Académique Documents

Professionnel Documents

Culture Documents

China Sets Hong Kong-Shanghai Trading Deal - NYTimes

Transféré par

xxmmxx1986Description originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

China Sets Hong Kong-Shanghai Trading Deal - NYTimes

Transféré par

xxmmxx1986Droits d'auteur :

Formats disponibles

http://nyti.

ms/1i4iTeK

INTERNATIONAL BUSINESS

China Sets Hong Kong-Shanghai Trading Deal

By NEIL GOUGH APRIL 10, 2014

HONG KONG It was a seven-year wait, but China on Thursday finally announced a plan to allow two-way investment between the Shanghai and Hong Kong stock exchanges. For the first time, individual investors in Hong Kong will be able to use their local brokerage accounts to trade the shares of companies listed in Shanghai, the China Securities Regulatory Commission and Hong Kongs Securities and Futures Commission said in a joint announcement on Thursday. At the same time, investors in mainland China would be able to use their local brokers to buy Hong Kong-listed shares. This outbound trading would be restricted to institutions or individual investors whose accounts have a minimum of 500,000 renminbi, or about $80,000. The combined daily trading would be capped at 23.5 billion renminbi, the regulators said. That is equal to about 20 percent of the combined average daily trading turnover of both markets. Despite their size and huge trading volumes, Chinas equity and debt markets remain largely off limits to foreign investors. Current two-way investment is restricted to licensed institutions not individuals and subject to comparatively tiny quotas. The preparatory work to introduce the new pilot trading program is expected to take about six months, officials said. The cumulative, combined trading flows will be capped at an aggregate 550 billion

renminbi. The quotas may be adjusted in the future, the regulators said. The program, called the Shanghai-Hong Kong Stock Connect, will not only help strengthen the two securities markets, but will also have long-term and strategic significance, John Tsang, Hong Kongs financial secretary, said Thursday in a statement. I am pleased to see that Hong Kong plays an important role in the two-way opening up of the mainlands capital market to the world. In the summer of 2007, senior Hong Kong government officials announced a plan, referred to as the through train, that would allow mainland Chinese investors to directly buy shares listed in Hong Kong. That announcement sent the local Hang Seng Index soaring, gaining more than 50 percent over a two-month period ending in October 2007 to peak at a high of over 31,000 points. But the through train never left the station. Hong Kong stocks plunged and, unlike shares in the United States and other major markets, have not come close to matching their pre-crisis highs. Investors are hoping this time around is different. The landmark agreement gives global investors greater access to Chinas extraordinary growth story and allows Chinese savers to diversify their holdings, said Peter Wong, the deputy chairman and chief executive of HSBCs Hong Kong unit. This is further confirmation of Chinas commitment to financial reform, and reaffirms Hong Kongs role as the fulcrum of Chinas broader economic integration with the global economy. Opening up Chinas financial markets to the world is a key goal of the package of overhauls announced by President Xi Jinping after a major plenum meeting of Communist Party leaders in November. Beyond allowing greater access to Chinas stock markets, other proposals include easing the states heavy-handed control of bank deposit rates, currency exchange rates and the banking sector. But critics say China has yet to implement some of the promised liberalizations, as has been demonstrated, for example, by slow progress in

developing the countrys new or planned free trade zones.

2014 The New York Times Company

Vous aimerez peut-être aussi

- General Purpose Standard Port ValvesDocument1 pageGeneral Purpose Standard Port Valvesxxmmxx1986Pas encore d'évaluation

- 高盛帝国 英文原版 the Partnership-The Making of Goldman Sachs (1) 3Document1 page高盛帝国 英文原版 the Partnership-The Making of Goldman Sachs (1) 3xxmmxx1986Pas encore d'évaluation

- Apollo Tech 4Document1 pageApollo Tech 4xxmmxx1986Pas encore d'évaluation

- ToC No Ordinary DisruptionDocument2 pagesToC No Ordinary Disruptionxxmmxx1986Pas encore d'évaluation

- Performance of Galvanized Steel Products 1Document1 pagePerformance of Galvanized Steel Products 1xxmmxx1986Pas encore d'évaluation

- Apollo 77C: The Contractors' Full-Port Bronze Ball ValveDocument1 pageApollo 77C: The Contractors' Full-Port Bronze Ball Valvexxmmxx1986Pas encore d'évaluation

- The Digital Tipping Point McKinsey Global Survey ResultsDocument8 pagesThe Digital Tipping Point McKinsey Global Survey ResultsrponnanPas encore d'évaluation

- Beware of Greeks Bearing Bonds - Vanity FairDocument4 pagesBeware of Greeks Bearing Bonds - Vanity Fairxxmmxx1986Pas encore d'évaluation

- A Dramatic Decline in Suicides - Back From The Edge - The EconomistDocument4 pagesA Dramatic Decline in Suicides - Back From The Edge - The Economistxxmmxx1986Pas encore d'évaluation

- The Road by Cormac McCarthyDocument37 pagesThe Road by Cormac McCarthyxxmmxx1986Pas encore d'évaluation

- The Pope As A Turnaround CEO - The Francis Effect - The EconomistDocument2 pagesThe Pope As A Turnaround CEO - The Francis Effect - The Economistxxmmxx1986Pas encore d'évaluation

- Economic Conditions Snapshot June 2014 McKinsey Global Survey ResultsDocument7 pagesEconomic Conditions Snapshot June 2014 McKinsey Global Survey Resultsxxmmxx1986Pas encore d'évaluation

- China Tries To Repair Malaysian Ties Damaged by Criticism of Flight 370 Probe - The Washington PostDocument3 pagesChina Tries To Repair Malaysian Ties Damaged by Criticism of Flight 370 Probe - The Washington Postxxmmxx1986Pas encore d'évaluation

- 20 Lessons BenjaminDocument23 pages20 Lessons Benjaminxxmmxx1986Pas encore d'évaluation

- 佳句有约Document1 page佳句有约xxmmxx1986Pas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Life Insurance Company The Whole Life Policy-Single PremiumDocument13 pagesLife Insurance Company The Whole Life Policy-Single PremiumNazneenPas encore d'évaluation

- National Income Determination: (Three Sector Model)Document12 pagesNational Income Determination: (Three Sector Model)Yash KumarPas encore d'évaluation

- Difference Between Domestic and International BusinessDocument3 pagesDifference Between Domestic and International BusinessVedansh PalPas encore d'évaluation

- Doctrine of Piercing of Corporate VeilDocument15 pagesDoctrine of Piercing of Corporate VeilFaisal AshfaqPas encore d'évaluation

- Msu Bba Vadodara.: Report On Jhaveri Securities Pvt. LTDDocument16 pagesMsu Bba Vadodara.: Report On Jhaveri Securities Pvt. LTDShalin PatelPas encore d'évaluation

- Sample QCD With Life EstateDocument2 pagesSample QCD With Life Estatemarioma12Pas encore d'évaluation

- Case Study of Canara BankDocument44 pagesCase Study of Canara BankAasrith KandulaPas encore d'évaluation

- Certificate in Accounting Level 2/series 3-2009Document14 pagesCertificate in Accounting Level 2/series 3-2009Hein Linn Kyaw100% (1)

- Consolidated Accounts QuestionsDocument10 pagesConsolidated Accounts QuestionsGiedrius SatkauskasPas encore d'évaluation

- BS 421 Assignments 2020Document2 pagesBS 421 Assignments 2020Daniel DakaPas encore d'évaluation

- Moodys KMV MaualDocument226 pagesMoodys KMV MaualPuneet MishraPas encore d'évaluation

- Fina1003abc - Hw#4Document4 pagesFina1003abc - Hw#4Peter JacksonPas encore d'évaluation

- OTCEIDocument11 pagesOTCEIvisa_kpPas encore d'évaluation

- EOI - Tanzania - Consultancy Services - Improvement of Road Safety and Road Safety Capacity Building DuringDocument2 pagesEOI - Tanzania - Consultancy Services - Improvement of Road Safety and Road Safety Capacity Building DuringArden Muhumuza KitomariPas encore d'évaluation

- Stock Dividends and Stock SplitsDocument18 pagesStock Dividends and Stock SplitsPaul Dexter Go100% (1)

- Hull RMFI3 RD Ed CH 23Document24 pagesHull RMFI3 RD Ed CH 23gs_waiting_4_uPas encore d'évaluation

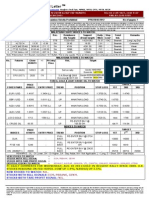

- AxcelasiaDocument12 pagesAxcelasiaInvest StockPas encore d'évaluation

- Financial Inclusion and Information TechnologyDocument8 pagesFinancial Inclusion and Information TechnologydhawanmayurPas encore d'évaluation

- FIS WorldpayDocument1 pageFIS WorldpayharikaPas encore d'évaluation

- Statement of Cashflow: Tutor Class - 101 HUDA AULIA ARIFIN - 1406533781Document13 pagesStatement of Cashflow: Tutor Class - 101 HUDA AULIA ARIFIN - 1406533781Fiza Xiena100% (1)

- Funds Flow Statement ProjectDocument99 pagesFunds Flow Statement Projecttulasinad12333% (3)

- DDB - Presentation5data Mining OverviewDocument19 pagesDDB - Presentation5data Mining OverviewCalebKpabiteyTettehPas encore d'évaluation

- Conflicts in Accounting Concepts and ConventionsDocument4 pagesConflicts in Accounting Concepts and ConventionsGuru Nathan71% (7)

- As HadDocument91 pagesAs HadAshad ZameerPas encore d'évaluation

- Fred Tam News LetterDocument7 pagesFred Tam News LetterTan Lip SeongPas encore d'évaluation

- History of BankDocument56 pagesHistory of BankJayshree ThakkarPas encore d'évaluation

- Sri Sairam Institute of Technology Department of Management StudiesDocument11 pagesSri Sairam Institute of Technology Department of Management StudiesAbhinayaa SPas encore d'évaluation

- Deposit Sources of FundsDocument6 pagesDeposit Sources of FundsSakib Chowdhury0% (1)

- As Unnit 5 Class NotesDocument38 pagesAs Unnit 5 Class NotesAlishan VertejeePas encore d'évaluation

- RTP - I Group PDFDocument177 pagesRTP - I Group PDFMadan SharmaPas encore d'évaluation