Académique Documents

Professionnel Documents

Culture Documents

The Effectiveness of Sukuk in Islamic Finance Market

Transféré par

Khairul AnnuwarDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

The Effectiveness of Sukuk in Islamic Finance Market

Transféré par

Khairul AnnuwarDroits d'auteur :

Formats disponibles

Australian Journal of Basic and Applied Sciences, 5(12): 472-478, 2011 ISSN 1991-8178

The Effectiveness of Sukuk in Islamic Finance Market

1

Mohamad Zaid Mohd Zin, 2Ahamad Asmadi Sakat, 1Nurfahiratul Azlina Ahmad, 3Mohd Roslan Mohd Nor, 1Azri Bhari, 1Saurdi Ishak, 1Mohd Sapawi Jamain

Centre for Islamic Thought and Understanding, University Technology Mara, 94300 Samarahan, Sarawak, Malaysia. 2 School of Al Quran and Sunnah Studies, Faculty of Islamic Studies, Universiti Kebangsaan Malaysia, 43600 Bangi, Selangor, Malaysia. 3 Department of Islamic History and Civilization, Academy of Islamic Studies, Universiti Malaya, 50603 Kuala Lumpur.

Abstract: Over the past decade, Islamic finance has been growing at an average rate of more than 30 percent per year. This impressive performance has greatly benefited many national economies, irrespective of faith or race by fostering significant growth and increased employment opportunities. No doubt, Islamic finance has been identified as one of the important growth areas for the National Key Economic Activities. Today, sukuk ( Islamic bond ) is among the most successful Islamic financial product in the industry and be one of the fastest-growing sectors in the global financial landscape. But, this sufficient operation are still new in the market, only a few research have been undertaken on this topic. In view of this limitation, this article aims to explore the practice and prospect of sukuk market in Malaysia. The application and mechanics of sukuk market will be discussed. It is also aims to look at the differences between the sukuk market and the conventional market. Subsequently, understanding of it among the investors were also examined and opportunities and challenges that need to be addressed will be reviewed. As will be evident in this article, this system has its own advantages and value added which would make it the system of choice in meeting specific investment interests and needs. Key words: Effectiveness, Financing, Sukuk, Bond, Islam.

INTRODUCTION Years ago Islamic finance was considered a wishful thinking. However, serious research and development of Islamic products shown that the Islamic finance is not only feasible and viable but it is also efficient and productive way of financial intermediation. The development of the sukuk market has accompanied the transformation of the economy that has now become more diversified and private sector driven. The market, initially dominated by the Government debt securities, now reflects the growing demand for the long term financing requirements of the private sector. In this highly competitive environment, the presence of a deep and liquid of sukuk market thus contributes towards the stability of the financial system. Sukuk also proved to be implemented during the economic downturn, or seeks to develop an economy. For example sukuk or Islamic bond is issuanced by the World Bank in 2005 for the redevelopment of Acheh following the tsunami and The Kuala Lumpur International Airport in Sepang, Malaysia through which many foreign delegates arrived here today, was financed by sukuk in 1996. (Zeti Akhtar, 2007) Nowadays sukuk or Islamic fixed-income securities that have emerged over the past 15 years become as an increasingly important asset class. These products have a number of objectives which is to enable organisations to raise capital in a Shariah-compliant fashion, whilst at the same time expanding the investor base and offering investment opportunities to new groups. Considering their relative infancy, Islamic securities can be structured in a number of increasingly complex ways. Indeed, new products are being consistently developed and introduced. Therefore, it is essential to remain conversant with the important principles of structuring Islamic securities. Sukuk may be defined as certificates of equal value that represent an undivided interest (proportional to the investors interest) in the ownership of an underlying asset (both tangible and intangible), usufruct, services or investments in particular projects or special investment activities. Through this concept, sukuk enjoy the benefit of being backed by assets, thereby affording the sukuk holder or investor a level of protection which may not be available from conventional debt securities. Furthermore, unlike conventional debt securities that mirror debts or loans on which interest is paid, sukuk can be structured based on innovative applications of Islamic principles and concepts. Nonetheless, sukuk share some similarities with conventional debt securities, in that they are similarly structured based on assets that generate revenue. The underlying revenue from these assets represents the source of income for the payment of profit on the sukuk. (Malaysia Debt Securities and Sukuk Market, 2009)

Corresponding Author: Mohamad Zaid Mohd Zin, Centre for Islamic Thought and Understanding, University Technology Mara, 94300 Samarahan, Sarawak, Malaysia.

472

Aust. J. Basic & Appl. Sci., 5(12): 472-478, 2011

MATERIALS AND METHODS Regulations Framework of Sukuk: (Al-Jarhi and Abozaid, 2010) impose rules and conditions (ahkam) related to the tradability of the sukuk in primary and secondary markets. To begin with, sukuk must be issued against some tangible assets and not against cash or debts. Therefore the tradability of sukuk at the time of issuance (primary market) as well as in the secondary market must follow these rules: 1. If sukuk are issued against specific assets (ayn) or services, then this issuance implies the sale of these assets to the sukuk holders in return for cash money based on current values of assets or services, and therefore the sukuk becomes tradable. 2. If sukuk are issued against described assets or services to be manufactured or constructed in the future (mausuf fii zimmah), then this issuance implies the sale of these assets to the sukuk holders in return for cash money, and these sukuk are not tradable until the deliverability of assets or services. 3. If sukuk are not issued against assets or services, but for the purpose of utilising the proceeds to acquire some assets, then sukuk do not become tradable until the stage at which those assets or services are purchased. This is because the sukuk up to that point represent liquid proceeds, i.e. cash money and money cannot be sold against money unless the Shariah rules of sarf are observed. 4. If there is any mixture between ayn and dayn then ayn must dominate dayn in sukuk issuance. Products of Sukuk: In theory sukuk are certificates of equal value representing undivided pro-rata ownership of tangible assets, usufruct or services. Although sukuk are in principle nonrecourse asset-backed instruments the Originator typically undertakes to repurchase the underlying assets at either a fixed or referenced price, rendering the sukuk asset-based and giving certificate holders exposure to the credit risk of the Originator. (Simmons and Simmons, 2010). Although in principle, sukuk are required to represent underlying assets that are tangible (ayn) as opposed to a debt (dayn), there have been sukuk issuances in which the underlying assets are a mix of cash and tangible assets. There have also been issuances of convertible and exchangeable sukuk. Sukuk can be structured alongside different techniques. While a conventional bond is a promise to repay a loan, sukuk constitutes partial ownership in a debt (Murabahah sukuk) asset (Al Ijarah sukuk), project (Al Istisnaa sukuk), business (Al Musyarakah sukuk) or investment (Al Istithmar sukuk). Recently, there is one type of sukuk are introduced the hybrid sukuk. 1. Ijarah Sukuk: It is divided into Purchase agreement, lease agreement, servicing agreement and purchase undertaking. It is based on letting property rights to any other benefits based on the agreed price. Al Ijarah sukuk are issued on a sale and leaseback arrangement (Ijarah) of real estate and have been a popular structure for sovereign issuers in particular. The issuer applies the sukuk proceeds to purchase real estate from the Originator and then leases it back to the Originator. The Originator undertakes to repurchase the real estate at maturity or upon early settlement at the original purchase price. The Issuer is required by Shariah law to undertake the major maintenance of the asset but will often appoint the Obligor to carry out such activity on its behalf. 2. Mudharabah Sukuk: It is divided into Mudharabah agreement and purchase undertaking. It is a cooperation agreement between two parties that investors and managers of capital. Mudharabah sukuk are investment sukuk that represent common ownership of units of equal value in the Mudharabah equity; the holders of Mudharabah sukuk are the suppliers of capital (Rabb al-mal) and own shares in the Mudharabah equity and its returns according to the percentage of ownership share. Mudharabah sukuk holders have the right to transfer the ownership by selling the deeds in the securities market. Mudharabah sukuk also should not contain a guarantee from the issuer or the manager for the fund, for the capital or a fixed profit, or a profit based on any percentage of the capital. 3. Musyarakah Sukuk: It is divided into Musyarakah agreement, management agreement, purchase undertaking. Its involves cooperation of two parties to incorporate a capital for a motivation. Al-Musyarakah sukuk was a popular structure among corporate issuers until the Accounting and Auditing Organisation for Islamic Financial Institutions (AAOIFI) ruling on sukuk at the beginning of 2008 clarified the prohibition of the use of nominal value Purchase Undertakings in such sukuk. In an al-Musyarakah sukuk, the Issuer contributes the subscription proceeds to enter into a joint venture with the Originator who contributes either his own capital/asset or makes a contribution in kind. The Issuer and the Originator share the profits according to an agreed ratio but Shariah requires that any losses must be shared according to the ratio of capital contributed. Besides that, the AAOIFI

473

Aust. J. Basic & Appl. Sci., 5(12): 472-478, 2011

ruling confirmed that while it is permissible in an al Ijarah sukuk for the lessee to undertake to purchase the sukuk assets at nominal value upon redemption, it is not permissible for a Sharik (partner) in an al Musyarakah sukuk or a Wakil (agent) in a sukuk al Wakalah bil Istithmar to undertake to do so. The Shariah considers such undertakings to effective guarantees of principal which are not permitted by Shariah in partnership and agency contracts. The AAOIFI ruling created a significant dent in the issuance of al Musyarakah sukuk and al Mudharabah sukuk. 4. Istisnaa Sukuk: Absale and purchase agreement in order to finance a project item. Istisnaa sukuk are certificates that carry equal value and are issued to mobilize funds required for production of goods products that will be owned by the certificate holders. The issuer of these certificates is the manufacturer; the subscribers are the buyers of the intended product, while the funds realized from subscription are the cost of the product. The Islamic bank funding the manufacturer during the construction of the asset, acquires title to that asset and up on completion either immediately passes title to the developer on agreed deferred payment terms or, possibly, leases the asset to the developer under an Ijarah sukuk. Shariah prohibits these certificates to be traded in the secondary market. 5. Murabahah Sukuk: In the case of Murabahah sukuk, the issuer of the certificate is the seller of the Murabahah commodity the subscribers are the buyers of that commodity, and they are entitled to its final sale price upon the re-sale of the commodity. Murabahah sukuk cannot be legally traded at the secondary market, as the certificates represent a debt owing from the subsequent buyer of the commodity to the sukuk holders and such trading in debt on a deferred basis is not permitted by Shariah. 6. Hybrid Sukuk: The innovative structures. Based on various demands of investors, a more diversified kind of hybrid sukuk or mixed sukuk emerged in the market. The assets can comprise of Istisnaa Murabahah as well as Ijarah. Islamic Development Bank issued the first Hybrid Sukuk for US$400 million. The assets comprised 66% alIjarah sukuk, 31% Murabahah and 3% al-Istisnaa sukuk.The hybrid sukuk structure represents the potential of new structures and benefits to the investors. RESULTS AND DISCUSSION Sukuk Market in Malaysia: In this decade, greater focus was particularly given to the institutional arrangements to develop the sukuk market. The sukuk market now accounts for more than fifty percent of Malaysias bond market. The market has drawn the participation from a wide range of international corporations and multilateral agencies in raising funds and investing in the sukuk issuances out of Malaysia. More recently, there has also been continuous innovation and an increasing number of issuances in foreign currency. As Malaysia offers international participation in the Islamic financial system, also offer to be an international gateway, particularly in strengthening the link between the two important dynamic growth regions of Asia and the Middle East. (Zeti Akhtar, 2010)

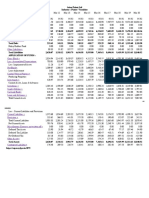

Breakdown of Global Sukuk Issues by Country for year 2010: Malaysia's sukuk market started with a simple issue size of RM125 million by Shell MDS Sdn. Bhd.. in 1990 and is now growing in size and increasingly sophisticated. This development is evident in the largest sukuk issue recently valued at RM15.4 billion (USD4.7 billion) by Binariang GSM Sdn. Bhd. Now, the sukuk

474

Aust. J. Basic & Appl. Sci., 5(12): 472-478, 2011

market in Malaysia is among the fastest growing in the world, with an average annual growth of 22% issued for the period 2001-2007. After introducing the first sovereign global sukuk in the world in 2002, Malaysia has continued it success by introducing innovative sukuk structures such as convertible musyarakah sukuk by Khazanah Nasional Berhad, the Malaysian government investment holding company. This is a historic issue of the first of its kind in the world, which combines the features of the first full convertibility is usually only used for conventional equity-linked transactions. (Central Bank of Malaysia, 2007) In the area of capacity building, Malaysia has also given priority to two areas which is one is in human capital development and the second, in catalysing mutual recognition of Shariah interpretations. The International Centre of Education in Islamic finance (INCEIF) was established in 2006 for advanced education for practitioners in Islamic finance, and in 2008, the International Shariah Research Academy (ISRA) was established to conduct applied Shariah research on the contemporary Islamic finance issues and to provide a platform for active international engagement among Shariah scholars. Malaysia will also continue to collaborate with other regulatory authorities to ensure financial stability in the Islamic financial system. This will be through Malaysias active involvement in the Islamic Financial Services Board (IFSB), the Islamic Financial Stability Forum (IFSF), the initiatives by the Islamic Development Bank (IDB), and finally in the newly formed International Islamic Liquidity Management Corporation (IILM). Secondary trading in the Malaysian sukuk market has increased the depth and liquidity of the market with the participation of more companies, including foreign-owned companies continued use of this market for funding purposes. A large number of corporate issuance is to finance long-term funding needs. The diversity and size of the sukuk transaction was the increasing value proposition is attractive to investors who want to diversify their asset portfolios, thus creating a vibrant secondary market. The Malaysian sukuk market has also grown to become more innovative and sophisticated to meet the diverse risk-return profiles and requirements of both issuers and investors. The proliferation of new types of instruments with extended maturity profiles have generated a diversified range of players, both local and foreign to participate in the market. This was facilitated by the liberalisation of the market in 2005 to allow for issuance of debt securities by foreign corporations and multilateral agencies in ringgit denominated papers. In 2007, this was extended to foreign currency denominated issuances. Indeed, this has attracted many foreign corporations, multinational corporations and multilateral agencies to raise funds and invest in issuances and origination out of Malaysia, hence enhancing the Malaysian market, and strengthening Malaysias inter-linkages with other international financial markets. The development of the sukuk market in Malaysia has accompanied the transformation of the Malaysian economy that has now become more diversified and private sector driven. The market, initially dominated by the Government debt securities, now reflects the growing demand for the long term financing requirements of the private sector. The corporate sector now raises 58% of their financing requirements through the debt securities and sukuk market compared to about 33% ten years ago. The presence of a deep and liquid debt securities and sukuk market thus contributes towards the stability of the financial system.

Global total issued Sukuk for 2010

2010 Year 2009 2008 0 10 16.22 20 30 40 50 60 31.93 47.77 sukuk

Amount ( US billion )

Source: Islamic Finance Information ServicesIFIS Global sukuk industry experienced impressive growth over ten years ago in Malaysia and is now the focus in the development of Islamic financial system rapidly. Size of the global sukuk market, including sukuk denominated in local currency, has increased from USD336 million (RM1.3 billion) in 2000 to an estimated USD82 billion (or RM281 billion) at the end of 2007, with average annual growth rate of 40%. However, the total sukuk issuance for 2007 is only worth USD 47billion (or RM161 billion), an increase of 73% of the total issued in 2006. (Central Bank of Malaysia, 2007). Although the performance is not as estimated because of the

475

Aust. J. Basic & Appl. Sci., 5(12): 472-478, 2011

economic crisis, but the flow of sukuk issuance seen more positively and surviving. Sukuk also almost unique because it not only offered to Muslim investors but also to other conventional investors. According to sources IFIS, in 2010 shows that the global sukuk reached US47.77 billion, an increase of 50% compared with the year 2009, which only reached US31.93 billion in the global market. As expected, Malaysia continued to dominate the issuance of sukuk in 2010 and became the leading position in the global sukuk market, with 65% of total outstanding sukuk and 75% of primary issuance of sukuk as at December 2010. (IFIS, 2011) Malaysia is the world's largest sukuk market with a number of Malaysia's sukuk issues by 68.9%, or USD62 billion (or RM213 billion) of total global outstanding at the end of 2007. Number of corporate sukuk in Malaysia more than RM30 billion in 2007. Malaysia will not only lead the development of the sukuk market in terms of total sukuk issuance, even in terms of the introduction of innovative sukuk structures and competitive to attract more investors. Moving forward, Malaysia will continue its efforts in strengthening the international linkages in the global Islamic financial system through collaborative partnerships and cooperation with the objective of contributing towards greater international financial and economic integration. No doubt, sukuk (Islamic bond) proved that it is among the most successful Islamic financial product in the industry and be one of the fastest-growing sectors in the global financial landscape. Differences Between Convensional Bond and Sukuk: The most prominent characteristics of conventional bonds may be summarized as follows:- sukuk and their contemporary applications. (Muhammad Taqi Usmani, 2009) 1. Bonds do not represent ownership on the part of the bond holders in the commercial or industrial enterprises for which the bonds were issued. Rather, they document the interest-bearing debt owed to the holders of the bonds by the issuer, the owner of the enterprise. 2. Regular interest payments are made to the bond holders. The amount of interest is determined as a percentage of the capital and not as a percentage of actual profits. Sometimes the interest is fixed, while oftentimes in bonds with longer tenors the rate of interest is allowed to float. 3. Bonds guarantee the return of principal when redeemed at maturity, regardless of whether the enterprise was profitable or otherwise. The issuer of such bonds is not required to return more than the principal and the agreed amount of interest. Whatever profits may have been earned by the enterprise accrue entirely and exclusively to the issuer. So the bond holders have no right to seek a share in the profits beyond the interest. However, the main difference between sukuk with conventional bond is a claim of a conventional bond investors on the future flow of money to the party that issued the bond. The contract between the investor and the issuer is a contract of debtors and creditors. For example, an investor subscribed for bonds worth about RM 1000 and each year will be given the benefit of RM 100 if the 10% interest rate until maturity. Upon maturity of the bond investors will be given the benefit of it and paid the price of the bond proceeds of RM 1000. In other word, for the sukuk, the method of calculating profit is similar to conventional bonds, but in the sukuk contracts, claims an investor rather than on cash flow alone, but claims the benefit of an investor is an asset used by the funds generated through sukuk financing. In the sukuk contracts, the money generated from the sukuk will be used to purchase an asset. Then Sukuk certificate holders have claims on the benefits generated by the asset is the investor. For example, if investors subscribe to RM 1000 with an agreement rate of 10% profit margin, the investor will receive RM 100 and RM 1100 per year at maturity. The Sukuk has been structured which the issue is not the exchange of money with the certificate alone but is based on the exchange of assets that have been approved with a few scales, which funding will enable investors to receive profits from the transaction. Another aspect that distinguishes between sukuk and conventional bonds is in a situation where the bond issuer can not repay the debt and interest to investors / creditors investors will lose all the investment as the bond contract is usually no guarantee that the assets can be secured to recover the principal investment. In the sukuk, not sukuk are not in the contract there must be assurance that the money raised from investors was used to buy a property in which investors profit comes from the benefits of the asset. If a bad situation occurs, investors can still claim some of their investment assets to be secured by collateral to the contract sukuk. Challenges in Sukuk Market: There are various forms of tax to be accounted for. For example, in the ECG sukuk, which was backed by oil and gas assets in the Gulf of Mexico, the structure utilised a funding arrangement that was heavily driven by US tax considerations. Legislation in some jurisdictions requires, in connection with the conveyance of title in real estate or property transactions (which would be required in the context of an Ijara wa iktinaa, or sale-leaseback structure), that the sale contract and the resulting title transfer be recorded in a real estate register and that a transfer of title fee or tax be paid. (Ayman H. Abdel-Khaleq and Peter Young,Vinson and Elkins RLLP, 2008).

476

Aust. J. Basic & Appl. Sci., 5(12): 472-478, 2011

Problems such as lack of uniformity in procedures that had applied the principles of shariah the lack of professional qualifications (lawyers, scholars and academics) are experienced in both conventional and Shariah standards and lack of awareness among employers and apparently the manager of the sukuk is also difficult to implement. As a proactive measure, ethical standards of inspection in accordance with shariah should be taken. Prospects for the development of Islamic finance should contain a balanced development of the shariah and integrated market by the prospect of a unique Islamic finance. In addition, the products and services must also not limited to Muslims market only. But, also emphasizes acceptance and applications globally. The creation of many innovations and initiatives have also contributed to the advancement of Islamic financial system. However, the challenges can be overcome by increased effort in every cooperation, increase understanding of the shariah concern, mutual respect and collaboration practices. Conclusion: Sukuk now has become the strongest segment in Islamic finance, are involved in the international market and generate significant cross-border flow of funds as may be achieved beyond domestic markets. Along with hard work, growth and balanced development agenda, all countries have the potential to expand the role of Islamic finance is increasing in contributing to global growth and financial stability. Investment sukuk are the ideal investment for investors requiring a fixed investment return with low risk and the Shariah Compliant. Sukuk also should be issued for new commercial and industrial ventures. If they are issued for established businesses, then the sukuk must ensure that sukuk holders have complete ownership in real assets. Islamic finance can also be used to establish a stronger financial flows of the entire border to contribute to the common agenda of improving growth and development agenda to achieve self-sustained global aspirations, balanced and growth, and long-lasting economic development. Sukuk instruments has become an attractive new asset class investors as a form of competitive businesses, thus proving the importance of Islamic finance in strengthening financial cooperation is increasingly real. REFERENCES Abozaid, A. and Al-Jarhi Mabid, 2010. Reasons for Failure of Some Sukuk Issuances, International Fiqh Academy, IRTI & Islamic Economics Research Center Conference, Islamic Sukuk: Examination & revaluation, King Abdul Aziz University & Westin Hotel, Jeddah, Saudi Arabia, May 24-25. Ayman, H., Abdel-Khaleq and Peter Young, R.L.L.P. Vinson and Elkins, 2008. Structuring and Offering Sukuk Products Involving Assets in the US: Challenges and Opportunities, pp: 56. Central Bank of Malaysia Financial Stability and Payment Systems Report, 2007., pp: 56-57. website: http://www.bnm.gov.my/files/publication/fsps/bm/2007/cp02_rencana_01.pdf General Council for Islamic Banks and Financial Institution, Islamic Financial Industry News Centre, website: http://www.cibafi.org/newscenter/english/SpecificProductsAndServicesNews.aspx?SubC=70 (accessed on on 4th February 2011). Governor of Central Bank of Malaysia, 2007. The Global Islamic Financial Services Industry, May 14, website http://www.bis.org/review/r070515b.pdf (accessed on 6th February 2011). Hilton Convention Centre, Istanbul, Turkey,(2009) Islamic Finance and Global Financial Stability", 5 October, website: http://www.bnm.gov.my/index.php?ch=62&pg=66&ac=345&lang=bm.http://award.mifc.com/index.php?ch=ifa _winner&pg=ifa_winner_recog&ac=446. http://www.failaka.com/downloads/Usmani_SukukApplications.pdf, (accessed on 6th February 2011). http://www.islamicfinancetraining.com/sukukpdnov.php Islamic Financial Training, Sukuk & Islamic Capital Markets: Products & Documentation, website: Malaysian Debt Securities and Sukuk Market, 2009. A Guide for Issuer and Investor, A joint Publication by Central Bank of Malaysia and Securities Commission Malaysia, pp: 29-34. Malaysian International Islamic Financial Centre (2010), Welcoming Remarks, website: Mohammad, Shamsiah, Mohd Fadhly Md Yusoff, and Abdul Aziz Al Qassar, 2009. Ground Rules for Sukuk Issuance in Sukuk: Islamic Capital Market Series, Malaysia: Sweet & Maxwell Asia. Simmons and Simmons Company, website: http://www.simmonssimmons.com/index.cfm?fuseaction=service_industry.display_left&page=3243&hsf=suku k (accessed on 2th February 2011). Muhammad Taqi Usmani, president of the AAOIFI Shariah Council, Sukuk and Their Contemporary Applications, website: Mushtak Parker, 2010. Malaysian promotes Islamic finance at international event, Arab News, 25 October 2010, published. Wikipedia, the Free Encyclopedia, website: http://en.wikipedia.org/wiki/Sukuk, (accessed on 4th February 2011).

477

Aust. J. Basic & Appl. Sci., 5(12): 472-478, 2011

Zeti Akhtar Aziz, Tan Sri Dato Sri Dr., Governor of Central Bank of Malaysia, Quarterly Bulletin, First Quarter 2010, website: http://www.bnm.gov.my/files/publication/qb/2010/Q1/bm_p6.pdf.

478

Vous aimerez peut-être aussi

- Cash Budget Template TilesDocument1 pageCash Budget Template TilesVeronica BaileyPas encore d'évaluation

- BANKING AWARENESS WITH MULTIPLE CHOICE QUESTIONSDocument458 pagesBANKING AWARENESS WITH MULTIPLE CHOICE QUESTIONSAbhi Saha100% (2)

- Islamic Bonds: Learning ObjectivesDocument20 pagesIslamic Bonds: Learning ObjectivesAbdelnasir HaiderPas encore d'évaluation

- An Introduction To Islamic Finance and The Malaysian ExperienceDocument10 pagesAn Introduction To Islamic Finance and The Malaysian Experiencecharlie simoPas encore d'évaluation

- Withdraw PayPal Money in Malaysia SolutionDocument16 pagesWithdraw PayPal Money in Malaysia Solutionafarz2604Pas encore d'évaluation

- Market Research and Product Development: Citi Global Consumer BankDocument4 pagesMarket Research and Product Development: Citi Global Consumer BankAnil Kumar ShahPas encore d'évaluation

- Merger Arbitrage Case StudyDocument5 pagesMerger Arbitrage Case Studychuff6675100% (1)

- Asset Liability Management in Banks: Components, Evolution, and Risk ManagementDocument29 pagesAsset Liability Management in Banks: Components, Evolution, and Risk Managementeknath2000Pas encore d'évaluation

- Arabic Arabic Certificates Islamic Bonds Islam Islamic Law: Sukuk (Document4 pagesArabic Arabic Certificates Islamic Bonds Islam Islamic Law: Sukuk (Zaid AlaviPas encore d'évaluation

- The Potential and Risks of Sukuk According to Shariah LawDocument30 pagesThe Potential and Risks of Sukuk According to Shariah Lawbadrul_ibrahim100% (1)

- SUKUK Not FinishedDocument14 pagesSUKUK Not FinishedAbdiKarem JamalPas encore d'évaluation

- Understanding Islamic Bonds (SukukDocument29 pagesUnderstanding Islamic Bonds (Sukukwokyoh91Pas encore d'évaluation

- Chapter 2 SukukDocument8 pagesChapter 2 SukukFahmi IzzuddinPas encore d'évaluation

- SukukDocument15 pagesSukuk2345008100% (1)

- Sana Islamic LawDocument7 pagesSana Islamic LawArslan MalikPas encore d'évaluation

- Are Sukuk and Conventional Bonds CompatibleDocument9 pagesAre Sukuk and Conventional Bonds CompatibleZouher EL BrmakiPas encore d'évaluation

- Sukuk StructuresDocument35 pagesSukuk StructuresCk Tham100% (1)

- Essay Week 5 On SukukDocument2 pagesEssay Week 5 On SukukRuddy Von OhlenPas encore d'évaluation

- FuzzyDocument16 pagesFuzzyAhmad FadzwanPas encore d'évaluation

- Sukuk in MalaysiaDocument30 pagesSukuk in Malaysiamusbri mohamedPas encore d'évaluation

- Managment Assigment Ali Irtaza Islamic BankingDocument4 pagesManagment Assigment Ali Irtaza Islamic BankingaliPas encore d'évaluation

- Islamic Capital Markets: The Role of Sukuk: Executive SummaryDocument4 pagesIslamic Capital Markets: The Role of Sukuk: Executive SummaryiisjafferPas encore d'évaluation

- SUKUK BOND: The Global Islamic Financial Instrument Salman Ahmed Shaikh & Shan SaeedDocument11 pagesSUKUK BOND: The Global Islamic Financial Instrument Salman Ahmed Shaikh & Shan SaeedASHYA SAFFA BINTI AHMADPas encore d'évaluation

- A Sukuk Is An Islamic Financial CertificateDocument11 pagesA Sukuk Is An Islamic Financial CertificateAbbasi WritesPas encore d'évaluation

- Islamic InstrumentsDocument7 pagesIslamic InstrumentslekshmiPas encore d'évaluation

- SecuritisationDocument43 pagesSecuritisationRonak KotichaPas encore d'évaluation

- Maksud Unit TrustDocument6 pagesMaksud Unit TrusthusainiPas encore d'évaluation

- The Role of Islamic Finance in Economic DevelopmentDocument13 pagesThe Role of Islamic Finance in Economic Developmentdachra2003Pas encore d'évaluation

- JURNAL-issues in Islamic Capital Markets Islamic Bond SukukDocument18 pagesJURNAL-issues in Islamic Capital Markets Islamic Bond SukukRiskaaPas encore d'évaluation

- SukukDocument9 pagesSukukanamejenicolePas encore d'évaluation

- ID NoneDocument14 pagesID NoneMtkps 2021Pas encore d'évaluation

- Sukuk PresentationDocument79 pagesSukuk PresentationJameel AhmadPas encore d'évaluation

- Securitization in Islamic BankingDocument6 pagesSecuritization in Islamic BankingFaisal RehmanPas encore d'évaluation

- ReportDocument4 pagesReportTonmoy DelwarPas encore d'évaluation

- Sukuk Defaults and Its Implication: A Case Study of Malaysian CapitalDocument37 pagesSukuk Defaults and Its Implication: A Case Study of Malaysian Capitalkhairul azlyPas encore d'évaluation

- Islamic Finance NotesDocument6 pagesIslamic Finance NotesHosea KanyangaPas encore d'évaluation

- Sukuk Features, TypesCharacteristisDocument2 pagesSukuk Features, TypesCharacteristisMohammed SaifulPas encore d'évaluation

- Islamic Sukuk Concepts & ApplicationsDocument79 pagesIslamic Sukuk Concepts & ApplicationsAsad UllahPas encore d'évaluation

- Topic 1Document5 pagesTopic 1fazlinhashimPas encore d'évaluation

- Islamic FinanceDocument9 pagesIslamic FinanceMohsin AijazPas encore d'évaluation

- IBF BY DaniDocument14 pagesIBF BY DaniDaniyal AwanPas encore d'évaluation

- Financial Market in Pakistan: Financial Markets and Their Roles: Commercial BanksDocument5 pagesFinancial Market in Pakistan: Financial Markets and Their Roles: Commercial BanksAnamMalikPas encore d'évaluation

- Critical Analysis of Shariah Issues in Ijara SukukDocument10 pagesCritical Analysis of Shariah Issues in Ijara SukukNajib Hj DamitPas encore d'évaluation

- Revised Chapter 2Document44 pagesRevised Chapter 2kellydaPas encore d'évaluation

- Products of Islamic FinanceDocument18 pagesProducts of Islamic FinanceTanveer Shah, MBA Scholar, Institute of Management Studies, UoPPas encore d'évaluation

- Finance Gears Up : Mohammed El QorchiDocument7 pagesFinance Gears Up : Mohammed El QorchiAleem BayarPas encore d'évaluation

- Development & Islamic - 4Document4 pagesDevelopment & Islamic - 4polmulitriPas encore d'évaluation

- Shariah-Compliant Investment OpportunitiesDocument12 pagesShariah-Compliant Investment OpportunitiesIbn Bashir Ar-RaisiPas encore d'évaluation

- Capital Markets PromotionDocument8 pagesCapital Markets Promotionkumeshk1983Pas encore d'évaluation

- Sukuk Structures Profiles and RisksDocument18 pagesSukuk Structures Profiles and Risksardelektrik 2021Pas encore d'évaluation

- Index: Executive SummaryDocument31 pagesIndex: Executive SummaryFaisal RehmanPas encore d'évaluation

- Islamic Finance Acca PaperDocument6 pagesIslamic Finance Acca PaperAmmar KhanPas encore d'évaluation

- What Are Definition of Islamic Capital Market (ICM)Document45 pagesWhat Are Definition of Islamic Capital Market (ICM)Zizie2014Pas encore d'évaluation

- Overview of Islamic Banking Services and PrinciplesDocument9 pagesOverview of Islamic Banking Services and PrinciplesNabeela ShahPas encore d'évaluation

- Rameen Khan 5B.Document18 pagesRameen Khan 5B.Umair FarooquiPas encore d'évaluation

- Marketing of Islamic Financial Products: January 2007Document18 pagesMarketing of Islamic Financial Products: January 2007AHMED MOHAMED YUSUFPas encore d'évaluation

- SECURITISATIONDocument40 pagesSECURITISATIONHARSHA SHENOYPas encore d'évaluation

- Project IBF Submitted To: DR. Sabeen Khurram KhanDocument7 pagesProject IBF Submitted To: DR. Sabeen Khurram KhanSheikh AbdullahPas encore d'évaluation

- Islamic Finance: Principles of Economics (HS19H020) Term PaperDocument12 pagesIslamic Finance: Principles of Economics (HS19H020) Term PaperLakshmi PuthiyedathPas encore d'évaluation

- Islamic FinanceDocument8 pagesIslamic FinancemcyhndhiePas encore d'évaluation

- Finance Project On "Analysis On Performance of Mutual Fund Companies in India"Document94 pagesFinance Project On "Analysis On Performance of Mutual Fund Companies in India"balaji bysani84% (32)

- Introduction On SukukDocument15 pagesIntroduction On SukukjeayrajparPas encore d'évaluation

- SecuritisationDocument78 pagesSecuritisationAshita DoshiPas encore d'évaluation

- Islamic Finance: Issues in Sukuk and Proposals for ReformD'EverandIslamic Finance: Issues in Sukuk and Proposals for ReformPas encore d'évaluation

- The Finace Master: What you Need to Know to Achieve Lasting Financial FreedomD'EverandThe Finace Master: What you Need to Know to Achieve Lasting Financial FreedomPas encore d'évaluation

- 2.direct Expenses and Indirect ExpensesDocument7 pages2.direct Expenses and Indirect ExpensesKhairul AnnuwarPas encore d'évaluation

- Session 1 Jamaluddin Nor MohamadDocument23 pagesSession 1 Jamaluddin Nor Mohamadshamy_53Pas encore d'évaluation

- Interest Free BankingDocument9 pagesInterest Free BankingKhairul AnnuwarPas encore d'évaluation

- Shariah & Legal Issues in Islamic Banking & Capital Markets - Missi Inchyra - AcademiaDocument6 pagesShariah & Legal Issues in Islamic Banking & Capital Markets - Missi Inchyra - AcademiaKhairul AnnuwarPas encore d'évaluation

- Paper 1.4Document137 pagesPaper 1.4vijaykumartaxPas encore d'évaluation

- Pristine's Cardinal Rules of TradingDocument44 pagesPristine's Cardinal Rules of Tradingsk77*100% (11)

- Tax Preparer ResumeDocument8 pagesTax Preparer Resumec2q5bm7q100% (1)

- PF Transfer From Satyam / Mahindra Satyam To New Employer - FAQ'sDocument3 pagesPF Transfer From Satyam / Mahindra Satyam To New Employer - FAQ'sbhavPas encore d'évaluation

- MA Florian Gronde Flashloans-Ohne AppendixDocument75 pagesMA Florian Gronde Flashloans-Ohne AppendixCollors TPLPas encore d'évaluation

- The Decision-Making Process of Fiscal Policy in Viet NamDocument21 pagesThe Decision-Making Process of Fiscal Policy in Viet NamADBI EventsPas encore d'évaluation

- Share Capital + Reserves Total +Document2 pagesShare Capital + Reserves Total +Pitresh KaushikPas encore d'évaluation

- Court Paperwork Regarding Detailing Foreclosure of Ramada PlazaDocument25 pagesCourt Paperwork Regarding Detailing Foreclosure of Ramada PlazaNews10NBCPas encore d'évaluation

- Management Information System (MIS)Document10 pagesManagement Information System (MIS)Md ImranPas encore d'évaluation

- BCTC Case 2Document10 pagesBCTC Case 2Trâm Nguyễn QuỳnhPas encore d'évaluation

- Money and BankingDocument8 pagesMoney and BankingMuskan RahimPas encore d'évaluation

- DR - Ritu Sapra - Distributions To ShareholdersDocument34 pagesDR - Ritu Sapra - Distributions To ShareholdersAdil AliPas encore d'évaluation

- Kick City Master Child Registration FormDocument2 pagesKick City Master Child Registration FormdanalbasPas encore d'évaluation

- CBSE Class 11 Accountancy Revision Notes Chapter-2 Theory Base of AccountingDocument8 pagesCBSE Class 11 Accountancy Revision Notes Chapter-2 Theory Base of AccountingAyush PatelPas encore d'évaluation

- Updated AP ListDocument12 pagesUpdated AP ListSusan KunklePas encore d'évaluation

- Fin542 Myr Againts Eur (Group 6 Ba2423d)Document9 pagesFin542 Myr Againts Eur (Group 6 Ba2423d)NAJWA SYAKIRAH MOHD SHAMSUDDINPas encore d'évaluation

- PM Sect B Test 5Document3 pagesPM Sect B Test 5FarahAin FainPas encore d'évaluation

- Stoic Lesson On FinanceDocument8 pagesStoic Lesson On Financefrank menshaPas encore d'évaluation

- Amazon Company ReportDocument9 pagesAmazon Company ReportjonsnowedPas encore d'évaluation

- Capital GainsDocument25 pagesCapital GainsanonymousPas encore d'évaluation

- Invitation To BidDocument1 pageInvitation To BidGladys Bernabe de VeraPas encore d'évaluation

- Rau's FEBRUARY Magazine - 2023 Final PDFDocument132 pagesRau's FEBRUARY Magazine - 2023 Final PDFshaik abdullaPas encore d'évaluation

- Strong Tie RatiosDocument2 pagesStrong Tie RatiosHans WeirlPas encore d'évaluation

- IGCSE2009 Accounting SAMsDocument44 pagesIGCSE2009 Accounting SAMsKhandaker Amir EntezamPas encore d'évaluation