Académique Documents

Professionnel Documents

Culture Documents

TBCH 12

Transféré par

Bill BennttTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

TBCH 12

Transféré par

Bill BennttDroits d'auteur :

Formats disponibles

Chapter 12: National Income Accounting and the Balance of Payments Multiple Choice Questions 1.

Over the decade from 1991 to 2000, A. Japans national product grew at an annual average rate of only .0 percent while that of the !nited "tates grew #y nearly .$ percent per year. %. Japans national product grew at an annual average rate of only 1.$ percent while that of the !nited "tates grew #y nearly .$ percent per year. &. 'he !nited "tates national product grew at an annual average rate of only 1. percent while that of Japan grew #y nearly .$ percent per year. (. Japans national product grew at the same annual average rate as that of the !nited "tates. ). Japans national product grew at an annual average rate of .$ percent while that of the !nited "tates grew only #y 1.$ percent per year. Answer* % 2. Over the decade from 1991 to 2000, A. Japans unemployment rate rose, reaching nearly percent. %. Japans unemployment rate rose, reaching nearly + percent. &. Japans unemployment rate rose, reaching nearly $ percent. (. Japans unemployment rate rose, reaching nearly $ percent and overta,ing that of the !nited "tates for the first time in fifty years. ). Japans unemployment rate rose, reaching nearly - percent and overta,ing that of the !nited "tates for the first time in fifty years. Answer* ( . A countrys gross national product ./012 is A. the value of all final goods and services produced #y its factors of production and sold on the mar,et in a given time period. %. the value of all intermediate goods and services produced #y its factors of production and sold on the mar,et in a given time period. &. the value of all final goods produced #y its factors of production and sold on the mar,et in a given time period. (. the value of all final goods and services produced #y its factors of production and sold on the mar,et. ). the value of all final goods and services produced #y its factors of production, e3cluding land, and sold on the mar,et in a given time period. Answer* A

+.

4or most macroeconomists, A. national income accounts and national output accounts are e5ual to each other. 1+6

%. &. (. ).

national income accounts e3ceed national output accounts. national output accounts e3ceed national income accounts. it is impossi#le to tell whether national income accounts are e5ual to national output accounts. 0one of the a#ove.

Answer* A $. 4or most macroeconomists, A. gross national income and gross national product are the same. %. gross national income e3ceeds gross national product. &. gross national product e3ceeds gross national product. (. it is hard to tell whether gross national income e5uals gross national product. ). 0one of the a#ove. Answer* A 7. 'he highest component of /01 is A. the current account. %. investment. &. government purchases. (. consumption. ). 0one of the a#ove. Answer* ( 6. 'he /01 of the !nited "tates in 2000 was a#out A. 6 trillion dollars. %. 1 trillion dollars. &. $ trillion dollars. (. 7 trillion dollars. ). 10 trillion dollars. Answer* )

1+-

-.

8n 2000, the !nited "tates had A. a surplus in the current account. %. a #alanced current account. &. a deficit in the current account. (. 8t is hard to tell from the data whether in 2000 the !nited "tates had a deficit or a surplus in the current account. ). 0one of the a#ove. Answer* & 8n order to move from units e3pressed in trillion to units e3pressed in #illions, you need to multiple the num#er in #illions #y A. 100. %. 10,000. &. 100,000. (. 1,000,000. ). 1,000. Answer* )

9.

10.

'he sale of A. a used te3t#oo, does enter /01. %. a used te3t#oo, does not enter /01, #ut the sale of a used house does. &. #oth a used te3t#oo, and a used house do not enter /01. (. a used house does not enter /01, #ut the sale of a used #oo, does. ). 0one of the a#ove. Answer* &

11.

9hich one of the following statements is the most accurate: A. 'he sale of a used te3t#oo, does generate income for factors of production. %. 'he sale of a used te3t#oo, does not generate income for any factor of production. &. 'he sale of a used te3t#oo, sometimes does and sometimes does not generate income for factors of production. (. 8t is hard to tell whether a sale of a used te3t#oo, does or does not generate income for factors of production. ). 0one of the a#ove. Answer* %

1+9

12.

9hich one of the following statements is the most accurate: A. /01 plus depreciation is called net national product .0012. %. /01 less depreciation is called net national product .0012. &. /01 less depreciation is called net factor product .0412. (. Answers A and & are #oth correct. ). 0one of the a#ove. Answer* %

1 .

0ational income e5uals /01 A. less depreciation, less net unilateral transfers, less indirect #usiness ta3es. %. less depreciation, plus net unilateral transfers, plus indirect #usiness ta3es. &. less depreciation, less net unilateral transfers, plus indirect #usiness ta3es. (. plus depreciation, plus net unilateral transfers, less indirect #usiness ta3es. ). less depreciation, plus net unilateral transfers, less indirect #usiness ta3es. Answer* )

1+.

'he !nited "tates #egan to report its gross domestic product ./(12 only since A. 1900 %. 1921 &. 19 1 (. 19+1 ). 1991 Answer* )

1$.

/(1 is supposed to measure A. the volume of production within a countrys #orders. %. the volume of services generated within a countrys #orders. &. the volume of production of a countrys output. (. /01 plus depreciation. ). 0one of the a#ove. Answer* A

1$0

17.

/01 e5uals /(1 A. minus net receipts of factor income from the rest of the world. %. plus receipts of factor income from the rest of the world. &. minus receipts of factor income from the rest of the world. (. plus net receipts of factor income from the rest of the world. ). 0one of the a#ove. Answer* (

16.

;ovements in /(1 A. and /01 usually do not differ greatly. %. and /01 usually do not differ greatly, as a practical matter. &. and /01 usually do differ greatly. (. are usually smaller than those of /01 movements, in practice. ). 0one of the a#ove. Answer* %

1-.

8n open economies, A. saving and investment are necessarily e5ual. %. as in a closed economy, saving and investment are not necessarily e5ual. &. saving and investment are not necessarily e5ual as they are in a closed economy. (. saving and investment are necessarily e5ual contrary to the case of a closed economy. ). 0one of the a#ove. Answer* &

19.

8n the !nited "tates since the <orean 9ar, the fraction of /01 devoted to consumption has fluctuated in a range of a#out A. +2 to +9 percent. %. 2 to 9 percent. &. 22 to 29 percent. (. -2 to -9 percent. ). 72 to 79 percent. Answer* )

1$1

20.

1urchases of inventories #y A. firms are not counted in investment spending. %. firms are also counted in investment spending. &. households are also counted in investment spending. (. households and firms are also counted in investment spending. ). 0one of the a#ove. Answer* %

21.

8nvestment is usually A. more varia#le than consumption. %. less varia#le than consumption. &. as varia#le as consumption. (. 8t is hard to tell from the data whether investment is more or less varia#le than consumption. ). 0one of the a#ove. Answer* A

22.

Any goods A. purchased #y federal, state, or local governments are classified as government purchases. %. and services purchased only #y federal government are classified as government purchases. &. and services purchased only #y federal or state governments are classified as government purchases. (. and services purchased #y federal, state, or local governments are classified as government purchases. ). 0one of the a#ove. Answer* (

2 .

/overnment transfer payments such as social security and unemployment #enefits are A. included in government purchases. %. not included in government purchases. &. not included in government purchases, #ut they are included in the consumption component of /01. (. not included in government purchases, #ut they are part of the investment component of /01. ). 0one of the a#ove. Answer* %

1$2

2+.

/overnment purchases currently ta,e up a#out A. 1- percent of !.". /01, and this share has not changed much since the late 19$0s. %. - percent of !.". /01, and this share has not changed much since the late 19$0s. &. 1- percent of !.". /01, and this share has #een increasing since the late 19$0s. (. 1- percent of !.". /01, and this share has #een decreasing since the late 19$0s. ). 0one of the a#ove. Answer* A

2$.

8n 1929, government purchases accounted for A. only 1-.$ percent of !.". /01. %. only -.$ percent of !.". /01. &. 2-.$ percent of !.". /01. (. -.$ percent of !.". /01. ). +-.$ percent of !.". /01. Answer* %

27.

9hich one of the following e3pressions is the most accurate: A. &A = )> ? 8;. %. &A = 8; ? )>. &. &A=)>=8;. (. &A = )> @ 8;. ). 0one of the a#ove. Answer* A

26.

A countrys current account A. #alance e5uals the change in its net foreign wealth. %. #alance e5uals the change in its foreign wealth. &. surplus e5uals the change in its foreign wealth. (. deficit e5uals the change in its foreign wealth. ). 0one of the a#ove. Answer* A

1$

2-.

'he &A is e5ual to A. A ? .&B8@/2. %. A @ .&@8@/2. &. A ? .&@8@/2. (. A ? .&@8B/2. ). A ? .&@8@/2 = B&A, .i.e., minus the &A2. Answer* &

29.

9hich one of the following statements is the most accurate: A. 8t is not hard to measure accurately a countrys net foreign wealth. %. 8t is surprisingly hard to measure accurately a countrys net foreign wealth. &. 8t is surprisingly hard to measure a countrys foreign wealth. (. 8t is surprisingly hard to measure accurately a countrys foreign transactions. ). 0one of the a#ove. Answer* %

0.

Over the 19-0s, A. there is no 5uestion that a large increase in !.". foreign assets did occur. %. there is a 5uestion whether a large decrease in !.". foreign assets did occur. &. there is no 5uestion that a large decrease in !.". foreign assets did occur. (. there is no 5uestion that there was almost no change in !.". foreign assets. ). 0one of the a#ove. Answer* &

1.

8n a closed economy, national saving A. sometimes e5uals investment. %. always e5uals investment. &. is always less than investment. (. is always more than investment. ). 0one of the a#ove. Answer* %

1$+

2.

4or open economies, A. " = 8. %. " = 8 @&A. &. " = 8 ? &A. (. " C 8 @ &A. ). " D 8 @ &A. Answer* %

An open economy A. can save only #y #uilding up its capital stoc,. %. can save only #y ac5uiring foreign wealth. &. cannot save either #y #uilding up its capital stoc, or #y ac5uiring foreign wealth. (. can save either #y #uilding up its capital stoc, or #y ac5uiring foreign wealth. ). 0one of the a#ove. Answer* (

+.

A closed economy A. can save either #y #uilding up its capital stoc, or #y ac5uiring foreign wealth. %. can save only #y #uilding up its capital stoc,. &. can save only #y ac5uiring foreign wealth. (. cannot save either #y #uilding up its capital stoc, or #y ac5uiring foreign wealth. ). 0one of the a#ove. Answer* %

$.

9hen economists refer to the word government, they usually mean A. only the federal government. %. only the federal and state governments. &. the federal, state, and local governments. (. only the federal and local governments. ). 0one of the a#ove. Answer* &

1$$

7.

(isposa#le income is 0ational income A. less ta3es collected from households and firms #y the government. %. plus net ta3es collected from households and firms #y the government. &. less net ta3es collected from households and firms #y the government (. less net ta3es collected from households #y the government. ). less net ta3es collected from households and firms #y the government. Answer* )

6.

/overnment savings, "g, is e5ual to A. ' ? /. %. ' @ /. &. ' = /. (. ' @ / ? 8. ). 0one of the a#ove. Answer* A

-.

8n a closed economy, private saving, "p, is e5ual to A. 8 B ./ ? '2. %. 8 @ ./ ? '2. &. 8 @ ./ @ '2. (. 8 B ./ @ '2. ). 8 @ ./ ? '2 @ &. Answer* %

9.

8n an open economy, private saving, "p, is e5ual to A. 8 B &A @ ./ B '2. %. 8 @ &A B ./ B '2. &. 8 @ &A @ ./ B '2. (. 8 B &A B ./ B '2. ). 8 @ &A @ ./ @ '2. Answer* &

1$7

+0.

Eicardian e5uivalence argues that when the government cuts ta3es and raises its deficit, A. consumers anticipate that they will face lower ta3es later to pay for the resulting government de#t. %. consumers anticipate that they will receive #etter services from the government. &. consumers anticipate that they will face higher ta3es later to pay for the resulting government de#t. (. consumers anticipate it will affect their future ta3es, in general in the direction of lowing future ta3es. ). 0one of the a#ove. Answer* &

+1.

Eicardian e5uivalence argues that when the government A. increases ta3es and raises its deficit, consumers anticipate that they will face higher ta3es later to pay for the resulting government de#t, thus people will raise their own private saving to offset the fall in government saving. %. cuts ta3es and decreases its deficit, consumers anticipate that they will face higher ta3es later to pay for the resulting government de#t, thus people will raise their own private saving to offset the fall in government saving. &. cuts ta3es and raises its surplus, consumers anticipate that they will face higher ta3es later to pay for the resulting government de#t, thus people will raise their own private saving to offset the fall in government saving. (. cuts ta3es and raises its deficit, consumers anticipate that they will face lower ta3es later to pay for the resulting government de#t, thus people will raise their own private saving to offset the fall in government saving. ). cuts ta3es and raises its deficit, consumers anticipate that they will face higher ta3es later to pay for the resulting government de#t, thus people will raise their own private saving to offset the fall in government saving. Answer* )

+2.

)very international transaction automatically enters the #alance of payments A. once either as a credit or as a de#it. %. twice, once as a credit and once as a de#it. &. once as a credit. (. twice, #oth times as de#it. ). 0one of the a#ove. Answer* %

1$6

Essay Questions 1. 9hat are the main aspects of economic life that macroeconomics analysis is most concerned with: 'here are four main aspects* unemployment, saving, trade im#alances, and money and the price level.

Answer* 2.

9hat is the national income identity for a closed economy: A = & @ 8 @ /.

Answer* .

9hat is the national income identity for an open economy: A = & @ 8 @ / @ )> ? 8;.

Answer* +.

(iscuss the values of private saving in closed and open economies.

Answer* 8n a closed economy, private saving, "p, is e5ual to 8 @ ./ ? '2. 8n an open economy, private saving, "p, is e5ual to 8 @ &A @ ./ B '2. An open economy helps in e3tending the opportunities for private saving or disBsaving, or #orrowing. $. (iscuss the effects of government deficits on the current account.

Answer* "ee pages 07 ? 06 A hard and difficult issue. (uring the Eeagan administration, the creation of twin deficits, where#y slashing ta3es, government deficits increased, which was accompanied with increased current account deficits. !sing the identity &A = 1rivate "aving B 8 B ./ ? '2, one can see that if private savings and 8 are constants, an increase in the deficit, namely an increase in ./ ? '2, necessarily increases the &A deficits #y the same magnitude. Fowever, government #udget deficit may change #oth private savings and investment, thus avoiding a creation of the twin deficits. An e3ample is the )uropean countries reducing their #udget deficits Gust prior to the introduction of the euro in January 1999. 0ow, under the Htwin deficits* theory,I one would have e3pected the )!s current account surpluses to increase. 'his has never happened. 'he main reason was sharp reduction in private saving rates. A good answer should discuss Eicardian e5uivalence, which argues that when the government cut ta3es and raises its deficit, consumers anticipate that they will face higher ta3es later to pay for the resulting government de#t. 8n anticipation, they raise their own private saving to offset the fall in government saving. 8n addition, one should mention wealth effect in anticipation of one )urope, assets prices increased, lowering private saving rates. +. 9hat types of international transactions are recorded in the #alance of payment accounts:

1$-

Answer* 'hree types* transactions that involve e3ports and imports of good and servicesJ transactions that involve the purchase or sell of financial assetsJ and e3ports and imports of good and servicesJ other activities resulting in transfer of wealth #etween countries that are recorded in the capital account. 6. H'he #alance of payments is always #alanced.I (iscuss.

Answer* 'rue. )very international transaction automatically enters the #alance of payments twice, once as a credit and once as a de#it. &urrent account @ financial account @ capital account = 0 -. H'he #alance of payments accounts seldom #alance in practice.I (iscuss.

Answer* 'rue. 'he main reasons are due to the fact that data collected or received from different sources may differ in coverage, accuracy, and timing. 8n addition, data on services are not as relia#le as data from the financial account. ;oreover, accurate measurements of international interest and dividend receipts are particularly difficult. 9. 9hat are the reasons for the world as a whole running a su#stantial current account deficit:

Answer* ."ee pages 1+ ? 1$.2 'his deficit increased sharply in the early 19-0s and has remained high. 'he main reasons are statistical discrepancies of national accounts, timing factors, while the main factor is the systematic misreporting of international interest income flows. "ince the world interest rates rose sharply after 19-0, the siKe of the world interest payment discrepancy increased with them. 8n addition, much of the worlds merchant shipping fleet is registered in countries that do not report maritime freight earnings to the 8;4, which collects these data.

1$9

Quantitati e!"raphing Pro#lems $. Assume & = +0 @ 0.-.A ? '2 / = 10 8 = 20 ' = 0, where ' are ta3es. A. &alculate A at e5uili#rium. A=&@8@/ A = $0 &alculate &, 8, and / at e5uili#rium. & = +0 @ 0.- A = 20 8 = 20 / = 10 0ow assume, )> = $ @ +)1LM1 8; = 10 @ 0.1 .A ? '2 ? )1LM1 )= 1L = 1.$ 1=2 4ind e5uili#rium A

Answer* %.

Answer* &.

Answer* A = 279.1776

170

2. /01

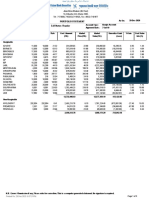

4ill in the following ta#le*

&onsumption 8nvestment /overnment )3ports 8mports 8nvestment 'otal Output 1urchases &onsumption

100 11$ 120 79 1 $ 9+0 11$0 12$0 Answer /01 'otal Output &onsumption

2$ 6$ 60 $6$ 1+0 700 600 2$ 10 0 1+0 1+0 200

10 12 10 $ 1+0 200 00

10 1+ 20 2$ 1+0 00 200 200

20 17 0 2 1+0 200 1$0 1$0

&onsumption 8nvestment /overnment )3ports 8mports 8nvestment 1urchases

100 11$ 120 79 1 $ +20 9+0 11$0 12$0

6$ 6$ 60 $6$ 1+0 $00 700 600

2$ 0 2$ 10 0 1+0 1+0 200 200

10 12 $ 10 $ 1+0 200 00 00

10 1+ 20 2 2$ 1+0 00 200 200

20 17 0 2 0 1+0 200 1$0 1$0

171

. 9hat can you learn from the figure #elow, which depicts the !" /01 and its components for the year 1996:

Answer* 'he figure shows the !" /01 and its components for the year 1996. 'he !.". /01 is a#out - trillion, consumption represents a#out 7 trillion, etc. 'he current account is in a small deficit, smaller than the one from 2000 that the students see in the "i3th )dition.

172

+.

9hat can one learn from the following figure:

Answer* 'he figure shows the !.". current account and net foreign wealth from 1966 until 1997. 8t shows that a string of current account deficits in the 19-0s reduced Americas net foreign wealth until, #y the end 1997, the country had accumulated a su#stantial net foreign de#t. 8n 19-6 the country #ecame a net de#tor to foreigners for the first time since 9orld 9ar 8.

17

$.

&onsider how the !nited "tates #alance of payments accounts are affected when !.". #an,s forgive two #illion in de#t owed to them #y the government of Argentina.

Answer* 8n this case, the !nited "tates ma,es a two #illion dollars capital transfer to Argentina, which should appear as a negative two #illion dollar entry in the capital account. 'he associated credit is in the financial account, in the form of a two #illion dollar reduction in !.". assets held a#road, i.e., a net asset He3port,I and therefore a positive #alance of payments entry.

17+

Vous aimerez peut-être aussi

- TBCH 16Document19 pagesTBCH 16Bill Benntt100% (1)

- TBCH 18Document24 pagesTBCH 18Bill BennttPas encore d'évaluation

- Chapter 4 MishkinDocument23 pagesChapter 4 MishkinLejla HodzicPas encore d'évaluation

- TBCH 11Document13 pagesTBCH 11Bill BennttPas encore d'évaluation

- TBCH 15Document29 pagesTBCH 15Bill Benntt100% (1)

- TBCH 07Document14 pagesTBCH 07Bill BennttPas encore d'évaluation

- TBCH 10Document12 pagesTBCH 10Bill BennttPas encore d'évaluation

- TBCH 13Document25 pagesTBCH 13Bill BennttPas encore d'évaluation

- TBCH 17Document23 pagesTBCH 17Bill Benntt100% (3)

- TBCH 14Document21 pagesTBCH 14Bill Benntt100% (1)

- TBCH 02Document14 pagesTBCH 02Bill Benntt100% (3)

- International EconomicsDocument25 pagesInternational EconomicsBill BennttPas encore d'évaluation

- Krugman TB Ch07 With AnswersDocument340 pagesKrugman TB Ch07 With AnswersJean ChanPas encore d'évaluation

- Chapter 12: National Income Accounting and The Balance of Payments Multiple Choice QuestionsDocument18 pagesChapter 12: National Income Accounting and The Balance of Payments Multiple Choice QuestionsBill BennttPas encore d'évaluation

- TBCH 01Document13 pagesTBCH 01Bill BennttPas encore d'évaluation

- 13.1 Exchange Rates and International TransactionsDocument27 pages13.1 Exchange Rates and International Transactionsjandihuyen83% (6)

- TBCH 05Document14 pagesTBCH 05Bill Benntt100% (1)

- Krugman TB ch01Document10 pagesKrugman TB ch01b4rfb4rf100% (2)

- TBCH 06Document12 pagesTBCH 06Bill BennttPas encore d'évaluation

- TBCH 08Document12 pagesTBCH 08Bill BennttPas encore d'évaluation

- TBCH 19Document22 pagesTBCH 19Bill BennttPas encore d'évaluation

- Chapter 14Document33 pagesChapter 14Tugay Elbeller67% (3)

- Chapter 13 National Income Accounting and The Balance of PaymentsDocument51 pagesChapter 13 National Income Accounting and The Balance of PaymentsBill BennttPas encore d'évaluation

- Macro II ch4 Q1 PDFDocument32 pagesMacro II ch4 Q1 PDFSimren DhillonPas encore d'évaluation

- Krugman TB ch08Document11 pagesKrugman TB ch08Teresita Tan ContrerasPas encore d'évaluation

- Chapter 22 Economic Growth: Parkin/Bade, Economics: Canada in The Global Environment, 8eDocument31 pagesChapter 22 Economic Growth: Parkin/Bade, Economics: Canada in The Global Environment, 8ePranta SahaPas encore d'évaluation

- Quiz 1Document2 pagesQuiz 1Umer IqbalPas encore d'évaluation

- Untitled13 PDFDocument22 pagesUntitled13 PDFErsin TukenmezPas encore d'évaluation

- ! ! ! ! Answers To Textbook ProblemsDocument6 pages! ! ! ! Answers To Textbook Problemsviren96Pas encore d'évaluation

- CH 4Document31 pagesCH 4ferasbarakat100% (2)

- Chapter 8 MishkinDocument20 pagesChapter 8 MishkinLejla HodzicPas encore d'évaluation

- Test 2 Sample MCQ (4-8)Document13 pagesTest 2 Sample MCQ (4-8)gg ggPas encore d'évaluation

- Macro Practice Test 4Document17 pagesMacro Practice Test 4ShankiegalPas encore d'évaluation

- International Economics: 15. Open-Economy Macroeconomics: Adjustment PoliciesDocument29 pagesInternational Economics: 15. Open-Economy Macroeconomics: Adjustment PoliciesMitul KathuriaPas encore d'évaluation

- StudentDocument31 pagesStudentKevin ChePas encore d'évaluation

- Study Questions - International EconomicsDocument27 pagesStudy Questions - International EconomicsDennis WangPas encore d'évaluation

- Krugman TB Ch09Document12 pagesKrugman TB Ch09vermanerds100% (1)

- Chapter 6 MishkinDocument23 pagesChapter 6 MishkinLejla HodzicPas encore d'évaluation

- Untitled14 PDFDocument22 pagesUntitled14 PDFErsin TukenmezPas encore d'évaluation

- Salvatore's International Economics - 10 EditionDocument19 pagesSalvatore's International Economics - 10 EditionMian NomiPas encore d'évaluation

- Chapter 2 World Trade: An Overview: International Economics, 10e (Krugman/Obstfeld/Melitz)Document8 pagesChapter 2 World Trade: An Overview: International Economics, 10e (Krugman/Obstfeld/Melitz)Mianda InstitutePas encore d'évaluation

- CHP 3Document5 pagesCHP 3Mert CordukPas encore d'évaluation

- Parkin 8e TIF Ch26Document40 pagesParkin 8e TIF Ch26Pranta SahaPas encore d'évaluation

- Chapter 10 MishkinDocument22 pagesChapter 10 MishkinLejla HodzicPas encore d'évaluation

- 1010 CHP 20Document40 pages1010 CHP 20haaaPas encore d'évaluation

- 203 Sample Midterm2Document16 pages203 Sample Midterm2Annas GhafoorPas encore d'évaluation

- NationalIncome HANDOUTDocument15 pagesNationalIncome HANDOUTSuman ShresthaPas encore d'évaluation

- M06 Bade 9418 04 Ch05aDocument15 pagesM06 Bade 9418 04 Ch05aLeon ZhangPas encore d'évaluation

- CH02 ProblemsDocument10 pagesCH02 ProblemsHaley Ann Martens100% (1)

- Ryerson University Department of Economics ECN 204 Midterm Winter 2013Document22 pagesRyerson University Department of Economics ECN 204 Midterm Winter 2013creepyslimePas encore d'évaluation

- Chapter # 3 Lecture # 4 Consumption, Saving, and InvestmentDocument13 pagesChapter # 3 Lecture # 4 Consumption, Saving, and InvestmentZuhaib AhmedPas encore d'évaluation

- Chapter 25aDocument7 pagesChapter 25amas_999Pas encore d'évaluation

- Concepts & Meaning of National IncomeDocument7 pagesConcepts & Meaning of National IncomeSonia LawsonPas encore d'évaluation

- Solutions Manual The Investment SettingDocument7 pagesSolutions Manual The Investment SettingQasim AliPas encore d'évaluation

- MULTIPLE CHOICE. Choose The One Alternative That Best Completes The Statement or Answers The QuestionDocument5 pagesMULTIPLE CHOICE. Choose The One Alternative That Best Completes The Statement or Answers The QuestionDiamante GomezPas encore d'évaluation

- Please Do Not Write On This Examination FormDocument9 pagesPlease Do Not Write On This Examination FormSamia KhalidPas encore d'évaluation

- Foreign Exchange TestBankDocument13 pagesForeign Exchange TestBankTan Kar Bin100% (1)

- ECON 203 Midterm1 2012WDocument13 pagesECON 203 Midterm1 2012WexamkillerPas encore d'évaluation

- Chapter 29bDocument7 pagesChapter 29bmas_999Pas encore d'évaluation

- l2.3 RGDP Versus NGDPDocument4 pagesl2.3 RGDP Versus NGDPPhung NhaPas encore d'évaluation

- Chapter 13 National Income Accounting and The Balance of PaymentsDocument51 pagesChapter 13 National Income Accounting and The Balance of PaymentsBill BennttPas encore d'évaluation

- Chapter 12: National Income Accounting and The Balance of Payments Multiple Choice QuestionsDocument18 pagesChapter 12: National Income Accounting and The Balance of Payments Multiple Choice QuestionsBill BennttPas encore d'évaluation

- Chapter 14 Exchange Rates and The Foreign Exchange Market An Asset ApproachDocument61 pagesChapter 14 Exchange Rates and The Foreign Exchange Market An Asset ApproachBill BennttPas encore d'évaluation

- Abel & Bernanke Macroeconomics Study Guide QuestionsDocument13 pagesAbel & Bernanke Macroeconomics Study Guide Questionskranium2391% (11)

- International EconomicsDocument25 pagesInternational EconomicsBill BennttPas encore d'évaluation

- International EconomicsDocument25 pagesInternational EconomicsBill BennttPas encore d'évaluation

- 392Document14 pages392Bill Benntt100% (1)

- TBCH 17Document23 pagesTBCH 17Bill Benntt100% (3)

- Chapter 12: National Income Accounting and The Balance of Payments Multiple Choice QuestionsDocument18 pagesChapter 12: National Income Accounting and The Balance of Payments Multiple Choice QuestionsBill BennttPas encore d'évaluation

- TBCH 19Document22 pagesTBCH 19Bill BennttPas encore d'évaluation

- TBCH 22Document27 pagesTBCH 22Bill BennttPas encore d'évaluation

- TBCH 21Document24 pagesTBCH 21Bill BennttPas encore d'évaluation

- TBCH 09Document13 pagesTBCH 09Bill BennttPas encore d'évaluation

- TBCH 10Document12 pagesTBCH 10Bill BennttPas encore d'évaluation

- TBCH 08Document12 pagesTBCH 08Bill BennttPas encore d'évaluation

- TBCH 13Document25 pagesTBCH 13Bill BennttPas encore d'évaluation

- TBCH 04Document15 pagesTBCH 04Bill BennttPas encore d'évaluation

- TBCH 14Document21 pagesTBCH 14Bill Benntt100% (1)

- TBCH 22Document27 pagesTBCH 22Bill BennttPas encore d'évaluation

- TBCH 05Document14 pagesTBCH 05Bill Benntt100% (1)

- TBCH 03Document13 pagesTBCH 03Bill BennttPas encore d'évaluation

- TBCH 01Document13 pagesTBCH 01Bill BennttPas encore d'évaluation

- TBCH 07Document14 pagesTBCH 07Bill BennttPas encore d'évaluation

- TBCH 06Document12 pagesTBCH 06Bill BennttPas encore d'évaluation

- TBCH 02Document14 pagesTBCH 02Bill Benntt100% (3)

- TBCH 19Document22 pagesTBCH 19Bill BennttPas encore d'évaluation

- Assignment 19 - Written Assignment - The Great Depression PDFDocument1 pageAssignment 19 - Written Assignment - The Great Depression PDFPedro Alvarez SabinPas encore d'évaluation

- Government of RajasthanDocument209 pagesGovernment of RajasthanEr Kamal SinghPas encore d'évaluation

- Full Download Test Bank For Management 10th Edition Ricky W Griffin PDF Full ChapterDocument34 pagesFull Download Test Bank For Management 10th Edition Ricky W Griffin PDF Full Chaptercrincumose.at2d100% (19)

- SW 47 Probable Cause RedactedDocument13 pagesSW 47 Probable Cause Redactedmark.stevensPas encore d'évaluation

- PPTDocument35 pagesPPTShivam ChauhanPas encore d'évaluation

- Principles of Taxation For Business and Investment Planning 2019 22nd Edition Jones Solutions ManualDocument36 pagesPrinciples of Taxation For Business and Investment Planning 2019 22nd Edition Jones Solutions Manualavadavatvulgatem71u2100% (23)

- 2008 TCFA Annual ConferenceDocument48 pages2008 TCFA Annual ConferenceaPas encore d'évaluation

- Is To Be Use When There Are Multiple Activities in One Cash WithdrawalDocument2 pagesIs To Be Use When There Are Multiple Activities in One Cash WithdrawalRyan Pazon0% (1)

- FR Assignment 4Document4 pagesFR Assignment 4shashalalaxiangPas encore d'évaluation

- Brazil Currency Slide To New LowDocument2 pagesBrazil Currency Slide To New LowFunded FXPas encore d'évaluation

- DownloadDocument4 pagesDownloadJames CarterPas encore d'évaluation

- FRM Practice Exam From EdupristineDocument52 pagesFRM Practice Exam From EdupristineAnish Jagdish LakhaniPas encore d'évaluation

- Gann Trend LinesDocument4 pagesGann Trend LinesAravind Tr100% (1)

- t113 PDFDocument151 pagest113 PDFViswanathan VPas encore d'évaluation

- PreliOfferDocument96 pagesPreliOfferMuhammad IbadPas encore d'évaluation

- Chapter 5. INTRODUCTION TO VALUATION THE TIME VALUE OF MONEYDocument33 pagesChapter 5. INTRODUCTION TO VALUATION THE TIME VALUE OF MONEYChloe JtrPas encore d'évaluation

- Portfolio Statement Client Code: W0015 Name: Asish Dey Status: Active Call Status: RegularDocument3 pagesPortfolio Statement Client Code: W0015 Name: Asish Dey Status: Active Call Status: RegularSumitPas encore d'évaluation

- Chapter 8 Debentures and ChargesDocument2 pagesChapter 8 Debentures and ChargesNahar Sabirah100% (1)

- Working Capital Management atDocument29 pagesWorking Capital Management atNavkesh GautamPas encore d'évaluation

- The Grameen BankDocument7 pagesThe Grameen BankBalkis BanuPas encore d'évaluation

- Economics 1BDocument91 pagesEconomics 1BsinghjpPas encore d'évaluation

- AdvanceReceipt2021 05 02 18 22 31Document2 pagesAdvanceReceipt2021 05 02 18 22 31ShubhamPas encore d'évaluation

- FRL 433 International Investment and DiversificationDocument38 pagesFRL 433 International Investment and DiversificationAnantharaman KarthicPas encore d'évaluation

- UPASDocument3 pagesUPASimteaj39730% (1)

- DIMO 2Q16 Post Earnings Review 4 Nov 2015Document6 pagesDIMO 2Q16 Post Earnings Review 4 Nov 2015Mithila SomasiriPas encore d'évaluation

- Case Study - So What Is It WorthDocument7 pagesCase Study - So What Is It WorthJohn Aldridge Chew100% (1)

- Credit and Lending Policies in The PhilippinesDocument2 pagesCredit and Lending Policies in The Philippinesmari bellogaPas encore d'évaluation

- Remuneration Bill Form FormatDocument2 pagesRemuneration Bill Form FormatmanishdgPas encore d'évaluation

- ACC 206 Test 2 2023Document9 pagesACC 206 Test 2 2023tawanaishe shoniwaPas encore d'évaluation

- Bus Com 12Document3 pagesBus Com 12Chabelita MijaresPas encore d'évaluation