Académique Documents

Professionnel Documents

Culture Documents

0811 en Multiple Derivative Action

Transféré par

Aaron GohCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

0811 en Multiple Derivative Action

Transféré par

Aaron GohDroits d'auteur :

Formats disponibles

P.

1

On the well established thinking as to why a single derivative action is maintainable, there is no

reason why a multiple derivative action is not. Per Mr Justice Bokhary PJ and Mr Justice

Chan PJ in the CFA

Shareholder May Sue on Behalf of the Company Under Limited Circumstances

As mentioned in our previous newsletter: Can a Shareholder Sue on Behalf of a Company (posted

at www.onc.hk/pub/oncfile/publication/litigation/0808_EN_Statutory_Derivative_Action.pdf),

shareholders may under limited circumstances sue for wrongs done to their company on the

companys behalf by way of derivative action. However, it has not been clear in the past whether a

person who is not a shareholder in the company but a shareholder in its parent or ultimate holding

company can bring a derivative action. Such an action has been described, conveniently but

somewhat misleading, as a double or multiple derivative action. In this article, the expression

multiple derivative action is used to embrace both double and multiple derivative actions.

No Multiple Derivative Action under the Existing Statutory Regime

In 2005, a statutory derivative action (SDA) was introduced in Hong Kong. Under the newly

added section 168BC of the Companies Ordinance (Cap. 32) (the Ordinance), an SDA only

applies to proceedings brought by a member of a company. The statutory regime hence does not

provide for a multiple derivative action. However, ones right to bring a derivative action at

Can Shareholder of Parent Company

Sue on Behalf of its Subsidiary?

The Hong Kong Court of Final Appeal (the CFA) clarified in Waddington Limited v Chan

Chun Hoo Thomas and Others (FACV No. 15 of 2007) that a shareholder of a parent company

may sue on behalf of its subsidiary in respect of wrongdoings committed against the subsidiary.

This is the first reasoned decision on multiple derivative actions in a common law jurisdiction

outside the USA.

Civil & Commercial Litigation November 2008

P. 2

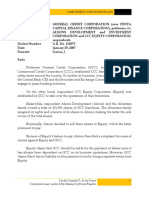

6.5%

100%

100% 100%

common law (CDA), which is expressly preserved in the introduction of SDA, remains a venue

to argue for a multiple derivative action.

Waddington Limited v Chan Chun Hoo Thomas and Others (FACV No. 15 of 2007)

The proceeding of this case was commenced in 2003, hence

the SDA was not applicable. The Plaintiff Waddington Ltd

(Waddington) is a minority shareholder of Playmates

Holdings Limited (Playmates), of which Playmates

International Limited (Playmates International) is its

wholly-owned subsidiary. Playmates International has two

wholly-owned subsidiaries: Profit Point Limited (Profit

Point) and Autoestate Properties Limited (Autoestate).

The primary issue in this case is whether Waddington may

bring a derivative action on behalf of Profit Point and

Autoestate regarding alleged wrongs inflicted on them. The

alleged wrongdoer, Thomas Chan, has been effectively in

control at every level of the corporate chain, and allegedly he

would not allow the companies to sue himself.

The CFA, having regard to the potential injustice which would result if a derivative action were not

available where the company is controlled by the alleged wrongdoers, unanimously held that a

multiple derivative action is in fact available at common law.

Double Recovery Precluded by Reflective Loss Doctrine

In the Court of First Instance, Waddington had formulated its action solely as a derivative action on

behalf of Playmates. As the claims advanced were merely reflective of the alleged losses of

Playmates subsidiaries Profit Point and Autoestate, they were precluded by the reflective loss

doctrine and liable to be struck out. Nevertheless, since a derivative action on behalf of Profit Point

was in principle available and was prima facie sustainable on the facts pleaded, Barma J granted

Waddington an opportunity to reconstitute its pleading to accord with the principle. CFA upheld

Barma Js finding and allowed Waddington to continue the proceedings as a multiple derivative

action on behalf of Profit Point.

Waddington

Playmates

Playmates International

Profit Point Autoestate

Published by ONC Lawyers 2008

P. 3

IMPORTANT:

The law and procedure on this subject are very specialized and complicated. This article is just a very general

outline for reference and cannot be relied upon as legal advice in any individual case. If any advice or

assistance is needed, please contact our solicitors.

CFA Clarifies Threshold Requirement in CDA

In addition, while minority shareholders are required to seek leave of

the Court to bring a SDA, leave is not required for a CDA. However,

the CFA has clarified that in either case, the minority shareholders

have to show a prima facie case before they could proceed, reversing

the finding of the Court of Appeal that at common law a plaintiff in a

derivative action is not required to establish a prima facie case.

CFA Recommends Changes to Law

The CFAs judgment does not extend the SDA to multiple derivative

action. Minority shareholders who wish to bring a multiple

derivative action must do so at common law. However, they cannot

enjoy the new statutory right to inspect the company's record, nor

can they bring a claim if the alleged wrongdoing does not fall within

the narrow meaning of fraud on minority. The CFA opined in

Waddington that the co-existence of SDA and CDA is merely a

source of confusion and complication. It is hoped that there will be

legislative change in due course creating a statutory mechanism for

multiple derivative actions. The legislature is also invited to

reconsider whether it is really sensible to maintain two parallel

regimes with different threshold tests, one requiring leave and the

other not.

For enquiries:

Please contact members

of our Civil & Commercial

Litigation Practice Group

Ludwig Ng

Senior Partner

+(852) 2107 0315

ludwig.ng@onc.hk

Sherman Yan

Partner, Head of Civil &

Commercial Litigation

Practice Group

+(852) 2107 0343

sherman.yan@onc.hk

Contacts:

http://www.onc.hk

onc@onc.hk

Tel : 2810 1212

Fax : 2804 6311

15/F, The Bank of East

Asia Building, 10 Des

Voeux Road Central,

Hong Kong

Branch Office:

Unit 1510, No. 9 Queens

Road Central, Hong

Kong

Vous aimerez peut-être aussi

- Company Law - Minority ShareholderDocument4 pagesCompany Law - Minority ShareholderFelwsyPas encore d'évaluation

- Yung Kee An Offshore Perspective The Winding Up of Bvi and Cayman Islands Companies in Hong KongDocument4 pagesYung Kee An Offshore Perspective The Winding Up of Bvi and Cayman Islands Companies in Hong KongervinisherePas encore d'évaluation

- Rule in Foss V HarbottleDocument2 pagesRule in Foss V HarbottleBHARATH JAJUPas encore d'évaluation

- The Statutory Derivative Action in MalaysiaDocument32 pagesThe Statutory Derivative Action in MalaysiaSha Kah RenPas encore d'évaluation

- 15 JCorp LStud 407Document10 pages15 JCorp LStud 407caltonmupandePas encore d'évaluation

- Study Unit 2 Discussion Questions and AnswersDocument4 pagesStudy Unit 2 Discussion Questions and AnswersArap KimalaPas encore d'évaluation

- Corp 3 - DigestsDocument14 pagesCorp 3 - DigestsMary Charise VillarandaPas encore d'évaluation

- Separate Legal Personality and Lifting The VeilDocument4 pagesSeparate Legal Personality and Lifting The Veilkusha100% (2)

- Mcl5901 Discussion QuestionsDocument16 pagesMcl5901 Discussion Questionskristin100% (1)

- Unit 1Document79 pagesUnit 1RonellePas encore d'évaluation

- Various Grounds On Which Corporate Veil Can Be LiftedDocument17 pagesVarious Grounds On Which Corporate Veil Can Be LiftedYashwanth KalepuPas encore d'évaluation

- Corporate PersonalityDocument5 pagesCorporate PersonalityMehedi Hasan ShaikotPas encore d'évaluation

- Session 6 Extra Reading Piercing The VeilDocument8 pagesSession 6 Extra Reading Piercing The VeilMasape ThomasPas encore d'évaluation

- Dissertation On Administrative LawDocument4 pagesDissertation On Administrative LawSomeoneWriteMyPaperCanada100% (1)

- Corporate-Personality EasyDocument4 pagesCorporate-Personality EasyNaim AhmedPas encore d'évaluation

- Mod2 - 6 - G.R. No. 75875 Aurbach V Sanitary Wares - DigestDocument2 pagesMod2 - 6 - G.R. No. 75875 Aurbach V Sanitary Wares - DigestOjie SantillanPas encore d'évaluation

- Jo Chung Cang Vs Pacific ComDocument1 pageJo Chung Cang Vs Pacific ComPACPas encore d'évaluation

- Spinning &manufacturing Co, LTD, The Apex Court Observed That The Proper Test For DeterminingDocument3 pagesSpinning &manufacturing Co, LTD, The Apex Court Observed That The Proper Test For DeterminingAshhab KhanPas encore d'évaluation

- Derivative ClaimsDocument18 pagesDerivative ClaimsreazPas encore d'évaluation

- Bell House Case AnalysisDocument7 pagesBell House Case AnalysisMunniBhavnaPas encore d'évaluation

- Petitioner Respondents Cayetano Sebastian Dado & Cruz Zulueta Puno and AssociatesDocument12 pagesPetitioner Respondents Cayetano Sebastian Dado & Cruz Zulueta Puno and AssociatesDe Vera CJPas encore d'évaluation

- Joel Odong Amen Anor V DrOcero Andrew Anor (HCT00CCCS 602 of 2004) 2006 UGCommC 51 (30 November 2006)Document11 pagesJoel Odong Amen Anor V DrOcero Andrew Anor (HCT00CCCS 602 of 2004) 2006 UGCommC 51 (30 November 2006)David OkelloPas encore d'évaluation

- Doc-1 VeenaDocument3 pagesDoc-1 VeenaGuy HoneyPas encore d'évaluation

- Bugging Corpo Cases1Document29 pagesBugging Corpo Cases1Verne SagunPas encore d'évaluation

- Piercing The Corporate Veil in Taxation Matters (Autosaved)Document17 pagesPiercing The Corporate Veil in Taxation Matters (Autosaved)PRERNA BAHETIPas encore d'évaluation

- Corporate Veil 4Document3 pagesCorporate Veil 4silvernitrate1953Pas encore d'évaluation

- Salomon V SalomonDocument6 pagesSalomon V Salomonjeff omangaPas encore d'évaluation

- ACL - Module 1 Summay DocumentDocument7 pagesACL - Module 1 Summay DocumentRoel WillsPas encore d'évaluation

- Holding and Subsidiary CompaniesDocument10 pagesHolding and Subsidiary CompaniesNilesh Yadav0% (1)

- U P & E S S: Niversity OF Etroleum Nergy Tudies Chool OF LAWDocument18 pagesU P & E S S: Niversity OF Etroleum Nergy Tudies Chool OF LAWpriyanka_kajlaPas encore d'évaluation

- Communication Materials v. CADocument2 pagesCommunication Materials v. CAerikagcvPas encore d'évaluation

- Members' Remedies (Company Law)Document9 pagesMembers' Remedies (Company Law)Siti Naquiah Mohd JamelPas encore d'évaluation

- GPCLDocument6 pagesGPCLGourav LohiaPas encore d'évaluation

- NVCA Letter - H R 3309 Innovation Act - 11!20!2013 - FinalDocument2 pagesNVCA Letter - H R 3309 Innovation Act - 11!20!2013 - FinalSaveTheInventorPas encore d'évaluation

- Notes2014 Entrep LawDocument69 pagesNotes2014 Entrep LawShivam NaikPas encore d'évaluation

- In The Honorable Supreme Court of Swatantra: Memorial For Respondent Page 1Document13 pagesIn The Honorable Supreme Court of Swatantra: Memorial For Respondent Page 1Ankit GuptaPas encore d'évaluation

- DR - Navrang Saini-IBC CASE LAWSDocument10 pagesDR - Navrang Saini-IBC CASE LAWSSachinPas encore d'évaluation

- Double Derivative Actions AssignmentDocument7 pagesDouble Derivative Actions Assignmentraghuvansh mishraPas encore d'évaluation

- Feb 17Document29 pagesFeb 17Bea AlduezaPas encore d'évaluation

- Summary of Arguments StarDocument2 pagesSummary of Arguments StarSuhani ChanchlaniPas encore d'évaluation

- Foss Vs HarbottleDocument4 pagesFoss Vs Harbottlesafa mogPas encore d'évaluation

- Jurists Lecture (Securities Regulation Code)Document16 pagesJurists Lecture (Securities Regulation Code)Lee Anne Yabut100% (1)

- Entrepreneurial Law NotesDocument70 pagesEntrepreneurial Law NotesPhebieon Mukwenha100% (1)

- BA DraftDocument3 pagesBA DraftNantume GloriaPas encore d'évaluation

- Case Digest: Corporation LawDocument2 pagesCase Digest: Corporation LawChrissa CarteraPas encore d'évaluation

- 09 Aurbach vs. Sanitary Wares Manufacturing CorporationDocument22 pages09 Aurbach vs. Sanitary Wares Manufacturing CorporationYaz CarlomanPas encore d'évaluation

- VI.4.b. G.R. No. 142616. July 31, 2001Document12 pagesVI.4.b. G.R. No. 142616. July 31, 2001SamPas encore d'évaluation

- Corpo Quiz Week 2 - Answer KeyDocument6 pagesCorpo Quiz Week 2 - Answer Keyzeigfred badanaPas encore d'évaluation

- Minority Shareholder's Rights Under UK Company Law 2006 and Rights To Derivative Actions.Document7 pagesMinority Shareholder's Rights Under UK Company Law 2006 and Rights To Derivative Actions.Raja Adnan LiaqatPas encore d'évaluation

- Commercial V Social Veil LiftingDocument3 pagesCommercial V Social Veil LiftingMuhammad Aaqil Umer MemonPas encore d'évaluation

- Santiago Jo Chung, Et Al. v. Pacific Commercial CompanyDocument2 pagesSantiago Jo Chung, Et Al. v. Pacific Commercial CompanyMike Zaccahry MilcaPas encore d'évaluation

- Opc and Corporate VeilDocument12 pagesOpc and Corporate Veilmugunthan100% (1)

- Ago Realty SyllabDocument5 pagesAgo Realty SyllabyxroskysPas encore d'évaluation

- Derivative Claim EssayDocument10 pagesDerivative Claim EssayAhmed YasinPas encore d'évaluation

- Renaldo Ramjohn 816024242 940790 1222522114Document6 pagesRenaldo Ramjohn 816024242 940790 1222522114ramjohnrenaldo46Pas encore d'évaluation

- Corpo Digests 1Document12 pagesCorpo Digests 1AnjPas encore d'évaluation

- Protection of Minority ShareholderDocument3 pagesProtection of Minority ShareholderMehedi Hasan ShaikotPas encore d'évaluation

- 500 Review Questions For The MCAT Biology, 2 EditionDocument192 pages500 Review Questions For The MCAT Biology, 2 EditionAaron GohPas encore d'évaluation

- 500 Review Questions For The MCAT Biology, 2 EditionDocument192 pages500 Review Questions For The MCAT Biology, 2 EditionAaron GohPas encore d'évaluation

- Bachelor of Science (Honours) Biomedical Science-Northumbria University - 130918 PDFDocument7 pagesBachelor of Science (Honours) Biomedical Science-Northumbria University - 130918 PDFAaron GohPas encore d'évaluation

- Articles and Shorter Notes What Is Right and What Is A Right?: The Claim To Same-Sex Marriage, The Politicization of Rights and The Morality of LawDocument45 pagesArticles and Shorter Notes What Is Right and What Is A Right?: The Claim To Same-Sex Marriage, The Politicization of Rights and The Morality of LawAaron GohPas encore d'évaluation

- (2010) 2 SLR 0776Document45 pages(2010) 2 SLR 0776Aaron GohPas encore d'évaluation

- For Better or For Worse - The Statutory Derivative Action in SingaporeDocument29 pagesFor Better or For Worse - The Statutory Derivative Action in SingaporeAaron GohPas encore d'évaluation

- Challenger AR Complete Low-ResDocument94 pagesChallenger AR Complete Low-ResAaron GohPas encore d'évaluation

- 2012 P5 Primary Five English Exam Papers With Answers From Various SchoolsDocument621 pages2012 P5 Primary Five English Exam Papers With Answers From Various SchoolsAaron Goh100% (2)

- FFL SMU Finance For Law .Sample Exam With SolutionDocument7 pagesFFL SMU Finance For Law .Sample Exam With SolutionAaron Goh100% (1)

- (1988) 2 SLR (R) 0165Document18 pages(1988) 2 SLR (R) 0165Aaron GohPas encore d'évaluation

- MMT LL DR Barinov Reply Limb Lengthening RussiaDocument3 pagesMMT LL DR Barinov Reply Limb Lengthening RussiaAaron GohPas encore d'évaluation

- Hooley's RecharacterisationDocument16 pagesHooley's RecharacterisationAaron GohPas encore d'évaluation

- Class Notes For Company Admin, Accounts and Audit (Corporate Law, SMU)Document22 pagesClass Notes For Company Admin, Accounts and Audit (Corporate Law, SMU)Aaron GohPas encore d'évaluation

- Fnce103 Term 2 Annual Year 2014. SMU Study Outline David DingDocument5 pagesFnce103 Term 2 Annual Year 2014. SMU Study Outline David DingAaron GohPas encore d'évaluation

- Retirement Planning Problem - SolutionDocument2 pagesRetirement Planning Problem - SolutionAaron Goh50% (2)

- LAW204 Notes-Standing (Jack Lee) AY2013-14Document10 pagesLAW204 Notes-Standing (Jack Lee) AY2013-14Aaron GohPas encore d'évaluation

- Bridge Leases Contract, Property, & StatusDocument17 pagesBridge Leases Contract, Property, & StatusAaron Goh100% (1)

- R V Barnsley MBC Ex P HookDocument12 pagesR V Barnsley MBC Ex P HookAaron Goh100% (1)

- AG V Tan Eng Hong (LawNet Copyright)Document38 pagesAG V Tan Eng Hong (LawNet Copyright)Aaron GohPas encore d'évaluation

- Constitutional Law 377A - Is It UnconstitutionalDocument21 pagesConstitutional Law 377A - Is It UnconstitutionalAaron GohPas encore d'évaluation

- C N L U S I M C C: (Prosecution) (Defence)Document28 pagesC N L U S I M C C: (Prosecution) (Defence)Aditi SoniPas encore d'évaluation

- Executing Court Should Decide Obstructions Made To Delivery of Possession by Holding Whether Obstructor Is Bound by Decree or Not Air 2002 SC 251Document11 pagesExecuting Court Should Decide Obstructions Made To Delivery of Possession by Holding Whether Obstructor Is Bound by Decree or Not Air 2002 SC 251Sridhara babu. N - ಶ್ರೀಧರ ಬಾಬು. ಎನ್Pas encore d'évaluation

- ERNESTO M. GUEVARA vs. ROSARIO GUEVARA DOCTRINAL DIGEST STORYLINESDocument2 pagesERNESTO M. GUEVARA vs. ROSARIO GUEVARA DOCTRINAL DIGEST STORYLINESEunice SkyPas encore d'évaluation

- Spouses Olib Vs Pastoral-Case DigestDocument2 pagesSpouses Olib Vs Pastoral-Case DigestCandypopPas encore d'évaluation

- Morandarte v. CADocument10 pagesMorandarte v. CARencePas encore d'évaluation

- Texaco CaseDocument7 pagesTexaco CaseDiorVelasquezPas encore d'évaluation

- Pavan Settlement AgreementDocument9 pagesPavan Settlement AgreementSurbhi GuptaPas encore d'évaluation

- Montesclaros v. COMELEC GR 152295, July 9, 2002Document2 pagesMontesclaros v. COMELEC GR 152295, July 9, 2002Jude IklamoPas encore d'évaluation

- Cua Lai Chu Vs LaquiDocument2 pagesCua Lai Chu Vs LaquiEM RGPas encore d'évaluation

- City of Dallas BriefDocument80 pagesCity of Dallas BriefThe Dallas Morning NewsPas encore d'évaluation

- Hedy Gan Va Ca (1988)Document3 pagesHedy Gan Va Ca (1988)Jon JamoraPas encore d'évaluation

- Uttar Pradesh State Legal Services Authority: Final Draft OnDocument22 pagesUttar Pradesh State Legal Services Authority: Final Draft OnAnkur BhattPas encore d'évaluation

- Alternative Dispute Resolution (Notes & Summaries of Related Literature)Document91 pagesAlternative Dispute Resolution (Notes & Summaries of Related Literature)Diane Garduce80% (5)

- Curative Petition ArticleDocument24 pagesCurative Petition ArticleAlan HowardPas encore d'évaluation

- KPMG Flash News United Breweries LTD 3Document4 pagesKPMG Flash News United Breweries LTD 3Sardar JunaidPas encore d'évaluation

- Ideal Toy Corporation v. Sayco Doll Corporation, 302 F.2d 623, 2d Cir. (1962)Document8 pagesIdeal Toy Corporation v. Sayco Doll Corporation, 302 F.2d 623, 2d Cir. (1962)Scribd Government DocsPas encore d'évaluation

- Santos Vs Bishop of Nueva CaceresDocument1 pageSantos Vs Bishop of Nueva CaceresCJPas encore d'évaluation

- Besnik Korbeci v. Attorney General United States, 3rd Cir. (2012)Document6 pagesBesnik Korbeci v. Attorney General United States, 3rd Cir. (2012)Scribd Government DocsPas encore d'évaluation

- Fulltext - Commissioner of Customs Vs Marina SalesDocument4 pagesFulltext - Commissioner of Customs Vs Marina Salesscartoneros_1Pas encore d'évaluation

- SubjectDocument15 pagesSubjectravi prakash0% (1)

- Ashok Puri Vs State of Punjab and Another On 19 December, 2011Document3 pagesAshok Puri Vs State of Punjab and Another On 19 December, 2011Siddarth AgarwalPas encore d'évaluation

- First Producers Holdings Corp vs. CoDocument4 pagesFirst Producers Holdings Corp vs. CoWILHELMINA CUYUGANPas encore d'évaluation

- Rewa Sidhi Gramin Bank 5 FebDocument2 pagesRewa Sidhi Gramin Bank 5 FebVimal KulshreshthaPas encore d'évaluation

- Mindanao II Geothermal Partnership vs. CIRDocument47 pagesMindanao II Geothermal Partnership vs. CIRAsHervea AbantePas encore d'évaluation

- Power of Review - Labour Courts or Industrial TribunalsDocument19 pagesPower of Review - Labour Courts or Industrial TribunalsShivam BhargavaPas encore d'évaluation

- Swiss Rules of International ArbitrationDocument29 pagesSwiss Rules of International ArbitrationBogdanSlaninaPas encore d'évaluation

- Nevada Supreme Court Decision On James Biela AppealDocument21 pagesNevada Supreme Court Decision On James Biela AppealReno Gazette JournalPas encore d'évaluation

- Alfaro WinningClaimantDocument52 pagesAlfaro WinningClaimantKai TehPas encore d'évaluation

- Pre-Trial JDR PMCDocument3 pagesPre-Trial JDR PMCTokie TokiPas encore d'évaluation

- Escheat ProceedingDocument1 pageEscheat ProceedingSheila G. DolipasPas encore d'évaluation