

- 70534sample Receipts and Invoices - Annex CDocument11 pages70534sample Receipts and Invoices - Annex CRamon Christopher GananPas encore d'évaluation

- Internship FileDocument38 pagesInternship FileRaviRamchandaniPas encore d'évaluation

- KPMG Budget Analysis 2022Document25 pagesKPMG Budget Analysis 2022raymanPas encore d'évaluation

- CIR v. UCSFADocument7 pagesCIR v. UCSFATheresa BuaquenPas encore d'évaluation

- Costlier or Cheaper Under GST?: What Will Be Cheaper?Document4 pagesCostlier or Cheaper Under GST?: What Will Be Cheaper?Anonymous pGIu2EwXXPas encore d'évaluation

- M& A - Case Study PresentationDocument71 pagesM& A - Case Study PresentationDilip JagadPas encore d'évaluation

- Digest Consolidated Cases G.R. Nos. 187485, 196113 and 197156Document6 pagesDigest Consolidated Cases G.R. Nos. 187485, 196113 and 197156Rebecca S. Ofalsa100% (2)

- Promoters AgreementDocument8 pagesPromoters AgreementGazal SandhuPas encore d'évaluation

- Establishing A Business in PortugalDocument30 pagesEstablishing A Business in Portugaldaniel francoPas encore d'évaluation

- AIIMS GK With LogicalDocument225 pagesAIIMS GK With Logicalvraj100% (1)

- EBTax UAT Test Script ARDocument2 pagesEBTax UAT Test Script ARchirag0% (1)

- CNG Compressor TenderDocument148 pagesCNG Compressor TenderRaghPas encore d'évaluation

- 01wbaar Apeal 2023 - 20230420Document7 pages01wbaar Apeal 2023 - 20230420ranadip mayraPas encore d'évaluation

- Business Taxation Midterm Quiz 1 2 PhineeeDocument4 pagesBusiness Taxation Midterm Quiz 1 2 PhineeeKaxy PHPas encore d'évaluation

- Impact Assessment Commercial Tax ComputerizationDocument539 pagesImpact Assessment Commercial Tax ComputerizationengineeringwatchPas encore d'évaluation

- TenderDocs PDFDocument73 pagesTenderDocs PDFdev kumarPas encore d'évaluation