Académique Documents

Professionnel Documents

Culture Documents

Bloomberg Guide by Topics Getting Started On Bloomberg Bloomberg Keyboard

Transféré par

rini_kTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Bloomberg Guide by Topics Getting Started On Bloomberg Bloomberg Keyboard

Transféré par

rini_kDroits d'auteur :

Formats disponibles

BLOOMBERG GUIDE BY TOPICS GETTING STARTED ON BLOOMBERG BLOOMBERG KEYBOARD Green Action Keys Yellow Functional Buttons FUNCTIONS

TO GET STARTED BU Bloomberg Training Resources EASY Display of Tips EXCH List of all Exchanges Available on Bloomberg N Access to Bloomberg News BBXL Overview of How to Import Bloomberg Data to Excel BLP Bloomberg Launchpad for Setting up Interactive Workstation ECONOMIC AND FINANCIAL MARKET INFORMATION ECO Calendar of Economic Releases WECO World Economic Calendar and Economic Indicators ECST World Economic Statistics, Economic Indicators and Beige Book CBQ Market Summary Benchmark Information FOMC Information on Policy Changes of the FOMC FED Calendar of Federal Reserve Releases ETF Exchange-Traded Funds MACROECONOMIC AND MARKET ANALYSIS ECO Key Indicators and Economic Information from Economic Menu ECST Key Economic Statistics by Country GDP Labor Sales Economic Indicators Housing and Construction Money and Banking Price Indicators Manufacturing and Trade TOP Monitoring Economic News TNI Searching for Economic News WECO Identifying Futures Economic Events CECO Creating a Customized Calendar of Current and Upcoming Economic Events

LAW BLAW Law and Cases 1

FUNCTIONS AND INFORMATION ON THE EQUITY MENU SCREEN BQ Price and Trade Data QRM Bid/Ask Quotes CF Corporate Filings and SEC Filings (EDGAR) MOST Most Active Stocks HILO Stocks, Mutual Funds, ABS, and REITS that have 52-Week High or Low HALT List of Suspended or Halted Stocks by Exchange TOP STK Top Bloomberg News Headline Related to Stocks CACT Displays Calendar of Corporate Actions

FUNCTION FOR STOCK RETURNS AND VARIABILITY GP Price and Volume Graph COMP Compares the Returns of Security with Benchmark Index BETA Beta Calculations HRA Historical Regression HS Historical Spreads HVG Volatility Graph ECCG Credit Company Graph

INDEX BY SECTORS IBQ For industry menu BBNI Industry News Index Menu Index Symbol [INDEX] <enter> Useful Function on Index Menu: RV Relative Value MEMB Index Weightings GWGT Group Weighting MRR Member Returns TECHNICAL FUNCTIONS ON A STOCKS EQUITY MENU Relative Strength Index RSI Moving Averages MACD Overview Chart GOC Bollinger Bands BOLL Money Flow GM Bullish and Bearish Trends CNDL

STOCK PORTFOLIO FUNCTIONSPRTU STEPS FOR CREATING PORTFOLIOS Step 1: PRTU: Create a Portfolio Using PRTU Step 5: Type PMEN to access a menu of functions to apply to the portfolio PORTFOLIO BASKET PBSK Puts the portfolio in a basket, calculates historical return, and allows the portfolio to be treated as an index to be analyzed on the Index menu. CIXB Newer Bloomberg basket function

CORPORATE BOND INFORMATIONTicker [CORP] RATC Search of Credit Rating Changes in the Market ISSD Quick Overview of a Companys Key Ratios DDIS Companys Outstanding Debt NIM Monitoring New Bonds Using Bloombergs SRCH Finds Corporate Bonds Using Bloombergs Search Function TREASURY AND FEDERAL AGENCY INSTRUMENTS [GOVT] BBT Monitors and Compares Prices of Government Security Dealers MUNICIPAL BONDS [MUNI] PICK Finds the Latest Municipal Offering SRC Finds Municipals Using Bloombergs Customized Search INTERMEDIATE SECURITIES Bloombergs Money Market Information [M-MKT] Bloombergs Mortgage Security Information [MRTG] Bloombergs Investment Fund Information [EQUITY] Bloombergs Foreign Bonds and Eurobonds Information by Corporation [CORP] Bloombergs Foreign Government Securities [GOVT]

BOND PRICE AND YIELD INFORMATION Corporate Bonds Price and Yield Ticker [CORP] DES To Obtain Information on the Bonds Coupons, Day-Count Convention, Maturity, and other Features BFV To Analyze where the Bond Should Trade given Comparable Bonds YAS To Determine the Bonds Price, YTM, and Yield to Worst 3

Treasury Securitys Price and Yield [GOVT] DES To Obtain Information on the Bonds Coupons, Day-Count Convention, Maturity, and other Features BFV To Analyze where the Bond Should Trade given Comparable Bonds YAS To Determine the Bonds Price, YTM, and Yield to Worst SRCH To Search for Government Bonds Using Different Criterion BTMM Finds Major Rates and Security Information GGR Finds Global Summary of Government Bill and Bond Rates for Countries FMC Finds Yields Across Maturities of Multiple Corporate and Government Bonds

TOTAL BOND RETURN TRA To Determine a Bonds Total Return

YIELD CURVE INFORMATION YCRV Finds Current and Historical Yield Curves for Government and Corporate Bond Sectors Using YCRV IYC Finds Yield Curves for Different Countries Using IYC FWCV Projects Implied Forward Rates ECONOMIC INFORMATION AND NEWS AFFECTING STRUCTURE OF INTEREST RATES TOP BON Top Bond Information NI FED Federal Reserve Information NI Information on Corporate and Country ratings THE LEVEL AND

DEFAULT RISK RATC and CRPR Evaluates a Corporations Current and Historical Credit Ratings RVM Evaluates a Bonds Spread ISSD Evaluates a Corporations Financial Information

STEPS FOR CREATING FIXED-INCOME PORTFOLIOS Step 1: PRTU: Create a Portfolio Using PRTU: Step 4: Type PMEN to Access a Menu of Functions to Apply to the Portfolio EXPLORING FIXED-INCOME PORFOLIO FUNCTIONS ON THE PMEN SCREEN PDSP Market Value and Price Display PSA Shock analysis on current portfolio given multiple yield curve shifts PSH Proposed Trade and Impact Analysis on Current portfolio KRR Portfolios Distribution by Sector and Maturity 4

ASSET-BACK SECURITY FUNCTIONS CLAS Glossary of CMO Class Types YT Yield Table CFG Cash Flow Graph WALG Weighted Average Life Graph CLC Collateral Composition CPH - Historical Prepayments CLC Collateral Information VALL Display Table of Dealer Prepayment Assumptions PVG Chart of Prepayment Model Available on Bloomberg DV Displays of Prepayment Model Based on Select Scenarios YT Values a Mortgage or Asset-Backed Security Given Different Assumptions

FUTURES CONTRACT INFORMATION CTM Steps for Finding Futures Contract Information CTM Contract Table Menu CT Contract Table FUTURES PRICING AND HEDGING FUNCTIONS FVD Finds the Fair Value and Carrying Cost Value HEDG FindS the Number of Futures Contracts Needed to Hedge a

OPTION INFORMATION OMST Finds the Most Actively Traded Options on a Particular Stock OSA Option Strategy Functions: Generates Profit Tables and Graphs OV Values Options using the Black-Scholes, Binomial, and other Option Pricing Models SKEW Volatility Smiles and Surfaces HVG Historical Volatility Function HIVG Historical Implied Volatilities OV Option Greek: delta, theta, gamma, vega and rho CALL and PUT Finds a Securitys call and put values, implied volatilities, and Greeks COAT AND POAT Option Value Sensitivity Analysis OVX Evaluates Exotic Options CREDIT SWAPS CDSW Credit Default Swap Valuation Calculator ASW Asset Swap Spread and Z-Spread Calculation CDS Evaluates a Default Swap Basket 5

Vous aimerez peut-être aussi

- Bloomberg Cheat SheetsDocument45 pagesBloomberg Cheat Sheetsuser12182192% (12)

- Financial Accounting & Reporting in T24Document31 pagesFinancial Accounting & Reporting in T24Zakaria Almamari100% (3)

- Investment Banking: Valuation, Leveraged Buyouts, and Mergers and AcquisitionsD'EverandInvestment Banking: Valuation, Leveraged Buyouts, and Mergers and AcquisitionsÉvaluation : 5 sur 5 étoiles5/5 (2)

- Mock Exam For CFA Level 1Document70 pagesMock Exam For CFA Level 1christyPas encore d'évaluation

- Bloomberg 53 ConvertiblesDocument1 pageBloomberg 53 ConvertiblesSiddharth JainPas encore d'évaluation

- Financial Management 2E: Rajiv Srivastava - Dr. Anil Misra Solutions To Numerical ProblemsDocument5 pagesFinancial Management 2E: Rajiv Srivastava - Dr. Anil Misra Solutions To Numerical ProblemsAnkit AgarwalPas encore d'évaluation

- Bloomberg Fixed IncomeDocument2 pagesBloomberg Fixed Incomeprachiz1Pas encore d'évaluation

- Guia de Terminologias BloombergDocument5 pagesGuia de Terminologias Bloombergalex GamboaPas encore d'évaluation

- HYDocument2 pagesHYkarasa1Pas encore d'évaluation

- Bloomberg Terminal Commonly Used FunctionsDocument24 pagesBloomberg Terminal Commonly Used FunctionsDarePas encore d'évaluation

- Bloomberg - Investment Banking CheatsheetDocument2 pagesBloomberg - Investment Banking CheatsheetjujonetPas encore d'évaluation

- Money MarketsDocument1 pageMoney Marketskarasa1Pas encore d'évaluation

- Bloomberg Functions Spreadsheet: Strictly ConfidentialDocument13 pagesBloomberg Functions Spreadsheet: Strictly ConfidentialKhau TúPas encore d'évaluation

- List of Business and Finance Abbreviations - WikipediaDocument33 pagesList of Business and Finance Abbreviations - Wikipediakrishan chaturvediPas encore d'évaluation

- Tools For FX Market Cheat SheetDocument2 pagesTools For FX Market Cheat SheetVikram SuranaPas encore d'évaluation

- Professional Services Brochure PDFDocument24 pagesProfessional Services Brochure PDFDahagam SaumithPas encore d'évaluation

- Bloom BergDocument1 pageBloom BergNhat TienPas encore d'évaluation

- Capital Asset Pricing Model (CAPM) - A Case Study: February 2015Document14 pagesCapital Asset Pricing Model (CAPM) - A Case Study: February 2015Rifat HelalPas encore d'évaluation

- Smart Money ConceptDocument5 pagesSmart Money ConceptweeleePas encore d'évaluation

- Hedge FundsDocument1 pageHedge Fundskarasa1Pas encore d'évaluation

- Bloomberg Equity Research and Analysis CheatsheetDocument2 pagesBloomberg Equity Research and Analysis Cheatsheetanshuljain785Pas encore d'évaluation

- Private Equity Cheat Sheet Bloomberg TerminalDocument1 pagePrivate Equity Cheat Sheet Bloomberg TerminalAmuyGnopPas encore d'évaluation

- 04 BDW Physical ModelDocument22 pages04 BDW Physical ModelAshwini PadhyPas encore d'évaluation

- S4 HANA Settlement Management - Condition Contract Configuration GuideDocument34 pagesS4 HANA Settlement Management - Condition Contract Configuration Guideagrawalmayur96Pas encore d'évaluation

- BMC Terminal FunctionsDocument2 pagesBMC Terminal FunctionsRohitGuleriaPas encore d'évaluation

- Bloomberg HelpDocument9 pagesBloomberg HelpRimsha NaeemPas encore d'évaluation

- EQPM and Analyst Cheat SheetDocument2 pagesEQPM and Analyst Cheat SheetPham Chi NhanPas encore d'évaluation

- Equity Cheat Sheet: Press After Each Command To Run The FunctionDocument2 pagesEquity Cheat Sheet: Press After Each Command To Run The FunctionwleongtPas encore d'évaluation

- Investment Banking Cheatsheet Bloomberg TerminalDocument2 pagesInvestment Banking Cheatsheet Bloomberg TerminalAmuyGnop100% (2)

- Bloomberg Fixed IncomeDocument2 pagesBloomberg Fixed IncomeLike CouponsPas encore d'évaluation

- Bloomberg FunctionsDocument1 pageBloomberg FunctionsMatthew McKeanPas encore d'évaluation

- MarkitSERV Preparing For Derivatives Clearing Webinar.10Jun2010Document24 pagesMarkitSERV Preparing For Derivatives Clearing Webinar.10Jun2010senapatiabhijitPas encore d'évaluation

- Executive Officer: News ForecastsDocument2 pagesExecutive Officer: News Forecastskarasa1Pas encore d'évaluation

- Soundview Home Loan Trust 2005 OPT4Document360 pagesSoundview Home Loan Trust 2005 OPT4Helpin HandPas encore d'évaluation

- Bloomberg Quick Codes SheetDocument1 pageBloomberg Quick Codes SheetFabian R. GoldmanPas encore d'évaluation

- PrimeX Marketing PresentationDocument30 pagesPrimeX Marketing PresentationDvNetPas encore d'évaluation

- Bloomberg 2015 Cheat Sheet FinalDocument3 pagesBloomberg 2015 Cheat Sheet FinalNgoc Son PhamPas encore d'évaluation

- Bond MathsDocument157 pagesBond Mathsnitesh chhutaniPas encore d'évaluation

- Useful Bloomberg Functions: News Equity Index OverviewDocument3 pagesUseful Bloomberg Functions: News Equity Index Overviewkarasa1Pas encore d'évaluation

- ISD Library: BloombergDocument7 pagesISD Library: BloombergSavvy KhannaPas encore d'évaluation

- BMC Terminal FunctionsDocument2 pagesBMC Terminal FunctionsYIN RUNFENGPas encore d'évaluation

- Bloomberg FunctionsDocument1 pageBloomberg Functionschandra_kumarbrPas encore d'évaluation

- Module 1 Conceptual Framework - IAS1Document37 pagesModule 1 Conceptual Framework - IAS1SIPHO TIMOTHY NGOVENIPas encore d'évaluation

- BVMF Presentation - Analyst Day SP - August 2013Document37 pagesBVMF Presentation - Analyst Day SP - August 2013BVMF_RIPas encore d'évaluation

- Tablas y Transacciones de SAPDocument8 pagesTablas y Transacciones de SAPMarianoPas encore d'évaluation

- (During Time Period T)Document14 pages(During Time Period T)Patta SunilPas encore d'évaluation

- Analyzing Industry ProspectsDocument24 pagesAnalyzing Industry Prospectsdr.akumar14Pas encore d'évaluation

- 02.using Bloomberg Terminals in A Security Analysis and Portfolio Management CourseDocument7 pages02.using Bloomberg Terminals in A Security Analysis and Portfolio Management Coursendmmdmsmms,s100% (1)

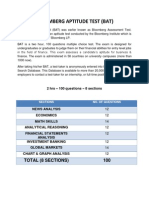

- Bloomberg Aptitude Test (BAT)Document10 pagesBloomberg Aptitude Test (BAT)Shivgan Joshi100% (1)

- GIOA Conference March 23 2016: Core Bloomberg Analytics For Our Current Market EnvironmentDocument37 pagesGIOA Conference March 23 2016: Core Bloomberg Analytics For Our Current Market EnvironmentazertyPas encore d'évaluation

- Capital MarketsDocument696 pagesCapital MarketsSaurabh VermaPas encore d'évaluation

- Fundamental Analysis and Technical Analysis of Unitech PROJECT REPORTDocument81 pagesFundamental Analysis and Technical Analysis of Unitech PROJECT REPORTBabasab Patil (Karrisatte)Pas encore d'évaluation

- Full Forms - AbbreviationsDocument19 pagesFull Forms - AbbreviationsA SinghPas encore d'évaluation

- Security Analysis Syllabus IBSDocument2 pagesSecurity Analysis Syllabus IBSnitin2khPas encore d'évaluation

- Bloomberg Cheat SheetDocument11 pagesBloomberg Cheat SheetKhalilBenlahccen100% (2)

- IFSFM M3 Sem2Document113 pagesIFSFM M3 Sem2navyagoyal23Pas encore d'évaluation

- Preparation of Project ReportDocument26 pagesPreparation of Project ReportJitendra NagwadiaPas encore d'évaluation

- Sony Kabushiki Kaisha: Form 20-FDocument250 pagesSony Kabushiki Kaisha: Form 20-FZarifah AbdullahPas encore d'évaluation

- Reinsurance Carrier Revenues World Summary: Market Values & Financials by CountryD'EverandReinsurance Carrier Revenues World Summary: Market Values & Financials by CountryPas encore d'évaluation

- Modifications + Conversions & Overhaul of Aircraft World Summary: Market Sector Values & Financials by CountryD'EverandModifications + Conversions & Overhaul of Aircraft World Summary: Market Sector Values & Financials by CountryPas encore d'évaluation

- Secondary Market Financing Revenues World Summary: Market Values & Financials by CountryD'EverandSecondary Market Financing Revenues World Summary: Market Values & Financials by CountryPas encore d'évaluation

- Presentation 1Document9 pagesPresentation 1rini_kPas encore d'évaluation

- SupplyDocument7 pagesSupplyjayamsecPas encore d'évaluation

- SupplyDocument7 pagesSupplyjayamsecPas encore d'évaluation

- SupplyDocument7 pagesSupplyjayamsecPas encore d'évaluation

- Higher Algebra - Hall & KnightDocument593 pagesHigher Algebra - Hall & KnightRam Gollamudi100% (2)

- Higher Algebra - Hall & KnightDocument593 pagesHigher Algebra - Hall & KnightRam Gollamudi100% (2)

- Cash Flow Know How - Lindsey JeanDocument40 pagesCash Flow Know How - Lindsey JeanMahid SamadPas encore d'évaluation

- AccountsDocument5 pagesAccountsAlyssa CasimiroPas encore d'évaluation

- Megan Sugar Corporation v. RTCDocument2 pagesMegan Sugar Corporation v. RTCcncrned_ctzen100% (3)

- Analysis On Deposits Schemes of Indusind BankDocument76 pagesAnalysis On Deposits Schemes of Indusind BankKarthik GsPas encore d'évaluation

- Chennammal V1Document19 pagesChennammal V1Aditi Soni100% (1)

- Contract CANS - Winter Final 2016 (V6)Document35 pagesContract CANS - Winter Final 2016 (V6)Sebastian JamesPas encore d'évaluation

- Barclays Municipal Research Detroit - Chapter 9 BeginsDocument22 pagesBarclays Municipal Research Detroit - Chapter 9 Beginsabcabc123123xyzxyxPas encore d'évaluation

- Q2 Summative Test Gen MathDocument4 pagesQ2 Summative Test Gen MathErnie LahaylahayPas encore d'évaluation

- Merchant Banking in IndiaDocument14 pagesMerchant Banking in IndiaMohitraheja007Pas encore d'évaluation

- Obtained A Loan From The Bank For Rs. 50 Lakhs: ST ST STDocument5 pagesObtained A Loan From The Bank For Rs. 50 Lakhs: ST ST STSumal kumarPas encore d'évaluation

- Loan Management of Nepal Bank Limited Full ThesisDocument116 pagesLoan Management of Nepal Bank Limited Full ThesisManjil ShresthaPas encore d'évaluation

- HBL Strategic ManagementDocument34 pagesHBL Strategic ManagementChaudhary Hassan Arain75% (4)

- 1928 Congressional RecordsDocument17 pages1928 Congressional RecordsNomadFamily Shabazz-ElPas encore d'évaluation

- CONCEPT AND ROLE OF BANKING June 22 PDFDocument210 pagesCONCEPT AND ROLE OF BANKING June 22 PDFgizachewnani2011Pas encore d'évaluation

- Obligation Request: Larry CampañaDocument4 pagesObligation Request: Larry CampañaFrancisco Lubas Santillana IVPas encore d'évaluation

- Philippine National Bank, Plaintiff-Appellant, vs. Jose C. ZuluetaDocument46 pagesPhilippine National Bank, Plaintiff-Appellant, vs. Jose C. ZuluetaLavin AguilarPas encore d'évaluation

- Impact of Micro FinanceDocument61 pagesImpact of Micro FinancePerry Arcilla SerapioPas encore d'évaluation

- Busfin 7 Sources and Uses of Short Term and Long Term FundsDocument5 pagesBusfin 7 Sources and Uses of Short Term and Long Term FundsRenz Abad50% (2)

- Deed of Absolute Sale TemplateDocument3 pagesDeed of Absolute Sale TemplateRem SerranoPas encore d'évaluation

- Oblicon ReportDocument2 pagesOblicon ReportRomilyn Gregorio100% (1)

- Cyber Solutions v. Priva Security - 6th Circuit PDFDocument19 pagesCyber Solutions v. Priva Security - 6th Circuit PDFMark JaffePas encore d'évaluation

- CCTV Template Recolha InglesDocument25 pagesCCTV Template Recolha Ingleskhalid.mallick7258Pas encore d'évaluation

- Article1456 HeirsofZoiloEspirituvsSpsMaximoDocument2 pagesArticle1456 HeirsofZoiloEspirituvsSpsMaximoAna leah Orbeta-mamburamPas encore d'évaluation

- Republic Planters Bank v. Court of Appeals 216 SCRA 738 (1992) PDFDocument4 pagesRepublic Planters Bank v. Court of Appeals 216 SCRA 738 (1992) PDFJulie Rose FajardoPas encore d'évaluation

- 2019 CafmoDocument40 pages2019 CafmoAmran AriffPas encore d'évaluation

- Policyloanapplicationform PDFDocument2 pagesPolicyloanapplicationform PDFEdgar Compala100% (1)

- Mercy Muriel MensahDocument92 pagesMercy Muriel MensahMacauley SelormPas encore d'évaluation

- 2016 Notes To Financial StatementsDocument66 pages2016 Notes To Financial StatementsErika Mariz CunananPas encore d'évaluation