Académique Documents

Professionnel Documents

Culture Documents

1

Transféré par

sufyanbutt0070%(1)0% ont trouvé ce document utile (1 vote)

526 vues6 pages1. EaseCorp plans to borrow $50 million in 25 days at LIBOR + 125 basis points for 270 days. To lock in the rate, it purchases an FRA at 6.75%. The effective cost of the loan will be approximately 8% if 270-day LIBOR in 25 days is 8.25%.

2. A bank plans to lend $25 million in 30 days at LIBOR + 150 basis points for 180 days. To lock in the lending rate, it shorts an FRA at 5.5%. The effective rate on the loan will be determined if 180-day LIBOR in 30 days is 3.25%.

3. A bond portfolio manager wishes to reduce the modified duration

Description originale:

arm

Copyright

© © All Rights Reserved

Formats disponibles

DOCX, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce document1. EaseCorp plans to borrow $50 million in 25 days at LIBOR + 125 basis points for 270 days. To lock in the rate, it purchases an FRA at 6.75%. The effective cost of the loan will be approximately 8% if 270-day LIBOR in 25 days is 8.25%.

2. A bank plans to lend $25 million in 30 days at LIBOR + 150 basis points for 180 days. To lock in the lending rate, it shorts an FRA at 5.5%. The effective rate on the loan will be determined if 180-day LIBOR in 30 days is 3.25%.

3. A bond portfolio manager wishes to reduce the modified duration

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

0%(1)0% ont trouvé ce document utile (1 vote)

526 vues6 pages1

Transféré par

sufyanbutt0071. EaseCorp plans to borrow $50 million in 25 days at LIBOR + 125 basis points for 270 days. To lock in the rate, it purchases an FRA at 6.75%. The effective cost of the loan will be approximately 8% if 270-day LIBOR in 25 days is 8.25%.

2. A bank plans to lend $25 million in 30 days at LIBOR + 150 basis points for 180 days. To lock in the lending rate, it shorts an FRA at 5.5%. The effective rate on the loan will be determined if 180-day LIBOR in 30 days is 3.25%.

3. A bond portfolio manager wishes to reduce the modified duration

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 6

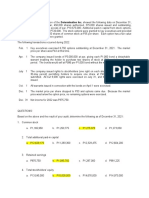

1. EaseCorp plans to borrow $50,000,000 in 25 days.

The loan will have a maturity of 270 days

and carry a rate of LIBOR plus 125 basis points. The company is concerned that interest rates

will raise, so in order to lock in the borrowing rate, it decides to purchase an FRA at a rate of

6.75 percent. Demonstrate that the effective cost of the loan is approximately 8 percent if 270-

day LIBOR in 25 days is 8.25 percent.

2. A bank has committed to lend $25,000,000 to a corporate borrower in 30 days. The loan will

mature in 180 days and carries a rate of LIBOR plus 150 basis points. The bank is concerned that

interest rates will fall, and in order to lock in the lending rate, it decides to short an FRA with a

rate of 5.5 percent. Determine the effective rate on the loan if 180-day LIBOR in 30 days is 3.25

percent.

3. A $500 million bond portfolio currently has a modified duration of 12.5. The portfolio

manager wishes to reduce the modified duration of the bond portfolio to 8.0 by using a futures

contract priced at $105,250. The futures contract has an implied modified duration of 9.25. The

portfolio manager has estimated that the yield on the bond portfolio is about 8 percent more

volatile than the implied yield on the futures contract.

A. Indicate whether the portfolio manager should enter a short or long futures position.

B. Calculate the number of contracts needed to change the duration of the bond portfolio.

C. Assume that on the horizon date, the yield on the bond portfolio has declined by

50 basis points and the portfolio value have increased by $31,343,750. The implied yield on

futures has decreased by 46 basis points, and the futures contract is priced at $109,742. Calculate

the overall gain on the position (bond plus futures). Determine the ex post duration with and

without the futures transaction.

4. A $200 million bond portfolio currently has a modified duration of 6.53. The portfolio

manager wishes to increase the modified duration of the bond portfolio to 9.50 by using a futures

contract priced at $95,650. The futures contract has an implied modified duration of 12.65. The

portfolio manager has estimated that the yield on the bond portfolio is about 12 percent more

volatile than the implied yield on the futures contract.

A. Indicate whether the portfolio manager should enter a short or long futures position.

B. Calculate the number of contracts needed to change the duration of the bond portfolio.

C. Assume that on the horizon date, the yield on the bond portfolio has increased by

30 basis points and the portfolio value have decreased by $3,929,754. The implied yield on

futures has increased by 30 basis points, and the futures contract is priced at $92,616. Calculate

the overall gain on the position (bond plus futures). Determine the ex post duration with and

without the futures transaction.

5. An investment management firm wishes to increase the beta for one of its portfolios under

management from 0.95 to 1.20 for a three-month period. The portfolio has a market value of

$175,000,000. The investment firm plans to use a futures contract priced at $105,790 in order to

adjust the portfolio beta. The futures contract has a beta of 0.98.

A. Calculate the number of futures contracts that should be bought or sold to achieve an increase

in the portfolio beta.

B. At the end of three months, the overall equity market is up 5.5 percent. The stock portfolio

under management is up 5.1 percent. The futures contract is priced at $1 11,500. Calculate the

value of the overall position and the effective beta of the portfolio.

6. A pension fund manager wishes to reduce the beta of the pension portfolio's small cap

component from 0.90 to 0.80 for a period of six months. The small-cap portfolio has a market

value of $485,000,000. The pension fund manager plans to use a futures contract priced at

$249,000 in order to adjust the portfolio beta. The futures contract has a beta of 0.93.

A. Calculate the number of futures contracts that should be bought or sold to achieve a change in

the portfolio beta.

B. At the end of six months, the overall equity market is down 8.65 percent. The Small-cap

portfolio is down 7.75 percent. The futures contract is down 8.05 percent and is priced at

$228,956. Calculate the value of the overall position and the effective beta of the portfolio.

7. Consider an asset manager who wishes to create a fund with exposure to the Russell

2000 stock index. The initial amount to be invested is $300,000,000. The fund will be

constructed using the Russell 2000 Index futures contract, priced at 498.30 with a $500

multiplier. The contract expires in three months. The underlying index has a dividend yield of

0.75 percent, and the risk-free rate is 2.35 percent per year.

A. Indicate how the money manager would go about constructing this synthetic index using

futures.

B. Assume that at expiration, the Russell 2000 is at 594.65. Show how the synthetic position

produces the same result as investment in the actual stock index.

8. A money manager wishes to create a fund with exposure to the Nikkei 225 stock average.

The initial amount to be invested is $650,000,000. The fund will be constructed using the Nikkei

225 futures contract, priced at 11,930 with a $5 multiplier. The contract expires in three months.

The underlying index has a dividend yield of 1.25 percent, and the risk-free rate is 3.35 percent

per year.

A. Indicate how the money manager would go about constructing this synthetic index using

futures.

B. Assume that at expiration, the Nikkei 225 is at ST. Show how the synthetic position produces

the same result as investment in the actual stock index.

9. An investment management firm has a client who would like to temporarily reduce his

exposure to equities by converting a $25 million equity position to cash for a period of four

months. The client would like this reduction to take place without liquidating his equity position.

The investment management firm plans to create a synthetic cash position using an equity futures

contract. This futures contract is priced at 1170.10, has a multiplier of $250, and expires in four

months. The dividend yield on the underlying index is 1.25 percent, and the risk-free rate is 2.75

percent.

A. Calculate the number of futures contracts required to create synthetic cash.

B. Determine the effective amount of money committed to this risk-free transaction and the

effective number of units of the stock index that are converted to cash.

C. Assume that the stock index is at 1031 when the futures contract expires. Show how this

strategy is equivalent to investing the risk-free asset, cash.

10. An equity portfolio manager currently has a $950 million equity position in the technology

sector. He wants to convert this equity position to cash for a period of six months, without

liquidating his holdings. An equity futures contract that expires in six months is priced at 1564

and has a multiplier of $100. The dividend yield on the underlying index is 0.45 percent. The

risk-free rate is 5.75 percent.

A. Calculate the number of futures contracts required to create synthetic cash.

B. Determine the effective amount of money committed to the risk-free asset and the effective

number of units of the stock index that are converted to cash.

C. Assume that the stock index is at 1735 when the futures contract expires. Show how this

strategy produces an outcome equivalent to investing in cash at the beginning of the six-month

period.

11. Consider a portfolio with a 65 percent allocation to stocks and 35 percent to bonds. The

portfolio has a market value of $200 million. The beta of the stock position is 1.15, and the

modified duration of the bond position is 6.75. The portfolio manager wishes to increase the

stock allocation to 85 percent and reduce the bond allocation to 15 percent for a period of six

months. In addition to altering asset allocations, the manager would also like to increase the beta

on the stock position to 1.20 and increase the modified duration of the bonds to 8.25. Assume

that the modified duration of cash equivalents is 0.25. A stock index futures contract that expires

in six months is priced at $157,500 and has a beta of 0.95. A bond futures contract that expires in

six months is priced at $109,000 and has an implied modified duration of 5.25. The stock futures

contract has a multiplier of one.

A. Show how the portfolio manager can achieve his goals by using stock index and bond futures.

Indicate the number of contracts and whether the manager should go long or short.

B. After six months, the stock portfolio is up 5 percent and bonds are up 1.35 percent.

The stock futures price is $164,005 and the bond futures price is $1 10,145. Compare the market

value of the portfolio in which the allocation is adjusted using futures to the market value of the

portfolio in which the allocation is adjusted by directly trading stocks and bonds.

12. A fixed income money manager has a bond portfolio with a 70 percent allocation to long-

term bonds and a 30 percent allocation to short-term bonds. The portfolio is currently valued at

$75 million. The manager wishes to reduce the long-term bonds allocation to 55 percent and

increase the short-term bonds allocation to 45 percent for a period of three months. The modified

duration of the long-term bonds is 7.5 and of the short-term bonds is 4.5. A bond futures contract

that expires in three months is priced at $95,750 and has a modified duration of 6.25. Assume

that the modified duration of cash equivalents is 0.25. Also assume that interest rates that drive

long-term and short-term bond prices have a yield beta of 1 with respect to interest rates that

drive the bond futures market.

A. Show how the manager can achieve his goals by using bond futures. Indicate the number of

contracts and whether the manager should go long or short.

B. After three months, the short-term bonds are down 5.63 percent and long-term bonds are

down 9.38 percent. The bond futures price is $88,270. Compare the market value of the portfolio

using futures to adjust the allocation with the market value of the same portfolio using direct

bond trading to adjust the allocation.

13. A portfolio manager has an equity portfolio with a 60 percent allocation to small-cap stocks

and a 40 percent allocation to large-cap stocks. The portfolio is currently valued at $150 million.

The manager wishes to reduce the small-cap allocation to 45 percent and increase the large-cap

allocation to 55 percent for a period of nine months. The large-cap beta is 1.15, and the small-cap

beta is 1.25. A small-cap futures contract that expires in nine months is priced at $195,750 and

has a beta of 1.12. A large-cap futures contract that expires in nine months is priced at $215,570

and has a beta of 0.92.

Assume that both contracts have multipliers of 1.

A. Show how the manager can achieve the reallocation using stock index futures. Indicate the

number of contracts and whether the manager should go long or short.

B. After nine months, the large-cap stocks are up 4.75 percent and small-cap stocks are up 6.25

percent. The large-cap futures price is $223,762, and the small-cap futures price is $206,712.

Compare the market value of the portfolio using futures to adjust the allocation with the market

value of the same portfolio using direct stock trading to adjust the allocation.

14. Consider a portfolio with a 65 percent allocation to stocks and 35 percent to bonds.

The portfolio has a market value of $750 million. The beta of the stock position is 1.20, and the

modified duration of the bond position is 7.65. The portfolio manager wishes to decrease the

stock allocation to 45 percent and increase the bond allocation to 55 percent for a period of six

months. Assume that the modified duration of cash equivalents is 0.25. The portfolio manager

intends to use a stock index futures contract, which is priced at $272,500 and has a beta of 0.90,

and a bond futures contract, which is priced at $139,120 and has an implied modified duration of

5.35. The stock futures contract has a multiplier of 1.

A. Show how the portfolio manager can achieve her goals by using stock index and bond futures.

Indicate the number of contracts and whether the manager should go long or short.

B. After six months, the stock portfolio is down 5 percent and bonds are down 1.75 percent. The

stock futures price is $262,280, and the bond futures price is $137,420. Compare the market

value of the portfolio using futures to adjust the allocation with the market value of the same

portfolio using direct stock and bond trading to adjust the allocation.

15. A pension fund manager expects to receive a cash inflow of $50,000,000 in three months and

wants to use futures contracts to take a $17,500,000 synthetic position in stocks and $32,500,000

in bonds today. The stock would have a beta of 1.15 and the bonds a modified duration of 7.65.

A stock index futures contract with a beta of 0.93 is priced at $175,210. A bond futures contract

with a modified duration of 5.65 is priced at $95,750.

A. Calculate the number of stock and bond futures contracts the fund manager would have to

trade in order to synthetically takes the desired position in stock and bonds today. Indicate

whether the futures positions are long or short.

B. When the futures contracts expire in three months, stocks have declined by 5.4 percent and

bonds have declined by 3.06 percent. Stock index futures are priced at, $167,559, and bond

futures are priced at $93,586. Show that profits on the futures positions are essentially the same

as the change in the value of stocks and bonds during the three-month period.

16. Consider a fund manager who expects to receive a cash inflow of $30,000,000 in two

months. The manager wishes to use futures contracts to take a $21,000,000 synthetic position in

stocks and $9,000,000 in bonds today. The stock would have a beta of 1.25 and the bonds a

modified duration of 6.56. A stock index futures contract with a beta of 0.96 is priced at

$225,130. A bond futures contract with a modified duration of 7.25 is priced at $105,120.

A. Calculate the number of stock and bond futures contracts the fund manager would have to

trade in order to synthetically take the desired position in stock and bonds today. Indicate

whether the futures positions are long or short.

B. When the futures contracts expire in two months, stocks have risen by 3.75 percent and bonds

have declined by 2.3 percent. Stock index futures are priced at $231,614, and bond futures are

priced at $102,453. Show that the profits on the futures positions are essentially the same as the

change in the value of stocks and bonds during the two-month period.

17. GEMCO manages fixed-income portfolios. It would like to alter the composition of a

$150 million segment of its portfolio for a period of four months. Specifically, the managers

wish to convert $60 million into cash and reduce the duration on the remaining $90 million in

bonds from 8.75 to 5.25. A bond futures contract that expires in four months is currently priced

at $97,250 and has a modified duration of 7.53. Assume that the modified duration of cash

equivalents is 0.25. Also assume that interest rates that drive long-term bond prices have a yield

beta of 1 with respect to interest rates that drive the bond futures market.

A. Show how the manager can achieve his goals by using bond futures. Indicate the number of

contracts and whether the manager should go long or short.

B. After four months, interest rates are up by 1.25 percent and long-term bonds are down 10.94

percent. The bond futures price is $88,096. Compare the market value of the portfolio using

futures to adjust the allocation with the market value of the same portfolio using direct bond

trading to adjust the allocation. To estimate the change in the portfolio value if the transaction is

done without derivatives, use the duration approximation.

18. A. Consider a U.S. company, GateCorp, that exports products to the United Kingdom.

GateCorp has just closed a sale worth 200,000,000. The amount will be received in two months.

Because it will be paid in pounds, the U.S. company bears the exchange risk. In order to hedge

this risk, GateCorp intends to use a forward contract that is priced at $1.4272 per pound. Indicate

how the company would go about constructing the hedge. Explain what happens when the

forward contract expires in two months.

B. ABCorp is a U.S.-based company that frequently imports raw materials from Australia.

It has just entered into a contract to purchase A$175,000,000 worth of raw wool, to be paid in

one month. ABCorp fears that the Australian dollar will strengthen, thereby raising the U.S.

dollar cost. A forward contract is available and is priced at $0.5249 per Australian dollar.

Indicate how ABCorp would go about constructing a hedge. Explain what happens when the

forward contract expires in one month.

19. Consider a U.S. asset management firm that wishes to allocate 50,000,000 to the

French stock market. This portfolio has a beta of 0.95. The spot exchange rate is $0.8823 per

euro. The foreign interest rate is 5.75 percent a year, and the domestic interest rate is 6.45

percent a year. A one-year forward contract on the euro is priced at $0.8881. A stock index

futures contract on the CAC 40 (French stock index) is priced at 46,390, with the multiplier

taken into account. The stock index futures contract has a beta of 1.05.

A. Would the asset manager take a long or short position to hedge the equity market risk?

Calculate the number of contracts needed.

B. Suppose the firm also wished to hedge the currency risk using a forward contract on the euro.

What should be the notional principal of the forward contract?

C. Assume that at the end of one year, the French market is up by 8 percent. The exchange rate

is $0.8765 per euro, and the futures price is 47,550. Calculate the return if

i. the portfolio is unhedged.

ii. Only the equity position is hedged.

iii. Both equity and currency risks are hedged.

20. A U.S. asset management firm currently has 150,000,000 allocated to the U.K. stock

market. This portfolio has a beta of 1.15. The spot exchange rate is $1.4194 per pound. The U.K.

interest rate is 6.75 percent a year, and the U.S. interest rate is 5.25 percent a year. Both rates are

quoted in the LIBOR manner of Rate X (DaysI360). A three-month forward contract on the

pound is priced at $1.4142. A stock index futures contract on the FTSE 100 (U.K. stock index) is

priced at 52,665, with the multiplier taken into account. The stock index futures contract has a

beta of 0.90.

A. Would the asset manager take a long or short position to hedge equity market risk?

Calculate the number of contracts needed.

B. Suppose the firm also wished to hedge the currency risk using a forward contract on the

pound. What should be the notional principal of the forward contract?

C. Assume that at the end of three months, the U.K. equity market is down by 3.25 percent. The

exchange rate is at $1.4396 per pound, and the futures price is 50,630. Calculate the return if

i. the portfolio is unhedged.

ii. only the equity position is hedged.

iii. both equity and currency risks are hedged

Vous aimerez peut-être aussi

- FIN 201 Chapter 11 Homework QuestionsDocument4 pagesFIN 201 Chapter 11 Homework QuestionsKyzer GardiolaPas encore d'évaluation

- Exam 3 FINC 631 Summer 2013Document12 pagesExam 3 FINC 631 Summer 2013Sammy Ben MenahemPas encore d'évaluation

- Financial AccountingDocument3 pagesFinancial AccountingManal Elkhoshkhany100% (1)

- An Hoài Thu CHAP 10 + FIN202Document18 pagesAn Hoài Thu CHAP 10 + FIN202An Hoài ThuPas encore d'évaluation

- CB Chapter 14 AnswerDocument2 pagesCB Chapter 14 AnswerSim Pei YingPas encore d'évaluation

- Practice Problems Capital Structure 25-09-2021Document17 pagesPractice Problems Capital Structure 25-09-2021BHAVYA KANDPAL 13BCE02060% (1)

- Key CH 11 TExt HWprobsDocument3 pagesKey CH 11 TExt HWprobsAshish BhallaPas encore d'évaluation

- Chapter One: Introducing The Firm and Its Goals: QuestionsDocument4 pagesChapter One: Introducing The Firm and Its Goals: QuestionsRavineahPas encore d'évaluation

- Solutions For Futures Questions and ProblemsDocument8 pagesSolutions For Futures Questions and ProblemsFomePas encore d'évaluation

- PGPM FLEX MIDTERM Danforth - Donnalley Laundry Products CompanyDocument3 pagesPGPM FLEX MIDTERM Danforth - Donnalley Laundry Products Companyhayagreevan vPas encore d'évaluation

- CH17Document7 pagesCH17mnbzxcpoiqwePas encore d'évaluation

- BUSS 207 Quiz 4 - SolutionDocument4 pagesBUSS 207 Quiz 4 - Solutiontom dussekPas encore d'évaluation

- If The Coat FitsDocument4 pagesIf The Coat FitsAngelica OlescoPas encore d'évaluation

- Mutual Funds: Answer Role of Mutual Funds in The Financial Market: Mutual Funds Have Opened New Vistas ToDocument43 pagesMutual Funds: Answer Role of Mutual Funds in The Financial Market: Mutual Funds Have Opened New Vistas ToNidhi Kaushik100% (1)

- NN 5 Chap 4 Review of AccountingDocument10 pagesNN 5 Chap 4 Review of AccountingNguyet NguyenPas encore d'évaluation

- Working Capital Practice SetDocument12 pagesWorking Capital Practice SetRyan Malanum AbrioPas encore d'évaluation

- CH 16Document43 pagesCH 16Angely May JordanPas encore d'évaluation

- Winter 2010 MidtermDocument13 pagesWinter 2010 Midtermupload55Pas encore d'évaluation

- Capital Budgeting: Dr. Akshita Arora IBS-GurgaonDocument24 pagesCapital Budgeting: Dr. Akshita Arora IBS-GurgaonhitanshuPas encore d'évaluation

- Fm14e SM Ch13Document7 pagesFm14e SM Ch13Syed Atiq TurabiPas encore d'évaluation

- Fin 300 Exam PracticeDocument6 pagesFin 300 Exam PracticePhillip Lee0% (1)

- Solution To Mid-Term Exam ADM4348M Winter 2011Document17 pagesSolution To Mid-Term Exam ADM4348M Winter 2011SKPas encore d'évaluation

- PS3 ADocument10 pagesPS3 AShrey BudhirajaPas encore d'évaluation

- Chapter 10 SolutionsDocument14 pagesChapter 10 SolutionsEdmond ZPas encore d'évaluation

- ProblemDocument3 pagesProblemNicole LabbaoPas encore d'évaluation

- Accounting Textbook Solutions - 43Document19 pagesAccounting Textbook Solutions - 43acc-expertPas encore d'évaluation

- Plant Assets, Natural Resources and Intangibles: QuestionsDocument42 pagesPlant Assets, Natural Resources and Intangibles: QuestionsCh Radeel MurtazaPas encore d'évaluation

- Interest Under Debt Alternative $50 (Million) × 10% $5 (Million) EPS (Debt Financing) EPS (Equity Financing)Document6 pagesInterest Under Debt Alternative $50 (Million) × 10% $5 (Million) EPS (Debt Financing) EPS (Equity Financing)Sthephany GranadosPas encore d'évaluation

- Central Bank RegulationDocument2 pagesCentral Bank RegulationGwenn PosoPas encore d'évaluation

- Chapter 9 Answer SheetDocument10 pagesChapter 9 Answer SheetJoan Gayle BalisiPas encore d'évaluation

- Chapter 6Document24 pagesChapter 6sdfklmjsdlklskfjd100% (2)

- Chapter 7 SolutionsDocument12 pagesChapter 7 SolutionsEdmond ZPas encore d'évaluation

- Assignment 14Document7 pagesAssignment 14Satishkumar NagarajPas encore d'évaluation

- Chapter 5Document21 pagesChapter 5MorerpPas encore d'évaluation

- Ch01 fm202 Finance Small Business EnterpriseDocument9 pagesCh01 fm202 Finance Small Business Enterprisepratik_483Pas encore d'évaluation

- Chapter 6 Answer SheetDocument7 pagesChapter 6 Answer SheetJoan Gayle BalisiPas encore d'évaluation

- Corporate Answer 13 Ledt PDFDocument11 pagesCorporate Answer 13 Ledt PDFHope KnockPas encore d'évaluation

- Chapter 12 Solution of Fundamental of Financial Accouting by EDMONDS (4th Edition)Document67 pagesChapter 12 Solution of Fundamental of Financial Accouting by EDMONDS (4th Edition)Awais AzeemiPas encore d'évaluation

- Case 11Document10 pagesCase 11Trương Quốc VũPas encore d'évaluation

- t10 2010 Jun QDocument10 pagest10 2010 Jun QAjay TakiarPas encore d'évaluation

- FAPDocument12 pagesFAPAnokye AdamPas encore d'évaluation

- Agro Chem, Inc.Document32 pagesAgro Chem, Inc.Camryn Bintz50% (2)

- Capital Budgeting - Homework-2 AnswersDocument3 pagesCapital Budgeting - Homework-2 AnswersYasmine GouyPas encore d'évaluation

- BD3 SM17Document3 pagesBD3 SM17Nguyễn Bành100% (1)

- FIN323 Exam 2 SolutionsDocument7 pagesFIN323 Exam 2 SolutionskatiePas encore d'évaluation

- Practice Test MidtermDocument6 pagesPractice Test Midtermrjhuff41Pas encore d'évaluation

- Chapter 4 LeaseDocument63 pagesChapter 4 Leasesamuel hailu100% (1)

- Capital BudgetingDocument13 pagesCapital Budgetingaon aliPas encore d'évaluation

- Chapter 5 ExerciseDocument7 pagesChapter 5 ExerciseJoe DicksonPas encore d'évaluation

- Payout Policy: File, Then Send That File Back To Google Classwork - Assignment by Due Date & Due Time!Document4 pagesPayout Policy: File, Then Send That File Back To Google Classwork - Assignment by Due Date & Due Time!Gian RandangPas encore d'évaluation

- Expected Questions of FIN 515Document8 pagesExpected Questions of FIN 515Mian SbPas encore d'évaluation

- R175367E Tinashe Mambodza BSFB401 AssignmentDocument8 pagesR175367E Tinashe Mambodza BSFB401 AssignmentTinashePas encore d'évaluation

- Chapter 9: The Capital Asset Pricing ModelDocument6 pagesChapter 9: The Capital Asset Pricing ModelJohn FrandoligPas encore d'évaluation

- R21 Capital Budgeting Q Bank PDFDocument10 pagesR21 Capital Budgeting Q Bank PDFZidane KhanPas encore d'évaluation

- Chapter Time Value of Money ExerciseDocument3 pagesChapter Time Value of Money ExerciseLưu Ngọc Tường ViPas encore d'évaluation

- Deegan5e SM Ch28Document20 pagesDeegan5e SM Ch28Rachel Tanner100% (2)

- Week 6 Tutorial QuestionsDocument3 pagesWeek 6 Tutorial QuestionsJess Xue100% (1)

- Paper - 2: Strategic Financial Management Questions Index FuturesDocument26 pagesPaper - 2: Strategic Financial Management Questions Index FutureskaranPas encore d'évaluation

- Ratios QuestionsDocument54 pagesRatios QuestionsSwathi AshokPas encore d'évaluation

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)D'EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Évaluation : 4.5 sur 5 étoiles4.5/5 (5)

- SWOT Analysis of Meezan BankDocument10 pagesSWOT Analysis of Meezan Banksufyanbutt007Pas encore d'évaluation

- Audit Working Papers What Are Working Papers?Document8 pagesAudit Working Papers What Are Working Papers?sufyanbutt007Pas encore d'évaluation

- Profit and Loss Account: Net Spread Earned 10,645 10,452 9,366Document8 pagesProfit and Loss Account: Net Spread Earned 10,645 10,452 9,366sufyanbutt007Pas encore d'évaluation

- BCRWDocument56 pagesBCRWsufyanbutt007Pas encore d'évaluation

- Ingredients: Buy These Ingredients NowDocument1 pageIngredients: Buy These Ingredients Nowsufyanbutt007Pas encore d'évaluation

- Economics of Pakistan Guess Papers 2015 BDocument6 pagesEconomics of Pakistan Guess Papers 2015 Bsufyanbutt007Pas encore d'évaluation

- Muhammad Tayyab Graphics Designer: Address: Muhalla Bakhtay Wala Gala Gulam Muhammad Thaikadar Wala Street # 1 House # 2Document2 pagesMuhammad Tayyab Graphics Designer: Address: Muhalla Bakhtay Wala Gala Gulam Muhammad Thaikadar Wala Street # 1 House # 2sufyanbutt007Pas encore d'évaluation

- Hu 1032 Principles of Investiga TonDocument4 pagesHu 1032 Principles of Investiga Tonsufyanbutt007Pas encore d'évaluation

- 1Document4 pages1sufyanbutt007Pas encore d'évaluation

- Management Acct Planning & ControlDocument5 pagesManagement Acct Planning & Controlsufyanbutt007Pas encore d'évaluation

- FORWARD:-A Forward Contract Is A Customized Contract Between Two EntitiesDocument1 pageFORWARD:-A Forward Contract Is A Customized Contract Between Two Entitiessufyanbutt007Pas encore d'évaluation

- 1Document6 pages1sufyanbutt007Pas encore d'évaluation

- Structural Equation Modeling Using AMOS: An IntroductionDocument64 pagesStructural Equation Modeling Using AMOS: An Introductionsufyanbutt007Pas encore d'évaluation

- Top Qualities of A Successful BusinessmanDocument40 pagesTop Qualities of A Successful Businessmansufyanbutt007Pas encore d'évaluation

- On January 1 2012 Mamood LTD Paid 322 744 44 For 12Document1 pageOn January 1 2012 Mamood LTD Paid 322 744 44 For 12Hassan JanPas encore d'évaluation

- Mergers, Etc.1Document4 pagesMergers, Etc.1Sebi CosminPas encore d'évaluation

- Ratio Analysis: Objectives: After Reading This Chapter, The Students Will Be Able ToDocument21 pagesRatio Analysis: Objectives: After Reading This Chapter, The Students Will Be Able TobanilbPas encore d'évaluation

- FIMDocument20 pagesFIMVIVEK SHARMAPas encore d'évaluation

- Foreign Currency Exchangeable BondsDocument5 pagesForeign Currency Exchangeable BondsMitesh LadPas encore d'évaluation

- QuestionsDocument3 pagesQuestionslois martinPas encore d'évaluation

- Assignment 2 - FIN320Document3 pagesAssignment 2 - FIN320Gustavo SchusterPas encore d'évaluation

- Chapter 07 Stocks and Stock ValuationDocument36 pagesChapter 07 Stocks and Stock ValuationAai NurrPas encore d'évaluation

- High Yield Covenants - Merrill Lynch - Oct 2005Document21 pagesHigh Yield Covenants - Merrill Lynch - Oct 2005fi5hyPas encore d'évaluation

- Chapter 5 Quantitative ProblemsDocument2 pagesChapter 5 Quantitative ProblemsVăn Ngọc PhượngPas encore d'évaluation

- Conceptual FrameworkDocument65 pagesConceptual FrameworkKatKat OlartePas encore d'évaluation

- Warehouse Receipts Law CasesDocument12 pagesWarehouse Receipts Law CasesNxxxPas encore d'évaluation

- WQU Financial Markets Module 4 Compiled ContentDocument29 pagesWQU Financial Markets Module 4 Compiled ContentPPP100% (1)

- Audit BoyntonDocument27 pagesAudit BoyntonMasdarR.MochJetrezzPas encore d'évaluation

- Benjamin Fulford - 7-6-15 Top Secret Negotiations Continue As Greek "No" Vote Pressures Western Oligarchy To SurrenderDocument3 pagesBenjamin Fulford - 7-6-15 Top Secret Negotiations Continue As Greek "No" Vote Pressures Western Oligarchy To SurrenderFreeman LawyerPas encore d'évaluation

- EconomyDocument12 pagesEconomyRayZa Y MiralPas encore d'évaluation

- MCQ's of Basics of Finance MBA 831Document42 pagesMCQ's of Basics of Finance MBA 831Parveen KajlePas encore d'évaluation

- Central Bank of Sri LankaDocument17 pagesCentral Bank of Sri LankaMadushan BandaraPas encore d'évaluation

- "A Study Mutual FundsDocument103 pages"A Study Mutual FundsMaster PrintersPas encore d'évaluation

- Management of Financial ServicesDocument346 pagesManagement of Financial ServicesHiral PatelPas encore d'évaluation

- CapSim Quiz Sample QuestionsDocument2 pagesCapSim Quiz Sample QuestionsDaniePas encore d'évaluation

- Corporate Finance in LawDocument19 pagesCorporate Finance in LawcmtinvPas encore d'évaluation

- Karkits Corporation PDFDocument4 pagesKarkits Corporation PDFRachel LeachonPas encore d'évaluation

- Chapter 5Document34 pagesChapter 5Minh NguyệtPas encore d'évaluation

- IF Sem IV Word Success and ThakurDocument28 pagesIF Sem IV Word Success and ThakurSanket MhetrePas encore d'évaluation

- MBE AssignmentDocument4 pagesMBE AssignmentDeepanshu Arora100% (1)

- Special Topics in Financial ManagementDocument4 pagesSpecial Topics in Financial ManagementChristel Mae BoseoPas encore d'évaluation

- IFR Magazine - July 04, 2020 PDFDocument110 pagesIFR Magazine - July 04, 2020 PDFFranky VincentPas encore d'évaluation

- Corporate BondsDocument36 pagesCorporate BondsCharlene LeynesPas encore d'évaluation

- Anh Van Chuyen Nganh Đ I Trà TCNH 2022Document69 pagesAnh Van Chuyen Nganh Đ I Trà TCNH 2022asdqwffqPas encore d'évaluation