Académique Documents

Professionnel Documents

Culture Documents

02 Certified Financial Accountant Program Syllabus

Transféré par

Fahad Dedhi0 évaluation0% ont trouvé ce document utile (0 vote)

64 vues31 pages02 Certified Financial Accountant Program Syllabus

Copyright

© © All Rights Reserved

Formats disponibles

PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce document02 Certified Financial Accountant Program Syllabus

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

64 vues31 pages02 Certified Financial Accountant Program Syllabus

Transféré par

Fahad Dedhi02 Certified Financial Accountant Program Syllabus

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 31

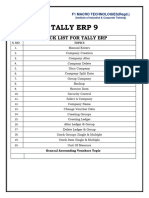

Module B (Certificate Stage)

Advanced Accounting Concepts

Financial Statement Analysis

Business Taxation

Fundamentals of Financial

Management

Module C (Professional Group I)

Strategic Business

Communication

Corporate Performance

Evaluation

Managerial Accounting &

Decision Making

Professional Values & Ethics

Module D (Professional Group II)

IFRS & External Independent

Reports

Financial Management Policy &

Procedure

Total Quality Management

Audit & Assurance

Module A (Foundation Stage)

Basic Accounting Tests &

Techniques

Industrial and Commercial Laws

Strategic Business Management

Corporate Governance

Syllabus of

Certified Financial Accountant Program

The Society of Accounting Education

Sr.

No.

Course

Code

Course

Class

Room

Hours

Credit

Hours

Module A (Foundation Stage)

1 FS-01 Basic Accounting Tests & Techniques 60 5

2 FS-02 Industrial and Commercial Laws 50 4

3 FS-03 Strategic Business Management 60 5

4 FS-04 Corporate Governance 60 5

Sub-Total (A) 230 19

Module B (Certificate Stage)

5 CS-01 Advanced Accounting Concepts 60 5

6 CS-02 Financial Statement Analysis 50 4

7 CS-03 Business Taxation 50 4

8 CS-04 Fundamentals of Financial Management 60 5

Sub-Total (B) 220 18

Module C (Professional Group I)

9 PG-01 Strategic Business Communication 60 5

10 PG-02 Corporate Performance Evaluation 60 5

11 PG-03 Managerial Accounting & Decision Making 60 5

12 PG-04 Professional Values & Ethics 50 4

Sub-Total (C) 230 19

Module D (Professional Group II)

13 PG-05 IFRS & External Independent Reports 50 4

14 PG-06 Financial Management Policy & Procedure 60 5

15 PG-07 Total Quality Management 60 5

16 PG-08 Audit & Assurance 60 5

Sub-Total (D) 230 19

Grand-Total (A+B+C+D) 910 75

The Society of Accounting Education

1

Course Outline of Certified Financial Accountant

Program

OBJECTIVE

The course objective is to develop the understanding of basic concepts and techniques of

accounting /book keeping.

COURSE CONTENTS:

Financial Accounting

Introduction

Accounting Standards

Accrual vs Cash Method

Underlying Assumptions, Principles and Conventions

Financial Statements

Double Entry Accounting

Fundamental Accounting Model

Transactions

The Accounting Process

Underlying Assumptions and Principles

Single Entry Bookkeeping

Double Entry Bookkeeping

The Accounting Equation

The Accounting Cycle

The Source Document

Journal Entries

Debit and Credit

Trial Balance

Adjusting Entries

Closing Entries

The Financial Statements

Financial Accounting Standards

The Society of Accounting Education

2

MODULE (A) COURSE CODE FS-01

BASIC ACCOUNTING TESTS & TECHNIQUES

RECOMMENDED BOOKS FOR READING:

Modern Accounting

By Mukerjee M.

Hanif Tata McGraw

Hill Publishing Co.

How to Read a

Financial

Report

By Tracy John

A

Accounting Principles

By Jerry J W.eygandt

Paul D. Kimmd &

Donard E. Kieso

Financial

Statements

By Ittelson,

Thomas R.

Accounting

By Meigs & Meigs

OBJECTIVE

This course has been selected to teach to the students, to equip in the application of Industrial

and Commercial Laws, during their services, or to run the businesses.

COURSE CONTENTS:

INDUSTRIAL LAWS

I. THE FACTORIES ACT

Definitions, certifying surgeon and inspector, their powers and duties, provisions relating to

Health, safety and welfare, hours of work and holidays, special provisions regarding

employment of women and children/adolescent.

II. INDUSTRIAL RELATIONS ORDINANCE

Definitions, Trade union and its registration, collective bargaining agent, unfair labour

practices, method of settlement of Industrial disputes labour courts, strike and lockout.

III. WORKMENS COMPENSATION ACT

Meaning of the terms Accident and arising out of and in the course of disablement, employers

liability, when employer is not liable to pay compensation.

COMMERCIAL LAWS

I. LAW OF CONTRACT

Introduction and definition of contract, Essentials of a valid contract, void agreements,

contingent of the contract, Discharge of contract, quasi contracts, Indemnity and Guarantee,

Bailment and Pledge, Agency etc.

II THE SALE OF GOODS ACT

Define goods and its classification, Distinction between sale and agreement to sell, price,

conditions and warranties, Transfer of property, Transfer of title, unpaid seller and his rights,

Delivery and its rules, Auction sale.

III. THE PARTNERSHIP ACT

Definition of partnership & Determination at will, Rights and duties of Partner(s) implied

authority of a partner, position of a Minor Partner, Dissolution of Partnership, Registration

and effect of non-registration of the firm.

The Society of Accounting Education

3

MODULE (A) COURSE CODE FS-02

INDUSTRIAL AND COMMERCIAL LAWS

IV. THE NEGOTIABLE INSTRUMENTS ACT

Introduction, meaning, requirements characteristics of negotiable instruments, Definition and

Distinction of Promissory notes, Bill of Exchange and cheque. Crossing object and kinds, A

brief introduction of endorsement, Negotiation, presentment, Acceptance and Dishonour.

Discharge from liability.

V. SECURITIES

A brief Introduction of Mortgages, changes and Hypothecation.

VI. CARRIAGE OF GOODS.

Common Carrier. Essentials of a Common Carrier, Rights, and Duties of a common

Carrier.Restricted Liability of Railway Carriage as common carriage and by Sea.

RECOMMENDED BOOKS FOR READING

Mercantile Law of Pakistan

Accountancy & Taxation

Services Institute, Lahore

(Latest Ed.)

By Khawaja Amjad Saeed.

Business Law

By Syed Mobin

Mahmud Co. Lahore.

Govt. of Pakistan

Relevant Acts and

Ordinances (latest Ed.)

A Manual of

Mercantile Law

11

th

Revised Edition

S. Chand and Co.

(Pvt.) Limited 1989

M.C. Shukla

Bare Acts,

Govt. of

Pakistan.

Elements of

Mercantile

Law

By Sultan

Chand & Sons

New Dehli.

OBJECTIVES

This course is very important to give full strength to manage the things in the Business

Environment and give professional knowledge to become a strong Manager.

COURSE CONTENTS:

o Management: An overview.

o The Managers Diverse Environment

o Social Responsibility and Business Ethics

o Managerial Decision Making

o The Planning Process

o Strategic Planning

o The Organizing Process and the Informal Organization

o Organizing Concepts and Organization Structure.

o Human Resource Management and the Staffing Function.

The Society of Accounting Education

4

MODULE (A) COURSE CODE FS-03

STRATEGIC BUSINESS MANAGEMENT

o Motivation.

o Leadership.

o Communication

o Group Performance, Team Building and Conflict.

o Power, Organizational Politics and Stress.

o Corporate Culture, Change and Development.

o The Controlling Processes and Techniques.

o Total Quality Management.

o Management in the Multinational Environment

o Production and Operation Management

o Management Information Systems

RECOMMENDED BOOKS FOR READING

Study Guide,

By Jeanne Daboval

McNeese State

University, Seventh

Edition.

Managmeent Concepts,

Pratices and Skills

By R. Wayne Mondy,

Shane R. Premeaux

Prentice Hall,

Englewood Cliffs, New

Jersey.

Essential of

Managmenet an

Innternational

Perspective

B y Harold

Koontz,

Weihrich, Tata

McGraw Hill

Management

By Stephen P.

Robins & Mary

Coulter

Prentice Hall

International

Inc. New York.

Principles of

Management

By George R.

Terry

OBJECTIVE

To provide the participants with a broad conceptual framework and understanding of

Industry practice and compliance issues in corporate governance.

COURSE CONTENTS

i. Corporate Governance and Corporate Accountability

An introduction and general mapping of the issues with reference to the relevant academic

literature on the subject:

o The legal model of the company, and its failure

o Forces driving corporate governance since the 90s

o The Cadbury model and codes of corporate governance

The Society of Accounting Education

5

MODULE (A) COURSE CODE FS-04

CORPORATE GOVERNANCE

ii. The Board as a Mechanism of Corporate Governance

The presenters will seek to elicit the views of participants while defining the issues,

summarizing research, and making their own suggestions on the following topics:

o Responsibilities of the Board;

o What constitutes "independence" of directors?

o What should non-executive directors be doing?

o Audit Committee

o Institutional Nominees;

o The need for a legislative statement of directors' duties.

iii. Corporate Governance and the Market

o Disclosure and transparency issues

o Accounting standards and auditors independence

o Do Institutional Investors have governance responsibilities?

o Corporate governance and takeover regulations

o Shareholder voting rights

iv. Between Self-Regulation and Compliance

o Corporate law and the Department of Corporate Affairs

o SEBI Code of Corporate Governance and Clause 49 of the Listing Agreement

o Compliance issues and some company responses

The Society of Accounting Education

6

OBJECTIVE

The primary objective of this course is to enable the students to understand the General

Accounting Theory pertaining to the Business Combinations. Secondly to make the students

familiar with the applicability of IAS /GAAP/IFRS regarding requisite financial disclosures for

consolidated financial statements resulting from Business Combinations.

At the completion of this course, the students will be able to understand the general

accounting theory pertaining to the Business Combinations. The students should be able to

complete various types of consolidate financial statements resulting from Business

Combinations. Finally, the students will be required to have a good understanding of the full

depth involving the international accounting environment, as well as disclosure requirements

for as prescribed in the IAS/ GAAP/ IFRS.

COURSE OUTLINE

o Business Combinations Introductions

o Business Combinations [Continued] The Environment

o Consolidated Statements Date of Acquisition

o Consolidated Statements Date of Acquisition [Continued]

o Consolidated Statements Subsequent to Acquisition

o Consolidated Statements Subsequent to Acquisition [Continued]

o Inter Company Transactions Merchandising, Plant Assets and Notes

o Inter Company Transactions Merchandising, Plant Assets and Notes

o Inter Company Transactions Merchandising, Plant Assets and Notes[Cont.]

o Inter Company Transactions Bonds and Leases

o The International Accounting Environment

o Interim Reporting Disclosure

o Segments of an Enterprise

RECOMMENDED BOOKS FOR READING

Intermediate

Accounting

By Donald E Kieso &

Jerry J. Wygandt

Modern Advanced

Accounting

By E. John Larsen & A.N.

Mosich

Advance

Accounting

By R.L. Gupta &

M. Radha

Swamy

International

Accounting

Standards

Advanced

Accounting

By S.P. Jain &

K.L. Narang

The society of Accounting Education

7

MODULE (B) COURSE CODE CS-01

ADVANCE ACCOUNTING CONCEPTS

OBJECTIVES

The learning objectives of this course, to develop know how about financial statement

analysis, which is very important to understand the whole scenario and trend analysis of the

Industry / Organization and to make corrective action to improve the business and its positive

results.

COURSE OUTLINE

Course Structure: The course is organized into three parts:

Part One: Overview of Financial Statement Analysis

This section emphasizes understanding business activities planning, financing, investing and

operating. It describes strategies underlying business activities and their effect on the

financial statements, and it discusses the objectives of analysis. Important tools and

techniques in analyzing and interpreting financial statements are illustrated.

Part Two: Accounting Analysis

This section describes the accounting measurement and reporting practices underlying

financial statements. Presentation is organized around financing (liabilities and equity),

investing (assets), and operating (income and cash flow) activities

Part Three: Financial Analysis

In this section, the processes and methods of financial statement analysis are examined. The

objectives of users and the analytical tools and techniques for meeting those objectives are

emphasized. This section demonstrates how analysis tools and techniques enhance users

decisions including company valuation and lending decisions. It also shows how financial

statement analysis reduces uncertainty and strengthens confidence in making timely business

decisions.

o Introduction to Investing and to the Financial Statements.

o Choosing a Technology: Method of comparables, Asset-based Valuation, Screening

Analysis, Pro Forma Analysis, Dividend Discount Analysis, Discounted Cash Flow

Analysis, and Contrasting Cash Accounting with Accrual Accounting

o Pricing Book Values and Pricing Earnings

o Analysis of the Statement of Shareholders Equity

o Balance Sheet and Income Statements

o Profitability analysis

The Society of Accounting Education

8

MODULE (B) COURSE CODE CS-02

FINANCIAL STATEMENT ANALYSIS

o Analysis of Sustainable Earnings and Growth

o Analysis of Cash Flow Statement

o Pro forma Analysis for Operating and Financial Activities, enterprise valuation and

leverage

o Simple Forecasting and Valuation

RECOMMENDED BOOKS FOR READING

Royal Modern

Advanced Accounting

By Spicer & Peglar

SAARC

requirements

Annual Reports of

the Top Few Listed

Companies.

Financial Statement

Analysis and Security

Valuation,

By Stephen Penman

McGraw Hill Irwin (4

th

Ed.)

Modern Advance

Accounting

By E. John

Larsen, McGraw

Hill Co. Inc.

OBJECTIVES

o To familiarize the students with the Income Tax Laws and its Practice.

o To elaborate the important elements and aspects of tax system and authorities and their

limits.

o To equip the students with necessary skills to deal with tax matters.

COURSE CONTENTS

o Introduction and scope of Income Tax Law in Pakistan

o Definitions and Terminologies

o Exclusions from total income

o Reduction in tax liability

o Exemption from specific provisions of income tax ordinance 2001

o Distinction between capital and revenue items of expenditures

o Tests for differentiating capital and revenue receipts

o Tests for differentiating capital and revenue expenditures

o Capital Loss.

The Society of Accounting Education

9

MODULE (B) COURSE CODE CS-03

BUSINESS TAXATION

o Income from Salary and Scope of Salary income

o Allowances and relieves under the Ordinance

o Types of provident fund, treatment of provident fund, sixth schedule employers

contribution of approved gratuity fund deduction from income, gratuity fund deduction

from income, gratuity fund and schemes

o Computation of income tax payable from salaries persons

o Income from business and professional terms used

o Considerations governing taxation of business profits

o Maintenance of accounts on mercantile or cash basis

o Income chargeability under income tax law on income from business

o Principles of computation of taxable profits, allowable deductions

o Deduction for computing business income, significant changes introduced by the

ordinance

o Non-admissible expense

o Bad debts

o Income from Property tax on agriculture income

o Calculation of ALV

o Allowable deduction from income from property

o Set-off and carry forward of losses

o Types of Losses

o Rules for set-off and carry forward

o Penalties, offenses, appeals and prosecutions

o Income tax authorities their appointments, duties, limitation and powers.

o Income from other sources

Deduction for computing income from other sources

o Exchange gain / losses, income deemed to accure or arise

o Tax accountings and assessment cycle, procedure filling of return.

o Assessment of individual salaried and non-salaried person

o Self-assessment scheme

o Appeals

o Practical Problems

The Society of Accounting Education

10

RECOMMENDED BOOKS FOR READING (LATEST EDITIONS)

Income Tax

Principles and

Practice,

By Syed Mobin & Co.

Lahore

Income Tax

Law

By Khawaja

Amjad Saeed,

Income Tax

Ordinance 2001,

Govt. of Pakistan.

&

Income Tax Law

By Luqman Baig

Direct Taxes in

Pakistan

By Huzaina

Bukhari & Dr.

Ikramul Haq.

Synopsis of Taxes in

Pakistan

By Mirza Munawar

Hussain

Iqbal Brothers, Lahore.

OBJECTIVES:

To develop:

o understanding of an integrated perspective for the inter-relation between financial

markets, financial institutions and management

o competence about the latest approaches/tools to critically examine and measure the

performance of business concerns

o skills to solve investment and financial problems in the light of specified goals of the firm

COURSE CONTENTS:

Section I

o Forms of business organization

o Goals of the Corporation

o Agency relationships

Section II

o Balance Sheet

o Income Statement

o Statement of cash flows (FASB Opinion NO.95) (IAS7)

o Personal Taxes

o Corporate Taxes

The Society of Accounting Education

11

MODULE (B) COURSE CODE CS-04

FUNDAMENTAL OF FINANCIAL MANAGMENT

Section III

o Ratio Analysis

o Du Pont system

o Effects of improving ratios

o Limitations of ratio analysis

o Qualitative factors

Section IV

o Forecasting sales

o Projecting the assets needed to support sales

o Projecting internally generated funds

Section V

o Projecting outside funds needed

o Deciding how to raise funds

o Seeing the effects of a plan on ratios

Section VI

o Stand-alone risk

o Portfolio risk

o Risk & return: CAPM/SML

Section VII

o Future value

o Present Value

o Rates of return

Section VIII

o Amortization key features of bonds

o Bond Valuation

o Measuring yield

o Assessing risk

The Society of Accounting Education

12

Section IX

o Features of common stock

o Determining common stock values

o Bonus / Right shares

Section X

o Efficient markets

o Preferred stock

o Sources of capital

Section XI

o Component costs

o Adjusting for flotation costs

o Adjusting for risk.

RECOMMENDED BOOKS FOR READING:

Fundamental of

Financial

Management

By James Van Horn

Business Finance

By McGraw Hill,

Sydny Peirson,

Grahem &

Brown, Rob

(1998)

Business Finance,

By Stanely B. &

Hirt Geoffroy A,

(2002)

Melicher, W.R

& Norton

A.E., (2005)

Finance

By John Wiley

and Sons Inc.

Fundamental of

Financial Management

(10

th

Ed.)

South Western College

Publication

Brigham / Houston

OBJECTIVES:

o To learn the most successful and proven ways that all forms of business communications

should be handled i.e. letters, emails, reports, presentations, telephone conversations etc.

o This course offers flexibility with the added-value of self-study, designed to enable you to

work at your own pace.

o On completion of the course you will be able to use Strategic Business technique of

Communications within your area of activity.

The Society of Accounting Education

13

MODULE (C) COURSE CODE PG-01

STRATEGIC BUSINESS COMMUNICATION

COURSE CONTENTS:

The Three Basic Steps to Business Writing

o Prewriting (Preparation)

o Writing (Organizing and Outlining)

o Revising and proof reading.

Improving Readability

o Using simple language focus on clarity and tone

o Avoid Stang, Jargon and Abbreviations

o Avoid usage of vague adjectives

o Avoid clichs and awkward references

Guidelines to Writing Good Sentences

o Focus on clarity and meaning rather than a complete thought.

o Sentences should be neither too long nor too choppy.

o Avoid empty phrases that make the sentence heavy.

o Be careful not to mix verb forms within a sentence.

Gender Inclusive Language

o In todays business world men and women both hold important positions hence

importance of gender inclusive language.

Words Commonly Confused

o These words often used in business writings, sound and are spelled similar but have very

different meanings.

Paragraphs

o How to use topic sentences to make your paragraph effective.

o Use opening, body and closing paragraphs to organize your business writing

Organizing and Writing Business Letters

o State your Purpose

o Know your Reader

o Determine the scope of your letter

o Research your subject

o Outline your letter

The Society of Accounting Education

14

o Proof read for grammar and errors

o Revise for Clarity, Brevity and Simplicity

Sample Business Letters

Forms of letter / sample may be viewed:

o Announcement of Change of Address

o Acknowledgement of Receipt of Documents

o Apology and Replacement of Damaged Goods

o Apology for Accounting errors, and passed due Notices.

o Appointment for Employment interview and Testing Complimentary Letter to Employee

on Handling of Difficulty.

o Congratulations on Increased Sales

o Covering Letter to Response to Catalog Request.

Written Communication

o Various Forms of Written Communication

o Disadvantages of Written Communication

o Meetings and Group discussions

o Running the sessions

o Important points to keep in mind while having a meeting

Email Etiquettes

o How do you enforce Email Etiquette?

o 32 Essential Email Etiquettes that will apply to all companies.

Tips for Using the Internet for Business Success

o Have an internet strategy?

o Use the internet to your advantage to keep in touch with customers.

o To increase business

o To make important business contacts.

o To have your own web site and use it to promote business

o Use the Internet for competitor research.

RECOMMENDED BOOKS FOR READING:

Effective

Performance

By Lockett

Measurement

Pitman Publishing

London

The Operational

Auditing

Handbook

By Andrew

Chambers &

Graham Rand

John Willey &

Sons Ltd.

England

Business

Communication &

Report Writing

Presentation

Skills.

Functional

English:

By K.M. Siddiqui

Al-Hamad

Academy, Karachi

Excellent in Business

Communication

By Join V Thill Courtland

LBoves

Prentice Hall International

inc.

Upper Saddle River, New

Jersey

Communication

for Business (A

practical

approach)

By Shirley

Taylor, Pitman

Publishing,

London

The Society of Accounting Education

15

OBJECTIVES:

Its a modernized course, which is necessary to learn the students, for getting complete edge

and ideas how to evaluate the Corporate Performance, material of this course is available in

the useful links, reference material section of the SOAE website.

COURSE CONTENTS:

o Why evaluate the performance of organizations?

o Why is so much measurement in purely financial terms?

o Are soft measures of performance of any use?

o Is performance evaluation an end in itself, or a potentially valuable tool for business

managers?

o Is it feasible to have a measurement system that monitors all the lead indicators of an

organizations performance?

o How do we look to our shareholders (what they term the financial perspective)?

o How do we look to our customers (the external perspective)?

o At what must we excel (the internal perspective, viewed in terms of core competencies)?

o How can we maintain continuous performance improvement, and create added value

(what they term the innovation & learning perspective)?

o How can measures be integrated both across an organizations functions

and through its hierarchy?

o How can conflicts between measures be avoided?

o Can functional and process measures co-exist?

o Everything can be measured but how can the number of measures be

kept to a meaningful but manageable set?

o How can the cost/benefit of a system be analyzed?

o How does process measurement build capability?

The Society of Accounting Education

16

MODULE (C) COURSE CODE PG-02

CORPORATE PERFORMANCE EVALUATION

o For Individual Measures:

o How can flexibility, which is often simply a property of the business process, be

measured?

o How can measures be designed to promote inter-function co-operation?

o How can measures be designed that do not encourage short-termism?

o How can measures be designed to encourage appropriate (e.g. employee) behaviour?

o How can flexible measures, those that take account of changes in the business

environment, be defined?

o How should data generated from a measure be displayed?

o How can management ensure that appropriate (perhaps corrective) action follows

measurement?

o How can predictive measures be identified and developed?

o Set-off and carry forward of losses.

For The Business Environment:

o How can organizations integrate measures into strategic control systems?

o How can management ensure that the system matches the organizations strategy and

culture?

o Where are the strongest links to business strategy?

o To which dimensions of the internal and external business environment does the system

have to be matched?

RECOMMENDED BOOKS FOR READING:

Effective Performance

By Lockett Measurement

Pitman Publishing London

The Operational Auditing Handbook

By Andrew Chambers & Graham Rand

John Willey & Sons Ltd. England

The Society of Accounting Education

17

OBJECTIVES:

o To develop the skills in students so they are be able to make proper distinction between

different types of costs.

o To equip the students with emerging new concepts and its application in the field of

managerial accounting.

o To develop the skills in students to design the costing system that help in decision making.

COURSE OUTLINE

Basic Cost Management Concepts:

Meaning of cost, manufacturing costs, manufacturing cost flow, different costs for different

purposes, costs and benefits of information.

The changing role of managerial accounting in a dynamic business environment:

o Managerial accounting: managerial vs financial accounting, managerial accounting in

different types of organization, evolution and adaptation in managerial accounting.

o Service vs. manufacturing firm, emergence of new industries, global competition, focus on

customer, cross functional team, computer integrated manufacturing, product life cycle

and diversity and time based competition.

Activity based Costing and Activity Based Management:

o Some key issues about cost drivers

o Activity dictionary and bill of activities, direct vs. indirect costs, when is new product-

costing system needed.

o Cost management systems.

o ABC and advanced manufacturing environment:

o Flexible manufacturing system,

o Two dimensional ABC,

The Society of Accounting Education

18

MODULE (C) COURSE CODE PG-03

MANAGERIAL ACCOUNTING & DECISION MAKING

o Customer profitability analysis.

o Target costing, kaizen costing.

o Bench marking and reengineering,

o Theory of constraints.

Activity Analysis, Cost Behaviour and Cost Estimation

o Cost behaviour patterns

o Operational based vs. volume based cost drivers

o Cost estimation methods.

Cost Volume Profit Relationship:

o Projected expenses and revenues,

o Breakeven point and target net profit,

o Applying CVP analysis, CVP analysis with multiple products, assumption under CVP

analysis, CVP and income estimation, cost structure and operating leverage.

o Profit planning, activity based budgeting and e-budgeting;

o Types of budgets (master budgets, budgeted financial statements), manufacturing

overhead budget, ABB and the cost hierarchy, financial planning models and budget

administration

o Zero based budgeting and international aspects of budget

o Standard costing, operational performance, and the balanced score card: managing costs,

setting standards, multiple types of direct material and direct labour.

Flexible budgeting and the management of overhead and support activity costs

overhead budgets:

o Choice of activity measure,

o Cost management using overhead cost, overhead cost performance report, and activity

based flexible budgets.

Responsibility accounting, quality control, and environmental cost management

o Responsibility centers and performance reports

o Behavioral effects of responsibility accounting,

o Segmented reporting and total quality management.

o ISO 9000 standards and environmental cost management

The Society of Accounting Education

19

Decision making, relevant cost and benefits:

The managerial Accountant role in decision making, relevant information, identifying relevant

costs and benefits and analysis of special decision.

RECOMMENDED BOOKS FOR READING:

Management

Accounting:

A Decision Emphasis

By John Wiley, Jessi,

Raiborn & Kenney

Management

Accounting and

By Sultan Chand

S.M. Maheswari

Management

Accountancy

By McDonald &

Evans

J. Batty

Financial Policy and

Management Accounting

By Bhabatosh Banerjee

World Press

Strategic Cost

Management

University of

Calcutta

By Basu,

Banerjee and

Dandapat

OBJECTIVES

This course introduces students to the practices and codes of conduct involved in the finance

function. The course covers ethical issues and the roles of the corporate financial manager,

other stakeholders and other participants in the investment industry. The emphasis of the

course will be on readings, rules, and regulations from the SOAE for Certified Financial

Accountant Program. Cases and speakers will be employed to bring a real world perspective

to the classroom. This course introduces students to the conflicts of interest faced by finance

professionals. In addition, students are introduced to the codes of conduct, rules, regulations,

and practices required of finance professionals by the SOAE through Certified Financial

Accountant Program. In particular, we look at the rationales for these rules. We also look at

the role of ethics in personal financial planning. This course is valuable to anyone who plans to

manage their own finances. This course is also valuable to any student who intends to pursue

a career as a Finance professional. Potential careers that come under this heading include:

Compliance Officer, Financial advisor, corporate financial manager, director or other officer,

money or investment manager, banking or investment banking professional, lawyer

specializing in the fiduciary relationship, and/or public sector finance manager, to name a few.

The Society of Accounting Education

20

MODULE (C) COURSE CODE PG-04

PROFESSIONAL VALUES & ETHICS

Upon completion of this course, students will be able to complete the following key

tasks:

o Recognize the principal conflicts of interests faced by those working in the Financial

Services industry

o Recognize the principal conflicts of interest faced by anyone involved in managing their

own finances

o Recognize the principal conflicts of interest faced by government and non-regulatory

agencies in regulating the Financial Services sector

o Understand why government, non-regulatory agencies, and Financial Service participants

do not always attempt or sincerely attempt to minimize these conflicts of interest

o Begin to think about ways to minimize these conflicts of interest that would appeal to the

various parties to the process

o Understand some of the rules and regulations that govern behaviour in the Financial

Services Industry

COURSE OUTLINE

Code of Ethics and Standards of Professional Conduct

o Standard I. Professionalism

o Standard II. Integrity of Capital

o Standard III. Duties to Clients

o Standard IV. Duties to Employers

o Standard V. Investment Analysis, Recommendations and Actions

o Standard VI. Conflicts of Interest

o Standard VII. Responsibilities as SOAE member of Certified Financial Accountant.

HELPING MATERIAL

Newspapers, Article and available presentations

The Society of Accounting Education

21

OBJECTIVES

IFRS adoption, while a significant regulatory event, is also an opportunity and potential

catalyst for organizations to create global standards and achieve benefits. Required changes

means that IFRS transitioning will have impact not only on the accounting process but will

also have an impact on the IT infrastructure, the financial reporting applications and the

business processes supporting financial reporting. This 1 day program is designed for Internal

Auditors, and focuses on the drivers to IFRS, conversion approaches and methodologies,

potential benefits and the role of key parties in implementing IFRS.

The program includes the presentation sessions, exercises and case study. It will also provide

opportunities to discuss the participants experience as well as problems concern.

Describe the global momentum towards IFRS.

Identify external and internal drivers to IFRS.

Discuss managing the risks for U.S. companies and maximizing the benefits of IFRS

implementation.

Describe conversion approaches.

Identify tools and resources for IFRS implementation.

Identify the roles of key parties in implementing IFRS: internal auditors, board of

directors/audit committee, management, and external auditors.

Design a roadmap to implementing IFRS for a given case study

COURSE OUTLINE

Setting the Baseline

IFRS overview

IFRS today and tomorrow

External and internal drivers

The Society of Accounting Education

22

MODULE (D) COURSE CODE PG-05

IFRS AND EXTERNAL INDEPENDENT REPORTS

Managing Risks for U.S. Companies

Different accounting standards

Statutory reporting implications and regulatory risks

Non-U.S. equity offerings

Creditors and debtors requirements

Acquisitions and divestitures

Impact on internal controls and system implications

Potential Benefits

Standardization and centralization of accounting policies

Improved controls

Better cash management

Effective use of people and resources

Streamlined processes

Case Study of a Typical U.S. Company

Business case for early implementations

Key impacts of IFRS implementations

Potential challenges and best practices

European Union observations and lessons learned

Phased adoption approach

Big bang approach

Approach to implementation

Current statutory reporting requirements

Net income impacts

Current and long-term strategies

Illustrative management activities

Phases of IFRS conversion efforts

Identify risks by performing assessments

Key components to a roadmap

IFRS Conversion Approach

Phase I Assess

o Assess technical accounting & tax implications and risks

o Assess supporting processes & infrastructure and change management

The Society of Accounting Education

23

o Formulate implementation Plan of assessing skill gaps and remediation plans

o Educating the audit committee and organization

Phase II Convert

o Perform technical accounting and tax Conversion

o Design supporting processes and infrastructure

o Develop organization and change strategy

Phase III Sustain

o Implement supporting processes & infrastructure

o Execute change management activities

o Complete knowledge & capability transfer with tools and resources

Conversion Methodologies

Technical accounting

o Analyze impact of IFRS statutory and regulatory requirements

o Impact of IFRS to key financial accounts

o Conversion methodology

o Protocol to monitor changing standards

Tax

o Reporting and method implications

o Costs and benefits

o Disclosure requirements

o Method changes

o Provision computations

Finance process

o Impact to accounting, reporting, close & consolidation and reconciliation

process and controls

o Designing, developing and deploying future state accounting, reporting, close &

consolidation and reconciliation processes

Risks & controls

o Impact on controls and governance

o Future state control environment to ensure accurate and timely financial

information

Technology

o Impact upon financial systems and architecture

The Society of Accounting Education

24

Organization & change

o Magnitude of change upon stakeholders and operating model

o Organizational structure

o Change management and learning strategies

Project management

o Program structure to develop IFRS roadmap

o Monitoring implementation

o Facilitating knowledge transfer

Roles of Key Parties in Implementing IFRS

Internal auditors

Management

Independent auditors

Board of directors/audit committee

OBJECTIVES

o Understand the terminology and basic concepts.

o Grasp the conceptual framework behind foundation topics including valuation techniques,

investment, financing and dividend policy decisions, and risk management.

o Problem-solve and improve your analytical skills in constructing rational approaches that

address fairly complex financial management issues.

o Apply and evaluate financial information in a simulated case setting.

o Increase your confidence to participate in financial decision making.

The Society of Accounting Education

25

MODULE (D) COURSE CODE PG-06

FINANCIAL MANAGEMENT POLICY & PROCEDURE

COURSE OUTLINE

Cost of Capital

o An overview: The agency problem

o Weighted Average Opportunity Cost and its component

o Optimal Capital structure; WACC and Marginal Cost

o Factors affecting Cost of Capital

Cash Flow and Capital Budgeting

o Cash Flow vs Profit

o NPV and Project Financing

o Project Selection

o Effects of Inflation

Risk Analysis for Optimum Capital Budget

o Three types of risks: Stand Alone, Corporate and Market

o Analytical techniques

o Estimating Project Beta

o Risk Adjusted Discount Rate

o Capital Rationing

Capital Structure and Leverage

o Operating Leverage and Profitability

o Financial Leverage

o How much Debt?

o Modigliani and Miller (MM) Proposition

o MM and Leverage Trade-off

Dividend Policy

o Optimal Dividend Policy and Stock Price

o Is Dividend Irrelevant?

o Residual Dividend Model

o Stock dividends and Stock splits

RECOMMENDED BOOKS FOR READING:

Principles of

Managerial Finance

By Gitman, Lawren Jo

Harper International

Basic Financial

Management

By Keown, A.J. & Martin JD

Prentice Hall

Managerial Finance

By Weston & Coperland

Financial Management

Policy and Procedures

By James Van Horn

The Society of Accounting Education

26

OBJECTIVES

Now a days we are in the modern era, and to discuss about the efficient management, we cant

learn this without knowing about the Quality Management.

COURSE OUTLINE

o The meaning of quality

o Quality from consumers perspective.

o Dimensions of service and product quality. Quality from producers perspective.

o Need for Total Quality.

o Total Quality Management.

o Evolution of Total Quality Management. Deming, Juran & Crosbys approaches to Total

o Quality Management.

o Principles and objectives of Total Quality Management.

o Strategic implications of Total Quality Management.

o Total Quality Management in service and manufacturing companies.

o The cost of quality.

o The effect of quality management on productivity and profitability. Identifying quality

problems and causes.

o Techniques to Total Quality Management.

o Seven tools to total quality control. ISO-9000 series and its implications.

RECOMMENDED BOOKS FOR READING:

Integrating Total

Quality Management

By Susan Jurow, Susan

B. Barnard

Total Quality Management

By Joel E. Ross

Susan Perry

Total Quality

Management

By Gopal K Kanji

Subburaj

Total Quality

Management

By Anand A Samuel

The Society of Accounting Education

27

MODULE (D) COURSE CODE PG-07

TOTAL QUALITY MANAGEMENT

OBJECTIVES

To understand objectives and concepts of auditing and gain working knowledge of generally

accepted auditing procedures, techniques and skills needed to apply them in audit and

attestation engagements and solving simple case-studies.

COURSE OUTLINE

o Auditing Concepts Nature and limitations of Auditing, Basic Principles governing an

audit, Ethical principles and concept of Auditors Independence, Relationship of auditing

with other disciplines.

o Auditing and Assurance Standards Overview, Standard-setting process, Role of

International Auditing and Assurance Standards Board and Auditing and Assurance

Standards Board in India.

o Auditing engagement Audit planning, Audit programme, Control of quality of audit

workDelegation and supervision of audit work.

o Documentation Audit working papers, Audit files: Permanent and current audit

files, Ownership and custody of working papers.

o Audit evidence Audit procedures for obtaining evidence, Sources of evidence,

Reliability of audit evidence, Methods of obtaining audit evidence, Physical verification,

Documentation, Direct confirmation, Re-computation, Analytical review techniques,

Representation by management.

o Internal Control Elements of internal control, Review and documentation, Evaluation

of internal control system, Internal control questionnaire, Internal control check list, Tests

of control, Application of concept of materiality, audit risk and concept of internal audit.

The Society of Accounting Education

28

MODULE (D) COURSE CODE PG-08

AUDIT AND ASSURANCE

o Internal Control and Computerized Environment, Approaches to Auditing in

Computerized Environment.

o Audit Sampling Types of sampling, test checking and techniques of test checks.

o Analytical review procedures.

o Audit of payments General considerations, Wages, Capital expenditure, Other

payments and expenses, Petty cash payments, Bank payments, Bank reconciliation.

o Audit of receipts General considerations, Cash sales, Receipts from debtors, Other

Receipts.

o Audit of Purchases Vouching cash and credit purchases, Forward purchases, Purchase

returns and allowance received from suppliers.

o Audit of Sales Vouching of cash and credit sales, Goods on consignment, Sale on

approval basis, Sale under hire-purchase agreement, Returnable containers, various types

of allowances given to customers and sale returns.

o Audit of suppliers ledger and the debtors ledger Self-balancing and the sectional

balancing system, Total or control accounts, Confirmatory statements from credit

customers and suppliers, Provision for bad and doubtful debts and writing off of bad

debts.

o Audit of impersonal ledger Capital expenditure, deferred revenue expenditure and

revenue expenditure, Outstanding expenses and income, Repairs and renewals,

Distinction between reserves and provisions and implications of change in the basis of

accounting.

o Audit of assets and liabilities.

o Company Audit Audit of Shares, Qualifications and Disqualifications of Auditors,

Appointment of auditors, Removal of auditors, Powers and duties of auditors, Branch

audit, Joint audit, Special audit, Reporting requirements under the Companies Act, 1956.

The Society of Accounting Education

29

o Audit Report Qualifications, Disclaimers, Adverse opinion, Disclosures, Reports and

certificates.

o Special points in audit of different types of undertakings, i.e., Educational institutions,

Hotels, Clubs, Hospitals, Hire-purchase and leasing companies excluding banks, electricity

companies, cooperative societies, and insurance companies).

o Features and basic principles of government audit, Local bodies and not-for-profit

organizations, Comptroller and Auditor General and its constitutional role.

RECOMMENDED BOOKS FOR READING:

Audit and Assurance

By Alvin A, Arens, Rano

Auditing

By Khawaja Amjad

Saeed

Audit and Assurance

By Grant E Gay, Gay

Timothy J. Louwers,

McGraw Hill Lecture

Notes

From useful link of

SOAE website

The Society of Accounting Education

30

Vous aimerez peut-être aussi

- Tally Record NoteDocument74 pagesTally Record NoteBarani DharanPas encore d'évaluation

- TYBCom Sem VI Financial Accounting and Auditing Paper IX Financial AccountingDocument181 pagesTYBCom Sem VI Financial Accounting and Auditing Paper IX Financial Accountingarbazshaha121Pas encore d'évaluation

- Grdae 9 - Ems - Financial Literacy SummaryDocument17 pagesGrdae 9 - Ems - Financial Literacy SummarykotologracePas encore d'évaluation

- Accountancy XiiDocument122 pagesAccountancy XiiNancy Ekka100% (1)

- Accounts Must Do Questions by Vinit Mishra SirDocument137 pagesAccounts Must Do Questions by Vinit Mishra SirCan I Get 1000 SubscribersPas encore d'évaluation

- KVS STUDY MATERIAL FOR CLASS 11 ACCOUNTANCYDocument144 pagesKVS STUDY MATERIAL FOR CLASS 11 ACCOUNTANCYmalathi SPas encore d'évaluation

- Vouchering and Posting Basic Accounting Problems in TallyDocument9 pagesVouchering and Posting Basic Accounting Problems in TallyM ZPas encore d'évaluation

- System AdministrationDocument1 708 pagesSystem AdministrationdyaPas encore d'évaluation

- AcctountancyDocument368 pagesAcctountancyvignesh100% (1)

- GST Marathon - CA Rahul Garg PDFDocument59 pagesGST Marathon - CA Rahul Garg PDFVivek JainPas encore d'évaluation

- Promissory NoteDocument20 pagesPromissory NoteAswaraj PandeyPas encore d'évaluation

- Bill of ExchangeDocument4 pagesBill of ExchangeSara SanamPas encore d'évaluation

- Secretarys Certificate (To Open Bank Account)Document3 pagesSecretarys Certificate (To Open Bank Account)Stewart Paul Torre100% (6)

- The Accounting Cycle FundamentalsDocument53 pagesThe Accounting Cycle FundamentalsGonzalo Jr. Ruales100% (1)

- Worksheet 5 NMIMSDocument4 pagesWorksheet 5 NMIMSvipulPas encore d'évaluation

- Sample Reports in Tally - Erp 9 - Tally Shopper - Access To Tally - Tally Web InterfaceDocument287 pagesSample Reports in Tally - Erp 9 - Tally Shopper - Access To Tally - Tally Web InterfacejohnabrahamstanPas encore d'évaluation

- Tally 036Document191 pagesTally 036anjalishah7Pas encore d'évaluation

- Tally E Book 2Document154 pagesTally E Book 2anjali44499Pas encore d'évaluation

- AccountingDocument191 pagesAccountingsandiPas encore d'évaluation

- AMFI - Investor Awareness Presentation - Jul'23Document69 pagesAMFI - Investor Awareness Presentation - Jul'23padmaniaPas encore d'évaluation

- Accountancy Handout RevisionDocument181 pagesAccountancy Handout RevisionSIMARPas encore d'évaluation

- Negotiable Instruments Reviewer (Agbayani Villanueva Sundiang Aquino)Document88 pagesNegotiable Instruments Reviewer (Agbayani Villanueva Sundiang Aquino)Lee Anne Yabut100% (3)

- LLB Hon. Intergrated Law Sem 1 To 8 Syllabus May 2019Document104 pagesLLB Hon. Intergrated Law Sem 1 To 8 Syllabus May 2019shah zavidPas encore d'évaluation

- Tally Assignment Yash ComDocument9 pagesTally Assignment Yash Comraj S.NPas encore d'évaluation

- Financial Reporting First Take - Ron KingDocument340 pagesFinancial Reporting First Take - Ron KingYuan Fu100% (1)

- Accounting BasicsDocument21 pagesAccounting BasicsasifparwezPas encore d'évaluation

- Intermediate Paper 11 PDFDocument456 pagesIntermediate Paper 11 PDFjesurajajPas encore d'évaluation

- Basics of Accounting - QBDocument7 pagesBasics of Accounting - QBsujanthqatarPas encore d'évaluation

- TS Grewal Solution For Class 11 Accountancy Chapter 5 - JournalDocument47 pagesTS Grewal Solution For Class 11 Accountancy Chapter 5 - JournalRUSHIL GUPTAPas encore d'évaluation

- FAA Ist AssignemntDocument9 pagesFAA Ist AssignemntRameshPas encore d'évaluation

- Tax FinalDocument23 pagesTax FinalJitender ChaudharyPas encore d'évaluation

- GST Tally ERP9 English: A Handbook for Understanding GST Implementation in TallyD'EverandGST Tally ERP9 English: A Handbook for Understanding GST Implementation in TallyÉvaluation : 5 sur 5 étoiles5/5 (1)

- Oracle Apps Course ContentsDocument12 pagesOracle Apps Course ContentsRabindra P.SinghPas encore d'évaluation

- Financial Reporting and Analysis GuideDocument16 pagesFinancial Reporting and Analysis GuideSagar KumarPas encore d'évaluation

- BOE & AR INT CalculationsDocument35 pagesBOE & AR INT CalculationsAman IamtheBestPas encore d'évaluation

- List of Ledgers and It's Under Group in TallyDocument5 pagesList of Ledgers and It's Under Group in Tallyrachel KujurPas encore d'évaluation

- Ultimate Guide To Investments For BeginnersDocument18 pagesUltimate Guide To Investments For BeginnersArkya MojumderPas encore d'évaluation

- Excise For ManufacturersDocument160 pagesExcise For ManufacturersPraveen CoolPas encore d'évaluation

- Paper 11 NEW GST PDFDocument399 pagesPaper 11 NEW GST PDFsomaanvithaPas encore d'évaluation

- GST Practical Record 40-50 Key PointsDocument48 pagesGST Practical Record 40-50 Key PointsAditya raj ojhaPas encore d'évaluation

- Negotiable Instruments Pre-test ReviewDocument4 pagesNegotiable Instruments Pre-test ReviewCharles D. FloresPas encore d'évaluation

- Civil liability arising from BP 22 violationDocument8 pagesCivil liability arising from BP 22 violationHannah MedesPas encore d'évaluation

- Metrobank 194 Scra 169Document9 pagesMetrobank 194 Scra 169Mp CasPas encore d'évaluation

- Persons precluded from setting-up forgery defenseDocument2 pagesPersons precluded from setting-up forgery defensemichelle m. templadoPas encore d'évaluation

- Accounting Imp 100 Q'sDocument159 pagesAccounting Imp 100 Q'sVijayasri KumaravelPas encore d'évaluation

- GST 9th Edition BookDocument542 pagesGST 9th Edition BookLalli DeviPas encore d'évaluation

- Trading Account PDFDocument9 pagesTrading Account PDFVijayaraj Jeyabalan100% (1)

- Villamor FinalDocument25 pagesVillamor FinalRinconada Benori ReynalynPas encore d'évaluation

- 42 Implementation of Tds in Tallyerp 9Document171 pages42 Implementation of Tds in Tallyerp 9P VenkatesanPas encore d'évaluation

- SUCC102Document264 pagesSUCC102joy100% (1)

- AccountingDocument8 pagesAccountingBasil Babym50% (2)

- 874 Taxation HandbookDocument170 pages874 Taxation HandbookYingYiga100% (1)

- Post-dated Voucher Creation Tally ERP 9Document5 pagesPost-dated Voucher Creation Tally ERP 9Heemanshu ShahPas encore d'évaluation

- D2K-Report6i-by Dinesh Kumar S PDFDocument98 pagesD2K-Report6i-by Dinesh Kumar S PDFallumohanPas encore d'évaluation

- Ap (Accounts Payable) ProcessDocument10 pagesAp (Accounts Payable) ProcessRabin DebnathPas encore d'évaluation

- Service TaxDocument239 pagesService TaxG Subramaniam100% (1)

- Chapter 1Document5 pagesChapter 1palash khannaPas encore d'évaluation

- Dma Module 1 Oracle SQL PL SQL IacDocument110 pagesDma Module 1 Oracle SQL PL SQL IacK T Hoq Himel100% (1)

- CS - EXE - Income Tax - Notes - Combined PDFDocument437 pagesCS - EXE - Income Tax - Notes - Combined PDFRam Iyer100% (1)

- Tally reports for Crockery Store transactionsDocument2 pagesTally reports for Crockery Store transactionsabhishek georgePas encore d'évaluation

- Cs Executive Aptech Training 1500 QuestionsDocument50 pagesCs Executive Aptech Training 1500 QuestionsparishkaaPas encore d'évaluation

- FA1 General JournalDocument5 pagesFA1 General JournalamirPas encore d'évaluation

- Accounting and Finance Numericals Problems and AnsDocument11 pagesAccounting and Finance Numericals Problems and AnsPramodh Kanulla0% (1)

- Cms Ug 19Document101 pagesCms Ug 19Aleena Clare ThomasPas encore d'évaluation

- HonsDocument28 pagesHonsBhavna MuthyalaPas encore d'évaluation

- BBA Course Structure and Exam Scheme for 3 YearsDocument22 pagesBBA Course Structure and Exam Scheme for 3 YearsbitturajaPas encore d'évaluation

- Commerce Syllabus FullDocument8 pagesCommerce Syllabus FullSatyabrata roulPas encore d'évaluation

- MBA-Tourism - PDF - INTERNATIONAL TOURISM PDFDocument38 pagesMBA-Tourism - PDF - INTERNATIONAL TOURISM PDFpadmavathiPas encore d'évaluation

- Accounting For Managerial Decisions (B205201) Total Credits-5 L T P Semester 2 4 1 0 Course OutcomesDocument9 pagesAccounting For Managerial Decisions (B205201) Total Credits-5 L T P Semester 2 4 1 0 Course Outcomesmani singhPas encore d'évaluation

- Mba 2020Document139 pagesMba 2020amit kargwalPas encore d'évaluation

- Draft Clauses For MOA of Food and Beverages CompanyDocument8 pagesDraft Clauses For MOA of Food and Beverages CompanyNikhil PatelPas encore d'évaluation

- Research ReportDocument66 pagesResearch ReportSuraj DubeyPas encore d'évaluation

- 1968-Philippine National Bank v. Court of AppealsDocument5 pages1968-Philippine National Bank v. Court of AppealsKathleen MartinPas encore d'évaluation

- What Is A Garnishee OrderDocument5 pagesWhat Is A Garnishee Ordergazi faisalPas encore d'évaluation

- Law 3 PrelimDocument5 pagesLaw 3 PrelimJohn Rey Bantay RodriguezPas encore d'évaluation

- Module 5Document10 pagesModule 5kero keropiPas encore d'évaluation

- Boc 2016 Mercantile PDFDocument332 pagesBoc 2016 Mercantile PDFMark Catabijan Carriedo100% (1)

- Asia Banking Corp Vs Ten Sen Guan G.R. No. 19397, February 16, 1923Document5 pagesAsia Banking Corp Vs Ten Sen Guan G.R. No. 19397, February 16, 1923Bianca BncPas encore d'évaluation

- De Ocampo Vs GatchalianDocument15 pagesDe Ocampo Vs GatchalianMaria Lourdes Nacorda GelicamePas encore d'évaluation

- Act 587 Pengurusan Danaharta Nasional Berhad Act 1998Document50 pagesAct 587 Pengurusan Danaharta Nasional Berhad Act 1998Adam Haida & CoPas encore d'évaluation

- S. No. Particulars Page No.: 5. Bibliography 14Document16 pagesS. No. Particulars Page No.: 5. Bibliography 14neerajPas encore d'évaluation

- NID in Banking OperationsDocument153 pagesNID in Banking OperationsAdebunmi Kate OmoniyiPas encore d'évaluation

- Collecting and Paying BankerDocument3 pagesCollecting and Paying Bankerswagat098Pas encore d'évaluation

- Export ManagementDocument302 pagesExport ManagementKaran WasanPas encore d'évaluation

- Metropolitan and Trust V CA DigestDocument4 pagesMetropolitan and Trust V CA DigestKaren Ryl Lozada BritoPas encore d'évaluation

- LMGTRAN Negotiable InstrumentsDocument36 pagesLMGTRAN Negotiable InstrumentsNastassja Marie DelaCruzPas encore d'évaluation

- Full Cases in Land, Titles and DeedsDocument54 pagesFull Cases in Land, Titles and Deedsemman2g.2baccayPas encore d'évaluation

- The Cpa Licensure Examination Syllabus Regulatory Framework For Business Transactions Effective May 2016 ExaminationDocument10 pagesThe Cpa Licensure Examination Syllabus Regulatory Framework For Business Transactions Effective May 2016 ExaminationGlenn TaduranPas encore d'évaluation

- Collection Reading MaterialDocument15 pagesCollection Reading MaterialVIJAYASEKARANPas encore d'évaluation

- Negotiable Instruments Law CasesDocument2 pagesNegotiable Instruments Law CasesMia Abegail ChuaPas encore d'évaluation