Académique Documents

Professionnel Documents

Culture Documents

G.R. No. 124520 August 18, 1997 - Nilo Cha, Et Al. v. Court of Appeals, Et Al.

Transféré par

Vanny Joyce Baluyut0 évaluation0% ont trouvé ce document utile (0 vote)

38 vues6 pagesNilo Cha, Et Al. v. Court of Appeals, Et Al.

Titre original

g.r. No. 124520 August 18, 1997 - Nilo Cha, Et Al. v. Court of Appeals, Et Al.

Copyright

© © All Rights Reserved

Formats disponibles

DOCX, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentNilo Cha, Et Al. v. Court of Appeals, Et Al.

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

38 vues6 pagesG.R. No. 124520 August 18, 1997 - Nilo Cha, Et Al. v. Court of Appeals, Et Al.

Transféré par

Vanny Joyce BaluyutNilo Cha, Et Al. v. Court of Appeals, Et Al.

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 6

FIRST DIVISION

[G.R. No. 124520. August 18, 1997.]

SPOUSES NILO CHA and STELLA UY CHA, and UNITED INSURANCE CO., INC., Petitioners, v.

COURT OF APPEALS and CKS DEVELOPMENT CORPORATION, Respondents.

D E C I S I O N

PADILLA, J.:

This petition for review on certiorari under Rule 45 of the Rules of Court seeks to set aside a decision

of respondent Court of Appeals.

The undisputed facts of the case are as follows:chanrob1es vi rtual 1aw li brary

1. Petitioner-spouses Nilo Cha and Stella Uy-Cha, as lessees, entered into a lease contract with private

respondent CKS Development Corporation (hereinafter CKS), as lessor, on 5 October 1988.cralawnad

2. One of the stipulations of the one (1) year lease contract states:jgc:chanrobles. com.ph

"18. . . . The LESSEE shall not insure against fire the chattels, merchandise, textiles, goods and effects

placed at any stall or store or space in the leased premises without first obtaining the written consent

and approval of the LESSOR. If the LESSEE obtain(s) the insurance thereof without the consent of the

LESSOR then the policy is deemed assigned and transferred to the LESSOR for its own benefit; . . ." 1

3. Notwithstanding the above stipulation in the lease contract, the Cha spouses insured against loss by

fire their merchandise inside the leased premises for Five Hundred Thousand (P500,000.00) with the

United Insurance Co., Inc. (hereinafter United) without the written consent of private respondent CKS.

4. On the day that the lease contract was to expire, fire broke out inside the leased premises.

5. When CKS learned of the insurance earlier procured by the Cha spouses (without its consent), it

wrote the insurer (United) a demand letter asking that the proceeds of the insurance contract

(between the Cha spouses and United) be paid directly to CKS, based on its lease contract with the

Cha spouses.

6. United refused to pay CKS. Hence, the latter filed a complaint against the Cha spouses and United.

7. On 2 June 1992, the Regional Trial Court, Branch 6, Manila, rendered a decision * ordering therein

defendant United to pay CKS the amount of P335,063.11 and defendant Cha spouses to pay

P50,000.00 as exemplary damages, P20,000.00 as attorneys fees and costs of suit.

8. On appeal, respondent Court of Appeals in CA GR CV No. 39328 rendered a decision ** dated 11

January 1996, affirming the trial court decision, deleting however the awards for exemplary damages

and attorneys fees. A motion for reconsideration by United was denied on 29 March 1996.

In the present petition, the following errors are assigned by petitioners to the Court of Appeals:chanrob1es virtual 1aw library

I

THE HONORABLE COURT OF APPEALS ERRED IN FAILING TO DECLARE THAT THE STIPULATION IN

THE CONTRACT OF LEASE TRANSFERRING THE PROCEEDS OF THE INSURANCE TO RESPONDENT IS

NULL AND VOID FOR BEING CONTRARY TO LAW, MORALS AND PUBLIC POLICY.

II

THE HONORABLE COURT OF APPEALS ERRED IN FAILING TO DECLARE THE CONTRACT OF LEASE

ENTERED INTO AS A CONTRACT OF ADHESION AND THEREFORE THE QUESTIONABLE PROVISION

THEREIN TRANSFERRING THE PROCEEDS OF THE INSURANCE TO RESPONDENT MUST BE RULED OUT

IN FAVOR OF PETITIONER.

III

THE HONORABLE COURT OF APPEALS ERRED IN AWARDING PROCEEDS OF AN INSURANCE POLICY

TO APPELLEE WHICH IS NOT PRIVY TO THE SAID POLICY IN CONTRAVENTION OF THE INSURANCE

LAW.

IV

THE HONORABLE COURT OF APPEALS ERRED IN AWARDING PROCEEDS OF AN INSURANCE POLICY

ON THE BASIS OF A STIPULATION WHICH IS VOID FOR BEING WITHOUT CONSIDERATION AND FOR

BEING TOTALLY DEPENDENT ON THE WILL OF THE RESPONDENT CORPORATION. 2

The core issue to be resolved in this case is whether or not the aforequoted paragraph 18 of the lease

contract entered into between CKS and the Cha spouses is valid insofar as it provides that any fire

insurance policy obtained by the lessee (Cha spouses) over their merchandise inside the leased

premises is deemed assigned or transferred to the lessor (CKS) if said policy is obtained without the

prior written consent of the latter.

It is, of course, basic in the law on contracts that the stipulations contained in a contract cannot be

contrary to law, morals, good customs, public order or public policy. 3

Sec. 18 of the Insurance Code provides:jgc:chanrobles.com.ph

"Sec. 18. No contract or policy of insurance on property shall be enforceable except for the benefit of

some person having an insurable interest in the property insured."cralaw virtua1aw l ibrary

A non-life insurance policy such as the fire insurance policy taken by petitioner-spouses over their

merchandise is primarily a contract of indemnity. Insurable interest in the property insured must exist

at the time the insurance takes effect and at the time the loss occurs. 4 The basis of such requirement

of insurable interest in property insured is based on sound public policy: to prevent a person from

taking out an insurance policy on property upon which he has no insurable interest and collecting the

proceeds of said policy in case of loss of the property. In such a case, the contract of insurance is a

mere wager which is void under Section 25 of the Insurance Code, which provides:jgc:chanrobles.com.ph

"Section 25. Every stipulation in a policy of Insurance for the payment of loss whether the person

insured has or has not any interest in the property insured, or that the policy shall be received as

proof of such interest, and every policy executed by way of gaming or wagering, is void."cralaw virtua1aw library

In the present case, it cannot be denied that CKS has no insurable interest in the goods and

merchandise inside the leased premises under the provisions of Section 17 of the Insurance Code

which provide:jgc:chanrobles.com.ph

"Section 17. The measure of an insurable interest in property is the extent to which the insured might

be damnified by loss of injury thereof."cralaw vi rtua1aw library

Therefore, respondent CKS cannot, under the Insurance Code a special law be validly a

beneficiary of the fire insurance policy taken by the petitioner-spouses over their merchandise. This

insurable interest over said merchandise remains with the insured, the Cha spouses. The automatic

assignment of the policy to CKS under the provision of the lease contract previously quoted is void for

being contrary to law and/or public policy. The proceeds of the fire insurance policy thus rightfully

belong to the spouses Nilo Cha and Stella Uy-Cha (herein co-petitioners). The insurer (United) cannot

be compelled to pay the proceeds of the fire insurance policy to a person (CKS) who has no insurable

interest in the property insured.

The liability of the Cha spouses to CKS for violating their lease contract in that the Cha spouses

obtained a fire insurance policy over their own merchandise, without the consent of CKS, is a separate

and distinct issue which we do not resolve in this case.chanroblesvi rtuallawl ibrary

WHEREFORE, the decision of the Court of Appeals in CA-G.R. CV No. 39328 is SET ASIDE and a new

decision is hereby entered, awarding the proceeds of the fire insurance policy to petitioners Nilo Cha

and Stella Uy-Cha.

SO ORDERED.

Bellosillo, Vitug, Kapunan and Hermosisima, Jr., JJ., concur.

Endnotes:

1. Rollo, p. 50.

* Penned by Judge Roberto M. Lagman.

** Penned by Justice Conchita Carpio-Morales with Justice Fidel P. Purisima and Fermin A. Matin, Jr., concurring.

2. Rollo, p. 18.

3. Article 1409(i), Civil Code.

4. Section 19, Insurance Code.

Spouses Cha v Court of Appeals227 SCRA 690

PADILLA, J

Facts:

Spouses Nilo Cha and Stella Uy-Cha, as lessees, entered into a lease contract with CKS Development

Corporation (CKS), as lessor. One of the stipulations of the one (1) year lease contract states:

"18. . . . The LESSEE shall not insure against fire the chattels, merchandise, textiles, goods and effects

placed at any stall or store or space in the leased premises without first obtaining the written consent

and approval of the LESSOR. If the LESSEE obtain(s) the insurance thereof without the consent of the

LESSOR then the policy is deemed assigned and transferred to the LESSOR for its own benefit; . . ."

Notwithstanding the above stipulation, the Cha spouses insured against loss by fire their merchandise

inside the leased premises for Five Hundred Thousand (P500,000.00) with the United Insurance without

the written consent CKS. On the day that the lease contract was to expire, fire broke out inside the

leased premises. When CKS learned of the insurance earlier procured by the Cha spouses (without its

consent), it wrote the United a demand letter asking that the proceeds of the insurance contract

(between the Cha spouses and United) be paid directly to CKS, based on its lease contract with the Cha

spouses. United refused to pay CKS, alleging that the latter had no insurable interest. Hence, the latter

filed a complaint against the Cha spouses and United.

Issue:

Whether or not CKS can claim the proceeds of the fire insurance.

Ruling:

NO. CKS has no insurable interest.

Sec. 18 of the Insurance Code provides:

"Sec. 18. No contract or policy of insurance on property shall be enforceable except for the benefit of

some person having an insurable interest in the property insured."

A non-life insurance policy such as the fire insurance policy taken by petitioner-spouses over their

merchandise is primarily a contract of indemnity. Insurable interest in the property insured must exist at

the time the insurance takes effect and at the time the loss occurs. The basis of such requirement of

insurable interest in property insured is based on sound public policy: to prevent a person from taking

out an insurance policy on property upon which he has no insurable interest and collecting the proceeds

of said policy in case of loss of the property. In the present case, it cannot be denied that CKS has no

insurable interest in the goods and merchandise inside the leased premises under the provisions of

Section 17 of the Insurance Code which provide:

"Section 17. The measure of an insurable interest in property is the extent to which the insured might be

damnified by loss of injury thereof."

Vous aimerez peut-être aussi

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Youth Amba 2014 Application Form FinalDocument2 pagesYouth Amba 2014 Application Form FinalVanny Joyce BaluyutPas encore d'évaluation

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Insular Life Assurance Co., Ltd. v. Serafin D. Feliciano, Et Al. - 074 Phil 468Document8 pagesInsular Life Assurance Co., Ltd. v. Serafin D. Feliciano, Et Al. - 074 Phil 468Vanny Joyce BaluyutPas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (894)

- Election LawDocument47 pagesElection LawVanny Joyce BaluyutPas encore d'évaluation

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

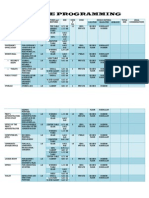

- Space ProgrammingDocument4 pagesSpace ProgrammingVanny Joyce Baluyut0% (1)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Quick Reference AutoCad2002Document6 pagesQuick Reference AutoCad2002Vanny Joyce BaluyutPas encore d'évaluation

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- What Is CARPDocument23 pagesWhat Is CARPVanny Joyce BaluyutPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Coconut Fibered Green AsphaltDocument19 pagesCoconut Fibered Green AsphaltVanny Joyce BaluyutPas encore d'évaluation

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- IV AsphaltDocument10 pagesIV AsphaltVanny Joyce BaluyutPas encore d'évaluation

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Barcenas Et Al.Document13 pagesBarcenas Et Al.Vanny Joyce BaluyutPas encore d'évaluation

- R.A. 8550 - FisheriesDocument27 pagesR.A. 8550 - FisheriesVanny Joyce BaluyutPas encore d'évaluation

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Dolphins Main IdeaDocument2 pagesDolphins Main IdeaVanny Joyce Baluyut100% (1)

- Anti TraffickingDocument6 pagesAnti TraffickingVanny Joyce BaluyutPas encore d'évaluation

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- CADTDocument24 pagesCADTVanny Joyce Baluyut100% (1)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- 2143 4646 1 PBDocument19 pages2143 4646 1 PBjayrenzo26Pas encore d'évaluation

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- Chainsaw ActDocument12 pagesChainsaw ActolofuzyatotzPas encore d'évaluation

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Broken VowDocument1 pageBroken VowVanny Joyce BaluyutPas encore d'évaluation

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- RA 7277 - Magna Carta of Disabled PersonsDocument18 pagesRA 7277 - Magna Carta of Disabled PersonsVanny Joyce Baluyut100% (3)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- Economics WomenDocument3 pagesEconomics WomenVanny Joyce BaluyutPas encore d'évaluation

- UST GN 2011 Criminal Law ProperDocument262 pagesUST GN 2011 Criminal Law ProperLariza AidiePas encore d'évaluation

- Bill of Rights Reviewer FullDocument31 pagesBill of Rights Reviewer Fullroansalanga100% (21)

- Philamcare Health Systems, Inc., Petitioner, vs. Court of Appeals and Julita TrinosDocument4 pagesPhilamcare Health Systems, Inc., Petitioner, vs. Court of Appeals and Julita TrinosClaudine Christine A VicentePas encore d'évaluation

- UST GN 2011 Political Law ProperDocument561 pagesUST GN 2011 Political Law ProperVanny Joyce BaluyutPas encore d'évaluation

- G.R. No. 47593 September 13, 1941 - The Insular Life Assurance Co. v. Serafin D. Feliciano, Et Al. - 073 Phil 201Document14 pagesG.R. No. 47593 September 13, 1941 - The Insular Life Assurance Co. v. Serafin D. Feliciano, Et Al. - 073 Phil 201Vanny Joyce BaluyutPas encore d'évaluation

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Insular Life Assurance Co., Ltd. v. Serafin D. Feliciano, Et Al. - 074 Phil 468Document8 pagesInsular Life Assurance Co., Ltd. v. Serafin D. Feliciano, Et Al. - 074 Phil 468Vanny Joyce BaluyutPas encore d'évaluation

- G.R. No. 92492 June 17, 1993 - Thelma Vda. de Canilang v. Court of Appeals, Et Al.Document11 pagesG.R. No. 92492 June 17, 1993 - Thelma Vda. de Canilang v. Court of Appeals, Et Al.Vanny Joyce BaluyutPas encore d'évaluation

- The Devastating Impact of Typhoon Yolanda in the PhilippinesDocument2 pagesThe Devastating Impact of Typhoon Yolanda in the PhilippinesVanny Joyce BaluyutPas encore d'évaluation

- Ordinance No. 506: An Ordinance Providing Guidelines For The Implementation of Ordinance No. 501Document10 pagesOrdinance No. 506: An Ordinance Providing Guidelines For The Implementation of Ordinance No. 501Vanny Joyce BaluyutPas encore d'évaluation

- Hedingham CastleDocument4 pagesHedingham CastleVanny Joyce BaluyutPas encore d'évaluation

- Cases of Insurable InterestDocument10 pagesCases of Insurable InterestVanny Joyce BaluyutPas encore d'évaluation

- Cle grADE 8Document88 pagesCle grADE 8JenMarlon Corpuz AquinoPas encore d'évaluation

- J. Bersamin - Legal Ethics PDFDocument46 pagesJ. Bersamin - Legal Ethics PDFLeslie Javier BurgosPas encore d'évaluation

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- 8.) Spouses Salvador Abella and Alma Abella Petitioners VS Spouses Romeo Abella and Annie Abella RespondentsDocument14 pages8.) Spouses Salvador Abella and Alma Abella Petitioners VS Spouses Romeo Abella and Annie Abella RespondentsJarvin David ResusPas encore d'évaluation

- Neeco I VS ErcDocument2 pagesNeeco I VS Ercangelsu04Pas encore d'évaluation

- Anjuman-I-Islam's Barrister A. R. Antulay College of Law F.Y. LL.B 2019-2020 Subject: Law of CrimesDocument7 pagesAnjuman-I-Islam's Barrister A. R. Antulay College of Law F.Y. LL.B 2019-2020 Subject: Law of CrimesAshish Bansode0% (1)

- Muslim Personal Law Shariat Application Act 1937Document3 pagesMuslim Personal Law Shariat Application Act 1937Rasel Hossen100% (1)

- The Law of Contract in South Africa: Fifth EditionDocument9 pagesThe Law of Contract in South Africa: Fifth Editionrayzvomuya063Pas encore d'évaluation

- Petitioners Vs Vs Respondents Siguion Reyna, Montecillo & Ongsiako San Jose, Enriquez, LagasDocument9 pagesPetitioners Vs Vs Respondents Siguion Reyna, Montecillo & Ongsiako San Jose, Enriquez, LagasdingPas encore d'évaluation

- Juvenile DelinquencyDocument18 pagesJuvenile DelinquencySUFIYAN SIDDIQUIPas encore d'évaluation

- Richard Reynolds RulingDocument57 pagesRichard Reynolds RulingHartford CourantPas encore d'évaluation

- Matalam V Sandiganbayan - JasperDocument3 pagesMatalam V Sandiganbayan - JasperJames LouPas encore d'évaluation

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Conciliation: About The Conciliation ProcessDocument2 pagesConciliation: About The Conciliation ProcessSuleimanRajabuPas encore d'évaluation

- CAR Court Had Exclusive Jurisdiction in Agrarian CaseDocument1 pageCAR Court Had Exclusive Jurisdiction in Agrarian CaseChristopher AdvinculaPas encore d'évaluation

- Public Notice Re CBD 12-12-18Document4 pagesPublic Notice Re CBD 12-12-18TheCullmanTribunePas encore d'évaluation

- Act 593 - Criminal Procedure Code (CPC)Document348 pagesAct 593 - Criminal Procedure Code (CPC)putihatauhitamPas encore d'évaluation

- Worksheet 4 (Non-Fatal Offences Against The Person) : Fagan V Metropolitan Police Commissioner (1969) EW 582Document14 pagesWorksheet 4 (Non-Fatal Offences Against The Person) : Fagan V Metropolitan Police Commissioner (1969) EW 582Tevin PinnockPas encore d'évaluation

- Land Association Dispute Ruling UpheldDocument19 pagesLand Association Dispute Ruling UpheldRegienald BryantPas encore d'évaluation

- Republic of the Philippines Supreme Court ruling on election disqualificationDocument22 pagesRepublic of the Philippines Supreme Court ruling on election disqualificationValen Grace MalabagPas encore d'évaluation

- 05 Amadora v. CADocument14 pages05 Amadora v. CAAndrew GallardoPas encore d'évaluation

- LICENCEDocument2 pagesLICENCEAbuzarPas encore d'évaluation

- Master Services Agreement GeneralDocument8 pagesMaster Services Agreement GeneralZia KhanPas encore d'évaluation

- IPay Clearing Services Private Limited V ICICI Bank LimitedDocument21 pagesIPay Clearing Services Private Limited V ICICI Bank LimitedArunjeet SinghPas encore d'évaluation

- 7 Geduspan - v. - People20210424-14-195fz0aDocument5 pages7 Geduspan - v. - People20210424-14-195fz0aCharisse SaratePas encore d'évaluation

- 2 (3) III Punjab Universities and Board of Intermediate and Secondary Education Malpractice Act 1950Document2 pages2 (3) III Punjab Universities and Board of Intermediate and Secondary Education Malpractice Act 1950HAMMAD raza0% (1)

- Ficep v. VoortmanDocument5 pagesFicep v. VoortmanPriorSmartPas encore d'évaluation

- TADA-Ramdas Nayak Murder Case.Document28 pagesTADA-Ramdas Nayak Murder Case.api-19981421Pas encore d'évaluation

- Quinagoran V CA. GR 155179. Aug 24 2007Document2 pagesQuinagoran V CA. GR 155179. Aug 24 2007Raymond Adrian Padilla ParanPas encore d'évaluation

- 04 Del Val v. Del ValDocument1 page04 Del Val v. Del ValBasil MaguigadPas encore d'évaluation

- 1987 Remedial Law Bar QuestionsDocument6 pages1987 Remedial Law Bar QuestionsJc GalamgamPas encore d'évaluation

- Permiten A Raphy Pina Que Vaya Al Cumpleaños de Su HijaDocument3 pagesPermiten A Raphy Pina Que Vaya Al Cumpleaños de Su HijaMetro Puerto RicoPas encore d'évaluation