Académique Documents

Professionnel Documents

Culture Documents

Chapter One: The Nyse: at The Heart of Global Financial Markets

Transféré par

Kimberly Rojas RojasDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Chapter One: The Nyse: at The Heart of Global Financial Markets

Transféré par

Kimberly Rojas RojasDroits d'auteur :

Formats disponibles

46.

45

3

23.55

81.03

95.73

The financial markets are an important part of our daily

lives. Making sure we are financially secure is a vital part of

how our economy grows. And investing in securities is

often a significant component of an investors portfolio.

Owning stock means you own a slice of a public company.

These companies span the global economy and form the

core of our private enterprise system. They spur job cre-

ation and economic growth while creating products and

providing services that improve our quality of life.

When a company needs to raise money to expand, it sells

stocks or bonds to the public through the financial markets.

Individuals become investors in this company by purchas-

ing those securities.

More than 90 million Americans own shares of stock

through individual investments or through mutual funds.

And many more participate in the stock market through the

investments of retirement funds, insurance companies, uni-

versities and banks. Owning stock allows investors, large and

small, to share in the worlds economic growth and vitality.

Central to this activity is the NYSE marketplace, where bil-

lions of dollars worth of stock change hands each day. Only

the highest quality companies can choose to list their secu-

rities on the NYSE. And once they do, the NYSE plays a

unique role in providing deep and liquid markets for the

trading of those securities, benefiting all investors, large

and small.

The NYSE has come a long way since 1792, when 24 bro-

kers and merchants signed the historic Buttonwood

Agreement to trade a handful of securities on New Yorks

Wall Street. In the more than two centuries that have fol-

lowed, the New York Stock Exchange has continued to

adapt and evolve into the worlds largest global equities

marketplace. The NYSE has remained unwavering in its

commitment to customers and to building a truly global

marketplace with great breadth of product and geographic

reach. Its mission is to add value to the capital-raising and

asset-management process by providing the highest-quali-

cu.v 1 v v oxv

THE NYSE:

AT THE HEART

OF GLOBAL

FINANCIAL

MARKETS

The signing of the Buttonwood Agreement in 1792

2.79

101.99

22.73

35.86

15.96

ty and most cost-effective marketplace for the trading of

financial instruments, to promote confidence in and under-

standing of that process, and to serve as a forum for discussion

of relevant national and international policy issues.

The NYSE is one of two U.S. securities exchanges the NYSE

Group Inc. operates:

The NYSE is the worlds largest and most liquid cash

equities exchange. The NYSE provides a reliable,

orderly, liquid and efficient marketplace where

investors buy and sell listed companies common stock

and other securities. On June 30, 2006, the NYSEs

more than 2,600 listed operating companiessome

450 of which are from outside the U.S.represent a

total global market capitalization of over $22.6 trillion.

In the second-quarter 2006, on an average trading day,

almost 1.8 billion shares, valued at over $68.5 billion,

were traded on the NYSE.

NYSE Arca

SM

operates the first open, all-electronic

stock exchange in the United States and has a leading

position in trading exchange-traded funds and

exchange-listed securities. NYSE Arca is also an

exchange for trading equity options. NYSE Arcas trad-

ing platform provides customers with fast electronic

execution and open, direct and anonymous market

access. Through NYSE Arca, customers can trade some

8,000 equity securities and more than 175,000 option

products. On average, about 700 million shares, valued

at more than $25 billion, are traded through NYSE

Arca each day.

NYSE Group pursues listings from all over the world, and the

two markets, with their different criteria for listings, allow the

Group to attract a wide range of companies. To be considered

for an NYSE listing, companies must meet strict financial and

regulatory criteria. (Companies that today cannot meet the

financial listing standards of the NYSE can choose to list with

NYSE Arca and begin on a track toward an NYSE listing.)

Companies list as initial public offerings (IPOs), as transfers

from other markets or as non-U.S. companies cross-listing at

exchanges worldwide.

The NYSE: At the Heart of Global Financial Markets

Listed companies pay both initial listing fees and annual fees.

In return, their stock is bought and sold on the NYSE or

NYSE Arca, following rules set by the Securities and Exchange

Commission (SEC), a U.S. federal government agency, and

NYSE Regulation Inc.

SM

, the independent NYSE Group sub-

sidiary that regulates the NYSE and NYSE Arca markets.

This publication focuses on the NYSE, the worlds premier

equities marketplace. In addition to having the highest over-

all listing standards of any securities marketplace in the

world, the NYSE is among the worlds most well-recognized

brand names. For 214 years, the NYSE has facilitated nation-

al and global capital formation and symbolized the strength

and vitality of the U.S. securities markets. Issuers that list with

the NYSE benefit from association with this brand name

while gaining access to the worlds largest, most liquid market

for the trading of their securities.

When companies first list on the NYSE, the companys top

officials are often invited to ring The Opening Bell

SM

on the

NYSE Trading Floor. Ringing the Bell, which signals the start

and close of the trading day, is part of the NYSEs rich heritage

and signifies the opportunities the financial markets provide.

The trading day

starts and ends

with the ringing

of the bell.

The NYSE: At the Heart of Global Financial Markets

46.45

3

23.55

81.03

95.73

Vous aimerez peut-être aussi

- A Guide To The Nyse MarketplaceDocument36 pagesA Guide To The Nyse MarketplaceHome ParkPas encore d'évaluation

- (J.Ganesh and Ankit Mour Sec-F GRP-B) POTENTIAL OF INDIAN STOCK MARKET TO BE ON THE TOP AMONG THE GLOBAL STOCK MARKETDocument23 pages(J.Ganesh and Ankit Mour Sec-F GRP-B) POTENTIAL OF INDIAN STOCK MARKET TO BE ON THE TOP AMONG THE GLOBAL STOCK MARKETAnkit MourPas encore d'évaluation

- Largest Stock: Exchange of The WorldDocument9 pagesLargest Stock: Exchange of The WorldgreenPas encore d'évaluation

- Stock Exchanges Around The World (2003, 4 Oldal)Document4 pagesStock Exchanges Around The World (2003, 4 Oldal)121CreativeCatPas encore d'évaluation

- What Is Stock Market (1) Yy6Document17 pagesWhat Is Stock Market (1) Yy6Waseel sultanPas encore d'évaluation

- Faiza Ibraahim Mohamed Final AssignmentDocument18 pagesFaiza Ibraahim Mohamed Final AssignmentAbdinasir abdullahi AbdiPas encore d'évaluation

- Final Ibm Project.......Document13 pagesFinal Ibm Project.......maryam azharPas encore d'évaluation

- Stock Market How It WorksDocument3 pagesStock Market How It WorksMeghananda s oPas encore d'évaluation

- The Stock Market Business and Accounting ProjectDocument11 pagesThe Stock Market Business and Accounting Projectaysilislam528Pas encore d'évaluation

- The Domestic and International Financial MarketplaceDocument56 pagesThe Domestic and International Financial MarketplaceMillyPas encore d'évaluation

- NYSEDocument184 pagesNYSEZaher HossainPas encore d'évaluation

- Equity SecuritiesDocument2 pagesEquity SecuritiesCharlemagne MuguerzaPas encore d'évaluation

- Equity Market Definition of 'Equity Market': Stocks Shares Securities Stock ExchangeDocument15 pagesEquity Market Definition of 'Equity Market': Stocks Shares Securities Stock ExchangeYogesh DevmorePas encore d'évaluation

- Financial Markets: FIN 3600: Chapter 5 Timothy R. Mayes, PH.DDocument40 pagesFinancial Markets: FIN 3600: Chapter 5 Timothy R. Mayes, PH.DStephen MagudhaPas encore d'évaluation

- Investment Analysis & Portfolio Management: Term Paper On International Stock ExchangeDocument18 pagesInvestment Analysis & Portfolio Management: Term Paper On International Stock ExchangeAashutosh ChandraPas encore d'évaluation

- Financial Systems and Service CIA - Component 1Document18 pagesFinancial Systems and Service CIA - Component 1SIRISHA N 2010285Pas encore d'évaluation

- Hanna Hussan 1bbads Cia1 IfsDocument16 pagesHanna Hussan 1bbads Cia1 Ifslakshya lashkariPas encore d'évaluation

- Moshahid ProjectDocument51 pagesMoshahid ProjectMoshahid HussainPas encore d'évaluation

- What Is NYSEDocument2 pagesWhat Is NYSElizan13Pas encore d'évaluation

- Introduction To Stock MarketDocument3 pagesIntroduction To Stock MarketOm AgrawalPas encore d'évaluation

- 6) NyseDocument9 pages6) NyseCesar FarfanPas encore d'évaluation

- Forecasting Using ANN'sDocument60 pagesForecasting Using ANN'sAndaleeb MudasiraPas encore d'évaluation

- Stock Market History in World and in IndiaDocument6 pagesStock Market History in World and in IndiaBhagyesh ThakurPas encore d'évaluation

- History & Processes of The Stock Market: Research StartersDocument7 pagesHistory & Processes of The Stock Market: Research StartersHemanthkumarKatreddyPas encore d'évaluation

- Essay On The New York Stock ExchangeDocument1 pageEssay On The New York Stock ExchangeMahadev Techno WorldPas encore d'évaluation

- NasdaqDocument71 pagesNasdaqAlexis Gonzalez Perez100% (2)

- Full ProjectDocument151 pagesFull ProjectShrivatsa JoshiPas encore d'évaluation

- ProjectDocument14 pagesProjectayten.ayman.elerakyPas encore d'évaluation

- Ramirez, Christine Marie T. - Financial MarketsDocument5 pagesRamirez, Christine Marie T. - Financial MarketsChristine Marie T. RamirezPas encore d'évaluation

- Portfolio ManagementDocument81 pagesPortfolio ManagementPrakash ReddyPas encore d'évaluation

- Stock MarketDocument19 pagesStock MarketNandhini EkambaramPas encore d'évaluation

- Financial Domain QuestionsDocument14 pagesFinancial Domain QuestionsNikhil SatavPas encore d'évaluation

- FINMA 2105 - Chapter 2Document13 pagesFINMA 2105 - Chapter 2John Lloyd Gonzales AlvarezPas encore d'évaluation

- NYSEDocument7 pagesNYSEJitender Thakur50% (2)

- Investment and Portfolio Chapter 2Document32 pagesInvestment and Portfolio Chapter 2MarjonPas encore d'évaluation

- What Is A Stock ExchangeDocument7 pagesWhat Is A Stock ExchangeFaizan ChPas encore d'évaluation

- Ifim Units 3&4Document19 pagesIfim Units 3&4kushalPas encore d'évaluation

- What Is Stock Exchanges?Document5 pagesWhat Is Stock Exchanges?Jeremy MarinayPas encore d'évaluation

- Financial Markets: IndicesDocument6 pagesFinancial Markets: IndicesjoysenguptaPas encore d'évaluation

- Financial Market SEM-3Document5 pagesFinancial Market SEM-3naomiPas encore d'évaluation

- Research Methodology.Document19 pagesResearch Methodology.VencyPas encore d'évaluation

- Financial Markets: Kashis Chakma ID-20IUT0360029Document23 pagesFinancial Markets: Kashis Chakma ID-20IUT0360029Ak LelouchKaiPas encore d'évaluation

- Financial Market SummaryDocument21 pagesFinancial Market SummaryJorufel Tomo PapasinPas encore d'évaluation

- A Guide To The Financial Markets For Architects, Engineers and SurveyorsDocument48 pagesA Guide To The Financial Markets For Architects, Engineers and SurveyorsHaydee ContrerasPas encore d'évaluation

- Nasdaq Vs NyseDocument10 pagesNasdaq Vs NyseribhiPas encore d'évaluation

- Global Finance and Electronic BankingDocument16 pagesGlobal Finance and Electronic BankingKrishaPas encore d'évaluation

- FM 02 - Mfis NotesDocument7 pagesFM 02 - Mfis NotesCorey PagePas encore d'évaluation

- What Is Stock MarketDocument47 pagesWhat Is Stock MarketSwadesh Kumar BhardwajPas encore d'évaluation

- Stock MarketDocument2 pagesStock MarketMONIKA KUMARPas encore d'évaluation

- Chapter 1Document12 pagesChapter 1bazinga83Pas encore d'évaluation

- Global Equity Market - Group 1 (IB)Document13 pagesGlobal Equity Market - Group 1 (IB)Heena SharmaPas encore d'évaluation

- Stock MarketDocument24 pagesStock MarketRig Ved100% (2)

- Stock Market in India and Its Regulation: ProjectDocument17 pagesStock Market in India and Its Regulation: ProjectvanshikaPas encore d'évaluation

- Functions of Stock ExchangeDocument3 pagesFunctions of Stock ExchangeayishaPas encore d'évaluation

- Key Takeaways: Understanding The Financial MarketsDocument4 pagesKey Takeaways: Understanding The Financial MarketsAk LelouchKaiPas encore d'évaluation

- How The Market Really WorksDocument81 pagesHow The Market Really WorksSana Agarwal100% (11)

- Risk Management Project - Risk Analysis of StocksDocument33 pagesRisk Management Project - Risk Analysis of StocksPrajwal Vemala JagadeeshwaraPas encore d'évaluation

- Introduction To Financial MarketsDocument7 pagesIntroduction To Financial MarketsMuhammad Azhar SaleemPas encore d'évaluation

- WD-40 Company Valuation - Final3Document36 pagesWD-40 Company Valuation - Final3Logan DoughertyPas encore d'évaluation

- Joint Stock CompanyDocument10 pagesJoint Stock CompanyrohitPas encore d'évaluation

- Combined TTLS Retail Merchandising IIDocument137 pagesCombined TTLS Retail Merchandising IIinzmam100% (1)

- Stock V NSDocument2 pagesStock V NSMervic Al Tuble-NialaPas encore d'évaluation

- Equity Securities MarketDocument23 pagesEquity Securities MarketILOVE MATURED FANSPas encore d'évaluation

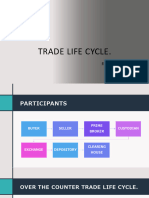

- OTC Trade Life Cycle 1687706562Document9 pagesOTC Trade Life Cycle 1687706562Mandar mahadikPas encore d'évaluation

- Matling Industrial and Commercial Corporation Vs Coros Facts: RulingDocument4 pagesMatling Industrial and Commercial Corporation Vs Coros Facts: RulingLara DellePas encore d'évaluation

- Lesson 15 The Stock Market 15.1. Warm-Up QuestionsDocument1 pageLesson 15 The Stock Market 15.1. Warm-Up QuestionsÖmer Faruk EserPas encore d'évaluation

- Electrosteel Steels Limited - Annual Report 2018-19Document88 pagesElectrosteel Steels Limited - Annual Report 2018-19dilip kumarPas encore d'évaluation

- How I Helped To Make Fischer Black Wealthier 1996Document5 pagesHow I Helped To Make Fischer Black Wealthier 1996JTPas encore d'évaluation

- 2022Q3 Alphabet Earnings ReleaseDocument9 pages2022Q3 Alphabet Earnings ReleaseAdam BookerPas encore d'évaluation

- Futures and Options Segment Circular No. 064: Date: Jul 9, 2010 Download No: 15173Document8 pagesFutures and Options Segment Circular No. 064: Date: Jul 9, 2010 Download No: 15173ShreyanPas encore d'évaluation

- Capital MarketDocument125 pagesCapital MarketForam ChhedaPas encore d'évaluation

- Raising Seed Capital: Steve Schlafman (@schlaf) RRE VenturesDocument82 pagesRaising Seed Capital: Steve Schlafman (@schlaf) RRE Venturesrezurekt100% (2)

- Waruingi - A Survey of Behavioral Factors Influencing Individual Investors Choices of Securities at The Nairobi Securities ExchangeDocument82 pagesWaruingi - A Survey of Behavioral Factors Influencing Individual Investors Choices of Securities at The Nairobi Securities ExchangeAmarbayasgalan GanochirPas encore d'évaluation

- Final PDocument72 pagesFinal PPriyanka balayaPas encore d'évaluation

- General Mathematics: LAS, Week 5 - Quarter 2Document16 pagesGeneral Mathematics: LAS, Week 5 - Quarter 2Prince Joshua SumagitPas encore d'évaluation

- Kakariki IM For Distribution 27 May 19Document122 pagesKakariki IM For Distribution 27 May 19Njatha Jack IrednPas encore d'évaluation

- Financial ManagementDocument46 pagesFinancial ManagementChirag VoraPas encore d'évaluation

- Fin ManDocument3 pagesFin ManDonna Mae HernandezPas encore d'évaluation

- 6 Strategic Alliance Development Corp. v. Star20170703-911-7630soDocument8 pages6 Strategic Alliance Development Corp. v. Star20170703-911-7630sodenbar15Pas encore d'évaluation

- Upa v. RupaDocument36 pagesUpa v. Rupaapi-9512659Pas encore d'évaluation

- MAS Answer KeyDocument25 pagesMAS Answer KeyAbigail PadillaPas encore d'évaluation

- Tugas FM FuzzyTronicDocument7 pagesTugas FM FuzzyTronicAnggit Tut PinilihPas encore d'évaluation

- Part Two Chapter 2 - Risk and ReturnDocument26 pagesPart Two Chapter 2 - Risk and ReturnbubuhomePas encore d'évaluation

- NLP in Stock Price AnalysisDocument12 pagesNLP in Stock Price AnalysisJyothi BurlaPas encore d'évaluation

- Dokumen - Tips Chap10-1 PDFDocument49 pagesDokumen - Tips Chap10-1 PDFdiahPas encore d'évaluation

- Individual Risk Return ExerciseDocument2 pagesIndividual Risk Return ExerciseAbirMdZaberTauhidPas encore d'évaluation

- ACD 223 - Company Accounting - Full CourseDocument96 pagesACD 223 - Company Accounting - Full CourseAHMED ABDALLAHPas encore d'évaluation

- 10 1016@j Iedeen 2020 08 002Document10 pages10 1016@j Iedeen 2020 08 002HgoglezPas encore d'évaluation