Académique Documents

Professionnel Documents

Culture Documents

Excel 5.19-6 Due Apr 24 - Rusincovitch

Transféré par

Michael ClarkDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Excel 5.19-6 Due Apr 24 - Rusincovitch

Transféré par

Michael ClarkDroits d'auteur :

Formats disponibles

INSTRUCTIONS

1. This assignment is worth 10 points. 2. It is due 11:59pm, Apr 24, Thursday. You can have a 1-day grace period with an upfront loss of 2 points. Submission later than 11:59 pm, Apr 25 will not be accepted. 3. Use Excel functions, formulas and cell reference to fill in the colored cells to complete the work. 4. After completing the work, upload the Excel file to Blackboard.

A 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52

Chapter: Problem:

19 6

As part of its overall plant modernization and cost reduction program, Western Fabrics' management has decided to instal automated weaving loom. In the capital budgeting analysis of this equipment, the IRR of the project was found to be 20% project's required return of 12%.

The loom has an invoice price of $250,000, including delivery and installation charges. The funds needed could be borrow the bank through a 4-year amortized loan at a 10% interest rate, with payments to be made at the end of each year. In the e the loom is purchased, the manufacturer will contract to maintain and service it for a fee of $20,000 per year paid at the end year. The loom falls in the MACRS 5-year class, and Western's marginal federal-plus-state tax rate is 40%.

Gardial Automation Inc., maker of the loom, has offered to lease the loom to Westen for $70,000 upon delivery and installat plus 4 additional annual lease payments of $70,000 to be made at the ends of Years 1 through 4. (Note that there are 5 leas payments in total.) The lease agreement includes maintenance and servicing. Actually, the loom has an expected life of ei at which time its expected salvage value is zero; however, after 4 years, its market value is expected to equal its book value $42,500. Tanner-Woods plans to build and entirely new plant in 4 years, so it has no interest in either leasing or owning th loom for more than that period. a. Should the loom be leased or purchased? First, we want to lay out all of the input data in the problem. INPUT DATA Invoice Price Length of loan Loan Interest rate Maintenance fee Tax Rate Lease fee Equipment expected life Expected salvage value Market value after 4 years Book value after 4 years $250,000 4 10% $20,000 40% $70,000 8 $0 $42,500 $42,500

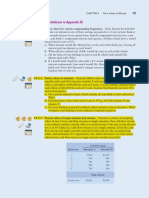

First, we can determine the annual loan payment that must be made on the new equipment. We will do so using the function wizard for PMT. Annual loan payment = Year Beginning loan balance Interest payment Principal payment Ending loan balance $78,868 1 $250,000 $25,000 $53,868 $196,132 2 $196,132 $19,613 $59,254 $136,878 3 $136,878 $13,688 $65,180 $71,698 4 $71,698 $7,170 $71,698 $0

A B C D E F G 53 Now, we see that the decision being made is whether to purchase the equipment at a net cost of $250,000 (with annual pay 54 $78,868) or lease the equipment and make annual payments of $70,000. To make this decision, we must analyze the increm 55 flows. 56

A 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97

Before proceeding with our NPV analysis we must determine the schedule of depreciation charges for this new equipment MACRS 5-year Depreciation Schedule Year 1 2 Depr. Rate 20.00% 32.00% Depr. Exp. $50,000 $80,000

3 19.20% $48,000

4 11.52% $28,800

5 11.52% $28,800

6 5.76% $14,400

We can now construct our table of incremental cash flows from these two alternatives. Remember, that the appropriate di in this scenario is the after tax cost of borrowing, or: 10%*(1-40%) = 6%. 0.06 NPV LEASE ANALYSIS OF INCREMENTAL CASH FLOWS Year = Cost of ownership Purchase cost Loan proceeds After-tax interest payment Principal payment Maintenance cost Tax savings from maintenance cost Tax savings from depreciation Salvage value Net cash flow from ownership PV cost of ownership Cost of leasing Lease payment Tax savings from lease payment Net cash flow from leasing PV cost of leasing Cost Comparison PV ownership cost @ 6% PV of leasing @ 6% Net Advantage to Leasing 0 ($250,000) $250,000 ($15,000) ($53,868) ($20,000) $8,000 $20,000 $0 ($185,323.87) ($60,868) ($11,768) ($59,254) ($20,000) $8,000 $32,000 ($51,022) ($8,213) ($65,180) ($20,000) $8,000 $19,200 ($66,193) 1 2 3

($70,000) $28,000 ($42,000) ($187,534.44)

($70,000) $28,000 ($42,000)

($70,000) $28,000 ($42,000)

($70,000) $28,000 ($42,000)

($185,324) ($187,534) ($2,211)

What is your suggestion, owning or leasing? Owning since NAL is negative

A 98 99 100 101 102 103 104 105 106 107 108 109 110 111 112 113 114 115 116 117 118 119 120 121 122 123 124 125 126 127 128 129 130 131 132 133 134 135

b. The salvage value is clearly the most uncertain cash flow in the analysis. Assume that the appropriate salvage value p discount rate is 15 percent. What would be the effect of a salvage value risk adjustment on the decision?

All cash flows would remain unchanged except that of the salvage value. Our new array of cash flows would resemble the following: Standard discount rate Salvage value rate Year = Net cash flow PV of net cash flows NPV of ownership New Cost Comparison PV ownership cost @ 6% PV of leasing @ 6% Net Advantage to Leasing Now what do you say? Buying since NAL is positive 10% 15% 0 $0 $0 ($188,880) 0.06 0.09 1 ($60,868) ($57,422) 2 ($51,022) ($45,410) 3 ($66,193) ($55,577) Operating cash 4 ($76,480) ($60,579)

($188,880) ($187,534) $1,345

c. Assuming that the after-tax cost of debt should be used to discount all anticipated cash flows, at what lease payment w firm be indifferent to either leasing or buying? Hint: Use the Goal Seek function to determine the lease payment that makes the Net Advantage to Leasing zero. Crossover = $70,502 Used what if analysis - set C117, to value 0, by changing C36

H 1 2

3 4 5 anagement 6 has decided to install a new he project7 was found to be 20% versus the 8 9 10 e funds needed could be borrowed from 11 at the end of each year. In the event that 12 f $20,000 13 per year paid at the end of each 14 tax rate is 40%. 15 16 17delivery and installation (at t=0) 0,000 upon 18 ugh 4. (Note that there are 5 lease 19 e loom has an expected life of eight years, 20 expected to equal its book value of 21 est in either leasing or owning the proposed 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 t. We will 42 do so using the 43 44 45 46 47 48 49 50 51 52

H I cost of $250,000 (with annual payments of 53 sion, we must 54 analyze the incremental cash 55 56

H I 57 charges for this new equipment. 58 59 60 61 62 63 64 emember, 65 that the appropriate discount rate 66 67 68 69 70 4 71 72 73 74 ($4,301.87) 75 ($71,698) 76 ($20,000) 77 $8,000 78 $11,520 79 $42,500 80 ($33,980) 81 82 83 84 ($70,000) 85 $28,000 86 ($42,000) 87 88 89 90 91 92 93 94 95 96 97

H I 98 the appropriate salvage value pre-tax 99 n the decision? 100 101 f cash flows 102 would resemble the 103 104 105 106 107 Salvage value cash 108 4 109 $42,500 110 $30,108 111 112 113 114 115 116 117 118 119 120 121 122 sh flows, 123 at what lease payment would the 124 125 ntage to Leasing 126 zero. 127 by changing 128C36 129 130 131 132 133 134 135

loan amount term in mos interest rate payment

100,000 180 7.0%

#######

Vous aimerez peut-être aussi

- Homework Chapter 18 and 19Document7 pagesHomework Chapter 18 and 19doejohn150Pas encore d'évaluation

- Group Assignment 1Document5 pagesGroup Assignment 1pushmbaPas encore d'évaluation

- Mini CaseDocument9 pagesMini CaseJOBIN VARGHESEPas encore d'évaluation

- Activity Based CostingDocument23 pagesActivity Based CostingLamhe Yasu0% (1)

- Garrison 11ce SM ch11 FinalDocument90 pagesGarrison 11ce SM ch11 FinalCoco ZaidePas encore d'évaluation

- (Solved) A Firm Has Determined Its Optimal Capital Structure Which Is... - Course HeroDocument4 pages(Solved) A Firm Has Determined Its Optimal Capital Structure Which Is... - Course HeroPauline EchanoPas encore d'évaluation

- Rais12 SM ch13Document32 pagesRais12 SM ch13Edwin MayPas encore d'évaluation

- Chapter 004 F2009Document7 pagesChapter 004 F2009mallumainhunmailPas encore d'évaluation

- Investment Analysis - Chapter 3Document34 pagesInvestment Analysis - Chapter 3Linh MaiPas encore d'évaluation

- Comparing Projects with Unequal Lives Using Replacement Chain Method and Equivalent Annual AnnuityDocument3 pagesComparing Projects with Unequal Lives Using Replacement Chain Method and Equivalent Annual AnnuitydzazeenPas encore d'évaluation

- Solved A Monopolist S Inverse Demand Function Is P 150Document1 pageSolved A Monopolist S Inverse Demand Function Is P 150M Bilal SaleemPas encore d'évaluation

- Chapter 12 HomeworkDocument4 pagesChapter 12 HomeworkMargareta JatiPas encore d'évaluation

- Tutorial CashflowDocument2 pagesTutorial CashflowArman ShahPas encore d'évaluation

- Coolplay Corp Is Thinking About Opening A Soccer Camp inDocument2 pagesCoolplay Corp Is Thinking About Opening A Soccer Camp inMuhammad ShahidPas encore d'évaluation

- The Controller of The Ijiri Company Wants You To Estimate A Cost Function From The Following Two Observations in A General Ledger Account Called MaintenanceDocument3 pagesThe Controller of The Ijiri Company Wants You To Estimate A Cost Function From The Following Two Observations in A General Ledger Account Called MaintenanceElliot RichardPas encore d'évaluation

- AF201 FINAL EXAM REVISION PACKAGEDocument8 pagesAF201 FINAL EXAM REVISION PACKAGENavinesh NandPas encore d'évaluation

- Pertemuan Asistensi 8 (Performance Measurement)Document2 pagesPertemuan Asistensi 8 (Performance Measurement)Sholkhi ArdiansyahPas encore d'évaluation

- Session 08: Tactical Decision MakingDocument18 pagesSession 08: Tactical Decision MakingFrancisco Pedro SantosPas encore d'évaluation

- Case Study-Monitoring Employees On Networks-Unethical or Good BusinessDocument5 pagesCase Study-Monitoring Employees On Networks-Unethical or Good Businessvamp ee100% (1)

- ch05 Managerial AccountingDocument75 pagesch05 Managerial AccountingFiryal Yulda100% (1)

- Problem 7: Ratios and Financial Planning at East Coast YachtsDocument3 pagesProblem 7: Ratios and Financial Planning at East Coast YachtsTAMIRAT ASEFAPas encore d'évaluation

- Cash Flows IIDocument16 pagesCash Flows IIChristian EstebanPas encore d'évaluation

- Calculate Z-Score for Private Company FinancialsDocument1 pageCalculate Z-Score for Private Company Financialskc103038Pas encore d'évaluation

- Koehl's Doll Shop Cash Budget and Loan RequirementsDocument3 pagesKoehl's Doll Shop Cash Budget and Loan Requirementsmobinil1Pas encore d'évaluation

- Solutions Chapter 7Document39 pagesSolutions Chapter 7Brenda Wijaya100% (2)

- Mployee Stakeholders and Workplace IssuesDocument25 pagesMployee Stakeholders and Workplace IssuesAlexander Agung HRDPas encore d'évaluation

- Cost Recovery Basics and MACRS TablesDocument4 pagesCost Recovery Basics and MACRS Tablesyea okayPas encore d'évaluation

- Current Cost Accounting (CCA) Technique - Inflation Accounting - Play AccountingDocument2 pagesCurrent Cost Accounting (CCA) Technique - Inflation Accounting - Play AccountingVikas Singh0% (1)

- Chapter 12 Mini Case SolutionsDocument10 pagesChapter 12 Mini Case SolutionsFarhanie NordinPas encore d'évaluation

- Case of NPV Others Criteria Investment JawabanDocument2 pagesCase of NPV Others Criteria Investment JawabanZuheryusuf SalimPas encore d'évaluation

- Self-Test Problems (Solutions in Appendix B) : LG5 LG2Document6 pagesSelf-Test Problems (Solutions in Appendix B) : LG5 LG2Hamad Gul0% (1)

- 288 33 Powerpoint Slides Chapter 16 Global Operations Supply Chain ManagementDocument51 pages288 33 Powerpoint Slides Chapter 16 Global Operations Supply Chain ManagementSachin MishraPas encore d'évaluation

- Dumandan, Kenneth R BSA 302-A Financial Markets P15-1Document8 pagesDumandan, Kenneth R BSA 302-A Financial Markets P15-1Lorielyn AgoncilloPas encore d'évaluation

- Problem 1. Estimating Hugo Boss' Equity Value (Updated 1-2011)Document4 pagesProblem 1. Estimating Hugo Boss' Equity Value (Updated 1-2011)Walm KetyPas encore d'évaluation

- Manajemen Keuangan LanjutanDocument4 pagesManajemen Keuangan Lanjutancerella ayanaPas encore d'évaluation

- Corporate Level Strategy - Types and ExamplesDocument21 pagesCorporate Level Strategy - Types and ExamplesSuraj RajbharPas encore d'évaluation

- CVP AnalysisDocument5 pagesCVP AnalysisAnne BacolodPas encore d'évaluation

- Accounting Errors and Dentist Business TransactionsDocument1 pageAccounting Errors and Dentist Business TransactionsJordy TangPas encore d'évaluation

- A. Laboratory Manager : : Exercise 1-11 The Managerial ProcessDocument2 pagesA. Laboratory Manager : : Exercise 1-11 The Managerial ProcessNero VedsuPas encore d'évaluation

- Group assignment cover sheet detailsDocument4 pagesGroup assignment cover sheet detailsPhan Huỳnh Châu TrânPas encore d'évaluation

- Movie Case StudyDocument7 pagesMovie Case StudySinta ClaudiaPas encore d'évaluation

- Expansion and Financial RestructuringDocument50 pagesExpansion and Financial Restructuringvikasgaur86100% (5)

- Strategic Planning in RetailDocument11 pagesStrategic Planning in RetailDILIP JAINPas encore d'évaluation

- 041924353041-Review Chapter 29Document5 pages041924353041-Review Chapter 29Aimé RandrianantenainaPas encore d'évaluation

- The Effect of Working Capital Management On Cash HoldingDocument79 pagesThe Effect of Working Capital Management On Cash Holdinglenco4eva6390Pas encore d'évaluation

- Project Cash Flow AnalysisDocument25 pagesProject Cash Flow Analysisaramsiva100% (1)

- Sample Problems On Transfer Pricing and Responsibility Acctg 1Document11 pagesSample Problems On Transfer Pricing and Responsibility Acctg 1Keyt's Collection PhPas encore d'évaluation

- Cornerstones of Cost Accounting Chapter 4 Answers Cornerstones of Cost Accounting Chapter 4 AnswersDocument3 pagesCornerstones of Cost Accounting Chapter 4 Answers Cornerstones of Cost Accounting Chapter 4 Answersnotperfectisgood0% (1)

- Question and Answer - 24Document30 pagesQuestion and Answer - 24acc-expertPas encore d'évaluation

- Tugas Cost AccountingDocument7 pagesTugas Cost AccountingRudy Setiawan KamadjajaPas encore d'évaluation

- COMM 220 Practice Problems 2 2Document11 pagesCOMM 220 Practice Problems 2 2Saurabh SaoPas encore d'évaluation

- International Investment AppraisalDocument6 pagesInternational Investment AppraisalZeeshan Jafri100% (1)

- Assignment 2 1 Warm-Up Exercises Chapter 5Document1 pageAssignment 2 1 Warm-Up Exercises Chapter 5drjones5Pas encore d'évaluation

- Big Deal Vs SmallDocument2 pagesBig Deal Vs Smallspectrum_48Pas encore d'évaluation

- Rangkuman Chapter 15Document3 pagesRangkuman Chapter 15Safitri Eka LestariPas encore d'évaluation

- Role of Financial Management in OrganizationDocument8 pagesRole of Financial Management in OrganizationTasbeha SalehjeePas encore d'évaluation

- On January 1 2014 Paxton Company Purchased A 70 InterestDocument1 pageOn January 1 2014 Paxton Company Purchased A 70 InterestMuhammad ShahidPas encore d'évaluation

- Buy vs. LeaseDocument4 pagesBuy vs. LeaseMuslimPas encore d'évaluation

- Chapter 20. CH 20-06 Build A ModelDocument4 pagesChapter 20. CH 20-06 Build A ModelCarol Lee0% (1)

- Unit 7 - Wiley Plus ExamplesDocument14 pagesUnit 7 - Wiley Plus ExamplesMohammed Al DhaheriPas encore d'évaluation

- Management Advisory Services: Costs and Cost ConceptsDocument46 pagesManagement Advisory Services: Costs and Cost ConceptsKlomoPas encore d'évaluation

- Ias 1 Presentation of Financial StatementsDocument30 pagesIas 1 Presentation of Financial Statementsesulawyer2001Pas encore d'évaluation

- Reviewer Module 1 To 5 TheoryDocument8 pagesReviewer Module 1 To 5 TheoryDharylle CariñoPas encore d'évaluation

- Introduction to Innovation Management and New Product DevelopmentDocument20 pagesIntroduction to Innovation Management and New Product DevelopmentWeeHong NgeoPas encore d'évaluation

- PUGEL 'Scale Economies Imperfect Competition and Trade' INTERNATIONAL ECONOMICS 6ED - Thomas Pugel - 001 PDFDocument29 pagesPUGEL 'Scale Economies Imperfect Competition and Trade' INTERNATIONAL ECONOMICS 6ED - Thomas Pugel - 001 PDFPraba Vettrivelu100% (1)

- A Company's Statement of Financial PositionDocument22 pagesA Company's Statement of Financial PositionThe Brain Dump PHPas encore d'évaluation

- Marketing Strategy AmazonDocument40 pagesMarketing Strategy AmazonMukesh Manwani40% (5)

- Resume Emad AdawyDocument4 pagesResume Emad AdawypriyankaPas encore d'évaluation

- SEO-Optimized Marketing Plan for Detergent Company in South AfricaDocument23 pagesSEO-Optimized Marketing Plan for Detergent Company in South AfricaDigvijay SinghPas encore d'évaluation

- IBM Assignment Lakshay KumarDocument3 pagesIBM Assignment Lakshay Kumarlakshay kumarPas encore d'évaluation

- Managerial Economics: Key Concepts ExplainedDocument248 pagesManagerial Economics: Key Concepts ExplainedGaurav gusaiPas encore d'évaluation

- A Stich in Time PDFDocument4 pagesA Stich in Time PDFdp JacobPas encore d'évaluation

- Format For Project Feasibility StudyDocument4 pagesFormat For Project Feasibility StudyIjLoriaMaderaPas encore d'évaluation

- Introduction To e Business Project ReportDocument32 pagesIntroduction To e Business Project ReportBikram SinghPas encore d'évaluation

- Business-Plan Entre2 FinalDocument41 pagesBusiness-Plan Entre2 Finaljustine santosPas encore d'évaluation

- Lower of Cost and Net Realizable ValueDocument1 pageLower of Cost and Net Realizable ValueFe ValenciaPas encore d'évaluation

- N5 Financial Accounting - UpdatedDocument28 pagesN5 Financial Accounting - UpdatedAnil HarichandrePas encore d'évaluation

- JLL Company ProfileDocument27 pagesJLL Company ProfileAashish Pant100% (1)

- BrandingDocument13 pagesBrandingvandana100% (8)

- Brannigan FoodsDocument6 pagesBrannigan FoodspedropesaoPas encore d'évaluation

- Sales Representative Client Service in San Francisco Bay CA Resume Chris GorgenDocument2 pagesSales Representative Client Service in San Francisco Bay CA Resume Chris GorgenChrisGorgenPas encore d'évaluation

- Distribution Definition - What Is Distribution - Marketing91Document15 pagesDistribution Definition - What Is Distribution - Marketing91Olayinka OyedejiPas encore d'évaluation

- Diagnostic Test EntrepreneurshipDocument5 pagesDiagnostic Test EntrepreneurshipSir FelgerPas encore d'évaluation

- Preqin Top Performing Hedge Funds February 2015Document13 pagesPreqin Top Performing Hedge Funds February 2015sbs5tzPas encore d'évaluation

- CAT T1 Recording Financial Transactions Course SlidesDocument162 pagesCAT T1 Recording Financial Transactions Course Slideshazril46100% (5)

- 10brittany King - Resume - Associate Director of Strategy and Analytics PDFDocument1 page10brittany King - Resume - Associate Director of Strategy and Analytics PDFBrittany KingPas encore d'évaluation

- Tut 2 TwoDocument56 pagesTut 2 TwoBraceley & CoPas encore d'évaluation

- Bank Account, Capital Account, Cash Account and Control Account ExplainedDocument5 pagesBank Account, Capital Account, Cash Account and Control Account ExplainedShanti GunaPas encore d'évaluation

- Strategic Marketing ManagementDocument23 pagesStrategic Marketing ManagementSadam IrshadPas encore d'évaluation