Académique Documents

Professionnel Documents

Culture Documents

7110 Nos SW 6

Transféré par

mstudy1234560 évaluation0% ont trouvé ce document utile (0 vote)

8 vues4 pagesThis unit covers the impact of a partnership relationship on the Financial Statements of a business. It also highlights the similarities in Financial Statements between different types of business as well as the differences. It is important that students understand that a partnership is a business in which two or more individuals have invested capital and it is the business profit as a whole that is calculated. They SHOULD NOT prepare separate columnar accounts splitting sales, purchase, expenses and so on between partners. Sharing of profits or losses takes place after profit for the year is

Description originale:

Titre original

7110_nos_sw_6

Copyright

© © All Rights Reserved

Formats disponibles

PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentThis unit covers the impact of a partnership relationship on the Financial Statements of a business. It also highlights the similarities in Financial Statements between different types of business as well as the differences. It is important that students understand that a partnership is a business in which two or more individuals have invested capital and it is the business profit as a whole that is calculated. They SHOULD NOT prepare separate columnar accounts splitting sales, purchase, expenses and so on between partners. Sharing of profits or losses takes place after profit for the year is

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

8 vues4 pages7110 Nos SW 6

Transféré par

mstudy123456This unit covers the impact of a partnership relationship on the Financial Statements of a business. It also highlights the similarities in Financial Statements between different types of business as well as the differences. It is important that students understand that a partnership is a business in which two or more individuals have invested capital and it is the business profit as a whole that is calculated. They SHOULD NOT prepare separate columnar accounts splitting sales, purchase, expenses and so on between partners. Sharing of profits or losses takes place after profit for the year is

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 4

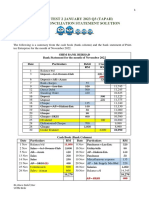

O Level Principles of Accounts (7110)

Unit 6: Financial Statements Partnerships: Limited Liability Companies

Recommended Prior Knowledge

It is important that students are able to prepare financial statements for sole traders, together with appropriate adjustments before beginning this unit.

Context

This unit covers the impact of a partnership relationship on the financial statements of a business and the impact of incorporation on businesses.

Outline

The unit serves to highlight the similarities in financial statements between different types of business as well as the differences.

AO Learning outcomes Suggested Teaching activities Learning resources

4.1 Candidates should be able to:

explain the advantages and

disadvantages of forming a

partnership

Compare the advantages and disadvantages of sole trader and

partnership businesses in terms of ownership, control and sources

of finance.

It can be useful to take the same information about fixed and

current assets and current liabilities as in the last example for a sole

trader and simply show the capital accounts as being different. This

treatment of the different type of business as a development of

financial statements rather than something completely new will help

students concentrate on the new information.

It is important that students understand that a partnership is a

business in which two or more individuals have invested capital and

it is the business profit as a whole that is calculated. They SHOULD

NOT prepare separate columnar accounts splitting sales, purchase,

expenses and so on between partners. Sharing of profits or losses

takes place after profit for the year is calculated.

http://www.tutor2u.net/revision_notes_accou

nting.asp

Past question papers available from CIE,

e.g.

Specimen Paper 1 Q19

Candidates should be able to:

outline the importance and

contents of a partnership

Explain what is meant by a partnership agreement and what it

contains. Explain the typical matters which will be defined in a

partnership agreement covering matters such as the sharing of

profits.

http://www.bized.ac.uk/stafsup/options/acco

unting/work07.htm

1

AO Suggested Teaching activities Learning resources Learning outcomes

agreement

explain the purpose of an

Appropriation Account

prepare partnership Income

Statements, Appropriation

Accounts and Balance Sheets

A key difference between partnerships and

sole traders is the use of appropriation accounts. This is the part of

the financial statements in which profits or losses are shared

between partners.

http://accounting10.tripod.com/content.htm

Past question papers available from CIE,

e.g.

J un 2003 Paper 1 Q31

J un 2005 Paper 1 Q32

explain the uses and differences

between capital and current

accounts

Explain the reasons for and against using current accounts in a

partnership and the implications of both on the bookkeeping.

draw up partners current and

capital accounts, both in ledger

form, as part of a Balance Sheet

presentation

Illustrate and provide practice for students in preparing current and

capital accounts.

Nov 2002 Paper 2 Q3

show the treatment of interest on

capital, partners salaries, interest

on partners loans and on

drawings

It is helpful for students to increase the number of transactions in

the appropriation account steadily. Initially, begin with the sharing of

profits. Then add partners salaries, the interest on capital and

drawings, gradually increasing the complexity.

Ensure students thoroughly understand the place of drawings and

that they do not appear in the appropriation account.

4.2 Candidates should be able to:

make simple entries for the

formation of a partnership via

capital contribution by each

partner in cash and/or non-cash

assets and amalgamation of two

sole traders, including the

calculation and recording of

Illustrate how sharing profit may not be equal because the capital

injection may not be equal, or the commitment of one partner to a

business may be less in terms of management than another and

this is reflected in profit share.

Students should be shown the calculation of goodwill as the surplus

of purchase price over net assets. They should be able to account

for goodwill and the net assets.

Past question papers available from CIE,

e.g.

Nov 2003 Paper 1 Q21, 26

2

AO Suggested Teaching activities Learning resources Learning outcomes

Goodwill

Explain and work through examples of goodwill and how it is

included in accounts. J ournal entries and ledgers should be fully

covered to prevent students reversing the entries. This is a common

error in examination answers.

http://www.bized.ac.uk/stafsup/options/acco

unting/work08.htm

make the other adjustments as

detailed under 4.1

Complete the study of partnerships by working through a full set of

partnership financial statements.

Students can be confused about when to use columnar

current/capital accounts. A consistent approach of using separate

full ledger accounts outside the balance sheet, bringing the closing

balance to the balance sheet is less confusing for students.

Past question papers available from CIE,

e.g.

Nov 2003 Paper 1 Q21, 26

J un 2004 Paper 2 Q5

J un 2006 Paper 2 Q5

Questions will not be set on the

dissolution of partnership.

4.5 Candidates should be able to:

prepare a simple limited company

appropriation account

explain the capital structure of a

limited company (comprising

preference shares capital, ordinary

share capital and retained profits)

and how it appears in the Balance

Sheet

recognise the distinctions between

called-up, issued and paid-up

share capital and between share

capital ordinary and preference

and loan capital e.g. debentures

Candidates will not be required to

prepare a company's Income

Statement or a complete Balance

Sheet, to make entries to record the

There are parallels with partnerships in the

case of the company appropriation account. In the case of a

company the main transactions seen in the appropriation account

are proposed and paid dividends and transfers to and from

reserves.

The structure of capital in a company can be complex including not

only shares but also capital and revenue reserves. Illustrate and

explain the use of the common types of reserve and the common

types of capital. Multiple choice questions are useful to help

students think through the variations.

Time should be spent outlining the features and differences

between an ordinary share, a preference share and a debenture.

Debentures are often regarded as part of loan capital although

loans rank as a creditor and not capital at all. It is important to

emphasise this important distinction and its implications to students.

It is important to clarify for students the extent of this syllabus so

that they spend their course and homework time on matters of

Past question papers available from CIE,

e.g.

Nov 2003 Paper 1 Q35

J un 2003 Paper 2 Q3

http://www.bized.ac.uk/dataserv/extel/notes/

seq-ex.htm

Nov 2005 Paper 2 Q3

Specimen Paper 1 Q36

Specimen Paper 2 Q5

http://www.bized.ac.uk/dataserv/extel/notes/l

tl-th.htm

http://www.bized.ac.uk/dataserv/extel/notes/l

tl-ex.htm

3

4

AO Learning outcomes Suggested Teaching activities Learning resources

issue of capital, or to know the

accounting requirements of the

Companies Acts.

Candidates need to be aware of

cumulative and non-cumulative

preference shares. They are not

required to have an awareness of

deferred, founders, participating,

redeemable or A shares, rights

issues, bonus issues, share premium

or capital redemption reserve.

direct relevance.

Vous aimerez peut-être aussi

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- 0547 s06 TN 3Document20 pages0547 s06 TN 3mstudy123456Pas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- 0486 w09 QP 4Document36 pages0486 w09 QP 4mstudy123456Pas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- 0654 w04 Ms 6Document6 pages0654 w04 Ms 6mstudy123456Pas encore d'évaluation

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Literature (English) : International General Certificate of Secondary EducationDocument1 pageLiterature (English) : International General Certificate of Secondary Educationmstudy123456Pas encore d'évaluation

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Frequently Asked Questions: A/AS Level Sociology (9699)Document1 pageFrequently Asked Questions: A/AS Level Sociology (9699)mstudy123456Pas encore d'évaluation

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- 9694 s11 QP 21Document8 pages9694 s11 QP 21mstudy123456Pas encore d'évaluation

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- 9694 w10 QP 23Document8 pages9694 w10 QP 23mstudy123456Pas encore d'évaluation

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- English Language: PAPER 1 Passages For CommentDocument8 pagesEnglish Language: PAPER 1 Passages For Commentmstudy123456Pas encore d'évaluation

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- 9693 s12 QP 2Document12 pages9693 s12 QP 2mstudy123456Pas encore d'évaluation

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- University of Cambridge International Examinations General Certificate of Education Advanced LevelDocument2 pagesUniversity of Cambridge International Examinations General Certificate of Education Advanced Levelmstudy123456Pas encore d'évaluation

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- 8780 w12 QP 1Document16 pages8780 w12 QP 1mstudy123456Pas encore d'évaluation

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- 8693 English Language: MARK SCHEME For The October/November 2009 Question Paper For The Guidance of TeachersDocument4 pages8693 English Language: MARK SCHEME For The October/November 2009 Question Paper For The Guidance of Teachersmstudy123456Pas encore d'évaluation

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- 9719 SPANISH 8685 Spanish Language: MARK SCHEME For The May/June 2009 Question Paper For The Guidance of TeachersDocument3 pages9719 SPANISH 8685 Spanish Language: MARK SCHEME For The May/June 2009 Question Paper For The Guidance of Teachersmstudy123456Pas encore d'évaluation

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- 8679 w04 ErDocument4 pages8679 w04 Ermstudy123456Pas encore d'évaluation

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- First Language Spanish: Paper 8665/22 Reading and WritingDocument6 pagesFirst Language Spanish: Paper 8665/22 Reading and Writingmstudy123456Pas encore d'évaluation

- Dpa20033 Chapter 1Document31 pagesDpa20033 Chapter 1King Fernandez100% (1)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Accounting IG Section 1.1 The Fundamentals of Accounting Section 1.2 The Accounting EquationDocument7 pagesAccounting IG Section 1.1 The Fundamentals of Accounting Section 1.2 The Accounting EquationJuné MaraisPas encore d'évaluation

- Bba SyllabusDocument19 pagesBba SyllabusamitpriyashankarPas encore d'évaluation

- Balance of Payments AccountingDocument20 pagesBalance of Payments AccountingWilly AndersonPas encore d'évaluation

- Report of Collections and Deposit orDocument2 pagesReport of Collections and Deposit orLILIBETH BACUDPas encore d'évaluation

- Accounting MaterialDocument161 pagesAccounting MaterialMithun Nair MPas encore d'évaluation

- Clerk 2019 Main PaperDocument29 pagesClerk 2019 Main PaperSaifi KhanPas encore d'évaluation

- Accounting 100 First ChapterDocument9 pagesAccounting 100 First ChapterMarjon VillanuevaPas encore d'évaluation

- Tally Erp 9.0 Material Sample Reports in Tally - Erp 9Document150 pagesTally Erp 9.0 Material Sample Reports in Tally - Erp 9Raghavendra yadav KMPas encore d'évaluation

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Accounting Fundamentals: Oubs023114, Oubs002111, Oubs003111, Oubs022111 Oubs009111, Oubs010113, Oubs008111, Oubs0021113Document113 pagesAccounting Fundamentals: Oubs023114, Oubs002111, Oubs003111, Oubs022111 Oubs009111, Oubs010113, Oubs008111, Oubs0021113Valérie CamanguePas encore d'évaluation

- Accountancy (Code No.055) : Class-XI (2020-21)Document8 pagesAccountancy (Code No.055) : Class-XI (2020-21)ALAQMARRAJPas encore d'évaluation

- Investment Advisory Business Plan TemplateDocument22 pagesInvestment Advisory Business Plan TemplatesolomonPas encore d'évaluation

- Solution Manual For Microeconomics 15th Canadian Edition Campbell R Mcconnell Stanley L Brue Sean Masaki Flynn Tom BarbieroDocument34 pagesSolution Manual For Microeconomics 15th Canadian Edition Campbell R Mcconnell Stanley L Brue Sean Masaki Flynn Tom Barbierowisardspoliate.ybjnr100% (47)

- JKSSB Finance SyllabusDocument4 pagesJKSSB Finance Syllabusangel arushiPas encore d'évaluation

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- HA3032 AuditingDocument9 pagesHA3032 AuditingAayam SubediPas encore d'évaluation

- Feedback: Not Answered Marked Out of 1.00Document30 pagesFeedback: Not Answered Marked Out of 1.00Mark John Paul CablingPas encore d'évaluation

- 663 Chemical TechnologyDocument28 pages663 Chemical TechnologyAnonymous okVyZFmqqXPas encore d'évaluation

- Fundamentals of AccountingDocument73 pagesFundamentals of AccountingCarmina Dongcayan100% (2)

- Auditing Book Gobind Kumar JhaDocument145 pagesAuditing Book Gobind Kumar Jhabinay chaudharyPas encore d'évaluation

- MMPC004 Book PDFDocument422 pagesMMPC004 Book PDFShivam ShivamPas encore d'évaluation

- Study Note 3, Page 148-196Document49 pagesStudy Note 3, Page 148-196samstarmoonPas encore d'évaluation

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Guidelines For The Administration of School FinancesDocument27 pagesGuidelines For The Administration of School FinancesLeilani RomaniaPas encore d'évaluation

- REVIEWER AACA (Midterm)Document15 pagesREVIEWER AACA (Midterm)cynthia karylle natividadPas encore d'évaluation

- Reviewer For Bookkeeping NCIIIDocument18 pagesReviewer For Bookkeeping NCIIIAngelica Faye95% (20)

- FA - FFA Syllabus and Study Guide 2020-21 FINAL PDFDocument17 pagesFA - FFA Syllabus and Study Guide 2020-21 FINAL PDFShah SujitPas encore d'évaluation

- Suspense Accounts and Error Correction Are Popular Topics For Examiners Because They Test Understanding of Bookkeeping Principles So WellDocument12 pagesSuspense Accounts and Error Correction Are Popular Topics For Examiners Because They Test Understanding of Bookkeeping Principles So WellocalmaviliPas encore d'évaluation

- (Revised) Officer of Bank Financial Institution AffidavitDocument1 page(Revised) Officer of Bank Financial Institution Affidavitin1or100% (8)

- Acc117 Test 2 Jan2023 - Tapah BRS SSDocument2 pagesAcc117 Test 2 Jan2023 - Tapah BRS SSNajmuddin Azuddin100% (1)

- SOL Financial Accounting Unit I-V PDFDocument242 pagesSOL Financial Accounting Unit I-V PDFshiv - aayPas encore d'évaluation

- ABM FABM1 AIRs LM Q4-M9 AdustingEntriesOfServiceBusDocument19 pagesABM FABM1 AIRs LM Q4-M9 AdustingEntriesOfServiceBusKarl Vincent DulayPas encore d'évaluation

- Getting to Yes: How to Negotiate Agreement Without Giving InD'EverandGetting to Yes: How to Negotiate Agreement Without Giving InÉvaluation : 4 sur 5 étoiles4/5 (652)