Académique Documents

Professionnel Documents

Culture Documents

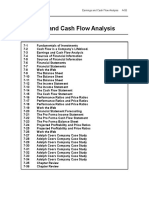

Chapter 5 - The Income State and The Statement of Cash Flow

Transféré par

Joey LessardTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Chapter 5 - The Income State and The Statement of Cash Flow

Transféré par

Joey LessardDroits d'auteur :

Formats disponibles

Chapter 5--The Income Statement and the Statement of Cash

Flows

Student: ___________________________________________________________________________

1. Together with the cash flow statement, the income statement enables the investors to determine the rate of

return the company is generating relative to the amount of capital invested.

True False

2. The income statement predicts a companys future income and cash flows.

True False

3. The amount of money that can be distributed to shareholders as a return on capital, without being a return of

capital, is the capital financial concept.

True False

4. .!. "##$ and %F&! companies commonly measure and report net income and comprehensive income.

True False

'. &evenue can be recogni(ed either when it is earned or collection has occurred or reasonably certain to occur.

True False

). !ystematic and rational allocation is used to recogni(e revenue.

True False

*. %f a company does not have any discontinued operations or e+traordinary items to list on its income

statement, the labels should still be there with a (ero balance noted.

True False

,. %nterperiod ta+ allocation involves apportioning a corporations total income ta+ e+pense for a period to the

various components of its net income and other comprehensive income items.

True False

-. .hen a parent company owns a ma/ority of the common shares of a subsidiary company but not 1001 of

them, the parent company will consolidate all of the subsidiarys revenues and e+penses into its financial

statements.

True False

10. .hen a company classifies a component as held for sale it must report the component on its balance sheet at

the lower of its boo2 value or its fair value minus costs to sell.

True False

11. # company does not have to disclose information about the sale of a discontinued component in the notes to

its financial statements until the actual sale has occurred.

True False

12. # terrorist attac2 would be considered an e+traordinary event because terrorist attac2s are infre3uent in

nature.

True False

13. To classify an event or transaction as e+traordinary it must be unusual in nature and infre3uent in

occurrence.

True False

14. There is no prescribed income statement format under %F&! whereas .!. "##$ re3uires the use of the

single4step or the multiple4step format.

True False

1'. To compute earnings per share the denominator is net income attributable to common shareholders less any

preferred stoc2 dividends for the period.

True False

1). nder .!. "##$ or %F&!, a company can report its comprehensive income or loss under present net

income and comprehensive income in a single continuous performance statement or in a separate but

consecutive financial statement.

True False

1*. "ains or losses associated with derivative financial instruments would be included in income from

continuing operations.

True False

1,. The statement of cash flows provides e+ternal users the ability to analy(e the information re3uired to access

a companys ris2, li3uidity, financial fle+ibility, and operating capability.

True False

1-. The most common way in which to prepare the statement of cash flows is the indirect method, which is

encouraged by F#!5.

True False

20. 6ompanies with lower coverage ratios have a greater ris2 and a lower financial fle+ibility.

True False

21. The !76 scrutini(es reported earnings numbers to assess the 3uality of earnings and to detect any potential

for earnings management.

True False

22. # segment must pass all of the tests in order for it to be considered a reportable segment. These tests include

the revenue, profit, and asset tests.

True False

23. # company is not re3uired to follow a specific format in ma2ing the disclosures for its segments but F#!5

encourages the most useful format for its specific circumstances.

True False

24. .ho is the income statement designed to inform8

#. creditors

5. investors

6. lenders

9. all of these

2'. :perating capability refers to

#. the ability of a company to adapt to une+pected needs and opportunities

5. the uncertainty or unpredictability of the future results of a company

6. a measure of overall company performance

9. a company;s ability to maintain a given level of operations

2). The income statement helps users

#. assess the companys ris2

5. review the impact of economic factors affecting the company

6. compare and contrast performance against a competitor

9. all of these

2*. .hich of the following is helpful to report separately8

#. e+penses that vary with volume of activity

5. e+penses that are discretionary

6. e+penses that depend on other economic factors

9. all of these

2,. .hich of the following is not a purpose of the income statement8

#. used to evaluate managements performance

5. predicts the companys future assets and liabilities

6. used to compare performance against other companies

9. assesses the companys ris2

2-. The income statement is an important financial statement for all of the following reasons, except

#. the income statement helps shareholders evaluate management;s operating effectiveness

5. past income statements can be useful indicators in predicting current and future cash dividend payments as

well as future stoc2 prices

6. the income statement provides useful information concerning the corporation;s ability to generate sufficient

cash flows from operations for use in payment of its operating obligations

9. the income statement reports the amount of net cash inflows resulting from operating, financing, and

investing activities to users

30. %n accrual accounting, net income is defined as

#. &evenues 4 7+penses < "ains < =osses

5. &evenues 4 7+penses

6. &evenues 4 7+penses < "ains 4 =osses

9. increase in net assets from nonowner transactions

31. The income statement reports

#. revenue and e+penses for a given point in time.

5. revenue and e+penses for a specific date.

6. revenue, e+penses, gains and losses for a specified period of time.

9. revenues, e+penses, gains and losses for a specific date.

32. 5elow is a list of account balances for Fraggle 6ompany>

6ash ? 123,'00

6ost of "oods !old *)*,'00

"ross $rofit '0*,'00

%ncome before ta+es 233,400

%ncome ta+ e+pense 8

%nterest e+pense 14,*00

%nterest revenue ',)00

%nventory 113,4)0

@et %ncome 8

@umber of 6ommon !hares 1'0,000

:perating e+penses 2)',000

:perating %ncome 242,'00

$roperty, plant, and e3uipment AnetB 2'',000

&eceivables AnetB -),000

!ales AnetB 1,2*',000

.hat is Fraggle 6ompanys net income, assuming a 301 ta+ rate8

#. ?1)3,3,0

5. ?233,400

6. ?242,'00

9. none of these

33. :n 9ecember 31, 2014, the net assets of Cartine( Canufacturing amounted to ?40,000. @et income

calculated by using the financial capital maintenance concept amounted to ?12,000. 9uring the year, additional

common stoc2 was issued for ?,,000, and ?',000 of dividends was paid. The net assets at Danuary 1, 2014,

amounted to

#. ?31,000

5. ?3*,000

6. ?20,000

9. ?2',000

34. "eorgio 6ompany began 2014 with net assets of ?,0,000. @et income calculated by using the capital

maintenance concept was ?21,000. 9uring 2014 owners contributed ?2),000 of new capital. 5y year4end, the

net assets totaled ?*,,000. 9ividends to the owners during 2014 were

#. ?4-,000

5. ?2,,000

6. ?23,000

9. ?2,000

3'. %n general, revenue is recogni(ed as being earned

#. during the production process

5. upon completion of the production process

6. when cash is received

9. when goods are sold or services are rendered

3). &eali(ation of revenue occurs when

#. the item is formally recorded and reported in the financial statements

5. noncash resources are converted into cash or rights to cash

6. the actual e+change of noncash resources into cash

9. when a transaction is both reali(ed and reali(able

3*. To be recogni(ed as revenue, an item must

#. meet the definition of earned revenue

5. be earned revenue and be reali(ed or reali(able

6. be reali(ed

9. be earned

3,. :ne method of revenue recognition that postpones the recognition until after the time of sale is

#. percentage4of4completion

5. proportional performance

6. cost recovery

9. point of sale

3-. .hich of the following is not an e+pense recognition approach recogni(ed by the F#!5 as an e+pense

recognition principle to properly match e+penses against revenues8

#. immediate recognition

5. systematic and rational allocation

6. cash payment

9. association of cause and effect

40. 7+amples of matching e+penses against revenues using the association of cause and effect include all of the

following except

#. insurance costs

5. transportation costs for delivery of goods to customers

6. costs of products sold

9. sales commissions

41. 9epreciation is an e+ample of which e+pense recognition principle8

#. association of cause and effect

5. systematic and rational allocation

6. cost recovery

9. immediate recognition

42. .hich of the following e+penses is an e+ample of e+pense recognition under the immediate recognition

principle8

#. sales commissions

5. depreciation

6. management salaries

9. transportation4out

43. %n distinguishing between revenues and gains, which of the following statements is false8

#. Core gains than revenues are beyond the entity;s control.

5. "ains are associated more with peripheral, nonoperating activities than are revenues.

6. "##$ does not provide precise distinctions between revenues and gains.

9. &evenues are reported net Arather than grossB more often than gains.

44. The ma/or components of the income statement are listed below>

# E e+traordinary items

5 E income from continuing operations

6 E earnings per share

9 E results from discontinued operations

%n what se3uence do they normally appear on the income statement8

#. 54#4946

5. 54#4649

6. 5494#46

9. 5494649

4'. .hich of the following are components of the income statement8

#. revenues

5. e+traordinary items

6. income from continuing operations

9. all of these

4). .hich of the following would appear after the heading of operating income8

#. cost of goods sold

5. other operating income items Agains or lossesB

6. operating e+penses

9. unusual and nonrecurring gains or losses

4*. .hich of the following is not a component of the income statement8

#. unusual and nonrecurring gains and losses

5. net income

6. income ta+es

9. accumulated other comprehensive income

4,. The subtotal, gross profit, will be disclosed on

#. a multiple4step income statement

5. both multiple4step and single4step income statements

6. neither multiple4step nor single4step income statements

9. a single4step income statement

4-. .hich of the following is not used as a caption if there is nothing to report8

#. income from continuing operations

5. e+traordinary items

6. interest e+pense

9. income ta+es

'0. #ll of the following are included in the computation of cost of goods sold except

#. freight4out

5. purchase returns and allowances

6. beginning finished goods inventory

9. freight4in

'1. From the following information, compute cost of goods sold.

$urchase returns ? 1,200

%nventory, 9ecember 31 2,'00

Freight4in 1,100

%nventory, Danuary 1 2,,00

$urchases 1',000

#. ?1',300

5. ?1',200

6. ?1',100

9. ?1',000

'2. #ll of the information re3uired in the computation of cost of goods sold is presented below, e+cept for

purchases, which must be what amount8

$urchase returns ? 1,200

%nventory, 9ecember 31 2,'00

6ost of goods sold 10,'00

$urchases 8

%nventory, Danuary 1 2,'00

Freight4in 1,'00

#. ?10,,00

5. ?11,200

6. ?-,*00

9. ?10,200

'3. The gross profit of =arry 6ompany for 2014 is ?300,000, cost of goods manufactured is ?400,000, the

beginning inventories of goods in process and finished goods are ?2,,000 and ?3',000, respectively, and the

ending inventories of goods in process and finished goods are ?'0,000 and ?*0,000, respectively. The cost of

goods sold of =arry 6ompany for 2014 must have been

#. ?3*,,000

5. ?2)',000

6. ?2*,,000

9. ?3)',000

'4. %n 2014, 9allas 6ompany had sales of ?)00,000F cost of sales of ?430,000F interest e+pense of ?12,000F a

gain on the sale of a component of ?'2,000F and an e+traordinary loss of ?2',000. For its income statement,

9allas uses the single4step format and the all4inclusive concept. .hat was 9allas;s reported preta+ income from

continuing operations8

#. ?1'0,000

5. ?1*0,000

6. ?1',,000

9. ?11,,000

''. %ntraperiod ta+ allocation

#. is used to allocate a company;s total income ta+ e+pense to the components of net income and

comprehensive income

5. involves temporary AtimingB differences between financial and ta+able incomes

6. re3uires allocation of deferred ta+es across accounting periods

9. results from differences between ta+ regulations and the principles followed to determine financial income

'). %ntraperiod ta+ allocation re3uires a corporation;s total income ta+ e+pense to be allocated to all of the

following except

#. e+traordinary items

5. other revenues and e+penses

6. discontinued operations

9. prior4period ad/ustments

'*. # company that discontinues and disposes of an operation AcomponentB should include the gain or loss on

sale in the income statement as aAnB

#. prior4period ad/ustment

5. e+traordinary item

6. amount after income from continuing operations and before e+traordinary items

9. bul2 sale of fi+ed assets included in income from continuing operations

',. .hen an entity reports on a sale of a component of the business

#. any income or loss from operations of the component should be reported in the income from continuing

operations section, but any gain or loss on the sale of the component should be presented below the income

from continuing operations section

5. current operating income or loss of the component and any gain or loss on sale of the component should be

presented in a separate section of the income statement

6. any gain or loss on the sale should always be presented in the e+traordinary gain or loss section of the

income statement

9. all information related to the sold component should be reported solely in the footnotes accompanying the

financial statements

'-. .hich of the following is a re3uired disclosure in the income statement when reporting the sale of a

component of the business8

#. The gain or loss on sale should be reported as an e+traordinary item.

5. &esults of operations of a discontinued component should be disclosed immediately below e+traordinary

items.

6. 7arnings per share from both income from continuing operations and net income should be disclosed on the

face of the income statement.

9. &evenue and e+penses applicable to the discontinued operations should be disclosed in the income

statement.

)0. .hich is least li2ely to be classified as a sale of a component8

#. sale by a communications company of its radio stations, but none of its television stations

5. sale by a food distributor of its wholesale supermar2et division while maintaining its wholesale fast4food

restaurants division

6. sale by an apparel manufacturer of a woolen suit manufacturing plant in order to concentrate on the

manufacture of suits from synthetic products

9. sale by a meat4pac2ing company of its AentireB 201 interest in a professional football team

)1. "regory 6ompany is disposing of a component of its company. The net loss from the sale is estimated to be

?)00,000. %ncluded in the ?)00,000 is termination pay of ?100,000, which is directly associated with the

decision to dispose of the componentF and net losses from component asset write4downs of ?400,000. %gnoring

ta+es, "regory;s income statement should report a loss on sale of a business component of

#. ?100,000

5. ?400,000

6. ?'00,000

9. ?)00,000

)2. Exhibit 5-1

The following condensed income statement of &anger 6orporation is presented for the two years ended

9ecember 31, 2014 and 2013>

2014 2013

@et sales ?10,000,000 ?-,000,000

6ost of sales ),000,000 ),000,000

"ross profit ? 4,000,000 ?3,000,000

:perating e+pense 2,'00,000 2,000,000

:perating income ? 1,'00,000 ?1,000,000

"ain on sale of a component -00,000 44

? 2,400,000 ?1,000,000

%ncome ta+ e+pense *20,000 300,000

@et income ? 1,),0,000 ? *00,000

:n Danuary 1, 2014, &anger entered into an agreement to sell one of its separate operating divisions for ?2,000,000. The sale resulted in a gain on

disposition of ?-00,000 on @ovember 12, 2014, and 3ualifies as a discontinued component. This division;s contribution to &angers reported income

before income ta+es for each year was as follows>

2014 ?*00,000 loss

2013 ?400,000 loss

#ssume an income ta+ rate of 301.

&efer to 7+hibit '41. %n the preparation of a revised comparative income statement, &anger should report income from continuing operations after

income ta+es for 2014 and 2013, respectively, amounting to

#. ?1,'40,000 and ?*00,000

5. ?1,'40,000 and ?-,0,000

6. ?1,),0,000 and ?*00,000

9. ?1,),0,000 and ?-,0,000

)3. Exhibit 5-1

The following condensed income statement of &anger 6orporation is presented for the two years ended

9ecember 31, 2014 and 2013>

2014 2013

@et sales ?10,000,000 ?-,000,000

6ost of sales ),000,000 ),000,000

"ross profit ? 4,000,000 ?3,000,000

:perating e+pense 2,'00,000 2,000,000

:perating income ? 1,'00,000 ?1,000,000

"ain on sale of a component -00,000 44

? 2,400,000 ?1,000,000

%ncome ta+ e+pense *20,000 300,000

@et income ? 1,),0,000 ? *00,000

:n Danuary 1, 2014, &anger entered into an agreement to sell one of its separate operating divisions for ?2,000,000. The sale resulted in a gain on

disposition of ?-00,000 on @ovember 12, 2014, and 3ualifies as a discontinued component. This division;s contribution to &angers reported income

before income ta+es for each year was as follows>

2014 ?*00,000 loss

2013 ?400,000 loss

#ssume an income ta+ rate of 301.

&efer to 7+hibit '41. %n the preparation of a revised comparative income statement, &anger should report under the caption G9iscontinued

:perationsG for 2014 and 2013, respectively,

#. income of ?140,000 and a loss of ?2,0,000

5. income of ?140,000 and a loss of ?0

6. income of ?200,000 and a loss of ?400,000

9. a loss of ?*00,000 and a loss of ?400,000

)4. @elly 6ompany sold its cattle ranching component on Dune 30, 2014, for a gain of ?1,000,000. From

Danuary through Dune, the component had sustained operating income of ?300,000. The income ta+ rate is 3'1.

How should @elly report the income and the sale on its income statement8

#. as ?300,000 operating income and a ?1,000,000 gain on sale of component

5. as a ?1,300,000 gain in operating income

6. as a net of ta+ gain of ?,4',000 after income from continuing operations

9. as ?1-',000 operating income and a ?)'0,000 gain on sale of the component shown before e+traordinary

items

)'. .hich of the following is re3uired to be disclosed, pursuant to "##$8

#. operating income or loss from discontinued component reported on the income statement

5. a description of facts and circumstances leading up to the sale of a discontinued component within the notes

of the financial statements

6. all gains or losses from sale of the component reported on the income statement or in the footnotes

9. all of these

)). To be considered an e+traordinary item, an event must be

#. unusual

5. unusual or infre3uent

6. infre3uent

9. infre3uent and unusual

)*. For an event or transaction to be classified as an e+traordinary item in the income statement, it should be

#. infre3uent and material, but it need not be unusual in nature

5. unusual in nature and material, but it need not be infre3uent

6. unusual in nature, infre3uent, and material

9. unusual in nature and infre3uent, but it need not be material

),. .hich of the following material gainsIlosses would be disclosed as an e+traordinary item on an entity;s

income statement8

#. a loss arising from the write4off of a large uncollectible accounts receivable balance

5. a loss arising from the e+propriation of a manufacturing plant by a foreign government

6. a gain from the sale of a component of the entity;s business

9. a gain from the sale of manufacturing e3uipment no longer needed by the entity

)-. nder which of the following conditions would hurricane damage be considered an e+traordinary item for

income reporting purposes8

#. only if hurricanes in the geographical area are unusual in nature and occur infre3uently

5. only if hurricanes are normal in the geographical area but do not occur fre3uently

6. only if hurricanes occur fre3uently in the geographical area but can be covered by insurance policies

9. under any circumstances hurricane damage should be classified as an e+traordinary item

*0. How should the gain or loss that is considered infre3uent but not unusual in nature be disclosed8

#. separately in the income statement immediately after income from continuing operations

5. on a net4of4ta+ basis in the income statement immediately after income from continuing operations

6. as an e+traordinary item

9. separately in the income statement as a component of income from continuing operations

*1. %n 2014, .al2er 6ompany wrote off a ?300,000 debt from a ma/or customer, lost ?2,2'0,000 when a foreign

country devalued its currency, gained ?2,'00,000 when a manufacturing plant was destroyed by a unusual and

infre3uent flood, lost ?)00,000 on the early retirement of its long4term bonds, and lost ?*',000 on the sale of

stoc2 from its investment portfolio. .hat amount of e+traordinary items Abefore income ta+esB will .al2er

report in 20148

#. ?3*',000

5. ?)00,000

6. ?2,'00,000

9. ?4,*'0,000

*2. .aters 7dge 6ompany operates a manufacturing plant overloo2ing the 6hesapea2e 5ay. %n early 201', a

hurricane destroyed the uninsured plant, resulting in ?'00,000 damage. !uch damage had occurred previously

only once in the last 110 years. .aters 7dges ?'00,000 loss should be reported on the income statement

#. after ordinary income, but before e+traordinary items

5. as an e+traordinary item

6. as an ad/ustment to net income

9. as a separate component of income from continuing operations

*3. How should a material, infre3uent event not meeting the criteria for an e+traordinary item be disclosed in

the income statement8

#. shown as a separate item in income from continuing operations

5. shown in income from continuing operations but not shown as a separate item

6. shown after income from continuing operations but before e+traordinary items

9. shown after e+traordinary items net of income ta+ but before net income

*4. # review of the 9ecember 31, 2014, financial statements of &un 6orporation revealed that under the caption

Ge+traordinary losses,G &un reported a total of ?300,000. Further analysis revealed that the ?300,000 in losses

comprised the following items>

1. &un recorded a gain of ?,0,000 incurred in the sale of e3uipment.

2. %n an unusual and infre3uent occurrence, a loss of ?3'0,000 was sustained as a result of tornado damage to a manufacturing facility.

3. 9uring 2014, several factories were shut down during a ma/or stri2e by employees of &un;s ma/or customer. !hutdown e+penses

totaled ?1'0,000.

4. %nventory in the amount of ?30,000 was written off as obsolete.

%gnoring income ta+es, what amount of loss should &un have reported as an e+traordinary loss on its 2014 income statement8

#. ?1'0,000

5. ?3'0,000

6. ?2,0,000

9. ?'00,000

*'. 7arnings per share is an important disclosure because

#. it provides information relevant to the common stoc2holders

5. net income disclosed in the financial statements can fluctuate based upon management;s intentions

6. it forces common and preferred stoc2holders to read the financial statements

9. it uses net income

*). The numerator in the earnings per share calculation is

#. only the amount available to common stoc2holders

5. net income attributable to common shareholders

6. net income minus declared preferred stoc2 dividends

9. all of these

**. Corgan 6ompany reported the following information for the year ended 9ecember 31, 2014>

@et income ? )00,000

$referred dividends declared and paid )0,000

6ommon dividends declared and paid -0,000

#verage common shares outstanding -0,000

7nding mar2et price per share 4'

@et sales ',100,000

Corgans earnings per share for 2014 was

#. ?).)*

5. ?).00

6. ?'.11

9. ?0.1'

*,. =ester 6ompany reported the following information for the year ended 9ecember 31, 2014>

@et income ? 1,000,000

$referred dividends declared and paid 1)0,000

6ommon dividends declared and paid -0,000

#verage common shares outstanding 100,000

7nding mar2et price per share 3'

@et sales 3,100,000

=esters earnings per share for 2014 was

#. ?,.40

5. ?10.00

6. ?*.'0

9. ?31.00

*-. %F&! content in the income statement is similar to .!. "##$ in all of the following areas except the

disclosure of

#. revenues

5. finance costs

6. e+traordinary items

9. ta+ e+pense

,0. 9ifferences that currently e+ist between %F&! and .!. "##$ with regard to the presentation of

information on the income statement include all of the following except

#. different acceptable terminology relating to revenue items

5. depreciation measures differ when e3uipment has been revalued

6. different performance measures such as 75%T9# are permitted under %F&!

9. differences resulting because %F&! does not re3uire the use of accrual accounting under the historical cost

framewor2

,1. %F&! reporting re3uires all of the following items except

#. earnings per share disclosure

5. comprehensive income disclosure in a statement of shareholders e3uity

6. disclosure of the results of discontinued operations

9. operating e+penses disclosure

,2. 6omprehensive income is an important concept in accounting because it represents

#. all changes in e3uity

5. changes in e3uity from nonowner sources

6. changes in liabilities minus assets

9. the impact on e3uity of all transactions

,3. 6omprehensive income includes the following changes in e3uity in a company during a period except

#. transactions with nonowners

5. events relating to nonowner sources

6. circumstances relating to nonowner sources

9. distributions to owners

,4. 6omprehensive income consists of

#. operating income < other income and losses

5. net income < other ad/ustments to retained earnings

6. net income < other comprehensive income

9. other comprehensive income < unreali(ed changes in the value of available4for4sale securities

,'. .hich of the following is not part of other comprehensive income8

#. unreali(ed changes in the value of trading securities

5. certain pension plan gains, losses, and prior service cost ad/ustments

6. certain gains and losses in derivatives

9. currency translation ad/ustments

,). .hich of the following is not considered part of comprehensive income8

#. translation ad/ustments from financial statement conversions

5. gains and losses on derivative financial instruments

6. gains and losses associated with the sale of a business component

9. gain and losses associated with ad/ustments to pension plan assets and liabilities

,*. .hich of the following is included in comprehensive income8

#. gains and losses associated with derivative financial instruments that hedge future cash flows

5. translation ad/ustments from converting foreign statements into .!. dollars

6. unreali(ed gains or losses associated with fair value of available4for4sale securities

9. all of these

,,. .hen is a company not re3uired to report comprehensive income8

#. when it has a net operating loss

5. when it has no other comprehensive income items

6. when it has no e+traordinary items

9. when it has no prior period ad/ustments

,-. .hich of the following is an acceptable way of reporting a company;s comprehensive income8

#. on the face of the income statement

5. in a separate, consecutive, statement of comprehensive income

6. in the statement of changes in shareholders; e3uity

9. both a and b are acceptable

-0. The primary purpose of a company;s statement of cash flows is to provide information about the company;s

#. operations

5. dividend policy

6. financing and investing activities

9. cash receipts and cash payments during the period

-1. The statement of cash flows is least li2ely to help e+ternal users assess

#. a company;s ability to generate positive future cash flows

5. the amount of a company;s future accrual4based sales revenue

6. a company;s ability to meet its obligations and pay dividends

9. a company;s need for e+ternal financing

-2. .hich of the following sections will not appear in the statement of cash flows8

#. operating activities

5. investing activities

6. financing activities

9. selling activities

-3. .hich of the following events would be classified as an operating activity in a statement of cash flows8

#. receipt of cash dividend on an e3uity investment

5. sale of a long4term investment

6. issuing notes payable

9. payment of cash dividends

-4. .hich of the following events would be classified as an investing activity on a statement of cash flows8

#. payment of interest on a loan

5. receipt of cash dividends on an available4for4sale investment

6. purchase of inventory

9. sale of an office building at a gain

-'. %n a statement of cash flows, the payment of a cash dividend on preferred stoc2 outstanding should be

classified as cash outflows for

#. operating activities

5. investing activities

6. lending activities

9. financing activities

-). %n a statement of cash flows, which of the following events would be classified as a financing activity8

#. purchase of a trading security

5. payment of interest on a loan

6. payment of cash dividends to shareholders

9. all of these

-*. .hich of the following statements regarding a statement of cash flows is false8

#. The most common method for reporting operating activities is the direct method.

5. :perating activities include all transactions and other events related to the earnings process.

6. %t re3uires a reconciliation of beginning and ending cash balances.

9. %t helps users assess a company;s need for e+ternal financing.

-,. Financial fle+ibility is generally defined as

#. the ability of a company to adapt to une+pected needs and opportunities

5. the uncertainty or unpredictability of the future results of a company

6. a measure of overall company performance

9. a company;s ability to maintain a given level of operations

--. .hich ratios are the most commonly analy(ed from the income statement8

#. gross profit margin

5. net profit margin

6. operating profit margin

9. all of these

100. Exhibit 5-2

The following is an income statement from the financial records of $eace, =ove and Doy 6ompany for the year

ended 9ecember 31, 201'>

Income Statement

!ales AnetB ? 24',)*'

6ost of "oods !old A)*,'00B

"ross $rofit ? 1*,,1*'

:perating e+penses 12',000B

:perating %ncome ? '3,1*'

%nterest revenue ',)00

%nterest e+pense A,,*'0B

%ncome before ta+es ? '0,02'

%ncome ta+ e+pense A1',00,B

@et %ncome ? 3',01,

&efer to 7+hibit '42. 6ompute the gross profit margin for $eace, =ove, and Doy 6ompany.

#. '01

5. 13*1

6. *2.'1

9. ,2.31

101. Exhibit 5-2

The following is an income statement from the financial records of $eace, =ove and Doy 6ompany for the year

ended 9ecember 31, 201'>

Income Statement

!ales AnetB ? 24',)*'

6ost of "oods !old A)*,'00B

"ross $rofit ? 1*,,1*'

:perating e+penses 12',000B

:perating %ncome ? '3,1*'

%nterest revenue ',)00

%nterest e+pense A,,*'0B

%ncome before ta+es ? '0,02'

%ncome ta+ e+pense A1',00,B

@et %ncome ? 3',01,

&efer to 7+hibit '42. 6ompute operating margin for $eace, =ove, and Doy 6ompany.

#. 1,.001

5. 2'.001

6. 20.)41

9. 21.)41

102. Exhibit 5-2

The following is an income statement from the financial records of $eace, =ove and Doy 6ompany for the year

ended 9ecember 31, 201'>

Income Statement

!ales AnetB ? 24',)*'

6ost of "oods !old A)*,'00B

"ross $rofit ? 1*,,1*'

:perating e+penses 12',000B

:perating %ncome ? '3,1*'

%nterest revenue ',)00

%nterest e+pense A,,*'0B

%ncome before ta+es ? '0,02'

%ncome ta+ e+pense A1',00,B

@et %ncome ? 3',01,

&efer to 7+hibit '42. 6ompute net profit margin for $eace, =ove, and Doy 6ompany.

#. 14.2'1

5. 1'.001

6. 2'.001

9. 13.2'1

103. Exhibit 5-2

The following is an income statement from the financial records of $eace, =ove and Doy 6ompany for the year

ended 9ecember 31, 201'>

Income Statement

!ales AnetB ? 24',)*'

6ost of "oods !old A)*,'00B

"ross $rofit ? 1*,,1*'

:perating e+penses 12',000B

:perating %ncome ? '3,1*'

%nterest revenue ',)00

%nterest e+pense A,,*'0B

%ncome before ta+es ? '0,02'

%ncome ta+ e+pense A1',00,B

@et %ncome ? 3',01,

&efer to 7+hibit '42. 6ompute earnings4based interest coverage for $eace, =ove, and Doy 6ompany.

#. '.0,

5. ).,,

6. ).,0

9. ).0,

104. .hich is the most commonly computed coverage ratio8

#. debt ratio

5. interest coverage ratio

6. return on common e3uity

9. net profit margin

10'. #n operating segment is a component of a company

#. that engages in business activities to earn revenues and incur e+penses

5. whose operating results are regularly reviewed by the company;s chief operating officer for budgeting and

evaluation purposes

6. for which financial information is available

9. all of these

10). #n operating segment is a component of a company that does all of the following except

#. has financial information available

5. engages in business activities to earn revenues and incur e+penses

6. is part of a publicly held company

9. has operating results that are regularly reviewed by the company;s chief operating officer

10*. #n operating segment is a reportable segment if it

#. satisfies the revenue, profit, and asset tests

5. satisfies the revenue, profit, or asset tests

6. operates predominately within a single industry

9. satisfies the net income test

10,. #n operating segment is significant and reportable if it satisfies at least one of three tests. .hich of the

following is not one of those three tests8

#. profit test

5. revenue test

6. asset test

9. ratio test

10-. nder "##$ for segment reporting, a company must report

#. a measure of profit or loss for each reportable segment

5. factors used to identify its reportable segments

6. the types of products and services from which each reporting segment derives its revenues

9. all of these

110. %nformation reported or disclosed about the profit or loss of reportable segments consists of

#. a measure of operating profit or loss

5. segment revenues Aseparated into sales to e+ternal customers and intersegment salesB

6. interest revenue and interest e+pense

9. all of these

111. .hich of the following is not true about interim financial statements8

#. %nterim financial statements are issued by all publicly held companies.

5. "##$ must be applied to the interim financial statements.

6. 7ach interim period is viewed as an integral part of an annual period.

9. %nterim financial statements are not issued by all publicly held companies.

112. 7+penses that affect the operating activities of more than one interim period are allocated among the

periods based on an estimate of

#. time e+pired

5. benefit received

6. activity associated with the periods

9. all of these

113. The following information relates to Jhulu 6orporation Ain thousandsB>

!ales revenue ?1,1-0

@et assets, end of year 1*0

@et income, capital maintenance method 12'

#dditional investment by shareholders 11'

@et assets, beginning of year 13'

Reqired!

6ompute the amount of dividends paid during the year, using the financial capital maintenance approach.

114. The following information relates to $eter 6ompany Ain thousandsB>

#dditional investment by Cr. $eter ? 1'

!ales revenue 1'0

@et assets, beginning of year 1,100

9istribution to Cr. $eter 110

6ost of goods sold 12'

@et assets, end of year 1,1,0

Reqired!

6ompute net income, using the capital maintenance approach.

11'. =isted below are the three e+pense recognition principles followed by a series of e+pense items.

a. association of cause and effect

b. systematic and rational allocation

c. immediate recognition

KKKK 1. #morti(ation

KKKK 2. !ales commissions

KKKK 3. 6ost of goods sold

KKKK 4. #dministrative salaries

KKKK '. #llocation of prepaid insurance

KKKK ). tilities

KKKK *. $roduct warranty costs

KKKK ,. 9epreciation

KKKK -. Transportation4out

KKKK 10. Travel and entertainment

Reqired!

Catch the e+pense recognition principles to their corresponding e+penses by placing the appropriate letter in the space provided.

11). The following income statement information for 2014 and 201' was obtained from the accounting records

of pperco 6ompany.

2014 201'

!ales ?200,000 ?1'0,000

5eginning inventory AaB KKKKKK AeB KKKKKK

$urchases AnetB 40,000 40,000

7nding inventory 2',000 ',000

6ost of goods sold AbB KKKKKK )0,000

"ross profit )',000 AfB KKKKKK

:perating e+penses AcB KKKKKK AgB KKKKKK

%ncome before income ta+es AdB KKKKKK 40,000

%ncome ta+ e+pense A301B 14,100 AhB KKKKKK

@et income AlossB 32,-00 AiB KKKKKK

Reqired!

Fill in the blan2s for the missing data.

11*. The information for &oberts 6ompany is presented below>

6ost of goods sold ?30,000

$urchases returns and allowances 1,'00

!ales returns and allowances 3,*'0

"ross profit 2',000

!elling e+penses -,000

@et income 10,*'0

Transportation4in 1,2'0

$urchases 3',000

7nding inventory ,,*-0

Reqired!

6ompute the following Aignore income ta+esB>

a. !ales

b. 5eginning inventory

c. "eneral and administrative e+penses

11,. The income statement information for 2014 and 201' of Lloe 6ompany is as follows>

2014 201'

5eginning inventory ? '0,000 AdB KKKKKKK

!ales 400,000 AeB KKKKKKK

$urchases 300,000 ?4-0,000

$urchases returns and allowances ',000 20,000

7nding inventory *0,000 '0,000

!ales returns and allowances 10,000 20,000

"ross profit AaB KKKKKKK 100,000

6ost of goods sold AbB KKKKKKK '00,000

!elling e+penses 40,000 )0,000

Transportation4in ,,000 10,000

"eneral and administrative e+penses '0,000 AfB KKKKKKK

@et income AcB KKKKKKK 20,000

Reqired!

Fill in the blan2s for the missing data. #ll the necessary information is listed.

11-. The information below is ta2en from the 9ecember 31, 2014 ad/usted trial balance of &ummer 6ompany>

%nventory, 1I1I14 ?140,000

!ales *00,000

!elling e+penses 2',000

"eneral and administrative e+penses '0,000

%nterest e+pense 1',000

$urchases 330,000

$urchases returns ',000

!ales discounts ta2en 10,000

Freight4in *,'00

=oss on sale of a ma/or component of the business Apreta+B 1',000

The inventory on 9ecember 31, 2014 was ?1)',000. The income ta+ rate is 301. There were 2',000 shares of common stoc2 outstanding throughout

the year.

Reqired!

a. $repare a schedule of the cost of goods sold.

b. $repare a 2014 income statement for &ummer 6ompany, using a multiple4step format Adisregard earnings per shareB.

c. $repare a 2014 income statement for &ummer 6ompany, using a single4step format Adisregard earnings per shareB.

120. Taylor 6orporation sold 9ivision C Aa business componentB. %t was determined that the preta+ loss from

the operations of 9ivision C during the year totaled ?'0,000 and that a preta+ gain of ?12',000 was reali(ed on

the sale of the division. The ta+ rate is 3'1.

Reqired!

%n good form, prepare the appropriate section of the income statement.

121. :n Cay 1, 2014, .heaton 6ompany decided to dispose of its foreign sales operations Aconsidered a ma/or

class of customerB. The component was sold on @ovember 24, 2014, for ?1,000,000 resulting in a ?-),000 loss

on the sale. The foreign sales operations recorded a ?300,000 operating profit in 2014 up to the date of sale.

.heaton 6ompany is sub/ect to a 301 income ta+ rate.

Reqired!

$repare the results from discontinued operations section of .heaton 6ompany;s income statement for 2014.

122. :n :ctober 1, 2014, 6roatan 6orporation finali(ed its plans to discontinue operations of its retail

component. The plan calls for the sale of the retail operations to another company for ?*00,000 Acurrent fair

valueB on #pril l, 201'. The current boo2 value of the assets is ?,00,000. For the first nine months of 2014, the

component incurred a preta+ operating income of ?)0,000. 9uring the last 3uarter of 2014, the preta+ income

was ?10,000, while the e+pected preta+ income for the first 3uarter in 201' is e+pected to be ?20,000. 6roatan

is sub/ect to a 301 income ta+ rate.

Reqired!

$repare the results from discontinued operations section of 6roatan;s income statement for 2014, using good format. !how all

computations.

123. 5a+ter, %nc., reported income from continuing operations Abefore ta+esB of ?'',000. %n addition, there was

a ?1',000 loss from an unusual and infre3uent flood. Ta+es of ?1),'00 A301B were paid.

Reqired!

$repare the bottom portion of the income statement.

124. 5elow are selected accounts ta2en from the ad/usted trial balance of !herris 9esigns on 9ecember 31,

201'>

:perating e+penses ?1,000

!ales revenue ',000

Finished goods inventory, Dan. 1, 201' 1,)00

$urchases 1,200

%nterest revenue 2'0

7+traordinary loss Apre4ta+B 400

Finished goods inventory, 9ec. 31, 201' *'0

%ncome ta+ e+pense ))0

!herris 9esigns has 2,000 shares of common stoc2 outstanding and net income per share for 201' was ?0.)3. The income ta+ rate is 301.

Reqired!

a. $repare a single4step income statement.

b. $repare a multiple4step income statement.

12'. The following accounts are ta2en from the accounting records of 9ory 6ompany at 9ecember 31, 2013,

after ad/ustments>

!ales revenue ?2'0,000

!ales salaries e+pense 14,000

#dministrative salaries e+pense 1',000

9epreciation e+pense> e3uipment ,,000

$urchases 1)0,000

!ales returns 1,000

$urchases returns 2,000

Freight4in 10,000

%nventory, 1I1I13 ,0,000

&etained earnings, 1I1I13 )0,000

%n addition, the following information is available>

M The inventory on 9ecember 31, 2013, was ?*',000.

M Ten thousand shares of common stoc2 were outstanding during the entire year. 9ory paid dividends of ?1.00 per share.

M #t the end of :ctober, 9ory sold its unprofitable restaurant component. From Danuary through :ctober, the component had incurred

an operating loss Apreta+B of ?14,000. The sale was made at a loss Apreta+B of ?,,000.

M %n @ovember, the company sold the only land it ever owned for a gain of ?10,000.

M The applicable ta+ rate is 301.

Reqired!

$repare a 2013 multiple4step income statement for the 9ory 6ompany.

12). !wiger Cusic 6ompany had the following information related to its financial statements>

1B The company issued bonds in the amount of ?'0,000.

2B 7arned net income of ?*,,-00, declared a cash dividend of ?0.2' per share, currently there are '0,000 shares

issued.

3B &etained earnings at Danuary 1, 2014 was ?,2,000.

Reqired!

$repare the reconciliation of retained earnings for 9ecember 31, 2014.

12*. %nformation from the accounts of "ause 6ompany is shown below>

!ales ?-,000,000

$urchases ',000,000

:perating e+penses 1,100,000

"ain on sale of e3uipment 100,000

7+traordinary loss due to earth3ua2e Apreta+B 400,000

"ain on sale of component 1,000,000

:perating loss from disposed component 200,000

Cerchandise inventory, 12I31I14 1,-00,000

The merchandise inventory on Danuary 1, 2014, was ?3,200,000. There were 2'0,000 shares of common stoc2 outstanding during the entire year.

Reqired!

#ssuming a 301 income ta+ rate, prepare a 2014 income statement for "ause 6ompany. se a multiple4step format.

12,. 5elow is a list of terms>

1B KKKKKK 7+penses

2B KKKKKK 7+traordinary items

3B KKKKKK "ains

4B KKKKKK %ncome from continuing operations

'B KKKKKK =osses

)B KKKKKK @et income

*B KKKKKK :perating %ncome

,B KKKKKK :ther comprehensive income items

-B KKKKKK &evenues

Reqired!

Catch the appropriate term with the definition below.

aB %ncreases in assets or settlement of liabilities from delivering goods or producing goods

bB :utflows or using up assets

cB :ther increases in e3uity resulting from transactions other than revenue producing

dB 9ecreases in e3uity

eB Top portion of the income statement

fB Cain body of the income statement

gB 5ottom line of the income statement

hB .ith net income in a single continuous statement

iB 5elow the discontinued operations results

12-. 5elow is the 6onsolidated !tatements of 7arnings Ain partB for !tarlights, %nc.

2"15 2"1# 2"1$

@et earnings attributable to !tarlights ? ,*' ? *2' ? )'0

7arnings per share4basic AaB ? 1.0- AeB

7arnings per share4diluted ? 1.2' AcB ? 1.04

.eighted average shares outstanding>

5asic )*, AdB )'4

9iluted AbB )-3 AfB

6ash dividends declared per share ? 0.2' ? 4 ? 4

Reqired!

6ompute the amounts for letters a through f.

130. #ccounting information might be separately reported in any of the following components of the income

statement or statement of retained earnings and their supporting schedules and footnotes>

a. income from continuing operations or supporting schedules

b. e+traordinary gains or losses

c. disclosure

d. statement of retained earnings

e. results from discontinued operations

!everal items of accounting information are listed below.

KKKK 1. 7arth3ua2e damage to the only silo owned by a company in Lansas, when the damage caused a material loss to the

company

KKKK 2. =oss on sale by a highly diversified company of one of its four manufacturing plants

KKKK 3. 9ividends to shareholders declared by the corporation during the year

KKKK 4. :perating loss of the current period of a component sold late in the year

KKKK '. Total amount of cash paid to employees during the year

KKKK ). Total selling e+penses incurred by a producer of farm e3uipment during the year

Reqired!

5y placing the letters Aa4eB in the space provided above, identify where the information would be most appropriately reported. %f the information

would not appear in any of the above components, place an ANB in the space. %tems may be reported in more than one location.

131. 5elow is a list of financial statement components with a corresponding letter code.

a. !ales revenue AnetB

b. 6ost of goods sold

c. !elling e+penses

d. "eneral and administrative e+penses

e. :ther revenue and e+penses

f. &esults from discontinued operations

g. 7+traordinary items

h. $rior period ad/ustments

i. #dditions to retained earnings Aother than hB

/. 9eductions from retained earnings Aother than hB

2. 9isclosures

l. 7nding balance sheet

KKKK 1. Cerchandise inventory AbeginningB

KKKK 2. 6ash dividends declared on common stoc2

KKKK 3. Flood loss Ainfre3uent and unusualB

KKKK 4. 7+penses incurred as a result of a stri2e

KKKK '. 9iscount on bonds payable

KKKK *. =oss from write4off of a significant accounts receivable Afre3uent, not unusualB

KKKK -. %nterest e+pense

KKKK 10. Transportation4in

Reqired!

%ndicate where each component would be reported in the financial statements by inserting the corresponding code letters in the space provided.

132. 5radleys %nc.;s ad/usted trial balance contains the following account balances at 9ecember 31, 2014>

6ost of goods sold ?2'0,000

9epreciation e+pense *,000

=oss on sale of e3uipment ',000

&ent e+pense 12,000

!ales 410,000

!ales commissions 34,000

!ales discounts 22,000

nreali(ed decrease in value of available for sale securities 12,000

%ncome ta+es are 301 on all items, and there were 2,000 shares of common stoc2 outstanding during the year.

Reqired!

$repare a statement of comprehensive income.

133. :n 9ecember 31, 2014, Celissa 6ompany;s ad/usted trial balance contained the following account

balances>

!ales AnetB ?1*',000

:perating e+penses 1,,000

nreali(ed decrease in value of available4for4sale securities 10,000

6ost of goods sold 100,000

The income ta+ rate is 301, and the company had 2,000 shares of common stoc2 outstanding during the year.

Reqired!

a. $repare the income statement for the year 2014 that includes comprehensive income.

b. $repare the income statement for the year 2014 and a separate statement of comprehensive income.

134. The following are accounting items ta2en from the records of $aul 6ompany for 2013>

$ayment of dividends ? 4,000

%ncrease in accounts payable ?1',000

%ncrease in accounts receivable ?1-,000

9ecrease in inventories ? ),000

9ecrease in salaries payable ?14,000

@et income ?20,000

$ayment for purchase of land and buildings ?)0,000

%ssuance of ten4year bonds payable at par ?'0,000

9epreciation e+pense ?10,000

Reqired!

$repare the net cash flow from operating activities section of $aul 6ompany;s 2013 statement of cash flows using the indirect method.

13'. The following are accounting items ta2en from the records of !terling 6ompany for 2014>

$ayment of dividends ?24,000

9ecrease in accounts payable ?1-,000

9ecrease in accounts receivable ?21,000

%ncrease in inventories ? ),000

%ncrease in salaries payable ?1,,000

@et income ?42,000

$ayment for purchase of land and buildings ?)0,000

%ssuance of ten4year bonds payable at par ?20,000

9epreciation e+pense ?10,000

$roceeds from sale of patent rights ?2*,000

Reqired!

$repare the statement of cash flows for !terling 6ompany for 2014 using the indirect method.

13). The following items involve the cash flow activities of $ri((ie 6ompany for 2014>

@et income ?1)2,000

$ayment of dividends ?2',000

1,000 shares of stoc2 issued at ?20 par ?20,000

#morti(ation e+pense on patents ? *,000

$lant assets ac3uired at a cost of ?*',000

#ccounts receivable increase of ? -,000

#ccounts payable decrease of ?10,000

!alaries payable increase of ? ),'00

5eginning cash balance ?1,,000

Reqired!

$repare the statement of cash flows of $ri((ie 6ompany for 2014 using the indirect method.

13*. The following cash flows and other information pertain to 7lon 6ompany for 2014>

$roceeds from sale of stoc2 ?2',000 %nterest collected ? 2,'00

9ividends received 1,000 $ayments to suppliers 12,000

9epreciation e+pense 1,'00 @et income 12,000

$roceeds from sale of e3uipment 1',000 9ecrease in inventory ,,000

6ollections from customers )',000 6ost of goods sold 4),000

$ayments of interest 3,'00

Reqired!

$repare the operating activities section of the statement of cash flows for 2014, using the direct method.

13,. For income reporting purposes, items can appear in any of the following components of the income

statement, the statement of retained earnings, and related schedules and footnotes>

a. income from continuing operations or supporting schedules

b. e+traordinary gains or losses

c. results from discontinued operations

d. statement of comprehensive income

e. statement of retained earnings

f. disclosure

!everal items of accounting information are listed below>

KKKK 2. !elling e+penses

KKKK 3. =oss on sale of plant assets

KKKK 4. nreali(ed losses due to mar2et value changes in available4for4sale e3uity security investments

KKKK ). 6ash dividends declared on common stoc2

KKKK *. nreali(ed gains due to foreign currency translation ad/ustments

KKKK ,. %nterest revenue

KKKK -. =oss on sale of a ma/or component of the business

KKKK 10. How a company defines cash and cash e3uivalents

Reqired!

5y placing the letters Aa4fB in the spaces provided above, identify where the information would be most appropriately reported. %f the information

would not appear in any of the above components, place an ANB in the space.

13-. Tiger 6orporation presents the following condensed comparative income statement for

2013, 2014, and 201'>

2"15 2"1# 2"1$

!ales AnetB ? '0,000 ? 4*,'00 ? 4',000

6ost of "oods !old A1*,000B A1',000B A13,000B

"ross $rofit ? 33,000 ? 32,'00 ? 32,000

:perating e+penses A1),000B A14,000B A12,'00B

%nterest revenue 2,000 1,,00 1,'00

%nterest e+pense A1,'00B A1,*'0B A2,'00B

%ncome before income ta+es ? 1*,'00 ? 1,,''0 ? 1,,'00

%ncome ta+ e+pense A',2'0B A',')'B A',''0B

@et %ncome ? 12,2'0 ? 12,-,' ? 12,-'0

@umber of shares of common stoc2 41,000 41,000 3-,'00

7arnings per share ? 0.30 ? 0.32 ? 0.33

Reqired!

$repare the rate of change analysis for Tiger 2014 and 201'.

140. 5elow are the income statement and balance sheet for =ily 6ompany>

Income Statement

!ales AnetB ?1,2*',000

6ost of "oods !old A*)*,'00B

"ross $rofit ? '0*,'00

:perating e+penses A2)',000B

:perating %ncome ? 242,'00

%nterest revenue ',)00

%nterest e+pense A14,*00B

%ncome before ta+es ? 233,400

%ncome ta+ e+pense A*0,020B

@et %ncome ? 1)3,3,0

@umber of shares of common stoc2 1'0,000

%alance Sheet

6ash ? 123,'00

&eceivables AnetB -),000

%nventory 113,4)0

$roperty, plant, and e3uipment AnetB 2'',000

Total #ssets ? ',*,-)0

#ccounts $ayable ? 4',-00

:ther current liabilities ,0,000

5onds $ayable 100,000

6ommon !toc2 100,000

#dditional $aid4in 6apital 100,000

&etained 7arnings 1)2,0)0

Total =iabilities O !hareholders 73uity ? ',*,-)0

Reqired!

6ompute the following ratios>

1B "ross $rofit Cargin

2B :perating $rofit Cargin

3B @et $rofit Cargin

4B 6urrent &atio

'B 7arnings per !hare

141. =ist five purposes of the income statement.

142. The !76 reported that overstating revenue and recogni(ing revenue too soon was the culprit in more than

half of the financial reporting frauds in the nited !tates. #s such Staff Accounting Bulletin No. 104 provided

additional guidance on revenue recognition. %t emphasi(ed four criteria for revenue recognition. .hat are these

criteria8

143. .hat are the three e+pense recognition principles used to properly recogni(e e+pense either by matching

revenues or matching periods8

144. .hat are the seven ma/or components of a companys income statement8

14'. .hat is the difference between interperiod ta+ allocation and intraperiod ta+ allocation8

14). .hat criteria must be met in order for a company to classify a component as held for sale8

14*. =ist five items that the F#!5 specifically states cannot be considered e+traordinary.

14,. .hat are the four items of other comprehensive income under .!. "##$8

14-. How does the statement of cash flows help e+ternal users assess the overall health of a company when used

in con/unction with the other financial statements8

1'0. .hat three tests are used to evaluate an operating segment in order to determine if it is a reportable

segment8

1'1. %ncome measurement is a fundamental accounting concept, and yet the computation of periodic income has

caused the accounting profession some difficulty. 7conomists and accountants have long debated what

constitutes income and how it should be measured. The capital maintenance method has been advocated as

means of determining and measuring periodic income. 9iscuss the income concept.

1'2. The accounting profession has developed three alternatives for matching e+penses> association of cause

and effect, systematic and rational allocation, and immediate recognition. 9iscuss the conceptual merits of each

alternative and give two e+amples for each e+pense matching alternative.

1'3. 9escribe the ma/or differences that still e+ist between the income statement information presentation

re3uirements under %F&! and "##$.

1'4. %n the preparation of interim income statements, the treatment of e+penses is recogni(ed differently

depending on whether or not they are directly related to product sales or services.

Reqired!

9iscuss the general treatment of e+penses in interim statements when they

a. are directly related to product sales or services.

b. are not directly related to product sales or services.

6hapter '44The %ncome !tatement and the !tatement of 6ash

Flows Ley

1. Together with the cash flow statement, the income statement enables the investors to determine the rate of

return the company is generating relative to the amount of capital invested.

F&'SE

2. The income statement predicts a companys future income and cash flows.

TR(E

3. The amount of money that can be distributed to shareholders as a return on capital, without being a return of

capital, is the capital financial concept.

F&'SE

4. .!. "##$ and %F&! companies commonly measure and report net income and comprehensive income.

TR(E

'. &evenue can be recogni(ed either when it is earned or collection has occurred or reasonably certain to occur.

F&'SE

). !ystematic and rational allocation is used to recogni(e revenue.

F&'SE

*. %f a company does not have any discontinued operations or e+traordinary items to list on its income

statement, the labels should still be there with a (ero balance noted.

F&'SE

,. %nterperiod ta+ allocation involves apportioning a corporations total income ta+ e+pense for a period to the

various components of its net income and other comprehensive income items.

F&'SE

-. .hen a parent company owns a ma/ority of the common shares of a subsidiary company but not 1001 of

them, the parent company will consolidate all of the subsidiarys revenues and e+penses into its financial

statements.

TR(E

10. .hen a company classifies a component as held for sale it must report the component on its balance sheet at

the lower of its boo2 value or its fair value minus costs to sell.

TR(E

11. # company does not have to disclose information about the sale of a discontinued component in the notes to

its financial statements until the actual sale has occurred.

F&'SE

12. # terrorist attac2 would be considered an e+traordinary event because terrorist attac2s are infre3uent in

nature.

F&'SE

13. To classify an event or transaction as e+traordinary it must be unusual in nature and infre3uent in

occurrence.

TR(E

14. There is no prescribed income statement format under %F&! whereas .!. "##$ re3uires the use of the

single4step or the multiple4step format.

TR(E

1'. To compute earnings per share the denominator is net income attributable to common shareholders less any

preferred stoc2 dividends for the period.

F&'SE

1). nder .!. "##$ or %F&!, a company can report its comprehensive income or loss under present net

income and comprehensive income in a single continuous performance statement or in a separate but

consecutive financial statement.

TR(E

1*. "ains or losses associated with derivative financial instruments would be included in income from

continuing operations.

F&'SE

1,. The statement of cash flows provides e+ternal users the ability to analy(e the information re3uired to access

a companys ris2, li3uidity, financial fle+ibility, and operating capability.

TR(E

1-. The most common way in which to prepare the statement of cash flows is the indirect method, which is

encouraged by F#!5.

F&'SE

20. 6ompanies with lower coverage ratios have a greater ris2 and a lower financial fle+ibility.

TR(E

21. The !76 scrutini(es reported earnings numbers to assess the 3uality of earnings and to detect any potential

for earnings management.

TR(E

22. # segment must pass all of the tests in order for it to be considered a reportable segment. These tests include

the revenue, profit, and asset tests.

F&'SE

23. # company is not re3uired to follow a specific format in ma2ing the disclosures for its segments but F#!5

encourages the most useful format for its specific circumstances.

TR(E

24. .ho is the income statement designed to inform8

#. creditors

5. investors

6. lenders

)* all of these

2'. :perating capability refers to

#. the ability of a company to adapt to une+pected needs and opportunities

5. the uncertainty or unpredictability of the future results of a company

6. a measure of overall company performance

)* a company;s ability to maintain a given level of operations

2). The income statement helps users

#. assess the companys ris2

5. review the impact of economic factors affecting the company

6. compare and contrast performance against a competitor

)* all of these

2*. .hich of the following is helpful to report separately8

#. e+penses that vary with volume of activity

5. e+penses that are discretionary

6. e+penses that depend on other economic factors

)* all of these

2,. .hich of the following is not a purpose of the income statement8

#. used to evaluate managements performance

%* predicts the companys future assets and liabilities

6. used to compare performance against other companies

9. assesses the companys ris2

2-. The income statement is an important financial statement for all of the following reasons, except

#. the income statement helps shareholders evaluate management;s operating effectiveness

5. past income statements can be useful indicators in predicting current and future cash dividend payments as

well as future stoc2 prices

6. the income statement provides useful information concerning the corporation;s ability to generate sufficient

cash flows from operations for use in payment of its operating obligations

)* the income statement reports the amount of net cash inflows resulting from operating, financing, and

investing activities to users

30. %n accrual accounting, net income is defined as

#. &evenues 4 7+penses < "ains < =osses

5. &evenues 4 7+penses

C* &evenues 4 7+penses < "ains 4 =osses

9. increase in net assets from nonowner transactions

31. The income statement reports

#. revenue and e+penses for a given point in time.

5. revenue and e+penses for a specific date.

C* revenue, e+penses, gains and losses for a specified period of time.

9. revenues, e+penses, gains and losses for a specific date.

32. 5elow is a list of account balances for Fraggle 6ompany>

6ash ? 123,'00

6ost of "oods !old *)*,'00

"ross $rofit '0*,'00

%ncome before ta+es 233,400

%ncome ta+ e+pense 8

%nterest e+pense 14,*00

%nterest revenue ',)00

%nventory 113,4)0

@et %ncome 8

@umber of 6ommon !hares 1'0,000

:perating e+penses 2)',000

:perating %ncome 242,'00

$roperty, plant, and e3uipment AnetB 2'',000

&eceivables AnetB -),000

!ales AnetB 1,2*',000

.hat is Fraggle 6ompanys net income, assuming a 301 ta+ rate8

&* ?1)3,3,0

5. ?233,400

6. ?242,'00

9. none of these

33. :n 9ecember 31, 2014, the net assets of Cartine( Canufacturing amounted to ?40,000. @et income

calculated by using the financial capital maintenance concept amounted to ?12,000. 9uring the year, additional

common stoc2 was issued for ?,,000, and ?',000 of dividends was paid. The net assets at Danuary 1, 2014,

amounted to

#. ?31,000

5. ?3*,000

6. ?20,000

)* ?2',000

34. "eorgio 6ompany began 2014 with net assets of ?,0,000. @et income calculated by using the capital

maintenance concept was ?21,000. 9uring 2014 owners contributed ?2),000 of new capital. 5y year4end, the

net assets totaled ?*,,000. 9ividends to the owners during 2014 were

&* ?4-,000

5. ?2,,000

6. ?23,000

9. ?2,000

3'. %n general, revenue is recogni(ed as being earned

#. during the production process

5. upon completion of the production process

6. when cash is received

)* when goods are sold or services are rendered

3). &eali(ation of revenue occurs when

#. the item is formally recorded and reported in the financial statements

%* noncash resources are converted into cash or rights to cash

6. the actual e+change of noncash resources into cash

9. when a transaction is both reali(ed and reali(able

3*. To be recogni(ed as revenue, an item must

#. meet the definition of earned revenue

%* be earned revenue and be reali(ed or reali(able

6. be reali(ed

9. be earned

3,. :ne method of revenue recognition that postpones the recognition until after the time of sale is

#. percentage4of4completion

5. proportional performance

C* cost recovery

9. point of sale

3-. .hich of the following is not an e+pense recognition approach recogni(ed by the F#!5 as an e+pense

recognition principle to properly match e+penses against revenues8

#. immediate recognition

5. systematic and rational allocation

C* cash payment

9. association of cause and effect

40. 7+amples of matching e+penses against revenues using the association of cause and effect include all of the

following except

&* insurance costs

5. transportation costs for delivery of goods to customers

6. costs of products sold

9. sales commissions

41. 9epreciation is an e+ample of which e+pense recognition principle8

#. association of cause and effect

%* systematic and rational allocation

6. cost recovery

9. immediate recognition

42. .hich of the following e+penses is an e+ample of e+pense recognition under the immediate recognition

principle8

#. sales commissions

5. depreciation

C* management salaries

9. transportation4out

43. %n distinguishing between revenues and gains, which of the following statements is false8

#. Core gains than revenues are beyond the entity;s control.

5. "ains are associated more with peripheral, nonoperating activities than are revenues.

6. "##$ does not provide precise distinctions between revenues and gains.

)* &evenues are reported net Arather than grossB more often than gains.

44. The ma/or components of the income statement are listed below>

# E e+traordinary items

5 E income from continuing operations

6 E earnings per share

9 E results from discontinued operations

%n what se3uence do they normally appear on the income statement8

#. 54#4946

5. 54#4649

C* 5494#46

9. 5494649

4'. .hich of the following are components of the income statement8

#. revenues

5. e+traordinary items

6. income from continuing operations

)* all of these

4). .hich of the following would appear after the heading of operating income8

#. cost of goods sold

5. other operating income items Agains or lossesB

6. operating e+penses

)* unusual and nonrecurring gains or losses

4*. .hich of the following is not a component of the income statement8

#. unusual and nonrecurring gains and losses

5. net income

6. income ta+es

)* accumulated other comprehensive income

4,. The subtotal, gross profit, will be disclosed on

&* a multiple4step income statement

5. both multiple4step and single4step income statements

6. neither multiple4step nor single4step income statements

9. a single4step income statement

4-. .hich of the following is not used as a caption if there is nothing to report8

#. income from continuing operations

%* e+traordinary items

6. interest e+pense

9. income ta+es

'0. #ll of the following are included in the computation of cost of goods sold except

&* freight4out

5. purchase returns and allowances

6. beginning finished goods inventory

9. freight4in

'1. From the following information, compute cost of goods sold.

$urchase returns ? 1,200

%nventory, 9ecember 31 2,'00

Freight4in 1,100

%nventory, Danuary 1 2,,00

$urchases 1',000

#. ?1',300

%* ?1',200

6. ?1',100

9. ?1',000

'2. #ll of the information re3uired in the computation of cost of goods sold is presented below, e+cept for

purchases, which must be what amount8

$urchase returns ? 1,200

%nventory, 9ecember 31 2,'00

6ost of goods sold 10,'00

$urchases 8

%nventory, Danuary 1 2,'00

Freight4in 1,'00

#. ?10,,00

5. ?11,200

6. ?-,*00

)* ?10,200

'3. The gross profit of =arry 6ompany for 2014 is ?300,000, cost of goods manufactured is ?400,000, the

beginning inventories of goods in process and finished goods are ?2,,000 and ?3',000, respectively, and the

ending inventories of goods in process and finished goods are ?'0,000 and ?*0,000, respectively. The cost of

goods sold of =arry 6ompany for 2014 must have been

#. ?3*,,000

5. ?2)',000

6. ?2*,,000

)* ?3)',000

'4. %n 2014, 9allas 6ompany had sales of ?)00,000F cost of sales of ?430,000F interest e+pense of ?12,000F a

gain on the sale of a component of ?'2,000F and an e+traordinary loss of ?2',000. For its income statement,

9allas uses the single4step format and the all4inclusive concept. .hat was 9allas;s reported preta+ income from

continuing operations8

#. ?1'0,000

5. ?1*0,000

C* ?1',,000

9. ?11,,000

''. %ntraperiod ta+ allocation

&* is used to allocate a company;s total income ta+ e+pense to the components of net income and

comprehensive income

5. involves temporary AtimingB differences between financial and ta+able incomes

6. re3uires allocation of deferred ta+es across accounting periods

9. results from differences between ta+ regulations and the principles followed to determine financial income

'). %ntraperiod ta+ allocation re3uires a corporation;s total income ta+ e+pense to be allocated to all of the

following except

#. e+traordinary items

%* other revenues and e+penses

6. discontinued operations

9. prior4period ad/ustments

'*. # company that discontinues and disposes of an operation AcomponentB should include the gain or loss on

sale in the income statement as aAnB

#. prior4period ad/ustment

5. e+traordinary item

C* amount after income from continuing operations and before e+traordinary items

9. bul2 sale of fi+ed assets included in income from continuing operations

',. .hen an entity reports on a sale of a component of the business

#. any income or loss from operations of the component should be reported in the income from continuing

operations section, but any gain or loss on the sale of the component should be presented below the income

from continuing operations section

%* current operating income or loss of the component and any gain or loss on sale of the component should be

presented in a separate section of the income statement

6. any gain or loss on the sale should always be presented in the e+traordinary gain or loss section of the

income statement

9. all information related to the sold component should be reported solely in the footnotes accompanying the

financial statements

'-. .hich of the following is a re3uired disclosure in the income statement when reporting the sale of a

component of the business8

#. The gain or loss on sale should be reported as an e+traordinary item.

5. &esults of operations of a discontinued component should be disclosed immediately below e+traordinary

items.

C* 7arnings per share from both income from continuing operations and net income should be disclosed on the

face of the income statement.

9. &evenue and e+penses applicable to the discontinued operations should be disclosed in the income

statement.

)0. .hich is least li2ely to be classified as a sale of a component8

#. sale by a communications company of its radio stations, but none of its television stations

5. sale by a food distributor of its wholesale supermar2et division while maintaining its wholesale fast4food

restaurants division

C* sale by an apparel manufacturer of a woolen suit manufacturing plant in order to concentrate on the

manufacture of suits from synthetic products

9. sale by a meat4pac2ing company of its AentireB 201 interest in a professional football team

)1. "regory 6ompany is disposing of a component of its company. The net loss from the sale is estimated to be

?)00,000. %ncluded in the ?)00,000 is termination pay of ?100,000, which is directly associated with the

decision to dispose of the componentF and net losses from component asset write4downs of ?400,000. %gnoring

ta+es, "regory;s income statement should report a loss on sale of a business component of

#. ?100,000

5. ?400,000

6. ?'00,000

)* ?)00,000

)2. Exhibit 5-1

The following condensed income statement of &anger 6orporation is presented for the two years ended

9ecember 31, 2014 and 2013>

2014 2013

@et sales ?10,000,000 ?-,000,000

6ost of sales ),000,000 ),000,000

"ross profit ? 4,000,000 ?3,000,000

:perating e+pense 2,'00,000 2,000,000