Académique Documents

Professionnel Documents

Culture Documents

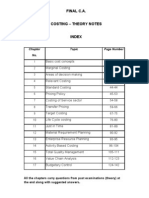

Cost Accounting

Transféré par

mahendrabpatelCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Cost Accounting

Transféré par

mahendrabpatelDroits d'auteur :

Formats disponibles

Study Material: Cost Accounting

Basics of Cost Accounting Unit 1 - Cost Accounting

1.1 Introduction:

Costing is a branch of accounting. It helps us to classify, record, and allocate the expenditure for the determination of costs of product. Expenditure involved in business has to be ascertained to fix the price of a product produced. The expenditure is to be understood in terms of material, labour and other direct and indirect expenses. The major purpose of such classification is to estimate the profit and to understand its relationship with costs and price. The three elements of a transaction i.e., cost, profit and price are necessary components of any business activity. Example: A Calculator factory introduces a new device. The factory incurs Rs. 400 for material, Rs.400 for labour and Rs.200 for overhead on every Calculator produced and supplied in the market. The total cost comes around Rs.1000. If the price of the device is Rs. 1500, the profit per device is Rs. 500 (1500-1000).

The management requires all information as seen in the example for each product produced. The above estimation is done for the purpose of planning, cost control and decision-making. The existing system of financial accounting does not provide the necessary information to do similar estimation. Such deficiency of financial accounting has given rise to the need of cost accounting. 1. 2 Define cost accounting: The word Costing refers to the technique and process of ascertaining costs. There have been certain rules and principles in the field of costing developed over years by our forefathers. These rules and principles help us to ascertain the cost of products produced. The term 'Cost Accounting refers to the recording of all incomes and expenditures and ends with the preparation of periodical statements and reports for ascertaining and controlling costs.

-1-

Study Material: Cost Accounting

Costing is System of computing cost of production or of running a business, by

allocating expenditure to various stages of production or to different operations of a firm. Definitions of Cost Accounting: According to the Terminology used by the Institute of Cost and Management Accountants, Cost accounting is the part of management accounting which establishes budgets and standard costs and actual costs of operations, processes, departments or products and the analysis of variances, profitability or social use of funds.

2. Objective of Costing

1. Ascertainment of Cost: The first and foremost objective of cost accounting is to find out cost of a product, process or service. The other objectives which have been mentioned hereafter scan be achieved only when the costs have been ascertained. The primary objectives of the cost accounting are to ascertain cost of each product, process, job, operation or service rendered. 2. Ascertainment of Profitability: Cost accounting determines the profitability of each product, process, job, operation or service rendered. The statement of profit or losses and Balance Sheet also submitted to the management periodically. 3. Classification of Cost: Cost accounting classifies cost in to different elements such as materials, laborer and expenses. It has further been divided as direct cost and indirect cost for cost control and recording. 4. Control of Cost: Cost accounting aims at controlling cost by setting standards and compared with the actual, the deviation or variation between two is identified and necessary steps are taken to control them. 5. Fixation or Selling Prices or Determining Selling Price: Cost accounting guides management in regard to fixation of selling prices of the products. It is also helpful for preparing tender and quotations. 6. Measuring and Increasing Efficiency: - Cost accounting involvers a study of the various operations used in manufacturing a product or providing a services. The study facilitates measuring of the efficiency of the organisation as a whole as well as of the departments besides devising means of increasing the efficiency. 7. Cost Management: - The term Cost Management includes the activities of managers in short-run and long-run planning and control of costs. Cost management has a broad focus. It includes both cost control and lost reduction. As a matter of fact cost management is often invariably linked with revenue and profit

-2-

Study Material: Cost Accounting

planning. For instance, to enhance revenue and profits, the management often

deliberately incurs additional costs for advertising and product modifications. 8. Providing Basis for Managerial Decision Making: - Costs accounting helps the management in formulation operative policies. These policies may relate to any of the following matters:(i) (ii) (iii) Determination of cost volume profit relationship. Shutting down or operating at a loss. Making or buying from outside supplies.

3. Advantage/ Importance of Cost Accounting

1. Costing helps in periods of trade depression and trade competition: - In periods

of trade depression the business cannot afford to have leakages which pass unchecked. The management should know where economies may be sought, waste eliminated and efficiency increased. The business has to wage a wax for its survival. The management should know the actual cost of their products before embarking on any scheme of reducing the prices on giving tenders. Adequate costing facilitates this.

2. Helps in price fixation:- Though economic law & supply and demand and activities

of the competitors, to a great extent, determine the price of the article, cost to the producer does play an important part. The producer can take necessary guidance from his costing records.

3. Helps in estimate:- Adequate costing records provide a reliable basis upon which

tenders and estimates may be prepared. The chances of losing a contract on account of over rating or losing in the execution of a contract due to under rating can be minimized. Thus, ascertained costs provide a measure for estimates, a guide to policy, and a control over current production.

4. Helps in channeling production on right lines:- Costing makes possible for the

management to distinguish between profitable and non-profitable activities profit can be maximized by concentrating on profitable operations and eliminating nonprofitable ones.

5. Wastages are eliminated:- As it is possible to know the cost of the article at every

stage, it becomes possible to chock various forms of waste, such as time, expenses etc. or in the use of machine, equipment and tools.

6. Costing makes comparison possible:- If the costing records are regularly kept,

comparative cost data for different periods and various volumes of production will be available. It will help the management in forming future lines of action.

-3-

Study Material: Cost Accounting 7.

Provides data for periodical profit and loss accounts:- Adequate costing records supply to the management such data as may be necessary for preparation of profit and loss account and balance sheet, at such intervals as may be desired by the management. It also explains in detail the sources of profit or loss revealed by the financial accounts thus helps in presentation of better information before the management.

8. Aids in determining and enhancing efficiency:- Losses due to wastage of material,

idle time of workers, poor supervision etc., will be disclosed if the various operations involved in manufacturing a product are studied by a cost accountant. The efficiency can be measured and costs controlled and through it various devices can be framed to increase the efficiency.

9. Helps in inventory control:- Costing furnishes control which management requires

in respect of stock of materials, work-in-progress and finished goods. (This has been explained in detail under the chapter Materials)

10. Helps in cost reduction:- Costs can be reduced in the long run when alternatives

are tried. this way. This is particularly important ion the present day context of global competition cost accounting has assumed special significance beyond cost control

11. Assists in increasing productivity:- Productivity of material and labour is

required to be increased to have growth and more profitability in the organisation costing renders great assistance in measuring productivity and suggesting ways to improve it.

4. Function of Cost Accountant

The cost accountant is an important person in an organization especially manufacturing organization. The responsibility of discharging the cost accounting functions of the organization lies on the cost accountants shoulders. Their role has attained a significant position, now. They are a part of senior management team. The role of a cost accountant can be understood from the following important functions to be performed by them. 1. Maintenance of records: The basic function is to maintain cost accounting records as per section 209(1)(d) of the Companies Act 1956. In pursuance of this provision, the Government of India has notified Cost Accounting Record Rules for more than 40 industries. These rules prescribe the manner in which cost accounting records have to be maintained. They specify the particulars that

-4-

Study Material: Cost Accounting

should be entered in the books of accounts. Some of the records are to be maintained under the following heads: Stores and raw materials; salaries and wages; business overheads; operations work-in-progress; and valuation of production stocks are (finished goods) sales; depreciation. These records should be kept in such a way so as to reveal the determined accurately. Reconciliation of the results from these cost records should be made with those of financial accounts. In case, if the firms are not governed by the statutory provision, the cost accountant himself has to maintain records in such a way that they are useful to the management for taking decisions. 2. Financial planning: The cost accountants role in financial planning cannot be minimized. The cost accountant assists the line and staff managers in the preparation of budgets, making changes as and when necessary, ensuring consistency, and final compilation of the budget and master budget. 3. Product pricing: This is an important function to be performed by a cost accountant. The cost accountant assists the management in pricing a product by providing valid information after analysing and interpreting various cost data relating to fixing the price of a product. 4. Cost ascertainment: Ascertainment of the cost of a product or service is another important function of a cost accountant. 5. Cost control: Controlling the costs of business operations is the prime function of a cost accountant. Cost accountants have to exercise cost control by using a variety of techniques such as budgetary control, standard costing, quality control. They have to assist the management by submitting periodical reports to facilitate cost-control function. For example, statement of inventory valuation with relevant ratios will help the management to appraise the level of stock. 6. Cost reduction: This is another important area in which a cost accountants role has gained much importance. Manufacturing quality goods and rendering prompt services at the minimum cost is the goal of any organization. The cost accountant aims at achieving reduction on the unit cost of goods produced or services rendered and at the same time maintaining quality. 7. Evaluation of performance: The cost accountant compares the actual results with the budget, and variances are ascertained. Variances are analysed by causes and responsibility centres and communicated to appropriate level for corrective action. The performance of the responsibility centre is evaluated constantly which enhances the efficiency of an organization. 8. Management decision: One more important function of a cost accountant is to adopt as well as adapt cost accounting tools and techniques for management

-5-

Study Material: Cost Accounting

decision analysis such as make or buy, to continue or shut down operation, to accept an order, to quote a price, to choose alternative proposal etc. and various problem-solving situations. 9. Communication: The cost accountant discloses the needed financial information to all needed centres. 10. Coordinator: The cost accountants role of coordination with other departments cannot be underestimated. Their constant flow of cost information with production department, purchase department, personnel department, finance and accounts department, marketing department is essential for the successful functioning of an organization. They coordinate the activities of all the departments by way of exercising cost control and cost reduction. 11. Reliable tax basis: As costs are ascertained precisely and profits shown in cost records are reliable and accurate, it facilitates the tax-levying authorities to assess the tax without great difficulty. So, the role of the cost accountant gains greater responsibility.

12. Customer

relationship all

management: CRM activities

initiatives as

use

technology sales

to

coordinate

customer-facing

(such

marketing,

calls,

distribution and post-sales support) and the design and production activities necessary to get products to customers.

5. Cost Accounting and Other Branches of Accounting

Accounting is classified into: 1. 2. Financial accounting and Management accounting

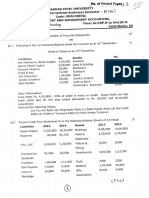

First, we shall look into the relationship between cost accounting and financial accounting. Notwithstanding the fact that both are concerned with systematic recording and presentation of data based on the same records and on the same principles of debit and credit rules, they differ widely in the aspects shown in Table.

5.1. Differences Accounting

Basis

between

Financial

Accounting

and

Cost

Financial Accounting

Cost Accounting

-6-

Study Material: Cost Accounting

1. Aim Financial accounting aims at Cost accounting aims at

strengthening the interests of strengthening the management the business, proprietors and for proper planning, operation, all others associated with it. 2. requirement with such statutory as control and decision-making. the requirements of Statutory These accounts have to comply Cost accounts have to comply requirements with act company and management. Of late, certain industries have to meet the requirements of company act (only obligatory). 3. Emphasis 4. analysis 5. Nature This emphasizes the Cost accounting emphasizes measurement of profitability. ascertainment of costs.

income tax act.

Profit This analyses accounts and This discloses profit made on discloses the profit of the firm each product, process, job or as a whole. of Transactions are service. recorded, Transactions are recorded and in an objective

recording transactions

classified and analysed in a analysed to the nature of expenditure.

subject manner, i.e., according manner, i.e., according to the purpose for which costs are incurred. accounting and deals with

6. Facts and Financial accounts deal mainly Cost estimates 7. 8. 9. with facts and figures only. facts

figures

besides

estimates. Valuation Stocks are valued at cost or Stocks are valued at cost price. market price whichever is less. of Costs are reported in aggregate Costs in financial accounts. does on of not the workers, accounts with information efficiency 10. Type of Financial concerned provide Cost are broken into unit provides relative basis in cost accounting. accounting on relative information machinery. are Cost accounts are concerned external with internal transactions, Nature of stock report of costs efficiency

Relative This

plant, efficiency of workers, plant and

machinery etc. transactions and basis

transactions, which form the which do not form the basis of basis of payment or receipt of payment or receipt of cash. cash.

-7-

Study Material: Cost Accounting

11. report Financial statements are Cost reports are prepared and most frequently,

Periodicity of prepared and reported only at reported in a year. accuracy it.

specified period, usually once whenever management requires

12. Degree of Financial statements are more These are comparatively less accurate as they are subject to accurate as they are intended scrutiny authorities. 13. Classification 14. Information Financial accounts do not In cost accounting, they are classified properly and and analysed perfectly. Proper and adequate Proper adequate information on each aspect of information on each and every business is not provided to aspect of business is provided outsiders, though it extends to outsiders. information to outsiders. classify accounts, expenses etc. by statutory mainly for the management.

-8-

Study Material: Cost Accounting

5.2. Cost Accounting and Management Accounting

Some accounting professionals are of the view that cost accounting is a branch of management accounting. Such a close relationship exists between the two categories of accounting. Both are internal to the organization. Both have the same objectives for instance, both assist management in its functions of planning, controlling and decisionmaking. Both use more or less similar techniques such as marginal costing and budgetary control. But cost accounting and management accounting differ in certain areas. The main points of distinction between cost accounting and management accounting are shown in Table.

Difference Accounting

Basis of Distinction

between

Cost

Accounting

and

Management

Cost Accounting

Management Accounting

Cost accounting is concerned with This is mainly concerned with (i) 1. Objective the ascertainment, and allocation, the impact (ii) effect aspects of accounting costs. cost Management accountant is placed distribution In 2. Hierarchy level an

aspects of costs. organization, accountant is placed at a lower at a higher hierarchy level than hierarchy level than management cost accountant. accountant. 3. Accounting data Cost accounting data are generally Management accounting data are derived by using management derived from cost accounts and financial accounts. is higher than cost accounting. accounting techniques. is not higher in cost accounting compared accounting. Tools and techniques used in cost 5. Usage of tools and techniques standard costing, A wide range of tools and accounting are limited such as techniques are used such as ratio budgetary analysis, cash flow in addition to tools and techniques used in cost accounting. 6. Period of planning Cost account with is generally Management account is concerned short-term both with short-term and with long-term planning. concerned planning. control, break-even analysis. to management

Relevance and objectivity of data Relevance and objectivity of data 4. Relevance and objectivity

-9-

Study Material: Cost Accounting

It 7. Evaluation of performance is mainly in concerned with It is concerned with both assisting

assisting performance. Cost

management management in its functions and the management. is generally It is generally futuristic in its It approach. It includes cost accounting as well

functions and in the evaluation of in evaluating the performance of accounting in its

8. Approach 9. Inclusion of other branches of accounting.

historical

approach.

projects the past. Cost accounting does not include financial accounting and accounting. tax as tax accounting.

6. Concepts of Cost

It is difficult to define the term cost. The term cost is ambiguous and uncertain. In general, cost means the amount of resource used in exchange for goods or services. The resources used shall be money or moneys worth, which is usually expressed in monetary units. The terminology of CIMA defines cost as the amount of expenditure (actual or motional) incurred on, or attributable to, a specified thing or activity. It may also be defined as Cost is a foregoing, measured in monetary terms, incurred or potentially to be incurred to achieve a specific objective. A cost has to be looked in relation to (i) the nature of business (ii) purpose, (iii) different conditions and (iv) the context in which it is used. As already said, cost is measured in terms of money. However, costs which do not give rise to actual cash outlay, namely, imputed (actual) or notional cost, are to be considered while decision-making. But these are not available from accounting records for instance, interest on capital invested by the owner in the firm in notional cost. 1. Nature of business: A cost has to be studied in relation to its nature of business. For example, a manufacturing organization is interested in knowing the cost per unit of its product, whereas the organizations rendering services such as electricity and transport are interested in ascertaining the costs of services they undertook. The cost per unit can be easily ascertained by dividing the total expenditure by number of units produced or quantum of services rendered. This is relatively easy if the organization produces only a single product. But if more than one product is produced, other factors have to be considered for determining the cost. 2. Purpose: A cost has to be studied in relation to its purpose. For example, the purpose is fixation of selling price cost. All items of expenditure relating to

- 10 -

Study Material: Cost Accounting

production, administration and selling will have to be included. But if the purpose is valuation of inventories, only cost of production will have to be taken into account. Hence, the concept of cost varies according to the purpose. It differs from purpose to purpose and has different denotations. 3. Conditions: A cost has to be ascertained under different conditions also. For instance, while dealing with inventory, work-in-progress is valued at factory cost, whereas stock of finished goods is valued at production cost. Different conditions lead to different modes of valuation of cost. Concept of cost varies thus. 4. Context: The term cost may not stand on its own and has to be qualified. It is a generic term. It is generally used to include all the various types of costs. However, when the term is used specifically, it is always modified with reference to the context costed by such descriptions as prime cost, fixed cost, variable cost, opportunity cost and sunk cost. Each such modification implies a certain attribute which is important in computing and measuring the cost. Concept of cost is not precise and cannot be pinpointed. It is ever-widening. It has its own terminology. Hence, different costs are to be used for different purposes

6.1. Define the term cost.

The terms Cost and expenditure are used interchangeably to mention same thing in the field of business. Cost means the amount of expenditure incurred on, or attributable to, a given thing. According to the committee on Cost Concepts and Standards of the American Accounting Association, Cost is foregoing, measured in monetary terms, incurred or potential to be incurred to achieve a specific objective It may be an actual cost or estimated expenditure. It also indicates a direct or indirect expenditure. It is also related to job, process, product or service. Examples of costs are material, labour, factory overhead, administrative overheads, and selling and distribution overheads. 6.1.1. Cost Centre Cost is generally ascertained by cost centres. Let us understand about cost centre. A cost centre is a location, person or item of equipment (or group of these) for which costs may be ascertained and used for the purposes of cost control. (I.C.M.A. London)

- 11 -

Study Material: Cost Accounting

The entire organization may be divided into specified cost centres, which jointly contribute to the total cost. A cost centre is primarily identified in two major ways. They are a. Personal cost centre: It consists of a person or a group of persons. b. Impersonal cost centre: It consists of a location or an item of equipment or group of these. Identification and establishments of cost centres depend on the nature and type of industry. Cost centres may be of the following types. i. Process cost centre (based on sequence of operation) ii. Production cost centre(for regular production in a shop) iii. Operation cost centre(where production process) iv. Service cost centre(for activities supporting the main production) Identification and establishment of cost centres help us in i) ii) ascertaining the centre-wise costs, comparing the centre-wise costs periodically, various operations are involved in the

iii) finding out the major trends of variance, iv) applying the techniques of control to check undue, undesirable or unexpected movements in costs. The concept of costing by cost centres may be applied to almost any industry. The number of cost centres and the size of each vary from one undertaking to another. The main purpose of identification of cost centres is to fix responsibilities for every cost centres. A large number of cost centres tend to be expensive but having too few cost centres defeat the very purpose of control. 6.1.2. Cost Unit

The cost centres help in ascertaining the costs by location, equipment or person. Cost unit is an extension of identification of cost centres. Cost unit helps in breaking up the cost into smaller sub-divisions. It also facilitates in ascertaining the cost of saleable product or services. According to I.C.M.A. London A cost unit is a unit of product, service or time in relation to which cost may be ascertained or expressed

- 12 -

Study Material: Cost Accounting

Cost units are the things that the business is setup to provide of which cost is ascertained. Cost units will normally be the quantity of a product for which price is quoted to the customers. Cost units may be: i. unit of product (e.g., cost per book) ii. unit of time (e.g., cost of generating electricity per hour) iii. unit of weight (e.g., cost per kilogram of sugar) iv. unit of measurement (e.g., cost per square foot of construction) v. operating unit of service (e.g., cost of running a car per kilometre) Selection of a cost unit must be appropriate. Convenience is the first criterion. Secondly, it should be easier to correlate expenses with cost units. Thirdly, it should be according to the nature and practice of the business. A few more examples of cost units in various industries are given: Industry Automobile Bricks Carpets Cars Cement Chemicals Cotton Electricity Hotel Mines Pencils Printing Press Shoes Timber Transport Thousand copies Pair or dozen pairs Cubic foot Passenger Kilometre Cost Unit Number 1,000 bricks Square yard Per Car Tonne Tonne, kilogram, litre, gallon etc Bale Kilowatt hour Room per day Tonne Dozen or gross

6.2. Components of Total Cost

- 13 -

Study Material: Cost Accounting

The total cost comprises of direct costs (also known as prime cost) and indirect costs (known as overheads). The prime cost consists of direct materials, direct labour and other direct expenses. Overhead consists of factory overheads, office overheads, and selling and distribution overheads. Mechanism of Cost Build Up Prime = Works = Cost Production Total = = Cost Direct + Cost Prime + of Works + Material Direct + Cost Factory Overhead Cost Office Overhead of Selling + Overhead And Distribution And Administrative Labour Direct Expenses

Cost Cost Production

7. Elements of Cost

There are three elements of Cost A. Materials: The word Materials refers to those commodities, which are used as raw materials, components, or consumables for manufacturing product. Materials can be direct or indirect. i. Direct materials: All materials used as raw-materials or components for a finished product are known as direct materials. Cotton for textiles, tyres for car are few examples of direct material. It also includes package material. ii. Indirect Materials: Consumable like lubricating oil, spare parts for machinery are called as indirect materials. Such commodities do not form part of the finished product. B. Labour : The workers are involved in converting raw material into finished goods. Such involvement of workers forms the word labour. The reward given to them for their involvement is called wages. Wages can be direct or indirect.

- 14 -

Study Material: Cost Accounting

i. Direct Labour: The workers who are directly involved in the production of goods are known as direct labour. The reward paid to them is called direct wages. ii. Indirect Labour: The workers employed for carrying out tasks incidental to production of goods or those engaged for office work and selling and distribution activities are known as indirect labour. The reward given to them is called indirect wages. C. Expenses :All expenditures other than material and labour are termed as expenses. Expenses can also be direct or indirect. i. Direct Expenses: Other expenses, which are incurred specifically for a particular product, job or processes are termed as direct expenses. Some examples are given below: Direct Expenses Carriage Inwards Production royalty Hire Charges of special equipment Cost of special drawings

ii. Indirect Expenses: All expenses other than indirect materials and labour which cannot be directly attributed to a particular product, job or service are termed as indirect expenses. Some examples are given below: Indirect Expenses: Rent of building, Repair of Machinery Lighting and heating Insurance D. Concept of Overhead: All material, labour and expenses, which cannot be identified as direct costs, are termed as indirect costs. The three elements of indirect costs namely indirect materials, indirect labour and indirect expenses are collectively known as Overheads or On costs. Overheads are grouped into three categories: i. factory (or manufacturing) overheads,

- 15 -

Study Material: Cost Accounting

ii. office (or administrative) overheads, and iii. selling and distribution overheads E. Conversion Cost: The cost of converting raw materials into finished goods is termed as conversion cost. It includes direct wages, direct expenses and factory overheads.

ELEMENTS OF COST

MATERIAL

LABOUR

EXPENSES

DIRECT

INDIRECT

DIRECT

INDIRECT

DIRECT

INDIRECT

FACTORY

FACTORY

FACTORY

OFFICE

OFFICE

OFFICE

SELLING DISTRIBUTION

SELLING DISTRIBUTION

SELLING DISTRIBUTION

OR

- 16 -

Study Material: Cost Accounting

Elements of cost

DIRECT MATERIAL

DIRECT LABOUR

DIRECT EXPENSES

OVERHEADS

FACTORY OVERHEADS

OFFICE OVERHEADS

SELLING & DISTRIBUTION OVERHEADS INDIRECT MATERIAL

INDIRECT MATERIAL

INDIRECT MATERIAL

INDIRECT LABOUR

INDIRECT LABOUR

INDIRECT LABOUR

INDIRECT EXPENSES

INDIRECT EXPENSES

INDIRECT EXPENSES

8.Classification of Costs

Costs have been classified according to various bases. 8.1. Classification based on functions: This is a traditional classification. The cost may have to be ascertained according to the functions carried out by the organisation. The functions generally are manufacturing, administration, selling, distribution and research. Manufacturing Costs refer to all expenditure incurred in the course of production from purchasing of materials to packing of the finished goods.

- 17 -

Study Material: Cost Accounting

Manufacturing Costs Material Labour Factory Rent Depreciation Power & Lighting Insurance Store Keeping Administration Costs are incurred for general administration of the organisation and for the operational control. Administration Costs Accounts office expenses Legal charges Audit charges Office Rent Remuneration to Director Postage Expenses Selling Costs are incurred to create and stimulate the demand and to secure the demand Selling Costs Salaries Commission to Salesmen Advertising Expenses Samples Travelling Expenses and promotion

Distribution Costs are incurred on dispatch of the finished goods to customer including transportation.

- 18 -

Study Material: Cost Accounting

Distribution Costs Packaging costs Warehousing Costs Carriage outwards Insurance Upkeep of Vans 8.2. Classification based on Variability or behavior :Costs have a definite relationship with the volume of production. They behave differently when volume of production rises or falls. On this basis, costs are classified into fixed cost, variable costs and semi-variable (semi-fixed) costs. Fixed Cost: Costs, which remain unaffected by changes in volume of production, are called as fixed Costs. For example, the rent and managers salary will not change when you increase the units of production from 1000 to 1200. Fixed Costs Rent lease Salary to Managers Building Insurance Salary and Wages Taxes to local authority Variable Cost: The cost that tends to vary in direct proportion to the volume of production is called variable cost. For example, for 1000 units of output, cost of raw materials consumed comes to Rs. 10,000. If the production is increased to 1200 units (20%) the cost of material will increase to Rs.12,000 (increase of 20%). Variable costs Direct Material Direct Labour Power Commission Salesmen Royalties of

- 19 -

Study Material: Cost Accounting

Semi-variable Costs: Costs, which increase or decrease with a change in volume of production but not in the same proportion as the change in the volume of production are called semi-variable costs. Semi-variable Costs Supervision Repairs Maintenance Telephone Charges Light and Power Depreciation 8.3. Classification according to their identifiability with Cost units: Costs are classified into direct and indirect based on their identifiability with cost units and jobs or processes: Direct Cost: It refers to expenses, which can be directly identified with the product, job or process. For example, in case of materials used and labour employed we can easily ascertain as to which product or job or process they relate. Indirect Cost: It refers to those expenses, which cannot be easily identified with a particular product, job or process. These are general, common or collective nature, which are to be allocated to various products manufactured in the factory. Few examples are: wages paid to night watchman, salary to the production manager. 8.4. Classification based on their association with product or period. Product Costs: These are those costs, which are necessary for production and which will not be incurred if there is no production. Direct material, direct wages and some of the factory overheads are examples of this kind. Period Costs: Costs, which are not necessary for production and are written off as expenses in the period in which these are incurred are called period costs. Rent, salaries of company executives, travelling expenses are some examples of period costs. 8.5. Classification based on their controllability :

- 20 -

Study Material: Cost Accounting

Controllable Costs: These are the costs, which may be directly regulated at a given level of authority. Variable costs are generally controllable by department heads. Uncontrollable Costs: Costs, which cannot be influenced by the action of a specified member of an organisation, are called uncontrollable costs. Factory rent is a good example.

9. Limitations of Cost Accounting:

Cost Accounting suffers from certain inherent limitations. i) There is not standard set of rules and regulations of cost accounting applicable to all industries and even the firms in the same industry. ii) The cost accounting principles themselves keep on changing. iii) There are widely recognised cost concepts but understood and applied differently by different concerns.

iv)

Cost accounting is not an exact science and its postulates cannot be verified by controlled experiment, but only by application in actual practice .

10. Methods of Costing:

The methods of costing refer to the techniques and processes employed in the ascertainment of costs. Many methods have been designed to suit the needs of different industries. These methods can be summarised as follows: It should be noted that two basic methods of costing are (1) Job costing, and (2) Process Costing. The other methods discussed below are simply variants of these two methods. 10.1. Job Costing: Under this method, costs are ascertained for each job separately. According to I.C.M.A London The method of job order costing applies where work is undertaken to be a job or work It is suitable for industries like car repairs, printing, foundries, painting and interior designing, where each job has its own specification.

- 21 -

Study Material: Cost Accounting

10.2. Contract Costing: This method is used in case of big jobs described as contracts. Since this is a variation of job costing, the principles of job costing are in general applied. The contract work usually involves heavy expenditure, spreaded over a long period. Each contract is treated as a separate unit for the purpose of cost ascertainment. Shipbuilding, construction of premises, roads and bridges are few examples suitable for contract costing. 10.3. Batch Costing: This is also another version of job costing. The cost of batch or group of uniform products is ascertained under this method. Each batch of products is a unit of cost for which costs are accumulated. It is generally used in industries like pharmaceuticals, readymade garments, shoes, toys, bicycle parts, bakery, etc. 10.4. Process costing: A product passes through various stages of production called processes in some industries. Each process is different and well defined. The output of one process is used as a raw material for the next process. Costs are accumulated for each process. To arrive at the unit cost, the total cost of the process is divided by the number of units. Textile mills, chemical works, sugar mills and food products may be cited as examples of industries which use this method. 10.5. Operating Costing: This method is used in undertakings, which provide services instead of manufacturing products. The unit cost is a service unit e.g., in case of buses, the unit of cost is passenger kilometer, and in case of nursing home, it is per bed per day. It is also called service costing. 10.6. Multiple costing: This method is an application of more than one method of cost ascertainment in respect of the same product. Where a produce comprises many assembled parts as in case of motor car, typewriter etc., costs have to be ascertained for each component as well as for the finished product. This may involve use of different methods of costing for different component. It is, therefore, called multiple or composite costing. 10.7. Single, output or unit costing: This method of cost ascertainment is used when production is uniform and consists of a single or two or three varieties of the same product. Where the product is produced in different grades, costs are ascertained gradewise. Since the units of output are identical, the cost per unit

- 22 -

Study Material: Cost Accounting

is found by dividing the total cost by the number of units produced. This method is used in mines, brick-kilns, steel production, floor mills, etc.

11. Types of Costing

Method of costing refers to the process and practice of ascertaining costs of product and services. The type of costing refers to the technique of analysing and presenting costs for the purpose of control and managerial decisions. The types of costing also known as techniques of costing generally used are as follows: 11.1. Marginal costing: Separation of costs into fixed and variable (marginal) is of special interest and importance. Under marginal costing, cost of a product is estimated with out considering fixed cost. This method allocates only variable costs (direct material, direct labour, direct expenses, and variable overheads) to production. It is also known as variable costing. 11.2. Absorption costing: It refers to the conventional technique of costing under which the total costs (fixed and variable) are charged to products. It is considered to have only a limited application today. 11.3. Historical Costing: It refers to a system of cost accounting under which costs are ascertained only after they have been incurred. The accounting is done in terms of actual costs and not in terms of predetermined costs. It is widely applied by many organizations today. 11.4. Standard Costing: This technique connotes the setting up of definite standards of performance in advance. These standards are expressed in monetary terms. Actual performance is measured against these standards. The differences are helping the management to initiate corrective actions. This is believed to be a valuable tool in cost control. 11.5. Budgetary Control: A budget is an estimated results expressed in numerical numbers. Budgetary control is a technique applied to the control of total expenditure on materials, wages and overhead by comparing actual performance with planned performance. This technique is also believed to be another valuable aid in cost control and coordination.

- 23 -

Study Material: Cost Accounting

12.

Installation of A Cost System

There cannot be a ready-made costing system for every organisation. In view of growing size and variety of organisations, a single system of costing cannot suit every business. The installation of a costing system requires a thorough study and understanding of all the aspects involved. Otherwise the system may be a misfit and the organisation may not be able to derive full advantage from it. In other words, it is only a properly designed system of costing suitable to the undertaking, which can help its successful operations. The cost benefit analysis should be initiated to install a costing system. The benefit of establishing cost system must exceed the amount spent on it. The system should be justified because of its value to management. 12.1. Problem Areas: The organisation must be aware of the difficulties in introducing the system of costing. The following are some difficulties i) ii) iii) iv) v) Inadequate support from top management, Resistance to change from staff involved in the operation of the financial accounting, Resentment at other levels in view of the additional work expected due to the costing system, Shortage of trained and qualified staff to handle the new system, Heavy costs involved in the process of installation.

12.2. Factors to be considered: The following factors should be considered before installation of a system of costing: i) ii) iii) iv) v) Objective of the costing system Nature of business Quality of the management Size and type of organisation, scope of authority, sources of information and reports to be submitted Technical aspect of the business

- 24 -

Study Material: Cost Accounting

vi) vii) Attitude and behaviour of the staff in extending co-operation to the system and the organisation Impact of different operations on variable expenses

12.3. Steps Involved in Installing a Costing System: i) Management conducts a preliminary investigation. For example, the nature of product and methods of production will help them to identify the right cost system. ii) iii) iv) v) vi) vii) viii) ix) The organisation structure should be studied to ascertain the scope of authority of each executive. The system of material procurement, issue and storage should be examined and changed as per the requirements. Method of remuneration to the labour should be altered to the new system of remuneration. Accounting system should be designed in such a way to involve minimum clerical labour and expenditure. The layout of the factory should be studied. Costing system should be simple and easy to operate. The installation and operation of the system should be economical. The system should be initiated gradually.

Review Questions

1. Why should there be costing in the field of business? 2. Define cost accounting. 3. What are the difference between financial accounting and cost accounting? 4. Bring out the difference between financial and management accounting 5. Compare cost accounting with management accounting. 6. List the advantages of cost accounting. 7. Define the term cost. 8. What are ascertainment costs? How does it differ from cost estimation? 9. What is cost centre? How is it identified? List its uses. 10. Describe about cost unit 11. Explain the components of total cost? 12. How will you classify costs? Explain

- 25 -

Vous aimerez peut-être aussi

- Power PhrasesDocument23 pagesPower Phrasesname isPas encore d'évaluation

- Financial Management Notes For MBADocument16 pagesFinancial Management Notes For MBASeyed BillalganiPas encore d'évaluation

- Branch AccountDocument78 pagesBranch AccountSigei Leonard100% (2)

- Management Accounting-Short Answers - Quick Revision NotesDocument23 pagesManagement Accounting-Short Answers - Quick Revision Notesfathimathabasum67% (9)

- Financial Accounting For ManagersDocument170 pagesFinancial Accounting For ManagersRamji Gupta100% (1)

- Financial AccountingDocument213 pagesFinancial AccountingMayank Jain100% (1)

- Cost Accounting Theory NotesDocument41 pagesCost Accounting Theory NotesShrividhya Venkata Prasath83% (6)

- Cbse Cost Accounting NotesDocument154 pagesCbse Cost Accounting NotesMANDHAPALLY MANISHAPas encore d'évaluation

- Notes On Cost AccountingDocument86 pagesNotes On Cost AccountingZeUs100% (2)

- Question BankDocument31 pagesQuestion BankmahendrabpatelPas encore d'évaluation

- Corporate AccountingDocument749 pagesCorporate AccountingDr. Mohammad Noor Alam71% (7)

- Accounting For ManagersDocument297 pagesAccounting For ManagersKausar ImranPas encore d'évaluation

- Costing Theory by Indian AccountingDocument48 pagesCosting Theory by Indian AccountingIndian Accounting0% (1)

- Unit Costing Methods & Cost SheetDocument51 pagesUnit Costing Methods & Cost SheetRavi Kumar PariharPas encore d'évaluation

- Cost Accounting Notes PDFDocument55 pagesCost Accounting Notes PDFadv suryakant jadhavPas encore d'évaluation

- Test Bank - Chapter16 ABC ApproachDocument31 pagesTest Bank - Chapter16 ABC ApproachAiko E. Lara50% (2)

- Costing in BriefDocument47 pagesCosting in BriefRezaul Karim TutulPas encore d'évaluation

- Intro to Statistics for ManagementDocument556 pagesIntro to Statistics for ManagementSimanta KalitaPas encore d'évaluation

- B ST XI Subhash Dey All Chapters PPTs Teaching Made EasierDocument1 627 pagesB ST XI Subhash Dey All Chapters PPTs Teaching Made EasierAarush GuptaPas encore d'évaluation

- Unit - I Cost AccountingDocument55 pagesUnit - I Cost AccountingRigved PrasadPas encore d'évaluation

- Lecture Notes-2 Contract CostingDocument9 pagesLecture Notes-2 Contract CostingRakeshPas encore d'évaluation

- Ethnic Food Restaurant Business PlanDocument6 pagesEthnic Food Restaurant Business PlanKruti SutharPas encore d'évaluation

- Chap 2 Basic Cost Management Concepts and Accounting For Mass Customization OperationsDocument15 pagesChap 2 Basic Cost Management Concepts and Accounting For Mass Customization OperationsMarklorenz SumpayPas encore d'évaluation

- Cost Sheet: Learning OutcomesDocument15 pagesCost Sheet: Learning OutcomesshubPas encore d'évaluation

- Job and Batch Costing NotesDocument5 pagesJob and Batch Costing NotesFarrukhsg100% (1)

- SEM II Cost-Accounting Unit 1Document23 pagesSEM II Cost-Accounting Unit 1mahendrabpatelPas encore d'évaluation

- Tools and Techniques of Cost ReductionDocument27 pagesTools and Techniques of Cost Reductionপ্রিয়াঙ্কুর ধর100% (2)

- Marginal costing concepts explainedDocument16 pagesMarginal costing concepts explainedFarrukhsg100% (2)

- Cost AccountingDocument201 pagesCost AccountingMikhil Pranay Singh100% (4)

- Marginal Costing Icai MaterialDocument73 pagesMarginal Costing Icai Materialsadhaya rajan100% (2)

- Director Manager Operations Logistics in Atlanta GA Resume Michael MaukDocument2 pagesDirector Manager Operations Logistics in Atlanta GA Resume Michael MaukMichael MaukPas encore d'évaluation

- "Cost Control & Cost Reduction": Submitted To - Prof. GanachariDocument20 pages"Cost Control & Cost Reduction": Submitted To - Prof. Ganachariamrita_amiable80% (5)

- Cost SheetDocument14 pagesCost Sheettanbir singhPas encore d'évaluation

- 4 Sem Bcom - Cost AccountingDocument54 pages4 Sem Bcom - Cost Accountingraja chatterjeePas encore d'évaluation

- National Income and Related Aggregates: There Are Four Sectors in An EconomyDocument29 pagesNational Income and Related Aggregates: There Are Four Sectors in An EconomyAryan RawatPas encore d'évaluation

- Integrated and Non Integrated System of AccountingDocument46 pagesIntegrated and Non Integrated System of AccountingGanesh Nikam67% (3)

- CLASS Cost SheetDocument38 pagesCLASS Cost Sheetyogesh50% (2)

- Cost and Cost AccountingDocument29 pagesCost and Cost AccountingVikash BarnwalPas encore d'évaluation

- B.Com Cost Accounting Study MaterialDocument39 pagesB.Com Cost Accounting Study MaterialShreya CPas encore d'évaluation

- Management Accounting NotesDocument72 pagesManagement Accounting NotesALLU SRISAIPas encore d'évaluation

- TdsDocument22 pagesTdsFRANCIS JOSEPHPas encore d'évaluation

- Output CostingDocument39 pagesOutput CostingTarpan MannanPas encore d'évaluation

- Management Accounting 5th SemDocument24 pagesManagement Accounting 5th SemNeha firdosePas encore d'évaluation

- Management Accounting NotesDocument9 pagesManagement Accounting NotesGazal GuptaPas encore d'évaluation

- Management and Cost AccountingDocument3 pagesManagement and Cost AccountingPrateek Dave100% (1)

- Costing Methods ExplainedDocument4 pagesCosting Methods ExplainedMehar BhagatPas encore d'évaluation

- Relationship Between Cost AccountingDocument9 pagesRelationship Between Cost AccountingAkhilesh Kumar100% (4)

- Cost Accounting SystemDocument64 pagesCost Accounting Systemaparna bingi0% (1)

- TS Grewal Solutions for Class 11 Accountancy Chapter 14 - Capital and Revenue ExpenditureDocument39 pagesTS Grewal Solutions for Class 11 Accountancy Chapter 14 - Capital and Revenue ExpenditureShivant GuptaPas encore d'évaluation

- Management AccountingDocument238 pagesManagement Accountingagyui100% (1)

- Final AccountDocument47 pagesFinal Accountsakshi tomarPas encore d'évaluation

- Ts Grewal Solutions For Class 11 Accountancy Chapter 7 SpecialDocument30 pagesTs Grewal Solutions For Class 11 Accountancy Chapter 7 Specialmahak guptaPas encore d'évaluation

- Key Notes IPCC Advanced AccountingDocument119 pagesKey Notes IPCC Advanced AccountingAnand Bhangariya100% (2)

- Characteristics of an Ideal Cost SystemDocument6 pagesCharacteristics of an Ideal Cost SystemNikhil Thomas AbrahamPas encore d'évaluation

- Costing AssignmentDocument15 pagesCosting AssignmentSumit SumanPas encore d'évaluation

- Accounting For Specialized Institution Set 2 Scheme of ValuationDocument19 pagesAccounting For Specialized Institution Set 2 Scheme of ValuationTitus Clement100% (1)

- Quantitative Methods Study GuideDocument65 pagesQuantitative Methods Study GuideAnakha Anil100% (2)

- Risk Analysis in Capital Bud PDFDocument32 pagesRisk Analysis in Capital Bud PDFbinu100% (1)

- Chapter 1 - Introduction To AccountingDocument18 pagesChapter 1 - Introduction To AccountingPaiPas encore d'évaluation

- Layout of Cost SheetDocument1 pageLayout of Cost SheetZahoor Soomro100% (1)

- Edu-Care Professional Academy:, 243, Sundaram Coplex, Bhanwerkuan Main Road, IndoreDocument10 pagesEdu-Care Professional Academy:, 243, Sundaram Coplex, Bhanwerkuan Main Road, IndoreCA Gourav Jashnani100% (1)

- Accounting For Business II PM Xii Chapter1Document27 pagesAccounting For Business II PM Xii Chapter1Anusga RamasamyPas encore d'évaluation

- Accounting For Business II PM Xii Chapter1Document27 pagesAccounting For Business II PM Xii Chapter1Senthil S. VelPas encore d'évaluation

- Defination of Cost AccountingDocument5 pagesDefination of Cost AccountingYaseen Saleem100% (1)

- Course Code - 102 Course Title-Accounting For Business Decisions 2. Learning Objectives of The CourseDocument29 pagesCourse Code - 102 Course Title-Accounting For Business Decisions 2. Learning Objectives of The Courseavinash singhPas encore d'évaluation

- Meaningof Cost AccountingDocument13 pagesMeaningof Cost AccountingEthereal DPas encore d'évaluation

- Cost AccountingDocument9 pagesCost Accountingyaqoob008Pas encore d'évaluation

- Material Variance: Unit 2 Standard Costing (MA-06101355)Document12 pagesMaterial Variance: Unit 2 Standard Costing (MA-06101355)mahendrabpatelPas encore d'évaluation

- Assignenment 1 DT Unit 1Document9 pagesAssignenment 1 DT Unit 1mahendrabpatelPas encore d'évaluation

- Get Started Right AwayDocument2 pagesGet Started Right AwaymahendrabpatelPas encore d'évaluation

- BASIC FEATURE OF Financial StatementDocument6 pagesBASIC FEATURE OF Financial StatementmahendrabpatelPas encore d'évaluation

- Historia Del Mondonguito A La ItalianaDocument7 pagesHistoria Del Mondonguito A La ItalianaJuan OrocoPas encore d'évaluation

- Meaning of Cost Reconciliation StatementDocument5 pagesMeaning of Cost Reconciliation StatementmahendrabpatelPas encore d'évaluation

- 1 CostsheetDocument8 pages1 CostsheetNash ShahPas encore d'évaluation

- Unit V Cost of CapitalDocument24 pagesUnit V Cost of CapitalmahendrabpatelPas encore d'évaluation

- Ch1 6Document109 pagesCh1 6Tia MejiaPas encore d'évaluation

- Advance Financial Management-IDocument5 pagesAdvance Financial Management-ImahendrabpatelPas encore d'évaluation

- MotivationDocument6 pagesMotivationmahendrabpatelPas encore d'évaluation

- Financial Accounting IntroductionDocument15 pagesFinancial Accounting IntroductionmahendrabpatelPas encore d'évaluation

- SP Uni CA 2015Document3 pagesSP Uni CA 2015mahendrabpatelPas encore d'évaluation

- SP Uni CA 2016 MayDocument4 pagesSP Uni CA 2016 MaymahendrabpatelPas encore d'évaluation

- SP Uni CA 2016Document2 pagesSP Uni CA 2016mahendrabpatelPas encore d'évaluation

- What Is Cost Reconciliation Statement?Document2 pagesWhat Is Cost Reconciliation Statement?mahendrabpatelPas encore d'évaluation

- Amit ResumeDocument3 pagesAmit ResumemahendrabpatelPas encore d'évaluation

- API Format 2017Document4 pagesAPI Format 2017mahendrabpatelPas encore d'évaluation

- Cost and Management Accounting exam questions and ratiosDocument3 pagesCost and Management Accounting exam questions and ratiosmahendrabpatelPas encore d'évaluation

- SP Uni CA 2013Document3 pagesSP Uni CA 2013mahendrabpatelPas encore d'évaluation

- Meaning of Cost Reconciliation StatementDocument5 pagesMeaning of Cost Reconciliation StatementmahendrabpatelPas encore d'évaluation

- Capital StructureDocument37 pagesCapital StructuremahendrabpatelPas encore d'évaluation

- SP Uni CA 1Document4 pagesSP Uni CA 1mahendrabpatelPas encore d'évaluation

- Capital BudgetingDocument24 pagesCapital BudgetingmahendrabpatelPas encore d'évaluation

- TestDocument2 pagesTestmahendrabpatelPas encore d'évaluation

- TestDocument2 pagesTestmahendrabpatelPas encore d'évaluation

- A2Z FincialDocument3 pagesA2Z FincialmahendrabpatelPas encore d'évaluation

- Instructor Effectiveness Form (IEF) Cronbach ReliabilitiesDocument3 pagesInstructor Effectiveness Form (IEF) Cronbach ReliabilitiesmahendrabpatelPas encore d'évaluation

- A2Z FincialDocument3 pagesA2Z FincialmahendrabpatelPas encore d'évaluation

- Chapter 4-Product Costing SystemsDocument17 pagesChapter 4-Product Costing SystemsQuế Hoàng Hoài ThươngPas encore d'évaluation

- Day 4 - Finance Presentation - CODocument73 pagesDay 4 - Finance Presentation - COrakeshranPas encore d'évaluation

- Budgeting and Decision Making Exercises II PDFDocument22 pagesBudgeting and Decision Making Exercises II PDFDGPT&T AUDIT100% (1)

- Case Study on Fortune Cotton & Agro Industries Process CostingDocument50 pagesCase Study on Fortune Cotton & Agro Industries Process CostingTippesh KokanurPas encore d'évaluation

- Joint Product and By-Product Costing: Measuring, Monitoring, and Motivating PerformanceDocument24 pagesJoint Product and By-Product Costing: Measuring, Monitoring, and Motivating PerformancearunprasadvrPas encore d'évaluation

- Advanced Financial Accounting and Auditing NotesDocument16 pagesAdvanced Financial Accounting and Auditing NotesWasim JamaliPas encore d'évaluation

- Management Accounting Tools & TechniquesDocument17 pagesManagement Accounting Tools & TechniquesAniket KarpePas encore d'évaluation

- Question Bank Paper: Cost Accounting McqsDocument8 pagesQuestion Bank Paper: Cost Accounting McqsDarmin Kaye PalayPas encore d'évaluation

- Accm507 SyllabusDocument2 pagesAccm507 Syllabusastitvaawasthi33Pas encore d'évaluation

- Make Cost Management Work for You! - Standard Features and Reporting ExtensionsDocument76 pagesMake Cost Management Work for You! - Standard Features and Reporting ExtensionsArka Roy100% (1)

- LP5 Standard Costing and Variance AnalysisDocument22 pagesLP5 Standard Costing and Variance AnalysisJace Czhristian SantosPas encore d'évaluation

- Pool Cafe NewDocument21 pagesPool Cafe NewDev duttaPas encore d'évaluation

- Vighnharta List For Costing Nov-23 - 230919 - 201728Document516 pagesVighnharta List For Costing Nov-23 - 230919 - 201728sixipa1033Pas encore d'évaluation

- Target and Kaizen Costing in ConstructionDocument7 pagesTarget and Kaizen Costing in ConstructionJordano Bruno MoraesPas encore d'évaluation

- U04 Cost Accumulation SystemDocument30 pagesU04 Cost Accumulation SystemIslam AhmedPas encore d'évaluation

- (Answer Keys) : Multiple Choice Exercise QuestionsDocument3 pages(Answer Keys) : Multiple Choice Exercise QuestionsCharlyn Jewel Olaes100% (1)

- Standard Costs and Balanced ScorecardsDocument29 pagesStandard Costs and Balanced ScorecardsGhaill CruzPas encore d'évaluation

- Management and Cost Accounting: Colin DruryDocument21 pagesManagement and Cost Accounting: Colin DruryYasmine MagdiPas encore d'évaluation

- CH 27Document26 pagesCH 27Jamesno LumbPas encore d'évaluation

- Cost Management Cloud: Supply Chain Financial OrchestrationDocument20 pagesCost Management Cloud: Supply Chain Financial Orchestrationhaitham ibrahem mohmedPas encore d'évaluation

- Responsibility AccountingDocument11 pagesResponsibility AccountingSheila Mae AramanPas encore d'évaluation

- What Is Cost AccountingDocument3 pagesWhat Is Cost AccountingWajahat BhattiPas encore d'évaluation

- Chapter 7 PPT Version 2Document61 pagesChapter 7 PPT Version 2islamasifPas encore d'évaluation