Académique Documents

Professionnel Documents

Culture Documents

Lehman vs. Microsoft

Transféré par

mahzari94Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Lehman vs. Microsoft

Transféré par

mahzari94Droits d'auteur :

Formats disponibles

Lehman vs.

Microsoft

Safa Mahzari

In order to further understand a companys underlying drivers an analyst may conduct a DuPont

Analysis. There are three ways a firm creates returns: profit margin, asset turnover, and leverage.

This example will compare 2007 SEC 10-K filings from Lehman Brothers Holdings Inc. to that

of Microsoft Corporation. First, the DuPont Formula will be introduced; next, the numbers for

Lehman and Microsoft will be prepared; and last, a brief comparison will be made.

DuPont Formula

Return on Equity = Return on Assets x Equity Multiplier

Return on Equity = (Profit Margin x Total Asset Turnover) x Equity Multiplier

To clarify, Return on Asset (ROA) is the product of Profit Margin (PM) multiplied by Total Asset

Turnover (TAT); they are used interchangeably in this paper

DuPont Analysis, Lehman 2007

ROE = (PM x TAT) x EM

ROE = (0.071 x 0.085) x 30.728

ROE = (0.006) x 30.728

ROE = 0.1844

ROE = 18.44%

The DuPont Analysis helps shed light on Lehmans business operations in 2007. With slim profit

margins and slow turnover, the firms Return on Asset (ROA) is only 0.6%. To compensate for

this, Lehman is leveraged at 30:1. Analysts often mistake leverage as a driver of returns; more

accurately, leverage is a driver of volatility. Leverage proportionally exaggerates both positive

and negative situations.

DuPont Analysis, Microsoft 2007

ROE = (PM x TAT) x EM

ROE = (0.275 x 0.809) x 2.031

ROE = (0.222) x 2.031

ROE = 0.4508

ROE = 45.08%

The Analysis for Microsoft unveils a completely different corporate structure. Microsoft has

much higher profit margins, nearly 28%, and nearly ten-times quicker asset turnover. This leads

to a ROA of 22.2%. With an ROA that is 37 times higher than Microsoft demonstrates how

MSFT can employs its assets more efficiently than Lehman. Microsofts advantage comes from

utilizing its intellectual property to drive returns in both the hardware and software industries.

Further, Microsoft is leveraged at a much safer 2:1 ratio. Lastly, it is important to remember that

Microsoft is one of only four private companies whose debt is rated AAA by Fitch Ratings.

Deconstructed DuPont Analysis

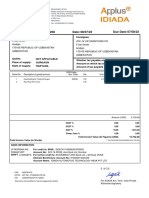

Table 1: Operations

Table 1 shows the operations of Lehman Brothers and Microsoft, and the difference between the

two companies. In addition to having an asset turnover that is nearly ten times faster, Microsoft

has a profit margin that is 287% higher than Lehman. This break down shows how Lehmans

operations were struggling in 2007.

Table 2: Financing

Table 2 shows how the firms management made financial decisions. The change from ROA to

ROE reflects the amount of leverage a company has taken on. The surprise is that Lehman is

leveraged 30:1. While this amount of leverage does raise their returns substantially, it is not a

sustainable business model. For comparisons sake, if Microsoft was as heavily leveraged as

Lehman Brothers, their ROE would be 682%.

Lehman Brothers Microsoft Delta

Profit Margin 0.071 0.275 (0.204)

Asset Turnover 0.085 0.809 (0.724)

Return on Assets 0.006 0.222 (0.216)

Lehman Brothers Microsoft Delta

Return on Assets 0.006 0.222 (0.216)

Equity Multiplier 30.728 2.031 28.697

Return on Equity 0.1844 0.4508 (0.2664)

Supplemental Data

Lehman Brothers Holdings Inc., reported in millions

Total Revenue: $59,003

Net Income: $4,192

Shareholders Equity: $22,490

Total Assets: $691,063

Source: http://www.sec.gov/Archives/edgar/data/806085/000110465908005476/a08-

3530_110k.htm

Microsoft Corporation, reported in millions

Total Revenue: $51,122

Net Income: $14,065

Shareholders Equity: $31,097

Total Assets: $63,171

Source: http://www.sec.gov/Archives/edgar/data/789019/000119312507170817/d10k.htm

Vous aimerez peut-être aussi

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- Customer Journey MappingDocument10 pagesCustomer Journey MappingpradieptaPas encore d'évaluation

- Answer Sheet - Docx ABC PARTNERSHIPDocument14 pagesAnswer Sheet - Docx ABC PARTNERSHIPCathy AluadenPas encore d'évaluation

- Auto Finance Industry AnalysisDocument15 pagesAuto Finance Industry AnalysisMitul SuranaPas encore d'évaluation

- Indian Securities Market ReviewDocument221 pagesIndian Securities Market ReviewSunil Suppannavar100% (1)

- VWB Case StudyDocument4 pagesVWB Case StudySamarth GargPas encore d'évaluation

- A Globalization and Public AdministrationDocument15 pagesA Globalization and Public AdministrationsemarangPas encore d'évaluation

- Digital - Marketing Notes On Bosch and Grainger Strategy Plan Final Problem Statement - CourseraDocument1 pageDigital - Marketing Notes On Bosch and Grainger Strategy Plan Final Problem Statement - CourseraSserunkuma MosesPas encore d'évaluation

- Ratio - Proportion - PercentDocument31 pagesRatio - Proportion - PercentRiyadh HaiderPas encore d'évaluation

- PM RN A4.Throughput CostingDocument5 pagesPM RN A4.Throughput Costinghow cleverPas encore d'évaluation

- ECO 120 Principles of Economics: Chapter 2: Theory of DEMAND and SupplyDocument30 pagesECO 120 Principles of Economics: Chapter 2: Theory of DEMAND and Supplyizah893640Pas encore d'évaluation

- My India in 2047Document3 pagesMy India in 2047Karttikeya Mangalam NemaniPas encore d'évaluation

- 2001 Parker Hannifin Annual ReportDocument46 pages2001 Parker Hannifin Annual ReportBill M.Pas encore d'évaluation

- New-Doing: How Strategic Use of Design Connects Business With PeopleDocument53 pagesNew-Doing: How Strategic Use of Design Connects Business With PeopleHernán Moya ArayaPas encore d'évaluation

- ALIGNINGDocument16 pagesALIGNINGgianlucaPas encore d'évaluation

- Barriers To Entry: Resilience in The Supply ChainDocument3 pagesBarriers To Entry: Resilience in The Supply ChainAbril GullesPas encore d'évaluation

- Canons of TaxationDocument2 pagesCanons of Taxationmadeeha_2475% (4)

- IINP222300238 JSC JV Homologation - 220714 - 110521Document1 pageIINP222300238 JSC JV Homologation - 220714 - 110521Gayrat KarimovPas encore d'évaluation

- Nov 19Document37 pagesNov 19kunal kumarPas encore d'évaluation

- Test Bank For Contemporary Labor Economics 9th Edition Campbell Mcconnell Full DownloadDocument9 pagesTest Bank For Contemporary Labor Economics 9th Edition Campbell Mcconnell Full Downloadkarenparrishsioqzcfndw100% (32)

- Pacific Oxygen Vs Central BankDocument3 pagesPacific Oxygen Vs Central BankAmmie AsturiasPas encore d'évaluation

- Capital Intensive Labor Intensive: Required: Determine The FollowingDocument2 pagesCapital Intensive Labor Intensive: Required: Determine The FollowingMahediPas encore d'évaluation

- Deed of Conditional Sale of Motor VehicleDocument1 pageDeed of Conditional Sale of Motor Vehicle4geniecivilPas encore d'évaluation

- Dataformatics IAPO - 81-76366 - 20191122 - 131616Document2 pagesDataformatics IAPO - 81-76366 - 20191122 - 131616Aseem TamboliPas encore d'évaluation

- Question On SFMDocument4 pagesQuestion On SFMjazzy123Pas encore d'évaluation

- Genjrl 1Document1 pageGenjrl 1Tiara AjaPas encore d'évaluation

- VAT ReportDocument32 pagesVAT ReportNoel Christopher G. BellezaPas encore d'évaluation

- Introduction To Macroeconomics (Eco 1102) C. Théoret Practice Exam #1 Answers On Last PageDocument19 pagesIntroduction To Macroeconomics (Eco 1102) C. Théoret Practice Exam #1 Answers On Last Pagerei makiikoPas encore d'évaluation

- CapitalCube - GBDC - GBDC US Company Reports - 4 PagesDocument4 pagesCapitalCube - GBDC - GBDC US Company Reports - 4 PagesSagar PatelPas encore d'évaluation

- Unit 12: MARKETING: Section 1: Reading Pre-Reading Tasks Discussion - Pair WorkDocument6 pagesUnit 12: MARKETING: Section 1: Reading Pre-Reading Tasks Discussion - Pair WorkChân ÁiPas encore d'évaluation

- McKinsey On Marketing Organizing For CRMDocument7 pagesMcKinsey On Marketing Organizing For CRML'HassaniPas encore d'évaluation