Académique Documents

Professionnel Documents

Culture Documents

Indian Real Estate Outlook and Regulatory Policies

Transféré par

John CarpenterCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Indian Real Estate Outlook and Regulatory Policies

Transféré par

John CarpenterDroits d'auteur :

Formats disponibles

Indian Real Estate:

An Outlook on

Industry Trends and

Regulatory Policies

2 On Point Indian Real Estate: An Outlook on Industry Trends and Regularity Policies On Point Indian Real Estate: An Outlook on Industry Trends and Regularity Policies 3

Foreword

Global meltdown, which led to changes in global economies, has paved its way.

While global economies are yet to fnd their way to stability, the Indian economy

has started its journey for growth. This growth is primarily attributable to proactive

steps taken by the Government.

As India gears itself to the growth path, the importance of real estate sector

becomes an area of utmost importance. Rapid urbanization and growing business

demands are some of the important factors, which are expected to drive real

estate demand in the nation.

Confederation of Real Estate Developers Association of India (CREDAI) is a

premier real estate organisation of more than 6000 organised private sector

developers and works closely with several

Central and State Government bodies. CREDAI also supports the Government in

its policies and programs.

Through this whitepaper, we have brought to the fore prevailing real estate

scenario with an outlook on 2011. We have also brought to the light various tax

and regulatory aspects under the changing tax regime.

We at CREDAI acknowledge the contribution of Jones Lang LaSalle (JLL) for

the chapters on Indian real estate sector scenario and the future outlook. We

acknowledge also the contribution of KPMG for the chapters on tax and regulatory

aspects relevant for the sector.

Sincerely,

Kumar Gera Santosh Rungta

Chairman, CREDAI President, CREDAI President, CREDAI

Indian Real Estate -

On a Comfortable Ground

It is a comfortable feeling to know that you stand on your own

ground. Land is about the only thing that cant fy away.

ANTHONY TROLLOPE, The Last Chronicle of Barset

After one and a half years of gradual consolidation, real estate

in India has fathomed its own comfortable ground, and is poised

at the right threshold to take a giant leap in years to come. While

a differential pace of strengthening is evident across sectors,

geographies and segments, several property market indicators point

to the fact that the industry has indeed bottomed out in the current

cycle. The fears of a possible double dip recovery have given way

to beliefs in the sustained healthy levels, if not a rapid growth. The

experience thus gained in this slowdown is invaluable and will serve

real estate strategists for years to come. The various stakeholders

in the entire supply chain the material manufacturers, developers,

property consultants, occupiers, investors and policy makers, have

all emerged stronger and primed than yesteryears.

And, if we have taken our lessons right, caution and diligence

would be the keywords for the industry in the medium term. On one

hand, the stakeholders cant afford to sway on the riding waves of

healthy demand, and lose the ground advantage that they have

so painfully regained by adapting to the rapidly changing business

environment. And on the other, the emerging opportunities should

be targeted with an unmatched fervor of potential and pragmatism.

The year 2011 would usher a new decade of opportunities for

Indian real estate, which will be a test of sorts for its stakeholders

between these two fringes of the fulcrum. And the winners would

be the ones who balance caution with diligence evaluating all the

potential opportunities with pragmatism.

It is a good thing to learn caution from the misfortune of others.

PUBILIUS SYRUS

4 On Point Indian Real Estate: An Outlook on Industry Trends and Regularity Policies On Point Indian Real Estate: An Outlook on Industry Trends and Regularity Policies 5

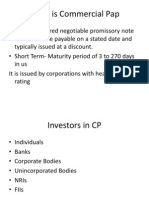

Outlook: Offce Real Estate

The commercial offce sector entered into a phase of gradual

recovery in 2010, when frms began charting their expansion

plans, strategically assessing the abundant real estate options

in the market. The rate of decline of property rates slowed down

considerably and was recorded to be stable across most of the

micro-markets by end of the year. Despite a rise in absorption

levels and stabilization of rents, construction delays have resulted

in the deferment of supply of offce projects across Indian cities.

However, upbeat over the tremendous response in the residential

sector, developers are increasingly focusing their energies on

execution and delivery of offce space, rather than launching new

ones. Outright purchases increased during the year, mostly by

offce occupiers who re-explored their exposure to real assets for

Source: Real Estate Intelligence Service (JLL), 2Q10

VALUE

DECLINING

VALUE

RISING

GROWTH

SLOWING

DECLINE

SLOWING

Bangalore

Pune & Chennai

Hyderabad

Kolkata

Hyderabad

Chennai

Bangalore

Kolkata

Mumbai

NCR Delhi

NCR Delhi

Mumbai

& NCR Delhi

2Q08

2Q10

2Q09

Mumbai

Bangalore

Pune

Chennai

Hyderabad

& Kolkata

3Q11F

STRATEGIC WINDOW OF

OPPORTUNITY

Offce rents to start appreciating after

mid-2011

The effect of strengthening absorption of offce space

in the past 3-4 quarters has already resulted in a

stabilisation of rental and capital values in most of the

markets. The period from 2Q10 to 3Q11 provides a

strategic window of opportunity for both buying and

leasing offce space, when both rental and capital

values are at their cyclical lows (Figure 1). Capital

values typically are a leading indicator and signs of

strengthening of capital values in selected micro-

markets have already been witnessed.

Several markets which were dormant during 2010

with respect to property rates will register an

appreciation in valuations. The prime markets of

Mumbai, Delhi and Bangalore are ahead in the

property cycle in terms of transactional volumes and

should be the frst to register rental growth in 2011.

However, the oversupplied suburban markets might

still feel the pressure of inadequate demand levels

and will be late to recover. Adequate volumes of offce

supply will keep hitting the markets every quarter,

keeping the segment interesting for occupiers as well

as investors.

Figure 1: Offce Property Clock and the Strategic Window of Opportunity

the accompanying benefts.

Overall, we believe that the year 2011 will be a strategic window

of opportunity for occupiers and investors, when rents and

capital values in most of the micro-markets would be at their

cyclical bottom and remain undervalued. Several markets have

already shown signs of steady revival in terms of strengthening of

demand for offce space as well as an increase in capital market

transactions.

The year 2011 should see more wealth being created across

industries in India, which will trickle down as demand for real

estate. We forecast the absorption of offce space across the top

seven cities of India to grow nearly 1.8 times from 19.6 million sq ft

recorded in 2009 to 35.7 million sq ft in 2011.

1

1

Unless mentioned, real estate fgures in the report are representative of the top seven cities (by population) of India Mumbai, NCR, Bangalore, Chennai, Kolkata, Pune

and Hyderabad.

Note: 1. IT projects include STPI registered units as well as other offce projects specially constructed

for IT/ITES occupiers.

2. IT SEZ projects include projects notifed under SEZ Act, 2005.

3. Size of bubble represents the total IT supply expected in various cities during 2010-2012.

Source: Real Estate Intelligence Service (JLL), 3Q10

Sustained traction for IT SEZ spaces

The announced sunset over the STPI regulations

on IT space has infuenced the demand scenario

for IT projects across cities. Healthy demand for IT

SEZ space was already visible in the second half of

2010, post the clarifcation in the Union Budget. The

revised Direct Tax Code, which also puts a deadline

to notifcation to SEZs in India, will have a signifcant

infuence on offce real estate in the coming years.

However, the traction for IT SEZ spaces is likely to

remain during 2011, as the deadline for notifying a

SEZ is March 2012 and operating out of the premises

is March 2014. Developers, who are planning to build

SEZs or have got approval for the same, should begin

the construction during to satisfy the March 2014

deadline for units to occupy spaces.

Among the Indian cities, Pune, Hyderabad, Chennai

and Kolkata have a balanced supply of IT and IT SEZ

projects. Mumbai, Bangalore and NCR-Delhi have

a larger supply of IT projects and relatively fewer IT

SEZ projects in pipeline (Figure 2).

Figure 2: IT and IT SEZ Projects Under Construction (As of 3Q10)

Source: Real Estate Intelligence Service (JLL), 3Q10

Proposed projects to begin construction

As of October 2010, a total of 88.2 million sq ft of

offce space is proposed in the top seven Indian

cities, supplemented by 161.1 million sq ft of offce

space that is under construction, implying that

they have broken ground but are yet to become

operational (Figure 3). In 2009 and 2010, developers

focused their attention and efforts in the execution

and delivery of projects that were under construction.

Increased confdence in the sector will ensure that

some of the proposed projects, which are lying

inactive, start witnessing construction activity and get

launched in the market during 2011.

Despite this, the focus would remain on execution and

delivery of ongoing projects.

Figure 3: Stages of Construction of Future Offce Supply (As of 3Q10)

Bangalore

Chennai

Hyderabad

Kolkata

Mumbai

NCR-Delhi

Pune

0.0

2.0

4.0

6.0

8.0

10.0

12.0

14.0

0.0 5.0 10.0 15.0 20.0 25.0

IT Supply Under Construction (million sq ft)

IT

S

E

Z

S

u

p

p

ly

U

n

d

e

r

C

o

n

s

tr

u

c

tio

n

(

m

illio

n

s

q

ft)

Ready for Fit-Outs

5%

Less than 50%

Structure Ready

17%

Proposed

35%

Excavation / Upto

Plinth

20%

50-100% Structure

Ready

23%

6 On Point Indian Real Estate: An Outlook on Industry Trends and Regularity Policies On Point Indian Real Estate: An Outlook on Industry Trends and Regularity Policies 7

Source: Real Estate Intelligence Service (JLL), 3Q10

More outright purchases by occupiers as

well as private equity players

As of 3Q10, a majority of the commercial markets in

India are undervalued relative to rental decline implied

by a greater decline in capital values than rental

values during 2Q08-2Q10. With this fundamental

attribute favouring purchase of offce properties, a rise

in the share of outright purchases has been witnessed

in the Indian market.

The share of outright purchases in total transactions

has increased from being 4-5% in 1H08 to 13-15%

in 2010 (Figure 4). This trend is likely to continue in

2011 as well, as several private equity funds as well

as occupiers evaluate the buy versus lease options

and look ahead towards acquisition of offce space at

reasonable capital values.

Figure 4: Share of Sale Transactions in Total Recorded Transactions (1H08-1H10)

Source: Real Estate Intelligence Service (JLL), 3Q10

Retroftting of prime locations

With several prime central locations of the cities

reeling under inadequate urban planning and

outmoded architectural standards, refurbishment of

offce projects is expected in Indian cities. We have

already witnessed instances of retroft during the

past 2-3 years and this is likely to continue as owners

and occupiers see value in up-gradation of their real

estate holdings into the investment grade category

(Figure 5). This will also imply an increased attention

towards sustainability, as the retroftting process

would upgrade the existing high energy consuming

facilities with better effcient projects.

Figure 5: Completed and Ongoing Instances of Refurbishment of Offce Space at

Prime Locations

Property Location

Expected

Completion

HT House - Press Building KG Marg, Delhi 2009

Prestige Delta Richmond Road, Bangalore 2010

Ashoka Raghupati Chambers Begumpet, Hyderabad 2010

Meenakshi Technopark Kondapur, Hyderabad 2010

KMDA Property Sealdah, Kolkata 2010

Hindustan Uniliver Fort, Mumbai 2011

Coke Factory Shankar Market, CP, Delhi 2011

Avani Heights Chowringhee, Kolkata 2011

Occupier focus shifting from consolidation to expansion strategies

The year 2009 and 2010 witnessed several instances of consolidation

2

and functional decentralisation

3

of offce spaces, as several

corporations restructured their real estate portfolios (Figure 6). However, by end of the year several expansion plans are being put into

place, particularly led by the IT/ITES and BFSI sectors. During the slowdown, when these two sectors were either stable or downsizing, the

sunshine sectors telecom, pharmaceuticals, semiconductors, healthcare and education were expanding.

The year 2011 should witness a greater number of expansion plans getting executed by corporations riding on good business sentiments.

2

Consolidated centralisation is the process of consolidating multiple offces to a single location. It is motivated by the synergy of economies of scale achieved by operating out of

a single offce. It helps in reducing real estate costs by merging functions and reducing shadow capacities lying idle at multiple existing locations.

3

Functional decentralisation is the process consolidating multiple offces or splitting a single offce to multiple locations. It helps in reducing real estate costs by distributing the

non-essential functions of a business to less expensive real estate locations while retaining or moving essential functions to a prime location

Source: Real Estate Intelligence Service (JLL), 3Q10

Lease Transactions Sale Transactions

% Sale Transactions in Total Transactions

4.2%

9.0%

11.4%

13.0%

14.9%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

1H08 2H08 1H09 2H09 1H10

S

a

le

/ L

e

a

s

e

T

r

a

n

s

a

c

tio

n

s

0%

2%

4%

6%

8%

10%

12%

14%

16%

%

S

a

le

T

r

a

n

s

a

c

tio

n

s

in

T

o

ta

l

Figure 6: Instances of Portfolio Restructuring Strategies During the Slowdown (2H08-1H10)

City Buyer / Lessee Year

Leasable /

Saleable Area

(sq ft)

Lease / Buy Strategy

Hyderabad Tata Consultancy Services 2010 180,322 Lease Expansion

Chennai Cybernet Slash Support 2010 128,000 Lease Consolidated Centralisation

Chennai Marg Constructions 2010 116,800 Lease Consolidated Centralisation

Bangalore Citrix 2010 127,000 Lease Expansion

Bangalore Sony 2010 130,000 Lease Consolidated Centralisation

Hyderabad Accenture 2010 103,000 Lease Expansion

Noida ACS 2010 102,000 Lease Relocation

Hyderabad Synopsis 2010 61,990 Lease Consolidated Centralisation

Hyderabad DST 2010 55,000 Lease Consolidated Centralisation

Chennai Tata Teleservices 2010 75,000 Buy Relocation

Mumbai Ernst & Young 2009 160,000 Lease Functional Decentralisation

Kolkata McNally Bharat 2009 123,000 Lease Consolidated Centralisation

Hyderabad Colruyt 2009 100,000 Buy Consolidated Centralisation

Noida Samsung 2009 66,000 Lease Functional Decentralisation

Kolkata M Junction 2009 62,000 Buy Consolidated Centralisation

Mumbai Deutsche Bank 2009 187,000 Lease Consolidated Centralisation

Gurgaon Capital IQ 2009 50,000 Lease Relocation

Mumbai ICICI Prudential 2009 41,000 Lease Functional Decentralisation

Mumbai Standard Chartered Bank 2008 220,000 Buy Consolidated Centralisation

Bangalore Delphi 2008 90,000 Lease Consolidated Centralisation

Bangalore LSI Logic 2008 277,000 Lease Consolidated Centralisation

Hyderabad Brigade 2008 60,000 Buy Consolidated Centralisation

8 On Point Indian Real Estate: An Outlook on Industry Trends and Regularity Policies On Point Indian Real Estate: An Outlook on Industry Trends and Regularity Policies 9

IT/ITES and BFSI would continue to

account for 60-70% of offce demand

Nearly 60-70% of the demand for offce space during

the past years has been contributed by the IT/ITES

and BFSI sectors (Figure 7).

IT and IT-enabled services (ITES) have been the

key drivers of the demand for offce space in India

during the last decade. Primary reasons for Indias

leadership in this sector has been the presence of

a huge English speaking population, a large part of

which is well educated & qualifed to handle technical

and professional jobs as well. Indias IT-ITES

export recorded 8.2% growth during FY 20092010.

According to the Department of Information

Technology, the IT-ITES export revenue is expected

to reach USD 60 billion and USD 72 billion by the end

of FY 20102011 and FY 20112012, respectively.

The Banking, Financial Services and Insurance

(BFSI) sector has also been a key contributor to

the demand for offce space in India. At the end of

FY 2000-2001, total number of offces of scheduled

commercial banks in India was 65,919, which had

increased to 80,547 by the end of FY 2009-2010.

Meanwhile, the per capita credit of the scheduled

commercial banks has increased from INR 5,221 in

2001 to INR 24,230 in 2009 (Figure 9).

Several foreign banks (both commercial and retail)

have set up shops in India over the last decade. Other

fnancial institutions such as insurance companies

and securities frms have also forayed into the Indian

market and have registered rapid expansion ever

since. In 2009 and 2010 so far, 16-22% demand for

offce space came from the BFSI sector (Figure 7).

More inter-city competition to build up among the IT/ITES destinations

At the peak during mid-2008, only 38% of the operational offce stock was available for leasing at less than USD 1 per sq ft per month. Post

the market crash, nearly 62% of the operational offce stock in India is available for leasing at less than USD 1 per sq ft per month. While the

slowdown has ensured a greater affordability of offce space to the occupier, it has grouped several cities into a narrow band of rents.

Since most of these markets are the IT destinations of Bangalore, Chennai, Pune, Hyderabad and Kolkata, the inter-city competition to

garner demand from the sector would be paramount in coming years. The key to success would be diversifying the occupier base into other

sectors such as BFSI, manufacturing, logistics, consulting services among others.

Activity Radar for 2011

Mumbai would leave Bangalore behind as the city with the highest offce stock by end of 2011.

Gurgaon is projected to be leader in terms of demand for offce space with 4 million sq ft of net absorption projected in 2011. Of this, NH-8

alone would contribute 60% of the demand.

Hyderabad and Pune are the only cities with a good mix of IT and IT SEZ projects in supply.

Around 10 million sq ft of offce space will become operational in Gurgaon and Mumbai suburbs each during 2011, the highest among all

the micro-markets.

Outlook: Residential Real

Estate

The residential sector continued its strong growth trajectory in

2010, which it has been treading from the second half of 2009.

Residential property rates have attained the previous peaks of 2008

across several markets. The year also saw an increased number of

launches in the premium segment, mostly in the Mumbai market.

However, sale velocities of houses have dropped by end of the

year and further hardening of interest rates along with high

infationary pressure can be a dampener for residential sales in

the coming quarters.

Source: Real Estate Intelligence Service (JLL), 3Q10

Figure 7: Major Sectors Contributing to Offce Demand

5

3

%

5

0

%

3

9

%4

8

%

1

6

%

1

9

%

1

6

%

2

2

%

5

%1

1

%

8

%

8

%

7

%

1

7

%

1

0

%

1

8

%1

3

%

2

0

%

1

7

%

3

%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

2009 1Q10 2Q10 3Q10

S

h

a

r

e

o

f D

e

m

a

n

d

fo

r

O

ffic

e

S

p

a

c

e

fr

o

m

V

a

r

io

u

s

In

d

u

s

tr

ie

s

Others

Manufacturing/

Industries

Telecom

BFSI

IT / ITES

Figure 8: IT/ITES Export Revenue and Employment

Source: Department of Information Technnology

0

15

30

45

60

75

2001-02 02-03 03-04 04-05 05-06 06-07 07-08 08-09 09-10

IT

-

IT

e

S

E

x

p

o

r

t R

e

v

e

n

u

e

(

U

S

D

B

illio

n

)

0.0

0.5

1.0

1.5

2.0

2.5

IT

-

IT

e

S

E

m

p

lo

y

m

e

n

t

(

N

u

m

b

e

r

o

f P

e

o

p

le

in

M

illio

n

)

IT-ITeS Employment IT-ITeS Export Revenue

Figure 9: Growth of Commercial Banking in India

Source: Reserve Bank of India

0

15

30

45

60

75

90

2001 2002 2003 2004 2005 2006 2007 2008 2009

N

u

m

b

e

r

o

f O

ffic

e

s

o

f S

c

h

e

d

u

le

d

C

o

m

m

e

r

c

ia

l

B

a

n

k

s

(

'0

0

0

)

0

5

10

15

20

25

30

P

e

r

C

a

p

ita

C

r

e

d

it o

f S

c

h

e

d

u

le

d

C

o

m

m

e

r

c

ia

l

B

a

n

k

s

(

IN

R

in

'0

0

0

)

Number of Offices of Scheduled Commercial Banks

Per Capita Credit of Scheduled Commercial Banks (INR)

Residential property rates are likely to continue their upward

trajectory, albeit at a slower pace than 2010. We believe that certain

locations that have witnessed rapid increments in price, will not

only witness resistance to any further price rise, but also some

downward pressure. We will continue to see rapid sale velocities

in the affordable segment for projects which are priced at or below

market averages. Likely hardening of interest rates, coupled with

high infationary pressures and rising property rates, will impact the

purchasing power of home buyers in 2011, which will infuence the

absorption dynamics of the residential sector.

10 On Point Indian Real Estate: An Outlook on Industry Trends and Regularity Policies On Point Indian Real Estate: An Outlook on Industry Trends and Regularity Policies 11

Launch of premium products to continue,

albeit at a slower pace

The activity in the high-end residential segment

dropped sharply during the slowdown and had

hit bottom by beginning of 2009, when very few

premium projects were being launched. Banking on

the tremendous response over residential sales in

the lower capital value segment, several developers

began launching premium residential projects by end

of 2010 (Figure 10). This was accompanied by a rise

in property rates across cities. Due to the impact of

rising prices, absorption rates have eventually wilted

and the effect is also being refected on the number of

units being launched in the premium segment, which

dropped for the frst time since 4Q09.

In 2011, although select developers would still launch

premium projects, the rate of new supply in the

segment is expected to remain range-bound in the

near term. However, the premium projects are slated

Figure 10: Launch of Premium Residential Units in India (Priced at more than

INR 7,500 per sq ft)

Note: Premium projects include all residential projects priced at more than INR 7,500 per sq ft at the

time of launch. The analysis doesnt consider the amenities offered as criteria to distinguish between

a premium and mid-segment project.

Source: Real Estate Intelligence Service (JLL), 3Q10

Large number of launches would

continue to be in the range of INR

2,000-3,000 per sq ft at the leapfrogged

suburban locations

Since 1Q09, more than 50% of the units that were

launched every quarter have been priced less than

INR 3,000 per sq ft at the time of launch (Figure 11).

Apart from Mumbai and NCR-Delhi, a majority of

upcoming nodes of residential growth in other cities

are priced within this range. The current scenario has

opened up new locations for residential development,

which were otherwise unattractive to the Indian home

buyer. The far fung suburban locations, where land is

relatively inexpensive, have witnessed the launch of

these aggressively priced projects.

This phenomenon known as leapfrogging is

not new to real estate but can have far reaching

implications. Initial nodes created by leapfrogging

lack in terms of social infrastructure, public services

and entertainment options due to the absence of

a threshold population to support these amenities.

However, planned growth of infrastructure can provide

tremendous impetus to residential and commercial

Figure 11: Share of Units Launched in Particular Ranges of Capital Value

(INR per sq ft)

Source: Real Estate Intelligence Service (JLL), 3Q10

to outperform each other with displays of irrational exuberance in terms of world

class architecture and unmatched amenities.

growth in these tertiary nuclei. If these projects are implemented with design

capacities for a long term vision, these far fung areas could serve as alternate

nodes to the city and help in decongesting the urban sprawls.

Several infrastructure initiatives are underway to connect these leapfrogged

locations with city centres and already developed offce locations. In 2011,

residential projects priced in the range of INR 2,000 3,000 per sq ft would

continue to get launched at these locations and should see increasing

acceptance from the price sensitive home buyers.

Launch of Ultra Low Cost (ULC) Housing

by private developers Housing for all

The ultra low cost housing (having a ticket size of

less than INR 10 Lakhs), so far, has not been fully

embraced at a large scale by the private real estate

development players in India. However, due to the

large shortfall of housing units in this particular

segment, the demand for housing units by the

economically weaker sections remains high and the

segment is critical for increasing homeownership

in India. With the Government trying to gather

momentum for the category further with the theme

Housing for all, the real estate industry is expected

to soon harness the massive opportunities of scale

and scope at the base of the pyramid.

Several developers have already launched and built

projects successfully in the segment, which should be

the one to watch for during 2011 (Figure 12).

Figure 12: Ultra Low Cost Housing by Private Developers

Source: Real Estate Intelligence Service (JLL), 3Q10

Developer Developments

Tata Housing

Shubh Griha, Boisar, Mumbai

Shubh Griha, Vasind, Mumbai

Matheran Realty Tanaji Malusare City, Karjat, Mumbai

Value and Budget Housing

Corporation

VBHC Vaibhava, Bangalore

Marg Constructions Maha Utsav, Seeknankuppam, Chennai

Vijay Shanti Builders Lotus Pond, Kelambakkam, Chennai

Shapoorji Pallonji SP Sukhobrishti, Rajarhat, Kolkata

HDIL Paradise City, Palghar, Mumbai

Impact on affordability will infuence the

price and absorption dynamics

Rapidly rising real estate rates is a cause of concern

for the money market regulators in India, who have

increased the Cash Reserve Ratio (CRR) and repo

rates in tranches during 2010 to tame liquidity and

infation. As a result, major banks increased the

offered housing interest rates recently. The hardening

of interest rates coupled with rise in residential rates

would impact the decision of the home buyer, who is

now dependent on rise of income levels to offset the

diminished affordability.

If residential rates increase by 10% during 4Q10-

1Q11 and interest rates rise by 100 bps, the

affordability will reduce from 15% to 2% of the

peak levels in 3Q08 (Figure 13). Eg. Residential

markets were 32% more affordable in 2Q09 when

compared to the peak in 3Q08. In 3Q10, due to the

rise in residential rates, they are now only 15% more

affordable when compared to the peak rates of 3Q08.

Figure 13: The Path of Residential Affordability

Note: Numbers denote change in affordability with respect to 12% mortgage rate and 0% price

correction from peak (Conditions in 3Q08)

Eg. Residential markets were 32% more affordable in 2Q09 when compared to the peak in 3Q08

Mortgage rates are average home loan rates prevalent during the period.

Change in income levels during the relevant time period has not been considered while studying

affordability.

Source: Real Estate Intelligence Service (JLL), 3Q10

0

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

4,500

5,000

1Q09 2Q09 3Q09 4Q09 1Q10 2Q10 3Q10

N

u

m

b

e

r

o

f R

e

s

id

e

n

tia

l U

n

its

L

a

u

n

c

h

e

d

7,500 - 10,000 10,000 - 15,000

More than 15,000 Total Premium Launches

4

1

%

3

9

%

5

2

%

4

3

%

5

3

%6

5

%

5

7

%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

1Q09 2Q09 3Q09 4Q09 1Q10 2Q10 3Q10

%

N

u

m

b

e

r

o

f U

n

its

in

T

o

ta

l U

n

its

L

a

u

n

c

h

e

d

More than 15,000

10,000 - 15,000

7,500 - 10,000

5,000 - 7,500

4,000 - 5,000

3,000 - 4,000

2,000 - 3,000

Less than 2,000

7 11 15 20 24 28 32

3Q10 2Q10 1Q10 4Q09 2Q09

2 6 24

1Q11F 4Q10F 1Q09

(4) 10

4Q08

(10) (5) 0

3Q08

10% +5% 0% -5% -10% -15% -20% -25% -30% -35%

8%

9%

10%

11%

12%

13% (16) (11) (5) (0)

12 16 20 24 28 32 36 40 44 48

37 41 45

10 15 19 28 33 37 42

1 5 15 20 24 29 34 38

5 10 15 20 25 30 35

5 10 16 21 26 31

Price Correction from Peak (3Q08)

M

o

r

tg

a

g

e

R

a

te

s

12 On Point Indian Real Estate: An Outlook on Industry Trends and Regularity Policies On Point Indian Real Estate: An Outlook on Industry Trends and Regularity Policies 13

The two-direction theory of price

movement

Average residential capital values have increased

between 20-35% across a majority of Indian cities

since hitting trough during mid-2009 (Figure 14). This

rapid reversion to peak levels has been driven by

a healthy absorption rate across cities during 2H09

and 2010. However, developers should be cautious

against further aggressive increments in residential

rates which would push the sector to become

overvalued. Stabilisation and wilting of absorption

rates have already been witnessed in certain markets.

Also, signifcant absorption volumes in the initial wave

during 2009 were taken up by investors, who would

be hawking an exit during 2011, which will further

increase the available stock in the secondary market.

The two-direction theory of price movement is likely

to be seen in the sector during 2011, wherein select

geographies would witness a rapid increase in

Figure 14: Quarterly Movement of Residential Capital Values

Source: Real Estate Intelligence Service (JLL), 3Q10

Note: The quarterly movement is the percentage change in average residential property rates, which

does not denote the movement of prices in respective markets.

Sustainability to gain focus as the

industry looks forward towards IGBC

Green Homes standards

Sustainability, which is already prominent in the

commercial sector, will gain focus in the residential

space as well in the coming years. Indian Green

Building Council (IGBC) recently rolled out Green

Homes, which is its frst rating programme,

exclusively for the residential sector (Figure 15).

Also, the IGBC Green Townships Rating System, a

pilot version of which has been launched, should be

benefcial at a larger scale of certifying residential

townships.

Interestingly, the sector has witnessed sustainable

construction across segments, be it value housing or

premium residential towers. We expect the trend to

continue in future, as buyers become aware of the

benefts of green buildings and in turn developers

look forward to market their products with a green

certifcation.

Project Name Developer Location Built-up Area (sq ft) (sq ft) Rating Achieved

Camelot Tata Housing Kansal-Mohali 4,229,000 Pre - Certifed, Gold

Palais Royale Shri Ram Infrastructure Mumbai 2,500,000 Pre - Certifed, Platinum

Aqua Lily Mahindra Lifespaces Chengulpet 1,300,000 Pre - Certifed, Platinum

Aliens Space Station I Aliens Group Hyderabad 853,776 Pre - Certifed, Platinum

Aquila Heigths Tata Housing Development Bangalore 650,950 Pre - Certifed, Gold

Nitesh Columbus Nitesh Estates Bangalore 567,365 Pre - Certifed, Gold

August Park Mr.Biju P.John Bangalore 408,379 Pre - Certifed, Gold

NOEL Greenature NOEL Villas & Apartments Kochi 245,745 Pre - Certifed, Gold

Springs Appaswamy Real Estate Limited Chennai 195,028 Pre - Certifed, Gold

BCIL T ZED Homes BCIL Bangalore 175,350 Platinum

Megapolis Pegasus Properties Pune 139,364 Pre - Certifed, Platinum

Raisina Residency Tata Housing Gurgaon 120,774 Pre - Certifed, Gold

Green Grace S&S Construction Limited Hyderabad 92,903 Pre - Certifed, Platinum

Shem Park Yuga Homes Chennai 90,610 Gold

Mahindra Splendour Mahindra Lifespaces Mumbai 80,000 Pre - Certifed, Platinum

Kalpataru Riverside Kalpataru Developers Mumbai 68,596 Pre - Certifed, Platinum

Srishti Kalpataru Developers Mumbai 68,596 Pre - Certifed, Platinum

Mahindra Chloris Mahindra Lifespaces Faridabad 42,735 Pre - Certifed, Platinum

Kalpataru Hills Kalpataru Developers Thane 37,966 Pre - Certifed, Platinum

Mahindra Royale Mahindra Lifespaces Pune 35,990 Pre - Certifed, Platinum

Kalpataru Pinnacle Kalpataru Ltd Mumbai 13,471 Pre - Certifed, Platinum

La Residency ACC Limited Mumbai 12,000 Pre - Certifed, Gold

Park Infnia Kumar Properties Pune 3,642 Pre - Certifed, Platinum

Source: Indian Green Building Council (IGBC) Website, December 2010

Activity Radar for 2011

In Navi Mumbai, the approval of the new airport has brought forth

a marked reaction on the residential space front, with several

existing residential projects in Panvel witnessing appreciation in

less than a week after the announcement. Several land deals

are on the anvil for development of hospitality, as the sector will

gather a lot of activity when the airport becomes operational. The

much awaited euphoria is expected to continue as the area has

tremendous potential for real estate growth.

Lower Parel has become the centre for luxury residential projects

in Mumbai with over USD 10 billion (INR 45,000 Crore) worth of

residential projects under construction. With the location providing

further opportunities for growth due to available land parcels from

auctioning of sick mills, the location should be the one to watch for

during 2011.

Noida (including Noida city, Noida-Greater Noida Expressway,

Noida Extension and Greater Noida) has been the dominant

leader in terms of residential launches during 2010 and is

expected to be the leader in 2011 as well. Apart from the large

scale availability of land due to opening of new sectors, the metro

rail connectivity to Noida has increased the size of its residential

market multifolds. However, investors should be wary of the

oversupply conditions being built up in Noida due to a massive

infux of residential supply.

Although the prime areas of Gurgaon are saturated in terms of

residential developments, the future growth corridors are the Golf

Course Extension Road and Dwarka Gurgaon Expressway.

The National Highway-8 and Sohna Road are also witnessing

considerable residential activity.

In Bangalore, Hosur Road and Bellary Road have witnessed high

residential activity during the past two years and are expected to

remain active in the coming years. While Hosur Road connects

the city to Electronic City, the Bellary Road connects to the new

international airport.

The southern suburbs of Chennai, including development along

the Old Mahabalipuram Road and Great Southern Trunk Road

should witness considerable residential activity.

The north-west (Wakad, Pimple, Aundh Annexe) and south-east

(NIBM Road, Hadapsar, Kondhwa) zones of Pune have seen

considerable activity during the last 2 years and should remain

active in the next year as well.

Hitec City and Gachibowli in Hyderabad have yet to register any

signifcant growth of activity and prices since 2008 due to the geo-

political instability in the region. However, taking cues from other

markets of India, if stability exists in other spheres, the locations

should record growth in 2011.

-4% -2% 0% 2% 4% 6% 8% 10%

NCR-Delhi

Hyderabad

Kolkata

Bangalore

Chennai

Pune

Mumbai

Simple Average of % Q-o-Q Change in Capital Values of Constituent Micro-markets

residential rates due to improving infrastructure, while others would languish due

to an already overvalued market.

Figure 15: Existing and Upcoming Residential Projects with IGBC Green Homes Rating in India

14 On Point Indian Real Estate: An Outlook on Industry Trends and Regularity Policies On Point Indian Real Estate: An Outlook on Industry Trends and Regularity Policies 15

Outlook: Retail Real Estate

Despite being the worst hit during the recent slowdown, the retail

property market has resurged with a marked increase in retail

sentiments. In 2010, retailers, both domestic and foreign, re-drafted

their plans for expansion into various Indian cities. The immediate

effect was felt by the increase in high street transactions as suitable

space was not available in prime shopping centres. Also, this led to

several shopping centre developers focusing on execution of their

ongoing projects. Rents have found support at the current levels

and there is low expected risk of further downslide. Hence, the

corrected rents provide a suitable opportunity for retailers to execute

their expansion plans. Revenue sharing models have gained more

traction with developers ensuring a better mall management. The

polarization of demand for certain locations was evident with select

shopping centres getting operational at high occupancies while

others languish.

The year 2011 will witness the completion of shopping centres

across tiers of geography and segments including value, lifestyle,

speciality and luxury. However, the focal point will still be value and

necessity retailing in the Tier III locations which limits the expansion

of lifestyle and luxury retail to Tier I and Tier II cities. While select

developers would demand a higher rent for their upcoming projects,

average valuations will not appreciate in a hurry. The possibilities of

100% FDI being permitted for multi-brand retailing are immense for

retail real estate in India. However, due to the associated beliefs of

negative effects to unorganized retail, the proposition will be tough to

get accepted unanimously.

More collaborative models such as revenue sharing

to emerge in the sector

In a rigorous business environment today, collaborative competition

or collabetition is the way forward for the stakeholders in the retail

industry - retailers, developers, consumers and the authorities.

Some of the trends that have already emerged such as revenue

sharing models are a form of collabetition between the retailers and

developers, where they are sharing the successes together, while

minimizing the downside risk.

In the slowdown, the retailers, concerned with the real estate

costs, increased their demand for renegotiating rents. Developers

were initially reluctant, which led many retailers to downsize their

portfolios across shopping centres in India. However, markets turned

rapidly to favour tenants, and retailers renegotiated on the rents

as well as demanded revenue sharing models (Figure 16). Such

fexible revenue models are highly acceptable to the retailers as the

risk is shared between the real estate owner and the retailer. Also,

it makes the developer more accountable for generating footfalls

and conversion rates in the shopping centre. For the developer,

it reduces the risk of high vacancy in the shopping centre while

counting on the probability of better revenues in future.

With their shopping centres under advanced stages of construction,

developers eventually saw value in the proposition, and provided

Source: Industry Sources

options for sharing revenue with retailers. Several malls that

became operational during the slowdown opted for a combination

of minimum guarantee and revenue sharing, which ensured foor

earnings for the developer. The transparency in revenue recognition

is expected to enhance with better mall management practices

employed in the industry. This will ensure greater confdence among

developers towards innovative rental sharing arrangements with the

retailers.

Figure 16: Prevalent Revenue Share Percentages across Major

Retail Categories in India

Category

Revenue share as rent (in (in

percentage)

Anchor Stores

Hyper Market 3-4

Departmental Stores 7-8

Vanilla Stores

Apparel 12-18

Footwear 15-18

Jewellery 2-2.5

Health and Beauty Products 10-12

Food 15-20

Entertainment 8-10

Rents to remain stable except select

prime locations

Rental values expanded rapidly during 2004-2Q07,

followed by a year of gradual growth. However,

the effect of the global slowdown had an impact on

retail sentiments in the region, which led to a rental

correction of 33.5% since the peak recorded in

3Q08 (Figure 17). Through 2009, several retailers

demanded renegotiation on rentals and preferred

revenue sharing models. While the terms of revenue

sharing have made the landlord accountable for

generating footfalls in the mall, it rewards them by

reducing the risk of near term vacancy and retaining

probabilities of better revenues in the future.

Rents have found support at the current levels and

there is low expected risk of further downslide. Hence,

the corrected rents provide a suitable opportunity

for retailers to execute their expansion plans in the

region. However, rents are not expected to appreciate

in a hurry, except in select prime locations, where

vacancy is low and the demand for retail space

is high.

Figure 17: Movement of Indian Retail Markets on the Property Clock

Source: Real Estate Intelligence Service (JLL), 3Q10

RENTS

DECLINING

RENTS

RISING

GROWTH

SLOWING

DECLINE

SLOWING

2Q07

4Q07

4Q08

2Q08

2Q09

4Q09

3Q10

1

5

M

O

N

T

H

S

9

M

O

N

T

H

S

2

4

M

O

N

T

H

S

Large number of malls slated to become

operational

At end-3Q10, NCR-Delhi and Mumbai together

constitute 70% of the total retail space (contributed

by shopping centres) in India, housing 127 of the 192

shopping centres currently operational in the country.

Bangalore and Kolkata have a retail stock of 3.8-3.9

million sq ft each, followed by Hyderabad, Pune and

Chennai. Apart from shopping centres, high streets

with standalone outlets of established brands are

prevalent in all these cities.

Sixty-fve shopping centres encompassing a total

retail space of 24 million sq ft are expected to become

operational during the next fve quarters between

4Q10-2011 across the top seven metropolitan cities

of India (Figure 18). The matured retail markets of

Mumbai and NCR-Delhi, which constitute 70% of the

operational stock of retail space, account for only 51%

Figure 18: Supply and Demand of Retail Space

Source: Real Estate Intelligence Service (JLL), 3Q10

of this new supply. This is due to increased construction activity in the Tier II

markets which are relatively underserved, despite having a large potential.

New Completions Net Absorption Vacancy

3

.8

4

.1

9

.4

8

.5

6

.3

9

.4

2

0

.1

1

3

.1

2

.83

.7

9

.6

6

.6

4

. 04

.9

1

1

.5

1

1

.3

0

4

8

12

16

20

24

2005 2006 2007 2008 2009 2010F 2011F 2012F

C

o

m

p

le

tio

n

s

/ A

b

s

o

r

p

tio

n

(

m

illio

n

s

q

ft

)

0%

6%

12%

18%

24%

30%

36%

V

a

c

a

n

c

y

(

%

)

16 On Point Indian Real Estate: An Outlook on Industry Trends and Regularity Policies On Point Indian Real Estate: An Outlook on Industry Trends and Regularity Policies 17

A signifcant portion of the medium term supply is

under advanced stages of construction, and has not

become operational due to controlled demand from

retailers. However, as demand for quality space

strengthens, this supply is expected to become

operational in medium term. Over 60% of the supply

expected to become operational during 4Q10-4Q12

has more than half of its structure ready, which

minimizes the construction risk for retailers planning

to begin operations in near term (Figure 19). Those

shopping centres which are being developed along

with already functioning townships are expected to

become operational frst they have a ready residential

catchment to tap into.

Figure 19: Status of Construction of Future Supply (4Q10-4Q12)

Source: Real Estate Intelligence Service (JLL), 3Q10

More international retailers to venture into India

In 2006, Government of India allowed upto 51% Foreign Direct

Investment (FDI) into single brand retailing, as a measure to

liberalise the retail sector. The conditions included that the products

sold should only be of a single brand, which is sold under the same

brand internationally, and single brand product-retailing would cover

only products which are branded during manufacturing. In 2008,

the sector was further liberalized when the government permitted

100% FDI under the automatic route for wholesale or cash-and-carry

trading.

Indian economy faces serious supply-side constraints, particularly

in the food-related retail chains. The argument against opening

of the retail sector has been that once foreign retailers open up

their stores in India, it would amount to unfair competition to small

domestic players. This would in turn lead to large scale exit of

domestic retailers causing displacement of people employed in the

retail sector. Another argument is that given the nascent stage of the

Indian organized retail, the sector should be allowed to grow and

consolidate before opening it to foreign investors.

However, in July 2010, the Department of Industrial Policy and

Promotion (DIPP) released a discussion paper on FDI in multi-

brand retailing in India. Indian government is likely to allow FDI in

multi-brand retailing in the near term, albeit in a phased manner to

safeguard the interests of local kirana stores and ensuring a positive

impact on employment generation. The initiative for discussion by

the government is a positive step towards bringing the much needed

capital to the industry. Retail space in India can see signifcant

growth of demand in the future, if the policies are indeed relaxed.

Even in the current setup, several international retailers have already

ventured into partnerships with domestic retailers in the B2B cash-

and-carry format or as strategic license and franchise agreements.

Retailers would continue to expand beyond Tier I

into Tier II and III cities

The retailing landscape varies signifcantly across Indian markets,

as cities differ greatly in size, maturity and purchasing power. Retail

real estate in the Tier III cities is currently dominated by traditional

high streets and is located at central business precincts, transport

nodes and along the major transport corridors. The retail stores are

generally located on the ground and frst foors of prime properties

along major roads and high streets. This type of retail space does

not have standardised facilities such as parking or central air

conditioning.

However consumer preferences are changing the retail real

estate landscape of the non-metro cities which are witnessing

the development of malls and modern shopping centres. Lack of

entertainment options and inconvenient retail environments in these

cities have assisted the success of the frst malls and shopping

centres. Cities like Ahmedabad, Jaipur, Nagpur, Ludhiana, Surat,

Vadodara, Aurangabad and Kochi have witnessed growth in mall

development in recent years. Although large sized malls like

Treasure Island (700,000 sq ft) in Indore have been successful,

smaller sized malls ranging between 200,000 sq ft and 400,000 sq

ft and strategically distributed across the city are more suitable for

these cities.

Store sizes vary across retail categories and Tier III markets.

While revenue share models are preferred by retailers, they are

less prominent in non-metro cities as these markets are relatively

immature and developers/property owners do not yet have

substantial understanding of these models.

The Tier III cities in India are the next destinations for retailers after

the Tier I and Tier II cities due to increased consumer spending and

changing consumer preferences in these cities. Many retailers are

exploring this opportunity and they are cautiously expanding into

the non-metro cities. Retailers are remodeling their strategies to suit

the non-metro cities. As real estate markets in the small cities are

still largely unorganised and immature, getting suitable properties

is a challenge for retailers. The properties mostly lack in quality,

aesthetics and parking facilities. In such a scenario developers and

operators of smaller Indian markets need to be more cognisant

of the viability of their retail projects while planning, building and

operating their properties to tap this demand. With the retail

industry poised to grow at the rate of 9% y-o-y, the retail sector in

India is again geared towards growth. However, this time the retail

landscape in India is growing beyond the metro cities.

Opportunities in retail real estate

Several urban agglomerations are being planned and developed

across the Indian landscape to cater to the rapidly urbanizing

population. With the growth of offce and residential space in

these areas, the opportunities to develop retail along with these

developments are immense.

Integrated Townships

Integrated townships, with an appropriate mix of offce, retail and

residential components, are being constructed and planned across

the country. These townships are either being developed at the

suburban locations of existing cities or second home destinations at

far-fung locations such as hill stations.

Special Investment Regions

The state of Gujarat recently enacted the Special Investment Region

(SIR) Act in 2009, under which large manufacturing and trading hubs

(more than 100 square km) are being planned in the state. Complete

with residential townships and industrial parks, these regions provide

immense potential for retail development.

Campus Towns

Several large educational campuses are being built which will bring

together a mass of people including students, educators and support

staffs.

Brownfeld Redevelopment in Prime City

With continual expansion of city limits over the years, the erstwhile

mills and industrial units which were located outside the city have

been engulfed in offce and residential developments. As land is

scarce in the city, these sick mills have become prime targets for real

estate development in several urban locations of India. Brownfeld

redevelopment at these locations provides an opportunity for

development of prime or luxury retail.

Excavation / Upto Plinth

(10%)

Less than 50%

Structure Ready

(27%)

50-100% Structure Ready

(42%)

Ready for Fit-Outs

(21%)

18 On Point Indian Real Estate: An Outlook on Industry Trends and Regularity Policies On Point Indian Real Estate: An Outlook on Industry Trends and Regularity Policies 19

Opportunities in Retail Segments

Destination Retailing

Destination retailing in India is in its nascent stage of development,

primarily due to unavailability of physical infrastructure to support

it. As transport infrastructure improves at urban locations, there are

tremendous opportunities for destination retailing in the suburban

and exurban locations. Clubbed with appropriate entertainment

options such as multiplex, restaurants, gaming and even theme

parks, these destinations across the globe have struck success as a

tourist hotspot. Indian shopping centres are already experimenting

with the concepts of experiential retailing (or experience retailing),

where they want to provide lifestyle shopping experiences to the

consumers.

Collabetition takes a leap of faith and enters a new paradigm with

destination retailing, where retailers and even developers come

together to partner in creating recreational shopping precincts.

Luxury Retailing

Luxury retailing in India is limited to few luxury shopping centres,

select high street locations and fve star hotels. Considering the

consumer class of the country, the penetration is evidently shallow.

According to the 2010 World Wealth Report by Capgemini, the

HNWIs population in India was over 126,700 in 2009, recording a

50.9% annual growth during the year. Several wealthy consumers

travel abroad for their luxury purchases, which exposes the lack

of suitable luxury destinations in the country. As of 2010, there are

only three shopping centres, which can be termed as luxury DLF

Emporio in Delhi, UB City in Bangalore and Palladium (High Street

Phoenix) in Mumbai.

An Outlook on Real Estate

Regulatory Policies in India

Foreign Direct Investment and Other Regulatory

Policies

1. Foreign Direct Investment

Historically, Foreign Direct Investments and Foreign Exchange fows

have been regulated by Governments world over to achieve their

objectives and priorities, India being no different in this regard. The

Foreign Direct Investment (FDI) in Real Estate Development being a

sensitive sector was restricted until 2005.

As part of the liberalization process which began in 1991 to improve

the growth and foreign exchange reserves position, the Government

opened up the sector to FDI in March 2005 by issuing the frst Press

Note 2 of 2005.

There are four different routes for foreign investors for making

investment in the Real Estate Sector.

Investment by all category of investors under FDI Route;

Investment by Foreign Institutional Investors (FIIs);

Investment by Non-Resident Indians (NRIs); and

Investment by Foreign Venture Capital Company/Fund

Presently, FDI upto 100% for the frst category is permitted under

the automatic route in townships, housing, built-up infrastructure

and construction development projects (which would include, but not

restricted to housing, commercial premises, hotel, resorts, hospitals,

educational institutions, recreational facilities, city and regional

level infrastructure). No prior approval is required for FDI subject to

fulfllment of the following conditions:

Nature of Project Minimum Development Area

Serviced housing plots 10 hectares (25 acres)

Construction development projects Built up area of 50,000 sq. mts.

Combination of the above two Any one of the above two conditions

Condition Requirements

Minimum capital infusion

Wholly Owned Subsidiary -USD 10 mn / Joint Venture

- USD 5 mn

Minimum Initial Investment Brought in within 6 months of commencement of business

Repatriation of Investments

After 3 years of complete capitalization (clarifcation to

Press Note 2 / 2005)

Early remittance permitted with FIPB approval

Minimum Area

Development Norms

Minimum

Capitalization Norms

Other Conditions

Development project to conform with local development rules and

regulations

Minimum 50% of project must be developed within 5 years

Sale of undeveloped plots would not be permitted

In case where the investment does not meet the aforesaid criteria,

then the investor can approach the Government for their specifc

proposal.

The intent of the Government is loud and clear that investment

for trading in Real Estate is strictly prohibited and only investment

for development purposes is permitted. Further, the investment is

permitted only in Green feld projects (i.e. new projects) and not in

Brown feld projects (i.e. existing projects).

As the investment started fowing in the country and innovative

investment structures emerged, various interpretation and practical

issues arose which created controversies and unintended results.

In order to clarify some of the interpretation issues, the Government

issued the following clarifcations vide Press Release dated 30

September 2010:

Share premium should be included while calculating Minimum

Capitalization.

The entire amount brought in as FDI is regarded as original

investment. The lock-in period of three years will be applied from

the date of receipt of each installment / trenche of FDI or from the

date of completion of minimum capitalization, whichever is later.

However, the ambiguity with respect to, inter-alia, the following

aspects still exists:

Whether investment is permissible in existing company proposing

to engage in Real Estate development?

What is meant by commencement of business?

Whether built-up area includes parking space / other amenities for

computing minimum threshold?

Whether FII investment is permissible in the Real Estate Sector

without compliance with the FDI policy?

Since the opening up of window for investment, the sector has

attracted total investment of USD

4

8.90 billion and it is expected

to reach a size of USD

5

180 billion by 2020, now the Real Estate

Sector is witnessing a next round of BUZZ and the Government

should proactively clarify most of the issues and develop an investor

friendly environment to attract signifcant investments and to avoid

controversy / aggressive interpretations.

Investment under this route is permitted via equity shares,

preference shares and fully and compulsorily convertible preference

shares/debentures. Investment through any other instruments, say

bonds, debentures, etc is regulated by the External Commercial

Borrowings Policy of the RBI.

Apart from the FDI route discussed above, NRI route for making

investment in challenging projects has been explored in the past.

Similarly, Foreign Venture Capital Investors route is also in vogue

with respect to planned investments by overseas Realty Funds and

Pension Funds into the Indian opportunities.

In order to provide more liquidity to the sector and also permit

retail investors to reap the benefts of Real Estate boom, the

Government released drafts of Real Estate Mutual Fund (REMF)

Regulations and Real Estate Investment Trust (REIT) Regulations.

REIT is a collective alternate investment scheme introduced by the

Government and is similar to mutual funds. REIT is a trust created

by the trustee company and managed by the Asset Management

Company (REIMC). REIT and REIMC are required to be registered

with SEBI. Detailed regulations have been prescribed by the SEBI

for the registration of REIT and REIMC, functioning of these entities,

scheme criteria, listing of scheme, valuation criteria, investment

and dividend policy, etc. The present FDI policy does not enable

foreign investments into REIT and the Government is evaluating

allowing of investments into REIT. Further, there is no clarity on

tax implications of REIT as well as the investors which is one of the

major bottlenecks which Government needs to work around. SEBI

introduced REMF regime in mid 2008 by amending the existing

Mutual Fund Regulations. REMF is effectively a Real Estate

dedicated close ended mutual fund. The draft REMF regulation

issued by SEBI prescribes various aspects such as eligibility,

registration, investment and dividend policy, valuation guidelines,

etc. The present FDI guidelines could permit foreign investments

and the tax regime for the mutual fund could equally apply to REMF.

These could provide REMF an edge over REIT. Due to certain

practical diffculties, these regulations are under consideration of the

Government for further refnement.

Construction of Special Economic Zone (SEZ)

The Government has also allowed 100% FDI under automatic route

in development of SEZ, without applicability of Press Note 2 of 2005

conditions. However, this relaxation is subject to the provisions of

SEZ Act 2005 and the SEZ Policy of the Department of Commerce.

4

Source: Fact sheet on Foreign Direct Investment fromAugust 1991 to September 2010, Department of Industrial Policy and Promotion

5

Source: www.ibef.org

20 On Point Indian Real Estate: An Outlook on Industry Trends and Regularity Policies On Point Indian Real Estate: An Outlook on Industry Trends and Regularity Policies 21

External Commercial Borrowings (ECB) Policy

The ECB is restricted for the Real Estate Sector. However, ECB

under the approval route is permissible to SEZ Developers for

providing the specifed infrastructure facilities. Similar relaxations

upto 31 December 2010 have been provided for integrated township

projects, as defned and subject to fulfllment of specifed conditions.

2. Other Exchange Control Regulations

In order to promote free fow of foreign exchange and trade, the

Reserve Bank of India (RBI) issues and monitors exchange control

regulations. Some of the following positive steps taken by the RBI

have benefted Real Estate Sector as well.

Royalty and technical collaboration fees could be remitted without

any restrictions.

Dividend and interest income is freely repatriable under the

Current Account transaction regulations.

3. Model Real Estate (Regulation of Development) Act

The necessity for a regulatory body to regulate the Real Estate

Sector, being dominated by unorganized and non-corporate players

has been echoed for the long time. Accordingly, in order to bring

the transparency and promote planned and healthy Real Estate

development of colonies and apartments, the Ministry of Housing

& Urban Poverty Alleviation has released a draft Model Real Estate

(Regulation of Development) Act. The respective State Governments

are expected to enact local laws on the same lines, to regulate the

sector.

The salient features of the Model Act (which is yet to be enacted) are

as follows:

Establishment of a Real Estate Regulatory Authority (RERA) and

Real Estate Appellate Tribunal (REAT);

Compulsory registration of specifed Real Estate projects;

Build to Sell Build to Lease

The income would be regarded as Income from Business

Income would be taxed on a net income basis at 30 per

cent (excluding surcharge and cess).

All business expenses generally allowable as a tax

deduction if.

- incurred after set up of business;

- revenue in nature;

- incurred wholly and exclusively for business purposes;

- after withholding appropriate tax (if any) and paid to the

exchequer;

- reasonable and at an arms length price if payable to

related party

Income from leasing of properties could be taxed as a Business Income

or Income from House Property.

Generally, lease rentals earned from exploitation of commercially complex

property is taxed as income from business. Whereas, pure lease rentals

earned could be taxed as income from house property.

Income earned from provision of services undertaken in a systematic and

regular basis should ideally be taxed as income from business.

The tax treatment of income from business is already discussed. The tax

treatment of income from house property would be subject to following

deductions:

- Municipal / local taxes and cess levied on property;

- 30 per cent of lease rentals (net of municipal taxes); and

- Interest on funds borrowed.

Furnishing of bank guarantee (5% of the estimated costs of

development works) to the local authority;

Make available all information and documents relating to the

property;

Upload on the website all project details and the names of

property dealers or brokers dealing in the project;

Enter into a registered agreement for sale with the allottee before

accepting any deposit or advance.

Income-tax Provisions and the Impact of Direct Tax

Code

1. Income-tax Provisions

Multiple Taxation Levy

Real Estate Sector is subject to multiple taxes such as corporate

tax (under the Income-tax Act, 1961 (the Act)), service tax, VAT,

stamp duty, etc. Corporate tax for an Indian company is 30% (plus

applicable surcharge and cess); whereas the rate for the foreign

company is 40% (plus applicable surcharge and cess). In certain

situations Minimum Alternate Tax (MAT) of 18% (plus applicable

surcharge and cess) is leviable where corporate tax liability is lower

than the MAT liability. Dividend Distribution Tax (DDT) of 16.995% is

payable on payment of dividend. The reintroduction of wealth tax on

some of the assets also increases tax cost though marginally.

Characterization of Income

Broadly, income of the Real Estate Sector can be broken into two

baskets depending upon the business model i.e. Build to Sell or

Build to Lease. The most important tax aspect which needs to be

considered is the characterization of income, which would depend

upon the precise business model followed and facts of each case.

Given below is the general tax treatment:

Another important aspect for Build to Sell model (mainly followed for

residential and commercial projects) is the accrual and taxability of

income as the project progresses. A question often arises whether the

income should be accounted and offered to tax on completion of the

project or it should be done as the project progresses on percentage

completion method. The recent accounting guidance notes issued

by the Institute of Chartered Accountants of India and the judicial

precedents of various Indian Courts, indicates that, by far, income

from such projects should ideally be accounted and offered to tax

following percentage of completion method.

Income-tax Incentives for the Developers

Indian Government has provided various Income-tax incentives to the

Developers depending upon the nature of project developed by the

Developer. The various Income-tax incentives are as under:

1) Development of Affordable Housing Project (including Slum

Redevelopment and Rehabilitation Projects) approved before 31

March 2008:

Proft linked incentive is available to the Developer of a qualifying

housing project under section 80-IB(10) of the Act. The incentive

is 100% tax deduction of the proft earned from the business of

developing and building a housing project subject to satisfaction of

following conditions:

Project should be approved by a local authority and the same

should be completed within the prescribed time period from the

date of such approval (fve years where the Project is approved

between 1 April 2005 to 31 March 2008) (relaxation from this

condition to Slum Redevelopment or Rehabilitation Projects is

provided).

Size of the project plot minimum area of one acre (relaxation

from this condition to Slum Redevelopment or Rehabilitation

Projects is provided)

Maximum built-up area of constructed residential unit - 1000 sq ft if

situated in or within 25 kms of Mumbai/Delhi, otherwise 1500 sq ft.

Built-up area of the shop or commercial establishments should not

exceed 5,000 sq. ft. or 3% of the aggregate built-up area of the

housing project.

Maximum one residential unit in the housing project can be allotted

to a person other than individual.

Not more than one residential unit should be allotted to an

individual or to his spouse or minor children or the HUF in which

the individual is a Karta or any other person representing such

individual, his spouse or the HUF.

While, the incentive is available, a Developer is confronted with

various issues. Some of the frequently faced tax issues are:

Eligibility to deduction, in case the construction gets delayed for

reasons beyond control of Developer?

Adjustment for actual losses in the year of completion of project

where percentage of completion method is applied by the Tax

Authorities?

Eligibility to deduction in case where project is executed on

adjacent pieces of land below 1 acre?

Whether ownership of land on which the housing project is a pre-

requisite for claiming deduction?

Whether income from sale of FSI from the eligible housing project

is eligible for claiming deduction?

Meaning of Built-up Area - whether area of common amenities,

stair cases, lobby, parking space/garages (not being shops or

commercial establishments) to be included?

2) Slum Redevelopment or Rehabilitation projects notifed by

the Central Board of Direct Taxes

In order to promote Slum Redevelopment or Rehabilitation Scheme

in India, the Finance Act, 2010 amended defnition of specifed

business for the purpose of section 35AD to include the developing

and building a housing project commenced on or after 1 April 2010

for Slum Redevelopment / Rehabilitation. Under the amended

provisions, Developers are eligible for claiming deduction of 100%

of the capital expenditure in the previous year in which the same

is incurred. Further, expenses incurred before commencement of

operations are allowable as a deduction in the frst year of operation.

It is pertinent to note that no deduction is allowable towards

expenses incurred for acquisition of land or goodwill or fnancial

instruments.

The section, in effect provides accelerated depreciation. Therefore,

a question arises as to whether the section really provides an

incentive. Further, the question becomes larger when it surmises

that a Developer paying taxes under the provision of the MAT, may

have to pay taxes on book proft calculated after claiming normal

book depreciation though accelerated depreciation is allowed under

section 35AD.

3) Development of Special Economic Zones (SEZs)

An SEZ Developer (including a Co-developer) is also eligible to

proft linked incentives under the provisions of the Act. Tax incentive

in the form of 100% deduction of the profts for the period of ten

consecutive assessment years out of ffteen years is available to a

Developer of SEZ. The deduction is available from the assessment

year in which the SEZ is notifed by the Central Government.

Further, the SEZ Developer also enjoys following exemption: