Académique Documents

Professionnel Documents

Culture Documents

A Comparative Analysis of Service Quality in

Transféré par

Pardeep KumarDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

A Comparative Analysis of Service Quality in

Transféré par

Pardeep KumarDroits d'auteur :

Formats disponibles

ijcrb.webs.

com

INTERDISCIPLINARY JOURNAL OF CONTEMPORARY RESEARCH IN BUSINESS A Comparative Analysis of Service Quality in Selected Commercial Banks in Delhi

Dr.Sathya Swaroop Debasish Senior Lecturer, Department of Business Management, Fakir Mohan University ,Balasore, Orissa

VOL 1, NO 7

NOVEMBER 2009

Listed in ULRICHS

Abstract The main objectives of the paper is to study the actual level of service quality in the nine selected commercial banks in Delhi by analyzing their scores as against the various service quality dimensions and to make a comparative analysis of the degree of service quality across Public, Private and Foreign banking sector operating in Delhi. The study has revealed that the foreign banks operating in Delhi provide better service quality , as compared to private and public sector banks . Citibank , ICICI Bank and State Bank of India (SBI) were perceived to deliver better services in their respective banking sectors . The point to worry is that public sector banks which account for over three-fourth of banking business in the country have failed to adequately satisfy their customers. Their Cumulative Service Quality (SQ) Score of 49.94 was found to be much below the expected score of 54.0. On the other hand, there is a close competition between the private sector banks (SQ of 69.77) and foreign banks (SQ of 72.33) for gaining the largest market share by providing excellent service. Keywords: Comparative Analysis, Service Quality , Commercial Banks , Delhi 1. Introduction The conceptualization and measurement of service quality have been the most debated and controversial topics in the services marketing literature to date. Perceived Service quality may be defined as the evaluation by the customers towards the overall excellence or uniqueness of the service rendered . Providing quality service for a commercial bank would mean the art of identification of customers needs and excelling at them. Various committees have been appointed from time to time to study service quality in banks and to provide concrete recommendations. Previous research has identified a number of critical factors that effect service quality in financial services . High level of service quality is associated with several key organizational outcomes including high market share (Buzzell and Gale , 1987) , enhanced customer loyalty( Zeithaml, Berry and Parasuraman, 1996) and improved profitability relative to

COPY RIGHT 2009 Institute of Interdisciplinary Business Research

172

ijcrb.webs.com

INTERDISCIPLINARY JOURNAL OF CONTEMPORARY RESEARCH IN BUSINESS

VOL 1, NO 7

NOVEMBER 2009

competitors (Kearns and Nadler, 1992). One of the measure of service quality is in terms of its perception by the service takers (customer), and this is utilized in this study with the use of Rust & Oliver (1994) Three Component Perceived Service Quality Model. 2. Theoretical Background Service delivery and Customer delight is probably one of the most debatable issues gripping the banking industry in our country. Quality in financial services sector has gained paramount importance by the increasing marketing profile of bank branch operations over time. The thrust on efficient customer service has increased manifold with the onset of competition from private players and the initiation of banking reforms in India since early 1990s( Narsimham Committee). Service industries are playing an increasingly important role in the overall economy. The Indian banking is an essential component of the service industry. The share of banking and insurance within the service industry has burgeoned from 2.78 % of GDP in 198081 to 12.27 % in 2007-08. Interest in the measurement of service quality is thus understandably high and the consistent delivery of superior service is the strategy that is increasing being offered as a key to service providers ( like banks ) to position themselves more effectively in the market place. Service is an invisible offering which is dependent on and inseparable from the person who extends it. Services in Indian Banks are mostly branch- based in the public Sector banks, while the Foreign banks are making strides into full scale technology enabled banking( like Net Banking ). Banking services constitute a hybrid type of offering that consists of both tangible goods ( like loan schemes , interest rate paid, kinds of accounts) and the intangible services (like behavior and efficiency of the staff, speed of transactions, the ambience). The conceptualisation and measurement of service quality have been the most debated and controversial topics in the services marketing literature to date. There is no generic definition of service quality and one can find quality defined as excellence (Garvin, 1984); value (Cronin and Taylor, 1992); Conformance to specifications (Garvin 1988) and meeting customers expectations (Parsuraman et.al. 1985; Gronoos, 1990). Service quality is an elusive and obstruct construct that is difficult to define and measure (Brown and Swartz 1989). Perceived Service quality may be defined as the evaluation by the customers towards the overall excellence or uniqueness of the service rendered. Providing quality service for a commercial bank would mean the art of

COPY RIGHT 2009 Institute of Interdisciplinary Business Research

173

ijcrb.webs.com

INTERDISCIPLINARY JOURNAL OF CONTEMPORARY RESEARCH IN BUSINESS

VOL 1, NO 7

NOVEMBER 2009

identification of customers needs and excelling at them. One of the measure of service quality is in terms of its perception by the service takers (customer), and this is utilised in this study with the use of Rust & Oliver (1994) Three Component Perceived Service Quality Model(discussed later, Fig.1) 3. Objectives of the Study The main objectives of the paper are : i. To throw light on Indian banking and some of the studies on quality of banking services in India . ii. To present a conceptual overview of the Three-Component model of Service quality as suggested by Rust & Oliver. iii. To study the actual level of service quality in the 9 selected commercial banks in Delhi by analyzing their scores as against the various service quality dimensions. iv. d To make a comparative analysis of the degree of service quality across Public, Private and Foreign banking sector studied

4 .Indian Banking An Overview The Indian banking industry can be segregated into 3 distinct segments- Public sector banks ( 27 in number), Private banks and the Foreign Banks . Bank branches are service providers (Antreas p. 300). As on September 2008, there are 26,62,125 branches/offices of schedule commercial banks, as against only 8,187 at the time of nationalisation (December 1969). As per RBI statistics (2008-09),there are 82 commercial banks operating in Delhi out of which 27 are in public sector , 31 in private sector and remaining 24 are foreign banks. As on March 2000, the total banks deposits in Delhi was Rs.19,05,382 crores as against Rs.125,50,705 crores in the all Indian scheduled commercial banks deposits. The number of accounts and the amount outstanding (as per sanction ) in Delhi was 39,75,463 and Rs.514,273 crores as on March 2009 [Source: RBI, Banking Statistics, Various issues].

COPY RIGHT 2009 Institute of Interdisciplinary Business Research

174

ijcrb.webs.com

INTERDISCIPLINARY JOURNAL OF CONTEMPORARY RESEARCH IN BUSINESS

5. Literature Review

VOL 1, NO 7

NOVEMBER 2009

Previous research has identified a number of critical factors that effect service quality in financial services . In Oslen (1992), the survey based report concludes with the three dimensions of service quality which are design quality ( existence of available tangible and intangible infrastructure for proving the service); the production quality ( the readinessand quality of the staff) and process quality ( the ability of the staff to provide the service in a better fashion). In order to develop greater understanding of the nature of service quality and how it is achieved in an organisation, a service quality model was developed by RUST & OLIVER (1994) called The Three-Component Service Quality Model (discussed later), which is surveyed on few selected banks in Delhi. Rust and Oliver do not test their conceptualisations ,but support has been found for similar models in retail banking( Mc Dougall and Levesque 1994). The study is primarily intended to measure the service quality across the three banking sectors public, private and foreign and scope is limited to the 9 sample commercial banks in New Delhi. 6. Banking Services in India Some Studies Various committees have been appointed from time to time to study service quality in banks and to provide concrete recommendations. The Banking commission appointed Saraiya Committee in 1972 which provided 77 recommendations, followed by Talwar committee(1975) with 176 suggestions and Goipuria Committee (1980) which studied the causes of below-par customer service in banks and suggested 97 recommendations for improvement of work culture in Indian banking. A nation wide survey on the 27 public sector banks Customers Service conducted on 3rd January 1997 by IBA( Indian Bankers Association ) provided useful findings .The western Region of our economy showed excellent results with 26 banks providing A rating ( above 75 % quality & satisfaction ) service followed by Southern and Northern region( which includes our field of study- DELHI) with 22 and 21 banks in A category respectively . In terms of quality standards and customer satisfaction, the central region was lagging far behind with only 1 bank in A group and majority in B category (60-75 % satisfaction).[Source:IBA Bulletin , March 1997, Pg.125] ( A rating denotes above 75 % customer satisfaction , B and C Rating refer to 60-75% and below 60 % satisafaction , respectively)

COPY RIGHT 2009 Institute of Interdisciplinary Business Research

175

ijcrb.webs.com

INTERDISCIPLINARY JOURNAL OF CONTEMPORARY RESEARCH IN BUSINESS

VOL 1, NO 7

NOVEMBER 2009

Similarily an All Indian Survey conducted by the National Institute of Bank Management (NIBM) covering 90,000 households and 10,000 institutions on behalf of IBA provided two eyeopening lacunas in Indian banking. Firstly, many customers respondents expressed dissatisfaction over the delays in collection of cheques and other instruments. Secondly, the banking sector has not effectively adopted any promotional strategy on the various schemes and products offered by the banks. A recent Study conducted by Sangeeta Aurora & Minakshi Malhotra(1997) concludes that Routine operation factors ( like Cash withdrawal time,time in opening account ,etc) and Staff factors ( staff attitude , knowledge of staff are the activities of highest satisfaction among customers of both public sector banks and Private sector banks , receptively. On the other hand, Interactive factors (banker-customers ) and Situational Factors (Location of the bank) are least satisfying in public sector and private banks, respectively.

7. Three-component Service Quality Model As part of the study, we adopt Rust and Olivers (1994) view that the overall perception of service quality is based on the customers evaluation of the three dimensions of the service encounter: (see Fig. 1).They are i. The customer-employee interaction, called the Functional Quality (FQ) [see Gronroos 1982, 1984)This aspect refers to the service delivery of the staff to the bank customers. ii. The service environment, called the Environment Quality (EQ) [see Bitner, 1992].This refers to the tangible and intangible infra-structure that support better service delivery. iii. The outcome (service product) also called as Technical Quality (TQ) [see Gronroos 1982, 1984 and figure 2]. This measures the product quality offered and relates to the tangible benefits which directly effect the bank customers. (Oliver ,1997) [that defines perceived service quality as a combination of Technical Quality & Function Quality], and the recent evidence that the service environment effect service quality perceptions (Baker 1986, Spangenberg, Crowley & Henderson, 1996), a framework that incorporates these three dimensions is justified.

COPY RIGHT 2009 Institute of Interdisciplinary Business Research

176

ijcrb.webs.com

INTERDISCIPLINARY JOURNAL OF CONTEMPORARY RESEARCH IN BUSINESS

8 .Sample for the study

VOL 1, NO 7

NOVEMBER 2009

The sample consisted of 600 respondents who are customers of 9 different commercial banks in Delhi. 210 customers from public sector banks in Delhi, 210 from private bank and remaining 180 from foreign banks were contacted at the bank premises for survey purpose. Three banks from each category (public, private and foreign banks) were chosen that have wide geographical coverage in Delhi. The banks selected are: State Bank of India(SBI), Punjab National Bank(PNB) & Corporation Bank (CORP) ICICI Bank, HDFC Bank & Karur Vyasa Bank (KVB) Citibank (CITI), HSBC & Bank of America(BOA) -(Public Sector Banks) - (Private Banks) - (Foreign Banks)

To make the study comprehensive and to provide generalizations, a minimum of two branches of each of the above 9 banks were visited. Table 1 gives the details of the sample selected. The study is based on non-probability, convenient sampling held during the period covering July 2008 to December 2008. The average age and banking tenure (number of years as customers of the bank) of the sample was 36 and 6 years respectively. 156 out of the 600 respondents were females. 9. Measure of Service Quality For the purpose of determining the Service Quality Level, the study is based on Rust & Olivers (1994) Three-component Model of SERVICE Quality. The Three components and the respective measurement dimensions (Statements & their No.) under each are listed below: Technical quality (Statement 1 to 5) Functional Quality ( Statement 6 to 13) Environment Quality i. ii. (Statement 14 to 18)

The bank offers a variety of attractive loan schemes which are easily sanctioned. The service fee charged by the bank is quite nominal relative to other similar financial institutions.

COPY RIGHT 2009 Institute of Interdisciplinary Business Research

177

ijcrb.webs.com

INTERDISCIPLINARY JOURNAL OF CONTEMPORARY RESEARCH IN BUSINESS

iii. iv. v.

VOL 1, NO 7

NOVEMBER 2009

The interest paid on saving and deposits is attractive enough to retain customers loyalty. The bank branch has adequate provision of locker facility. The publication and advertisements about the bank and its products are high enough to adequately spread consumer awareness.

vi. vii.

The customers does not have to wait for long while withdrawing money. The time taken in opening an account ( of any kind ) is very less. 8. The bank employees are always available at their respective counters. 9. The customers are always welcomed with a smile and made to feel as special.

viii.

10. The bank offers hassle-free, error-free satisfaction of customers.

processing of all transactions to the utmost

ix. x.

Whenever a customer is dissatisfied, the complaint is solved within 24 hours. The bank staff is highly knowledgeable regarding bank services and are always ready to extend a helping hand.

xi. xii.

The bank timings are highly convenient. 14.The bank branches are situated at prime locations, easily accessible to one and all and have wide network of ATMs.

xiii.

The inside ambience and the layout of the bank is eye-catching, with adequate sitting facility.

xiv. xv. xvi.

The parking space outside the bank is large enough to avoid any discomfort 17.The extent of computerization in the banks operations is very high. 18.The number of transaction processing terminals is large, which reduces waiting time.

9. Methodology The study is based on primary data obtained through a well designed questionnaire. The

questionnaire consisted of the 18 service quality statements 5 each on Technical (TQ)and Environment(EQ) dimensions and 8 on functional quality(FQ) dimensions . The customers were required to mark their response for each statements on the Likert Scale (range 1 to 5) where 1

COPY RIGHT 2009 Institute of Interdisciplinary Business Research

178

ijcrb.webs.com

INTERDISCIPLINARY JOURNAL OF CONTEMPORARY RESEARCH IN BUSINESS

VOL 1, NO 7

NOVEMBER 2009

referred to Mostly Disagree and 5 meant Mostly Agree. The total minimum score for a bank would be 18 [i.e., 18 statements x 1(minimum score)] and maximum would be 90 (18x5). The possible range of service quality therefore would be from 18 to 90. The actual mean score for each bank against all the 18 service quality dimensions were calculated. (see Table 2). Successively, the average score for each service quality component (TQ, FQ, EQ) was arrived for each banking sector. Finally, the cumulative service quality score (SQ) for each sector (public, private and foreign) was computed and compared for further analysis. Symbolically, SQ = TQ + FQ + EQ. Table-3 gives the Service Quality (SQ) scores for each of the 3 banking sectors, and also the weighted average score for the 3 components across the 9 banks sampled.

10. Analysis of Data The analysis of service quality standards in the study can be done on two levels: i. Studying the average score of each bank and their scores against each service quality parameter/dimension . (Table-2) ii. Analyzing the weighted mean score for each of the 3 components of service quality for each banking sector. (Table 3). Results Table-2 shows the actual Mean scores for each of the 9 banks as against the 18 service quality dimensions (statements). We analyze each individual bank and the respective banking sector on the Three component service quality model. 10.1 Public Sector Banks As seen in Table-2, the State Bank of India(SBI) has moderate SQ score of 2.61, followed by CORP (2.53) and PNB (2.35). All the 3 banks have performed relatively better on product quality (Technical quality-TQ) dimension with score of 2.76, 3.05 and 2.8 for PNB, SBI and CORP respectively. The service delivery (functional quality-FQ) is far from satisfaction in public sector banks and the worst performer is PNB (1.93) with the lowest score on each dimension of functional quality. Environment Quality is not very satisfactory either.

COPY RIGHT 2009 Institute of Interdisciplinary Business Research

179

ijcrb.webs.com

INTERDISCIPLINARY JOURNAL OF CONTEMPORARY RESEARCH IN BUSINESS

10.1.1 Product Quality ( Technical Quality)

VOL 1, NO 7

NOVEMBER 2009

As shown in Table 3, the mean score for public sector banks operating in Delhi is 14.35(TQ) that is below the expected score (15.0). While the customers are moderately satisfied with service fee charged by the public sector banks and Locker facility, much needs improvement in Banks advertisements and publications. SBI is currently having its in-house journal- SBI Monthly Review. PNB has got least rating in 4 out of 5 technical dimensions and this will surely bother the bank in the long run. The interest paid on deposits is barely satisfying as evident from below average (<3.0) scores for each banks; but service fee charged has score above average (> 3.0) for the banks. 10.1.2 Service delivery (Functional Quality) A pathetic below average score of 17.44 against the expected mean of 24.0 is quite revealing of the bad state of affairs in public sector banks. Corporation Bank (CORP) is still better with score of at least 2.0 on each dimension (except 1.8 on making customer feel special); but Punjab National Bank (PNB) has scored least (<2.0) in most of the quality standards regarding service delivery .Error free processing has managed to be rated above average (>3.0). The waiting time to open account or withdraw money is perceived to be very high, and the bank employees are sometimes not available at counters (1.8 for PNB; 2.05 for SBI; 2.1 for CORP). The knowledge level of the staff and their helping tendency needs to be improved. (1.2 for PNB , 1.45 for SBI , 2.15 for CORP) 10.1.3 Service Environment (Environment Quality) Table-3 show that public sector banks have below average score of 13.15 (<15.0) for Environment Quality. CORP is observed to be least performing on adequate parking space (2.0) , on the extent of measure computerization (3.5), location of bank branches (2.4) and number of processing terminals (2.4). SBI is perceived to have relatively wide network of branches at prime locations (2.9) and large number of transaction processing terminals (3.0). PNB has moderate ratings on each dimension with average 2.62 on Environment Quality.

COPY RIGHT 2009 Institute of Interdisciplinary Business Research

180

ijcrb.webs.com

INTERDISCIPLINARY JOURNAL OF CONTEMPORARY RESEARCH IN BUSINESS

10.2 Private Sector Banks

VOL 1, NO 7

NOVEMBER 2009

Table-3 shows that private banking is perceived to be conducting satisfactory business with above average score of 69.77 ( >54.0) on the overall service quality scoring.

10.2.1 Technical Quality With a cumulative score of 18.35 , the private banks have performed better than public (14.35) and foreign banks(17.7) on this measure. ICICI Bank has garnered 3.99 score with above 4.0 score on three dimensions interest paid (4.15), provision of locker facility (4.25) and banks publication and advertisements (4.25). HDFC bank is closely inching towards ICICI with a minor lag in each dimension, averaging to 3.77. Karur Vyasa Bank has failed on two dimensions (below average score) i.e., attractive, easily available loan schemes (2.9) and locker facility (2.1)

10.2.2 Functional Quality The service delivery is quite satisfactory with the actual mean score of 4.04 (table 3) with again ICICI bank (4.18) leading the other banks. Both ICICI and HDFC bank have managed to obtain above 4.0 score on each service delivery standard except for two waiting time for withdrawing money (3.7 for ICICI; 3.6 for HDFC) and bank branch timings (3.9 for ICICI; 3.8 for HDFC). The bank staff is relatively superior on knowledge and are of helping tendency ; and the customer complaints, if any, are safely handled (above 4.0 score for each bank). The private banks have been successful in providing hassle free error free processing (above 4.5 for each bank). Karur Vyasa Bank was perceived to take relatively longer time in (4.25) opening customers account (3.7) and falling short of ICICI in terms of making customers feel specials (3.5) .

10.2.3 Environment Quality On this measure, the private bank have a cumulative score of 19.1 (above the expected 15.0).The wide networking and location of bank branches is not very satisfactory (3.9 for ICICI; 3.7 for HDFC; 3.1 for KVB). The banks have definitely improved their inside ambience and

COPY RIGHT 2009 Institute of Interdisciplinary Business Research

181

ijcrb.webs.com

INTERDISCIPLINARY JOURNAL OF CONTEMPORARY RESEARCH IN BUSINESS

VOL 1, NO 7

NOVEMBER 2009

parking space, as compared to public sector banks. But table-3 shows that the foreign banks (Citibanks e.g.) have excelled on the above dimensions with score of above dimensions with score of above 4.0 . Owing to the metropolis demographic of Delhi, parking space may be a constraint but the interiors can definitely be improved. The computerization and number of processing terminals are perceived to be superior for ICICI and HDFC bank with score of above 4.0. Karur Vyasa Bank needs to excel at bank layout and sitting facility (3.25) in near future.

10.3 Foreign Banks The foreign banking sector witnessed an overall cumulative SQ score of 72.33 (highest amongst the 3 banking sectors) with Citibank leading the lot by average overall mean score of 4.29, followed by HSBC (3.91) and Bank of America (3.85)

10.3.1 Technical Quality Citibank was the leading provider of superior product quality (avg. of 4.20) with the best scores (across all banks , see table 2) against each of the five technical quality standards. HSBC was perceived to offer a moderate quality (3.26) with the average score hovering above 3.0 for all dimensions except facility of Locker (2.50). Bank of America had the same story with locker facility obtaining least score (2.1) across all banks sampled. Availability of easy loans schemes, service fees charges and interest paid in foreign banks were rated comparable with private sector banking. 10.3.2 Functional Quality Unlike technical quality, the service delivery component in foreign banking is quite satisfactory with cumulative score of 34.48 , and individual bank score of above 4.0 (average) for each foreign bank sampled (4.46 for ICICI ; 4.27 for HSBC ; 4.20 for BOA). The highest scores was obtained by Citibank on 6 out of 8 service delivery standards. Unlike the public sector bank, the customers in foreign banks are relatively welcomed with a smile and made to feel special ( 4.55 for ICICI Bank). Bank of America was perceived to take relatively (with ICICI, HSBC) longer time in opening account (3.95). Customer complaint is handled well as evidenced from above 4.0 score in all three banks. The point to note is that, unlike other sectors foreign banks employee

COPY RIGHT 2009 Institute of Interdisciplinary Business Research

182

ijcrb.webs.com

INTERDISCIPLINARY JOURNAL OF CONTEMPORARY RESEARCH IN BUSINESS

enough to be available at counters most of the time (4.55 for ICICI) 10.3.3 Environment quality

VOL 1, NO 7

NOVEMBER 2009

staff have good knowledge base and have helping attitude (4.50 for ICICI) and are responsible

The foreign banks in Delhi are perceived to provide service environment with cumulative score of 20.15 ( see table-3). HSBC is perceived to provide highest quality (among all 9 banks) with respect to inside ambience and sitting facility (4.2). Citibank has above 4.0 rating on all service environment dimension and leads all bank in terms of its wide network of branches & ATMs situated at prime locations (4.2). The degree of computerisation is on par with the private banks studied. The inside ambience of bank branch and the sitting facility is definitely better than private sector banks operating in Delhi and Citibank has above 4.0 rating on all service environment dimensions and leads all banks in terms of its wide network of bank branches and ATMs, situated at prime location in Delhi(4.2). The degree of computerisation is on par with the private banks studied. The inside ambience of bank branches of bank branch and the sitting facility is definitely better than private and public sector banks( see Table 2) . Both HSBC and Bank of America has comparable ratings with Citibank except on two parameters, i.e., parking space and the number of processing terminals.On both these factors, Citibank scores above 4,0 while HSBC rate below 4.0. In the overall Analysis , the foreign banks in Delhi are perceived to deliver superior service Quality , totalling to cumulative SQ score of 72.3 with Citibank being the best with average SQ of 4.29. Private banking comes second (69.77) although they are perceived relatively better on technical quality dimension(18.35) ; but the difference is not large. Public sector banking in Delhi was perceived to deliver lowest service quality (44.94) , far below the expected score of 54.0 (see Table-3) . Punjab National Bank has performed miserably on the service delivery front (FQ). Table-3 shows that private banks have excelled in technical quality (18.35), while foreign banks have topped in both functional (34.48) and environment quality( 20.15). 11. Conclusion The study has revealed that the foreign banks operating in Delhi provide better service quality , as compared to private and public sector banks . Citibank , ICICI Bank and State Bank of India (SBI) were perceived to deliver better services in their respective banking sectors . The point to

COPY RIGHT 2009 Institute of Interdisciplinary Business Research

183

ijcrb.webs.com

INTERDISCIPLINARY JOURNAL OF CONTEMPORARY RESEARCH IN BUSINESS

VOL 1, NO 7

NOVEMBER 2009

worry is that public sector banks which account for over three-fourth of banking business in the country have failed to adequately satisfy their customers. Their Cumulative SQ Score (49.94) is much below the expected score of 54.0. On the other hand, there is a close competition between the private sector banks (SQ of 69.77) and foreign banks (SQ of 72.33) for gaining the largest market share by providing excellent service. A more in-depth , comprehensive study on a larger sample can provide generalized conclusions. Our study achieves three important objectives. First, it consolidates multiple service quality conceptualization into a single measuring framework. Secondly, it probes into the customers perceptions of service quality in Delhi, the countrys Capital City. Thirdly, the study has measured service quality in banks under three established components (TQ, FQ, EQ) of Service .These advances and analysis are particularly significant because a high level of service quality is associated with several key organizational outcomes including high market share (Buzzell and Gale , 1987) , enhanced customer loyalty( Zeithaml, Berry and Parasuraman, 1996) improved profitability relative to competitors (Kearns and Nadler, 1992). and

COPY RIGHT 2009 Institute of Interdisciplinary Business Research

184

ijcrb.webs.com

INTERDISCIPLINARY JOURNAL OF CONTEMPORARY RESEARCH IN BUSINESS

References

VOL 1, NO 7

NOVEMBER 2009

Ambastha,Manoj Kumar and Kumari Sunita (1999). Customer Satisfaction in Banking Industry, Marketing Strategy and Challenges , Indian Journal of Commerce, 52. 60-69. Athanassopoulos, Antreas D (1997). Service Quality and operating efficiency synergies for management control in the provision of financial services: Evidence from Greek bank branches, European Journal of Operation Research , 98, 300-313. Aurora Sangeeta and Minakshi Malhotra (1997). Customer Satisfaction: A Comparative Analysis of Public and private Bank , DECISION (IIM-C), 24 (1),109-130. Baker,Julie (1986). The Role of the Environment in marketing Services: The Consumer Perspective in The Service Challenge: Integrating for Competitive Advantage, John A.Czepielet al .eds(p.79-84)., Chicago: American Marketing Association. Bateson, John E (1989).Managing Service Marketing , London, Dryden Press. Bitner,Mary Jo( 1992). Service scapes: The Impact of Physical Surroundings on Customers and Employees , Journal of Marketing ,56, p. 57-71. Brown, Stephen W and Teresa A. Swartz (1989) . A Gap Analysis of Improfessional service Quality , Journal of Marketing , 53, p. 92-98. Brown, Stephen W. and Teresa A. Swartz(1989), A Gap Analysis of Professional Service Quality, Journal Of Marketing, 53, (April ), 92-98. Christian Groonos (1984), A Service quality Model and Its Marketing Implications , European Journal of Marketing , 18(4), 36-44. Cronin, J. Joseph and Steven A. Taylor (1992). Measuring Service Quality: A Reexamination and Extension , Journal of Marketing, 56, p.55-68. Garvin , D. (1984). What does product quality really mean? , Sloan Management Review , 26, p.25-43. Garvin , D.(1998). Managing Quality: The Strategic and Competitive Edge, Free Press, New York.

COPY RIGHT 2009 Institute of Interdisciplinary Business Research

185

ijcrb.webs.com

INTERDISCIPLINARY JOURNAL OF CONTEMPORARY RESEARCH IN BUSINESS

VOL 1, NO 7

NOVEMBER 2009

McDougall, Gordon H.G. and Terrence J. Leversque (1994).A Revised View for Service Quality Dimensions: An Empirical Investigation, Journal of Professional Services Marketing, 11 (1), p.189-209. Mohr, Lois A. and Mary Jo Bitner(1995).The Role of Employee Effort in Satisfaction with Service Transactions, Journal of Business Research , 32(3), p.239-52. Oslen, M. (1992) . Quality in banking services ,Working paper-11A, Department of Business Studies, Stockholm University. Parasuraman,A., Valarie.A.Zeithaml, and Leonard L. Berry(1985). A Conceptual Model of service Quality and Its Implications for Future Research , Journal of Marketing, 49 (Fall), p.41-50. Rust Roland T. and Richard L.Oliver (994), Service Quality Insights and Managerial Implications form the Frontier , in Service Quality: New Directions in Theory and Practice , Roland T.Rust and Richard L.Oliver eds.(p.1-9), Thousand Oaks, CA :sage Publications. Spangenberg, Eric R.., An E. Crowley, and Pamela W. Henderson (1996). Improving the Store Environment: Do Olfactory Cues Affect Evaluations and Behaviors?, Journal of Marketing, 60, p.67-80.

COPY RIGHT 2009 Institute of Interdisciplinary Business Research

186

ijcrb.webs.com

INTERDISCIPLINARY JOURNAL OF CONTEMPORARY RESEARCH IN BUSINESS

Annexure

Figure-1 (Rust & Oliver 1994) The Three Component Model

VOL 1, NO 7

NOVEMBER 2009

Service Quality

Service Product

Service Delivery

Service Environment

Given the growing support for revisiting Gronroos(Fig-2)seminal conceptualisation (Mohr & Bitner 1995,

Figure-2

Gronross Model (1984)

Expected Service Perceived Service Quality

Perceived Service

Technical Quality

Functional Quality

Table 1. Sample Distribution

Public sector bank Private Sector Banks Foreign Bank � � Total sample size 600 The figures in parenthesis show the number of bank customers chosen from each bank . State Bank of India SBI (70) ICICI Bank ICICI (70) Citibank CITI (60) Corporation Bank CORP (70) HDFC Bank HDFC (70) HSBC (65) Punjab National Bank PNB (70) Karur Vyasa Bank KVB (70) Bank of America BOA (65)

COPY RIGHT 2009 Institute of Interdisciplinary Business Research

187

ijcrb.webs.com

INTERDISCIPLINARY JOURNAL OF CONTEMPORARY RESEARCH IN BUSINESS

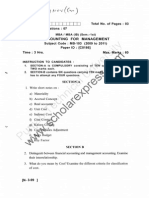

Table-2: Nature of Service Quality in the Indian Banks St.#No. 01 02 03 04 05 TQ 06 07 08 09 10 11 12 13 FQ 14 15 16 17 18 EQ SQ PublicSector Banks PNB SBI CORP 2.70 2.5 2.35 3.3 3.4 3.1 2.95 2.90 2.9 3.3 3.55 2.75 2.75 2.45 2.15 2.76 3.05 2.8 2.3 2.4 2.1 2.15 2.25 1.9 2.05 2.1 1.8 1.6 1.8 1.5 3.4 3.7 3.1 2.3 2.1 1.4 1.45 2.15 1.2 2.6 2.7 2.5 1.93 2.23 2.40 2.7 2.9 2.4 2.05 2.15 1.75 2.25 2.2 2.0 3.9 3.8 3.5 2.5 3.0 2.4 2.62 2.79 2.49 2.35 2.61 2.53 Private Sector Banks ICICI HDFC KVB 3.9 3.7 2.9 3.2 3.15 3.4 4.15 4.2 4.25 4.25 3.7 2.1 4.45 4.1 3.7 3.99 3.77 3.27 3.7 3.6 3.5 4.25 4.2 3.9 4.25 4.35 3.75 4.25 4.1 3.5 4.7 4.8 4.7 4.2 4.1 3.2 4.25 4.25 4.0 3.9 3.8 3.9 4.18 4.15 3.8 3.9 3.7 3.1 3.95 3.5 3.4 3.95 3.8 3.25 4.4 4.2 3.9 4.2 4.1 3.95 4.08 3.86 3.52 4.09 3.96 3.57

VOL 1, NO 7

NOVEMBER 2009

Foreign Banks CITI HSBC 4.1 3.7 3.5 3.4 4.4 3.5 4.45 2.5 4.55 43.2 4.2 3.26 4.2 4.15 4.4 4.35 4.55 4.2 4.55 4.25 4.85 4.9 4.45 4.25 4.5 4.4 4.2 4.25 4.46 4.27 4.2 4.0 4.1 4.2 4.1 3.9 4.3 3.7 4.0 4.15 4.14 3.99 4.29 3.91

BOA 3.85 3.45 3.4 2.1 3.1 3.18 4.25 3.95 4.1 4.20 4.45 4.15 4.45 4.1 4.20 3.9 4.0 3.55 4.45 3.9 3.96 3.85

# St.No- Statement Number (See- Measures of Service Quality) TQ-Technical quality ; FQ- Functional Quality ; EQ Environment Quality ; SQ- Service Quality ; Lowest Score ; - Highest Score

Table-3: Service Quality in Indian Banks- The Overall Picture Quality Dimension TQ FQ EQ SQ No. of Items 5 8 5 18 Expected Mean Score 15 24 15 54 Actual Score Public Banks 14.35 17.44 13.15 44.94 Private Banks 18.35 32.32 19.1 69.77 Foreign Banks 17.7 34.48 20.15 72.33 Weighted Average 16.68 27.28 17.13 61.13

COPY RIGHT 2009 Institute of Interdisciplinary Business Research

188

Reproduced with permission of the copyright owner. Further reproduction prohibited without permission.

Vous aimerez peut-être aussi

- Executive Data Science A Guide To Training and Managing The Best Data Scientists by Brian Caffo, Roger D. Peng, Jeffrey T. LeekDocument150 pagesExecutive Data Science A Guide To Training and Managing The Best Data Scientists by Brian Caffo, Roger D. Peng, Jeffrey T. LeekName TATA100% (1)

- Regional Rural Banks of India: Evolution, Performance and ManagementD'EverandRegional Rural Banks of India: Evolution, Performance and ManagementPas encore d'évaluation

- EBS 341-Lab Briefing-19 Feb 2019Document71 pagesEBS 341-Lab Briefing-19 Feb 2019NNadiah Isa100% (1)

- Gap Analysis of HDFC BankDocument6 pagesGap Analysis of HDFC BankPragati KumariPas encore d'évaluation

- Comparative Analysis On Service Quality of ICICI and SBI Bank in Rajapalayam Taluk - An Empirical StudyDocument10 pagesComparative Analysis On Service Quality of ICICI and SBI Bank in Rajapalayam Taluk - An Empirical StudyNaveen HemromPas encore d'évaluation

- Customers Perception and Attitude Towards ServiceDocument17 pagesCustomers Perception and Attitude Towards ServiceDhrumil ModiPas encore d'évaluation

- Chapter 1Document7 pagesChapter 1nishaPas encore d'évaluation

- PROjECT 1Document12 pagesPROjECT 1Monisha satheeshaPas encore d'évaluation

- 7 PDFDocument14 pages7 PDFSaiful BahriPas encore d'évaluation

- Customer Expectations and Perceptions Across The Indian Banking Industry and The Resultant Financial ImplicationsDocument20 pagesCustomer Expectations and Perceptions Across The Indian Banking Industry and The Resultant Financial ImplicationsAradha SharmaPas encore d'évaluation

- Munich Banking Gap AnalysisDocument9 pagesMunich Banking Gap AnalysisArpit JainPas encore d'évaluation

- Service Quality Gap Analysis in Private Sector Bank - A Customer PerspectiveDocument9 pagesService Quality Gap Analysis in Private Sector Bank - A Customer Perspectivemanoj kumar DasPas encore d'évaluation

- An Analysis of Customer PerceptionDocument28 pagesAn Analysis of Customer PerceptionAshis SahooPas encore d'évaluation

- F016214451 PDFDocument8 pagesF016214451 PDFramyaPas encore d'évaluation

- Customer Satisfaction in Indian Banking Services (A Study in Aligarh District)Document13 pagesCustomer Satisfaction in Indian Banking Services (A Study in Aligarh District)Siva Venkata RamanaPas encore d'évaluation

- Customer Satisfaction of Commercial Indian Bank Using SERVQUAL ModelDocument24 pagesCustomer Satisfaction of Commercial Indian Bank Using SERVQUAL ModelFaizan Ahmad67% (3)

- Servqual TechniqueDocument8 pagesServqual TechniqueNimit JainPas encore d'évaluation

- Service Quality of Public Sector Banks - A Study: ManagementDocument7 pagesService Quality of Public Sector Banks - A Study: ManagementgherijaPas encore d'évaluation

- Assessing The Customer Satisfaction For Kokan Mercantile Co-Op Bank LTDDocument25 pagesAssessing The Customer Satisfaction For Kokan Mercantile Co-Op Bank LTDiffu rautPas encore d'évaluation

- 246 655 1 SMDocument20 pages246 655 1 SMsarthakPas encore d'évaluation

- A Study On Customers Satisfaction-1102-With-cover-page-V2 Ex ProjectDocument16 pagesA Study On Customers Satisfaction-1102-With-cover-page-V2 Ex ProjectFelix ChristoferPas encore d'évaluation

- Servqual Analysis of HDFC Bank & Indian BankDocument18 pagesServqual Analysis of HDFC Bank & Indian Bank``err100% (1)

- Service Quality Gap Analysis in Private Sector Bank - A Customer PerspectiveDocument9 pagesService Quality Gap Analysis in Private Sector Bank - A Customer PerspectiveOmotayo AkinpelumiPas encore d'évaluation

- Service Quality of Commercial Banks in Rural Areas PDFDocument12 pagesService Quality of Commercial Banks in Rural Areas PDFdva99977Pas encore d'évaluation

- Interrelations Between Service Quality Attributes, Customer Satisfaction and Customer Loyalty in The Retail Banking Sector in Bangladesh - Kazi OmaDocument26 pagesInterrelations Between Service Quality Attributes, Customer Satisfaction and Customer Loyalty in The Retail Banking Sector in Bangladesh - Kazi OmaRiyan Adiputra PrayitnoPas encore d'évaluation

- Comparative Study Service Quality Assesment of Public & Private Sector Banks Using Servqual ModelDocument12 pagesComparative Study Service Quality Assesment of Public & Private Sector Banks Using Servqual ModelgherijaPas encore d'évaluation

- Related Papers: IOSR JournalsDocument9 pagesRelated Papers: IOSR JournalsMavani snehaPas encore d'évaluation

- Service Quality of Public Sector Banks in India A Gap Between Perception and ExpectationDocument6 pagesService Quality of Public Sector Banks in India A Gap Between Perception and ExpectationMANAV SAHUPas encore d'évaluation

- Market Research Project ReportDocument24 pagesMarket Research Project ReportleoatcitPas encore d'évaluation

- SBI Vs ICICIDocument18 pagesSBI Vs ICICISimran JainPas encore d'évaluation

- Servqual ModelDocument16 pagesServqual Modelsharmamohit2000Pas encore d'évaluation

- Service Quality Gap Analysis in Private Sector Bank - A Customer PerspectiveDocument9 pagesService Quality Gap Analysis in Private Sector Bank - A Customer PerspectiveNeeraj DaniPas encore d'évaluation

- Service Quality OF HDFC BANKDocument47 pagesService Quality OF HDFC BANKSubhendu GhoshPas encore d'évaluation

- Service Quality Satisfaction and Customer LoyaltyDocument11 pagesService Quality Satisfaction and Customer LoyaltyJakia SultanaPas encore d'évaluation

- Customers' Perception About The Determinants of Service Quality of Foreign and Domestic Banks: An Empirical Study On BangladeshDocument14 pagesCustomers' Perception About The Determinants of Service Quality of Foreign and Domestic Banks: An Empirical Study On BangladeshImran IqbalPas encore d'évaluation

- Comparative Study of Customer Satisfacti PDFDocument27 pagesComparative Study of Customer Satisfacti PDFRAJKUMAR CHETTUKINDAPas encore d'évaluation

- Customer Satisfaction: A Comparative Study of Public and Private Sector Banks in BangladeshDocument8 pagesCustomer Satisfaction: A Comparative Study of Public and Private Sector Banks in BangladeshKRUPALI RAIYANIPas encore d'évaluation

- Assessing Customers' Perceived Service Quality in Private Sector Banks in IndiaDocument13 pagesAssessing Customers' Perceived Service Quality in Private Sector Banks in IndiaKondasani RamPas encore d'évaluation

- 744-752 Rrijm180309149Document9 pages744-752 Rrijm180309149Chetan Sunil SonawanePas encore d'évaluation

- The Impact of Service Quality Determinants On Customer Satisfaction A Study of Bank of Bhutan Limited in GEDU Town, BhutanDocument12 pagesThe Impact of Service Quality Determinants On Customer Satisfaction A Study of Bank of Bhutan Limited in GEDU Town, Bhutanarcherselevators100% (1)

- 10 - Chapter 3 PDFDocument38 pages10 - Chapter 3 PDFtejas100% (1)

- 7.Md. Borak Ali - FinalPaperDocument12 pages7.Md. Borak Ali - FinalPaperiistePas encore d'évaluation

- Comparative Study of Customer Satisfaction in Public Sector and Private SECTOR BANKS IN INDIA (A Case Study of Meerut Region of U.P.)Document8 pagesComparative Study of Customer Satisfaction in Public Sector and Private SECTOR BANKS IN INDIA (A Case Study of Meerut Region of U.P.)VIKASH GARGPas encore d'évaluation

- 07 Chapter2Document6 pages07 Chapter2Akshata NetkePas encore d'évaluation

- Determinants of Customer Satisfaction of Banking Industry in BangladeshDocument15 pagesDeterminants of Customer Satisfaction of Banking Industry in BangladeshFauzi DjibranPas encore d'évaluation

- Customer Satisfaction With Service Quality: An Empirical Study of Public and Private Sector BanksDocument12 pagesCustomer Satisfaction With Service Quality: An Empirical Study of Public and Private Sector BankspadmavathiPas encore d'évaluation

- Title of The PaperDocument16 pagesTitle of The PapervikramkayshapPas encore d'évaluation

- bmd11011 PDFDocument11 pagesbmd11011 PDFGiang Nguyen TrongPas encore d'évaluation

- Performance Comparison of Private Sector Banks With The Public Sector Banks in IndiaDocument8 pagesPerformance Comparison of Private Sector Banks With The Public Sector Banks in IndiaRaviPas encore d'évaluation

- 2 Service Quality Dimensions of Islamic BanksDocument11 pages2 Service Quality Dimensions of Islamic Banksauroob_irshadPas encore d'évaluation

- IJMSS6Oct19 8320 PDFDocument18 pagesIJMSS6Oct19 8320 PDFJithinPas encore d'évaluation

- An Assessment of The Perceived Service Quality: Comparison of Islamic and Conventional Banks at PakistanDocument15 pagesAn Assessment of The Perceived Service Quality: Comparison of Islamic and Conventional Banks at PakistanAakash HassanPas encore d'évaluation

- A Study On The Impact of Banking OmbudsmanDocument6 pagesA Study On The Impact of Banking OmbudsmanAshwin J NairPas encore d'évaluation

- BankDocument54 pagesBankSawant SwapnilPas encore d'évaluation

- A Study On Measurement of ServDocument16 pagesA Study On Measurement of ServMɽ HʋŋteɽPas encore d'évaluation

- 9991 36797 1 PB PDFDocument14 pages9991 36797 1 PB PDFNarendra kandelPas encore d'évaluation

- Sikkim Manipal University: "Comparative Study On Customer's Loyalty inDocument8 pagesSikkim Manipal University: "Comparative Study On Customer's Loyalty inSubrat PatnaikPas encore d'évaluation

- 5 Servqual and ServperfDocument13 pages5 Servqual and ServperfDidin Dimas Ponco AdiPas encore d'évaluation

- Service Quality Measurement in Cooperative Banking SectorDocument6 pagesService Quality Measurement in Cooperative Banking SectorInternational Journal of Innovative Science and Research TechnologyPas encore d'évaluation

- 7 Chapter 1 Introduction and Conceptual Frame WorkDocument56 pages7 Chapter 1 Introduction and Conceptual Frame WorkANKIT SINGH RAWATPas encore d'évaluation

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)D'EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)Pas encore d'évaluation

- 12 PRINCIPLES of QUALITY SERVICE: How America's Top Service Providers Gain A Competitive AdvantageD'Everand12 PRINCIPLES of QUALITY SERVICE: How America's Top Service Providers Gain A Competitive AdvantagePas encore d'évaluation

- 4 S2444969516300191 PDFDocument16 pages4 S2444969516300191 PDFPardeep KumarPas encore d'évaluation

- QUIZ QuestionsDocument2 pagesQUIZ QuestionsPardeep KumarPas encore d'évaluation

- 4 S2444969516300191 PDFDocument16 pages4 S2444969516300191 PDFPardeep KumarPas encore d'évaluation

- Problem Solving ExcerciseDocument10 pagesProblem Solving ExcercisePardeep KumarPas encore d'évaluation

- Jalvehra, Punjab Affiliated To Punjabi Uni. Patiala Jalvehra, Punjab Affiliated To Punjabi Uni. PatialaDocument1 pageJalvehra, Punjab Affiliated To Punjabi Uni. Patiala Jalvehra, Punjab Affiliated To Punjabi Uni. PatialaPardeep KumarPas encore d'évaluation

- 4 S2444969516300191 PDFDocument16 pages4 S2444969516300191 PDFPardeep KumarPas encore d'évaluation

- Project Proposal On Secured Shelter For Flood Victims in Krishna District, Andhra PradeshDocument3 pagesProject Proposal On Secured Shelter For Flood Victims in Krishna District, Andhra PradeshPardeep KumarPas encore d'évaluation

- QUESTIONAIRE On Consumer BehaviorDocument5 pagesQUESTIONAIRE On Consumer BehaviorPardeep KumarPas encore d'évaluation

- Conumer Adoption of Internet BankingDocument40 pagesConumer Adoption of Internet BankingPardeep KumarPas encore d'évaluation

- Harshad MehtaDocument4 pagesHarshad Mehtanishat0702Pas encore d'évaluation

- Life Insurance Premium CertificateDocument1 pageLife Insurance Premium CertificatePardeep KumarPas encore d'évaluation

- MB 103Document3 pagesMB 103Pardeep KumarPas encore d'évaluation

- Income Tax Calculator FY 2014 15Document2 pagesIncome Tax Calculator FY 2014 15Pardeep KumarPas encore d'évaluation

- FewfewDocument14 pagesFewfewPardeep KumarPas encore d'évaluation

- 26BT CS071210Document1 page26BT CS071210Pardeep KumarPas encore d'évaluation

- An Empirical Study On Customer's Satisfaction TowardsDocument18 pagesAn Empirical Study On Customer's Satisfaction TowardsPardeep KumarPas encore d'évaluation

- Banking and FinanceDocument4 pagesBanking and FinancePardeep KumarPas encore d'évaluation

- Conumer Adoption of Internet BankingDocument40 pagesConumer Adoption of Internet BankingPardeep KumarPas encore d'évaluation

- An Empirical Analysis of The AwarenessDocument23 pagesAn Empirical Analysis of The AwarenessPardeep KumarPas encore d'évaluation

- Dr. Vikram Bansal (VB) Dr. Vikram Bansal (VB) : S.No. Subject Code Subject FacultyDocument8 pagesDr. Vikram Bansal (VB) Dr. Vikram Bansal (VB) : S.No. Subject Code Subject FacultyPardeep KumarPas encore d'évaluation

- Conumer Adoption of Internet BankingDocument40 pagesConumer Adoption of Internet BankingPardeep KumarPas encore d'évaluation

- A Comparative Study of Customer Services in ICICI and SBI.Document90 pagesA Comparative Study of Customer Services in ICICI and SBI.Pardeep KumarPas encore d'évaluation

- Jensen AlphaDocument1 pageJensen AlphaPardeep KumarPas encore d'évaluation

- Registration Form International-ConferenceDocument1 pageRegistration Form International-ConferencePardeep KumarPas encore d'évaluation

- Mba Books ListDocument4 pagesMba Books ListPardeep KumarPas encore d'évaluation

- Cave - PuzzleDocument1 pageCave - PuzzlePardeep KumarPas encore d'évaluation

- Cave - PuzzleDocument1 pageCave - PuzzlePardeep KumarPas encore d'évaluation

- Management Information Systems: Course OverviewDocument24 pagesManagement Information Systems: Course OverviewPardeep KumarPas encore d'évaluation

- Self-Organizing Map and Cellular Automata CombinedDocument8 pagesSelf-Organizing Map and Cellular Automata CombinedMarco Antonio Reséndiz DíazPas encore d'évaluation

- Test Bank For Educational Psychology 7th Canadian Edition Anita Woolfolk Philip H Winne Nancy e PerryDocument22 pagesTest Bank For Educational Psychology 7th Canadian Edition Anita Woolfolk Philip H Winne Nancy e PerryByron Holloway100% (42)

- Chatelier & McNeil (2020) Electricity Demand of Non-Residential Buildings in MexicoDocument14 pagesChatelier & McNeil (2020) Electricity Demand of Non-Residential Buildings in MexicoFidel Flores ChapaPas encore d'évaluation

- Top Engineering Colleges in West Bengal - All About EducationDocument6 pagesTop Engineering Colleges in West Bengal - All About EducationAditya KrPas encore d'évaluation

- Chest PainDocument10 pagesChest PainYeri HoloPas encore d'évaluation

- Is Rebranding All Activities Under The "We" Umbrella The Right Decision? What Are The Pros and Cons?Document8 pagesIs Rebranding All Activities Under The "We" Umbrella The Right Decision? What Are The Pros and Cons?SeemaPas encore d'évaluation

- Lab Sheet PDFDocument9 pagesLab Sheet PDFtehpohkeePas encore d'évaluation

- Part 2 ProjectDocument50 pagesPart 2 Projectramakrishnad reddyPas encore d'évaluation

- Reading With Ingold. An Analysis of Tim PDFDocument94 pagesReading With Ingold. An Analysis of Tim PDFLeon Hersch GonzalezPas encore d'évaluation

- A Study On Consumers Buying Behaviour Towards FMCG Products With Reference To Karur DistrictDocument6 pagesA Study On Consumers Buying Behaviour Towards FMCG Products With Reference To Karur DistrictMelky BPas encore d'évaluation

- Oam Week 1 10Document16 pagesOam Week 1 10Leah Sandra Eugenio50% (2)

- Bride Price DissertationDocument62 pagesBride Price Dissertationbaguma100% (2)

- Factors Affecting The Mental Health of A Student Amidst Covid-19 PandemicDocument17 pagesFactors Affecting The Mental Health of A Student Amidst Covid-19 PandemicNiño Jessie Val LupianPas encore d'évaluation

- Lachs Moot Court Problem 2019 Suniza V Azasi 29 August 2018Document6 pagesLachs Moot Court Problem 2019 Suniza V Azasi 29 August 2018Vaibhav GhildiyalPas encore d'évaluation

- Case Study Research DesignDocument12 pagesCase Study Research DesignOrsua Janine AprilPas encore d'évaluation

- Analyzing Noise Robustness of MFCC and GFCC Features in Speaker IdentificationDocument5 pagesAnalyzing Noise Robustness of MFCC and GFCC Features in Speaker Identificationhhakim32Pas encore d'évaluation

- Grade: 10 Revision Worksheet Chapter: StatisticsDocument3 pagesGrade: 10 Revision Worksheet Chapter: StatisticssidharthPas encore d'évaluation

- Lightweight Document Clustering Sholom Weiss, Brian White, Chid Apte IBM Research Report RC-21684Document13 pagesLightweight Document Clustering Sholom Weiss, Brian White, Chid Apte IBM Research Report RC-21684cs_bd4654Pas encore d'évaluation

- Michael Owusu AmankwahDocument84 pagesMichael Owusu AmankwahThuraMinSwePas encore d'évaluation

- Testing Procedure 1Document4 pagesTesting Procedure 1api-357357202Pas encore d'évaluation

- Accepted Manuscript: Computer Methods and Programs in BiomedicineDocument23 pagesAccepted Manuscript: Computer Methods and Programs in BiomedicineToyota MitsubishiPas encore d'évaluation

- Ms. Annieska Alde Instructor ApplicantDocument2 pagesMs. Annieska Alde Instructor ApplicantMaria AnnieskaPas encore d'évaluation

- Checklist PDFDocument20 pagesChecklist PDFNarmadha0% (1)

- HR Decision MakingDocument12 pagesHR Decision Makingemmanuel JohnyPas encore d'évaluation

- Npioh, JURNAL ERIKA 203-207 PDFDocument5 pagesNpioh, JURNAL ERIKA 203-207 PDFReski AmaliyaPas encore d'évaluation

- Organizational Learning Capability (1998)Document230 pagesOrganizational Learning Capability (1998)Sara Kožić100% (1)

- Name: Nurul Atika Binti Zaini Matrix Number: 255326Document11 pagesName: Nurul Atika Binti Zaini Matrix Number: 255326Muhd NurhaqimPas encore d'évaluation

- EE3302 Lab Report: Ziegler-Nichols & Relay Tuning ExperimentsDocument9 pagesEE3302 Lab Report: Ziegler-Nichols & Relay Tuning ExperimentsEngr Nayyer Nayyab MalikPas encore d'évaluation