Académique Documents

Professionnel Documents

Culture Documents

Adb2014 Sri Lanka

Transféré par

Randora LkDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Adb2014 Sri Lanka

Transféré par

Randora LkDroits d'auteur :

Formats disponibles

This chapter was written by Tadateru Hayashi, Nimali Hasitha Wickremasinghe, and

Savindi Jayakody of the Sri Lanka Resident Mission, Asian Development Bank, Colombo.

Sri Lanka

Growth rebounded last year from a slowdown in , and the current account deficit narrowed

substantially. As inflation eased, the central bank relaxed monetary policy. The outlook is for

sustained rapid growth leveraging easy private access to credit and the governments continued drive

to expand infrastructure. An improving external environment will lift trade, but the current account

deficit will expand on higher imports. Fiscal consolidation will focus on revenue enhancement.

Economic performance

GDP growth rebounded to 7.3% in 2013 (Figure 3.21.1). The recovery

reected domestic demand strengthening and a pickup in exports

and tourism. Faster growth in wholesale and retail trade, hotels

and restaurants, transport, banking, insurance and real estate lifted

performance in the large service sector to 6.4% from 4.6% a year earlier,

providing the impetus for the rebound. Industry grew by 9.9%, slightly

less than a year earlier, as slower growth in mining and quarrying and

in construction ofset a pickup in manufacturing and utilities. Favorable

weather helped maintain agriculture growth at a relatively favorable 4.7%.

Ination trended downward in 2013, averaging 6.9% for the year.

Food ination was at about 12% during the rst quarter, as drought late in

2012 had disrupted domestic food supplies, but then dropped markedly to

0.9% in February 2014 (Figure 3.21.2). Nonfood ination also moved lower

over the year but picked up to 7.1% in January 2014 on large increases in

communications and transport prices that month.

The 2013 scal decit is estimated at 5.8% of GDP, in line with the

target (Figure 3.21.3). The target was hit, despite unexpectedly weak

revenues, by compressing current expenditure. Capital expenditure was

largely maintained but was again slightly below the target of 6% of GDP.

Revenue including grants is estimated at 13.8% of GDP, lower than both

the budget and the 2012 performance. The shortfall in revenue partly

reected measures that curbed certain imports such as automobiles, which

suppressed value-added tax (VAT) collections and import-related taxes.

The ratio of government debt to GDP fell to 78.4% in September 2013

from 79.1% in 2012 (Figure 3.21.4). Debt composition is changing with the

gradual move toward marketable and non-concessional instruments and

foreign investment in government securities with the rise in income levels

as a middle income country.

To address weak growth evident in 2012, the Central Bank of Sri

Lanka relaxed its monetary stance for 2013, which was facilitated by a

declining trend in ination during the year. The bank began its relaxation

3.21.1 GDP growtb by sector

3.5

8.0

8.3 6.3

7.3

0

3

6

9

12

2009 2010 2011 2012 2013

%

Agriculture Industry

Services GDP

Soutce Depattmeot oj Ceosus aoa Stat|st|cs St| Lao|a. ottp//

www.stat|st|cs.gov.||/ (accessea I8 Matco 20I4).

3.21.2 !nf|ation

-5

0

5

10

15

Jan

2009

Jan

2010

Jan

2011

Jan

2012

Jan

2013

Feb

2014

%

Food Nonfood Overall

Soutce Depattmeot oj Ceosus aoa Stat|st|cs St| Lao|a. ottp//

www.stat|st|cs.gov.|| (accessea I0 Matco 20I4).

I88As|ao Deve|opmeot Out|oo| 20I4

in mid-December 2012 by cutting policy rates by 25 basis points and

continued in May and October 2013 with rate reductions of 50 points in

each adjustment (Figure 3.21.5). Commercial bank lending interest rates

declined markedly during the year from 14.3% in January 2013 to 9.9% in

December. However, credit to the private sector continued to decelerate

with year-on-year growth slowing to 7.5% in December 2013 from 17.6% at

the end of 2012.

After the sharp depreciation of the Sri Lanka rupee in the early months

of 2012, when the exchange rate was allowed to oat, the currency has

been broadly stable against the US dollar (Figure 3.21.6). Foreign investors

exit from emerging markets in mid-2013 had only a modest and temporary

efect on the exchange rate. The rupee depreciated against the dollar by

only 1.9% over 2013. The real efective exchange rate has risen markedly

since April 2012, essentially moving back to the rate prevailing prior to the

decision to let the currency oat.

Exports and imports both posted positive growth only in the second

half of 2013, following weakness a year earlier. Export earnings increased

by 6.3% for the year to $10.4 billion, reecting gradual recovery of demand

in partner countries, with garment exports increasing by 13.0% and

agricultural exports, mostly tea, advancing by 10.7%. Imports, on the

other hand, declined by 6.2% during 2013 to $18.0 billion, as a result of less

demand for oil, policy measures adopted in 2012 to rationalize imports, and

subdued commodity prices in international markets. Most of the fall was

due to reduced imports of transport equipment by 32.7% and fuel by 14.7%.

The trade decit fell to 11.4% of GDP, a marked decline of 4.4 percentage

points from 2012.

The tourism boom continued in 2013 with the number of visitors

growing by 27% to reach 1.2 million and earnings expanding by 35% to

$1.4 billion. Tourist arrivals from the Peoples Republic of China and the

Russian Federation increased signicantly, but Western Europe continued

to be a large source of visitors. Workers remittances expanded by 13% to

$6.8 billion in 2013. The main factors boosting remittance inows were

increased labor migration under the professional and skilled category, the

expansion of formal channels for remitting money, and the introduction of

a swift web-based money-transfer system. These earnings held the current

account decit to an estimated $1.4 billion, which is an estimated 2.0%

of GDP and a marked improvement on the 6.6% decit seen a year earlier

(Figure 3.21.7).

Portfolio investments recorded a net inow of $269.9 million for the

year, of which about half went into the Colombo Stock Exchange in the

form of secondary market transactions. Foreigners monthly net purchases

on the exchange were broadly stable throughout the year. Foreign direct

investment increased by 42% to $870.1 million in the rst 9 months of

2013 from the corresponding period in 2012. Financial account net inows

brought the balance of payments surplus to an estimated $700 million.

Consequently, Sri Lankas gross ofcial reserves increased to $7.2 billion in

December 2013, equal to 4.5 months of imports (Figure 3.21.8).

3.21.3 Fisca| indicators

-10

0

10

20

30

40

-500

0

500

1,000

1,500

2,000

2009 2010 2011 2012 2013 2014

% of GDP

SLRs billion

Tax revenue Nontax revenue

Grants Recurrent expenditure

Investment & net lending Foreign financing

Domestic financing Budget balance (right axis)

Budget estimate

Soutces Ceotta| ao| oj St| Lao|a. 20I3. Aooua| Pepott 20I2.

ottp//www.cos|.||, M|o|stty oj l|oaoce aoa P|aoo|og aoa toe

Tteasuty oj St| Lao|a. 20I3. uaget Speeco 20I4. ottp//www.

tteasuty.gov.||

3.21.4 Government debt

86.2

81.9

78.5 79.1 78.4

0

30

60

90

2009 2010 2011 2012 2013

% of GDP

Domestic Foreign

Note Data jot 20I3 |s up to eoa oj Septemoet.

Soutce Ceotta| ao| oj St| Lao|a. 20I3. Aooua| Pepott 20I2.

ottp//www.cos|.||

3.21.5 Credit growtb and interest rates

0

25

50

75

Jan

2012

Jul Jan

2013

Jul Jan

2014

0

5

10

15

% %

Weighted average prime lending rate

Repurchase rate

Reverse-repurchase rate

Government sector credit growth (right axis)

Private sector credit growth (right axis))

Soutce Ceotta| ao| oj St| Lao|a. Wee||y cooom|c

loa|catots. ottp//www.cos|.|| (accessea I8 Matco 20I4).

cooom|c tteoas aoa ptospects |o aeve|op|og As|a Souto As|a St| Lao|aI89

Economic prospects

An improving external environment, higher investments, and a recovery

in domestic consumption will sustain a rapid pace of GDP growth in the

next 2 years. The recent relaxation in monetary policy will allow more

lending to the private sector and provide an impetus for expansion. Sri

Lankas post-conict growth has been buoyed by construction, which

has increased its share of GDP from 6.6% in 2009 to 8.1% in 2012, and

by transport and telecommunications, its share up from 12.8% to 14.3%

in the same period. The governments focus on infrastructure and post-

conict reconstruction and development has supported this expansion

and will continue to drive growth in the medium term. The expansion

in tourism and related construction has been noteworthy and is

reected in hotel and restaurant expansion, though modest scale limits

the contribution to growth. As tourist numbers continue to rise rapidly

and large hotel projects in the pipeline open their doors, economic

growth and foreign exchange earnings from tourism will continue to be

buoyant over the next several years.

On the demand side, the investment ratio improved from 28%

in 2010 to 31% in 2013. This gradual gain reects the governments

infrastructure drive and the expansion in construction. Monetary

policy relaxation will start to take efect on private sector credit

around mid-2014 and continue in 2015, facilitating private investment.

Moreover, foreign direct investment is expected to continue to expand

as the economy strengthens and the investment climate improves.

Exports, having recovered since mid-2013, will continue to expand.

With these factors pushing up income, private consumption will pick

up after slowing in 2013 and contribute signicantly to higher growth.

Growth is thus expected to accelerate to 7.5% in 2014 and maintain that

rate in 2015.

While high ination has been a problem in the past, it has been

contained below 10% since 2009. Ination is expected to remain in the

middle single digits in 2014 and 2015. Broadly stable international fuel

and food prices will help to keep ination in check over the next 2 years,

assuming normal weather. While high ination in the past has been

attributed to governments borrowing from banks, among other things,

improved scal discipline and a falling scal decit have eased such

inationary pressures in recent years.

As the pace of economic growth picks up, the central bank will use

monetary policy to keep ination acceptable. In January 2014 the bank

compressed the policy rate corridor, now renamed the standing rate

corridor, to reduce variability in the transmission of its policy intentions,

and then continued with monetary easing. The standing lending facility

rate (the upper band) was cut by 50 basis points to 8.0%, narrowing the

corridor to 150 basis points from 200. Credit to the private sector, which

decelerated throughout 2013, will expand in 2014 by 16%, according to

central bank projections. However, broad money is expected to grow

at a slower pace as credit demand from the public sector will decline.

Average ination in 2014 is expected to fall to 5.0% from 6.9% in 2013,

then accelerates slightly to 6.0% in 2015.

The scal decit steadily shrank to 5.8% of GDP in 2013 from a peak

of 9.9% in 2009. The government has deployed both revenue measures

3.21.1Se|ected economic indicators ()

2014 2015

GDP growth 7.5 7.5

Ination 5.0 6.0

Current account balance

(share of GDP)

2.6 3.5

Source: ADB estimates.

3.21.6 Excbange rates

100

110

120

130

140 70

80

90

100

110

Jan

2011

Jul Jan

2012

Jul Jan

2013

Jul Dec

SLRs/$

Index, 2010

= 100

Nominal effective

Real effective

Monthly average (right axis)

Soutce Ceotta| ao| oj St| Lao|a. ottp//www.cos|.||

(accessea I8 Matco 20I4).

3.21.7 Current account components

-40

-20

0

20

40

2009 2010 2011 2012 2013

% of GDP

Exports Imports

Services balance Income balance

Current transfers Current account balance

Soutces Ceotta| ao| oj St| Lao|a. 20I3. Aooua| Pepott

20I2, Ceotta| ao| Ptess Pe|ease. ottp//www.cos|.||, AD

est|mates.

I90As|ao Deve|opmeot Out|oo| 20I4

and expenditure reduction to narrow the decit. However, the revenue

ratiotax collections as a percentage of GDPhas not picked up as

expected, so decit reduction has been achieved mainly by rationalizing

expenditure. The government expects the decit to narrow further

over the medium term. The 2014 budget estimates the decit at 5.2%,

with a higher revenue ratio and expansive 16% growth in expenditure.

Better economic performance and more imports will catalyze higher

revenue collection in 2014 and 2015, but continued policy action is also

needed, together with improved revenue administration, to achieve

a higher revenue ratio. Some measures are being introduced through

the 2014 budget to broaden the revenue base, such as expanding the

nation building tax (NBT) to the nancial sector and lowering the VAT

threshold for retail and wholesale trade. The NBT is an indirect tax

that has been levied since 2009 to help nance rehabilitation of conict

damage; it is passed on in the sales price of goods or services sold.

One risk to achieving the targeted revenue ratio is that the

measures to expand the revenue base may take efect more slowly than

anticipated. If revenue collection is lower than anticipated, the capital

budget will be hard pressed to meet its target of 6%7% of GDP, as

expenditure rationalization is already substantial in the 2014 budget and

2015 projections.

Exports are expected to strengthen with better economic

performance in the EU and the US, Sri Lankas main export

destinations. After declining in 2013, imports will pick up in 2014 as

domestic demand normalizes. However, policy measures taken to limit

food imports to support local production will afect imports in the

medium term. Measures that helped improve remittances will continue

to bolster such inows in 2014 and 2015. The current account decit is

projected to widen from an estimated 2.0% in 2013 to 2.6% in 2014 and

3.5% in the following year (Figure 3.21.9).

Po|icy cba||engeboosting sca| revenues

Sri Lanka has been focusing on scal consolidation and taking many

steps in recent years to improve revenue collection. However, the revenue

ratio (excluding grants) remains low, at 13.6% of GDP in 2013 (Figure

3.21.10). In fact, it has fallen over the past few years, underperforming

its target each year. As the government continues its scal consolidation,

reversing the revenue ratios declining trend is critical.

The main cause for the erosion of the revenue ratio has been the

VAT, which accounts for 25% of tax revenue. VAT revenue has declined

from 5.8% of GDP in 2004 to 2.7% of GDP in 2012 (Figure 3.21.11).

The VAT was introduced in 2002, replacing the goods and services

tax with rates of 0%, 10%, and 20%. There are many exemptions: food

such as rice, wheat, tea, and domestically produced sugar; machinery,

including that for agriculture and construction; and other items such

as crude oil, diesel, kerosene, liqueed petroleum gas, electricity,

and public transportation. Many amendments to the VAT Act have

taken place since 2002, mainly to improve collection. However, VAT

collection has relentlessly declined, afected by exemptions, the

3.21.8 Gross officia| reserves

0

3

6

9

0

3

6

9

Jan

2009

Jan

2010

Jan

2011

Jan

2012

Jan

2013

Dec

Months of

imports $ billion

Amount Import cover (right axis)

Soutce Ceotta| ao| oj St| Lao|a. Wee||y cooom|c

loa|catots. ottp//www.cos|.gov.|| (accessea I8 Matco 20I4).

3.21.9 Current account indicators

-15

-10

-5

0

5

10

-30

-20

-10

0

10

20

2008 2009 2010 2011 2012 2013 2014 2015

% of GDP $ billion

Exports

Imports

Current account balance (right axis)

Forecasts

Note 20I3 va|ues ate est|mates.

Soutces Ceotta| ao| oj St| Lao|a. 20I3. Aooua| Pepott

20I2. Ceotta| ao| Ptess Pe|ease. ottp//www.cos|.||, AD

est|mates.

3.21.10 Government finance

0

10

20

30

2009 2010 2011 2012 2013 2014

% of GDP

Bugdet deficit

Revenue excluding grants

Expenditure

Budg

Soutces Ceotta| ao| oj St| Lao|a. 20I3. Aooua| Pepott 20I2.

ottp//www.cos|.||, M|o|stty oj l|oaoce aoa P|aoo|og aoa toe

Tteasuty oj St| Lao|a. 20I3. uaget Speeco 20I4. ottp//www.

tteasuty.gov.||

cooom|c tteoas aoa ptospects |o aeve|op|og As|a Souto As|a St| Lao|aI9I

unication of the rate at 12% in 2011, and the poor performance of

imports since 2009.

In the context of faster growth reached in the post-conict

years and increased income per capita, the low revenue ratio implies

that revenue generation has not kept pace with the rising capacity

of the population to pay. Average tax buoyancyhow well revenue

mobilization tracks GDP growthhas hovered for the past 5 years

at 0.78, which is signicantly below unity. This indicates that tax

collection has been unresponsive to the pace of economic expansion.

A study released in 2013 by the International Monetary Fund

entitled Understanding Countries Tax Efort estimates Sri Lankas tax

capacity at 21.9% of GDP, one of the lowest in South Asia. This suggests

that strengthening institutions and improving administration can

increase tax capacity. With regard to eforts at scal consolidation, so

far the reduction in the decit has come about mainly by rationalizing

expenditure. However, improving the revenue ratio is key to reining

in the scal decit to a sustainable level and ensuring that public

investment is not curtailed. As interest payments are a large drain

on Sri Lankas budget, higher revenue collection will contribute to

lowering the borrowing requirement and future borrowing costs to the

government.

The government recognizes the importance of improving the

revenue ratio and has set up a tax reform committee. The committee

submitted reform recommendations in 2009 that began to be

introduced through the 2010 budget. The major tax reform in 2011

reduced rates as it sought to broaden the tax base. Many rationalization

measures were introduced, including simplifying the economic service

charge (a tax withholding system) and lowering the tax slabs of the

personal income tax. In 2013, the government expanded the VAT base

by bringing in the retail trade, which had been exempt. The 2014

budget introduced further measures to expand coverage and lower the

threshold for certain taxes, such as expanding the nation building tax

to the nancial sector and lowering the VAT threshold for the retail

and wholesale trades.

The government has brought the Board of Investment under the

Inland Revenue Act in an efort to limit exemptions and tax holidays

provided to new companies that apply for incentives. Many existing

concessions are ending in the near future, which will broaden the

tax base. The government expects the reforms introduced in recent

years to contribute to a higher revenue ratio in 2014. It is currently

implementing in the Inland Revenue Department the new Revenue

Administration Information System to make revenue collection more

efcient.

3.21.11 GDP sbare of tax revenue

0

2

4

6

2004 2006 2008 2010 2012

% of GDP

Taxes on foreign trade

VAT

Exercise tax

Income tax etc

Others

Soutce Ceotta| ao| oj St| Lao|a. cooom|c Stat|st|cs 20I3.

ottp//www.cos|.||

Vous aimerez peut-être aussi

- Hotel Master Critical PathDocument14 pagesHotel Master Critical Pathtaola80% (25)

- Problems On Cash Budget MBADocument3 pagesProblems On Cash Budget MBAsafwanhossainPas encore d'évaluation

- Admin Assistant III IPCRFDocument8 pagesAdmin Assistant III IPCRFJeond Jeff88% (8)

- Egypt's Foreign Currency Crisis ExplainedDocument34 pagesEgypt's Foreign Currency Crisis ExplainedShashank VarmaPas encore d'évaluation

- Philippines fiscal policy overviewDocument4 pagesPhilippines fiscal policy overviewEmmanuel Jimenez-Bacud, CSE-Professional,BA-MA Pol Sci100% (1)

- India Special Report - Assessing The Economic Impact of India's Real Estate Sector - CREDAI CBREDocument20 pagesIndia Special Report - Assessing The Economic Impact of India's Real Estate Sector - CREDAI CBRErealtywatch108Pas encore d'évaluation

- Barangay Development CouncilDocument5 pagesBarangay Development CouncilJohny VillanuevaPas encore d'évaluation

- BOM For LGUs 2023 Edition - Fin1 - UnlockedDocument329 pagesBOM For LGUs 2023 Edition - Fin1 - UnlockedNatacia Rimorin-Dizon100% (2)

- NIFK16289689Document28 pagesNIFK16289689Yuki TakenoPas encore d'évaluation

- Pakistan's Economic Performance and Prospects in FY2014Document6 pagesPakistan's Economic Performance and Prospects in FY2014Abdul Ghaffar BhattiPas encore d'évaluation

- SA's 2013 National Budget focuses on fiscal disciplineDocument7 pagesSA's 2013 National Budget focuses on fiscal disciplineBrilliant MycriPas encore d'évaluation

- Nepal's Economic Growth, Fiscal Stability and Financial Sector ReformsDocument7 pagesNepal's Economic Growth, Fiscal Stability and Financial Sector Reformsakyadav123Pas encore d'évaluation

- Prospects 2012Document7 pagesProspects 2012IPS Sri LankaPas encore d'évaluation

- Snapshot of Bosnia and HerzegovinaDocument53 pagesSnapshot of Bosnia and HerzegovinaDejan ŠešlijaPas encore d'évaluation

- Press 20140408eaDocument7 pagesPress 20140408eaRandora LkPas encore d'évaluation

- India Union Budget 2013 PWC Analysis BookletDocument40 pagesIndia Union Budget 2013 PWC Analysis BookletsuchjazzPas encore d'évaluation

- Update On Indian Economy, March 2013Document12 pagesUpdate On Indian Economy, March 2013megaacePas encore d'évaluation

- Malaysian Economy Grows 6.4% in Q4 2012Document7 pagesMalaysian Economy Grows 6.4% in Q4 2012Yana NanaPas encore d'évaluation

- Budget PublicationDocument50 pagesBudget PublicationAmit RajputPas encore d'évaluation

- Bangladesh Economic Brief 2012 May 31Document18 pagesBangladesh Economic Brief 2012 May 31Mohammad MynoddinPas encore d'évaluation

- Regional GDP Growth Slows Further to 4.7% in 1Q12Document9 pagesRegional GDP Growth Slows Further to 4.7% in 1Q12enleePas encore d'évaluation

- Case Study On NDB and DFCCDocument34 pagesCase Study On NDB and DFCCRantharu AttanayakePas encore d'évaluation

- Pakistan Economic Survey 2011-12 PDFDocument286 pagesPakistan Economic Survey 2011-12 PDFAli RazaPas encore d'évaluation

- Monetary Policy Statement September 2013 HighlightsDocument42 pagesMonetary Policy Statement September 2013 HighlightsScorpian MouniehPas encore d'évaluation

- Country Strategy 2011-2014 MoldovaDocument21 pagesCountry Strategy 2011-2014 MoldovaBeeHoofPas encore d'évaluation

- Getting To The Core: Budget AnalysisDocument37 pagesGetting To The Core: Budget AnalysisfaizanbhamlaPas encore d'évaluation

- Bangladesh Quarterly Economic Update - September-December 2012Document29 pagesBangladesh Quarterly Economic Update - September-December 2012Asian Development BankPas encore d'évaluation

- Main Indicators: GDP, State Budget, Foreign Trade, Exchange Rate, InflationDocument5 pagesMain Indicators: GDP, State Budget, Foreign Trade, Exchange Rate, InflationUrtaBaasanjargalPas encore d'évaluation

- The World Bank Group - Tajikistan Partnership Program SnapshotDocument31 pagesThe World Bank Group - Tajikistan Partnership Program SnapshotamudaryoPas encore d'évaluation

- Therefore GDP C+ G+ I + N ExDocument10 pagesTherefore GDP C+ G+ I + N Exyashasheth17Pas encore d'évaluation

- Economic and Social Survey of Asia and The Pacific 2013 - Briefing Notes For The Launch in AnkaraDocument2 pagesEconomic and Social Survey of Asia and The Pacific 2013 - Briefing Notes For The Launch in AnkaraUNDP TürkiyePas encore d'évaluation

- Bank of Tanzania Mid-Year Monetary Policy ReviewDocument58 pagesBank of Tanzania Mid-Year Monetary Policy Reviewafzallodhi736Pas encore d'évaluation

- Acroeconomic Cenario: Source: Please See AnnexureDocument2 pagesAcroeconomic Cenario: Source: Please See AnnexureehsankabirPas encore d'évaluation

- Maybank May 2013 IssueDocument12 pagesMaybank May 2013 IssueMarlon MoncadaPas encore d'évaluation

- Pakistan's Resilient Economy Shows Signs of RecoveryDocument15 pagesPakistan's Resilient Economy Shows Signs of RecoveryMian HamzaPas encore d'évaluation

- Kinh Te 2013-2014Document2 pagesKinh Te 2013-2014Olivia TranPas encore d'évaluation

- Cambodia 1433Document60 pagesCambodia 1433Tanmay SahaiPas encore d'évaluation

- Vanuatu Article IV Consultation 2013Document52 pagesVanuatu Article IV Consultation 2013Kyren GreiggPas encore d'évaluation

- State of EconomyDocument21 pagesState of EconomyHarsh KediaPas encore d'évaluation

- Investment Growth Factors Pakistan EconomyDocument5 pagesInvestment Growth Factors Pakistan EconomyaoulakhPas encore d'évaluation

- Economics GNP MalaysiaDocument14 pagesEconomics GNP Malaysiakayrul700% (1)

- Updated Sept 10 2013 - EB July 2013Document120 pagesUpdated Sept 10 2013 - EB July 2013Kyren GreiggPas encore d'évaluation

- Budget 2015-16Document100 pagesBudget 2015-16bazitPas encore d'évaluation

- 2012 Budget PublicationDocument71 pages2012 Budget PublicationPushpa PatilPas encore d'évaluation

- Update On Indian Economy November 2013 - Mega Ace ConsultancyDocument10 pagesUpdate On Indian Economy November 2013 - Mega Ace ConsultancyMegaAceConsultancyPas encore d'évaluation

- Assignment OnDocument30 pagesAssignment OnMashruk AhmedPas encore d'évaluation

- China's Economic Trend Under The Impact of The EpidemicDocument10 pagesChina's Economic Trend Under The Impact of The EpidemicRumi AzhariPas encore d'évaluation

- UBL Financial StatementsDocument23 pagesUBL Financial StatementsUsmAn MajeedPas encore d'évaluation

- India's Economic Position Despite Slowdown in GrowthDocument21 pagesIndia's Economic Position Despite Slowdown in GrowththakursahbPas encore d'évaluation

- Full AssignmentDocument37 pagesFull AssignmentMd Sifat Khan83% (6)

- The Ghanaian Cedi Depreciation - The Way To GoDocument5 pagesThe Ghanaian Cedi Depreciation - The Way To GoIsaac MensahPas encore d'évaluation

- State of The Economy 2011Document8 pagesState of The Economy 2011agarwaldipeshPas encore d'évaluation

- Monetary Policy Statement: State Bank of PakistanDocument32 pagesMonetary Policy Statement: State Bank of Pakistanbenicepk1329Pas encore d'évaluation

- Prospects 2010Document5 pagesProspects 2010IPS Sri LankaPas encore d'évaluation

- DirectorDocument49 pagesDirectorrohitkoliPas encore d'évaluation

- Press 20130117eDocument2 pagesPress 20130117eran2013Pas encore d'évaluation

- Fiscal Situation of PakistanDocument9 pagesFiscal Situation of PakistanMahnoor ZebPas encore d'évaluation

- Global Economic Prospects January 2013Document16 pagesGlobal Economic Prospects January 2013Dhananjaya HathurusinghePas encore d'évaluation

- Mustard Garment Industry: 1. Remittance 2. Inflation 3. Exchange Rate 4. GDP GrowthDocument9 pagesMustard Garment Industry: 1. Remittance 2. Inflation 3. Exchange Rate 4. GDP GrowthTanjeemPas encore d'évaluation

- Economic Analysis of IndiaDocument120 pagesEconomic Analysis of Indiamonish147852Pas encore d'évaluation

- Madagascar 2013Document15 pagesMadagascar 2013HayZara MadagascarPas encore d'évaluation

- HS101 ProjectDocument5 pagesHS101 ProjectRevathi KotniPas encore d'évaluation

- Republic of the Congo Economic OverviewDocument15 pagesRepublic of the Congo Economic OverviewKunal BagadePas encore d'évaluation

- LNG Investment in Mozamibique (Final)Document15 pagesLNG Investment in Mozamibique (Final)Denis KipkoechPas encore d'évaluation

- Thailand's Economic Performance in Q4 and Outlook For 2012 - 0Document36 pagesThailand's Economic Performance in Q4 and Outlook For 2012 - 0thailand2dayPas encore d'évaluation

- Global Market Update - 04 09 2015 PDFDocument6 pagesGlobal Market Update - 04 09 2015 PDFRandora LkPas encore d'évaluation

- Weekly Update 04.09.2015 PDFDocument2 pagesWeekly Update 04.09.2015 PDFRandora LkPas encore d'évaluation

- Weekly Foreign Holding & Block Trade Update: Net Buying Net SellingDocument4 pagesWeekly Foreign Holding & Block Trade Update: Net Buying Net SellingRandora LkPas encore d'évaluation

- Wei 20150904 PDFDocument18 pagesWei 20150904 PDFRandora LkPas encore d'évaluation

- 03 September 2015 PDFDocument9 pages03 September 2015 PDFRandora LkPas encore d'évaluation

- Press 20150831ebDocument2 pagesPress 20150831ebRandora LkPas encore d'évaluation

- ICRA Lanka Assigns (SL) BBB-rating With Positive Outlook To Sanasa Development Bank PLCDocument3 pagesICRA Lanka Assigns (SL) BBB-rating With Positive Outlook To Sanasa Development Bank PLCRandora LkPas encore d'évaluation

- Daily 01 09 2015 PDFDocument4 pagesDaily 01 09 2015 PDFRandora LkPas encore d'évaluation

- Press 20150831ea PDFDocument1 pagePress 20150831ea PDFRandora LkPas encore d'évaluation

- Global Market Update - 04 09 2015 PDFDocument6 pagesGlobal Market Update - 04 09 2015 PDFRandora LkPas encore d'évaluation

- CCPI - Press Release - August2015 PDFDocument5 pagesCCPI - Press Release - August2015 PDFRandora LkPas encore d'évaluation

- Sri0Lanka000Re0ounting0and0auditing PDFDocument44 pagesSri0Lanka000Re0ounting0and0auditing PDFRandora LkPas encore d'évaluation

- Results Update Sector Summary - Jun 2015 PDFDocument2 pagesResults Update Sector Summary - Jun 2015 PDFRandora LkPas encore d'évaluation

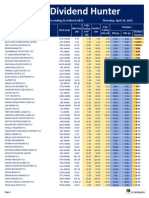

- Dividend Hunter - Apr 2015 PDFDocument7 pagesDividend Hunter - Apr 2015 PDFRandora LkPas encore d'évaluation

- Earnings & Market Returns Forecast - Jun 2015 PDFDocument4 pagesEarnings & Market Returns Forecast - Jun 2015 PDFRandora LkPas encore d'évaluation

- Earnings Update March Quarter 2015 05 06 2015 PDFDocument24 pagesEarnings Update March Quarter 2015 05 06 2015 PDFRandora LkPas encore d'évaluation

- BRS Monthly (March 2015 Edition) PDFDocument8 pagesBRS Monthly (March 2015 Edition) PDFRandora LkPas encore d'évaluation

- Results Update For All Companies - Jun 2015 PDFDocument9 pagesResults Update For All Companies - Jun 2015 PDFRandora LkPas encore d'évaluation

- Dividend Hunter - Mar 2015 PDFDocument7 pagesDividend Hunter - Mar 2015 PDFRandora LkPas encore d'évaluation

- Daily - 23 04 2015 PDFDocument4 pagesDaily - 23 04 2015 PDFRandora LkPas encore d'évaluation

- Dividend Hunter - Mar 2015 PDFDocument7 pagesDividend Hunter - Mar 2015 PDFRandora LkPas encore d'évaluation

- Microfinance Regulatory Model PDFDocument5 pagesMicrofinance Regulatory Model PDFRandora LkPas encore d'évaluation

- GIH Capital Monthly - Mar 2015 PDFDocument11 pagesGIH Capital Monthly - Mar 2015 PDFRandora LkPas encore d'évaluation

- CRL Corporate Update - 22 04 2015 - Upgrade To A Strong BUY PDFDocument12 pagesCRL Corporate Update - 22 04 2015 - Upgrade To A Strong BUY PDFRandora LkPas encore d'évaluation

- Janashakthi Insurance Company PLC - (JINS) - Q4 FY 14 - SELL PDFDocument9 pagesJanashakthi Insurance Company PLC - (JINS) - Q4 FY 14 - SELL PDFRandora LkPas encore d'évaluation

- N D B Securities (PVT) LTD, 5 Floor, # 40, NDB Building, Nawam Mawatha, Colombo 02. Tel: +94 11 2131000 Fax: +9411 2314180Document5 pagesN D B Securities (PVT) LTD, 5 Floor, # 40, NDB Building, Nawam Mawatha, Colombo 02. Tel: +94 11 2131000 Fax: +9411 2314180Randora LkPas encore d'évaluation

- Chevron Lubricants Lanka PLC (LLUB) - Q4 FY 14 - SELL PDFDocument9 pagesChevron Lubricants Lanka PLC (LLUB) - Q4 FY 14 - SELL PDFRandora LkPas encore d'évaluation

- The Morality of Capitalism Sri LankiaDocument32 pagesThe Morality of Capitalism Sri LankiaRandora LkPas encore d'évaluation

- Weekly Foreign Holding & Block Trade Update - 02 04 2015 PDFDocument4 pagesWeekly Foreign Holding & Block Trade Update - 02 04 2015 PDFRandora LkPas encore d'évaluation

- Daily Stock Watch 08.04.2015 PDFDocument9 pagesDaily Stock Watch 08.04.2015 PDFRandora LkPas encore d'évaluation

- New Haven Budget 2020-21Document485 pagesNew Haven Budget 2020-21Helen Bennett100% (1)

- Ethiopia Report - Jan 2020Document71 pagesEthiopia Report - Jan 2020Shime HI RayaPas encore d'évaluation

- Master's Thesis - Factors Affecting Theatrical Success of Films: An Empirical ReviewDocument45 pagesMaster's Thesis - Factors Affecting Theatrical Success of Films: An Empirical Reviewsiddharth_uPas encore d'évaluation

- Pork BarrelDocument2 pagesPork BarrelJunjun16 JayzonPas encore d'évaluation

- Edney Company Employs A Standard Cost System For Product CostingDocument2 pagesEdney Company Employs A Standard Cost System For Product CostingAmit PandeyPas encore d'évaluation

- Evaluation GridDocument6 pagesEvaluation GridDaniel BWINO AMANYAPas encore d'évaluation

- Finance Process FlowDocument13 pagesFinance Process FlowHasan NasirPas encore d'évaluation

- CH 1 Gov - AccountingDocument16 pagesCH 1 Gov - AccountingMohamed DiabPas encore d'évaluation

- Boulder City Tentative Capital Improvement Plan Presentation and Executive SummaryDocument46 pagesBoulder City Tentative Capital Improvement Plan Presentation and Executive SummaryBoulder City ReviewPas encore d'évaluation

- Accounting for Government Budgetary AccountsDocument33 pagesAccounting for Government Budgetary AccountsRia BagoPas encore d'évaluation

- Abstract: Budget Process and Performance of Local Governments in IndonesiaDocument1 pageAbstract: Budget Process and Performance of Local Governments in IndonesiaHarryanto EndhyPas encore d'évaluation

- Master Budget Example MC Watters AIP8-13Document2 pagesMaster Budget Example MC Watters AIP8-13Muhammed muhabaPas encore d'évaluation

- Zero Based Budgeting OverviewDocument4 pagesZero Based Budgeting OverviewSazidur RahmanPas encore d'évaluation

- Colloquim Jan 29 Abstract Corrected Jan 6Document87 pagesColloquim Jan 29 Abstract Corrected Jan 6bryan001935Pas encore d'évaluation

- Cost accounting and financial managementDocument22 pagesCost accounting and financial managementEsha Bhardwaj100% (1)

- Capacity Assessment Checklist (CACHE) For CSO/NGODocument1 pageCapacity Assessment Checklist (CACHE) For CSO/NGOTaskin Reza KhalidPas encore d'évaluation

- The Importance and Use of Budgets Within An OrganizationDocument6 pagesThe Importance and Use of Budgets Within An OrganizationAndrei MunteanuPas encore d'évaluation

- PESS and PCER Report PDFDocument29 pagesPESS and PCER Report PDFEm Calvento MacaraegPas encore d'évaluation

- City of Oneida Department SalariesDocument1 pageCity of Oneida Department SalariesOneida Daily DispatchPas encore d'évaluation

- Third Outline Perspective Plan (Opp3) Chapter 3 - Macro Economic PerspectiveDocument24 pagesThird Outline Perspective Plan (Opp3) Chapter 3 - Macro Economic PerspectiveChristy BrownPas encore d'évaluation

- Review Materials Chapters 8, 10, 3 & 4 Term 3 Y18-19 PDFDocument19 pagesReview Materials Chapters 8, 10, 3 & 4 Term 3 Y18-19 PDFKrizelle Anne TaguinodPas encore d'évaluation

- Consumer Theory Practice ProblemsDocument22 pagesConsumer Theory Practice Problemsben114Pas encore d'évaluation

- DLG Chapter 4 (Combined)Document14 pagesDLG Chapter 4 (Combined)Puth RathanaPas encore d'évaluation