Académique Documents

Professionnel Documents

Culture Documents

Influence of Some Economic Parameters On Cut Off Grade and Ore Reserve Determination at Itakpe Iron Ore Deposit North Central Nigeria

Transféré par

luisparedesDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Influence of Some Economic Parameters On Cut Off Grade and Ore Reserve Determination at Itakpe Iron Ore Deposit North Central Nigeria

Transféré par

luisparedesDroits d'auteur :

Formats disponibles

International Research Journal of Geology and Mining (IRJGM) (2276-6618) Vol. 2 (4) pp.

82-87, June 2012 Available online http://www.interesjournals.org/IRJGM Copyright 2012 International Research Journals

Full Length Research Paper

Influence of some economic parameters on cut-off grade and ore reserve determination at Itakpe iron ore deposit, North central Nigeria

Nwosu J.I and *Nwankwoala H.O

Department of Geology, University of Port Harcourt, Nigeria

Accepted 26 June, 2012

Optimum determination of cut-off grade and ore reserve of a deposit is critical to a viable operation of an open-pit mine. The controlling variables in the determination of cut-off grade and ore reserve are the price of iron ore concentrate and its production cost. This paper studies the influence of changes in price and production cost of concentrate on cut-off grade and ore reserve determination of Itakpe Iron Ore Deposit, North Central Nigeria. The study utilizes graphical and mathematical models to show the relationship between cut-off grades and ore reserves at Itakpe Mine with changing pricecost ratios. It concludes that management of National Iron Ore Mining Company Limited Itakpe should promptly react to changes in price-cost ratios by lowering cut-off grades with increasing price-cost ratio or by increasing cut-off grade with decreasing price-cost ratio. This will subsequently determine the ore reserve of the deposit. Keywords: Economic parameter, Ore reserve, Deposit, Cut-off grade, Ore concentrate, Cost ratio. INTRODUCTION Ct-off grade can be defined as the grade at which potential revenue balances all costs (Camisani et al). Alwyn (1991) observed that no profit margin is built in the above definition. However, if all costs may include the cost of capital, then the above definition can be justified. Further more, it is necessary to define or state succinctly the components of all costs in Camisanis definition. Consequently, in relation to open- pit mining, cut-off grade can be defined as the minimum grade at which the value of the ore balances all costs on mining, waste removal, mineral processing, and smelting, together with the administrative costs attached to the above unit operations, and leave the corporate organization with at least, a minimum corporate rate of return. The above definition shows that cut-off grade depends on factors which are very susceptible to changes. The prices of mineral commodities have been volatile over the past years. So also are the cost of mining equipment, consumables, salaries and wages and even the cost of capital, which affect corporate acceptable rate of return on investment. On its own part, the cut-off grade affects the mineable ore reserve of a deposit. When cut-off grade increases, the tonnage of ore reserve that can be included as mineable ore reserve is reduced (Gerald, 1992). When cut-off grade decreases more tonnage of ore among the lower grade ores can now be regarded as mineable ore and thus ore reserve increases. Proper assessment and consideration of the above factors in mine planning and design will lead to the optimum operation of Itakpe mine. In particular, it is essential to foresee into the future how variability of economic factors will affect future operations of the mine. Knowledge of this will affect the mode of operation of the company, their strategic management plan, and the economy of the mining venture as a whole. METHODOLOGY The geologic reserve of Itakpe deposit is about 200mt. This geologic reserve is made up of 14 layers with varying tonnages and grades. Table 1 below, shows the various ore layers, their tonnages and grades. In order to assess the influence of price and cost changes on grade-tonnage relationship, the mathematical

*Corresponding Author Email: nwankwoala_ho@yahoo.com

Nwosu and Nwankoala 83

Table 1. Ore layers, their tonnage and grade at Itakpe iron ore deposit EAST PIT

Ore Layers Ore Layer Index Northern N1 Northern N2 Northern N3 Intermediate I1 Intermediate I2 Intermediate I3 Central C1 Central C2 Central C3 Central C4 Southern S1 Southern S2 Southern S3 Total reserve of east pit

WEST PIT

Grade % 34.19 37.88 35.01 29.5 34.95 36.44 40.95 29.88 34.42 37.037 38.68 36.45 18.2

Tonnage mt 15.49 31.58 5.22 0.95 3.6 10.68 6.2 9.54 20.1 32 2.8 4.41 3.8 147.04mt Tonnage mt 3.8 2.5 5.6 2.8 3.6 4.5 2.27 5.6 7.6 2.6 3.6 4.6 49.27mt

Ore Layers Ore Layer Index Northern N1 Northern N2 Northern N3 Intermediate I1 Intermediate I2 Intermediate I3 Central C1 Central C2 Central C3 Southern S1 Southern S2 Southern S3 Total reserve of east pit

Grade % 25.3 15.8 14.8 15.8 20.6 34.7 20.5 18.7 17.8 20.8 28.6 24.4

(SOURCE: NIOMCO Project Report, 1980)

model for cut-off grade estimation will be utilized. As defined above, cut-off grade is the minimum grade of ore at which the value of the smelted ore will balance all cost in mining, waste removal, mineral processing and smelting and leave the corporate output with at least a minimum acceptable level of profit. Value of smelted ore V= Fg x MR x Pm Where Fg - Grade of ore MR - Metallurgical recovery Pm - Price per ton of smelted ore Total production cost T = (Cm + (SR x W) + Cp + Cs) Where Cm = Cost of mining per ton of ore including haulage and administrative costs. SR = Stripping ratio

W = Stripping cost per ton of waste including administrative cost. Cp= Cost of mineral processing per ton of ore including administrative costs. Cs = Cost of smelting per ton of ore including administrative costs. If the corporate outfit is to make a minimum acceptable rate of return r%, then production cost plus profit margin: Tp = (1+r/100) (Cm + (SR x W) + Cp + Cs) By definition: Fc. MR. Pm = (1+r/100) (Cm + (SR x W) + Cp + Cs) Where Fc = Cut-off grade Or Fc = (1 + r / 100 ) (C m + (S R x W ) + C p + C s ) (4)

M R x Pm

The above: formula is a modified form of the existing formula for cut-off grade estimation (Alwyn, 1991). It

84 Int. Res. J. Geol. Min.

Table 2. Values of parameters for cut-off grade estimation of Itakpe deposit.

Parameter Value

r, % 25

Y 0.48

PC, N 12,000

SR, t/t 4

CM, N 300

W, N 200

CP,, N 280

Table 3. Decrease of cut-off grades with increasing prices of concentrates when yield and total production cost are constant.

Price N FC, %

10,000 35.94

11,000 32.67

12,000 29.95

13,000 27.64

14,000 25.67

15,000 23.96

16,000 22.46

17,000 21.14

18,000 19.97

19,000 18.91

20,000 17.98

40 35 30 Cut-off Grade % 25 20 15 10 5 0 0 5,000 10,000 15,000 20,000 25,000 Price per ton of concentrate, N

Figure 1. Lowering of cut-off grades with increasing price of concentrate when production cost and yield are constant

charges an acceptable rate of return on invested funds as well as separates mineral processing cost and smelting cost. If a mining outfit does not own a smelting plant but merely exploits and beneficiates the run-of-mine ore and sells to smelting companies as it is the case with Itakpe, then formula (4) becomes: FC = (1 + r / 100) (C m + (S R x W ) + C p + C s ) (5)

Y x Pc

formula means that the tonnage of ore that represent the cut-off grade must be exploited with a minimum corporate rate of return. RESULTS AND DISCUSSIONS Table 2 below shows the values of the parameters for Itakpe open-pit mire. The cost components were estimated as recommended by Alan et al (1992). Using formula (5) cut-off grade of Itakpe deposit can be estimated as follows: FC = 1.25(300 + (4 x 200) + 280 ) = 0.2995 or 30%

0.48 x 12,000

Where Y = Concentrate yield per ton ore Pc = Price per ton of concentrate In both formula (4) and (5) the numerator represents the total production cost per ton of ore plus return on investment. Consequently, the cut-off grade can be rewritten for formula (4) as: Fc= Total production cos t + Re turn on Investment (6)

Re cov ery x Pr ice per ton of Smelted ore

And for formula (5) Fc = Total production cos t + Re turn on Investment

Yield x Pr ice per ton of Concentrat e

(7)

The return on investment component of the above

In general, cut-off grade varies with varying price-cost ratios. In special cases when either only the price varies or only the production cost varies, cut-off grade will vary accordingly. By utilizing formula (5) cutoff grades have been calculated for various price options when total cost of production and yield are constant. As can be seen from Table 3 and Figure 1 cut-off grade lowers with increasing price of concentrate. On the other hand, when price and yield are constant and total cost of production

Nwosu and Nwankoala 85

Table 4. Increase of Fc with increasing total production cost when price and yield are constant

Cost N FC, %

1667 28.94

1692.3 29

1725 29.95

1742.6 30.25

1742 30.24

1748 30.35

1768 30.69

1983 30.95

1803 313

1853 32.17

1892 32.85

33.5 33 32.5 32 Cut-Off Grade % 31.5 31 30.5 30 29.5 29 28.5 1650

1700

1750

1800

1850

1900

1950

Total Production Cost Per Ton of Concentrate

Figure 2. Increase of Fc with increasing total production cost when price of concentrate and yield are constant

Table 5. Showing varying prices and production costs but the same price-cost ratio

Price N Cost N P/C Fc,%

10,000 1333.38 7.5 27.78

11,000 1466.67 7.5 27.78

12,000 1600 7.5 27.78

13,000 1733.33 7.5 27.78

14,000 1866.67 7.5 27.78

15,000 2000 7.5 27.78

16,000 2133.33 7.5 27.78

17,000 2266.67 7.5 27.78

18,000 2400 7.5 27.78

19,000 2533.33 7.5 27.78

20,000 2666.67 7.5 27.78

increases, cut-off grade increases (Table 4, Figure 2). The more common situation is that both price and cost can change simultaneously. In such a case, (which is a more general case), it is more appropriate to calculate the cut-off grades for varying price-cost ratios. Provided that yield is constant, cut-off grades will lower with increasing price cost ratios and will increase with decreasing price-cost ratios. Irrespective of whatever value the price and total production cost may be, cut-off grade will be the same provided price-cost ratio does not change and yield is constant. The above statement can be proved using the mathematical model for cut-off grade estimation. Suppose the price per ton of concentrate is N15, 000 and total production cost is N2, 000 then pricecost ratio is 7.5. If the concentrate yield per ton of ore is 0.48; then, using formula 7, cut-off grade:

FC = 2000 100 x = 27.28% 0.48 x15000 1

If price per ton of concentrate changes to 4417,000 and total, production cost changes to N2, 267, (i.e. the pricecost ratio still remaining 7.5) while yields 0.48, then table 5 above shows the cut-off grade of ore at varying prices

of concentrate and varying total production cost but the, same price-cost ratio. As can be seen, cut-off grade remains the same 27.78 %Fe even though prices and total production costs vary. The yield is constant as usual. Since cut-off grade remains the same with varying prices and costs that generate the same price-cost ratio, then price-cost ratio can be plotted against cut-off grades and the plot can be used to ascertain graphically, the appropriate cut-off grade of the deposit by knowing the price-cost ratios. This is particularly useful when both price and cost of production are changing simultaneously. Table 6 below shows the cut-off grades at various pricecost ratios in the situation where both prices arid costs vary simultaneously. In order to operate optimally, the National Iron Ore Mining Company Itakpe, needs to adjust its cut-off grade and mineable ore reserve with changing price-cost ratios. Table 7 shows the mineable ore reserves that Itakpe iron ore deposit can yield at the stated cut-off grades. When prices of concentrate and/or cost of production change to alter the existing price-cost ratio, the new

86 Int. Res. J. Geol. Min.

Table 6. Showing varying prices, cost, price-cost ratios and cut-off grades

Price N Cost N P/C Fc,%

10,000 1667 6.0 34.7

11,000 1692.3 6.5 32.1

12,000 1725 6.96 29.95

13,000 1742.6 7.46 27.93

14,000 1742 8.04 25.92

15,000 1748 8.58 24.28

16,000 1768 9.05 23.02

17,000 1783 9.53 21.85

18,000 1803 9.98 20.85

19,000 1853 10.25 20.32

20,000 1892 10.57 19.71

Table 7. Showing mineable ore reserves that can be generated by ore layers at Itakpe deposit, at various cut-off grades

FC% Ore Reserve mt

34.19 137.2 5

29.88 146.7 9

29.5 147.7 4

28.6 151.3 4

25.3 155.1 4

24.4 159.9 4

20.8 162.5 4

20.6 166.1 4

20.5 168.4 1

18.7 174.0 1

18.2 177.8 1

17.8 185.4 1

15.8 190.7 1

14.8 196.3 1

40 35 Price-Cost Ratio 30 25 20 15 10 5 0 0 2 4 6 8 10 12 Cut-Off Grade % Fc,%

Figure 3. Cut-off grade at varying price-cost ratios

price- V cost ratio is used to ascertain the applicable cutoff grade in Figure 3. This applicable cut-off grade is used in Table 7 to obtain the new mineable ore reserve of Itakpe deposit that justifies investment. For example, suppose the price per ton of concentrate at Itakpe was N12, 000 and total production cost was N1725; at such economic indicators, Itakpe would be applying a cut-off grade of 29.95% (30%) as per Figure 3. If the price per ton of concentrates changes to N15, 000 and cost of production changes to N748, it means that price-cost ratio has changed from 6.96 to 8.58. From Figure 3, the new cut-off grade will be 24.28 %Fe. This can be established by tracing to the new cut-off grade that corresponds to a price-cost ratio of 8.58 in Figure 3. When the cut-off grade is established, this cut-off grade is used In Table 7 to obtain the new mineable ore reserve of Itakpe that will justify investment in the exploitation of the deposit. Care should be taken not to draw a graph with the data in Table 7 and attempt to interpolate to the exact ore reserve that corresponds to the new cut-off grade. This is because such an ore reserve may not be generated by the deposit given the tonnages and grades

of the ore layers at Itakpe deposit. If the cut-off grade is not among those calculated in Table 7, then the ore reserve corresponding to the next higher cut-off grade in Table 7 should be chosen. CONCLUSIONS Increase in the price of concentrate lowers the cut-off grade of a deposit and increases the mineable ore reserve. On the other, hand increase in total: production cost increases the cut-off grade and decreases the mineable ore reserve of a deposit. When the price of concentrate and total production cost change simultaneously (within a production period) to alter the existing price-cost ratio, the graph of price-cost ratio against cut-off grade is more suitable for estimating the new cut-off grade. In that case, the new price cost ratio is used to ascertain the applicable cut-off grade. The cut-off grade can then be used to determine the corresponding mineable ore reserve of the deposit. The Management of National Iron Ore Mining Company

Nwosu and Nwankoala 87

Ltd, Itakpe can optimize their operations by reacting promptly to changes in price-cost ratios of iron ore concentrate. When price-cost ratio increases, cut-off grade should be lowered proportionately. When pricecost ratio decreases, cut-off grade should be increased.

REFERENCES Alan T, Ohara O, Stanley CS (1992). Costs and Cost Estimation. SME Mining Engineering Handbook. 2nd Edition Edited by Howard .L. Hartman. 1:

Alwyn E Annels (1991). Mineral Deposit Evaluation: A Practical Approach. Published by Chapman and Hall, London. Camisani C, Merwe PT (1985). Assessment of South African Uranium Resources: Transactions of Geological Society of South Africa Pp. 83-97. Gerald CD (1992). Open-Pit Feasibility Study SME Mining Engineering Handbook. 2nd Edition, Edited by Howard .L. Hartman. NIOMCO Project Report (1980). National Iron Ore Mining Project Itakpe.

Vous aimerez peut-être aussi

- PT Inco cut-off gradeDocument4 pagesPT Inco cut-off gradeilham nasrunPas encore d'évaluation

- Optimization Model of Surface Mine Production Rate: J. Changsheng and Z. YoudiDocument3 pagesOptimization Model of Surface Mine Production Rate: J. Changsheng and Z. YoudiEdward ChirinosPas encore d'évaluation

- Determination of A Mining Cutoff Grade Strategy Based On An Iterative Factor PDFDocument5 pagesDetermination of A Mining Cutoff Grade Strategy Based On An Iterative Factor PDFRenzo MurilloPas encore d'évaluation

- Optimumblasting PDFDocument14 pagesOptimumblasting PDFPermadi Saputra SitanggangPas encore d'évaluation

- Costos 1 TrabDocument16 pagesCostos 1 TrabrannscribdPas encore d'évaluation

- Energy and Exergy Analysis of The Crude Oil Fractionation UnitsDocument10 pagesEnergy and Exergy Analysis of The Crude Oil Fractionation UnitsAlvin PhươngPas encore d'évaluation

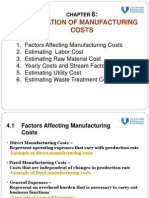

- 4 Manufacturing Cost EstimationDocument22 pages4 Manufacturing Cost EstimationMuhammad Syafiq0% (1)

- Air Pollution Control Technology Fact SheetDocument5 pagesAir Pollution Control Technology Fact SheetSiddharth RajendranPas encore d'évaluation

- Effects of Deterioration Equipment Reliability in A Gas Turbine Cogeneration Power PlantDocument4 pagesEffects of Deterioration Equipment Reliability in A Gas Turbine Cogeneration Power PlantAneta HaziPas encore d'évaluation

- Study of Merrill-Crowe Processing. Part II - Regression Analysis of Plant Operating DataDocument8 pagesStudy of Merrill-Crowe Processing. Part II - Regression Analysis of Plant Operating DataChristy Alexandra Solano GavelánPas encore d'évaluation

- MINE3230 Mine Planning Sample ExamDocument9 pagesMINE3230 Mine Planning Sample Exam2685866100% (3)

- 10 A Simplified Economic Filter For Underground Mining of MassiveDocument20 pages10 A Simplified Economic Filter For Underground Mining of MassiveRosângela TapiaPas encore d'évaluation

- IJEE 04 v5n1 PDFDocument8 pagesIJEE 04 v5n1 PDFbabarPas encore d'évaluation

- Biomass CHP: Lovro Foretic Josipa Ljubicic Marin GalicDocument22 pagesBiomass CHP: Lovro Foretic Josipa Ljubicic Marin GalicMarin GalicPas encore d'évaluation

- Economic Evaluation of The Industrial Solar Production of LimeDocument22 pagesEconomic Evaluation of The Industrial Solar Production of Limeoscop2009Pas encore d'évaluation

- Case Study On Cement Kiln Energy SavingDocument3 pagesCase Study On Cement Kiln Energy Savingengr kazamPas encore d'évaluation

- Chap 6.0 Manufacturing Cost EstimationDocument20 pagesChap 6.0 Manufacturing Cost EstimationIR Ika EtyEtyka DoraPas encore d'évaluation

- Planeamiento de Mina 2Document43 pagesPlaneamiento de Mina 2Edgar Lucho100% (1)

- Energy Balances and CO2 ImplicationsDocument6 pagesEnergy Balances and CO2 ImplicationskayePas encore d'évaluation

- Optimal Long Term Planning at El Teniente MineDocument15 pagesOptimal Long Term Planning at El Teniente MinePatricio Fernando Muñoz MorenoPas encore d'évaluation

- 071 DosSantosDocument10 pages071 DosSantosTiago HenriquesPas encore d'évaluation

- Mygov 149300716733022984Document21 pagesMygov 149300716733022984Keyur MakwanaPas encore d'évaluation

- 2.4.2 Costs From Actual Operations: Cost June 1989 Cost June 1978 X Buiiding Cost Index (1989) Building Cost Index (1978)Document4 pages2.4.2 Costs From Actual Operations: Cost June 1989 Cost June 1978 X Buiiding Cost Index (1989) Building Cost Index (1978)Jorge Burgos IbañezPas encore d'évaluation

- SPE 180835 MS (2016) Effective Flare and Vent ManagementDocument8 pagesSPE 180835 MS (2016) Effective Flare and Vent ManagementJustin LochanPas encore d'évaluation

- Small unit emission control methodsDocument4 pagesSmall unit emission control methodsRaviPas encore d'évaluation

- Cost Rate CurvesDocument27 pagesCost Rate CurvesThiện VươngPas encore d'évaluation

- Cement Industries in Satna Cost, Efficiency and Environment ImpactDocument19 pagesCement Industries in Satna Cost, Efficiency and Environment ImpactNeeraj Bhalerao100% (1)

- Work Book ModelDocument52 pagesWork Book ModelkamlPas encore d'évaluation

- SKPP3113 Evaluation & Management of Petroleum ProjectsDocument18 pagesSKPP3113 Evaluation & Management of Petroleum ProjectsHemakkesha ArumugamPas encore d'évaluation

- National Certification Examination 2008 FOR Energy AuditorsDocument10 pagesNational Certification Examination 2008 FOR Energy AuditorsMukesh KumarPas encore d'évaluation

- Energy Consuming EquipmentDocument13 pagesEnergy Consuming EquipmentMukhtiar AliPas encore d'évaluation

- Hydrogen TechDocument57 pagesHydrogen Techruk1921Pas encore d'évaluation

- v112n04p301 Economic Modelinf FeCr FurnaceDocument8 pagesv112n04p301 Economic Modelinf FeCr FurnaceergfaradPas encore d'évaluation

- Mine Planning and Optimisation Using NPV MethodDocument15 pagesMine Planning and Optimisation Using NPV Methodmfouou zeh macmillanPas encore d'évaluation

- Feasibility Analysis of A Nuclear Power PlantDocument5 pagesFeasibility Analysis of A Nuclear Power PlantBetsy SebastianPas encore d'évaluation

- Coursework Due Date Matric No 1900385: Drilling and Well EngineeringDocument21 pagesCoursework Due Date Matric No 1900385: Drilling and Well EngineeringloladePas encore d'évaluation

- Simulation and Evaluation of Flare Gas Recovery Unit For RefineriesDocument7 pagesSimulation and Evaluation of Flare Gas Recovery Unit For RefineriesJohnPas encore d'évaluation

- Power Transformer Efficiency - Survey Results and Assessment of Efficiency ImplementationDocument7 pagesPower Transformer Efficiency - Survey Results and Assessment of Efficiency ImplementationsergeykrustevPas encore d'évaluation

- Perform Achieve and Trade: Target SettingDocument12 pagesPerform Achieve and Trade: Target SettingS Vikash RanjanPas encore d'évaluation

- Pergamon: Energy Convers. MGMTDocument6 pagesPergamon: Energy Convers. MGMTTriani NurjanahPas encore d'évaluation

- Cash Flow Grades - Scheduling Rocks With Different Troughput CharacteristicsDocument8 pagesCash Flow Grades - Scheduling Rocks With Different Troughput CharacteristicsGaluizu001Pas encore d'évaluation

- Optimizing The Cut Off Grade in Sarcheshmeh Copper Mine Using Lane Quartet ModelDocument9 pagesOptimizing The Cut Off Grade in Sarcheshmeh Copper Mine Using Lane Quartet ModelzergPas encore d'évaluation

- National Certification Examination 2005: General InstructionsDocument7 pagesNational Certification Examination 2005: General InstructionsSundara VeerrajuPas encore d'évaluation

- Design of Methanol Plant Optimization and Carbon Capture AnalysisDocument25 pagesDesign of Methanol Plant Optimization and Carbon Capture AnalysisAnonymous 0QumXG6NPas encore d'évaluation

- The Economics of Hardfacing: Home PageDocument10 pagesThe Economics of Hardfacing: Home PageJR ZookPas encore d'évaluation

- Slides - Lecture 4Document37 pagesSlides - Lecture 4Syed Faisal HassanPas encore d'évaluation

- Offshore Wind Farm AnalysisDocument22 pagesOffshore Wind Farm AnalysisShahab SadeghpourPas encore d'évaluation

- Spe 71431 MSDocument4 pagesSpe 71431 MSAhmed Khalil JaberPas encore d'évaluation

- Optimization in Mine DesignDocument26 pagesOptimization in Mine DesignDiana Catalina Munera0% (1)

- Energy and Resources - China: China Asia (Excl. Middle East) WorldDocument6 pagesEnergy and Resources - China: China Asia (Excl. Middle East) WorldJorge Paredes ApontePas encore d'évaluation

- CM803-Introduction To Climate Change Module 1: Physical Science Problem Set-2Document5 pagesCM803-Introduction To Climate Change Module 1: Physical Science Problem Set-2Nandini SureshPas encore d'évaluation

- Lc-6 Flue Gas Monitoring For Coal Fired Thermal Power PlantDocument25 pagesLc-6 Flue Gas Monitoring For Coal Fired Thermal Power PlantNinh Quoc TrungPas encore d'évaluation

- 22 Appendix C Sizing CostingDocument33 pages22 Appendix C Sizing CostingRaffi Richard100% (1)

- GN - ART - T.Torries - 1995 - Comparative Costs of Nickel Sulphides and LateritesDocument9 pagesGN - ART - T.Torries - 1995 - Comparative Costs of Nickel Sulphides and LateritesEduardo CandelaPas encore d'évaluation

- BU5053 Introduction to Energy Economics & Investment Decision MakingDocument46 pagesBU5053 Introduction to Energy Economics & Investment Decision MakingEnzo MichelPas encore d'évaluation

- UG Mine Design for Fishmeri Gold DepositDocument97 pagesUG Mine Design for Fishmeri Gold DepositLiPas encore d'évaluation

- Manicaland State University Mining Project PlanDocument20 pagesManicaland State University Mining Project PlanPanashe kapesiPas encore d'évaluation

- Thermo-hydrodynamic Lubrication in Hydrodynamic BearingsD'EverandThermo-hydrodynamic Lubrication in Hydrodynamic BearingsPas encore d'évaluation

- Animales de Jungla para CasaDocument7 pagesAnimales de Jungla para CasaluisparedesPas encore d'évaluation

- Plane Amien To 11Document13 pagesPlane Amien To 11luisparedesPas encore d'évaluation

- Curso Strategic Mine Planning Optimization InglesDocument3 pagesCurso Strategic Mine Planning Optimization InglesluisparedesPas encore d'évaluation

- Rating Dozer BladesDocument4 pagesRating Dozer BladesluisparedesPas encore d'évaluation

- Meikle Mine OpensDocument5 pagesMeikle Mine OpensluisparedesPas encore d'évaluation

- Certificate of Analysis - pm424nDocument1 pageCertificate of Analysis - pm424nluisparedesPas encore d'évaluation

- Week 11Document18 pagesWeek 11luisparedesPas encore d'évaluation

- Plane Amien To 12Document6 pagesPlane Amien To 12luisparedesPas encore d'évaluation

- Hoist DesignDocument16 pagesHoist DesignluisparedesPas encore d'évaluation

- 4 - Steps in Hoist DesignDocument93 pages4 - Steps in Hoist Designluisparedes50% (2)

- Q 42013 Supplementary Operational InformationDocument53 pagesQ 42013 Supplementary Operational InformationluisparedesPas encore d'évaluation

- Extensometro en BarraDocument4 pagesExtensometro en BarraluisparedesPas encore d'évaluation

- Certificate of Analysis - pm423nDocument1 pageCertificate of Analysis - pm423nluisparedesPas encore d'évaluation

- STDS Min 00Document1 pageSTDS Min 00luisparedesPas encore d'évaluation

- Certificate of Analysis - Cu154Document1 pageCertificate of Analysis - Cu154luisparedesPas encore d'évaluation

- Certificate of Analysis - Cu160Document1 pageCertificate of Analysis - Cu160luisparedesPas encore d'évaluation

- WCM Sales LTD Precious Metal OresDocument2 pagesWCM Sales LTD Precious Metal OresluisparedesPas encore d'évaluation

- Certificate of Analysis - Cu154Document1 pageCertificate of Analysis - Cu154luisparedesPas encore d'évaluation

- Canmet Kc1 ADocument2 pagesCanmet Kc1 AluisparedesPas encore d'évaluation

- Patrec: Ultra-Heavy Axle Loads: Design and Management Strategies For Mine PavementsDocument15 pagesPatrec: Ultra-Heavy Axle Loads: Design and Management Strategies For Mine PavementsSunilkumar ReddyPas encore d'évaluation

- Ramani (T)Document13 pagesRamani (T)luisparedesPas encore d'évaluation

- Guidelines For Mine Haul Road DesignDocument10 pagesGuidelines For Mine Haul Road Designlxo08Pas encore d'évaluation

- Algorithms For Multi-Parameter Constrained Compositing of Borehole Assay Intervals From Economic AspectsDocument14 pagesAlgorithms For Multi-Parameter Constrained Compositing of Borehole Assay Intervals From Economic AspectsluisparedesPas encore d'évaluation

- General Approach To Distribute Waste Rocks Between Dump Sites in Open Cast MinesDocument11 pagesGeneral Approach To Distribute Waste Rocks Between Dump Sites in Open Cast MinesluisparedesPas encore d'évaluation

- De Lara (T)Document6 pagesDe Lara (T)luisparedesPas encore d'évaluation

- Q 42013 Supplementary Operational InformationDocument53 pagesQ 42013 Supplementary Operational InformationluisparedesPas encore d'évaluation

- Integrated Asset Management Strategies For Unpaved Mine Haul RoadsDocument13 pagesIntegrated Asset Management Strategies For Unpaved Mine Haul RoadsluisparedesPas encore d'évaluation

- Modern Drilling Equipment For Underground ApplicationsDocument5 pagesModern Drilling Equipment For Underground ApplicationsAnkur MandawatPas encore d'évaluation

- Preliminary Stope Stability Assessment for the Meliadine Gold ProjectDocument33 pagesPreliminary Stope Stability Assessment for the Meliadine Gold ProjectluisparedesPas encore d'évaluation

- n30331309 PHD AbstractDocument4 pagesn30331309 PHD AbstractluisparedesPas encore d'évaluation

- Global BusinessDocument78 pagesGlobal BusinessSIVA RAMA KRISHNAPas encore d'évaluation

- SevensReport9 23 20 PDFDocument6 pagesSevensReport9 23 20 PDFsirdquantsPas encore d'évaluation

- Purchase From Unregister DealerDocument13 pagesPurchase From Unregister DealerShahnawaz ShaikhPas encore d'évaluation

- CH 5 - 1Document25 pagesCH 5 - 1api-251535767Pas encore d'évaluation

- Practice Questions 2 For Mid - Term ExamDocument3 pagesPractice Questions 2 For Mid - Term ExamMukhrizIzrafAzmanAzizPas encore d'évaluation

- Price Schedule For Goods Offered From Within The PhilippinesDocument2 pagesPrice Schedule For Goods Offered From Within The PhilippinesTj GasolinePas encore d'évaluation

- MTIDocument14 pagesMTIavinas@333Pas encore d'évaluation

- Investment and Decision Analysis For Petroleum ExplorationDocument24 pagesInvestment and Decision Analysis For Petroleum Explorationsandro0112Pas encore d'évaluation

- AIA Doc Synopses by SeriesDocument43 pagesAIA Doc Synopses by Seriesdupree100% (1)

- Hong, P. and Kwon, H.B., 2012. Emerging Issues of Procurement Management A Review and Prospect. International Journal of Procurement Management 4, 5 (4), pp.452-469.Document19 pagesHong, P. and Kwon, H.B., 2012. Emerging Issues of Procurement Management A Review and Prospect. International Journal of Procurement Management 4, 5 (4), pp.452-469.Anonymous BJNqtknPas encore d'évaluation

- Netflix NotesDocument9 pagesNetflix NotesQ bPas encore d'évaluation

- Small-Scale Enterprise Wholesale Establishments Retail EstablishmentsDocument5 pagesSmall-Scale Enterprise Wholesale Establishments Retail EstablishmentsY D Amon Ganzon100% (1)

- Part 2 Integrative CaseDocument2 pagesPart 2 Integrative Caseebebebyayaya0% (2)

- Cma ArttDocument427 pagesCma ArttMUHAMMAD ALIPas encore d'évaluation

- MBA Project On Fundamental and Technical Analysis of Kotak BankDocument109 pagesMBA Project On Fundamental and Technical Analysis of Kotak BankSneha MaskaraPas encore d'évaluation

- Break EvenDocument21 pagesBreak EvenbrainstormPas encore d'évaluation

- Kimball International case studyDocument4 pagesKimball International case studyVedantBhasinPas encore d'évaluation

- Vera Bradley in 2014Document9 pagesVera Bradley in 2014Adrian BenczePas encore d'évaluation

- Case Study - Project ScorpioDocument18 pagesCase Study - Project ScorpioKarthick SrinivasanPas encore d'évaluation

- CHAPTER 6 - Capital Asset Pricing ModelDocument23 pagesCHAPTER 6 - Capital Asset Pricing Modelemmiliana kasamaPas encore d'évaluation

- Profitability Ratios: Return On Asset (ROA)Document11 pagesProfitability Ratios: Return On Asset (ROA)Saddam Hossain EmonPas encore d'évaluation

- 6 Marlin Pring On Market MomentumDocument1 page6 Marlin Pring On Market MomentumTUAN NGUYỄNPas encore d'évaluation

- Investing in Perak's Manufacturing SectorDocument12 pagesInvesting in Perak's Manufacturing SectorPrasath RajuPas encore d'évaluation

- Describing Statistics in GraphsDocument4 pagesDescribing Statistics in GraphsNurul AuliaPas encore d'évaluation

- 1.3 Interest Rates and Price Volatility (Oct 28) PDFDocument58 pages1.3 Interest Rates and Price Volatility (Oct 28) PDFRedPas encore d'évaluation

- IGNOU Amk 2014Document11 pagesIGNOU Amk 2014Amandeep DahiyaPas encore d'évaluation

- Colgate Palmolive Company: A Quick SWOT AnalysisDocument14 pagesColgate Palmolive Company: A Quick SWOT AnalysisPalak SinghalPas encore d'évaluation

- Globalization, exchange rates, and international credit markets explainedDocument6 pagesGlobalization, exchange rates, and international credit markets explainednoordonPas encore d'évaluation

- FAR23 Employee Benefits - With AnsDocument13 pagesFAR23 Employee Benefits - With AnsAJ Cresmundo100% (1)

- FM Study Notes ZellDocument185 pagesFM Study Notes Zell5561 ROSHAN K PATELPas encore d'évaluation