Académique Documents

Professionnel Documents

Culture Documents

Alcohol Market Trends - AU - April 2009

Transféré par

Priya JainDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Alcohol Market Trends - AU - April 2009

Transféré par

Priya JainDroits d'auteur :

Formats disponibles

Alcohol trends markets and innovations

Analyses and forecasts, compiled from Business Insights 2008/9 reports

Anders Ulstein

April 2009

Eurocare Secretariat:

Rue des Confdr 96-98, 1000 Brussels, Belgium Tel +32 2 736 05 72 info@eurocare.org

Alcohol trends markets and innovations

Analyses and forecasts, compiled from Business Insights 2008/9 reports

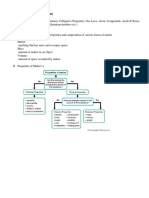

Asia leads the way W-Europe decline E-Europe strong growth innovations in health and size. While consumers in emerging markets tend to drink like Europeans, Western Europe itself is of relative less importance to the producers compared to the opportunities in Eastern Europe, Russia and Asia and other emerging markets. Market analysts predict solid global growth in the coming three year period in spite of financial crises. Innovations to watch are trends in packaging/size/labeling and in health.

Major market developments Most big alcohol producers performed well over the last years. In Western Europe some companys continue to see stagnation and fall in sales, and equally some countries like Germany, France and Spain are expected to see a fall in volume consumption, in particular in beer and wine over the next years. Company strategies are therefore mainly to focus on emerging markets in particular in Asia and Russia but also Eastern Europe and not least on innovation and new products. According to Business Insights the three key drivers of growth are 1) the expansion of the worlds young adult population, 2) the emergence and growth of the middle class with disposable income, and, to a lesser extent, 3) consumers desire to trade-up to more premium products. In short, Asia and a few other developing economies see a huge increase in people with money to spend on alcohol and increasingly on more expensive alcohol. For example, there are an estimated 300 million young, upwardly-mobile consumers in India alone. These young adults and the emerging middle class are increasingly taking over the patterns of consumption from Europe. Premiumisation is one of them as well as the ascendency of more female drinkers and a tendency to switch from traditional spirits to wine and beer. The shift from beer to wine will continue in countries like the UK and Sweden which will increasingly be established as high beer and high wine consumers together with some countries in Eastern Europe. Wine consumption will continue to grow at a steady pace in Western Europe, the worlds biggest consumer of wine. Interestingly, the Italian wine market continues to grow both in value and volume terms while the decrease in Spain continues. In France there is a small value growth but volume fall.

Eurocare 2009

Alcohol Trends

Asia-Pacific was the largest beer market in volume terms (with 62bn liters sold), followed by Western Europe (29bn litres) and North America (28bn). In 2012 compared to 2007 62% of the global increase of beer/cider/FABs will take place in Asia-Pacific and 29% will be in Eastern Europe while there will continue to be a decline in the Western European market. The global growth in beer market is largely caused by an increase in disposable income. Sales volumes in beer are expected to reach 210m hectolitres in 2011, with the Middle East and Africa contributing 6.0% of the total volume growth, Central and South America 19.5%, Asia 55.0% and Eastern Europe 19.5%. The biggest increase in consumption per capita is expected to take place in Eastern Europe, Business Insights predicts, for both beer and wine. 40% of the worlds increase in wine consumption in the next three years will take place in Eastern Europe. Poland will see a substantial growth in beer consumption in the coming three years, followed by Romania and Ukraine. In 2008 the Romanian beer market grew by around 10%, although Business Insights believes this rate of growth will not be sustained as the market reaches maturity over the next five years. By this time Romanian per head consumption is likely to be one of the highest in Europe. The biggest overall business opportunity will be in Russia, says Business Insights, where beer is still benefiting from consumers switching from vodka. And for the RTDs, they are still a very small part of the alcohol market, only about 1% of the total beer/cider/RTD sales globally. The category is still interesting in particular markets of Europe like in Germany where it is forecast to continue its strong growth. RTDs are interesting category in terms of its role in innovation and segmentation and because of the controversies surrounding drinking and young people. Business Insights believes the key consumer drivers for RTDs are: The desire for healthier, less alcoholic products; The desire to socialize more without increasing ones alcohol consumption; The demand for more, particularly sweeter and fruitier, flavors; The growing consumption of alcoholic drinks by young adult women.

Eurocare 2009

Alcohol Trends

In plain words its a party drink for young women, as it has been. The world spirits market has slowed for several years largely because of the fall in vodka consumption in Eastern Europe. Spirits market is forecast to rise substantially over the period 20072012. Almost 70% of this increase will take place in Asia-Pacific, and almost a third (31%) will be in India alone. In Western Europe and North America distillers are increasingly looking to the female market for growth. At the same time they are seeking to build on the growing reputation of spirits as a healthier alternative to beer, Business Insights predicts.

Good times for the biggest producers Consolidation is expected to continue in the alcohol industry, as players seek to add new brands to their portfolio and enhance their market positions. As of June 2007, the top five brewers accounted for 50.0% of the global beer market. This has led to globalization, with the top 20 brewers generating on an average 53.0% of sales from outside their traditional home markets as compared with 33.0% in 2001. Beer mega-brands will emerge with near universal availability. They will also enable brewers to streamline marketing by creating different sub-brands that feature different product attributes or target particular consumer groups. The emergence of three mega-brewers, Anheuser-Busch InBev, SABMiller and Heineken, has resulted in two of these companies being in the top three brewers of every region in the world. Heineken remains the top producer in Europe. The strengths of multinational companies like SABMiller and Diageo is its geographic spread and the opportunities that lie in emerging markets. Typically, SABMillers acquisitions primarily focus on attaining a wide geographical spread with good exposure to emerging markets. In Africa, mainstream beer brands such as St. Louis, Kilimanjaro, Club, and 2M account for 80.0% of its total portfolio. SABMillers has revamped the sales of these local brands by investing in packaging. For example, it relaunched St Louis in Botswana in a new package, repackaged its Kilimanjaro brand in a new 500ml long-neck bottle in Tanzania, and recaptured the Ghana lager market by aggressively advertising the local Club brand. SABMiller aims to expand its portfolio of affordable and premium brands in Africa, given the double digit growth in these segments due to an increase in consumption, Business Insights predicts.

Financial crises? Business Insights believes the financial crises will have both negative and positive effects on the alcoholic drinks market. On balance it is likely to help volume growth but slow value growth. Consumers are more likely to consume alcohol at home and they will be less likely to premiumize their consumption, meaning they will buy cheaper brands. 4 Eurocare 2009 Alcohol Trends

Trends in product development Upscale was the most common product tag on beer and wine products launched worldwide in both 2005 and 2008. Environmental concerns have meant that recyclable packaging has moved up from being the #5 claim in 2005 to the #2 position in 2008. Ethical and health concerns both underpin the entry of organics into the top five standing at #3 in 2008. Traditional beer, niche products and craft beer will see a stronger growth the coming years. The perhaps most pronounced trend in the market is the development of healthy products, or drinks with functional benefits (although there are now legal limitations in the EU on health claims). These are mixes of alcohol and health-related ingredients. Related to this is the continued search for new flavours and category blurring. One of the perhaps most extreme example is the launch of Asahi Vegesh in Japan By Asahi, an RTD low-alcohol cocktail (right). This carbonated drink has a grapefruit taste as the base and is made with 21 types of vegetables including yellow carrots, spinach, asparagus, red bell peppers, and five types of fruit including grapefruit, lemon, and pineapple. Asahi Vegesh contains 4.0% alcohol. SABMiller launched several new products and repackaged others. Miller Chill Chelada Style (below) beer was introduced in the US market in February 2007, with innovative formulation targeting the Hispanic market. It is a low-calorie beer flavored with lime and salt. SABMillers Arany Aszok 7 (below) It was launched in the Hungary in February 2007. The product consists of a seven count carrier pack of half liter glass bottles of beer that are each labelled for one day of the week, and with football images on the packaging. Heineken announced the launch of Red, a new variety of Tequila flavored beer in France in April 2008. Its a blend of Brazilian sugar cane brandy flavor and natural guarana extracts in addition to its tequila flavor. In addition, in March 2008, it launched Affligem Biere in red fruit variety, targeting women consumers in France. This product contains raspberry and a hint of spice.

Germany has seen a number of RTD product launches in 2008 based on beer that builds on the health theme.

Eurocare 2009

Alcohol Trends

Beer + apple juice (Veltins V+); Beer + fruit juice with ginger (Amrita Ingwer); Beer + soft drink with lime and mint (Becks Ice); Wheat beer + cola (Karlsberg Mixery); Wheat beer + elderberry drink (Licher X2).

Wine producers are still far behind in terms of modern marketing, branding and company centralisation, but change may be underway - but hardly imminent. Wine is increasingly seen as less elitist as before, and this trend will continue. Some in wine trade attempts to create a simpler labelling system in order to not scare off new consumers. Such ideas may eventually travel to Europe. A small chain of wine shops (Best Cellars) in the US has developed a labelling scheme of eight distinct groupings which company literature states is designed to ease consumer navigation (see below). Together with branding and more colourful labelling this might be innovations that will force its way even in Europe at some point.

Another trend is smaller bottles of wine in order to attract younger consumers and to increase number of drinking occasions. Younger consumers are more used to new and smaller packaging formats. Personal size wine in smaller pack sizes, typically 187ml, is now the fastest-growing trend in the US wine market. Even wine enthusiasts like the idea since it enables them to trey different types of wine during one meal. This trend is not only seen in wine, but in liqueurs and RTDs too. Interestingly it is matched by the emergence of super size packs in particular in beer for home or outdoor consumption. Branding and better labelling might together with smaller bottles be important opportunities in maturing markets like the UK in order to secure growth. Rose wines are getting back in fashion as they are increasingly discovered by young women, it seems. They have less alcohol content than wine and are not very different from some of the RTDs. Business Insights believes ros is a stepping stone between RTDs and onwards to wine. Women are 6 Eurocare 2009 Alcohol Trends

the driving force behind sales of ros and in 2008 Gallo started selling a wine box shaped like a handbag (right). Its so far mostly a UK phenomenon, but like many other drinking trends, it might travel eastwards. A number of spirits products have been launched that targets women, both in the US and in Europe, in particular liqueurs, tequila and vodka. BI predicts strong growth of liqueurs in Germany and of premium Vodka in Poland. This may indicate that some consumers in the East are now switching back to vodka, some to cheap products and others to premium products.

Copyright: All images taken from Business Insights LTD

Eurocare 2009

Alcohol Trends

Vous aimerez peut-être aussi

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Cold Drink ProjectDocument28 pagesCold Drink ProjectHitesh Sharma100% (1)

- Chemistry Sample Lab ReportDocument23 pagesChemistry Sample Lab ReportUltramix100% (2)

- IM Sep 2014Document12 pagesIM Sep 2014Jovi DacanayPas encore d'évaluation

- Experiment 04 Identification of Carboxylic AcidDocument8 pagesExperiment 04 Identification of Carboxylic Acidsandi fernandoPas encore d'évaluation

- Alcoholic Liver Disease - A Complete SpectrumDocument160 pagesAlcoholic Liver Disease - A Complete SpectrumViju K GPas encore d'évaluation

- Modals Obligation Prohition and PermissionDocument6 pagesModals Obligation Prohition and PermissionNoelia SeguraPas encore d'évaluation

- Carbon and Its Compounds PDFDocument31 pagesCarbon and Its Compounds PDFHari kumarPas encore d'évaluation

- Reaction Notes For Organic ChemistryDocument11 pagesReaction Notes For Organic ChemistryTyler Lawrence CoyePas encore d'évaluation

- Recommended Methods For Purification Solvent PDFDocument10 pagesRecommended Methods For Purification Solvent PDFNestor Armando Marin SolanoPas encore d'évaluation

- Lte AhDocument15 pagesLte AhOmar Javier Quintero DelvastoPas encore d'évaluation

- Chemistry SQPDocument12 pagesChemistry SQPpenny singh88% (8)

- Chapter IDocument17 pagesChapter IShairuz Caesar DugayPas encore d'évaluation

- Biodiesel Lab7Document20 pagesBiodiesel Lab7Karla LopezPas encore d'évaluation

- 99s11 AbsDocument2 pages99s11 Absqwerasdf0123Pas encore d'évaluation

- FB FBM Acc Beverage ParstockDocument3 pagesFB FBM Acc Beverage ParstockTrần Xuân QuýPas encore d'évaluation

- Sample Question Paper 2021-22 Term 1 Subject: ChemistryDocument16 pagesSample Question Paper 2021-22 Term 1 Subject: Chemistrysarthak MongaPas encore d'évaluation

- Introduction To SpiritsDocument34 pagesIntroduction To Spiritsjaikishen balchandaniPas encore d'évaluation

- Addition Reactions of KetenesDocument27 pagesAddition Reactions of Ketenes張君睿Pas encore d'évaluation

- Ken Burns Prohibition Episode 1Document22 pagesKen Burns Prohibition Episode 1marcus_coleman_5Pas encore d'évaluation

- M/S Jagatjit Industries Limited, Hamira: Annexure-CDocument8 pagesM/S Jagatjit Industries Limited, Hamira: Annexure-CAlex caprioPas encore d'évaluation

- Giando's Beverage Package 2017.09Document1 pageGiando's Beverage Package 2017.09The Caprioli Hospitality GroupPas encore d'évaluation

- Parental Supervision of Teenage Drinking Encourages Dangerous BehaviorDocument5 pagesParental Supervision of Teenage Drinking Encourages Dangerous BehaviorJanet BellPas encore d'évaluation

- NMAT - Must Know-ChemistryDocument45 pagesNMAT - Must Know-ChemistryElise TraugottPas encore d'évaluation

- Familiarization of The BarDocument26 pagesFamiliarization of The BarChristian AlejandrinoPas encore d'évaluation

- WoodwardDocument21 pagesWoodwardanastasia0% (1)

- Naming Alcohols PDFDocument1 pageNaming Alcohols PDFumairgul841Pas encore d'évaluation

- Dibal HDocument6 pagesDibal HAnthony BasantaPas encore d'évaluation

- Separation of Isopropanol From Aqueous Solution by Salting-Out ExtractionDocument7 pagesSeparation of Isopropanol From Aqueous Solution by Salting-Out ExtractionbhuniakanishkaPas encore d'évaluation

- Formal Report Exp 9Document13 pagesFormal Report Exp 9Rianne SolivenPas encore d'évaluation

- All-in-One: PrakashanDocument22 pagesAll-in-One: PrakashanGamerNeverDiesPas encore d'évaluation