Académique Documents

Professionnel Documents

Culture Documents

Ensions Enefits Razil: Who, What, When?

Transféré par

Eder Carvalhaes da Costa e SilvaTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Ensions Enefits Razil: Who, What, When?

Transféré par

Eder Carvalhaes da Costa e SilvaDroits d'auteur :

Formats disponibles

November 2, 2009

Volume 1, Issue 1

P ENSIONS & B ENEFITS - B RAZIL

Powered by NKL2

Who, what, when? I NSIDE T HIS I SSUE

Who, what, when? 1

NKL2 is a Brazilian firm providing companies with Lower pensions benefits? 1

benefits consulting and insurance brokerage Corporate health plans 2

Insured Plans – Fees and Returns 2

services. We are specialized in retirement plans,

What is this picture of? 3

health programs and group life insurance. Our

Pension fund costs to increase in 2010 3

target clients are mid-sized multinational

Economic Insight 5

companies, with a workforce ranging from 100 to

1,000 employees in Brazil.

We have world-class quality services and vast Our main goal is to help your company to obtain and

expertise aiding multinational companies to maintain profitable operations in Brazil. If you are

better understand the local environment, market reading this first issue, you will be following our steps

practices and the main challenges posted to from the very beginning. We hope you enjoy our style

human resources and benefits management. and we are confident that our articles will be valuable

to you.

Pensions & Benefits – Brazil is a newsletter

intended to bring to you, every other month, Your insights, suggestions, comments and opinions are

information and news about what’s happening in welcome. Thanks for the privilege of having you as a

the benefits arena in the country. reader.

The editor.

Lower pensions benefits?

By Eder Costa e Silva

Asset management fees are usually deducted from

It’s market practice in Brazil for employers to pay

the returns on investments. On defined

for the total administrative costs of private

contribution programs, offsetting fees directly

retirement programs offered to its employees.

from investment returns means, in the long run,

Companies usually credit a specific monthly

lower benefits for employees.

contribution to the plan intended to provide for

the administrative costs. Administrative costs

According to recent regulations pension funds,

include services such as recordkeeping, benefits,

which in Brazil are known as Closed Private

payroll administration, toll free numbers and

Pension Entities and are similar to US’ trustee

Internet services. The specific contribution paid by

funds, will be allowed to pay not only the asset

the sponsor company for administrative services

management services through deductions from

comes out of the company’s cash flow.

Please see …pensions benefits? on page 4

Page 2 Pensions & Benefits - Brazil

Corporate health plans

By Eder Costa e Silva

It’s reasonably common in Brazil for small and

sometimes even for mid-sized companies to hire

Medical symbol

its top executives and high management as third

party contractors as opposed to having them on

the payroll as regular employees. This practice

poses labor risks to employers, but many statutory directors are entitled to participate in

companies consider the greater profitability worth the company’s health program. In other words,

the risk. A recent regulation brings new challenges the health plan will no longer be extended to

to such companies. According to Article 5th of contractors. Together with Normative

Normative Resolution # 195/09 published last July Resolution # 200/09, as of August 31, 2009,

by the Brazilian National Supplementary Health the new rule is expected to increase the cost of

Agency (ANS-“Agência Nacional de Saúde company-provided health plans, specially for

Supmementar”) only regular employees and small and mid-sized employers.

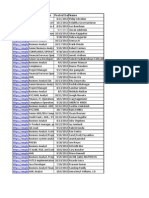

Insured Plans – Fees and Returns

By Eder Costa e Silva

The two main financial vehicles administering employer-sponsored retirement plans in Brazil are the

Closed Private Pension Entities - similar to the US’ trustee funds - and the Open Private Pensions

Entities - insurance companies specialized in administering retirement products. Most small and

medium-sized companies use Open Entities to manage their corporate pension programs. This section

of Pensions & Benefits – Brazil will be dedicated to track the investment returns and asset

management fees of the main funds offered by insured plans in Brazil.

ASSET MANAGEMENT FEES (1)

PRIVATE RETIREMENT FUNDS Min. Max. Mean Total Market (2)

Fixed Income (3)

0.10% 5.00% 1.71% 0.93%

Fixed Income – DI Reference (4)

0.36% 5.00% 1.68% 0.97%

Multimarket–Including Variable Income (5)

0.20% 5.00% 1.64% 1.46%

Multimarket-Balanced (6)

0.24% 4.00% 2.09% 2.22%

Please see Fees and Returns on page 5

“Returns on investments are

dropping very fast in Brazil due

to the historically low interest

rates while asset management

fees are still high, unable to

recognize the new

environment” Brazilian Currency

Pensions & Benefits - Brazil Page 3

What is this picture of?

By Rosa Clement

Guaraná is an Amazon fruit used to make a pleasant

and sweet commercial soda. It is a very popular drink

in the Amazon. The origin of this fruit is explained in

this folk tale: An Indian couple, belonging to the

Maués tribe, lived together for many years, always Picture of the Guaraná fruit

wishing that they could have a child. One day they from the Amazon jungle

asked their God, Tupã, to give them a child as a

present to complete their happiness. Tupã, the king

of the gods, knowing that the couple had good bit the boy, killing him instantly. The sad news

hearts, fulfilled their wish, bringing to them a spread quickly. At that moment, thunder echoed

beautiful boy. Time passed by quickly and the boy and a lightening bolt fell near the Indian longhouse.

grew up handsome, generous and kind. However, The mother, who was crying in despair, understood

Juruparí, the God of Darkness, felt an extreme envy that the thunder was a message from Tupã,

of the boy and the peace and happiness that he explaining that she should plant the child's eyes and

transmitted, and decided to end that blooming life. that from them a new plant would grow, yielding

One day the boy went to gather fruits in the forest tasty fruits. The Indians obeyed the mother's voice

and Juruparí decided that his vengeance time had and planted the boy's eyes. In that spot grew the

arrived. He transformed himself into a serpent and Guaraná tree, whose seeds are black, each with a

Please see What is this… page 4

Pension fund costs to increase in 2010

By Eder Costa e Silva

The Senate Committee on Economic Issues The TAFIC is expected to be quarterly according to

approved last October a new law bill submitted by 17 value brackets, ranging from R$ 15 to R$ 2.2

the Brazilian government creating the National million (US$ 8 to US$ 1.2 million), depending on

Supervisory Agency for Private Pensions dubbed the total assets managed by each retirement plan.

PREVIC, which will report to the Social Security The minimum R$ 15 tax will apply for retirement

Ministry. The new agency role will be to oversee plans whose assets total R$ 5 million (US$ 2.6

the activities of pension funds that are known in million) while plans holding assets over R$ 60

Brazil as Closed Private Pension Entities and are million (US$ 31.5 million) will have to pay the

similar to the US’ Trustee Funds. Currently the maximum R$ 2.2 million tax. The agency’s annual

SPC-Secretaria de Previdência Complementar, a budget, of R$ 29 million (US$ 15.2 million), will

structure under the Social Security Ministry, has count on other revenue sources such as money

the responsibility to supervise these funds. coming from fines applied over non-compliant

pension funds, federal budget, and third parties

The main revenue source of the new agency will be agreements.

a supervisory tax to be charged from pension

funds – the so called TAFIC – “Taxa de Fiscalização Over the years, the supervision of pension funds

e Controle da Previdência Complementar”. has experienced an increase in complexity and

Please see … funds’ costs on page 4

Page 4 Pensions & Benefits - Brazil

.…pensions benefits? from page 1

investment returns but also administrative that returns on investments are dropping very fast in

expenses. The recent regulations we referred to Brazil due to the historically low interest rates, and that

above are Resolutions CGPC # 28 and # 29 issued, asset management fees are still high unable to

respectively on Jan/26/2009 and Aug/31/2009. recognize the new environment. Transparency from

The government’s “Secretaria de Previdência retirement plans administrators will be necessary along

Complementar” was responsible for publishing with adopting that practice to avoid future claims

both. Many sponsor companies, pressured to coming from participants.

reduce costs, will opt to deduct from the

investments returns all administrative expenses of We will return to this subject at a later date.

their retirement plan. That shall happen in the

2010 fiscal year and companies need to be aware

…funds costs from page 3 comingled funds and are sponsored by banks, and

sophistication, requiring a wider, more Open Private Pension Entities, which are insurance

professional and, consequently, more expensive companies specialized in administering retirement

structure. The cost of all that structure is to fall products. Two Senate committees still need to analyze

on the sponsor companies’ shoulders since it is a the project before it becomes law. Experts seem to

market practice in Brazil for private companies to have no doubt that the project will pass and turn into

law before year-end.

fully pay the administrative costs of their

retirement plans. As a result, some small and

medium-sized pension funds have been If that really occurs, pension plans administered by

terminated and their retirement plans transferred Closed Entities will increase at the end of 2009 and for

to less costly financial vehicles such as the Multi- the full 2010 fiscal year.

Sponsored Pension Funds, that work as

What is this… from page 3

“Some small and medium- white aril around it that reminds one of a human eye.

Guara = human being na = similar, alike. It is easy to

sized pension funds have

find the basis for this myth. The fruit of the Guaraná

been terminated and their looks very much like an eyeball with a small dark seed

retirement plans transferred surrounded by white orbit. You can notice that in the

to less costly financial picture. Guaraná is most commonly encountered in a

popular Brazilian soft drink.

vehicles.”

Guaraná Antarctica in can

Pensions & Benefits - Brazil Page 5

Fees and Returns from page 2

RETURNS ON INVESTMENTS – SEPTEMBER/2009

PRIVATE RETIREMENT FUNDS Min. Max. Median Mean

Fixed Income (3)

0.2737% 3.1225% 0.6045% 0.6498%

Fixed Income – DI Reference (4)

0.2833% 0.6910% 0.6060% 0.5866%

Multimarket–Including Variable Income (5)

0.1967% 9.5328% 2.0423% 2.3322%

Multimarket - Balanced (6)

0.6772% 5.7614% 2.1325% 2.4487%

Source: ANBID (only funds with assets over R$ 1 Million around US$ 575,000)

RETURNS ON INVESTMENTS – 12 MONTHS (SEP/2008 TO SEP/2009)

PRIVATE RETIREMENT FUNDS Min. Max. Median Mean

Fixed Income (3)

3.3151% 21.1117% 7.1472% 7.4144%

Fixed Income – DI Reference (4)

3.8572% 7.6756% 6.7648% 6.6102%

Multimarket–Including Variable Income (5)

3.5832% 56.0892% 16.6514% 18.8154%

Multimarket – Balanced (6)

6.1523% 32.6939% 16.4530% 17.9402%

Source: ANBID (only funds with assets over R$ 1 million = US$ 575,000)

Notes:

(1) Disregarded funds with zero fees and those with flat rates established in reais (R$). Considered only fees charged as a

% of invested assets.

(2) Considers all industry of funds, including the private retirement funds as the PGBL, VGBL and FAPI.

(3) 80% min. asset allocation benchmarking federal government bonds or low credit risk investments. Leverage admitted.

(4) 95% min. allocation benchmarking the interest rate (SELIC) or the Interbank Certificates of Deposit (CDI)

(5) Asset allocation benchmark not disclosed. Admits fixed income investments, stocks etc. and can considered 100%

allocation in only one asset class. Leverage not allowed.

(6) Similar to the Multimarket – Including Variable Income type fund but has to disclose the asset allocation benchmark

and concentration in only one asset class is not allowed.

Economic Insight

EXCHANGE RATE

Last day Last Month Last year

US Dollar (US$) R$ 1.74 R$ 1.74 R$ 2.33

“The Brazilian

Euro (€R) R$ 2.56 R$ 2.56 R$ 3.23

Source: Central Bank (as of the last working day of the month\year) Central Bank

estimates a 0.1%

INFLATION

GDP growth for

Last month Year to date Last year 2009 and 4.8% for

IPCA Index 0,24% 3.21% 5.90% 2010”

Source: IBGE

MINIMUM WAGE

Last Month Last year Two years

Brazilian Real R$ 465.00 R$ 415.00 R$ 380.00

US Dollar US$ 267.24 US$ 178.11 US$ 214.69

Euros €R 181.64 €R 128.48 €R 146.15

Please see Economic… on page 6

Source: IBGE (variation are due to the exchange rate)

Page 6 Pensions & Benefits - Brazil

NKL2 Soluções

Economic… from page 5

Atuariais

Rua Porto Feliz 89

INTEREST RATE

Cajamar, SP - Brazil

07750-000 Last day Last year Two years

SELIC (annual) 8.75% 13.75% 11.18%

Phone: Source: Central Bank

+55 11 9624-0952

Fax: MACRO ECONOMICS

+55 11 4407-6062

Year to date Last year 12 months

E-Mail: GDP Growth -1.5% 5.08% 1.3%

Eder@nkl2.com.br Unemployment rate 8.4% 7.9% -0.2%

Your independent Source: Central Bank and IBGE

information source

Disclosures: The information in the sections Economic Insight and Insured

Retirement Plans – Fees and Returns has been derived from sources believed to

be accurate as of November 2009. It contains general information only on

Soon on the Web! economic matters and investments should not be considered as a comprehensive

statement on any matter and should not be relied upon as such. The information

You will visit us at:

it contains does not take account of any investor’s investment objectives,

www.nkl2.com.br

particular needs or financial situation and should not be relied upon as a

significant basis for an investment decision.

Note: The columns “Last Month” and “Year to date” on the Inflation and Macro

Economics’ tables were accrued until September/2009 (the most recent data

available).

Vous aimerez peut-être aussi

- CapAlt Risk Solutions Business Owners EditionD'EverandCapAlt Risk Solutions Business Owners EditionPas encore d'évaluation

- Ensions Enefits Razil: Same-Sex Private PensionsDocument6 pagesEnsions Enefits Razil: Same-Sex Private PensionsEder Carvalhaes da Costa e SilvaPas encore d'évaluation

- A Net Zero Pensions Guide For Sme: Make Your Money MatterDocument5 pagesA Net Zero Pensions Guide For Sme: Make Your Money MatterMake My Money MatterPas encore d'évaluation

- A Race Between Time and Money: Strategies for a Successful RetirementD'EverandA Race Between Time and Money: Strategies for a Successful RetirementPas encore d'évaluation

- Life Insurance in India - 4Document7 pagesLife Insurance in India - 4Himansu S MPas encore d'évaluation

- 2023 Colleague GuideDocument24 pages2023 Colleague GuideTiffany BarnesPas encore d'évaluation

- Ensions Enefits Razil: Same-Sex Health PlansDocument6 pagesEnsions Enefits Razil: Same-Sex Health PlansEder Carvalhaes da Costa e SilvaPas encore d'évaluation

- Understanding Your Options During CoronavirusDocument9 pagesUnderstanding Your Options During CoronavirusKhaja MohiddinPas encore d'évaluation

- Coronavirus Financial Support GuideDocument9 pagesCoronavirus Financial Support GuidePaulus BudiantoPas encore d'évaluation

- Build Financial Confidence: One of A Series of Papers On The Confident Retirement ApproachDocument9 pagesBuild Financial Confidence: One of A Series of Papers On The Confident Retirement ApproachBiki sahaPas encore d'évaluation

- The Broker Network Powerpoint 2019Document18 pagesThe Broker Network Powerpoint 2019api-325349652Pas encore d'évaluation

- Dunlapslk PresentationDocument18 pagesDunlapslk Presentationapi-325349652Pas encore d'évaluation

- Dividend Growth Investing: The Ultimate Investing Guide. Learn Effective Strategies to Create Passive Income for Your Future.D'EverandDividend Growth Investing: The Ultimate Investing Guide. Learn Effective Strategies to Create Passive Income for Your Future.Pas encore d'évaluation

- Coronavirus Financial Support GuideDocument9 pagesCoronavirus Financial Support GuideKatherine CiancioPas encore d'évaluation

- You Wouldn't Hike Without a Compass, Don't Buy Health Insurance Without This Book: Simplifying and Explaining Health VocabularyD'EverandYou Wouldn't Hike Without a Compass, Don't Buy Health Insurance Without This Book: Simplifying and Explaining Health VocabularyPas encore d'évaluation

- "Moment of Truth" For Canada's Banks - Victor Dodig Interview Part 2Document1 page"Moment of Truth" For Canada's Banks - Victor Dodig Interview Part 2GeniePas encore d'évaluation

- Copy of Study Guide For Final ExamDocument8 pagesCopy of Study Guide For Final ExamNoah MontgomeryPas encore d'évaluation

- 100 Business Ideas: Discover Home Business Ideas, Online Business Ideas, Small Business Ideas and Passive Income Ideas That Can Help You Start A Business and Achieve Financial FreedomD'Everand100 Business Ideas: Discover Home Business Ideas, Online Business Ideas, Small Business Ideas and Passive Income Ideas That Can Help You Start A Business and Achieve Financial FreedomÉvaluation : 2.5 sur 5 étoiles2.5/5 (2)

- Retirement Planning Guide Book: Steering you Through Crucial Choices to Shape Your Ideal Retirement SuccessD'EverandRetirement Planning Guide Book: Steering you Through Crucial Choices to Shape Your Ideal Retirement SuccessPas encore d'évaluation

- Bulletin 2010 JanDocument6 pagesBulletin 2010 JangmigukPas encore d'évaluation

- Quaid I Azam School of Management Sciences: Internship Report On Jubilee Family TakafulDocument40 pagesQuaid I Azam School of Management Sciences: Internship Report On Jubilee Family TakafulHamad Ur RehmanPas encore d'évaluation

- Understanding IUL's: Financial Tips From The ExpertsDocument2 pagesUnderstanding IUL's: Financial Tips From The Expertsjhuaman74897667% (3)

- Should Immediate Annuities Be a Tool in Your Retirement Planning Toolbox?D'EverandShould Immediate Annuities Be a Tool in Your Retirement Planning Toolbox?Pas encore d'évaluation

- StepUp AccountingForCorporateLifeInsurance en WebDocument3 pagesStepUp AccountingForCorporateLifeInsurance en WebRafael Renz DayaoPas encore d'évaluation

- Get Help Paying Your Medicare CostsDocument2 pagesGet Help Paying Your Medicare CostsdfdgfdfgfdfgPas encore d'évaluation

- The Real Retirement: Why You Could Be Better Off Than You Think, and How to Make That HappenD'EverandThe Real Retirement: Why You Could Be Better Off Than You Think, and How to Make That HappenÉvaluation : 5 sur 5 étoiles5/5 (2)

- International CompensationDocument3 pagesInternational CompensationGowtham ChinnuPas encore d'évaluation

- Insurance at A GlanceDocument9 pagesInsurance at A Glancesamay_khandelwalPas encore d'évaluation

- It's All About The Income: The Simple System for a Big RetirementD'EverandIt's All About The Income: The Simple System for a Big RetirementPas encore d'évaluation

- Tax Strategies for High Net-Worth Individuals: Save Money. Invest. Reduce Taxes.D'EverandTax Strategies for High Net-Worth Individuals: Save Money. Invest. Reduce Taxes.Évaluation : 5 sur 5 étoiles5/5 (1)

- Under The Radar How To Protect And Maintain Your Own Financial Fortress By Flying Under The RadarD'EverandUnder The Radar How To Protect And Maintain Your Own Financial Fortress By Flying Under The RadarPas encore d'évaluation

- Group Insurance ProductsDocument8 pagesGroup Insurance Productshamza omarPas encore d'évaluation

- Executive SummaryDocument56 pagesExecutive Summaryshwetachalke21Pas encore d'évaluation

- Compensation Report of National Bank LTDDocument16 pagesCompensation Report of National Bank LTDFarzana Rahman PuthiPas encore d'évaluation

- FintooDocument70 pagesFintoorakeshPas encore d'évaluation

- For LTC Protection Look To AnnuitiesDocument6 pagesFor LTC Protection Look To AnnuitiesMark HoustonPas encore d'évaluation

- OrionBiz Dec. 2009Document11 pagesOrionBiz Dec. 2009Sherman Publications, Inc.Pas encore d'évaluation

- How to Retire Early on Dividends: Dividend Growth Machine: Mastering the Art of Maximizing Returns Through Dividend InvestingD'EverandHow to Retire Early on Dividends: Dividend Growth Machine: Mastering the Art of Maximizing Returns Through Dividend InvestingPas encore d'évaluation

- Tax Free Wealth: Learn the strategies and loopholes of the wealthy on lowering taxes by leveraging Cash Value Life Insurance, 1031 Real Estate Exchanges, 401k & IRA InvestingD'EverandTax Free Wealth: Learn the strategies and loopholes of the wealthy on lowering taxes by leveraging Cash Value Life Insurance, 1031 Real Estate Exchanges, 401k & IRA InvestingPas encore d'évaluation

- How Much Life Insurance Do You Really NeedDocument4 pagesHow Much Life Insurance Do You Really NeedIshita AgrawalPas encore d'évaluation

- CommuniK 2004.V4.1 FeesDocument4 pagesCommuniK 2004.V4.1 FeesAlireza GoodarziPas encore d'évaluation

- Become Your Own BankerDocument3 pagesBecome Your Own BankerKpsikaPas encore d'évaluation

- Business Interruption: Coverage, Claims, and Recovery, 2nd EditionD'EverandBusiness Interruption: Coverage, Claims, and Recovery, 2nd EditionPas encore d'évaluation

- Economic, Business and Artificial Intelligence Common Knowledge Terms And DefinitionsD'EverandEconomic, Business and Artificial Intelligence Common Knowledge Terms And DefinitionsPas encore d'évaluation

- Robots, Dorks or Old Men: Finding the right financial advisor for YOU!D'EverandRobots, Dorks or Old Men: Finding the right financial advisor for YOU!Pas encore d'évaluation

- Flyer - Rating QV of Responsible Investments in The Brazilian Pension FundsDocument2 pagesFlyer - Rating QV of Responsible Investments in The Brazilian Pension FundsEder Carvalhaes da Costa e SilvaPas encore d'évaluation

- Ensions Enefits Razil: Same-Sex Health PlansDocument6 pagesEnsions Enefits Razil: Same-Sex Health PlansEder Carvalhaes da Costa e SilvaPas encore d'évaluation

- US and Brazil Search For The Right Risk Balance in A Global and Interdependent Economy - Sep2009 - Global ViewDocument8 pagesUS and Brazil Search For The Right Risk Balance in A Global and Interdependent Economy - Sep2009 - Global ViewEder Carvalhaes da Costa e SilvaPas encore d'évaluation

- Sales Presentation NKL2 EnglishDocument10 pagesSales Presentation NKL2 EnglishEder Carvalhaes da Costa e SilvaPas encore d'évaluation

- Intershi Report On Uttora Bank Ltd.Document114 pagesIntershi Report On Uttora Bank Ltd.Sirajul Islam Srabon100% (1)

- (9783110926583 - Legal Capital in Europe) The Future of Creditor Protection Through Capital Maintenance Rules in European Company Law An Economic PerspectiveDocument24 pages(9783110926583 - Legal Capital in Europe) The Future of Creditor Protection Through Capital Maintenance Rules in European Company Law An Economic PerspectiveRachel VelkinuPas encore d'évaluation

- Innovation and Markets - How Innovation Affects The Investing ProcessDocument21 pagesInnovation and Markets - How Innovation Affects The Investing Processpjs15Pas encore d'évaluation

- Introduction To Finacial Markets Final With Refence To CDSLDocument40 pagesIntroduction To Finacial Markets Final With Refence To CDSLShoumi Mahapatra100% (1)

- Retirement PlanningDocument27 pagesRetirement Planningvinodkp1947100% (1)

- BTRM BrochureDocument27 pagesBTRM BrochureSibabrata PanigrahiPas encore d'évaluation

- Economies of Scale HandoutDocument2 pagesEconomies of Scale HandoutrobtriniPas encore d'évaluation

- Corporate Reporting Manual Part 2 - Up To 2018Document774 pagesCorporate Reporting Manual Part 2 - Up To 2018Masum GaziPas encore d'évaluation

- Maximizing Firm Value Through Optimal Capital StructureDocument60 pagesMaximizing Firm Value Through Optimal Capital StructureSayeedMdAzaharulIslamPas encore d'évaluation

- Diagnostic Test General MathematicsDocument4 pagesDiagnostic Test General MathematicsMa Crestyl Tandugon Alcoser100% (1)

- The Wall Street Journal - 15 02 2022Document28 pagesThe Wall Street Journal - 15 02 2022Владислав ВойтенкоPas encore d'évaluation

- Company PerformanceDocument2 pagesCompany PerformanceZiaZuhdyPas encore d'évaluation

- Olbres NH SCT 1997Document6 pagesOlbres NH SCT 1997Chris BuckPas encore d'évaluation

- Partnership 2Document64 pagesPartnership 2Anis AlwaniPas encore d'évaluation

- Audit Group 5 (Investment Audit and Cash Balance)Document12 pagesAudit Group 5 (Investment Audit and Cash Balance)feny febbianiPas encore d'évaluation

- Strategic AllianceDocument5 pagesStrategic Alliancesuse2037Pas encore d'évaluation

- Review of Financial Analysis of HDFC BankDocument12 pagesReview of Financial Analysis of HDFC BankAnonymous jHWYI2Pas encore d'évaluation

- PHEI Yield Curve: Daily Fair Price & Yield Indonesia Government Securities January 31, 2022Document6 pagesPHEI Yield Curve: Daily Fair Price & Yield Indonesia Government Securities January 31, 2022inata takeshiPas encore d'évaluation

- The Essential Guide To Reinsurance Updated 2013Document51 pagesThe Essential Guide To Reinsurance Updated 2013dingdongbellsPas encore d'évaluation

- University of Mumbai Revised Syllabus for Financial Markets ProgramDocument20 pagesUniversity of Mumbai Revised Syllabus for Financial Markets Programshoaib8682Pas encore d'évaluation

- DatabaseDocument4 pagesDatabaseMikey MessiPas encore d'évaluation

- Ratio & RateDocument2 pagesRatio & RateWilliam RyandinataPas encore d'évaluation

- Chartered Institute of Stockbrokers Business Communication and EconomicsDocument11 pagesChartered Institute of Stockbrokers Business Communication and EconomicsejoghenetaPas encore d'évaluation

- Branches and Types of Accounting ActivitiesDocument19 pagesBranches and Types of Accounting ActivitiesYzzabel Denise L. TolentinoPas encore d'évaluation

- 21 Asian Terminals vs. First LepantoDocument9 pages21 Asian Terminals vs. First LepantoMichelle Montenegro - AraujoPas encore d'évaluation

- Florida Attorney General Fraudclosure Report - Unfair, Deceptive and Unconscionable Acts in Foreclosure CasesDocument98 pagesFlorida Attorney General Fraudclosure Report - Unfair, Deceptive and Unconscionable Acts in Foreclosure CasesForeclosure Fraud100% (12)

- Primary Dealer System - A Comparative StudyDocument5 pagesPrimary Dealer System - A Comparative Studyprateek.karaPas encore d'évaluation

- AGENCY PROBLEMS IN CORPORATE GOVERNANCE: Accountability of Managers and StockholdersDocument65 pagesAGENCY PROBLEMS IN CORPORATE GOVERNANCE: Accountability of Managers and Stockholdersrachellesg75% (12)

- FAC 320 Test 1 2022F With MemoDocument10 pagesFAC 320 Test 1 2022F With MemoNolan TitusPas encore d'évaluation