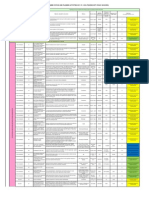

Académique Documents

Professionnel Documents

Culture Documents

Techno-Economic Performance of The Coal-To-olefins Process With CCS

Transféré par

Albertus ArdikaDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Techno-Economic Performance of The Coal-To-olefins Process With CCS

Transféré par

Albertus ArdikaDroits d'auteur :

Formats disponibles

Techno-economic performance of the coal-to-olens process with CCS

Dong Xiang

1

, Siyu Yang

1

, Xia Liu, Zihao Mai, Yu Qian

School of Chemical Engineering, South China University of Technology, Guangzhou 510640, PR China

h i g h l i g h t s

Conduct a techno-economic analysis of the coal-to-olens (CTO) with CCS.

Analyze effects of key factors on the CTO with appropriate capture rate 80%.

Present strengths and weaknesses of the CTO compared to the methanol-to-olens.

a r t i c l e i n f o

Article history:

Received 5 September 2013

Received in revised form 21 November 2013

Accepted 23 November 2013

Available online 28 November 2013

Keywords:

Energy efciency

Cost

Coal-to-olens

CCS

Methanol-to-olens

a b s t r a c t

Coal-to-olens (CTO) has been attracting more attention of the chemical process industry, in the light of

the scarcity of oil resources and richness of coal in China. However, it is inherently accompanied with the

problem of severe greenhouse gas emissions. CTO processes therefore face increasing challenges from

other alternative processes, especially methanol-to-olens (MTO) process. This paper conducts a detailed

techno-economic analysis of the CTO process with CCS. The effect of carbon capture is studied. The CTO

process with 80% carbon capture is slightly less thermodynamically efcient than the conventional CTO

process. The corresponding mitigation cost of the process is 150 RMB/t, which is roughly equivalent to

the current carbon price. Thus, the effect of energetic and economic penalties on this carbon capture con-

guration is negligible. In comparison to the MTO process, the CTO process with CCS is competitive in

product cost even considering carbon tax and it is capable of resisting to market risk. CTO processes with

appropriate CO

2

reduction are more applicable to olens industry in China.

2013 Elsevier B.V. All rights reserved.

1. Introduction

As the backbone of the petrochemical industry, olens produc-

tion scale is critical to development of national economy. As more

and more oil-to-olens projects launched in China, the production

grows quickly, and the self-sufcient rate of ethylene and propyl-

ene will increases up to 53% and 74% by 2015 [1]. However, there

is still a big gap between the domestic supply and demand, which

is in urgently needed to be lled by olens based on alternative re-

sources. From 2005 to 2011, coal accounted for 75.1% of the total

energy production of China, oil for 15.2%, and natural gas for

2.8%, as shown in Fig. 1. The oil import dependence was ap-

proached to 57% in 2012. Thus, development of the coal-based ole-

ns industry is favorable in the context of increasingly severe oil

supply shortage. There are now three coal-to-olens (CTO) projects

under operation and other two CTO projects in plan in the next

there years in China. These installations are going to approach a

capacity of 3 Mt/y [3].

However, CTO is facing the problem of high CO

2

emissions.

There have been a number of techniques of CO

2

mitigation devel-

oped from chemical and physical methods [4]. For chemical meth-

ods, CO

2

is reused mostly as feedstock to produce valued chemical

products. Although these methods enable us to exploit CO

2

as a

valuable feedstock in many different applications such as the pro-

duction of urea and methanol, their contribution to CO

2

mitigation

is nite. Physical methods are generally regarded as geologically

storing CO

2

underneath. In recent years, carbon capture and stor-

age (CCS) technology has received increasing attention because

of its large capacity of reducing CO

2

emissions. It is a more eco-

nomical and efcient method compared to developing renewable

energy, retrotting major equipments, and improving energy inte-

gration for resource and energy saving [5].

A CCS process in general involves three stages: separating CO

2

from ue gas, compressing CO

2

for pipeline transport, and inject-

ing CO

2

into geologic reservoirs. For carbon capture, there are

mainly three technologies developed, including post-combustion

capture, oxy-fuel combustion capture, and pre-combustion

1385-8947/$ - see front matter 2013 Elsevier B.V. All rights reserved.

http://dx.doi.org/10.1016/j.cej.2013.11.051

Corresponding author. Address: Center for Process Systems Engineering, School

of Chemical Engineering, South China University of Technology, Guangzhou

510640, PR China. Tel.: +86 20 87113046, +86 13802902300.

E-mail address: ceyuqian@scut.edu.cn (Y. Qian).

URL: http://www2.scut.edu.cn/ce/pse/qianyuen.htm (Y. Qian).

1

Dong Xiang and Siyu Yang contributed equally to this paper.

Chemical Engineering Journal 240 (2014) 4554

Contents lists available at ScienceDirect

Chemical Engineering Journal

j our nal homepage: www. el sevi er . com/ l ocat e/ cej

capture [6]. These technologies are usually applied in pulverized-

coal power plants and some chemical plants [7]. Introducing a

CCS will bring penalties on both energetic and economic perfor-

mance [810]. For example, in most coal-based power plants, the

CO

2

avoidance cost is about 250330 RMB/t, which is much

higher than the current carbon price. The penalties brought by

the CCS on chemical processes is, however, lower than those

on power generation processes [11,12]. It demonstrates that it

is necessary to assess the impact of CCS on the whole perfor-

mance of CTO processes.

Planning a sound development roadmap for alternative olens

production requires a broad and comprehensive assessment. Tech-

no-economic analysis is an essential part of this process. More

importantly, the role of CCS in CTO development is needed to be

analyzed to nd the trade-off among environmental protection, en-

ergy penalty, and economic performance. There have been some

studies on techno-economic analysis of CTO processes [1318].

However, the literatures on analyzing CTO processes with CCS from

techno-economic point of view could not be found. Besides, some

views back up developing methanol-to-olens (MTO) processes

since they have the advantages of low capital investment and envi-

ronmental impact. There are now 1 MTO project under operation

and other 10 MTO projects in plan in the next three years in China,

which will approach to a capacity of 6.8 Mt/y [3]. With the poten-

tial challenge of the MTO process, how should people congure

CCS on the CTO process? We answer this question by the techno-

economic comparison of the CTO process with CCS and the MTO

process in this paper.

2. Process modeling

As a base of techno-economic analysis, major units of a CTO

process are modeled, including an air separation unit (ASU), a coal

gasication unit (CG), an acid gas removal unit (AGR), a carbon

capture and storage unit (CCS), a water gas shift unit (WGS), a

methanol synthesis unit (MS), and a methanol-to-olens unit

(MTO). For a plant with given capacity and specied operating con-

ditions, the model calculates all mass and energy ows. The details

of the modeling are described in the following sections.

2.1. Coal-to-olens process

The ow diagram of the CTO process, including the MTO pro-

cess, is shown in Fig. 2. Coal and water are gasied with the oxygen

agent from the ASU, to produce syngas in the CG. The hot syngas is

quenched in a radiant cooler and a convection condenser, where

heat is recovered to generate steam. The syngas is then fed into

the WGS to increase the ratio of H

2

/CO for the methanol synthesis.

Before methanol synthesis, the syngas is cleaned in the AGR to re-

move H

2

S and CO

2

. The clean syngas is then sent to the MS to pro-

duce methanol. The crude methanol solution is concentrated to

90% (moral fraction) before fed into the MTO. Prior to olens sep-

aration, there are a serial of steps: quenching, washing, drying, and

compression. The front-end depropanization separation technique

is applied to separate olens into ethylene and propylene [18].

2.1.1. Coal gasication unit

In the CG, Texaco gasication technique was adopted. For mod-

eling, coal is rstly divided into three kinds of nonconventional

matter as coke, ash, and unburned carbon. Then nonconventional

matter is decomposed in RYield model in Aspen Plus by element

Nomenclature

Abbreviations

AGR acid gas removal

ASU air separation unit

CCS carbon capture and storage

CG coal gasication

CTO coal-to-olens

LHV lower heating value

MS methanol synthesis

MTO methanol-to-olens

RMB ren min bi

WGS water gas shift

Notations in formulation

h domestic-made factor

C

AC

administrative cost (RMB/t)

CCF cumulative cash ow (RMB)

CCR carbon capture rate (%)

C

D

depreciation cost (RMB/t)

C

DSC

distribution and selling cost (RMB/t)

CF

i

cash ow of year i (RMB)

C

O&M

operating & maintenance cost (RMB/t)

C

POC

plant overhead cost (RMB/t)

C

R

raw material cost (RMB/t)

C

TS&M

cost of CO

2

transportation, sequestration and monitor-

ing (RMB/t)

C

U

utilities cost (RMB/t)

EI equipment investment (RMB)

EI

r

J

reference equipment investment of unit j (RMB)

E

wCCS

quantity of CO

2

emitted from the CTO plant with CCS

(Mt/y)

E

w/oCCS

quantity of CO

2

emitted from the CTO plant without CCS

(Mt/y)

MC mitigation cost (RMB/t)

OP olens price (RMB/t)

OY

i

olens yield (Mt/y)

PC product cost (RMB/t)

PC

w CCS

product cost of the CTO plant with CCS (RMB/t)

PC

w/o CCS

product cost of the CTO plant without CCS (RMB/t)

RF

i

ratio factor of component i (%)

S

j

practical scale of unit j

S

r

J

reference scale of unit j

sf scale factor

TCI total capital investment (RMB/t/y)

0

500

1000

1500

2000

2500

3000

3500

1990 1992 1994 1996 1998 2000 2002 2004 2006 2008 2010

M

t

Year

Hydro,Nuclear,Wind

Natural gas

Crude oil

Coal

Fig. 1. Prole of major energy production in China [2].

46 D. Xiang et al. / Chemical Engineering Journal 240 (2014) 4554

analysis [19]. After this, decomposed components, O

2

, water, etc.

are all fed into RGibbs reactor, which calculates chemical equilib-

rium by Gibbs energy minimization. The composition of gaseous

mix was determined according to the property of the input coal

as shown in Table 1. The simulation was veried by comparing

the composition of the output syngas with that of Zheng and Furin-

skys work [21]. The simulated composition is similar to the refer-

ence composition with only a small relative error less than 1.5%

[22].

2.1.2. Methanol synthesis unit

For modeling of methanol synthesis, Lurgi synthesis reactor was

used and modeled by using the Requil model in Aspen Plus. In gen-

eral, there are several major reversible reactions in the methanol

synthesis reactor. CuZnAl catalyst was used for this reaction

with its suitable temperature 513 K and pressure 8.2 MPa [22,

23]. The main reactions are shown in Eqs. (1 and 2):

CO 2H

2

!CH

3

OH 1

CO

2

3H

2

!CH

3

OHH

2

O 2

The raw syngas from the CG is cleaned in the AGR presented in

the CCS and then shifted into syngas with the molar ratio between

hydrogen and carbon monoxide of about 2 [24]. The clean syngas is

put into the MS as the feedstock. Following the synthesis reaction,

the unreacted syngas are separated out fromthe chemical products

and recycled back to the MS to increase the methanol production

[6]. RadFrac model was used to simulate the separation columns

and Peng-Rob was selected as the thermodynamic method. Details

of the simulation refer to the authors previous work [22].

2.1.3. Methanol-to-olens unit

Methanol with molar fraction 90% is converted into product gas

in MTO reactor. The hot product gas is cooled in the quenching

tower and cleaned in the alkaline tower with NaOH solution to re-

move H

2

S and CO

2

. After then, ethylene and propylene are ex-

tracted by the front-end depropanization seperation technique.

DMTO technique was used to synthesize olens. The main reac-

tions in the synthesis reactor could be summarized as follow:

2CH

3

OH !C

2

H

4

2H

2

O 3

3CH

3

OH !C

3

H

6

3H

2

O 4

4CH

3

OH !C

4

H

8

4H

2

O 5

An attrition resistant SAPO-34 was employed as the catalyst.

According to the specication of the catalyst, the temperature

and pressure were xed at 763 K and pressure 0.22 MPa. In this

condition, the methanol conversion has reported to be close to

Mill

Water

Screen

Coal

Water & slag

Gasifier

&

Cooler

Radiant

Water

Steam

Convective

Cooler

Raw syngas

Steam

Scrubber

Water

Regenerator

Methanol

Crude methanol

Purge gas

Lurgi

methanol

reactor

Methanol

Methanol

Unreacted

gas

Bottom liquid

Pressure

distillation

column

Atmospheric

distillation

column

DMTO

reactor

Tail gas

H2S

Air

S

Tail gas

Quenching

tower

Alkaline

tower Water

scrubber

Waste water

Dryer

Water Water

Water

NaOH

C2 splitter

C4

=

Ethylene Fuel gas

Propane

Clean syngas

Ethane

Propylene

Water

Acid gas

absorber

C3 splitter

N2

H2S concentration

tower

Waste water

Depropanizer Demethanizer Dethanizer

WGS reactor

!

?

3

Oxygen

from ASU

+

8

9

b

!0

!!

!?

!3

Fig. 2. Process ow diagram of the CTO process.

Table 1

Properties of coal in Yanzhou, China [20].

Proximate analysis (wt.%) Ultimate analysis (wt.%, dry)

Moisture content 5.81 Ash 7.53

Fixed carbon 49.85 Carbon 73.64

Volatile matter 37.24 Hydrogen 5.24

Ash 7.10 Nitrogen 1.13

Sulfur 2.63

Oxygen 9.83

D. Xiang et al. / Chemical Engineering Journal 240 (2014) 4554 47

100%. The olens synthesis was modeled by Rstoic model in Aspen

Plus. The composition of product gas was calculated according to

the Ref. [25]. RadFrac model was used to simulate rectifying col-

umns. The process compressors were modeled by assuming com-

mon isentropic and mechanical efciency. The NRTL, ELECNRTL,

and RKS-BM were adopted as the thermodynamic methods of

water scrubber, alkaline tower, and separation tower, respectively.

Details of the simulation referred to the authors previous work

[18,26].

2.2. Carbon capture and storage process

The CCS includes carbon capture, compression, transportation,

and storage. The process ow diagram is shown in Fig. 3. The crude

syngas from the gasifer consists of impurities that are mainly ash

and acid gases. It is necessary to remove these impurities before

methanol synthesis. We employed Rectisol method in this paper.

The syngas from the WGS is fed into the water scrubber to remove

ammonia and y ash. After ash dehydration, it is fed into the bot-

tom of the acid gas absorber and absorbed by top-down low tem-

perature methanol, which is obtained from the regeneration tower

and cooled through multistage cooling to 223 K. The upper part of

the absorber mainly removes CO

2

while the lower part removes

sulfur containing compounds. Without CO

2

capture process, CO

2

is separated and exhausted to environment by using N

2

as the

stripping gas. In this case, the exhausted gas is a mixture of N

2

and CO

2

. For CO

2

capture process, a desorber and a companying

ash are introduced to purify CO

2

to the high concentration of

about 98%. The capture rate of CO

2

could be increased by changing

the temperature and pressure of the ash. The H

2

S separated from

methanol regenerator is placed into CLAUS conversion process for

sulfur recovery.

For modeling, RadFrac model was used to simulate the acid gas

absorber, the desorber, the H

2

S concentration tower, and the

regenerator. Flash model and Compr model were adopted for sim-

ulating ashes and compressors, respectively. PSRK was selected as

the thermodynamic method. The described CCS referred to the CCS

demonstration of coal-to-liquild process installed by Shenhua

group in Ordos, China [27]. Different from this CCS, we use pipeline

to transport CO

2

in our model. Puried CO

2

is rstly compressed to

15 MPa and then transported to and injected into underground

reservoirs. 20 km for transportation distance and the saline aquifer

at 2 km deep as the geological position of the reservoirs was

conducted.

3. Analysis methodology

In this section, we mainly analyze the CTO process with CCS

from technical and economic points of view. A few indexes are se-

lected involving energy efciency, capital investment, product cost,

and cumulative cash ow.

The energy efciency is dened as the product energy gener-

ated by all input energy, as shown in Eq. (6). The energy of coal,

methanol, and olens is calculated based on their lower heating

values. The all input energy involves both the energy of feedstock

and utilities.

Energy efficiency

Product energyMW

All input energyMW

6

Another technical factor is carbon capture rate (CCR) which is

dened as the mass ow of captured CO

2

divided by CO

2

emissions,

as shown in Eq. (7).

CCR

Captured CO

2

mass flow Mt=y

CO

2

emissions Mt=y

7

For economic indexes, the capital invested for manufacturing

and plant facilities is dened as the xed capital investment, while

those for the plant operation is dened as the working capital. The

sum of the xed capital investment and the working capital is de-

ned as the total capital investment. In order to evaluate these in-

dexes of olens production processes, it is necessary to know the

capital investment of the basic equipments of the CTO process that

could be calculated according to the benchmark case shown in Ta-

ble 2. The detailed calculation of these equipments follows Eq. (8).

While the equipment investment of CO

2

transportation and storage

was calculated by the Ref. [30]. The other components of the total

capital investment could be determined according to their ratios to

Waste water

Regenerator

Methanol

Tail gas

H

2

S

Air

S

Tail gas

Acid gas

absorber

H

2

S concentration

tower

Clean syngas

Desorber

CO

2

transport

(Pipeline)

CO2 storage

(Saline acquifer)

Crude syngas

Water

N

2

CO

2

Water

scrubber

Fig. 3. Process ow diagram of the CCS process.

48 D. Xiang et al. / Chemical Engineering Journal 240 (2014) 4554

the equipment investment. The ratios are shown in Table 3 and the

calculation follows Eq. (9) [3133]. In this paper, the capital invest-

ment was updated to 2012 prices by using the Chemical Engineer-

ing Plant Cost Index [34,35]. The currency exchange rate between

US$ and RMB was 6.2 in 2012 and the olens price was set to be

10,000 RMB/t [36].

EI

X

J

h EI

r

j

S

j

S

r

j

!

sf

8

TCI EI 1

X

i

RF

i

!

9

where EI is the equipment investment, h is the domestic-made fac-

tor, EI

r

j

is the reference equipment investment of unit j, S

j

is the

practical scale of unit j, S

r

j

is the reference scale of unit j, sf is the

scale factor, TCI is the total capital investment, RF

i

is the ratio factor

of capital investment of component i.

For calculation of the product cost, we made some assumptions

as listed in Table 4. The consumption of raw materials and utilities

was determined according to simulation results. Their correspond-

ing costs were calculated on the basis of the average prices of 2012

in China [18]. Operating labor cost was calculated referring to

Hans work [13]. A straight-line method was adopted to calculate

the depreciation cost under the assumption of 20 years life time

and 4% salvage value. CO

2

TS&M cost was calculated by Mantri-

pragada and Rubins work [11]. The rest part of product cost was

calculated according to the ratio to product cost [31,32]. The prod-

uct cost is dened as the sumof the above components as shown in

Eq. (10).

PC C

R

C

U

C

O&M

C

D

C

POC

C

AC

C

DSC

C

TS&M

10

where PC is the product cost, C

R

is the raw material cost, C

U

is the

utilities cost, C

O&M

is the operating & maintenance cost, C

D

is the

depreciation cost, C

POC

is the plant overhead cost, C

AC

is the admin-

istrative cost, C

DSC

is the distribution and selling cost, C

TS&M

is the

cost of CO

2

transportation, sequestration, and monitoring.

The cost related to CO

2

emissions reduction should also be con-

sidered during product cost estimation. In this paper, we used mit-

igation cost (MC) to evaluate the cost according to Refs. [37,38]. MC

represents the difference of cost per ton of CO

2

emissions avoided

between the plant without CCS and the plant with CCS expressed

in Eq. (11).

MC

PC

wCCS

PC

w=oCCS

E

w=oCCS

E

wCCS

11

where PC is the product cost of the CTO plant, E is the quantity of

CO

2

emitted from the CTO plant, the subscripts w CCS and w/o

CCS are referred to the plant congurations with and without CCS.

Besides the capital investment and the product cost, there is an-

other important economic factor-plant cash ow. It is usually con-

sidered as the cumulative ow over the life of the project.

Cumulative cash ow was calculated by adding all of the cash

ows from the inception of projects, as shown in simplied Eq.

(12). As project life, 23 years was used in this paper, of which

3 years for plant construction and 20 years for operation. Assump-

tions were made for construction phase that the expenditure factor

was 80% for the rst 2 years and 20% for the last year [37].

CCF

X

i

CF

i

X

i

OP PC C

D

i

OY

i

12

where CCF is the cumulative cash ow, CF

i

is the cash ow of year i,

OP is the olens price, PC is the product cost, C

D

is the depreciation

cost, OY

i

is the olens yield of year i.

Table 2

Summary of investment data for main equipment components.

Unit Benchmark Scale (S

r

J

) Size factor (sf) Domestic-made factor (h) EI

r

J

(M$) Refs.

ASU Oxygen supply 21.3 kg/s 0.50 0.50 45.70 [22]

Coal handing Daily coal input 27.4 kg/s 0.67 0.65 29.10 [22]

CG Daily coal input 39.2 kg/s 0.67 0.80 78.00 [22]

WGS Material caloric value 1377 MW 0.67 0.65 39.80 [28]

AGR Sulfur output 29.3 mol/s 0.67 0.65 67.30 [28]

Pure CO

2

captured 2064.4 mol/s 0.67 0.65 32.80 [28]

MS Syngas input 10,810 mol/s 0.67 0.65 20.40 [22]

MTO Methanol input 62.5 kg/s 0.60 1.00 223.06 [29]

Table 3

Ratio factors for capital investment.

Component Ratio factor (RF, %)

(1) Direct investment

(1.1) Equipment 100

(1.2) Installation 48

(1.3) Instruments and controls 24

(1.4) Piping 57

(1.5) Electrical 29

(1.6) Buildings(including services) 71

(1.7) Land 5

(2) Indirect investment

(2.1) Engineering and supervision 48

(2.2) Construction expenses 43

(2.3) Contractors fee 19

(2.4) Contingency 33

(3) Fixed capital investment 477

(4) Working capital 80

(5) Total capital investment 557

Table 4

Assumptions for the estimation of product cost.

Component Basis

(1) Coal Coal price 620 RMB/t; methanol 2,400 RMB/

t

(2) Utilities Water 2 RMB/t, electricity 0.7 RMB/kWh,

steam 42 RMB/GJ

(3) Operating & Maintenance

(3.1) Operating labor CTO 300 labors, MTO 100 labors, 100,000

RMB/labor/year

(3.2) Direct supervisory and

clerical labor

20% of operating labor

(3.3) Maintenance and repairs 2% of xed capital investment

(3.4) Operating supplies 0.7% of xed capital investment

(3.5) Laboratory charge 15% of operating labor

(4) Depreciation Life period 20y, salvage value 4%

(5) Plant overhead cost 60% (3.1 + 3.2 + 3.3)

(6) Administrative cost 2% of product cost

(7) Distribution and selling

cost

2% of product cost

(8) CO

2

TS&M 64 RMB/t CO

2

(9) Product cost (1) + (2) + (3) + (4) + (5) + (6) + (7) + (8)

D. Xiang et al. / Chemical Engineering Journal 240 (2014) 4554 49

4. Results and discussion

This section reports the mass and energy data as well as com-

pares the different cases of CTO processes with CCR ranging from

60% to 95%. A MTO process is also involved in this comparison,

aiming to get which alternative olens production should be devel-

oped in large-scale. In the end of this section, we analyze three

important parameters, plant scale, carbon tax, feedstock price to

nd their effects on economic performance.

4.1. Energy efciency analysis

The CTO plant with CCS and the MTO plant producing the same

0.7 Mt/y olens were simulated in Aspen Plus, which produce all

process data needed to assess the techno-economic and environ-

mental performance of cases studied. As an illustrative example

for mass and energy balance, Table 5 presents the main stream

properties in key points of the CTO plant diagram, and Table 6 pre-

sents properties of N

2

stream, CO

2

stream, and tail gas stream of

CCS at CCR 60%, 80%, and 95%. The properties of shift syngas stream

and clean syngas stream of CCS can be found in Table 5.

The total material and energy consumption of MTO and CTO

plants at different CCRs is shown in Table 7. The energy consump-

tions or generations of ASU, CG, WGS, CCS, MS, and MTO are also

placed in this table. Producing 0.7 Mt/y of olens needs about

1.8 Mt/y methanol for the MTO plant and 2.87 Mt/y coal for the

CTO plant. The resulting CO

2

emissions of the CTO plant are close

to 4.05 Mt/y. The energy efciency to olens product in Table 5

is calculated according to Eq. (6). With shorter conversion route,

the energy efciency of the MTO plant is around 80.98%, much

higher than that of the CTO plant which is only 36.16%.

CTO processes with CCS have two scenarios divided by CCR 80%.

In the rst scenario, the CTO process has a low CCR between 60%

and 80%. The corresponding energy efciency ranges from 35.86%

to 35.69% since the electricity consumption changes from

172.54 MW to 187.58 MW. In the second scenario, the CTO process

has a high CCR between 80% and 95%. The corresponding energy

efciency ranges from 35.69% to 35.38% since the electricity con-

sumption changes from 187.58 MW to 215.93 MW. It is clear that

the increasing rate of electricity consumption of CCS in the second

scenario is about 2 times larger than that in the rst scenario

shown in Fig. 4. The decrease of energy efciency is caused by

the increase of electricity consumption of the CCS. On the one

hand, we should raise the ash temperature and reduce the ash

pressure in order to increase CCR and cool the methanol out of

the ash to 223 K for recycling use. Correspondingly, the increas-

ingly temperature difference leads to bigger ammonia cold energy

consumption when CCR changing from 60% to 95%. On the other

hand, with increasing CCR, CO

2

processing capacity and the com-

pression energy consumption increase linearly, as shown in Fig. 4.

4.2. Economic analysis

4.2.1. Capital investment, product cost, and cumulative cash ow

The breakdown of total capital investment of CTO plants is

shown in Fig. 5. The MTO takes 45.6% of the total capital invest-

ment, followed by the ASU and CG (about 37.3%). It is seen that

additional investment for CCS makes the total capital investment

increase from 2.52 10

4

RMB/t/y to 2.71 10

4

RMB/t/y when

CCR is as high as 95%.

On the other hand, the product cost of MTO and CTO plants are

calculated and shown in Fig. 6. For the CTO plant, most of capital is

expended on purchasing coal, accounting for 39.5% of the product

cost. The second largest is the cost for utilities, about 24.8% of the

product cost. The total capital investment is involved in the prod-

uct cost as the form of depreciation, amounting to 16.8% of the

Table 5

Simulation results of main streams in the CTO process.

Stream

a

Coal (1) Water

(2)

Oxygen

(3)

Syngas

(4)

Shift

syngas

(5)

N

2

(6) Tail gas

(7)

Clean

syngas

(8)

Methanol

(9)

Product

gas (10)

C

4

=

(11)

Ethylene

(12)

Propylene

(13)

Molar fraction (%)

N

2

1.39 0.87 0.85 100.00 30.21 1.00 0.11

O

2

95.00

AR 3.61 1.03 0.98 0.99 0.81

H

2

O 100.00 19.07 01.61 10.18 69.59

CO 40.47 18.71 0.66 27.29

CO

2

11.67 31.56 67.10 3.46 0.01 0.06

H

2

S 0.34 0.32

H

2

26.55 45.97 1.02 67.44 0.44

C 3.16

CH

4

1.11

CH

3

OH 0.02 89.70 0.12

C

2

H

6

0.25 0.18

C

2

H

4

13.75 99.82

C

3

H

8

0.57 0.74 0.38

C

3

H

6

8.90 3.50 99.62

C

4

H

10

0.04 2.56

C

4

H

8

1.63 92.61

C

4

H

6

0.21

C

5

H

12

0.38 0.38

Molar ow

(kmol/hr)

10,708 10,358 36,359 37,676 4893 16,410 25,433 8017 11,002 148 1499 883

Mass ow

(kg/hr)

358,295 192,926 333,886 771,303 794,423 137,070 633,439 283,069 245,440 245,440 8253 42,064 37,184

Temperature

(K)

314 314 383 425 363 293 302 302 318 763 326 182 315

Pressure

(Mpa)

0.1 0.1 4.1 2.76 5.00 0.2 0.2 2.78 0.40 0.22 0.55 0.20 1.73

Enthalpy

(MW)

1128.52 842.74 6.58 1347.27 1535.44 0.22 1206.44 308.34 542.73 463.06 0.30 19.74 4.68

a

In order to simplify the table, some minor streams are not included, such as water & slag stream in CG unit, S stream in AGR unit, and purge gas stream in MS unit.

50 D. Xiang et al. / Chemical Engineering Journal 240 (2014) 4554

product cost, which is the next major contributor to product cost.

By introducing the CCS process, a large amount of CO

2

is mitigated,

ranging from 7360 t/d to 11,660 t/d.

However, there is additional cost required for CCS energy use,

geological sequestration, and monitoring. For the scenario with

low CCR, the product cost increases from 6911 RMB/t to

7131 RMB/t, leading to an increase of 3.2%. For the scenario with

high CCR, the product cost increases to 7437 RMB/t, leading to an

increase of 7.6%. It is obvious that the big change happens at the

Table 6

Simulation results of CCS at CCR 60%, 80%, and 95%.

Stream CCR 60% CCR 80% CCR 95%

N

2

CO

2

Tail gas N

2

CO

2

Tail gas N

2

CO

2

Tail gas

Molar fraction (%)

N

2

100.00 0.04 34.93 100.00 0.03 32.12 100.00 0.03 48.98

AR 0.02 2.34 0.02 4.98 0.02 17.39

CO 0.75 0.82 0.59 1.66 0.54 5.31

CO

2

98.50 60.18 98.90 57.30 99.00 14.73

H

2

0.69 1.73 0.43 3.94 0.38 13.59

CH

3

OH 0.03 0.03 0.03

Mole ow (kmol/hr) 2350 6958 6909 1478 9255 3240 391 10,984 925

Mass ow (kg/hr) 65,832 303,295 258,877 27,397 404,681 119,068 10,953 480,601 26,715

Temperature (K) 293 293 302 293 293 302 293 293 302

Pressure (Mpa) 0.2 15 0.2 0.2 15 0.2 0.2 15 0.2

Enthalpy (MW) 0.10 773.01 436.40 0.04 976.51 195.44 0.02 1226.38 14.29

Table 7

Mass and energy performance results from the techno-economic model for MTO and CTO plants at different CCRs.

Item MTO plant CTO plant with CCS

CCR 0% CCR 60% CCR 70% CCR 80% CCR 90% CCR 95%

Input

Coal (Mt/y)/(MW LHV)

a

2.87/2800.24 2.87/2800.24 2.87/2800.24 2.87/2800.24 2.87/2800.24 2.87/2800.24

Methanol (Mt/y)/(MW LHV)

b

1.80/1250

Net Electricity input (MW

e

)

c

36.61 146.21 172.54 179.10 187.58 204.14 215.93

Net Steam input (MW

th

)

c

123.98 212.75 212.75 212.75 212.75 212.75 212.75

ASU (MW

e

/MW

th

) 144.57/ 144.57/ 144.57/ 144.57/ 144.57/ 144.57/

CG (MW

e

/MW

th

) 70.74/ 70.74/ 70.74/ 70.74/ 70.74/ 70.74/

WGS (MW

e

/MW

th

) /15.10 /15.10 /15.10 /15.10 /15.10 /15.10

AGR or CCS (MW

e

/MW

th

) 9.86/26.59 36.19/26.59 42.75/26.59 51.23/26.59 67.79/26.59 79.58/26.59

MS (MW

e

/MW

th

) 25.91/77.28 25.91/77.28 25.91/77.28 25.91/77.28 25.91/77.28 25.91/77.28

MTO (MW

e

/MW

th

) 36.61/123.98 36.61/123.98 36.61/123.98 36.61/123.98 36.61/123.98 36.61/123.98 36.61/123.98

Total energy input (MW) 1410.59 3159.20 3185.53 3192.09 3200.57 3217.13 3228.92

Output

Ethylene (Mt/y)/(MW LHV)

b

0.33/538.54 0.33/538.54 0.33/538.54 0.33/538.54 0.33/538.54 0.33/538.54 0.33/538.54

Propylene (Mt/y)/(MW LHV)

b

0.30/489.57 0.30/489.57 0.30/489.57 0.30/489.57 0.30/489.57 0.30/489.57 0.30/489.57

C

4

=(Mt/y)/(MW LHV)

b

0.07/114.24 0.07/114.24 0.07/114.24 0.07/114.24 0.07/114.24 0.07/114.24 0.07/114.24

Product energy (MW LHV) 1142.35 1142.35 1142.35 1142.35 1142.35 1142.35 1142.35

CO

2

emissions (Mt/y) Negligible 4.05 1.39 1.04 0.69 0.35 0.17

Energy efciency (%, LHV basis) 80.98 36.16 35.86 35.79 35.69 35.50 35.38

a

The LHV is based on Ref. [39].

b

The LHV is based on Ref. [16].

c

MW

e

represents the energy of electricity and MW

th

represents the energy of steam. The symbol of are used to make a distinction between generated and consumed

energy.

0

0.2

0.4

0.6

0.8

1

1.2

1.4

1.6

1.8

2

0

10

20

30

40

50

60

70

80

90

60 65 70 75 80 85 90 95

C

O

2

e

m

i

s

s

i

o

n

s

(

M

t

/

y

)

E

n

e

r

g

y

c

o

n

s

u

m

p

t

i

o

n

(

M

W

)

CCR (%)

Electricity consumption for ammonia cold

Electricity consumption for compression

CCS electricity consumption

CO

2

emissions

Fig. 4. The relationship between CCR and electricity consumption.

0

5

10

15

20

25

30

35

40

0 60 70 80 90 95

T

o

t

a

l

c

a

p

i

t

a

l

i

n

v

e

s

t

m

e

n

t

(

1

0

0

0

R

M

B

/

t

/

y

)

CCR (%)

Increase of CCS MTO MS

WGS AGR CG

ASU

Fig. 5. Distribution of total capital investment for CTO plants at different CCRs.

D. Xiang et al. / Chemical Engineering Journal 240 (2014) 4554 51

CCR 80%, which divides CTO plants with CCS into low capture con-

guration and high capture conguration. The big change could

also be found in the mitigation cost and energy consumption of

CCS, as shown in Figs. 7 and 4. Thus, CTO with this carbon capture

conguration is appropriate choice for olens production consider-

ing energy penalties, economic performance, and environmental

protection. The product cost of the MTO plant is about

7896 RMB/t, which is much higher than that of the CTO plant with

CCS. The methanol cost is the biggest part, amounting to 78.1%, fol-

lowed by the utilities cost of 6.7% and depreciation cost of 6.0%.

As shown in Fig. 8, the plant with the highest cumulative cash

ow is the CTO plant without CCS, followed by the ones with

CCS and the MTO plant. The cumulative cash ow decreases from

5.0 10

9

RMB to 3.5 10

9

RMB as CCR increasing from 0% to

95%. While the cash ow of the MTO plant is only 2.9 10

9

RMB.

Although the capital investments of CTO plants are about 2 times

larger than that of MTO plant, the ratio of cumulative cash ow

to the MTO plant is 1.21.7. In Fig. 8, we could also nd the

break-even point and the payback period. The payback period is

about 8 y for the plant without CCS, about 9 y for the plant with

CCS, and about 7 y for the MTO plant.

4.2.2. Effects of plant scale, carbon tax, and feedstock price

As discussed above, we select an appropriate CCR equal to 80%

for case study of the effect of production scale, carbon tax, and

feedstock price on its economic performance.

As production scale is one of the most important factor for eco-

nomic performance, we therefore study the effect of this factor on

the capital investment and the product cost of the CTO plant with

CCS. According to the results, it is clear to nd that the capital

investment will decrease as the plant capacity varies from

0.3 Mt/y to 2.0 Mt/y, as shown in Fig. 9. The total capital invest-

ment of a 2.0 Mt/y plant is about 46.8% of a 0.3 Mt/y plant. Since

depreciation is a important factor, the product cost also decreases

with increasing plant capacity. However, the production scale

shows less effect on product cost. For example, the product cost

of a 2.0 Mt/y plant is about 19.3% less than a 0.3 Mt/y plant, as

shown in Fig. 10. For the MTO plant, the effect of economies of

scale is relatively small since the capital investment of the MTO

plant is less than half of the CTO plant.

As the largest developing country, China is facing increasing

criticism for the largest greenhouse gas emissions. Chinas 12th

ve-year plan clearly promised that a carbon trading market would

be gradually established and CO

2

emissions intensity be reduced at

the same time. The city of Shenzhen launched a carbon trading

scheme on 18 June 2013, Chinas rst market for compulsory car-

bon trading. The scheme covers 635 industrial companies and

some public buildings accounting for about 40% of the citys emis-

sions [40]. This means that there will be an explicit cost associated

with CO

2

emissions in the near future in China.

The effect of increasing carbon tax on the product cost is shown

in Fig. 11. It is obvious that when carbon tax exceeds 250 RMB/t

the product cost of the CTO plant without CCS is higher than that

of the MTO plant, while the product cost of the CTO plant with

0

1000

2000

3000

4000

5000

6000

7000

8000

9000

MTO CCR 0% CCR 60% CCR 70% CCR 80% CCR 90% CCR 95%

P

r

o

d

u

c

t

c

o

s

t

(

R

M

B

/

t

)

CO2 TS&M Distribution and selling cost

Administrative cost Plant overhead cost

Depreciation Operating & Maintenance

Fig. 6. Distribution of product cost for MTO and CTO plants at different CCRs.

120

130

140

150

160

170

180

190

60 65 70 75 80 85 90 95

M

i

t

i

g

a

t

i

o

n

c

o

s

t

(

R

M

B

/

t

C

O

2

)

CCR (%)

Fig. 7. Relationship between CCR and mitigation cost.

-2000

-1000

0

1000

2000

3000

4000

5000

6000

5 10 15 20 23

C

u

m

u

l

a

t

i

v

e

c

a

s

h

f

l

o

w

(

m

i

l

l

i

o

n

R

M

B

)

Year

CTO without CCS

CTO with CCR 80%

CTO with CCR 95%

MTO

Fig. 8. Cumulative cash ow of MTO and CTO plants at different CCRs.

0

5

10

15

20

25

30

35

40

0.3 0.5 0.7 0.9 1.1 1.3 1.5 1.7 2.0

T

o

t

a

l

c

a

p

i

t

a

l

i

n

v

e

s

t

m

e

n

t

(

1

0

0

0

R

M

B

/

t

/

y

)

Capacity (Mt/y)

Incremental investment of CCS

CTO without CCS

Fig. 9. Total capital investment of the CTO plant with CCS varying with different

capacities.

52 D. Xiang et al. / Chemical Engineering Journal 240 (2014) 4554

CCS is much lower than that of the MTO plant when carbon tax is

as high as 400 RMB/t. For the CTO plant with CCS, the break-even

carbon tax between CTO plants with and without CCS is about

150 RMB/t, roughly equivalent to the current carbon price. Thus,

the CTO plant with CCS could be rstly built to demonstrate the

potential application of CCS technologies from the aspects of envi-

ronmental protection and overall economic performance. It is

important to underline that, if the carbon price increases up to

300400 RMB/t in the next few years, the application of CCS tech-

nologies for large-scale CTO plants will become very protable.

The effect of feedstock price on product cost of the MTO plant is

about 2 times that of the CTO plants with and without CCS, as

shown in Fig. 12. This means that the product cost of the MTO

plant is highly affected by feedstock price and that for CTO plants

the inuence is relatively small. Besides, coal price is more stable

than methanol which is mostly determined by oil price in the past

several years [18]. Although MTO plants have advantages of low

capital investment and low environmental impact, their economic

performances are easily intervened by methanol price. In other

words, MTO plants have less anti-risk capability of market uctu-

ation than CTO plants in China. Expanding development of CTO

plants with CCS should be encouraged since it could relieve the

conict between the supply and demand of olens, meanwhile re-

duce CO

2

emissions, and manifest a strong anti-risk capability to

the raw material market.

5. Conclusions

Techno-economic performance of the CTO process with CCS was

analyzed in this paper. The CTO process was also compared with

the MTO process. The performance results indicate that the CTO

plant with CCS is slightly less thermodynamic efcient than the

conventional CTO plant without CCS. For the CTO plant with 80%

carbon capture compared to the CTO plant, the total capital invest-

ment increases by 6%, from 2.52 10

4

RMB/t/y to 2.69 10

4

RMB/

t/y, and the product cost rises nearly 11%, from 6442 RMB/t to

7131 RMB/t.

The effects of economies of scale and carbon tax were also ana-

lyzed. It was found that production scale has more effect on capital

investment than product cost. If the scale of the CTO plant with CCS

increases from 0.3 Mt/y to 2.0 Mt/y, the total capital investment

and product cost will drop approximately 53.2% and 19.3%. The

mitigation cost of CTO with CCS is about 150 RMB/t, roughly equiv-

alent to the current carbon price.

On the other hand, the product cost of the MTO plant is

7896 RMB/t, which is much higher that of the CTO plant with

CCS even in the context of carbon tax as high as 400 RMB/t.

Although the MTO plant has low capital investment and CO

2

emis-

sions, its product cost ratio to the CTO plant with CCS is 0.9, its

cumulative cash ow ratio is 0.7, and its economic performance

is susceptible to uctuation of market price. In contrast, the prod-

uct cost of the CTO with CCS is lower and it could resist market risk.

In a word, developing CTO processes with CCS is important to the

sustainable development of olens industry in China from the

perspectives of resource reserve, economic performance, and envi-

ronmental protection.

Acknowledgments

The authors are grateful for nancial support from the China

NSF Key Project (No. 21136003), the China NSF Project (No.

21306056), the National Basic Research Program (No.

2012CB720504; 2014CB744306), the Fundamental Research Funds

for the Central Universities (No. 2013ZP0010), and Guangdong

Province NSF Team Project (No. S2011030001366).

References

[1] Y. Qu, The prospect of Chinas olen market during the twelfth ve-year plan,

Petro. Petrochem. Today 20 (2012) 1625 (in Chinese).

[2] National Bureau of Statistics, China energy statistics yearbook, China Stat.

Press, Beijing, 2010 (in Chinese).

[3] ICIS, China develops coal-to-olens projects, which could lead to ethylene self-

sufciency, 2012 (assessed 25.08.2013), <http://www.icis.com/Articles/2012/

02/27/9535534/china+develops+coal-to-olens+projects+which+could+lead+

to+ethylene.html>.

[4] P. Markewitz, W. Kuckshinrichs, W. Leitner, J. Linssen, P. Zapp, R. Bongartz, A.

Schreiber, T.E. Mller, Worldwide innovations in the development of carbon

capture technologies and the utilization of CO

2

, Energy Environ. Sci. 5 (2012)

72817305.

0

1000

2000

3000

4000

5000

6000

7000

8000

9000

0.3 0.5 0.7 0.9 1.1 1.3 1.5 1.7 2.0

P

r

o

d

u

c

t

c

o

s

t

(

R

M

B

/

t

)

Capacity (Mt/a)

Incremental cost of CCS CTO without CCS

Fig. 10. Product cost of the CTO plant with CCS varying with different capacities.

5000

5500

6000

6500

7000

7500

8000

8500

9000

0 30 60 90 120 150 180 210 240 270 300 330 360 400

P

r

o

d

u

c

t

c

o

s

t

(

R

M

B

/

t

)

Carbon tax (RMB/t CO

2

)

CTO without CCS CTO with CCS

MTO

Fig. 11. Effect of carbon tax on product cost.

3000

5000

7000

9000

11000

13000

15000

P

r

o

d

u

c

t

c

o

s

t

(

R

M

B

/

t

)

Coal price/methanol price (RMB/t)

CTO without CCS CTO with CCS

MTO

200/800 400/1600 600/2400 800/3200 1000/4000 1200/4800

Fig. 12. Effect of prices of feedstock on product cost.

D. Xiang et al. / Chemical Engineering Journal 240 (2014) 4554 53

[5] K.Z. House, C.F. Harvey, M.J. Aziz, D.P. Schrag, The energy penalty of post-

combustion CO

2

capture & storage and its implications for retrotting the U.S.

installed base, Energy Environ. Sci. 2 (2009) 193205.

[6] Z. Luo, M. Fang, M. Li, L. Gao, The Technology of CO

2

Capture, Storage and

Usage, China Elec. Power Press, Beijing, 2012 (in Chinese).

[7] H. Lin, H. Jin, L. Gao, W. Han, Techno-economic evaluation of coal-based

polygeneration systems of synthetic fuel and power with CO

2

recovery, Energy

Convers. Manage. 52 (2011) 274283.

[8] A. Pettinau, F. Ferrara, C. Amorino, Combustion vs. gasication for a

demonstration CCS (carbon capture and storage) project in Italy: a techno-

economic analysis, Energy 50 (2013) 160169.

[9] Q. Yi, B. Lu, J. Feng, Y. Wu, W. Li, Evaluation of newly designed polygeneration

system with CO

2

recycle, Energy Fuel 26 (2012) 14591469.

[10] K.S. Ng, Y. Lopez, G.M. Campbell, J. Sadhukhan, Heat integration and analysis of

decarbonised IGCC sites, Chem. Eng. Res. Des. 88 (2010) 170188.

[11] H.C. Mantripragada, E.S. Rubin, Techno-economic evaluation of coal-to-liquids

(CTL) plants with carbon capture and sequestration, Energy Policy 39 (2011)

28082816.

[12] W. Zhou, B. Zhu, D. Chen, F. Zhao, W. Fei, Technoeconomic assessment of

Chinas indirect coal liquefaction projects with different CO

2

capture

alternatives, Energy 36 (2011) 65596566.

[13] H. Han, Economic analysis of producing olen from naphtha, coal and natural

gas, Chem. Techno-Eco. 23 (2005) 1418 (in Chinese).

[14] X. Yang, L. Dong, Technical progress and economic analysis on the direct

production of light olens from syngas, Chem. Ind. Eng. Progr. 31 (2012) 1726

1731 (in Chinese).

[15] T. Ren, M.K. Patel, K. Blok, Steam cracking and methane to olens: energy use,

CO

2

emissions and production costs, Energy 33 (2008) 817833.

[16] T. Ren, M.K. Patel, Basic petrochemicals from natural gas, coal and biomass:

energy use and CO

2

emissions, Resour. Conserv. Recycl. 53 (2009) 513528.

[17] D. Xiang, L.J. Peng, S. Yang, Y. Qian, A review of oil and coal resource processes

for olens production, Chem. Ind. Eng. Progr. 32 (2013) 959970 (in Chinese).

[18] D. Xiang, Y. Qian, Y. Man, S. Yang, Techno-economic analysis of the coal-to-

olens process in comparison with the oil-to-olens process, Appl. Energy 113

(2014) 639647, http://dx.doi.org/10.1016/j.apenergy.2013.08.013.

[19] L. Zhou, S. Hu, Y. Li, Q. Zhou, Study on co-feed and co-production system based

on coal and natural gas for producing DME and electricity, Chem. Eng. J. 136

(2008) 3140.

[20] G. Liu, Z. Li, M. Wang, W. Ni, Energy savings by co-production: a methanol/

electricity case study, Appl. Energy 87 (2010) 28542859.

[21] L.G. Zheng, E. Furinsky, Comparison of Shell, Texaco, BGL and KRW gasiers as

part of IGCC plant computer simulations, Energy Convers. Manage. 46 (2005)

17671779.

[22] S. Yang, Q. Yang, H. Li, X. Jin, X. Li, Y. Qian, An integrated framework for

modeling, synthesis, analysis, and optimization of coal gasication-based

energy and chemical processes, Ind. Eng. Chem. Res. 51 (2012) 1576315777.

[23] K. Xie, D. Fang, Methanol Technology, Chem. Ind. Press, China, Beijing, 2010 (in

Chinese).

[24] K.S. Ng, J. Sadhukhan, Process integration and economic analysis of bio-oil

platform for the production of methanol and combined heat and power,

Biomass Bioenergy 35 (2011) 11531169.

[25] Dalian institute of chemical physics, Chinese Academy of Sciences. The typical

operating conditions and product component of methanol to olens, 2011

(assessed 25.08.2013). <http://www.syn.ac.cn/doshow1.php?id=26>. (in

Chinese).

[26] Y. Qian, J. Liu, Z. Huang, A. Kraslawski, J. Cui, Y. Huang, Conceptual design and

system analysis of a poly-generation system for power and olen production

from natural gas, Appl. Energy 86 (2009) 20882095.

[27] Z. Li, D. Zhang, L. Ma, W. Logan, W. Ni, The necessity of and policy suggestions

for implementing a limited number of large scale, fully integrated CCS

demonstrations in China, Energy Policy 39 (2011) 53475355.

[28] L. Zhou, S. Hu, D. Chen, Y. Li, B. Zhu, Y. Jin, Study on systems based on coal and

natural gas for producing dimethyl ether, Ind. Eng. Chem. Res. 48 (2009) 4101

4108.

[29] J. Cheng, C. Li, X. Cheng, The Review on Oil Replacement, China Petrochem.

Press, Beijing, 2009 (in Chinese).

[30] R.T. Dahowski, C.L. Davidson, X.C. Li, N. Wei, A $70/t CO

2

greenhouse gas

mitigation backstop for Chinas industrial and electric power sects: insights

from a comprehensive CCS cost curve, Int. J. Greenh. Gas Con. 11 (2012) 7385.

[31] M.S. Peter, K.D. Timmerhaus, Plant Design and Economics for Chemical

Engineers, 5 ed., McGraw Hill, USA, New York, 2003.

[32] M. Orhan, I. Dincer, G. Naterer, Cost analysis of a thermochemical CuCl pilot

plant for nuclear-based hydrogen production, Int. J. Hydrogen Energy 33

(2008) 60066020.

[33] Y. Zhang, T.R. Brown, G. Hu, R.C. Brown, Techno-economic analysis of two bio-

oil upgrading pathways, Chem. Eng. J. 225 (2013) 895904.

[34] K.S. Ng, N. Zhang, J. Sadhukhan, Techno-economic analysis of polygeneration

systems with carbon capture and storage and CO

2

reuse, Chem. Eng. J. 219

(2013) 96108.

[35] Chemical engineerings plant cost index, 2012 (assessed 25.08.2013), <http://

www.che.com/business_and_economics/economic_indicators.html>.

[36] J. Zhao, The Economic Data Express of China Petroleum and Chemical Industry,

China Petro. Chem. Ind, Beijing, 2012 (in Chinese).

[37] C.C. Cormos, Integrated assessment of IGCC power generation technology with

carbon capture and storage CCS, Energy 45 (2012) 434445.

[38] O. Lassagne, L. Gosselin, M. Desilets, M. Iliuta, Techno-economic study of CO

2

capture for aluminum primary production for different electrolytic cell

ventilation rates, Chem. Eng. J. 230 (2013) 338350.

[39] X. Hu, A. Li, H. Cheng, D. Xin, D. Zhang, B. Zheng, General Principles of the

Comprehensive Energy Consumption Calculation, China Stand. Press, Beijing,

2008 (in Chinese).

[40] China Daily, China starts carbon trading in Shenzhen, 2013 (assessed

25.08.2013), <http://www.chinadaily.com.cn/bizchina/2013-06/19/

content_16635384.htm>.

54 D. Xiang et al. / Chemical Engineering Journal 240 (2014) 4554

Vous aimerez peut-être aussi

- Brand Guidelines Oracle PDFDocument39 pagesBrand Guidelines Oracle PDFMarco CanoPas encore d'évaluation

- MMSA Methanol World Supply and Demand Summary Jan 2020Document2 pagesMMSA Methanol World Supply and Demand Summary Jan 2020rifqi98Pas encore d'évaluation

- Coke Drum DesignDocument6 pagesCoke Drum Designkutts76Pas encore d'évaluation

- Two 2 Page Quality ManualDocument2 pagesTwo 2 Page Quality Manualtony sPas encore d'évaluation

- Nguyen Dang Bao Tran - s3801633 - Assignment 1 Business Report - BAFI3184 Business FinanceDocument14 pagesNguyen Dang Bao Tran - s3801633 - Assignment 1 Business Report - BAFI3184 Business FinanceNgọc MaiPas encore d'évaluation

- Tajima TME, TMEF User ManualDocument5 pagesTajima TME, TMEF User Manualgeorge000023Pas encore d'évaluation

- Cinnamon Peelers in Sri Lanka: Shifting Labour Process and Reformation of Identity Post-1977Document8 pagesCinnamon Peelers in Sri Lanka: Shifting Labour Process and Reformation of Identity Post-1977Social Scientists' AssociationPas encore d'évaluation

- Prepositions Below by in On To of Above at Between From/toDocument2 pagesPrepositions Below by in On To of Above at Between From/toVille VianPas encore d'évaluation

- Upgrade Your Furnace For Clean FuelsDocument4 pagesUpgrade Your Furnace For Clean Fuelssagar1503Pas encore d'évaluation

- Biomass Gasification Smallwood04patelDocument37 pagesBiomass Gasification Smallwood04patelGiovani de MoraisPas encore d'évaluation

- Ccs 125m FundingDocument3 pagesCcs 125m Fundingkirandas_mullasseryPas encore d'évaluation

- Enhancement of Hydrotreating Process Evaluation: Correlation Between Feedstock Properties, In-Line Monitoring and Catalyst DeactivationDocument13 pagesEnhancement of Hydrotreating Process Evaluation: Correlation Between Feedstock Properties, In-Line Monitoring and Catalyst Deactivationleilasalimleal_27406Pas encore d'évaluation

- Ccs - ReportDocument25 pagesCcs - Reportammar sangePas encore d'évaluation

- Southern Company/MHI Ltd. Plant Barry CCS DemonstrationDocument23 pagesSouthern Company/MHI Ltd. Plant Barry CCS Demonstrationrecsco2100% (1)

- Conversion of Syngas To Diesel - Article Ptq-EnglishDocument6 pagesConversion of Syngas To Diesel - Article Ptq-Englishrkhandelwal96040% (1)

- JamnagarDocument3 pagesJamnagarkallurisuryaPas encore d'évaluation

- Index - 2017 - Integrated Gasification Combined Cycle IGCC Technologies PDFDocument23 pagesIndex - 2017 - Integrated Gasification Combined Cycle IGCC Technologies PDFrusdanadityaPas encore d'évaluation

- PTQ PTQ: OptimisingDocument124 pagesPTQ PTQ: OptimisingTruth SeekerPas encore d'évaluation

- Uop RCD Unionfining Process: Daniel B. GillisDocument10 pagesUop RCD Unionfining Process: Daniel B. GillisBharavi K SPas encore d'évaluation

- ImpactOfLoadFollowingOnPowerPlantCostAndPerformance FR Rev1 20121010Document49 pagesImpactOfLoadFollowingOnPowerPlantCostAndPerformance FR Rev1 20121010Anonymous knICaxPas encore d'évaluation

- CASE STUDY-Rockwell PetroleumDocument2 pagesCASE STUDY-Rockwell Petroleumanurag10julyPas encore d'évaluation

- Refineria de Cartagena (Reficar) Refinery Expansion - Hydrocarbons TechnologyDocument3 pagesRefineria de Cartagena (Reficar) Refinery Expansion - Hydrocarbons TechnologyGjorgeluisPas encore d'évaluation

- AFPMQA 2013 DayOneDocument20 pagesAFPMQA 2013 DayOneosmanyuksePas encore d'évaluation

- 00 PR PH 00002 - 2 Service Definition PhilosophyDocument8 pages00 PR PH 00002 - 2 Service Definition PhilosophyStevanNikolicPas encore d'évaluation

- Costperf Ccs PowergenDocument51 pagesCostperf Ccs PowergenJose DenizPas encore d'évaluation

- BycoDocument22 pagesBycoAhmed ZafarPas encore d'évaluation

- Case Study - Fuel OilDocument34 pagesCase Study - Fuel OilironitePas encore d'évaluation

- Biomass Gasification ProcessDocument27 pagesBiomass Gasification ProcessTony AppsPas encore d'évaluation

- 2012 PTQ q1Document132 pages2012 PTQ q1jainrakeshj4987Pas encore d'évaluation

- Methanol Market Services Asia, Xiaoshu WangDocument27 pagesMethanol Market Services Asia, Xiaoshu WangAnggit Saputra DwipramanaPas encore d'évaluation

- BFD Coal To PropyleneDocument1 pageBFD Coal To PropyleneEmir DjafarPas encore d'évaluation

- FCC Lightcycle OilDocument25 pagesFCC Lightcycle OilMallela Sampath KumarPas encore d'évaluation

- 2013 PTQ q4 - PDFDocument156 pages2013 PTQ q4 - PDFSalinas Salcedo Jorge KarolPas encore d'évaluation

- SSW - April 2020 - Lowres Pages 42 45 PDFDocument4 pagesSSW - April 2020 - Lowres Pages 42 45 PDFBaher ElsheikhPas encore d'évaluation

- Advanced Catalytic Olefins ACO First Commercial Demonstration Unit Begins OperationsDocument12 pagesAdvanced Catalytic Olefins ACO First Commercial Demonstration Unit Begins OperationsmakhadermfPas encore d'évaluation

- 112 Refinery Overview ChevronDocument2 pages112 Refinery Overview Chevronupender345Pas encore d'évaluation

- 08 Hydrocracking Example PDFDocument17 pages08 Hydrocracking Example PDFAshwani KumarPas encore d'évaluation

- CCS in Mexico and Associated Costs (Poza Rica)Document18 pagesCCS in Mexico and Associated Costs (Poza Rica)Dominic angelPas encore d'évaluation

- Review of Small Stationary Reformers For Hydrogen ProductionDocument52 pagesReview of Small Stationary Reformers For Hydrogen ProductionSoineth GuzmánPas encore d'évaluation

- TCM 701Document20 pagesTCM 701OYINLOLA ADESOKANPas encore d'évaluation

- Brunel OGJS Energy OutlookDocument74 pagesBrunel OGJS Energy OutlookSUDHEER NANDIPas encore d'évaluation

- Safety in Operations - Human Aspect - DorcDocument119 pagesSafety in Operations - Human Aspect - DorcAdanenche Daniel Edoh100% (1)

- Advanced FCC Troubleshooting Via Ecat Data InterpretationDocument4 pagesAdvanced FCC Troubleshooting Via Ecat Data Interpretationsaleh4060Pas encore d'évaluation

- 6 UOP. Honeywel Egypt - Technologies For Distillate Production - Hydrocracking - E SvenssonDocument17 pages6 UOP. Honeywel Egypt - Technologies For Distillate Production - Hydrocracking - E SvenssonCamilo inversionesPas encore d'évaluation

- HPCL Vizag RefineryDocument26 pagesHPCL Vizag RefinerykshitijPas encore d'évaluation

- Assignment NO 3:: Question 1: Define Cracking. Classify Cracking OperationsDocument6 pagesAssignment NO 3:: Question 1: Define Cracking. Classify Cracking OperationsMilan MoradiyaPas encore d'évaluation

- PTQ Q2 2011Document133 pagesPTQ Q2 2011asadashfaqlodhi100% (1)

- Booz Company Feedstock Developments Nov26 PresentationDocument21 pagesBooz Company Feedstock Developments Nov26 PresentationHưng LucaPas encore d'évaluation

- Asian Refining GrowningDocument40 pagesAsian Refining GrowninggustavoemirPas encore d'évaluation

- Why Do Waste Heat Boilers Fail?: Excessive TemperatureDocument4 pagesWhy Do Waste Heat Boilers Fail?: Excessive TemperatureMaheesha GunathungaPas encore d'évaluation

- Contributors To Refinery FlaringDocument3 pagesContributors To Refinery Flaringrvkumar61Pas encore d'évaluation

- EthyleneDocument2 pagesEthyleneEmOosh MohamedPas encore d'évaluation

- 4 S2-5 Mr. Fuji 20150115 Rev3(ト書き入り) JCCP Chiyoda Presentation on Jan2015Document29 pages4 S2-5 Mr. Fuji 20150115 Rev3(ト書き入り) JCCP Chiyoda Presentation on Jan2015hutuguoPas encore d'évaluation

- 2012 AFPM AM-12-72 Coke On-Line-Spalling F PDFDocument11 pages2012 AFPM AM-12-72 Coke On-Line-Spalling F PDFpoloPas encore d'évaluation

- Hyundai Shell Revamp Paper PDFDocument2 pagesHyundai Shell Revamp Paper PDFProcess EngineerPas encore d'évaluation

- DME Synthesis Technology Ready For Market: © Gastech 2005Document6 pagesDME Synthesis Technology Ready For Market: © Gastech 2005yan energiaPas encore d'évaluation

- Oil Refinery Information SourcesDocument5 pagesOil Refinery Information SourcesBien Molintapang BastianPas encore d'évaluation

- Oil Industry in Japan (Ken-Morota)Document67 pagesOil Industry in Japan (Ken-Morota)Hoang ThangPas encore d'évaluation

- Pep TocDocument2 pagesPep Tocomda4wadyPas encore d'évaluation

- Asia Petrochemical Outlook 2019 h1Document20 pagesAsia Petrochemical Outlook 2019 h1Cindy GallosPas encore d'évaluation

- Process DescriptionDocument9 pagesProcess DescriptionnoelPas encore d'évaluation

- UOP CCR Catalysts Target A Range of Objectives Tech Paper1Document5 pagesUOP CCR Catalysts Target A Range of Objectives Tech Paper1nikitaambePas encore d'évaluation

- CFC 1criterionbrochureDocument19 pagesCFC 1criterionbrochureSuraj Amin100% (1)

- Waste and Biodiesel: Feedstocks and Precursors for CatalystsD'EverandWaste and Biodiesel: Feedstocks and Precursors for CatalystsPas encore d'évaluation

- Biodiesel Production by Transesterification Catalyzed by An Efficient Choline Ionic Liquid CatalystDocument7 pagesBiodiesel Production by Transesterification Catalyzed by An Efficient Choline Ionic Liquid CatalystAlbertus ArdikaPas encore d'évaluation

- Fuel Processing Technology: Jian Zhuang, Xinqi Qiao, Jinlong Bai, Zhen HuDocument10 pagesFuel Processing Technology: Jian Zhuang, Xinqi Qiao, Jinlong Bai, Zhen HuAlbertus ArdikaPas encore d'évaluation

- Rapid Jatropha-Biodiesel Production Assisted by A Microwave SystemDocument8 pagesRapid Jatropha-Biodiesel Production Assisted by A Microwave Systemfmd16Pas encore d'évaluation

- The Optimized Operational Conditions For Biodiesel Production From Soybean Oil and Application of Artificial Neural Networks For Estimation of The Biodiesel YieldDocument6 pagesThe Optimized Operational Conditions For Biodiesel Production From Soybean Oil and Application of Artificial Neural Networks For Estimation of The Biodiesel YieldAlbertus ArdikaPas encore d'évaluation

- Organic Chemistry Reactions of Aromatic CompoundsDocument24 pagesOrganic Chemistry Reactions of Aromatic CompoundsAlbertus ArdikaPas encore d'évaluation

- Organic Chemistry Aromatic CompoundsDocument22 pagesOrganic Chemistry Aromatic CompoundsAlbertus ArdikaPas encore d'évaluation

- Hid RogenDocument23 pagesHid RogenAlbertus ArdikaPas encore d'évaluation

- Catalog enDocument292 pagesCatalog enSella KumarPas encore d'évaluation

- EMI-EMC - SHORT Q and ADocument5 pagesEMI-EMC - SHORT Q and AVENKAT PATILPas encore d'évaluation

- Brazilian Mineral Bottled WaterDocument11 pagesBrazilian Mineral Bottled WaterEdison OchiengPas encore d'évaluation

- Summary - A Short Course On Swing TradingDocument2 pagesSummary - A Short Course On Swing TradingsumonPas encore d'évaluation

- IIBA Academic Membership Info-Sheet 2013Document1 pageIIBA Academic Membership Info-Sheet 2013civanusPas encore d'évaluation

- Opel GT Wiring DiagramDocument30 pagesOpel GT Wiring DiagramMassimiliano MarchiPas encore d'évaluation

- ADS Chapter 303 Grants and Cooperative Agreements Non USDocument81 pagesADS Chapter 303 Grants and Cooperative Agreements Non USMartin JcPas encore d'évaluation

- Government of India Act 1858Document3 pagesGovernment of India Act 1858AlexitoPas encore d'évaluation

- A.2 de - La - Victoria - v. - Commission - On - Elections20210424-12-18iwrdDocument6 pagesA.2 de - La - Victoria - v. - Commission - On - Elections20210424-12-18iwrdCharisse SaratePas encore d'évaluation

- Eclipsecon MQTT Dashboard SessionDocument82 pagesEclipsecon MQTT Dashboard Sessionoscar.diciomma8446Pas encore d'évaluation

- Rhino HammerDocument4 pagesRhino HammerMichael BPas encore d'évaluation

- Analysis of Brand Activation and Digital Media On The Existence of Local Product Based On Korean Fashion (Case Study On Online Clothing Byeol - Thebrand)Document11 pagesAnalysis of Brand Activation and Digital Media On The Existence of Local Product Based On Korean Fashion (Case Study On Online Clothing Byeol - Thebrand)AJHSSR JournalPas encore d'évaluation

- AN610 - Using 24lc21Document9 pagesAN610 - Using 24lc21aurelioewane2022Pas encore d'évaluation

- How To Unbrick Tp-Link Wifi Router Wr841Nd Using TFTP and WiresharkDocument13 pagesHow To Unbrick Tp-Link Wifi Router Wr841Nd Using TFTP and WiresharkdanielPas encore d'évaluation

- Modeling and Fuzzy Logic Control of A Quadrotor UAVDocument5 pagesModeling and Fuzzy Logic Control of A Quadrotor UAVAnonymous kw8Yrp0R5rPas encore d'évaluation

- DTMF Controlled Robot Without Microcontroller (Aranju Peter)Document10 pagesDTMF Controlled Robot Without Microcontroller (Aranju Peter)adebayo gabrielPas encore d'évaluation

- Statable 1Document350 pagesStatable 1Shelly SantiagoPas encore d'évaluation

- Business Plan GROUP 10Document35 pagesBusiness Plan GROUP 10Sofia GarciaPas encore d'évaluation

- Solutions To Questions - Chapter 6 Mortgages: Additional Concepts, Analysis, and Applications Question 6-1Document16 pagesSolutions To Questions - Chapter 6 Mortgages: Additional Concepts, Analysis, and Applications Question 6-1--bolabolaPas encore d'évaluation

- Frito Lay AssignmentDocument14 pagesFrito Lay AssignmentSamarth Anand100% (1)

- Ting Vs Heirs of Lirio - Case DigestDocument2 pagesTing Vs Heirs of Lirio - Case DigestJalieca Lumbria GadongPas encore d'évaluation

- Mathematics 2 First Quarter - Module 5 "Recognizing Money and Counting The Value of Money"Document6 pagesMathematics 2 First Quarter - Module 5 "Recognizing Money and Counting The Value of Money"Kenneth NuñezPas encore d'évaluation

- Flyer Manuale - CON WATERMARK PAGINE SINGOLEDocument6 pagesFlyer Manuale - CON WATERMARK PAGINE SINGOLEjscmtPas encore d'évaluation

- A Varactor Tuned Indoor Loop AntennaDocument12 pagesA Varactor Tuned Indoor Loop Antennabayman66Pas encore d'évaluation