Académique Documents

Professionnel Documents

Culture Documents

Butler Lumber Case Solution

Transféré par

Pierre HeneineTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Butler Lumber Case Solution

Transféré par

Pierre HeneineDroits d'auteur :

Formats disponibles

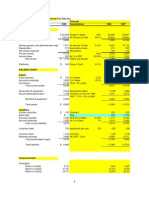

Butler Lumber Company Balance Sheet Dec.

1988 ASSETS Cash Accounts receivable, net Inventory CURRENT ASSETS Property, net TOTAL ASSETS LIABILITIES AND NET WORTH Notes payable, bank Notes payable, Mr. Stark Notes payable, trade Accounts payable Accrued expenses Long-term debt, current portion CURRENT LIABILITIES Long-term debt TOTAL LIABILITIES Net worth TOTAL LIABILITIES AND NET WORTH Income Statement Sales Cost of goods sold Beginning inventory Purchases Ending inventory Total cost of goods sold Gross profit Operating expenses Operating income Plus: Purchase discount Less: Interest expense Net income before taxes Provision for income taxes Net income 1697 183 1278 1461 239 1222 475 425 50 13 37 6 31 2013 239 1524 1763 326 1437 576 515 61 20 41 7 34 2694 326 2042 2368 418 1950 744 658 86 33 53 9 44 3600 146 105 124 24 7 260 64 324 270 594 192 30 7 375 57 432 304 736 256 39 7 535 50 585 348 933 10.00 1% 233 58 171 239 468 126 594 Dec. 1989 48 222 326 596 140 736 Dec. 1990 Assumptions 41 317 418 776 157 933 1.52% 12% 16% 6%

76%

72% 24% 2% 10.50%

a/ Purchases/sales Purchases 1991 - Q1 of 1991 Provision for income taxes

Average 75% 2062 15% 0 to 50000 25% 50000 to 75000 35% 75000 + 641 81 76% 76% 76%

Assets - Liabilties (without the Bank note) - Net worth Net Income

Projected Dec. 1991 54.79 424 559 1037 210 1247

641

0 Assumption 0 Assumption 75 52 7 775 43 818 429 1247

3600 418 2722 3140 559 2606 994 879 115 41 52 105 24 81

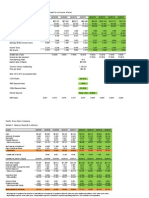

Butler Lumber Company Balance Sheet Funds Flow between 1988 and 1990 ASSETS Cash Accounts receivable, net Inventory CURRENT ASSETS Property, net TOTAL ASSETS LIABILITIES AND NET WORTH Notes payable, bank Notes payable, Mr. Stark Notes payable, trade Accounts payable Accrued expenses Long-term debt, current portion CURRENT LIABILITIES Long-term debt TOTAL LIABILITIES Net worth TOTAL LIABILITIES AND NET WORTH -17 146 179 308 31 339

233 -105 0 132 15 0 275 -14 261 78 339

Funds Flow Statement APPLICATIONS Increase in Accounts Receivables Increase in Inv. Increase in Property Notes payable, Mr. Starck Decrease in LT debt TOTAL APPLICATIONS SOURCES Decrease in Cash Notes payable, bank Increase in Accounts payable Increase in Accrued Expenses Increase in Net worth TOTAL SOURCES

146 179 31 105 14 475

17 233 132 15 78 475

Vous aimerez peut-être aussi

- Butler Lumber SuggestionsDocument2 pagesButler Lumber Suggestionsmannu.abhimanyu3098Pas encore d'évaluation

- Historical Financials and Analysis for Tire CityDocument2 pagesHistorical Financials and Analysis for Tire Cityadityaintouch60% (5)

- TCI's Financial Performance and Forecasts 1993-1997Document8 pagesTCI's Financial Performance and Forecasts 1993-1997Kyeli TanPas encore d'évaluation

- Play Time Toy Company Financial AnalysisFebMarAprMayJunJulAugSepOctNovDecTotal10812614512512512514514581655192520571006900070.3782.1094.4881.4581.4581.4594.48950.031,078.401,254.331,340.34Document16 pagesPlay Time Toy Company Financial AnalysisFebMarAprMayJunJulAugSepOctNovDecTotal10812614512512512514514581655192520571006900070.3782.1094.4881.4581.4581.4594.48950.031,078.401,254.331,340.34Brian Balagot100% (3)

- Tire City Spreadsheet SolutionDocument6 pagesTire City Spreadsheet Solutionalmasy99100% (1)

- Paper 2 Study MaterialDocument328 pagesPaper 2 Study MaterialGF BF100% (1)

- Tire - City AnalysisDocument17 pagesTire - City AnalysisJustin HoPas encore d'évaluation

- Case Analysis Toy WorldDocument11 pagesCase Analysis Toy WorldNiketa Jaiswal100% (1)

- Play Time Toy Financial AnalysisDocument4 pagesPlay Time Toy Financial AnalysischungdebyPas encore d'évaluation

- Assignment 7 - Clarkson LumberDocument5 pagesAssignment 7 - Clarkson Lumbertesttest1Pas encore d'évaluation

- Case of Joneja Bright Steels: The Cash Discount DecisionDocument10 pagesCase of Joneja Bright Steels: The Cash Discount DecisionRHEAPas encore d'évaluation

- CA Excel .Problem - Set A.BDocument65 pagesCA Excel .Problem - Set A.BStephen McSweeneyPas encore d'évaluation

- Tire City CaseDocument12 pagesTire City CaseAngela ThorntonPas encore d'évaluation

- Condensed Financial Statements and Sales DataDocument23 pagesCondensed Financial Statements and Sales DataArjun Jayaprakash Thirukonda80% (5)

- Urban Water PartnersDocument2 pagesUrban Water Partnersutskjdfsjkghfndbhdfn100% (2)

- Butler Lumber Company Funding AnalysisDocument2 pagesButler Lumber Company Funding AnalysisDucPas encore d'évaluation

- Tire City Spreadsheet SolutionDocument7 pagesTire City Spreadsheet SolutionSyed Ali MurtuzaPas encore d'évaluation

- Preparing simple consolidated financialsDocument10 pagesPreparing simple consolidated financialstapia4yeabuPas encore d'évaluation

- Finance Tata Chemicals LTDDocument5 pagesFinance Tata Chemicals LTDzombeeeePas encore d'évaluation

- Butler Lumber Company Financial ProjectionsDocument8 pagesButler Lumber Company Financial ProjectionsHadi KhawajaPas encore d'évaluation

- Butler Lumber 1Document6 pagesButler Lumber 1Bhavna Singh33% (3)

- Case 4 - Tire CityDocument4 pagesCase 4 - Tire Cityfriendsaks100% (1)

- Butler Lumber CompanyDocument8 pagesButler Lumber CompanyAnmol ChopraPas encore d'évaluation

- Case - Polar SportsDocument12 pagesCase - Polar SportsSagar SrivastavaPas encore d'évaluation

- Clarkson Lumber Financial AnalysisDocument7 pagesClarkson Lumber Financial AnalysisSharon RasheedPas encore d'évaluation

- PLAY TIME TOY COMPANY CASH BUDGET AND INVENTORY SCHEDULEDocument15 pagesPLAY TIME TOY COMPANY CASH BUDGET AND INVENTORY SCHEDULEjtang512100% (3)

- Tire City AssignmentDocument7 pagesTire City AssignmentShivam Kanojia100% (1)

- Butler Excel Sheets (Group 2)Document11 pagesButler Excel Sheets (Group 2)Nathan ClarkinPas encore d'évaluation

- Butler Lumber - Pro Forma - Balance and Income StatementDocument4 pagesButler Lumber - Pro Forma - Balance and Income StatementJack Benjamin83% (6)

- Play Time Toys. Supplement 1 (To Do) Pro Forma Income Statements Under Level Production (1991)Document12 pagesPlay Time Toys. Supplement 1 (To Do) Pro Forma Income Statements Under Level Production (1991)cpsharma15Pas encore d'évaluation

- Butler Lumber CaseDocument4 pagesButler Lumber CaseLovin SeePas encore d'évaluation

- Exhibit No.1 Toy World, Inc.'s Pro-Forma Balance Sheet Under Level Production, 1994 (Thousands of Dollars)Document5 pagesExhibit No.1 Toy World, Inc.'s Pro-Forma Balance Sheet Under Level Production, 1994 (Thousands of Dollars)Rohit Jhawar100% (2)

- Budgetary Planning: Learning ObjectivesDocument75 pagesBudgetary Planning: Learning ObjectivesRomuell Banares100% (1)

- Glaxo ItaliaDocument11 pagesGlaxo ItaliaLizeth RamirezPas encore d'évaluation

- Polar Sports, Inc SpreadsheetDocument19 pagesPolar Sports, Inc Spreadsheetjordanstack100% (3)

- (S3) Butler Lumber - EnGDocument11 pages(S3) Butler Lumber - EnGdavidinmexicoPas encore d'évaluation

- Butler Lumber Company Financials 1988-1991Document7 pagesButler Lumber Company Financials 1988-1991Sam Rosenbaum100% (1)

- Butler Lumber Company Case Analysis: Assessing Financial Strategy and Expansion NeedsDocument2 pagesButler Lumber Company Case Analysis: Assessing Financial Strategy and Expansion NeedsJem JemPas encore d'évaluation

- A1.2 Roic TreeDocument9 pagesA1.2 Roic TreemonemPas encore d'évaluation

- Tire City AnalysisDocument3 pagesTire City AnalysisKailash HegdePas encore d'évaluation

- Toy World CaseDocument9 pagesToy World Casedwchief100% (1)

- Ch14 P13 ModelDocument6 pagesCh14 P13 ModelJusto Valverde0% (4)

- Investment Analysis - Polar Sports (A)Document9 pagesInvestment Analysis - Polar Sports (A)pratyush parmar100% (13)

- New Heritage Doll Company Capital Budgeting Teaching Note NPV AnalysesDocument5 pagesNew Heritage Doll Company Capital Budgeting Teaching Note NPV AnalysesShivam Goyal71% (24)

- Estimating Funds Requirements Butler Lumber CompanyDocument18 pagesEstimating Funds Requirements Butler Lumber CompanyNabab Shirajuddoula71% (7)

- Pacific Grove Spice Company Case Write UpDocument3 pagesPacific Grove Spice Company Case Write UpVaishnavi Gnanasekaran100% (4)

- Quiz and Major Exam Accounting For Special Transactions 1Document38 pagesQuiz and Major Exam Accounting For Special Transactions 1CmPas encore d'évaluation

- John M CaseDocument6 pagesJohn M CaseSwapnil JainPas encore d'évaluation

- Gilbert Lumber LC ExcelDocument3 pagesGilbert Lumber LC ExcelEvelyn De de Leon100% (3)

- Butler Lumber Case SolutionDocument4 pagesButler Lumber Case SolutionCharlenePas encore d'évaluation

- Butler Lumber CaseDocument14 pagesButler Lumber CaseSamarth Mewada83% (6)

- Financial Management IIDocument3 pagesFinancial Management IIjakartiPas encore d'évaluation

- Income Statement and Balance Sheet Analysis 1988-1991Document1 pageIncome Statement and Balance Sheet Analysis 1988-1991arnab.for.ever9439100% (1)

- Pacific Grove Spice CompanyDocument7 pagesPacific Grove Spice CompanySajjad Ahmad100% (1)

- Clarkson Lumber Company (7.0)Document17 pagesClarkson Lumber Company (7.0)Hassan Mohiuddin100% (1)

- PGSC Debt obj. income statement ratios 2006-2010Document68 pagesPGSC Debt obj. income statement ratios 2006-2010Jose Luis ContrerasPas encore d'évaluation

- Tire City IncDocument12 pagesTire City Incdownloadsking100% (1)

- Toy World Inc. Financial AnalysisDocument10 pagesToy World Inc. Financial AnalysisHàMềm100% (1)

- Polar SportsDocument7 pagesPolar SportsShah HussainPas encore d'évaluation

- 2009 Notes Amount (In Millions) : Current Tax Deffered TaxDocument29 pages2009 Notes Amount (In Millions) : Current Tax Deffered TaxKushal TodiPas encore d'évaluation

- Chapter 4Document5 pagesChapter 4Kamarulnizam ZainalPas encore d'évaluation

- ProfitDocument1 pageProfitSathyaraj MathivananPas encore d'évaluation

- TB 2 Dan TB 1Document6 pagesTB 2 Dan TB 1Andita Arum CintyawatiPas encore d'évaluation

- Excel Solutions To CasesDocument38 pagesExcel Solutions To CaseselizabethanhdoPas encore d'évaluation

- CartwrightDocument4 pagesCartwrightno_one1410Pas encore d'évaluation

- Page 32 - P&L AnnexureDocument1 pagePage 32 - P&L AnnexureKelly GandhiPas encore d'évaluation

- Total Application of Funds Fixed Assets Fixed AssetsDocument14 pagesTotal Application of Funds Fixed Assets Fixed AssetsSam TyagiPas encore d'évaluation

- Financial Management AssignmentsDocument7 pagesFinancial Management AssignmentsPrachi Bajaj100% (1)

- FSAI EXAM2 Solutions Fraser 10thDocument14 pagesFSAI EXAM2 Solutions Fraser 10thGlaiza Dalayoan Flores0% (1)

- Transactions For The Month of June WereDocument3 pagesTransactions For The Month of June WereErica Mae GuzmanPas encore d'évaluation

- Capital Structure + International WACCDocument34 pagesCapital Structure + International WACCSiobhainPas encore d'évaluation

- Latihan AKL 2 Alice Nadine 35160267Document4 pagesLatihan AKL 2 Alice Nadine 35160267ALICE NADINE KURNIA SURYAPas encore d'évaluation

- Questions and AnswersDocument28 pagesQuestions and AnswersSamuel LeitaoPas encore d'évaluation

- MergerDocument38 pagesMergerJatin PandePas encore d'évaluation

- Cfas ReviewerDocument10 pagesCfas ReviewerMarian grace DivinoPas encore d'évaluation

- Module A (June 2013) - AnswerDocument16 pagesModule A (June 2013) - Answer徐滢Pas encore d'évaluation

- Tutorial 6Document26 pagesTutorial 6Mya Hmuu KhinPas encore d'évaluation

- CH 10Document74 pagesCH 10Satria WijayaPas encore d'évaluation

- Teaching Introduction To Managerial Accounting Using An Excel Spreadsheet ExampleDocument16 pagesTeaching Introduction To Managerial Accounting Using An Excel Spreadsheet Examplesamuel kebedePas encore d'évaluation

- Week 12 Cost Volume Profit Analysis RevDocument47 pagesWeek 12 Cost Volume Profit Analysis RevMefilzahalwa AlyayouwanPas encore d'évaluation

- Finance Interview QuestionsDocument40 pagesFinance Interview QuestionsOmkar JangamPas encore d'évaluation

- Understanding Long-Lived AssetsDocument14 pagesUnderstanding Long-Lived AssetsmostakPas encore d'évaluation

- Accounts Receivable Classification and MeasurementDocument12 pagesAccounts Receivable Classification and MeasurementPrincess Darlyn AlimagnoPas encore d'évaluation

- Accounting concepts, principles and policies explainedDocument12 pagesAccounting concepts, principles and policies explainedNicole TaboralouisPas encore d'évaluation

- Fundamentals of Accounting 2 - PrefinalsDocument3 pagesFundamentals of Accounting 2 - PrefinalsCary JaucianPas encore d'évaluation

- 0976 Module 10 RossFCF9ce SM Ch10 FINALDocument21 pages0976 Module 10 RossFCF9ce SM Ch10 FINALYuk SimPas encore d'évaluation

- RHB Report SCB Final A 40766288941930055cca58db36969Document54 pagesRHB Report SCB Final A 40766288941930055cca58db36969sinyc760% (1)

- Adjusting The Accounts: Learning ObjectivesDocument83 pagesAdjusting The Accounts: Learning Objectivesorstyd100% (1)

- 001 Unit Three Intangible Assets 2020Document11 pages001 Unit Three Intangible Assets 2020scoormcxPas encore d'évaluation

- FinMan Assign. No. 3 - ToyWorldDocument6 pagesFinMan Assign. No. 3 - ToyWorldKristine Nitzkie SalazarPas encore d'évaluation