Académique Documents

Professionnel Documents

Culture Documents

ACA and Small Biz Presentation

Transféré par

Manny Munson-Regala0 évaluation0% ont trouvé ce document utile (0 vote)

9 vues30 pagesShort presentation of the impact of the Affordable Care Act on small business owners; with particular emphasis on the impact to Minnesota.

Copyright

© © All Rights Reserved

Formats disponibles

PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentShort presentation of the impact of the Affordable Care Act on small business owners; with particular emphasis on the impact to Minnesota.

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

9 vues30 pagesACA and Small Biz Presentation

Transféré par

Manny Munson-RegalaShort presentation of the impact of the Affordable Care Act on small business owners; with particular emphasis on the impact to Minnesota.

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 30

Manny Munson-Regala JD

Assistant to the Commissioner

Minnesota Department of Health

September 30th, 2013

THE ACAS AND SMALL BUSINESS:

IMPACT IN MN

AGENDA

2

Why Reform?

Provisions affecting Small

Businesses

MNsure

What Next

WHY PASS THE ACA?

3

VALUE PROPOSITION?

4

MINNESOTA

5

HOW IS MN DOING?

6

Recognized as a leader in health and health care, but

Increase in uninsured

Health disparities between populations

Health care spending continues to increase (13.9% of

state economy (up from 12.8% in 2006)

Used to be 1

st

in the UnitedHealthcare rankings, now 5th

ENROLLMENT FOR SMALL GROUP

491,079

359,775

0

100,000

200,000

300,000

400,000

500,000

1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010

7

Fully Insured market only

Source: MDH, Health Economics Program; estimates based on data from various sources.

COMPOSITION OF THE WORK FORCE

Up to 100% FPL,

2.7%

101 to 200% FPL,

35.3%

201 to 300% FPL,

29.5%

301 to 400% FPL,

12.0%

More than 400%

FPL , 11.9%

Small employer population includes employees who work for an employer with 2 to 50 employees.

Source: MDH Health Economics Program analysis of the 2011 Minnesota Health Access Survey.

8

ACA AND SMALL BUSINESS

9

SELF EMPLOYED

10

Individual mandate- can be satisfied by ESI (including

COBRA and retiree coverage), Medicare, Medicaid,

CHIP, VA coverage and TRICARE

Can purchase on the MNsure

Access to tax credits on sliding scale

Coverage through Medicaid expansion

Coverage through Minnesota Care

No employer mandate

Protected by MLR rule

Limited to $2500 contribution for

FSAs

Medicare withholding increases

from 1.45% to 2.35% for higher

compensated employees (e.g.

200k)

No more waiting period after

2014 for ESI

Eligible to participate in MNsure

If offer coverage, must provide

Summary of Benefits and

Coverage

Wellness incentives up to 30% of

premium; with up to 50%

difference for tobacco use

Two tax credit programs- but not

for employers 25 to 50

Must provide notices to their

employees about exchange, tax

credits and potential impact on

employer contribution

50 OR FEWER EMPLOYEES

11

Department of Labor (DOL) requires

employers to notify current and new

employees notices of their coverage

options

Generally applicable to all employers

that employ one or more employees

that produce $500,000 annually

All new employees must begin

receiving the notification by October

1st, 2013 within 14 days of hire

Current employees hired prior to

October 1st, 2013 must receive the

notification by October 1st, 2013

Can be sent via email

Examples can be found on the DOL

website

http://www.dol.gov/ebsa/healthreform/i

ndex.html

Must inform the employee of:

the existence of Mnsure

contact information of Mnsure

explain that employees may be

eligible for premium tax credits

under the ACA; and

that purchasing products through

MNsure may eliminate employer

contributions

EMPLOYER NOTICE

12

13

GOAL? 1.3 MILLION MINNESOTANS

14

Individual Consumers

300,000

Small Businesses and

Employees 150,000

Medical Assistance/

MNCare 850,000

Advantages of Exchanges in general

Transparent, competitive market with

better information and more choices

Aggregated buying power

Defined contribution and employee

choice of issuers and plans

Option for employer defined

contribution with one bill, one check

administration

Advantages specific to MNsure

Employer tax credits

Advantages resulting from market reforms

Rating reforms in individual and small

group markets

Risk adjustment in small group market

Limits on allowable Minimum Loss

Ratio

Increased risk pool from more

Americans covered

WHY MNSURE AND ACA INSTEAD OF CURRENT

MARKET

15

Must exist in each state (either as

state or federal exchanges) Minnesota

decided to implement state-based

exchange or marketplace called

MNsure

May be separate or combined with

individual exchange We have one

marketplace

Must be self-supporting by 2015

MNsure funded by fee of up to 3.5% of

MNsure premiums

Individual and small group risk pools

may be combined or kept separate

Currently separated

Serves 1-100, or, at state option: 1-50

until 2016 Minnesota at 50

States may expand to larger

employers beginning in 2017 Policy

decision still to come

State agency, non-profit or hybrid

Minnesota created quasi state agency

(subject to some but not all state rules)

Active purchaser or clearinghouse

Clearinghouse in 2014, Boards option

afterwards

SHOP EXCHANGES: ACA OPTIONS AND

MINNESOTA'S CHOICES

MNSURE: DEFINED CONTRIBUTION

States can offer employers options:

(1) employees can choose any QHP offered in the SHOP in any tier;

(2) employers select specific tiers from which an employee may choose

a QHP;

(3) employers select specific QHPs from different tiers of coverage from

which an employee may choose a QHP; or

(4) employers to select a single QHP to offer employees

MNsure will offer all of the employer options

MNSURE: BILLING AND OTHER SERVICES

18

MNsure will:

provide bill with details of employer and employee contribution

employee pays employee contribution through payroll deduction

employer sends total premium to the SHOP

Premiums remain the same throughout the employers plan year

Customer service provided by a broker, MNsure or the insurer

Changes to coverage during the year (adds/drops) made on MNsure

MNsure notifies employer of renewal process

MNSURE: PRODUCT OFFERINGS

19

Three companies approved to sell small group health policies on MNsure

Blue Cross Blue Shield

Medica

Preferred One

63 products at all metal levels

All products must meet new insurance rules

Essential Health Benefits

Rules on annual/lifetime limits

Definition of dependents

Mix of broad and narrower networks

In 2014, small group health

rates inside and outside

can only use:

an individual or family

geographic area

age (but by no more

than a 3:1 ratio), and

tobacco use (but by no

more than a 1.5:1 ratio).

In region 8 (metro area), a

business with five employees

can buy:

Bronze from $507 to

$1,014

Silver from $594 to $1,187

Gold from $702 to $1,403

Platinum from $894 to

$1,788

MNSURE: COSTS

20

MNSURE: TAX CREDIT

21

Only available in MNsure

Small employers that provide healthcare coverage are eligible (a qualified

employer) if:

They have fewer than 25 full-time equivalent employees (FTEs) for the

tax year

The average annual wages paid are less than $50,000 per FTE

The employer pays at least 50% of the premium cost under a qualified

arrangement

For more information on the tax credit, go to this link

http://www.irs.gov/uac/Small-Business-Health-Care-Tax-Credit-for-Small-

Employers

MNSURE: ENROLLMENT

22

Because small employers do not have to offer

coverage, they can:

Enroll starting October 1, 2013 for coverage starting

as soon as January 1, 2014

Enroll and begin coverage any time after January 1,

2014

If you plan to use MNsure, you must offer coverage to

all of your full-time employees

MNSURE: PARTICIPATION

REQUIREMENTS

23

Current MN law only requires guaranteed issue for small

employers if the small employer:

contributes at least 50 percent toward the cost of coverage

for each eligible employee;

AND at least 75 percent of the eligible employees who have

not waived coverage participate in the plan.

MNsure will waive both requirements for employers purchasing

November 15 to December 15, 2013.

PROJECTED IMPACT

24

MNsure commissioned study by Gruber-Gorman to

model out impact of ACA on MN. Some relevant

findings:

Increased premiums for a healthier groups and decrease

premiums for the less healthy groups

Overall premium impact flat

150,000 projected small employers enrolled in MNsure

DECISION POINTS FOR SMALL

BUSINESSES

25

No requirement to offer health insurance but there are

some incentives.

MNsure offers more options and possible bargaining power

Premium tax credits available through MNsure.

Employee demand

Some workers better off with a premium tax credit if they go through the

exchange

Other workers not eligible for large exchange tax credits will take

coverage offered through work

AFTER THE ACA, WHAT NEXT?

26

FROM HEALTH CARE TO HEALTH

Economic and social conditions

influence the health of people and

communities .

Factors related to health outcomes

include:

Early childhood development

Education

Employment status

Type of work

Food security

Access to health services and quality of those

services

Housing status

Income

Discrimination and social support

Minnesota

Your ZIP Code May Be More

Important to Your Health Than

Your Genetic Code

28

SUMMARY

29

Small Employers have many options

Employer Mandate does not apply

One option is MNsure which offers:

3 carriers with various products

Defined contribution options

Aggregated billing

Access to Agents and Brokers

Access to Tax Credits

Potential aggregated buying power

Next? From Health Care to Health

RESOURCES

30

www.mnsure.org , www.mnsure.com or 855-3-MNSURE, or 855-

366-7873- for information on Mnsure

Agents or Brokers

In-Person assisters (check MNsure for up to date locations and

names)

Small Business Minnesota

www.healthreform.gov- for information on the ACA generally

Vous aimerez peut-être aussi

- Social Security / Medicare Handbook for Federal Employees and Retirees: All-New 4th EditionD'EverandSocial Security / Medicare Handbook for Federal Employees and Retirees: All-New 4th EditionPas encore d'évaluation

- Healthcare Reform TimelineDocument16 pagesHealthcare Reform TimelinenfibPas encore d'évaluation

- Summary, Analysis & Review of Philip Moeller’s Get What’s Yours for MedicareD'EverandSummary, Analysis & Review of Philip Moeller’s Get What’s Yours for MedicarePas encore d'évaluation

- Health Economics Health System Reform: Tianxu ChenDocument32 pagesHealth Economics Health System Reform: Tianxu ChenRobert MariasiPas encore d'évaluation

- Maximize Your Medicare (2019 Edition): Understanding Medicare, Protecting Your Health, and Minimizing CostsD'EverandMaximize Your Medicare (2019 Edition): Understanding Medicare, Protecting Your Health, and Minimizing CostsÉvaluation : 5 sur 5 étoiles5/5 (1)

- Aca Powerpoint 12 3 13 RevisedDocument17 pagesAca Powerpoint 12 3 13 Revisedapi-242371940Pas encore d'évaluation

- Health Care Reform Act: Critical Tax and Insurance RamificationsD'EverandHealth Care Reform Act: Critical Tax and Insurance RamificationsPas encore d'évaluation

- Financial Decision-Making Theory and The Small Employer Health Insurance Market in TexasDocument17 pagesFinancial Decision-Making Theory and The Small Employer Health Insurance Market in TexasSajid AnothersonPas encore d'évaluation

- HCRprovisions - Older Adults 3-30-10Document6 pagesHCRprovisions - Older Adults 3-30-10hcreformPas encore d'évaluation

- Healthcare Reform Resource Guide and Fact Book - March2009Document37 pagesHealthcare Reform Resource Guide and Fact Book - March2009SEIUOnlinePas encore d'évaluation

- Health Economics The Organization of Health Insurance MarketsDocument33 pagesHealth Economics The Organization of Health Insurance MarketsRobert MariasiPas encore d'évaluation

- P ERC Obama Announcement For Transition Relief1Document3 pagesP ERC Obama Announcement For Transition Relief1c62ke40Pas encore d'évaluation

- Financing Health CareDocument56 pagesFinancing Health Carewelcome martinPas encore d'évaluation

- Affordable Care Act: Where Do We Go From Here?: Presented ToDocument70 pagesAffordable Care Act: Where Do We Go From Here?: Presented TonketchumPas encore d'évaluation

- Affordable Care Act: Where Do We Go From Here?: Presented ToDocument55 pagesAffordable Care Act: Where Do We Go From Here?: Presented TonketchumPas encore d'évaluation

- WP Insight HCR Impact On Rewards StrategiesDocument4 pagesWP Insight HCR Impact On Rewards StrategiesGeorge B. BuckPas encore d'évaluation

- Health Care Reform-Required Exchange Notice To Employees: Technical Release No. 2013-02Document5 pagesHealth Care Reform-Required Exchange Notice To Employees: Technical Release No. 2013-02batambintanPas encore d'évaluation

- Healthcare Reform ActDocument3 pagesHealthcare Reform Actpeterlouisanthony7859Pas encore d'évaluation

- AHM 250 SummaryDocument116 pagesAHM 250 SummaryDinesh Anbumani100% (5)

- AHM 250 SummaryDocument117 pagesAHM 250 Summarysenthilj82Pas encore d'évaluation

- CM Employee Benefit and ServicesDocument63 pagesCM Employee Benefit and ServicesFaisal AminPas encore d'évaluation

- Employee BenefitsDocument16 pagesEmployee BenefitsCindy ConstantinoPas encore d'évaluation

- ACA Overview 2016 - 421Document29 pagesACA Overview 2016 - 421Bahaa TakieddinePas encore d'évaluation

- English 1103 Research PresentationDocument18 pagesEnglish 1103 Research PresentationZnaLeGrandPas encore d'évaluation

- March 2009 Nyscaa Hra Hsa CobraDocument18 pagesMarch 2009 Nyscaa Hra Hsa CobraKristiePas encore d'évaluation

- Health in Reform 2010: Understanding The Patient Protection and Affordability Act and Its Impact On YouDocument18 pagesHealth in Reform 2010: Understanding The Patient Protection and Affordability Act and Its Impact On YouDennis AlexanderPas encore d'évaluation

- AHIPDocument5 pagesAHIPPeter SullivanPas encore d'évaluation

- The Impact of The Economic Recovery Act of 2009 On HealthcareDocument31 pagesThe Impact of The Economic Recovery Act of 2009 On Healthcareasg_akn8335Pas encore d'évaluation

- Healthcare 101 An Introduction Day II - USTDocument59 pagesHealthcare 101 An Introduction Day II - USTAnonymous sthlPa7100% (1)

- PRMB PDFDocument13 pagesPRMB PDFkshitijsaxenaPas encore d'évaluation

- ObamaCare Power PointDocument16 pagesObamaCare Power PointPBS NewsHour100% (3)

- State Health Exchanges and Qualified Health PlansDocument49 pagesState Health Exchanges and Qualified Health PlansRajiv GargPas encore d'évaluation

- Health Care Reform White PaperDocument5 pagesHealth Care Reform White Papervanessa_parks_1Pas encore d'évaluation

- LO 3 - Chapter 7 Healthcare BenefitsDocument24 pagesLO 3 - Chapter 7 Healthcare BenefitssalwaPas encore d'évaluation

- Ternian HCIS InteractiveDocument10 pagesTernian HCIS InteractivetrninsgrpPas encore d'évaluation

- Health Insurance Unit - 4: Soumendra RoyDocument27 pagesHealth Insurance Unit - 4: Soumendra RoybapparoyPas encore d'évaluation

- Summary of Health Care Reform SeminarDocument8 pagesSummary of Health Care Reform SeminarTheFedeliGroupPas encore d'évaluation

- Health Insurance L4Document32 pagesHealth Insurance L4aochu111Pas encore d'évaluation

- Ahm 250 5 HmoDocument10 pagesAhm 250 5 Hmodeepakraj610Pas encore d'évaluation

- Fundamentals of Medical Insurance UnderwritingDocument13 pagesFundamentals of Medical Insurance UnderwritingYash baghel 19 GGB 259Pas encore d'évaluation

- HMO Fraser General Hospital The New Way To Look at LifeDocument12 pagesHMO Fraser General Hospital The New Way To Look at LifeSoumyadip MistryPas encore d'évaluation

- Affordable Care ActDocument5 pagesAffordable Care Actneha24verma3201Pas encore d'évaluation

- Murray Alexander Market Stabilization SummaryDocument1 pageMurray Alexander Market Stabilization SummaryKING 5 NewsPas encore d'évaluation

- Acahealthcare Update 4102014Document5 pagesAcahealthcare Update 4102014api-250294225Pas encore d'évaluation

- MI Consumer Guide To Health InsuranceDocument40 pagesMI Consumer Guide To Health InsuranceMichigan NewsPas encore d'évaluation

- Introduction To Health Insurance PPT 8 23 13 FinalDocument38 pagesIntroduction To Health Insurance PPT 8 23 13 Finalapi-225367524100% (1)

- Health Insurance in IndiaDocument6 pagesHealth Insurance in Indiachhavigupta1689Pas encore d'évaluation

- RMI Chapter 16Document21 pagesRMI Chapter 16Jayvee M FelipePas encore d'évaluation

- ACA White PaperDocument4 pagesACA White PaperTom GaraPas encore d'évaluation

- DAY-3 Cobra: Qualifying/Triggering Events For Employees and DependentsDocument7 pagesDAY-3 Cobra: Qualifying/Triggering Events For Employees and DependentsHarman SinghPas encore d'évaluation

- An Analysis of Health Insurance Premiums Under The Patient Protection and Affordable Care ActDocument29 pagesAn Analysis of Health Insurance Premiums Under The Patient Protection and Affordable Care ActKFFHealthNewsPas encore d'évaluation

- DRC Oct 2012 Without CartoonsDocument21 pagesDRC Oct 2012 Without CartoonsdallaschamberPas encore d'évaluation

- Eow HC Aca Upheld 062812Document4 pagesEow HC Aca Upheld 062812marshall_johnso6704Pas encore d'évaluation

- How Will U.S. Healthcare Reform Affect Medical Tourism Jonathan Edelheit, CEO Medical Tourism Association™Document31 pagesHow Will U.S. Healthcare Reform Affect Medical Tourism Jonathan Edelheit, CEO Medical Tourism Association™Patrick AdamsPas encore d'évaluation

- Norton BenefitsDocument48 pagesNorton BenefitsTPas encore d'évaluation

- HealthcareReformNewsletter August IndividualDocument2 pagesHealthcareReformNewsletter August IndividualConcha Burciaga HurtadoPas encore d'évaluation

- Mediclaim Insurance: - M.ANUSHA (10AD03) - PREETHI (10AD22) - Poorna Chandra (10ad40)Document22 pagesMediclaim Insurance: - M.ANUSHA (10AD03) - PREETHI (10AD22) - Poorna Chandra (10ad40)Preethi LathicaPas encore d'évaluation

- IPM Presentation 010312 FINALDocument17 pagesIPM Presentation 010312 FINALTerri BimmPas encore d'évaluation

- 602036992Document21 pages602036992Ifeanyi MbahPas encore d'évaluation

- 100000000420152Document1 page100000000420152Sandeep SranPas encore d'évaluation

- A Study On The Role of Bajaj Finserv in Consumer Durable FinanceeDocument58 pagesA Study On The Role of Bajaj Finserv in Consumer Durable Financeeshwetha17% (6)

- Actuarial Valuation LifeDocument22 pagesActuarial Valuation Lifenitin_007100% (1)

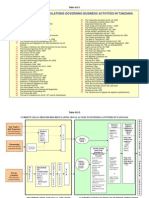

- List of Laws and Regulations Governing Business Activities in TanzaniaDocument9 pagesList of Laws and Regulations Governing Business Activities in TanzaniaSebastian_Lidu_7416Pas encore d'évaluation

- Afc U 23 Championship Thailand 2020 Competition Regulations PDFDocument44 pagesAfc U 23 Championship Thailand 2020 Competition Regulations PDFAditya Eka WPas encore d'évaluation

- US Internal Revenue Service: Irb07-39Document72 pagesUS Internal Revenue Service: Irb07-39IRSPas encore d'évaluation

- Third Party AdministratorsDocument8 pagesThird Party Administratorsmanoj_pareek_3Pas encore d'évaluation

- WYSE Advisors - Company ProfileDocument2 pagesWYSE Advisors - Company ProfileKarthick ThiyaguPas encore d'évaluation

- Chairman, L.I.C. of India & Others V Rajeev Kumar BhaskarDocument4 pagesChairman, L.I.C. of India & Others V Rajeev Kumar BhaskarAashi VermaPas encore d'évaluation

- BBA Insurance Management 2022Document4 pagesBBA Insurance Management 2022Ꮢ.Gᴀɴᴇsн ٭ʏт᭄Pas encore d'évaluation

- Iress Xplan Risk Profile Question Air ReDocument11 pagesIress Xplan Risk Profile Question Air ReCara ElliottPas encore d'évaluation

- Your Turn PT AssignmentDocument2 pagesYour Turn PT Assignmentdrifter987Pas encore d'évaluation

- Financial InclusionDocument69 pagesFinancial InclusionthenosweenPas encore d'évaluation

- Insurance For Libraries: Christine Lind Hage, Director, Rochester Hills (MI) Public LibraryDocument11 pagesInsurance For Libraries: Christine Lind Hage, Director, Rochester Hills (MI) Public Librarysps fetrPas encore d'évaluation

- From Crisis To Financial Stability Turkey Experience 3rd EdDocument98 pagesFrom Crisis To Financial Stability Turkey Experience 3rd Edsuhail.rizwanPas encore d'évaluation

- Cir Cta Notes 3-119Document1 pageCir Cta Notes 3-119BGodPas encore d'évaluation

- Question Bank BSDocument18 pagesQuestion Bank BSDeivanai K CSPas encore d'évaluation

- 2022-2023 Leavers HandbookDocument69 pages2022-2023 Leavers Handbookapi-251248979Pas encore d'évaluation

- Pri FactoidsDocument11 pagesPri FactoidsPaul Lish CarsonPas encore d'évaluation

- Prospectus 375 Park AvenueDocument321 pagesProspectus 375 Park AvenueJagadeesh YathirajulaPas encore d'évaluation

- Q420 Handbook of Metric GearsDocument526 pagesQ420 Handbook of Metric Gearslebob12100% (1)

- Carlos Superdrug Corp. v. DSWDDocument11 pagesCarlos Superdrug Corp. v. DSWDMadelle PinedaPas encore d'évaluation

- 4 Profit Planning Budgeting PDFDocument85 pages4 Profit Planning Budgeting PDFNadie LrdPas encore d'évaluation

- Customer Relationship Management (CRM) Practices in Life Insurance IndustryDocument9 pagesCustomer Relationship Management (CRM) Practices in Life Insurance IndustryRaghav RawatPas encore d'évaluation

- Contract PDFDocument7 pagesContract PDFAnonymous i3lOdBVSRPas encore d'évaluation

- What Is A Switch Bill of Lading and When and Why Is It UsedDocument5 pagesWhat Is A Switch Bill of Lading and When and Why Is It UsednavinkapilPas encore d'évaluation

- Business LawDocument45 pagesBusiness LawCherwin bentulan100% (2)

- Contract To Sell Axeia PagibigDocument15 pagesContract To Sell Axeia PagibigMark Rye100% (2)

- Employee Attrition in Insurance SectorDocument6 pagesEmployee Attrition in Insurance SectorJuthika AcharjeePas encore d'évaluation

- Modern Warriors: Real Stories from Real HeroesD'EverandModern Warriors: Real Stories from Real HeroesÉvaluation : 3.5 sur 5 étoiles3.5/5 (3)

- Power Grab: The Liberal Scheme to Undermine Trump, the GOP, and Our RepublicD'EverandPower Grab: The Liberal Scheme to Undermine Trump, the GOP, and Our RepublicPas encore d'évaluation

- The Next Civil War: Dispatches from the American FutureD'EverandThe Next Civil War: Dispatches from the American FutureÉvaluation : 3.5 sur 5 étoiles3.5/5 (48)

- The Russia Hoax: The Illicit Scheme to Clear Hillary Clinton and Frame Donald TrumpD'EverandThe Russia Hoax: The Illicit Scheme to Clear Hillary Clinton and Frame Donald TrumpÉvaluation : 4.5 sur 5 étoiles4.5/5 (11)

- The Courage to Be Free: Florida's Blueprint for America's RevivalD'EverandThe Courage to Be Free: Florida's Blueprint for America's RevivalPas encore d'évaluation

- Crimes and Cover-ups in American Politics: 1776-1963D'EverandCrimes and Cover-ups in American Politics: 1776-1963Évaluation : 4.5 sur 5 étoiles4.5/5 (26)

- Game Change: Obama and the Clintons, McCain and Palin, and the Race of a LifetimeD'EverandGame Change: Obama and the Clintons, McCain and Palin, and the Race of a LifetimeÉvaluation : 4 sur 5 étoiles4/5 (572)

- The Red and the Blue: The 1990s and the Birth of Political TribalismD'EverandThe Red and the Blue: The 1990s and the Birth of Political TribalismÉvaluation : 4 sur 5 étoiles4/5 (29)

- Stonewalled: My Fight for Truth Against the Forces of Obstruction, Intimidation, and Harassment in Obama's WashingtonD'EverandStonewalled: My Fight for Truth Against the Forces of Obstruction, Intimidation, and Harassment in Obama's WashingtonÉvaluation : 4.5 sur 5 étoiles4.5/5 (21)

- The Science of Liberty: Democracy, Reason, and the Laws of NatureD'EverandThe Science of Liberty: Democracy, Reason, and the Laws of NaturePas encore d'évaluation

- Bad Religion: How We Became a Nation of HereticsD'EverandBad Religion: How We Became a Nation of HereticsÉvaluation : 4 sur 5 étoiles4/5 (74)

- To Make Men Free: A History of the Republican PartyD'EverandTo Make Men Free: A History of the Republican PartyÉvaluation : 4.5 sur 5 étoiles4.5/5 (21)

- Witch Hunt: The Story of the Greatest Mass Delusion in American Political HistoryD'EverandWitch Hunt: The Story of the Greatest Mass Delusion in American Political HistoryÉvaluation : 4 sur 5 étoiles4/5 (6)

- The Invisible Bridge: The Fall of Nixon and the Rise of ReaganD'EverandThe Invisible Bridge: The Fall of Nixon and the Rise of ReaganÉvaluation : 4.5 sur 5 étoiles4.5/5 (32)

- The Magnificent Medills: The McCormick-Patterson Dynasty: America's Royal Family of Journalism During a Century of Turbulent SplendorD'EverandThe Magnificent Medills: The McCormick-Patterson Dynasty: America's Royal Family of Journalism During a Century of Turbulent SplendorPas encore d'évaluation

- The Deep State: How an Army of Bureaucrats Protected Barack Obama and Is Working to Destroy the Trump AgendaD'EverandThe Deep State: How an Army of Bureaucrats Protected Barack Obama and Is Working to Destroy the Trump AgendaÉvaluation : 4.5 sur 5 étoiles4.5/5 (4)

- A Short History of the United States: From the Arrival of Native American Tribes to the Obama PresidencyD'EverandA Short History of the United States: From the Arrival of Native American Tribes to the Obama PresidencyÉvaluation : 3.5 sur 5 étoiles3.5/5 (19)

- Socialism 101: From the Bolsheviks and Karl Marx to Universal Healthcare and the Democratic Socialists, Everything You Need to Know about SocialismD'EverandSocialism 101: From the Bolsheviks and Karl Marx to Universal Healthcare and the Democratic Socialists, Everything You Need to Know about SocialismÉvaluation : 4.5 sur 5 étoiles4.5/5 (42)

- Resistance: How Women Saved Democracy from Donald TrumpD'EverandResistance: How Women Saved Democracy from Donald TrumpPas encore d'évaluation

- Corruptible: Who Gets Power and How It Changes UsD'EverandCorruptible: Who Gets Power and How It Changes UsÉvaluation : 4.5 sur 5 étoiles4.5/5 (45)

- Slouching Towards Gomorrah: Modern Liberalism and American DeclineD'EverandSlouching Towards Gomorrah: Modern Liberalism and American DeclineÉvaluation : 4 sur 5 étoiles4/5 (59)

- Revealing the Wickedness of the American Government: Organized Stalking, Electronic Harassment, and Human ExperimentationD'EverandRevealing the Wickedness of the American Government: Organized Stalking, Electronic Harassment, and Human ExperimentationÉvaluation : 5 sur 5 étoiles5/5 (1)

- UFO: The Inside Story of the US Government's Search for Alien Life Here—and Out ThereD'EverandUFO: The Inside Story of the US Government's Search for Alien Life Here—and Out ThereÉvaluation : 4.5 sur 5 étoiles4.5/5 (16)

- Manufacturing Consent: The Political Economy of the Mass MediaD'EverandManufacturing Consent: The Political Economy of the Mass MediaÉvaluation : 4 sur 5 étoiles4/5 (495)