Académique Documents

Professionnel Documents

Culture Documents

Air Scoop November 2007

Transféré par

airscoopCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Air Scoop November 2007

Transféré par

airscoopDroits d'auteur :

Formats disponibles

Highlights in this Issue

SWOT Analysis of SkyEurope p. 7

SkyEurope in Trouble... p. 15

easyJet and Ryanair to Adapt to French Labor Laws p. 18

French Airports Uncomfortable With Subsidies p. 21

Safety and Security Worries for LCCs p. 23

The Low Cost Carriers Analysis Newsletter

EDITORIAL

Survival of the Fittest

M

ay 2007. Ryanair website crashed due to tech- As for the new entrants, all their marketing efforts and

nical difficulties. There were too many people advantageous offers look rather helpless and faded against

booking “free” flights. Ryanair made an unpre- the backdrop of such monsters as Ryanair and easyJet.

cedented offer of 1 mln free seats hoping to raise money Neither have they the fleet that could compete nor can

from ancillary income. Sheer generosity? Scarcely. Most they negotiate favourable terms with airports that are

likely it was a mass attempt to stimulate demand for the already in hands of Irish-UK team. In other words, it is

dark cloud of overcapacity has appeared on the LCCs’ ho- almost impossible for a smaller budget airline - with the

rizon. exception of those which already serve South-East and

Northern Europe - to succeed since there are no more

Overcapacity, or in other words a situation when there unexplored markets left.

are more seats offered than passenger demand, shows that

LCCs’ growth simply cannot last for ever and ever. Pro- The amount of LCCs killed in action or never even star-

bably, European LCCs have developed to maximum size ted operating is very close to the amount of extant ones.

possible. There are now around 60 no-frills operators in One further thing is the example of the USA where the

Europe which specialize on leisure destinations or casual LCC model failed. In other words, it is high time for new

travelling. Except for Northern and Central and Eastern LCCs to stop springing and for successful ones to recon-

Europe, there are too many rival carriers and too many sider their strategy. It is evident now that aggressive de-

seats available. However, it is demand that basically bols- velopment is almost over and leads nowhere. As regards

ters LCCs’ development. One of the keys to LCC suc- business travel the major shortcoming is that LCCs ope-

cess is quick turnaround which ensures high capacity, i.e. rate flights to secondary airports which are often far away

a certain number of seats bought per km. Therefore, it is from the place of actual destination. Merging won’t solve

hard to survive with demand going down when the whole the problem either since merging airlines does not mean

existence is staked on the load factor. reducing fleet; and, therefore, the amount of seats availa-

ble will remain the same. The conclusion suggests itself.

When the low-cost model was just being introduced, the In the nearest future, only a few major LCCs will still be

carriers did not have to fight for demand because it had operating flights in Europe. And perhaps two of them are

already existed, they opened routes to popular leisure already known: Ryanair and easyJet.

destination and major cities that simply lacked afforda-

ble tickets and had a plenty of willing travellers. There

have been countless attempts to establish successful LCC;

however, it was the pioneers (Ryanair and easyJet) that

came to rule the skies. Their example inspired prolifera-

tion of even more carriers seeking to capture the market.

Rush for the sky has created the situation when popular

destination are served by several carriers which operate

more than one flight per day. Reasonably, the amount of

people willing to travel had to reach its finite point. Hen-

ce, the percentage of unsold tickets has gradually begun to

grow as new offers appeared. The emergence of low-cost

service did generate new traffic especially amongst youn-

ger travellers but the initial boom is rapidly descending.

Air Scoop - November 2007 www.air-scoop.com

BIRD’S EYE VIEW

Interview of Joachim Hunold

Joachim Hunold

(CEO of Air Berlin) (CEO of Air Berlin)

Could you please present Air Berlin to our readers? – if so, it is good for the business, and can be furtherer of

What are your specificities compared to other European innovation. In Germany, we are the second biggest airline,

LCCs? What do you do better than your competitors? in Europe the third biggest Low Cost Carrier – but all in

all: we differ from every other airline in Europe. We offer

We never wanted to be a low-frills carrier and never wan- much higher customer service levels than all other Euro-

ted to be like a flag carrier. Where we position ourselves is pean Low Cost or Low fare carriers, and most of Europe’s

as a hybrid carrier- in between the competitive European National or legacy carriers.

scheduled aviation sector. A sector rife with competition

and generally low margins. We have greatly raised the What is your position on environmental issues concer-

‘customer experience’ in this sector by creating its own ning European LCCs?

segment, and providing an industry leading high quality

service at significantly low fares. Air Berlin is aware of its responsibility for environment-

The service aspect is at the core of Air Berlin’ strategy friendly behaviour and adheres to policies designed to

as we believe there is a large market who appreciate the keep emission levels as low as possible. One of the central

value added benefits of our services. Air Berlin’s customer elements of Air Berlin’s environmental commitment is its

management strategy is to provide the most attractive and fleet policy. Our company operates one of the industry’s

‘best in the market value’ scheduled air transportation ser- youngest fleets. Almost all aircraft are fitted with Win-

vices. glets or Wingtips, to improve the wings’ aerodynamics

and contribute to reduced fuel consumption up to 3%.

From the most comfortable,modern fuel efficient aircraft, Moreover, the new Air Berlin aircraft also are considera-

to inflight menus created by the famous Sansibar restau- bly quieter than comparable other aircraft.

rant, Air Berlin’s processes are driven with the customer

in mind. We firmly believe that quality produces efficien- Emissions trading in air transport can only be one com-

cy, by delivering the best product in the market sector ponent of a comprehensive overall strategy to reach the

and achieving customer retention. ultimate goal of a reduction in emissions. In particular,

this has to include the implementation of new techno-

The market has understood our strategy and continues to logies and the creation of adequate infrastructure, both

reward us with a consistent buying interest on the stock parts of which must be carried out simultaneously. The

market. After initial concerns, experts now consider the “Single European Sky” project alone, which has been in

“Air Berlin model” as exemplary for the sector. So far, we political discussion for almost 15 years, would reduce the

are the only German hybrid carrier, namely a carrier that CO2 emission by up to 12 %. Considerable potential is

uses all conceivable sales channels, thereby making itself available here, which should be made use of. The current

less dependent on seasonal fluctuations. In the future, we target date of 2020 is not ambitious enough. The German

also plan to grow faster than the market in which we do air transport industry therefore continues to insist on a

business. For a long time, Air Berlin has considered this coherent and well-balanced overall strategy.

market to embrace not only Germany but Europe as a

whole The European Low cost carriers market has reached

a certain maturity which leads to its consolidation.

How do you analyze the competition in Germany with During this transition, what are, for you, the greatest

German carriers (TUI, Condor, Germanwings…)? threats to the European Low cost carriers? Fuel rising?

And especially with Ryanair, easyJet and other LCCs? Overcapacity? Evolution of airports? Regulation?...

Which LCC is for you the main competitor?

The airline industry is highly competitive and this is true

Every airline to fly on the same routes as we do is a com- especially for the low-cost segment. Moreover, aviation

petitor. Competition can be tough, but it has to be fair competes with ground transportation options particularly

2 Air Scoop - November 2007 www.air-scoop.com

BIRD’S EYE VIEW

with regards to short haul routes. We see these “risks” as Many LCCs look after extra-revenues to offset the low

challenges that will be overcome with the successful hy- price of their tickets. What are the projects of Air Berlin

brid business model. Its unique position clearly separates in terms of Extra-revenues?

us from other LCC and from the problems of overcapa-

city, where the battle for market share is carried out al- We successfully integrated additional meals and high-qua-

most exclusively through pricing and, as a result, through lity service, such as the on top gourmet “Sansibar” meal,

cost cutting, Air Berlin takes advantage of the opportu- which has become very popular among our customers.

nity of the accelerating consolidation process. The acquisi- Additional in-flight products or tickets for ground trans-

tions of dba and LTU are examples of such participation. portation and our premium partners for our frequentflyer

Accounting for approximately 22 per cent of overall ope- program Top Bonus are further examples from which we

rating expenses, aviation fuel represents by far the most and our customers will profit.

significant cost for Air Berlin. Fuel prices are subject to

notoriously wide and poorly predictable fluctuations that Do you believe that consolidation of the market will

often enough are only minimally correlated with business lead to 2-3 main LCCs in Europe, or do you think there

developments. Thus, in order to improve planning confi- will always be many LCCs on niche markets?

dence and to reduce the influence of price fluctuations on

profitability, Air Berlin systematically engages in hedging I think there might be more consolidation, not only in

transactions. Germany, but also in Europe. There are a lot of low-cost

carriers and you don’t know how long they will last and

What are your expansion projects for the coming some flag carriers are in a very weak position. Look for

year(s)? example to Austria or Italy.

We were never aiming to be big or not big, expansion pro- Are you worried about the shortage of pilots and crew

jects must be profitable and must make sense. In light of hitting LCC market?

the quickly progressing concentration process of European

aviation, integrating Condor in 2010 into the Air Berlin As we started this year with our own flightschool we can

Group secures the future for both companies. Together, secure our need of pilots.

we will achieve international competitiveness. This step

makes sense, especially following the takeover of LTU, What are the options for Air Berlin to transform its busi-

since it will enable us to offer our clients a more tightly- ness model in order to make more costs savings?

meshed long-haul flight network.

Our expansion and the thereby resulting joint market pre-

sence offers cost-cutting potentials and positive synergies.

3 Air Scoop - November 2007 www.air-scoop.com

DOWN TO EARTH

‘‘IdeaWorks AISLE’’

Is airline branding a waste of money and

do airlines really care?

91% of airline executives in a worldwide survey say the

power of an airline’s brand can attract more customers, by Jay Sorensen

but 56% admit funding for branding initiatives is a pro- (President of IdeaWorks)

blem. www.IdeaWorksCompany.com

Michael O’Leary, the CEO of Ryanair, may have tried

to remove luxury and romance from the airline industry

with this comment, “Air transport is just a glorified bus

operation.” (1) The cost-cutting behavior of many air-

line executives tends to support Mr. O’Leary’s premise; The following pie chart displays the global representa-

travelers have witnessed the removal of niceties such as tion of survey participants. All regions of the world are

headrest covers, pillows, blankets and even that venerable represented with 80% of respondents outside the United

industry icon - - the peanut packet. But has this activity States and Canada. The large concentration of respon-

also removed the essence of what is a brand? dents from Europe and Russia is likely attributable to the

London location of the conference.

Recent advertising by Southwest Airlines mocks this un-

compromising attack on amenities by suggesting other

airlines might someday charge for use of a window shade.

Of course, the joke doesn’t apply to Ryanair - - which

long ago stripped their aircraft of window shades in a

campaign to reduce weight and save fuel. The “lowest

cost wins” mantra (another quote from Mr. O’Leary) (2)

may suggest to some marketers that brand building is a

luxury the airline industry can’t afford. Have low cost

carriers, along with the rest of the airline industry, tossed

the idea of brand building onto the scrapheap of history?

Or, has the concept of branding evolved with the growth

of the low cost carrier sector?

To answer these questions, IdeaWorks, in cooperation The survey contained five questions on the topic of airline

with airline conference organizer Terrapinn, recently branding, the response rate per survey item ranged from a

distributed a survey on the topic of branding to airline high of 142 respondents, to a low of 81 respondents.

executives all over the globe. The survey was distributed

online and attracted participation by over 140 airline ma- Brands are created in the consumer’s mind

nagers. It was prepared in anticipation of the World Low

Cost Airlines Congress hold in London on September The discussion of branding is best begun with a few de-

17-19, 2007. finitions of a word that is understood by all, but difficult

to describe exactly. Walter Landor, the founder of Lan-

Representatives from more than 110 airlines will gather in dor Associates, once said, «Products are created in the

London, making it the largest event designed for the low factory, but brands are created in the mind.» (3) Jack

cost airline sector. Airlines sending representatives range Trout, a leading marketer and originator of the concept of

in size from major carriers such as JetBlue, Southwest product positioning, defined it this way, “So, dear reader,

Airlines, easyJet and Japan Airlines, to smaller carriers if you want a simple definition of branding, here it is: It’s

such as Air Baltic (Latvia), Nok Air (Thailand), and Sky all about establishing a name for your product and a diffe-

Express (Crete). Jay Sorensen, president of IdeaWorks, rentiating idea in the mind of your prospect.” (4)

will lead a panel of airline executives in a debate on the

topic of branding initiatives. Joining Mr. Sorensen on the David Ogilvy, the famous advertising copywriter and

panel will be Brett Godfrey (CEO of Virgin Blue), Paul ad agency founder, defined brand as: «The intangible sum

Simmons (Head of Brand Marketing for easyJet), and An- of a product’s attributes: its name, packaging, and price,

drea Spiegel (VP of Marketing at JetBlue). its history, its reputation, and the way it’s advertised.» 5

4 Air Scoop - November 2007 www.air-scoop.com

DOWN TO EARTH

These definitions suggest that brands can be defined by factors other

than the inclusion of extra services and amenities. Branding has the power to attract passengers

Airline branding is alive and well Marketing legends fervently believe in the effec-

tiveness of good branding. But CFOs are quick to

The public perception of airline quality, and by extension the repu- ask if branding-related expenditures generate addi-

tation of airline brands, remains the subject of jokes by comedians, a tional revenue. The responses to Question 4 pro-

hot topic in the media, and an easy target for politicians. Given this vide a resounding “yes” to this question. 91% of the

“excess baggage” it may be surprising that airline executives believe airline executives surveyed said branding conveys a

in the power of their brands. The results of the survey generally des- commercial advantage that delivers additional tic-

cribe a marketing environment in which brand building is practiced ket sales. Nearly half, or 45% of respondents, say

at airlines throughout the world. branding can prevail even when competitors offer

lower fares.

The responses to Question 1 indicate 99% of respondents report

some level of branding activity occurs at their airline; only 1% indi- Question 4: Which response would best describe

cate branding is not relevant. The responses by 59% of the executi- the importance of the brand of an airline when

ves suggest branding has been integrated into the company culture compared to ticket prices?

and the services provided to passengers. If the ticket price is the same for 2 airlines, the

airline with the stronger brand will attract more

Economics may suggest branding efforts are largely directed to busi- passengers. 46%

ness travelers, who an airline’s most profitable passengers. Surprisin- The brand strength of an airline can attract passen-

gly, 70% of the respondents to Question 2 placed equal importance gers from another airline, even if the ticket is more

on “all” passengers. Only 28% said branding was of greatest impor- expensive. 45%

tance to business travelers. Lowest price always wins regardless of brand

strength. 9%

Contrarian marketers might identify an opportunity from the res-

ponses to Question 2. While measurable importance is placed on Branding naysayers, or perhaps those who don’t

branding for business travelers, the importance associated with a consider price leadership to represent a true bran-

pure leisure audience is virtually nil. It would appear airlines have ding attribute, subscribe to the notion that lowest

created brands that appeal to a broad audience, but also emphasize price always wins. These airline executives are

higher yielding business travelers. It would be ironic if leisure trave- clearly in the minority and only comprise 9% of

lers, who represent the bedrock customer group of low cost carriers, survey respondents.

have become neglected.

Question 5 merges the sometimes separate worlds

The responses to Question 3 support the concept that branding is of marketing and finance. While the overwhelming

beneficial to a broad spectrum of customers . . . and airlines. The majority (95% of respondents) indicate branding

overwhelming majority of respondents indicate branding not only activities are included in their budget, the majority

offers benefits to their airline, but also to all types of carriers. of these executives say additional funding is unli-

kely, or express the concern that existing budgets

Question 3: Does the importance of a brand vary for different types could be cut.

of airlines?

Branding is an important factor for all airlines, regardless of type. Question 5: Please describe the likelihood of in-

83% creased funding for branding initiatives at your air-

Branding is most important for full-service or legacy airlines, and line.

offers fewer benefits for other types. 11% Branding initiatives are an existing part of the mar-

Branding is most important for new airlines or low cost carriers, and keting budget, but additional funding is not likely.

offers few benefits for other types. 6% 45%

Branding is not an important factor for any airline. 0% Branding initiatives are an existing part of the mar-

keting budget, and getting additional funding is li-

As in Question 2, not a single respondent rated branding as unim- kely. 44%

portant from the perspectives of customers and management. This Branding initiatives are always in danger of being

is an important result, as it reveals branding can include the low cost cut. 6%

airline sector - - in which price is paramount, and amenities can be Branding initiatives are not part of the budget, and

non-existent. new expenditures are not likely. 5%

5 Air Scoop - November 2007 www.air-scoop.com

DOWN TO EARTH

Conclusion and Observations Sources used in this Industry Analysis: Unless otherwise

noted, the survey results described in this analysis were

While practically all respondents expressed support for collated from the surveys completed by airline executives.

branding initiatives, the perception of its effectiveness The survey was conducted during July 2007. Multiple

varies among airline executives. The similarity of the surveys (based upon IP address) from any one individual

responses to Questions 4 and 5 is compelling. The 45% were not accepted.

of respondents that indicate “The brand strength of an

airline can attract passengers from another airline, even Disclosure: IdeaWorks makes every effort to ensure the

if the ticket is more expensive” likely represent the 44% quality of the information in this report. Before relying

that said they could get more money in their budget for on the information, readers should obtain any appropriate

their branding activities. professional advice relevant to their particular circums-

tances. IdeaWorks cannot guarantee, and assumes no le-

The results from this global survey provide a strong gal liability or responsibility for the accuracy, currency or

answer to the question posed by the title of this report: completeness of the information.

“Is airline branding a waste of money?” Branding widely

practiced at airlines worldwide and is a valuable tool for World Low Cost Airlines Congress: More information is

attracting more passengers and gaining revenue. Its allure available at this link: http://www.Terrapinn.com/2007/

is not without limits, with approximately 45% of respon- wlca

dents saying it can be more powerful than pricing, but a

nearly equal group saying it’s only a deciding factor when Endnotes:

prices are equal. Amazingly, not a single respondent said,

“Branding is not an important factor for any airline.” 1: Michael O’Leary, Ryanair’s chief executive, quoted in

BusinessWeek Online, 12 September 2002.

Traditional airline branding may have assumed its pri- 2: Ryanair May 31, 2005 Press Release, “Ryanair Celebra-

mary purpose was to romanticize air travel and to ex- tes 20 Years of Operations,”

tol the virtues of amenities and services. Today, many Ryanair.com.

consumers believe “travel and romance” is nothing more 3: Tales From The Marketing Wars, ‘Branding’ Simplified

than a quaint artifact from another era - - lowest fare is by Jack Trout, Forbes.com, April 19, 2007.

most important to them. The definition of branding has 4: Tales From The Marketing Wars, ‘Branding’ Simplified

obviously changed for the majority of airline marketers; by Jack Trout, Forbes.com, April 19, 2007.

the absence of amenities and services can be used as attri- 5: Ogilvy, D. (1983), Ogilvy on Advertising, John Wiley

butes to define a company’s brand. Perhaps Mr. O’Leary’s and Sons, Toronto, 1983.

intent to define his brand as a “glorified bus operation”

may be one of the most successful branding statements in

the marketplace today.

EVENTS

International IIR Conference

LCCs Evolving Business Models

November 6 and 7 2007 in Cologne

Low cost carriers are facing challenging times: they struggle with cut-throat competition, search frantically for promising

niches, seek the most compelling business model and agonize about the ideal strategy. Alexander Tamdjidi from PA

Consulting Group shows how to master the pitfalls of a strongly competitive and potentially saturated European low

cost market. He advises on different business models, presents a holistic picture of the European low cost market, points

to attractive niches and introduces a ground- breaking tool that rapidly evaluates options and possible strategies for a

sustainable, long term positioning against competitors.

Visit the website to view the agenda and register: www.aircraft-conferences.com/index_lowcost.htm

6 Air Scoop - November 2007 www.air-scoop.com

BIRD’S EYE VIEW

SWOT Analysis of SkyEurope SWOT TEAM

Introduction Košice and Poprad-Tatry. Bratislava is by far the most si-

gnificant of these, since the bulk of the traffic is concen-

Central and Eastern Europe (CEE) is one of the most dy- trated at this airport. Košice is served only by SkyEurope;

namic marketplaces in the world. Eight CEE countries joi- daily domestic flights connect the city with Bratislava. Si-

ned the European Union in 2004 and at the beginning of milarly, Poprad-Tatry, which is a popular tourist resort, is

2007, Romania and Bulgaria joined. The key facts driving served solely by SkyEurope and regular flights are offered

passenger traffic in this region are EU enlargement, strong to London. Its other unique flight routes include: from all

economic activity and stability, the increase in leisure tou- hub cities to Catania on the island of Sicily, Italy; and a di-

rism, and the ongoing liberalization of civil aviation in the rect route between Copenhagan and Budapest (this route

region. has currently been suspended).

Low cost air travel in CEE has blossomed primarily from In 2006, 1.93 million passengers landed or departed from

the new EU members, as their entry allowed carriers to Bratislava, 94% of them traveled on international routes.

operate freely among all the member states without the SkyEurope carried 48% of total passengers, Ryanair took

restriction of bilateral agreements limiting the number of 24%.

flights and favoring national airlines. The trend spread far-

ther east and into the bloc’s neighboring countries, with Their largest base, Bratislava, is located approximately 50

several LCCs launching services into Croatia, Bulgaria and kilometers from Vienna, which is also their base, thereby

Romania. providing access to Austria, one of the most mature air

travel markets in Central and Eastern Europe. They ope-

The citizens of Central and Eastern Europe, along with rate a leased fleet of 14 aircraft, comprising of fourteen

the local and multinational businesses operating there now 149-seat Boeing 737-700 (Next Generation) aircraft. The

have a dizzying array of airline choices available. Besides twelve Boeing 737-700 (Next Generation) aircraft delive-

the well-known state carriers like Poland’s LOT, CSA red between March 2006 and May 2007 have been acqui-

Czech Airlines, and Malev Hungarian Airlines, low-cost red by GECAS and leased to the airline under operating

European airlines like Ryanair, SkyEurope, Centralwings, leases, each with a term of eight years.

Wizz Air, EasyJet, SmartWings etc have a significant pre-

sence in this region. Central and Eastern Europe is a high growth area, and a

host to several low airlines, sometimes operating the same

In the New EU member countries, current market share routes (SmartWings, Centralwings, Wizz Air, SkyEuro-

stands at 80% traditional carriers, 20% LCCs, and by 2010 pe...) and a growing amount of Western companies. The

it is predicted that LCC market share will grow by 8% to battle could become very intense as some of these carriers

28%. This figure is similar to the UK (currently 79%:21%, have some financial weakness. Also high fuel prices and

to increase to 72%:28% in 2010) where the LCC market is tough competition have put pressure on low-cost carriers

the most developed in Europe. around Europe, and analysts predict Central and Eastern

European LCCs need strong balance sheets to compete

SkyEurope airlines is the largest and first multi-based low with deeper-pocketed rivals such as Ryanair and easy-

cost airline in Central Europe. It was established in 2001 Jet. Will SkyEurope, introduced on the Stock Exchange

and started operation in the following year. It had five ba- in 2005, be able to defeat its local challengers and to resist

ses in Czech Republic, Hungary, Poland and Slovakia. The Ryanair and easyJet, in a « Centralers » Vs « Islanders »

airline uses Bratislava’s Stefanik airport in Slovakia as its fight?

home base. The Firsts’ of SkyEurope: In 2002 SkyEurope became the

first LCC to start operations in the CEE region. It was also

The airlines principal activity is to provide international the first to operate low-fare flights from London Stansted

air transport to passengers and cargo in Central and Eas- directly to Budapest in November 2003.

tern Europe. Since 2002, the company has been gradually In September 2005, SkyEurope became the first low-cost

growing and dominating the Slovakian air transport mar- airline to fly to Romania when it launched flights to Bu-

ket. charest that winter. In the same month, SkyEurope beca-

me the first and only publicly listed airline in Central and

Currently, there are three international airports in the Eastern Europe, and one of the only five low-cost airlines,

Slovakia that are served by a low-cost carrier: Bratislava, together with easyJet and Ryanair, listed in Europe.

7 Air Scoop - November 2007 www.air-scoop.com

BIRD’S EYE VIEW

In October 2006, SkyEurope became the first airline that SkyEurope and KLM E&M signed a Total Care package,

paid its passengers for flying for a stated period of time. which would take care of all aspects of maintenance on

In October 2007 it also launched the first intra-Austrian the SkyEurope fleet including heavy maintenance and

service to be operated by an LCC. On October 23rd, spare parts supply. SkyEurope has JAR145 certification for

SkyEurope Airlines engaged Seattle, Washington-based its bases in Bratislava and Budapest, which means that its

Naverus to prepare required navigation performance own engineers take care of line maintenance at those two

(RNP) approaches to airports in its network, making it the airports. KLM E&M helped SkyEurope set up the entire

first airline in Europe to do so. operation and trained most of their engineering staff.

Growth: In July, 2003, SkyEurope started flights from

Awards and Records London Stansted to Vienna Bratislava. Bratislava airport

In December 2004, Christian Mandl (Chairman & CEO) is only 30 miles away from Vienna and a SkyShuttle bus

was awarded Entrepreneur of the Year in Austria. SkyEu- took travelers from the Bratislava airport to Vienna. Ser-

rope was awarded best Low Cost Airline in Hungary in vices from Budapest to London-Stansted and Paris-Orly

February, 2005. It also won the Superbrand Award in the started in November 2003, and to Milan-Bergamo and Zu-

same year in Hungary. In November, 2005, the airline was rich from December 2003. Also in November it opened its

awarded Bronze “Effie Award” in Poland. During the same second base in Budapest.

period it was also awarded the “Airline of the Year 2005” SkyEurope launched services from June 2004 into and out

by Austrian Business World Magazine. of Warsaw competing with Airpolonia. Austrian Airlines

On January 27, 2007 SkyEurope brought in first, its 2007 and Lufthansa also announced services into Bratislava and

Boeing 737-700NG after record-breaking flyover of 8 382 with SkyEurope adding more services out of Budapest,

miles without any fuel stop. Nonstop flight from Seatt- the whole region was being awakened to a sudden change

le to Prague breaks the current world record in distance from a drizzle to a shower of airlines. In September 2004,

flown of this type in commercial configuration. SkyEurope it opened its base in Krakow, Poland.

brings its 10th Boeing 737-700NG and breaks world record SkyEurope Holding AG completed its initial public of-

in distance flown when landed in Bratislava without any fering in September 2005. It raised €60 million (gross) of

fuel stop in 10 hours and 27 minutes on March 18, 2007. new equity capital and the shares were simultaneously lis-

Overview of SkyEurope ted on the Vienna and Warsaw Stock Exchanges, reflecting

the Central European focus of its operations. The founders

History: SkyEurope Airlines was established in Septem- beneficially owned 8.8% of the company. The other major

ber 2001, founded by two entrepreneurs in 2001: Chris- shareholders included Endavour Holdings, East Capital,

tian Mandl and Alain Skowronek. The airline began Merrill Lynch and Griffin Capital. The free float amoun-

flying passengers on a single domestic route in the Slovak ted to 57.3% at that point in time.

Republic in February 2002 using a 30-seat Embraer 120ER

aircraft, becoming the first LCC to commence operations SkyEurope became the first low-cost airline to fly to Ro-

in Central Europe. mania when it launched flights to Bucharest from Bratis-

The airline’s business development strategy initially sought lava in December 2005. The airline operated three flights a

to serve unsatisfied demand and stimulate additional de- week from the Slovakian capital, Bratislava, to Bucharest.

mand in the Slovak Republic for air travel services and also

subsequently start flights to Central and Eastern Europe. On Feb. 14, 2006, SkyEurope Airlines became the third

Gradually, it expanded its reach beyond the Slovak Re- air carrier to establish a base at Prague Ruzyně Interna-

public and established additional bases in other countries tional Airport, in addition to flagship carrier Czech Air-

with the potential for additional demand stimulation. lines (ČSA) and Czech low-cost airline SmartWings,

In the early part of 2003, a consortium of investors con- which is operated by Travel Service. The airline based

sisting of private equity funds funded the development of two new Boeing 737-700 aircraft in Prague. During April

SkyEurope Airlines. Investors in these funds include the 2006, SkyEurope started scheduled services from Prague

European Bank for Reconstruction and Development to airports serving seven European cities: Amsterdam, the

(EBRD), the European Union and ABN AMRO Bank. Netherlands; Barcelona, Spain; Naples, Milan’s Bergamo

The airline then operated a fleet of 2 Boeing 737 and 4 airport and Rome’s Fiumicino in Italy; and Nice and Paris’

Embraer 120 aircraft. Orly in France.

It later changed the composition of its fleet from the regio-

nal 30-seat Embraer aircraft through longer-range 133-seat SkyEurope`s load factor reached 84.2% in July 2006 and

Boeing 737-500 (Classic) aircraft towards 149-seat Boeing achieved highest monthly passenger volume in the airline’s

737-700 (Next Generation) aircraft. history. The load factor for the 12 months ended July 2006

reached 75.3%.

8 Air Scoop - November 2007 www.air-scoop.com

BIRD’S EYE VIEW

In August 2006, SkyEurope sold €56.3 million worth of from Bank of Scotland Corporate. It extended its support

shares and bonds to fund growth. The stock was down to SkyEurope Airline with the conclusion of a committed

56% that year, giving the Bratislava, Slovakia-based car- pre-delivery payment loan facility for five new 737-700

rier a market value of €43 million. The airline raised €38.8 aircraft to be delivered in 2008.

million from an investment by York Global Finance and In February 2007, Avis Europe signed an exclusive three-

€17.5 million from a public offering of shares. London- year partnership with SkyEurope. As per the deal, SkyEu-

based York bought around 9 million new shares at €1.75 a rope customers booking through the airline’s website can

share. York also bought about €6.7 million worth of bonds reserve a rental car with Avis.

“mandatory” convertible into 3.8 million new shares. If On March 25, 2007 SkyEurope started to serves 16 destina-

such conversion takes place, York’s pro forma equity stake tions from International Airport Schwechat in Vienna to

in SkyEurope will rise to 29.9 percent. It also purchased Hol¬land, Greece, Spain, Belgium, Italy, France, Romania,

€17 million worth of bonds that need not be converted Bulgaria, Cyprus and Croatia, and became the second big-

into shares. gest airline in terms of flight network right after Austrian

Airlines. In Vienna, SkyEurope competes with the local

The share sale follows an agreement on August 24th for a low-cost leader, the German-Austrian alliance Air Berlin

long-term loan from the Bank of Scotland to buy four new - Niki.

Boeing Co. 737-700 airplanes for delivery in 2007. This

would expand its current fleet of 12 Boeing 737 aircraft to In April, Nick Manoudakis, a founding member of easy-

16 by 2007. Jet, was appointed as SkyEurope’s Chief Financial Officer.

Alain Skowronek, SkyEurope’s co-founder and Chairman,

In October 2006 at Prague, SkyEurope Airline cut ticket stepped down from his executive functions with the Com-

prices to minus 10 koruna (US$0.44; €0.35), claiming to pany. Christian Mandl became the Chairman and CEO of

become the first airline that paid people to fly with them. SkyEurope Holdings AG and Jason Bitter became CEO of

The cuts applied to tickets for flights between Nov.1- SkyEurope airlines.

Dec.15 and Jan.9-March24 and these tickets were to be

booked between Oct. 17, and Oct 22 midnight. In the 12 months ended May 2007, the load factor increased

by 4.9 percentage points and reached 81.0%.

In December, the airline announced that it would fly from On 25th July 2007 SkyEurope Airlines introduced the first

Vienna to 16 cities in Europe starting on March 25th, 2007. directly-purchased Boeing 737-700NG into service. This

The cities include Amsterdam, Brussels, London and Paris. brand-new aircraft registered as OM-NGN landed at Bra-

The move was aimed at boosting efficiency and profitabi- tislava Airport on 19th July 2007 and was being financed

lity. It was also cutting spending and eliminating unprofi- by Halifax Bank of Scotland.

table routes after posting a euro57.3 million (US$75.6 mil- In July 2007 SkyEurope announced that it would start

lion) loss in the last fiscal year. operating flights into London Luton Airport from later

this year. The airline also announced that it would leave

The Year 2007: Erhard Schmidt, SkyEurope’s Chief Finan- Stansted and operate flights from Luton to Košice, Poprad

cial Officer left SkyEurope as of 31.12.2006. Effective with Tatry and Bratislava, in Slovakia, as well as to Vienna. A

January 2007, the position of the Chief Financial Officer new service between Dublin and Košice would be added

was held on an interim basis by Lane Zirnhelt, the com- to the airline’s network alongside a route between Cork

pany’s current Finance Manager. and Bratislava.

In August, SkyEurope shares plummeted on news that

At the beginning of 2007, two Austrian businessmen, Ron- private investor Ronny Pecik had reduced his stake in the

ny Pecik and his partner George Stump, took over 16.5% airline, putting an end to takeover speculation. It crashed

of the Bratislava-based company, quoted on the Vienna 12.94 pct to close at 4.60 euros.

Stock Exchange. In August, the discount airline reported third-quarter los-

ses of 5.24 million euros (7.18 million dollars), a reduction

SkyEurope launched its SkyCorporate initiative in early compared with 16.54 million euros net loss in the same pe-

Feb-07, offering a range of services aimed at encouraging riod last year. Losses for the first 9 months of the 2006/07

business travelers to use the carrier, as well as extending business year fell from 50.2 million euros to 37.6 million

the service options that the carrier offers to corporate cus- euros in the year-on-year comparison. The company’s de-

tomers. bts however increased from 79.5 to 121.6 million euros.

SkyEurope remains heavily affected by high leasing costs

SkyEurope secured aircraft financing in February 2007 for its 12 aircraft.

9 Air Scoop - November 2007 www.air-scoop.com

BIRD’S EYE VIEW

Operative earnings before interest, taxes, depreciation, in October 2007.These are daily flights to Amsterdam,

amortization, share profits of associates and lease pay- Brussels, Paris, Innsbruck, Warsaw, Thessalonica, Venice

ments (EBITDAR) were 3.23 million euros, up from a and Nice. It also has flights to Krakow and Athens and

negative EBITDAR of 7.09 million euros. EBIT improved between Sofia and Vienna. SkyEurope also connected

from minus 14.5 million euros of last year 3rd quarter to Bergamo Orio al Serio Airport with Vienna.

minus 5.2 euros in the corresponding 3rd quarter this year.

The losses of the first nine months of the year reduced In October the airline became the most convenient car-

from 48.8 million euros in 2006 to 35.2 million euros this rier between London and Prague after Czech Airlines and

year. Revenues increased by 26 per cent to 66.6 million Thomsonfly announced their withdrawal from the routes

euros. SkyEurope said it expected to report a positive between Prague and London during this month. SkyEu-

EBIT for the fourth quarter. rope planned to attract more business travelers in Central

In early September, SkyEurope Airlines announced that it and Eastern Europe by making Vienna its principle base.

would cease flights from Budapest, Hungary, and Krakow, SkyEurope would increase it’s VIE fleet from two 737-

Poland, at the end of October. Besides all routes from Bu- 700s to four and add flights to 12 destinations while boos-

dapest and Krakow it would also give up its routes from ting frequencies on existing routes like Amsterdam and

Bratislava to Amsterdam, Barcelona, Basle/Mulhouse and Sofia. It also would launch the first intra-Austrian service

Copenhagen, from Bucharest Baneasa to Rome Fiumi- to be operated by an LCC, a twice-daily VIE-Innsbruck

cino, from Prague to Barcelona and from Warsaw to Paris flight.

Orly. They also planned to sell their airport handling unit

at Budapest Ferihegy International airport, for about USD SkyEurope also became the first airline in Europe to

3.5 million. SkyEurope currently flew to 39 destinations in operate satellite navigation-guided precision approaches,

19 countries. when it engaged Seattle, Washington-based Naverus in

SkyEurope would have its bases only in Prague, Bratislava October to prepare required navigation performance

and Vienna. SkyEurope also stopped flying to Turin, Italy, (RNP) approaches to airports in its network. This would

due to low seat occupancy and in the winter season there ensure more efficient operations under any weather con-

would be no flights between Prague and Barcelona, Spain. ditions, reducing flight times and fuel consumption but

The idle aircraft would be used for expansion in Prague, enhancing safety.

Vienna and Bratislava. SkyEurope would continue to

fly to Krakow from Vienna. The reasons quoted for wi- On 5th October, shares of SkyEurope surged 9.76 pct to

thdrawal were high taxes, drop in demand and seasonality 2.25 euros, which was helped by the improved liquidity

of the markets. outlook through the sale of its two jets. In the following

week SkyEurope shares jumped 8.89 pct to 2.45 euros

On September 14 Analysts at CAIB Research downgra- on the news that the low-cost carrier has been upgraded

de SkyEurope Holding AG (ticker: S8E) from «buy» to to ‘hold’ from “sell” at UniCredit with a new target pri-

«sell.» The target price has been reduced from €4.6 to ce reduced to 2.45 euros from 2.60 euros. Although the

€2.6. In a research note published the analysts mentioned conversion of York Capital’s convertibles had improved

that the company continued to face liquidity issues, des- SkyEurope Holding’s equity situation, the analyst of CAIB

pite its successful restructuring initiatives. Although the Research said that the company’s capital position conti-

company’s EBIT was in-line with the estimates, its capital nued to be tight.

expenditure was high and the company’s operating cash

flows continued to be negative. SkyEurope Holding AG Commencing 28 October 2007, SkyEurope Airlines fur-

said that its passenger traffic in September 2007 increased ther expanded the London Luton Airport route network

by 18.9 pct year-on-year, while its load factor reached 86.1 into Central Europe with 3 destinations in Slovakia and

pct, up 5.4 percentage points from a year earlier. also flights to Prague in the Czech Republic.

In September 2007, SkyEurope Holding AG (Vienna: Challenges:

SKY.VI - news) stated that its largest shareholder York

Global Finance II had boosted its shareholding in the 1. Would SkyEurope survive the winter credibly?

low-cost airline to 29.9 pct from 23.06. York converted all 2. Will it show a positive EBIT in the last quarter?

its Tranche B convertible bonds into just over 3.8 million 3. How can it improve its overall load factor?

common bearer shares at a price of 1.75 euro a share. 4. What is the game plan for progress once it survives this

winter?

Low-cost airline SkyEurope launched new direct flights

from Bulgaria to 11 European capitals and major cities

10 Air Scoop - November 2007 www.air-scoop.com

BIRD’S EYE VIEW

Business Model of SkyEurope aircrafts with leather seats, to convenient major airports

and having outstanding on time performance, SkyEurope

SkyEurope, operating one of Europe’s fastest growing low- has added some specials on board. The major features of

cost low-fare passenger airlines is focused on services to and its business model are presented below:

from Central and Eastern Europe. They offer short-haul

“point-to-point” scheduled services currently to around 35 1. Online Booking: SkyEurope.com is a travel portal that

destinations in approximately16 countries and operates on offers a one stop shop as solution to all travel needs: car

95 routes. The Group’s operations are carried out through rental, hotels, hostels, travel insurance, access to airport

two segments: Scheduled flights and Charter flights. Its lounges, downloadable city guides, audio travel guides, in

hubs are: M.R. Stefanik Airport (Bratislava); Ruzyne In- winter ski equipment rentals etc. These services can be

ternational Airport; Vienna International Airport. Some of booked together with your flight on our website www2.

its major destinations are: Amsterdam, Athens, Barcelona, SkyEurope.com. The purchase of airport lounge access,

Brussels, Dublin, London, Milan, Paris, Rome, Vienna etc. trip insurance, and seat assignments has been seamlessly

inte¬grated into the booking process. The site also allows

The Top Management team comprises of : Christian customers to arrange airport transfers, hotel accommoda-

Mandl – Chairman and CEO of SkyEurope Holding AG; tions, car rentals, and even ski rentals. Customers can add

Jason Bitter – CEO of SkyEurope Airlines; Nick Manou- fee-based baggage services for pet kennels and sporting

dakis – Chief Financial Officer; Karim Makhlouf – Chief equipment. SkyEurope does not charge for regular pieces

Commercial Officer; Klaus Niedl – Chief People Officer. of checked baggage.

2. Pre-Assigned Seating: SkyEurope introduced seat se-

Strategy: SkyEurope targets both leisure and business tra- lection on all its services. Passengers can book their seats

velers, as well as travelers visiting friends and relatives when the reservation is made. Price for the new service

(“VFRs”). Their network comprises routes that connect will be E5 per pre-assigned and will be charged if selec-

cities within Central Europe as well as between Central ted together with the flight. Customers are presented a

Europe and Western Europe. The network has been de- seat map that is color coded with 3 zones. Assigned seats

veloped using a business model that first seeks to stimu- in the first row are priced at 10 Euros, window and aisle

late “point-to-point” local market demand for flights to seats are 5 Euros, and the dreaded middle seat is priced at

other destinations already served by existing bases in our 2 Euros. SkyEurope charges a 5 Euro fee per passenger for

network which is referred to as “joining-the-dots” in the payments made by credit card. Infants under the age of 2

network. As this local market demand increases, additio- years (on the date of travel) are carried for £8 when not

nal destinations are introduced from a base to satisfy the occupying a seat - that means they sit on an adult’s lap. A

increased demand. separate seat if needed for an infant, the passenger must

purchase a ticket similar to that for a child. Children over

SkyEurope has three strategic priorities: increase fre- the age of two years are charged the same fare as an adult.

quencies on existing routes, join the dots within the exis- 3. Confirmation of ticket on the mobile: SkyEurope star-

ting SkyEurope network (reducing of marketing invest- ted the SMS booking confirmation service for the custo-

ments…), and open new destinations to satisfy the local mer while booking a flight. It comes as an option during

needs of the respective bases. The choice of new destina- the ticket booking process with a charge of €1 plus VAT

tions is based on destinations which are under-serviced, per booking. If chosen, all the relevant information will be

which are in the optimal range of two hours flight time (reservation number, flight details) sent directly to the cus-

(because of the rhythm of two or three rotations a day), tomer’s mobile handset. Customers may also choose to re-

and which may be served from more SkyEurope bases. ceive confirmation via facsimile for an additional one Euro

SkyEurope management focuses on profitability and not fee. SkyEurope is a ticket less airline so all one needs to fly

just passenger volumes. Its flight schedules reflect seasonal is your passport for international flights, or photo identity

changes in customer demand whereby flights are operated card for domestic flights, your confirmation number, and a

to attractive ski resorts in winter and increasingly to war- visa, if applicable.

mer destinations like France, Italy, Spain and Croatia. 4. Changes in reservations: Change of destination and time

of departure can be made until up to 2 hours before the

Features: SkyEurope unlike few of its counterparts be- scheduled departure of the flight against payment of a fee

lieves in providing service with a smile. Operating the specified on its website and payment of the difference

youngest fleet in the world consisting purely of Boeing between the original fare and the lowest possible fare

737-700NG with an average age of 8 months per aircraft, available at the time of reservation change. This service can

SkyEurope is the first lifestyle and business airline with be availed only at its reservation center and is not available

an innovative and stylish product. Besides flying modern online. The change in name of the passenger can be made

11 Air Scoop - November 2007 www.air-scoop.com

BIRD’S EYE VIEW

until up to 2 hours before the scheduled departure against Sources of Ancillary Revenue: Ancillary revenue includes

payment of a fee. The change of name is only possible if fees and charges (including credit card surcharges, excess

no part of the journey has been made. The change fee per baggage charges, seat assignment fees, sporting equipment

passenger per flight is 25 euros. charges, infant fees, change fees), profit share from in-fli-

5. Variable modes for ticket booking: The airline offers ght sales (including food, beverages, and boutique items),

different modes for booking the ticket for its passengers. cargo, and commissions received from products and servi-

He or she can book the flight ticket online, through call ces sold (such as hotel bookings, car rental bookings and

centers or via a cash deposit system with some of the lar- travel insurance).

gest local retail banks as well as through travel agents. Its

website is available in seven languages while it operates an SWOT Analysis

eight-language call center in Bratislava with local access

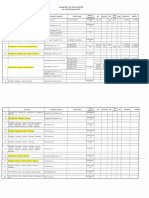

numbers in each country. SkyEurope claims to be the first lifestyle and business air-

6. SkyCorporate: SkyEurope launched its SkyCorporate line with an innovative and stylish product. In the words

initiative in early Feb-07, offering a range of services aimed of their CCO “We guarantee lowest fares, the most inno-

at encouraging business travelers to use the carrier, as well vative quality product and the most stylish way to fly at

as extending the service options that the carrier offers to convenient airports.

corporate customers. The program offers improved re-

servation options, including a new option via its website,

through a business-to-business ID number and password,

as well as through its existing phone reservation system.

7. SkyShuttle: The Vienna and Bratislava hubs of SkyEuro-

pe are supported by its SkyShuttle airport bus connection. Conclusion

The sale of bus tickets has been integrated into the reser-

vation system as a code share operation. Passengers trave- SkyEurope seems to have a long and harsh winter ahead of

ling to Vienna can choose direct flights to Vienna Schwe- it. The major obstacles to its survival are its critical cash re-

chat Airport, or fly to Bratislava and connect to Vienna on serve position and the fragile share value levels. The major

a one-hour bus trip. Similar airport bus service is offered reasons for being in this situation are its initial over-rapid

between Bratislava Airport and Vienna’s city center. The growth and its policy of using leased new aircraft over an

SkyShuttle is a key component in SkyEurope’s dual-hub extended period of time. Whether SkyEurope will come

strategy to tap into a regional population of 6 million peo- out of this winter with minor scratches or with fractures

ple. remains to be seen.

8. SkyDelights: SkyEurope differentiates itself by offering

high quality products and services onboard. Buy-on-board

services, branded as SkyDelights, include an extensive

menu of hot and cold snacks, and a full selection of alco-

holic and non-alcoholic beverages. The airline has introdu-

ced authentic Italian espresso and cappuccino drinks on

all its flights. The espresso (3 Euros) and cappuccino (4

Euros) drinks are served individually in Illy branded porce-

lain cups, accompanied with a little chocolate square and

a glass of water on a personal tray adding consumer allure

and generating higher onboard sales activity. The SkyDeli-

ghts menu also features “Fly to Win” scratch cards that are

sold on international flights for 3 Euros. Prizes include cre-

dit vouchers for onboard purchases and SkyEurope tickets.

The airline promotes a 1 in 5 chance of winning a prize.

12 Air Scoop - November 2007 www.air-scoop.com

BIRD’S EYE VIEW

13 Air Scoop - November 2007 www.air-scoop.com

BIRD’S EYE VIEW

14 Air Scoop - November 2007 www.air-scoop.com

BIRD’S EYE VIEW

SkyEurope in Trouble – Can the Repositioning of its Business Save the Company?

This spring major changes took place in the management of syJet, SkyEurope tends to fly to main airports and until

SkyEurope Airlines. When Christian Mandl, founder and recently a large part of its destinations were Mediterranean

CEO stepped down from his position, while co-founder holiday resorts, therefore the obvious consequence arose

and CFO Alain Skowronek also left the management to that demand was showing great fluctuation due to seaso-

be replaced by Nick Manoudakis, former CFO of easyJet, nality. SkyEurope has not been able to take advantage of

it was a clear sign that sooner or later significant strategic the relatively constant demand posed by Central European

changes of the company’s business model would follow. migrant workers to Western European countries, whereas

Even though both Mandl and Skowronek were assigned Wizz Air has successfully built its strategy on targeting this

a new position as Mandl kept the leadership role at the niche market. In addition, customers of the Central Euro-

Austrian branch of the company, while Skowronek have pean region are more price sensitive than in Western Euro-

become an advisor, they are no longer involved in day to pe, and many of them might choose their holiday destina-

day operations and decision-making. tions based solely on ticket prices. Therefore, SkyEurope

may have been losing out on this as well, as on average its

Jason Bitter, the newly appointed CEO and Nick Manou- prices have been higher than that of the major low cost

dakis did not hesitate long to take far-reaching decisions. rivals.

On 31 August, the first low-cost/low-fare airline of Central

Europe announced in a press conference that at the end The problem is that what easyJet has been able to achieve

of October it would close its bases and entire operation by taking advantage of economies of scale, SkyEurope has

in Krakow, Poland and Budapest, Hungary. Even though failed to do so with a similar business model due to a much

rumours had already been spreading about this in the mar- smaller scale of operation in a very different market. One

ket, SkyEurope consistently declined them until the end of of the most urgent tasks of the new management there-

the summer. The company explained to the press that the fore was to bring under control the cost explosion and im-

decision was motivated by the circumstances that became prove overall performance by increasing productivity and

unfavourable in these markets as taxes were high while cutting costs. The withdrawal from Hungary and Poland

effective demand was substantially exposed to seasonality nearly halved the number of routes offered: while during

and overall, it kept decreasing. the summer SkyEurope was flying to 39 destinations on 97

routes, the winter timetable contains only 30 destinations

Indeed, SkyEurope was flying a total of 2.7 million pas- and 52 routes. This has resulted in an approximate cost

sengers in the first 9 month of 2007, but the Hungarian reduction of 2 million Euros. A further 1.25 million Euros

market represented only 380 thousand of them. In other of annual savings is attributed to the move from Stansted

words, a rough 20 percent of the routes contributed to a to Luton as the company is using this airport since the end

mere 14 percent of the passenger turnover. This is indeed of October. Compared to 2006, Sky also decreased staff by

a bad performance, however, last year SkyEurope was able a significant 13.3 %. As a consequence, the average staff per

to achieve much better results (approximately 500 thou- aircraft is down to 61 from last year’s 64, which has also

sand passengers flown in the Hungarian market) on less translated to cost savings and a higher efficiency.

routes offered from Budapest. Does the decline in passen-

ger numbers simply reflect that unlike the other new EU The newly introduced measures by the management

members’ states, the Hungarian economy has been in a se- have delivered results also in terms of productivity. In the

rious recession for years? Although the real GDP growth first half of 2007 load factor reached a relatively satisfac-

in Hungary this year is estimated to be just slightly over a tory 79.7 %, which further increased in the third quarter

sluggish 1 percent, which might translate into less demand of 2007 to 80.7 %. Just to compare with, in the first half

for air transport, it does not explain why SkyEurope deci- of 2006 SkyEurope’s load factor reached a mere 68.4 %,

ded to abandon the fast-growing Polish market (5.5 percent which would be a low performance even for a legacy car-

growth estimated for 2007) where there are still a lot of rier. Daily aircraft utilisation has also gradually increased

potentials. The question is then, what did go wrong? from last year’s 8:08 hours to 11:25 hours in the third quar-

ter of 2007. This has contributed significantly to the rise in

The answer lies in SkyEurope’s cost base, which, compared productivity. All in all, the loss per share decreased from

to the major regional rival, Wizz Air, is highly unfavoura- a shocking 0.83€ to 0.13€ but it seems that profitability is

ble. According to estimates, Wizz Air’s cost per passenger still a long way ahead.

is around €3.7 (only Ryanair is able to perform better with

an average expense of €3.4 per passenger), while SkyEuro- The new concept introduced by Jason Bitter and Nick

pe’s is approximately €5.5. This significant contrast is due Manoudakis is to concentrate on the Czech (Prague),

to the differences in the business models: similarly to ea- Slovakian (Bratislava and Košice) and Austrian (Vienna)

15 Air Scoop - November 2007 www.air-scoop.com

BIRD’S EYE VIEW

market only and offer higher frequencies to fewer desti- passenger demand may not keep up with capacity expan-

nations. In other words, the company is trying to expand sion and seasonality will continue to characterise passenger

capacity on the most profitable routes to create a denser turnover. One of the greatest potential threats to SkyEu-

network. They also attempt to strengthen the Vienna hub rope is an entry of a stronger player that is able to offer

by offering flight connections to passengers, which is rather lower prices that SkyEurope would be unable to compete

unusual for a low cost carrier. However, the route portfolio with in its current situation. Ryanair has introduced a

is still lacking a clear focus as the routes from Prague and scheduled flight from Bristol to Bratislava and already ad-

Vienna seem to lead to destinations in the entire continent ded destinations such as Stockholm, Barcelona and Dublin

and it is only Bratislava which is potentially more clearly that are served from the Slovakian capital. If further ex-

targeted to business travellers and migrant workers from pansion takes place in the Slovakian market, the already

France and the UK. Nevertheless, Slovakia has the highest defensive position of SkyEurope might result in a com-

car production per capita in the world and the large pro- plete withdrawal of operations.

duction facilities of Volkswagen, Audi, Porsche, Peugeot,

Citroen and KIA around Bratislava clearly pose a constant The new business strategy of the carrier does not allow for

demand for air transport. extending the route portfolio as it is aimed at increasing

the market share on the existing routes and in the home

Further good news for SkyEurope is that in mid-Novem- market. However, a stronger position is only possible to

ber a motorway will open between Bratislava and Vienna, achieve by further reduction of unit costs and a potential

thereby making the connection between the two bases of move towards Wizz Air’s business model. This is unlikely

the airline faster and easier. Regarding the mid-term pros- to happen in the short run especially since the fleet is being

pects, the increasing labour migration and the blossoming reduced, which does not enable the airline to take advanta-

property market of Bratislava may translate into higher de- ge of economies of scale. In case price competition increases

mands for air transport while the planned introduction of in the market where SkyEurope is present, it is questiona-

the euro in Slovakia by 2009 may also generate additional ble whether the company will be able to incur more losses.

demand for flights especially by business people. It might be the unfortunate case that SkyEurope is in a

stuck-in-the-middle position as it is not a genuine no-frills

However, the immediate and most threatening problem low cost/low fare carrier but at the same time its service

is the liquidity of the airline. The already planned entry levels are far from that of traditional carriers. Unless the

to the Russian and the Ukrainian market requires a lot of company finds an appropriate market niche that can be

cash as even the purchase of flight licences to these coun- sustained in the long run, it is doubtful whether it will

tries amounts to a great sum. In order to obtain cash, the survive the forthcoming years.

company may have to consider selling an airplane or the

Hungarian ground-handling unit. A further threat is that Source of data: Financial Reports of SkyEurope

AIR SCOOP ANNOUNCEMENTS

French Connect 2008

April 9 to 11 in Courchevel

Air Scoop is proud to be part of the 5th French Connect in Courchevel.

For the 5th consecutive year, CEOs of French airports and European low cost airlines will gather for 3 days of debates

and networking.

French Connect, the only professional forum dedicated to low cost air traffic development in France, will take place in

Courchevel, French Alps from 9th to 11th April 2008. Created in 2004 to respond to the specific needs of French airports,

French Connect has become, in just a few years, a must-attend meeting and debating forum for French airports and low

cost airlines.

For 3 days, decision-makers will gather from over 20 low cost airlines and 50 French airports together with representa-

tives from regional, national and European political institutions. French Connect 2008 is hosted by Grenoble-Isère and

Chambéry-Savoie Airports, two airports managed by VINCI Airports and Keolis Airports on behalf of the Conseils Gé-

néraux (County Councils) of Isère and Savoie. Innovation and dynamism are the key words for next year’s event, which

will be an exceptional opportunity to understand the issues of low cost air traffic development in France.

To have more informations about last edition of French Connect in La Baule, read the full coverage in Air Scoop May

2007.

For more information on French Connect 2008, visit www.frenchconnect.net

16 Air Scoop - November 2007 www.air-scoop.com

DOWN TO EARTH

17 Air Scoop - November 2007 www.air-scoop.com

BIRD’S EYE VIEW

easyJet and Ryanair are Forced to Adapt to the French Labor Law

easyJet will finally pay social charges in France on 100 However, the French executive order is unlikely to change

of its 170 employees based at the Parisian Orly airport. radically the plans of the two European low-cost leaders

The company made this decision at the end of February, in France. Representing only 17% of the air traffic, compa-

after several months of juridical struggle with the French red to more than 30% in Europe, the LCC market is still

administration. underdeveloped in this country.

Until now, easyJet’s employees in France, benefiting from The potential is huge, and easyJet and Ryanair cannot

a British employment contract, were not submitted to the neglect it. In spite of the new juridical situation, easy-

French social security contributions. But since November Jet plans to open six new routes from France in 2007,

2006, an executive order from the French government has for example Paris-Athens, Lyon-Madrid and Lyon-Rome.

forced foreign airlines whose employees (including the na- The company expects 6 million passengers in France (5.4

vigation crew) are based and live in France to pay those millions in 2006), and even thinks about opening a new

contributions. They also have to respect the French labor French base in Lyon. After settling down in Marseille,

law, as regards for instance employee’s representation and Ryanair also could open new bases in the next years.

unions.

According to the two LCCs, the French measure to force

With its important base in Orly, easyJet is particularly foreign airlines to adapt to its labor law is a new attempt

impacted by this new measure. And the firm has been from the state to protect national leader Air France from

quickly called to order by the authorities. In last Decem- foreign low-cost challengers. Air France, which just laun-

ber, French factory inspectors and officers from the Natio- ched its own LCC Transavia.com, is well-known for its

nal Health Service made a snap inspection at the airline’s juridical battles to keep LCCs away from the national

Orly headquarter. They established that the company did market. In contrary, from the French state’s point of view,

not respect the new executive order, and charged it with the airlines which do not pay their employees at French

« hidden labor ». conditions are guilty of « social dumping ».

easyJet tried to protest against the law, by asking the

Council of State to suspend it. The airline claims for free

competition, and argues that its Orly premises are just a

restroom for the employees, whose true workplace is the French TV Investigations about LCCs

planes. But the request was rejected. A final decision of in Europe

the Council will occur in the following months. For now,

easyJet decided to respect the French law and to pay For French speakers, TF1 has released a documentary

charges for 100 out of its 170 Orly employees (the rest are about Low-Cost Carriers in Europe. Journalists have in-

members of the navigation crew living abroad). vestigated to understand how LCCs can offer such low

prices. Ryanair “business model” is analyzed in details,

The other company really concerned by the French especially concerning connections with airports that pay

measure is Ryanair, which opened its new base in the indirect “subsidies” through marketing subsidiaries of Rya-

southern city of Marseille, with 70 employees. The Irish nair.

airline reacted even stronger than EasyJet, seizing not only

the Council of State, but also the European commission, Low cost : l’avion pas cher, Droit de Savoir, TF1, No-

and refusing to pay any social security charges until a final vember 30th 2007

decision would be given by these institutions. http://videos.tf1.fr/video/emissions/droitdesa-

voir/0,,3604403,00-tf1-video-droit-savoir-low-cost-avi-

French taxes on labor are said to be quite high, and the la- on-pas-cher-.html

bor law more binding than in other countries. For EasyJet

and Ryanair, employing their French staff with British or

Irish employment contracts is a way to reduce their costs

and to gain flexibility. And adapting to the French rules

could mean, in the worst-case scenario, a small increase in

fares for passengers. A very small one, indeed (about one

or two Euros), but still too much for these LCC’s, espe-

cially for Ryanair’s very aggressive fare policy.

18 Air Scoop - November 2007 www.air-scoop.com

BIRD’S EYE VIEW

Coming Soon: Cheap Trans-Atlantic Flights?

March next year the airspace between Europe and the cost. Fast turnarounds that are peculiar to LCCs are not

USA will be liberalised in accordance with the Open Sky efficient on long-distance routes since the plane can only

Programme. Any airline of any member-state of the EU be used twice a day.

will be able to get flight permission and operate flights Ryanair’s new airline is coming to incredibly tense market

to the USA. Perhaps, it will be then that the American and will compete against serious network airlines, both in

airline market will be shattered by low-cost invaders from Europe and America. It would probably engender back

Europe. reaction and foster American LCCs to open trans-Atlantic

destination as well.

Ryanair CEO Michael O’Leary has recently told trade

magazine Flight International about his plans to connect History knows several attempts of budget carriers flying

the Old World with the New World by launching new long-haul. Oasis HongKong airline flies from HongKong

low-cost long haul airline affiliated with Ryanair. The ser- to London; Australian Virgin Blue plans to carry passen-

vice will have been set up by 2010 with flights operating gers from Sidney to the western coast of the USA in 2008.

from three main bases in London-Stansted, Dublin and Canadian Zoom Airlines will open trans-Atlantic destina-

Frankfurt-Hahn to New York, Florida, Dallas, San Fran- tion from London to New York JFK two years ahead of

cisco, San Diego and some other secondary American air- Ryanair. BMI is also rumored to set up USA flights. As far

ports. The fare ranges from $12 to $280 and the airline will back as 1982 budget Laker Airways operating Skytrain

fly fleet of approximately 50 aircraft. flights between London and New York went bankrupt

because of low income and insufficient passenger flow.

Money is the least problematic thing for this project, be- Apparently, the project airline will have to fight for load

lieves O’Leary. Not only are there many sponsors who are factors as well.

willing to invest their money in the airline, but also there

are plenty of ways of raising money on board. Passengers Michael O’Leary himself does not make any secret of his

will be offered some additional facilities for extra money. direct involvement in the project. He is planning to leave

Airline is planning to sell tickets for business-like-class. Ryanair in three of four years when the daughter com-

Selling food, duty-free goods and in flight entertainment pany would be on its feet to live independently from the

programmes promises to be profitable as well. However, parent.

there are certain disadvantages in being transatlantic low-

19 Air Scoop - November 2007 www.air-scoop.com

DOWN TO EARTH

LCCs: Friends or Foes to Malta?

While some believe low-cost carriers are the saviors to licies, said 2,000 jobs stand to be lost in a scenario where

Malta’s tourism, more believe it is a double-edged sword nothing is done.

stabbing at the heart of the country’s economy. Ger-

manwings landed at the Malta International Airport It is under such circumstances that both Malta govern-

(MIA) as the third low-cost carrier serving the Malta rou- ment and MIA roll out the red carpets to lure LCC. Ne-

te, following Ryanair, which flies to and from London Lu- vertheless, Air Malta remains a major employer and some

ton, Pisa and Dublin, and Italian carrier Meridiana, which in the tourist sector feel upswing in new visitors would

operates between Malta and Bologna. disturb Malta’s cultural and natural landscapes. The above

MHRA report presented by Deloitte read the LCC traf-

In November 2006, the European Commission gave the fic would generate Lm29 million more revenue annually,

green light to a scheme launched by the government last with a possible one to 1.5% growth for the economy and

July subsidizing a number of new air routes to and from Lm3.6 million more towards the VAT coffers. The price is

Malta. MIA chief executive officer Peter Bolech said in Lm4 million less in the public coffers from the abolition

October last year that LCCs are expected to carry around of the departure tax, a condition for Ryanair to start its

230,000 passengers to and from Malta in 2007. Ryanair operations from Malta.

alone is expected to carry 183,000 passengers on the Malta

route. A confidential report dated 15 June 2006 requested by go-

vernment and commissioned by Air Malta on the impact

Such start-up aids granted to LCC aim to boost the num- of LCC on Malta was leaked to Malta Today in which

ber of new routes flying to MIA are under criticism that Air Malta claims that a 50 per cent increase in visitors in

whether it worth risking the survival of Air Malta, which one year is a “high risk” strategy for a self-contained and

may lead to job slashes, to subsidize foreign LCCs to do- small destination like Malta, with the advent of the “inde-

minate Malta’s aviation. In an answer to a parliamentary pendently minded” low-cost traveler bringing new strains

question earlier this year Malta Minister for Tourism and upon the Maltese infrastructure.