Académique Documents

Professionnel Documents

Culture Documents

Difference Between International and Domestic Marketing

Transféré par

David ThambuCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Difference Between International and Domestic Marketing

Transféré par

David ThambuDroits d'auteur :

Formats disponibles

Difference between International and Domestic Marketing International Marketing Domestic Marketing It refers to those activities which results

It refers to those activities which results into transfers of goods and services from into transfers of goods and services inside 1. Meaning one country to another. the country itself. International trade is characteristics by Domestic marketing has no such 2. Barriers tariff and non tariff barriers. restrictions. It involves exchange on the basis of It involves exchange in the basis of same 3. Currencies different currencies. currencies. Exchange takes place under government Government in interference is zero or 4.Government rules and regulations. There is minimum only incase of Interference high degree of government interference. essential commodities. Trade should be done taking diverse into consideration. Even things like colour Culture does not affect in domestic 5. Culture combination can be affect the trade. marketing. Letter of credit is normally as mode of Cash, Cheques, DDs are the most 6.Mode of Payment payment. common. Factors of Production are relatively 7.Mobility ofFactors of immobile as compared to domestic Domestic Trade enjoys greater mobility Production marketing. in factors of production. International Trade is subject to intense Competition is not as intense as it is 8. Competition competition. in international marketing. International Marketing is subject to Domestic trade does not involve much of 9. Documentation complex documentation documentation. International Marketing is subject tohigh risk. Political, foreign exchange risk, bad Domestic Marketing is also subject to risk 10. Risk debt risk are few of them. but not as high as international marketing.

Following are the major differences: Exposure to Foreign Exchange: The most significant difference is of foreign currency exposure. Currency exposure impacts almost all the areas of an international business starting from your purchase from suppliers, selling to customers , investing in plant and machinery, fund raising etc. Wherever you need money, currency exposure will come into play and as we know it well that there is no business transaction without money. Macro Business Environment: An international business is exposed to altogether a different economic and political environment . All trade policies are different in different countries. Financial manager has to critically analyze the policies to make out the feasibility and profitability of their business propositions. One country may have business friendly policies and other may not. Legal and Tax Environment: The other important aspect to look at is the legal and tax front of a country. Tax impacts directly to your product costs or net profits i.e. the bottom line for which the whole story is written. International finance manager will look at the taxation structure to find out whether the business which is feasible in his home country is workable in the foreign country or not. Different group of Stakeholders: It is not only the money which along matters, there are other things which carry greater importance viz. the group of suppliers, customers, lenders, shareholders etc. Why these group of people matter? It is because they carry altogether a different culture, a different set of values and most importantly the language also may be different. When you are dealing with those stakeholders, you have no clue about their likes and dislikes. A business is driven by these stakeholders and keeping them happy is all you need. Foreign Exchange Derivatives : Since, it is inevitable to expose to the risk of foreign exchange in a multinational business . Knowledge of forwards, futures, options and swaps is invariably required. A financial manager has to be strong

enough to calculate the cost impact of hedging the risk with the help of different derivative instruments while taking any financial decisions. Different Standards of Reporting: If the business has presence in say US and India, the books of accounts need to be maintained in US GAAP and IGAAP. It is not surprising to know that the booking of assets has a different treatment in one country compared to other. Managing the reporting task is another big difference. The financial manager or his team needs to be familiar with accounting standards of different countries. Capital Management: In an MNC, the financial managers have ample options of raising the capital. More number of options creates more challenge with respect to selection of right source of capital to ensure the lowest possible cost of capital. There may be such more points of difference between international and domestic financial management. Mentioned above are list of major differences. We need to consider each of them before taking any decision involving multinational financial environment.

Vous aimerez peut-être aussi

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- A Study On Derivatives (Future& Option)Document1 pageA Study On Derivatives (Future& Option)David Thambu100% (1)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- AircelDocument1 pageAircelDavid ThambuPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- An Over View of Indian Share Market: David Ashirvadam Sharekhan PVT LTDDocument31 pagesAn Over View of Indian Share Market: David Ashirvadam Sharekhan PVT LTDDavid Thambu100% (1)

- Ford Motor CoDocument9 pagesFord Motor CoDavid ThambuPas encore d'évaluation

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Blank CV TemplateDocument3 pagesBlank CV TemplateDavid ThambuPas encore d'évaluation

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Financial ServicesDocument29 pagesFinancial ServicesDavid ThambuPas encore d'évaluation

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- AsherDocument1 pageAsherDavid ThambuPas encore d'évaluation

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Date S.No Particulars Buying SellingDocument2 pagesDate S.No Particulars Buying SellingDavid ThambuPas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- CIOSA NGO Membership Core Activities PDFDocument139 pagesCIOSA NGO Membership Core Activities PDFDavid ThambuPas encore d'évaluation

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Name Peer EvalDocument1 pageName Peer EvalDavid ThambuPas encore d'évaluation

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Women Empowerment & Reservation: Presented By: Shruti GuptaDocument21 pagesWomen Empowerment & Reservation: Presented By: Shruti GuptaDavid ThambuPas encore d'évaluation

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Stock WarzDocument19 pagesStock WarzDavid ThambuPas encore d'évaluation

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Summer-Internship-Report#page 40: Subject MarksDocument2 pagesSummer-Internship-Report#page 40: Subject MarksDavid ThambuPas encore d'évaluation

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- Women and EntrepreneurshipsDocument15 pagesWomen and EntrepreneurshipsDavid ThambuPas encore d'évaluation

- Punjab National Bank: CMP: INR760 TP: INR964 Buy Asset Quality Deteriorates Asset-Liability Well-MatchedDocument14 pagesPunjab National Bank: CMP: INR760 TP: INR964 Buy Asset Quality Deteriorates Asset-Liability Well-MatchedDavid ThambuPas encore d'évaluation

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Asan Business School: Post Graduate Programme in ManagementDocument1 pageAsan Business School: Post Graduate Programme in ManagementDavid ThambuPas encore d'évaluation

- Empowerment of Women in Knowledge Based SocietyDocument12 pagesEmpowerment of Women in Knowledge Based SocietyDavid ThambuPas encore d'évaluation

- Orporate Social Responsibility: - by Amrita Jadhav - by Amita KoliDocument35 pagesOrporate Social Responsibility: - by Amrita Jadhav - by Amita KoliDavid ThambuPas encore d'évaluation

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Invite Letter 2013Document2 pagesInvite Letter 2013David ThambuPas encore d'évaluation

- Eclectica Agriculture Fund Feb 2015Document2 pagesEclectica Agriculture Fund Feb 2015CanadianValuePas encore d'évaluation

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Topaz ManualDocument37 pagesTopaz ManualbookerPas encore d'évaluation

- Soal Dan JWBN Siklus DGGDocument17 pagesSoal Dan JWBN Siklus DGGGhina Risty RihhadatulaisyPas encore d'évaluation

- VisionLife EN 100801Document26 pagesVisionLife EN 100801Jeff HsiaoPas encore d'évaluation

- Company Analysis Report On M/s Vimal Oil & Foods LTDDocument32 pagesCompany Analysis Report On M/s Vimal Oil & Foods LTDbalaji bysani100% (1)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Auditing and Assurance: Specialized Industries - Midterm ExaminationDocument14 pagesAuditing and Assurance: Specialized Industries - Midterm ExaminationHannah SyPas encore d'évaluation

- Extension of Time Claim ProcedureDocument108 pagesExtension of Time Claim ProcedureAshish Kumar GuptaPas encore d'évaluation

- PEPSI FinalDocument29 pagesPEPSI FinalIda AgustiniPas encore d'évaluation

- Enterprise Structure SAPDocument10 pagesEnterprise Structure SAP03OmegaPas encore d'évaluation

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Unemployment ProblemDocument12 pagesUnemployment ProblemMasud SanvirPas encore d'évaluation

- Management: Fifteenth Edition, Global EditionDocument46 pagesManagement: Fifteenth Edition, Global EditionAnna Maria TabetPas encore d'évaluation

- The Role of Internal Audit in Risk ManagementDocument3 pagesThe Role of Internal Audit in Risk ManagementZain AccaPas encore d'évaluation

- Auto Rickshaw - Business PlanDocument28 pagesAuto Rickshaw - Business PlanAbhishek1881100% (1)

- Analisa Biaya & Metode Penilaian Investasi Pada Kebakaran - OkDocument22 pagesAnalisa Biaya & Metode Penilaian Investasi Pada Kebakaran - OkCarter GansPas encore d'évaluation

- Week 6 Financial Accoutning Homework HWDocument7 pagesWeek 6 Financial Accoutning Homework HWDoyouknow MEPas encore d'évaluation

- Invoice 41071Document2 pagesInvoice 41071Zinhle MpofuPas encore d'évaluation

- Book On Making Money, The - Steve OliverezDocument177 pagesBook On Making Money, The - Steve Oliverezpipe_boy100% (1)

- DOSRIDocument2 pagesDOSRICara ZelliPas encore d'évaluation

- Sop PDFDocument15 pagesSop PDFpolikopil0Pas encore d'évaluation

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Impsa: Restructuring To Innovate Existing ResourcesDocument1 pageImpsa: Restructuring To Innovate Existing ResourcesSydney LangenPas encore d'évaluation

- Admission FormDocument1 pageAdmission FormhinPas encore d'évaluation

- Amul SIP ReportDocument29 pagesAmul SIP ReportAshish KumarPas encore d'évaluation

- EntrepreneurshipDocument87 pagesEntrepreneurshipAmit Sharma100% (1)

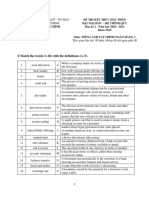

- Đề thi tiếng Anh chuyên ngành Tài chính Ngân hàng 1Document4 pagesĐề thi tiếng Anh chuyên ngành Tài chính Ngân hàng 1Hoang TrieuPas encore d'évaluation

- Iride: Bike & Scooty Rental ServicesDocument21 pagesIride: Bike & Scooty Rental ServicesSidharth ChowdhuryPas encore d'évaluation

- Notes of Business Environment Class 12Document5 pagesNotes of Business Environment Class 12s o f t a e s t i cPas encore d'évaluation

- About Formation And.... of Share CompanyDocument27 pagesAbout Formation And.... of Share CompanyDawit G. TedlaPas encore d'évaluation

- Module Session 10 - CompressedDocument8 pagesModule Session 10 - CompressedKOPERASI KARYAWAN URBAN SEJAHTERA ABADIPas encore d'évaluation

- Double Entry and Balancing Off AccountsDocument2 pagesDouble Entry and Balancing Off AccountsbabePas encore d'évaluation

- Midterm Task - Units 1,2,3-Be IDocument9 pagesMidterm Task - Units 1,2,3-Be IALBERT D BlanchPas encore d'évaluation

- Summary: $100M Leads: How to Get Strangers to Want to Buy Your Stuff by Alex Hormozi: Key Takeaways, Summary & Analysis IncludedD'EverandSummary: $100M Leads: How to Get Strangers to Want to Buy Your Stuff by Alex Hormozi: Key Takeaways, Summary & Analysis IncludedÉvaluation : 3 sur 5 étoiles3/5 (6)

- Fascinate: How to Make Your Brand Impossible to ResistD'EverandFascinate: How to Make Your Brand Impossible to ResistÉvaluation : 5 sur 5 étoiles5/5 (1)

- $100M Offers: How to Make Offers So Good People Feel Stupid Saying NoD'Everand$100M Offers: How to Make Offers So Good People Feel Stupid Saying NoÉvaluation : 5 sur 5 étoiles5/5 (25)

- Yes!: 50 Scientifically Proven Ways to Be PersuasiveD'EverandYes!: 50 Scientifically Proven Ways to Be PersuasiveÉvaluation : 4 sur 5 étoiles4/5 (154)