Académique Documents

Professionnel Documents

Culture Documents

Teofisto Guingona Case

Transféré par

Dave Lumasag CanumhayCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Teofisto Guingona Case

Transféré par

Dave Lumasag CanumhayDroits d'auteur :

Formats disponibles

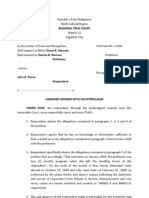

TEOFISTO GUINGONA, JR., ANTONIO I. MARTIN, and TERESITA SANTOS vs. THE CITY FISCAL OF MANILA, HON.

JOSE B. FLAMINIANO, ASST. CITY FISCAL FELIZARDO N. LOTA and CLEMENT DAVID FACTS: From March 1979 to March 1981, Clement David made several investments with the National Savings and Loan Association. On March 21, 1981, the bank was placed under receivership by the Bangko Sentral. Upon Davids request, petitioners Guingona and Martin issued a joint promissory note, absorbing the obligations of the bank. On July 17, 1981, they divided the indebtedness. David filed a complaint for estafa and violation of Central Bank Circular No. 364 and related regulations regarding foreign exchange transactions before the Office of the City Fiscal of Manila. Petitioners filed the herein petition for prohibition and injunction with a prayer for immediate issuance of restraining order and/or writ of preliminary injunction to enjoin the public respondents to proceed with the preliminary investigation on the ground that the petitioners obligation is civil in nature. ISSUE: 1. Whether the contract between NSLA and David is a contract of depositor a contract of loan, which answer determines whether the City Fiscal has the jurisdiction to file a case for estafa. 2. Whether there was a violation of Central Bank Circular No. 364. RULING: 1. When private respondent David invested his money on nine. and savings deposits with the aforesaid bank, the contract that was perfected was a contract of simple loan or mutuum and not a contract of deposit. Hence, the relationship between the private respondent and the Nation Savings and Loan Association is that of creditor and debtor; consequently, the ownership of the amount deposited was transmitted to the Bank upon the perfection of the contract and it can make use of the amount deposited for its banking operations, such as to pay interests on deposits and to pay withdrawals. While the Bank has the obligation to return the amount deposited, it has, however, no obligation to return or deliver the same money that was deposited. And, the failure of the Bank to return the amount deposited will not constitute estafa through misappropriation punishable under Article 315, par. l(b) of the Revised Penal Code, but it will only give rise to civil liability over which the public respondents have no jurisdiction. But even granting that the failure of the bank to pay the time and savings deposits of private respondent David would constitute a violation of paragraph 1(b) of Article 315 of the Revised Penal Code, nevertheless any incipient criminal liability was deemed avoided, because when the aforesaid bank was placed under receivership by the Central Bank, petitioners Guingona and Martin assumed the obligation of the bank to private respondent David, thereby resulting in the novation of the original contractual obligation arising from deposit into a contract of loan and converting the original trust relation between the bank and private

respondent David into an ordinary debtor-creditor relation between the petitioners and private respondent. Consequently, the failure of the bank or petitioners Guingona and Martin to pay the deposits of private respondent would not constitute a breach of trust but would merely be a failure to pay the obligation as a debtor. Moreover, while it is true that novation does not extinguish criminal liability, it may however, prevent the rise of criminal liability as long as it occurs prior to the filing of the criminal information in court. In the case at bar, there is no dispute that petitioners Guingona and Martin executed a promissory note on June 17, 1981 assuming the obligation of the bank to private respondent David; while the criminal complaint for estafa was filed on December 23, 1981 with the Office of the City Fiscal. Hence, it is clear that novation occurred long before the filing of the criminal complaint with the Office of the City Fiscal. Consequently, as aforestated, any incipient criminal liability would be avoided but there will still be a civil liability on the part of petitioners Guingona and Martin to pay the assumed obligation. 2. Petitioner Guingona merely accommodated the request of the Nation Savings and loan Association in order to clear the bank draft through his dollar account because the bank did not have a dollar account. Immediately after the bank draft was cleared, petitioner Guingona authorized Nation Savings and Loan Association to withdraw the same in order to be utilized by the bank for its operations. It is safe to assume that the U.S. dollars were converted first into Philippine pesos before they were accepted and deposited in Nation Savings and Loan Association, because the bank is presumed to have followed the ordinary course of the business which is to accept deposits in Philippine currency only, and that the transaction was regular and fair, in the absence of a clear and convincing evidence to the contrary. In conclusion, considering that the liability of the petitioners is purely civil in nature and that there is no clear showing that they engaged in foreign exchange transactions, We hold that the public respondents acted without jurisdiction when they investigated the charges against the petitioners. Consequently, public respondents should be restrained from further proceeding with the criminal case for to allow the case to continue, even if the petitioners could have appealed to the Ministry of Justice, would work great injustice to petitioners and would render meaningless the proper administration of justice.

Vous aimerez peut-être aussi

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Steps To Private Placement Programs (PPP) DeskDocument7 pagesSteps To Private Placement Programs (PPP) DeskPattasan U100% (1)

- Answer With CounterclaimDocument5 pagesAnswer With CounterclaimDave Lumasag CanumhayPas encore d'évaluation

- Answer With CounterclaimDocument5 pagesAnswer With CounterclaimDave Lumasag CanumhayPas encore d'évaluation

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- ETP48300-C6D2 Embedded Power User Manual PDFDocument94 pagesETP48300-C6D2 Embedded Power User Manual PDFjose benedito f. pereira100% (1)

- Make $50 A Day Autopilot MethodDocument4 pagesMake $50 A Day Autopilot MethodJadon BoytonPas encore d'évaluation

- Susan Abbotson - Critical Companion To Arthur Miller - A Literary Reference To His Life and Work-Facts On File (2007) PDFDocument529 pagesSusan Abbotson - Critical Companion To Arthur Miller - A Literary Reference To His Life and Work-Facts On File (2007) PDFTaha Tariq0% (1)

- ICT FX4Model FrameworkDocument20 pagesICT FX4Model FrameworkSnowPas encore d'évaluation

- Philippine Deposit Insurance Corporation Case 2Document2 pagesPhilippine Deposit Insurance Corporation Case 2Dave Lumasag CanumhayPas encore d'évaluation

- Pre Trial Brief - RespondentDocument4 pagesPre Trial Brief - RespondentDave Lumasag CanumhayPas encore d'évaluation

- Bpi Employees Union CaseDocument2 pagesBpi Employees Union CaseDave Lumasag CanumhayPas encore d'évaluation

- Bpi Employees Union CaseDocument2 pagesBpi Employees Union CaseDave Lumasag CanumhayPas encore d'évaluation

- Karen Salvacion CaseDocument2 pagesKaren Salvacion CaseDave Lumasag CanumhayPas encore d'évaluation

- Philippine Deposit Insurance Corporation Case - 8Document1 pagePhilippine Deposit Insurance Corporation Case - 8Dave Lumasag CanumhayPas encore d'évaluation

- BANCO FILIPINO SAVINGS AND MORTGAGE BANK vs. HON. FIDEL PURISIMA, Etc., and HON. VICENTE ERICTA and JOSE DEL FIERO, Etc.Document2 pagesBANCO FILIPINO SAVINGS AND MORTGAGE BANK vs. HON. FIDEL PURISIMA, Etc., and HON. VICENTE ERICTA and JOSE DEL FIERO, Etc.Dave Lumasag CanumhayPas encore d'évaluation

- BANCO FILIPINO SAVINGS AND MORTGAGE BANK vs. HON. FIDEL PURISIMA, Etc., and HON. VICENTE ERICTA and JOSE DEL FIERO, Etc.Document2 pagesBANCO FILIPINO SAVINGS AND MORTGAGE BANK vs. HON. FIDEL PURISIMA, Etc., and HON. VICENTE ERICTA and JOSE DEL FIERO, Etc.Dave Lumasag CanumhayPas encore d'évaluation

- Should Always: Exercise 1-1. True or FalseDocument7 pagesShould Always: Exercise 1-1. True or FalseDeanmark RondinaPas encore d'évaluation

- Westmont Bank CaseDocument2 pagesWestmont Bank CaseDave Lumasag CanumhayPas encore d'évaluation

- Joseph Ejercito CaseDocument2 pagesJoseph Ejercito CaseDave Lumasag CanumhayPas encore d'évaluation

- 2013 Bar Q&A in Political LawDocument9 pages2013 Bar Q&A in Political LawDave Lumasag CanumhayPas encore d'évaluation

- Luis G. Peralta CaseDocument1 pageLuis G. Peralta CaseDave Lumasag CanumhayPas encore d'évaluation

- Simex CaseDocument1 pageSimex CaseDave Lumasag CanumhayPas encore d'évaluation

- The Consolidated Bank CaseDocument1 pageThe Consolidated Bank CaseDave Lumasag CanumhayPas encore d'évaluation

- Government Service Insurance System CaseDocument2 pagesGovernment Service Insurance System CaseDave Lumasag CanumhayPas encore d'évaluation

- Philippine Deposit Insurance Corporation CaseDocument1 pagePhilippine Deposit Insurance Corporation CaseDave Lumasag CanumhayPas encore d'évaluation

- Carmen LL Intengan CaseDocument1 pageCarmen LL Intengan CaseDave Lumasag CanumhayPas encore d'évaluation

- Bank of The Philippines Island and Grace Romero CaseDocument1 pageBank of The Philippines Island and Grace Romero CaseDave Lumasag CanumhayPas encore d'évaluation

- Sample DNA Paternity Report (Exclusive)Document1 pageSample DNA Paternity Report (Exclusive)Dave Lumasag CanumhayPas encore d'évaluation

- Sample Departure-AdmittanceDocument1 pageSample Departure-AdmittanceDave Lumasag CanumhayPas encore d'évaluation

- Bank of The Philippine Islands - Casa CaseDocument1 pageBank of The Philippine Islands - Casa CaseDave Lumasag CanumhayPas encore d'évaluation

- Affidavit of LossDocument2 pagesAffidavit of LossDave Lumasag CanumhayPas encore d'évaluation

- Sample Boarding PassesDocument1 pageSample Boarding PassesDave Lumasag CanumhayPas encore d'évaluation

- Regional Trial Court: Petitioner, ForDocument5 pagesRegional Trial Court: Petitioner, ForDave Lumasag CanumhayPas encore d'évaluation

- Regional Trial Court: Petitioner, ForDocument5 pagesRegional Trial Court: Petitioner, ForDave Lumasag CanumhayPas encore d'évaluation

- Regional Trial Court: Petitioner, ForDocument5 pagesRegional Trial Court: Petitioner, ForDave Lumasag CanumhayPas encore d'évaluation

- Resignation LetterDocument1 pageResignation LetterDave Lumasag CanumhayPas encore d'évaluation

- Solid Waste On GHG Gas in MalaysiaDocument10 pagesSolid Waste On GHG Gas in MalaysiaOng KaiBoonPas encore d'évaluation

- Mecafix 120: Description Technical DataDocument1 pageMecafix 120: Description Technical DataJuan Carlos EspinozaPas encore d'évaluation

- DMT80600L104 21WTR Datasheet DATASHEETDocument3 pagesDMT80600L104 21WTR Datasheet DATASHEETtnenPas encore d'évaluation

- Papi AdbDocument50 pagesPapi AdbSilvio Figueiredo0% (1)

- Cache Memory in Computer Architecture - Gate VidyalayDocument6 pagesCache Memory in Computer Architecture - Gate VidyalayPAINPas encore d'évaluation

- Hydropneumatic Accumulators Pulsation Dampeners: Certified Company ISO 9001 - 14001Document70 pagesHydropneumatic Accumulators Pulsation Dampeners: Certified Company ISO 9001 - 14001Matteo RivaPas encore d'évaluation

- PrefaceDocument16 pagesPrefaceNavaneeth RameshPas encore d'évaluation

- TN1Ue Reference Manual Issue 9.0Document144 pagesTN1Ue Reference Manual Issue 9.0Reinaldo Sciliano juniorPas encore d'évaluation

- Constitutional Law of India-II CCSU LL.B. Examination, June 2015 K-2002Document3 pagesConstitutional Law of India-II CCSU LL.B. Examination, June 2015 K-2002Mukesh ShuklaPas encore d'évaluation

- Analysis of Financial Ratios of Manufacturing CompaniesDocument61 pagesAnalysis of Financial Ratios of Manufacturing CompaniesNine ZetPas encore d'évaluation

- Emiish Me: Answer BookDocument7 pagesEmiish Me: Answer BookNickPas encore d'évaluation

- ME6019 - NON DESTRUCTIVE TESTING AND MATERIALS MCQ PadeepzDocument13 pagesME6019 - NON DESTRUCTIVE TESTING AND MATERIALS MCQ PadeepzAjithPas encore d'évaluation

- Python Lecture PSBCDocument83 pagesPython Lecture PSBCPedro RodriguezPas encore d'évaluation

- Activity Problem Set G4Document5 pagesActivity Problem Set G4Cloister CapananPas encore d'évaluation

- Convert MS Word Documents to LinuxDocument16 pagesConvert MS Word Documents to Linux8043 Nitish MittalPas encore d'évaluation

- Nº SSR-1 NS-R-3 Draf R1 Site Evaluation For Nuclear Installations FRDocument33 pagesNº SSR-1 NS-R-3 Draf R1 Site Evaluation For Nuclear Installations FRdaniel addePas encore d'évaluation

- COA (Odoo Egypt)Document8 pagesCOA (Odoo Egypt)menams2010Pas encore d'évaluation

- CSCE 3110 Data Structures and Algorithms NotesDocument19 pagesCSCE 3110 Data Structures and Algorithms NotesAbdul SattarPas encore d'évaluation

- Presenting India's Biggest NYE 2023 Destination PartyDocument14 pagesPresenting India's Biggest NYE 2023 Destination PartyJadhav RamakanthPas encore d'évaluation

- Aegis SGR BrochureDocument2 pagesAegis SGR BrochureAmazonas ManutençãoPas encore d'évaluation

- CRM Chapter 3 Builds Customer RelationshipsDocument45 pagesCRM Chapter 3 Builds Customer RelationshipsPriya Datta100% (1)

- CSCI5273 PS3 KiranJojareDocument11 pagesCSCI5273 PS3 KiranJojareSales TeamPas encore d'évaluation

- Getting Started With DAX Formulas in Power BI, Power Pivot, and SSASDocument19 pagesGetting Started With DAX Formulas in Power BI, Power Pivot, and SSASJohn WickPas encore d'évaluation

- Critical Aspects in Simulating Cold Working Processes For Screws and BoltsDocument4 pagesCritical Aspects in Simulating Cold Working Processes For Screws and BoltsstefanomazzalaiPas encore d'évaluation