Académique Documents

Professionnel Documents

Culture Documents

Other ASX Research 3

Transféré par

asxresearchCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Other ASX Research 3

Transféré par

asxresearchDroits d'auteur :

Formats disponibles

CuDECO SHAREHOLDER RESEARCH

CHAPTER 7:

ISSUES IDENTIFIED BY CUDECO SHAREHOLDER RESEARCH

AS THEY IMPACT OTHER ASX COMPANIES

7.3 A Review of Billabong Trading Based on Iress Broker Data

DISCLAIMER: All Information presented as shareholder research has been sourced from

broker trading records and Cudeco registry records. While the author considers the data

to be accurate and the summaries presented as also being an accurate reflection of

trading, no guarantees are given as to the reliability of data or any conclusions put

forward. Shareholders and investors are encouraged to do their own Due Diligence and to

make up their own minds in regard to any trends present in the trading data.

DISCLAIMER: All information presented as shareholder research has been sourced from

broker trading records, CuDeco registry records and official data as published by the ASX

and ASIC on their respective websites. While the author considers the data and the

summaries presented as being an accurate reflection of trading, no guarantees are given

as to the reliability of information presented. The author provides the information as a

free educational service for those with an interest in the financial markets and requests

that the information contained is used for private use only. No remuneration is involved

in making the research available. It is hoped that the research may assist ASX investors in

becoming more fully informed and in a position to make better judgements about events

that might affect their investments.

Contact Email:

asx.trading.issues@gmail.com

2

REFERENCE LINKS TO PREVIOUS RESEARCH PAPERS

Chapter 1: Introduction

1.1 Why Blog?

1.2 The Current Situation

1.3 Blog Content

Chapter 2: An Overview of Trends Associated With 15 Months of Trading

2.1 Introduction

2.2 Trading Trends Over a 15 Month Period

Chapter 3: Trading Trends Leading up to Aug 18, 2010

3.1 Trading Leading Up to the Aug 18 Resource Upgrade

3.2 An Analysis of Price Under-Performance During Jan-Feb 2010

3.3 Market Manipulation Issues, 7.5 Months of Auction Investigations and Down Tick Analysis

3.4 A Review of June/July 2006 JORC Issues

3.5 Market Reactions to Significant Announcements 2010

3.6 The 2010 Resource Estimate and Issues Related to JORC Code Compliance

Chapter 4: Trading that Occurred Following the Aug 18, 2010 Resource Upgrade

4.1 Historic Trends and Aug 18, 2010 Trading Data

Chapter 5: Trading Updates

5.1 Short Position Update - Nov 1, 2011

5.2 Registry Update as at Nov 3, 2011

5.3 Market Update Nov 14

5.4 Summary of Issues Plus Trading Anomalies During November 2011 and in a Broader Context

Chapter 6: Registry Anomalies

6.1 An Overview of Monthly Registry Anomalies Spanning 2 Years of Trading

6.2 Increased Registry Activity Versus ASX Buying and Selling

6.3 Trading Featuring Substantially Increased Registry Activity Over ASX Activity - Part 2

6.4 Trading Featuring Substantially Increased ASX Activity Over Registry Activity.

6.5 The Impact of Institutions on the CuDeco Register

Chapter 7: Research Into Other ASX Companies

7.1 Research Findings in Relation to CDU, LYC, BBG and EGP

7.2 Further Research Into ASX 200 Companies - Linc Energy (LNC)

7.3 ASX 200 Company Research Billabong Broker Data (BBG)

3

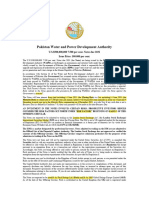

INTRODUCTION

Research Paper 7.3 examines data trends and trading issues in relation to Billabong Corporation as revealed by

Iress broker data. The investigation covers trading from Jan 2010 through to the end of April 2013 during which

the BBG share price has lost 95.7% of its value in falling from $11.00 to $0.475. The previous research into

Billabong (refer Research Paper 7.1 Section 3) looked at issues concerning the Company in the absence of

broker trading data.

The issues raised concerning Billabong have application to trading in all companies across the ASX and suggest

that the entire market is compromised by inadequacies in the current system of regulation. The system seems

to lack both the procedures and the capability to make brokers and their clients fully accountable for their

actions, making Michael Wests article back in Nov 2012 For dark pools, just wade into the ASX disturbingly

accurate.

One of the main outcomes of research into Billabong trading is that market regulation without the capacity to

generate an accurate audit trail of what has taken place, and to make entities fully accountable for their

actions, effectively amounts to non-regulation. In many respects, an unregulated market is what the ASX

appears to have become.

The current Paper further supports many of the issues identified in the executive summary of Research Paper

7.1 as having a major impact on the integrity of the ASX market.

The issues include:

The role that short selling has had in hastening share price declines and leading to undervaluations;

The contradiction between short selling forcing share prices lower but short covering having little or

no impact on share prices, due to covering off-market which avoids price discovery;

The extent of data anomalies associated with official daily data, substantial shareholder disclosures,

and the wide variances in both the quality and usefulness of substantial holder disclosures;

The prevalence of anomalous daily spikes and troughs in open short positions as an indicator of

unorthodox trading behaviours;

The lack of correlation between major changes to open short positions and changes in net borrowing

and net lending data because of unreliable reporting systems and/or non-disclosures;

A reporting system that enables sophisticated investors to conceal their activities with a 4 day delay in

reporting short positions, a 3 day delay in reporting securities lending arrangements and broker trades,

reporting short selling the following day but only after a delay that enables exposures to be managed.

Importantly there is no requirement for reporting short covering, which provides a large amount of

flexibility to fudge exposed positions with off-market adjustments;

The use of managed funds (e.g.; pension fund and mutual funds) for stock lending and the

contradiction represented by fund managers securing relatively small income streams for their clients

from such stock lending, while ensuring substantial devaluations of holdings through the facilitation of

short selling;

The likely collusion by fund managers and institutional brokers and other entities when companies are

targeted corporately in facilitating each others trades and through co-operation in off-market

activities that avoid price discovery;

Severe transparency issues concerning trading and settlements that sit at the heart of spurious trading

and makes market manipulation entirely possible without detection;

4

The vulnerability of all ASX companies because of open ended lending agreements between major

financial entities that can span decades in time, and where because of strategic relationships between

high profile financial entities managing pooled funds, stock can be made available to facilitate any

number of corporate purposes at the expense of clients in managed funds;

Patterns of trading that suggest buying & selling from related accounts or a pass the parcel exercise

between fund managers who are likely to be colluding with their trading. The key to suspicious, non-

genuine trading is that holdings dont change substantially despite extremely large volumes of buying

and selling being put through the market;

The use of media reports as a trigger and a smoke screen to implement aberrant trading behaviours that

force irrational share price fluctuations;

The use of the media to promote trading agendas by the leaking of confidential information, which

when reported, provides both the catalyst and the camouflage for unfair trading behaviours;

A compromised market system where:

o The manipulative use of short selling, back and forth trading churn and extensive use of Dark

Trades and off-market activity have overridden genuine market forces and have led to both

diminished market integrity and undervalued share prices;

o Large amounts of liquidity being withdrawn from the lit market through dark pools, and

extensive off market dealings, and liquidity is also withdrawn at critical times through

algorithms moving non genuine buying out of the way of incoming orders, thus exacerbating

price falls;

o Price discovery associated with short covering is avoided through off-market adjustments;

o Price discovery has increasingly become just a reflection of the trading agendas of powerful

financial interests rather than a fair appraisal of a companys worth based on fundamentals;

o Trading for profits looks to be a secondary consideration compared to forcing undervalued

share prices that prepare the way for large scale corporate activity. Essentially, much more

money can be made by entities through cheap acquisitions whether through placements or by

takeover, than can be stripped from each other through trading. Trading losses in such

instances become a cost of doing business and are likely to be booked to client funds under

management;

o The style of trading undertaken generally represents a zero sum game with powerful interests

overwhelming the market through weight of numbers while achieving their pricing agendas;

o For firms that are targeted corporately, positive news about company achievements virtually

becomes irrelevant because of trading designed to quickly override any lift from good news.

Yet negative news or perceived negative news is seized upon to implement share price falls

through short selling and through collusive trades where control over stock is maintained

despite the falls in price.

Data-based insights into BBG trading based on IRESS broker data reveal a fundamental contradiction within

our investment market. On the one hand, our system is meant to provide a medium for fair exchange of

securities between genuine sellers and genuine buyers, and to provide companies with access to capital to

grow their businesses, thereby generating wealth and employment that should strengthen the economy.

On the other hand, the system allows, and in some cases facilitates, substantial shareholder status to

management entities who repeatedly borrow and short-sell large tranches of shares with a focus on

destroying value in those targeted companies for their own ends.

This contradiction means that share investing for some of the most influential players in the market can be

predicated by the destruction of wealth and trying to ensure that the share prices of targeted companies are

kept as low as possible. Efficient market theory would argue that others would step in to take advantage of

5

cheap prices but if entities are colluding, or simply standing aside knowing there will be other opportunities

for them to benefit, then companies become extremely vulnerable and the system itself is placed at extreme

risk.

The system of stock lending and short selling receives support from Treasury, the ASX, ASIC and the

establishment press with arguments mainly centering on the liquidity it is meant to provide. However apart

from the fact that liquidity is elusive, particularly when it is really needed such as during times of financial

crisis, the system of short selling raises questions that suggest it is fundamentally flawed in the way it

operates.

The questions arising from research into ASX200 companies which have been stripped of considerable wealth

over the last several years include:

1. Who acting in good faith and with full knowledge of the risks entered into would allow their shares to

be borrowed to facilitate the massive devaluation of a company they are significantly invested in?

2. What responsible fund manager conscious of the need to perform against his/her peers while

entrusted to increase the investment portfolio of clients, would facilitate short selling through the

lending of client shares knowing that client portfolios would be substantially devalued by the activity?

3. Who would actively assist entities to cover large short exposures in such a way as to avoid any price

impact when short sellers under pressure to cover would be expected to pay a premium to access

large tranches of shares?

4. Has extensive stock lending created a situation where the focus by influential entities is to destroy

value and to ensure that prices remain under pressure to manage exposures and to minimize the need

for supplying additional collateral in the event of price increases?

5. How can market integrity be maintained for an industry that effects the financial welfare of so many

people through compulsory superannuation when vested interests choosing to put their own interests

ahead of the clients whose funds they manage;

6. Given the massive losses faced by superannuation funds in recent years and in the years following the

GFC, who are the entities who have positioned themselves to benefit from the massive amounts of

short selling that has occurred and where have those profits been repatriated to?

It is difficult if not impossible to successfully answer questions such as the above without getting into issues of

collusion, collaboration and share price manipulation which were also addressed1 In Research Paper 7.1 from

the point of view of historical precedent. The fact that people do participate in a financially treacherous

environment with trust that their funds will be managed professionally and their best interest highlights the

misinformation associated with the funds management industry where client risks are in a form not able to be

fully understood.

Importantly, many of the trading houses that are prominent throughout the research have track histories of

share price manipulation and abuses of the financial markets and have incurred heavy fines but always with

no admission of guilt. It raises the question, Why pay fines for something for which you are not guilty of?

A system that tolerates such convenient remedies for situations where clear wrong doing has taken place

simply guarantees that manipulative abuses will continue with perhaps increased care to ensure that any

aberrant activities are even more difficult to detect in future.

1

Refer Paper 7.1, Section 7.1.3.15.1 Regarding possible collusion by fund managers, brokers and their affiliates

6

EXECUTIVE SUMMARY

The focus of Research Paper 7.3 has been to assess broker trading in response to the news events that have

accompanied share price falls in Billabong Corporation (BBG). The purpose for doing so is to demonstrate that

trading issues raised by research into CuDeco Limited are not only valid, but they are replicated in trading

across the ASX 200 and even further afield as well.

The Paper draws attention to possible insider activity associated with Billabong trading in relation to:

A major capital raising where broker trading and shorting activity may be suggesting unfair dealings and

a compromised market, and;

The leaking of confidential information to the media and the implementation of dubious trading

strategies under the cover of negative news. Denials by the Billabong Board contributed to a grossly

uninformed market especially as the media reports eventually proved to be correct.

The focus of research has not been on share price levels which should reflect the emerging fundamentals of

the company. Based on earnings and future prospects 45 cents may (or may not) be a reasonable price for

BBG. However, of particular concern is the likelihood that manipulative and unfair trading practices have

accompanied share price declines and have continuously advantaged one class of investors over another.

Research into trading data has focussed attention on the activities of fund managers (and/or custodians) in

making shares available for short selling from the holdings they have management rights to, especially when

the fees earned for clients have been minor compared to the massive portfolio losses managers have

facilitated through short selling. The practice has persisted for at least 5 years during which time the share

price has retreated from around $13.70 to its current $0.45.

The situation makes no logical sense within a fund management industry that has little tolerance for under

performance. Substantial shareholder notices have shown portfolios under management often consist of

mutual fund and pension fund portfolios, suggesting that the investments of individuals who lodge money to

invest in good faith have been used by sophisticated investors to extract profits from the market at the

expense of fund holders. Such a system could only work if there was a benefit for managers in making the

funds available and that raises the spectre of collusion. Collusion is suggested by:

The making of funds available for short selling when both the lender and the borrower represent the

sophisticated sector of the market with access to quality information and more than likely a shared view

about the future direction of the BBG share price a view based on company fundamentals and possibly

by inside knowledge of corporate activity;

The facilitation of short covering without price impact;

The constant shuffling of shares back between sophisticated investors while prices are taken lower;

The facilitation of trading agendas whereby trading churn is put through a number of brokers to

condition the market and to camouflage attempts to acquire or dispose large tranches of shares.

Trading data demonstrates that the market has become seriously impaired through entities regularly

becoming substantial shareholders through the borrowing of shares rather than through purchases. The use of

other peoples shares in becoming a major shareholder with the sole intention of profiting by the destruction

of productive wealth is a bizarre take on investing that is sanctioned by our current system but the practice

has placed the market in an untenable and chronically dysfunctional position.

The other feature of Billabong trading is the manipulative abuses associated with various offers for the

company that are never actually consummated. The strategy has been described by Minter Ellison as Bear

Hugs or Virtual Bids where a bidder pressures a target to accept a takeover proposal by making the proposal

on an indicative, non-binding and highly conditional basis. The wriggle room made available by such an offer

can then used to pressure the company and as highlighted by Billabong, with devastating effect.

The share flows associated with NAB, JP Morgan and UBS as Billabong substantial shareholders, highlight

the extent of unorthodox trading activity associated with securities lending. The charts that follow contrast

share flows associated with securities lending against share flows associated with buying and selling activity

as disclosed in substantial notices. Total movements ON and OFF the register resulting from securities

lending activity are compared to totals for buying and selling.

7

Securities Lending versus Buying & Selling for Billabong Substantial Shareholders

The data suggests motives for trading that are likely to have significant ramifications for the integrity and

fairness of the market for other participants as it has become known that if entities require lower prices to

suit a trading agenda there a number of ways whereby lower prices can be achieved. (Refer Section 7.3.1.6)

The substantial notices also highlight the likely extent of trading imbalances given that the majority of trading

occurs without any disclosures whatsoever simply because the mandatory 5% substantial shareholder

reporting disclosures are not triggered. JP Morgan and UBS havent issued many substantial shareholder

notices over the last 3 years and yet the trading in the market corresponding to the above charts, as well at

other times, reveals large quantities of buying and selling about which little or nothing is known.

JPM

UBS

Re: Above Charts Sells Buys

Sells Buys

Affiliate Activity 127,245 411,125

1,101,069 357,831

Broker Activity 1,819,056 2,174,685

23,505,701 17,603,002

All Broker Trading

3 Year Period

(2010, 2011 & 2012)

84,187,051 79,794,249

217,120,649 214,899,183

Period 2010, 2011 & 2012

NAB AFFILIATES

Period Dec 31 12 to Apr 30 13

JP MORGAN AFFILIATES

Period Aug 8, 2011 to Dec 5, 2011

UBS AFFILIATES

3 Months OFF ON

ASX Activity 127,245 411,125

Securities Lending 35,800 17,690,200

4 Months OFF ON

ASX Activity 1,101,069 357,831

Securities Lending 29,180,434 30,038,528

Share flows associated

with securities lending

3 Months OFF ON

ASX Activity 15,738,269 17,729,786

Securities Lending 197,872,630 198,774,745

Share flows from

Buying & Selling

92.2% 97.1%

97.6%

When combined with the trading of other brokers

over the last 3 years, that has also passed

beneathe the 5% reporting limit, it shows that

very little is known about the trading taking place

with no way of finding out other than through

audits. Any attempts to regulate the market are

clearly taking place blindfolded because of the

opaque systems that are allowed to enshroud

practically all dealings by sophisticated investors.

Finally, the incessant algorithmic trading churn that is a feature of trading has translated into a group of

institutional brokers dominating trading but with their roles reversed from time to time. Interestingly, despite

continuous falls in the share price, institutional ownership as a group has remained at relatively constant

levels with a lot of the trading likely to be associated with minimal changes to beneficial ownership. Much of

the trading therefore appears non-genuine with collusion and cooperation likely in support of shared trading

objectives. For example, short selling and short covering looks to have been a cooperative effort and pushing

prices to undervalued levels may have been a cooperative strategy as well in support of takeover activity.

The use of retail brokers to disguise buying or selling during critical trading periods gives strong support to

views of collaboration and such activity ought to be relatively easy to verify from audits. While data trends

and trading anomalies suggest manipulation, identifying those responsible would require the relationships of

entities and brokers who have dominated trading to be fully understood, and that comes back to a

preparedness to carry out much needed regulatory audits. The results could be very revealing and sadly, the

current avoidance of that approach by regulators might be signalling that they would rather not know.

Broker Activity versus Affiliate Buying & Selling for JPM & UBS

The majority of trading takes place undisclosed

and is virtually invisible on the register

8

CONTENTS

Section 1 ......Pg. 9

A REVIEW OF BILLABONG CORPORATION BROKER DATA

7.3.1.1 AN OVERVIEW OF TRADING IN BILLABONG CORPORATION Pg.10

7.3.1.2 PROMINENT BROKERS ASSOCIATED WITH DOWN TRENDS Pg. 11

7.3.1.3 SUMMARY OF BROKER DATA Pg. 14

7.3.1.4 TIMELINE OF SIGNIFICANT EVENTS: Pg. 18

7.3.1.5 THE BBG SHARE PRICE CORRESPONDING TO SIGNIFICANT EVENTS: Pg. 19

7.3.1.6 SHARE PRICE MANIPULATION ISSUES Pg. 20

7.3.1.7 TRADING ACCOMPANYING SIGNIFICANT EVENTS Pg. 21

Section 2 ........... Pg. 61

SHORT SELLING TRENDS REVISITED

7.3.2.1 OPEN SHORT POSITIONS 2013 Pg. 62

7.3.2.2 FURTHER ANOMALOUS OPEN SHORT ACTIVITY Pg. 63

Section 3 . ...Pg. 64

BROKER DATA ACCOMPANYING SUBSTANTIAL SHAREHOLDER NOTICES

7.3.3.1 JP MORGAN SUBSTANTIAL NOTICE MAY 2013 Pg. 65

7.3.3.2 NAB SUBSTANTIAL SHAREHOLDER DISCLOSURES Pg. 66

7.3.3.3 UBS SUBSTANTIAL SHAREHOLDER DISCLOSURES Pg. 67

7.3.3.4 MACQUARIE GROUP SUBSTANTIAL SHAREHOLDER DISCLOSURES Pg. 68

Appendix . ...Pg. 69

QUESTIONS CONCERNING BILLABONG TRADING

9

Section 7.3.1

A REVIEW OF BILLABONG CORPORATION BROKER DATA

(ASX CODE: BBG)

Period: Jan 2010 Apr 2013

10

7.3.1.1 BILLABONG CORPORATION (BBG) An Overview of Trading

The chart tracks the Billabong share price from the beginning of January 2010 through to the end of April

2013, a period that encompasses 13 quarters of trading where the price has retreated from a high of $12 to a

low of 47 cents.

To tie in with previous research on Lynas Corporation, open short position movements are again compared to

share price trends below. Official open short positions have been available only since June 16, 2010 although

research has demonstrated that open short position data is generally an unreliable indicator of market activity

due to extensive off-market dealings concerning securities lending. The covering of short positions rarely

results in price increases as it is accomplished cooperatively between stakeholders and usually takes place off-

market. It could be argued that depressing share prices through short selling on-market and then covering off-

market provides a legal pathway for share price manipulation.

0

10

20

30

40

50

M

i

l

l

i

o

n

s

June 16, 2010

2010 2011 2012 2013

Open Short

Positions

Share Price

The long term decrease in the share

price has generally coincided with an

increase in open short positions

Commnencement of Open Short Position reporting

Trading over 3.25 years has seen 2.154 Billion shares bought

and sold while the share price has lost 96% of its value. And

yet Annual Reports show that institutional shareholders, who

have mainly been responsible for the trading volumes, have

retained their holdings as a group with their ownership

averaging 63% of the register up until the 2012 Report.

$12

$2

$8

$6

$10

$4

2011 2012 2010 2013

11

7.3.1.2 PROMINENT BROKERS ASSOCIATED WITH DOWN TRENDS

In an attempt to identify who the prominent brokers have been in the trading of Billabong Corporation shares,

several downtrend periods have been identified on the chart and broker statistics corresponding to each

trend have been sourced from IRESS data. The results follow.

PERIOD 1: A down trending BBG share price from around Apr 12, 2010 through to Aug 20, 2010

LEADING BROKERS BY MARKET SHARE LEADING BROKERS BY NET BUYING & NET SELLING

BROKER SELLS BUYS NET SHARE % BROKER SELLS BUYS NET BUYS NET %

GS 14,954,878 11,820,195 -3,134,683 12.2% MACQ 10,703,331 14,387,987 3,684,656 37.6%

UBS 13,113,894 13,783,151 669,257 12.1% DMG 10,646,509 13,402,793 2,756,284 28.2%

MACQ 10,703,331 14,387,987 3,684,656 12.0% MERL 1,241,882 2,449,920 1,208,038 12.3%

DMG 10,646,509 13,402,793 2,756,284 10.7% UBS 13,113,894 13,783,151 669,257 6.8%

CITI 10,520,097 9,834,198 -685,899 9.4% COMM 1,833,118 2,222,581 389,463 4.0%

CIMB 8,748,826 8,732,482 -16,344 8.2% ITG 288,171 620,059 331,888 3.4%

CSUI 8,028,627 7,310,811 -717,816 7.3% MOELIS 0 290,000 290,000 3.0%

MSDW 7,847,056 7,316,612 -530,444 7.0% PSL 25,982 154,043 128,061 1.3%

JPM 6,005,706 5,728,559 -277,147 5.1% DAIW 321,534 441,091 119,557 1.2%

SUSQ 2,983,210 3,005,823 22,613 2.8% Others 2 5,800,689 6,010,401 209,712 2.1%

COMM 1,833,118 2,222,581 389,463 1.8%

MERL 1,241,882 2,449,920 1,208,038 1.7% Total 9,786,916

INST 1,483,841 1,470,630 -13,211 1.3% NET SELLS

EVAN 1,982,130 172,912 -1,809,218 1.0% GS 14,954,878 11,820,195 -3,134,683 32.0%

IMCP 968,947 987,665 18,718 0.9% EVAN 1,982,130 172,912 -1,809,218 18.5%

ETRD 858,968 842,640 -16,328 0.8% TAYL 872,428 33,848 -838,580 8.6%

CLSA 667,398 586,673 -80,725 0.6% CSUI 8,028,627 7,310,811 -717,816 7.3%

AIEX 656,539 632,218 -24,321 0.6% CITI 10,520,097 9,834,198 -685,899 7.0%

BBY 596,375 599,093 2,718 0.5% MSDW 7,847,056 7,316,612 -530,444 5.4%

NAL 439,624 457,101 17,477 0.4% MACP 559,194 124,898 -434,296 4.4%

ITG 288,171 620,059 331,888 0.4% JPM 6,005,706 5,728,559 -277,147 2.8%

TAYL 872,428 33,848 -838,580 0.4% SHAW 234,210 16,220 -217,990 2.2%

Others 1 3,689,390 2,732,994 -956,396 2.9% ORDS 202,053 32,085 -169,968 1.7%

Others 3 13,949,456 12,978,581 -970,875 9.9%

Totals 109,130,945 109,130,945 0 100% Total -9,786,916

Period 1

Period 2

Period 3

Period 4

Period 5

Share Price

Note: Others 1, refers to all brokers other than the leading brokers by market share that have been listed

Others 2, refers to all brokers that show net buying other than those listed as leading net buyers

Others 3, refers to all brokers that show net selling other than those listed as leading net sellers

12

PERIOD 2: A down trending BBG share price from around Nov 1, 2010 through to Aug 31, 2011

LEADING BROKERS BY MARKET SHARE LEADING BROKERS BY NET BUYING & NET SELLING

BROKER SELLS BUYS NET SHARE % BROKER SELLS BUYS NET BUYS NET %

CITI 51,573,003 60,085,548 8,512,545 16.3% CITI 51,573,003 60,085,548 8,512,545 40.7%

GS 48,213,527 45,914,219 -2,299,308 13.0% MACQ 23,393,895 27,735,489 4,341,594 20.8%

UBS 42,070,934 39,319,180 -2,751,754 11.7% ITG 1,802,351 3,705,415 1,903,064 9.1%

DMG 35,888,353 34,599,898 -1,288,455 9.9% INST 5,452,161 6,825,157 1,372,996 6.6%

MACQ 23,393,895 27,735,489 4,341,594 7.5% CSUI 23,479,068 24,663,126 1,184,058 5.7%

CSUI 23,479,068 24,663,126 1,184,058 7.1% AUST 145,478 799,825 654,347 3.1%

MSDW 20,799,499 21,410,282 610,783 5.3% MSDW 20,799,499 21,410,282 610,783 2.9%

NAL 16,671,409 13,218,162 -3,453,247 4.1% MOELIS 120,000 711,055 591,055 2.8%

JPM 13,042,342 11,870,653 -1,171,689 3.9% MFGBL 184,095 714,876 530,781 2.5%

CIMB 11,151,170 11,120,948 -30,222 3.8% Other 13,724,485 14,944,877 1,220,392 5.8%

MERL 12,137,831 9,505,113 -2,632,718 3.3%

COMM 9,630,180 9,565,721 -64,459 2.6% Total 20,921,615

SUSQ 7,018,935 7,021,729 2,794 2.1% Net Selling

INST 5,452,161 6,825,157 1,372,996 1.7% NAL 16,671,409 13,218,162 -3,453,247 16.5%

ITG 1,802,351 3,705,415 1,903,064 0.8% DAIW 3,647,270 683,439 -2,963,831 14.2%

BBY 2,546,940 2,617,759 70,819 0.7% UBS 42,070,934 39,319,180 -2,751,754 13.2%

AIEX 2,500,812 2,385,884 -114,928 0.7% MERL 12,137,831 9,505,113 -2,632,718 12.6%

ETRD 2,263,135 2,414,379 151,244 0.6% GS 48,213,527 45,914,219 -2,299,308 11.0%

CLSA 2,328,444 1,879,647 -448,797 0.6% DMG 35,888,353 34,599,898 -1,288,455 6.2%

DAIW 3,647,270 683,439 -2,963,831 0.6% JPM 13,042,342 11,870,653 -1,171,689 5.6%

MACP 1,786,235 1,562,100 -224,135 0.5% EVAN 1,338,251 302,397 -1,035,854 5.0%

RBSM 1,955,751 1,428,576 -527,175 0.4% NDAL 643,558 5,008 -638,550 3.1%

Others 11,603,603 11,424,424 -179,179 2.9% RBSM 1,955,751 1,428,576 -527,175 2.5%

Other 34,673,587 32,514,553 -2,159,034 10.3%

Totals 350,956,848 350,956,848 0 100% Total -20,921,615

PERIOD 3: A down trending BBG share price from around Oct 24, 2011 through to Dec 24, 2011

LEADING BROKERS BY MARKET SHARE LEADING BROKERS BY NET BUYING & NET SELLING

BROKER SELLS BUYS NET SHARE % BROKER SELLS BUYS NET BUYS NET %

CITI 25,585,522 26,691,802 1,106,280 15.1% COMM 17,691,686 24,631,403 6,939,717 27.0%

DMG 22,557,107 22,788,276 231,169 12.4% ORDS 580,949 3,717,800 3,136,851 12.2%

MSDW 19,174,337 12,467,211 -6,707,126 8.1% MACQ 13,371,030 16,342,374 2,971,344 11.6%

MACQ 13,371,030 16,342,374 2,971,344 8.1% AIEX 2,686,530 4,645,977 1,959,447 7.6%

COMM 17,691,686 24,631,403 6,939,717 7.8% ETRD 2,816,399 4,488,320 1,671,921 6.5%

CSUI 23,512,098 13,172,638 -10,339,460 7.7% MACP 1,635,073 2,944,439 1,309,366 5.1%

UBS 13,769,321 13,995,145 225,824 7.2% CITI 25,585,522 26,691,802 1,106,280 4.3%

GS 15,599,751 15,422,341 -177,410 6.9% CIMB 2,575,290 3,382,376 807,086 3.1%

MERL 7,376,039 7,986,990 610,951 4.2% SBAR 216,447 894,022 677,575 2.6%

JPM 6,189,096 1,979,071 -4,210,025 2.0% Other 65,548,128 70,684,214 5,136,086 20.0%

INST 2,889,876 2,895,604 5,728 1.7%

CIMB 2,575,290 3,382,376 807,086 1.7% 25,715,673

BBY 3,408,888 4,005,503 596,615 1.7%

SUSQ 2,719,933 2,898,859 178,926 1.6% CSUI 23,512,098 13,172,638 -10,339,460 40.2%

AIEX 2,686,530 4,645,977 1,959,447 1.4% MSDW 19,174,337 12,467,211 -6,707,126 26.1%

ETRD 2,816,399 4,488,320 1,671,921 1.3% JPM 6,189,096 1,979,071 -4,210,025 16.4%

ITG 3,426,630 1,109,941 -2,316,689 1.1% ITG 3,426,630 1,109,941 -2,316,689 9.0%

MACP 1,635,073 2,944,439 1,309,366 0.9% DAIW 1,083,000 25,000 -1,058,000 4.1%

SOSL 2,522,072 2,721,381 199,309 0.9% RBSM 856,519 557,014 -299,505 1.2%

ORDS 580,949 3,717,800 3,136,851 0.9% PETRA 271,062 21,062 -250,000 1.0%

HUB24 2,584,615 2,452,615 -132,000 0.8% GS 15,599,751 15,422,341 -177,410 0.7%

NAL 1,281,106 1,340,083 58,977 0.8% HUB24 2,584,615 2,452,615 -132,000 0.5%

Others 12,048,706 13,921,905 1,873,199 5.8% SHAW 211,551 91,954 -119,597 0.5%

Other 386,341 280,480 -105,861 0.4%

Totals 206,002,054 206,002,054 0 100% Total -25,715,673

13

PERIOD 4: A down trending BBG share price from March 1, 2012 to Jun 30, 2013

LEADING BROKERS BY MARKET SHARE LEADING BROKERS BY NET BUYING & NET SELLING

BROKER SELLS BUYS NET SHARE % BROKER SELLS BUYS NET BUYS NET %

GS 28,480,063 30,804,010 2,323,947 13.7% ORDS 1,064,960 9,515,000 8,450,040 25.8%

UBS 19,535,069 21,868,594 2,333,525 10.8% COMM 16,025,081 22,499,918 6,474,837 19.8%

CITI 14,449,455 13,470,782 -978,673 7.7% ETRD 3,821,812 6,591,428 2,769,616 8.5%

COMM 16,025,081 22,499,918 6,474,837 7.5% UBS 19,535,069 21,868,594 2,333,525 7.1%

MACQ 14,095,150 13,193,618 -901,532 6.8% GS 28,480,063 30,804,010 2,323,947 7.1%

CSUI 14,787,234 9,605,237 -5,181,997 6.5% AIEX 3,675,670 5,562,856 1,887,186 5.8%

DMG 16,405,774 7,060,536 -9,345,238 5.9% BELL 3,212,647 4,914,665 1,702,018 5.2%

MSDW 7,207,731 6,064,783 -1,142,948 4.1% JPM 5,070,023 6,540,312 1,470,289 4.5%

JPM 5,070,023 6,540,312 1,470,289 3.8% CCZ 32,917 760,000 727,083 2.2%

ORDS 1,064,960 9,515,000 8,450,040 3.3% Other 10,769,475 15,404,144 4,634,669 14.1%

MERL 7,413,673 4,647,923 -2,765,750 2.8%

BBY 5,484,470 5,326,320 -158,150 2.7% 32,773,210

BELL 3,212,647 4,914,665 1,702,018 2.6%

CIMB 7,201,414 2,680,452 -4,520,962 1.8% DMG 16,405,774 7,060,536 -9,345,238 28.5%

AIEX 3,675,670 5,562,856 1,887,186 1.8% CLSA 4,585,102 605,173 -3,979,929 12.1%

ETRD 3,821,812 6,591,428 2,769,616 1.8% CSUI 14,787,234 9,605,237 -5,181,997 15.8%

CLSA 4,585,102 605,173 -3,979,929 1.7% CITI 14,449,455 13,470,782 -978,673 3.0%

NAL 2,808,297 3,040,414 232,117 1.7% MERL 7,413,673 4,647,923 -2,765,750 8.4%

TPPM 2,692,096 2,682,023 -10,073 1.4% CIMB 7,201,414 2,680,452 -4,520,962 13.8%

SUSQ 2,760,845 2,867,437 106,592 1.4% BTIG 1,819,575 861,174 -958,401 2.9%

ITG 1,941,393 1,730,759 -210,634 1.0% MACQ 14,095,150 13,193,618 -901,532 2.8%

BTIG 1,819,575 861,174 -958,401 0.9% MOELIS 877,700 100,089 -777,611 2.4%

Others 18,141,180 20,545,300 2,404,120 8.3% INST 2,349,085 1,516,183 -832,902 2.5%

Other 27,006,835 24,476,620 -2,530,215 7.7%

Totals 202,678,714 202,678,714 0 100% Total -32,773,210

PERIOD 5: A down trending BBG share price from Aug 1, 2012 to Apr 30, 2013

LEADING BROKERS BY MARKET SHARE LEADING BROKERS BY NET BUYING & NET SELLING

BROKER SELLS BUYS NET SHARE % BROKER SELLS BUYS NET BUYS NET %

UBS 98,276,918 81,429,403 -16,847,515 11.98% COMM 76,869,618 94,419,007 17,549,389 24.7%

COMM 76,869,618 94,419,007 17,549,389 11.50% CSUI 23,545,757 37,085,365 13,539,608 19.0%

CITI 77,935,701 71,146,862 -6,788,839 10.40% BELL 5,766,353 12,485,129 6,718,776 9.4%

MSDW 52,967,801 39,533,919 -13,433,882 7.45% ETRD 24,329,361 30,294,443 5,965,082 8.4%

DMG 43,756,636 48,799,422 5,042,786 6.49% AIEX 11,744,519 16,859,773 5,115,254 7.2%

JPM 39,107,055 39,521,896 414,841 6.41% DMG 43,756,636 48,799,422 5,042,786 7.1%

GS 46,829,463 38,069,757 -8,759,706 6.24% NATO 4,749,965 8,766,014 4,016,049 5.6%

MACQ 35,436,929 33,571,824 -1,865,105 4.93% PETRA 1,600,000 5,005,000 3,405,000 4.8%

CSUI 23,545,757 37,085,365 13,539,608 4.33% TIMR 2,599,225 5,683,177 3,083,952 4.3%

ETRD 24,329,361 30,294,443 5,965,082 3.75% Other 73,219,910 79,961,596 6,741,686 9.5%

SOSL 19,185,247 18,521,513 -663,734 2.46%

MERL 17,565,804 11,595,150 -5,970,654 2.39%

Totals 71,177,582

BBY 17,964,088 15,143,359 -2,820,729 2.25% Net Selling

AIEX 11,744,519 16,859,773 5,115,254 1.95% UBS 98,276,918 81,429,403 -16,847,515 23.7%

SUSQ 13,798,620 13,441,619 -357,001 1.91% MSDW 52,967,801 39,533,919 -13,433,882 18.9%

MACP 8,697,349 10,502,263 1,804,914 1.33% GS 46,829,463 38,069,757 -8,759,706 12.3%

BELL 5,766,353 12,485,129 6,718,776 1.29% CITI 77,935,701 71,146,862 -6,788,839 9.5%

VIRT 8,760,871 7,181,438 -1,579,433 1.09% MERL 17,565,804 11,595,150 -5,970,654 8.4%

ITG 5,790,602 6,147,515 356,913 0.88% CIMB 4,021,857 760,148 -3,261,709 4.6%

INST 5,723,426 6,970,342 1,246,916 0.86% BBY 17,964,088 15,143,359 -2,820,729 4.0%

NATO 4,749,965 8,766,014 4,016,049 0.83% MACQ 35,436,929 33,571,824 -1,865,105 2.6%

TPPM 5,019,538 5,546,000 526,462 0.83% ORDS 5,054,101 3,378,869 -1,675,232 2.4%

Others 61,555,147 58,344,755 -3,210,392 8.45% VIRT 8,760,871 7,181,438 -1,579,433 2.2%

Other 72,381,891 64,207,113 -8,174,778 11.5%

Totals 705,376,768 705,376,768 0 100% Totals -71,177,582

14

7.3.1.3 SUMMARY OF BROKER DATA.

The trading data reveals a number of brokers who have been prominent with their trading throughout all

periods. They are summarized below with their market shares across all 5 periods itemized and with their

average market share across all trading also listed. The prominent brokers by market share for each period

have also been highlighted.

Period CITI UBS GS DMG MACQ CSUI COMM MSDW JPM

1 9.4% 12.1% 12.2% 10.7% 12.0% 7.3% 1.8% 7.0% 5.1%

2 16.3% 11.7% 13.0% 9.9% 7.5% 7.1% 2.6% 5.3% 3.9%

3 15.1% 7.2% 6.9% 12.4% 8.1% 7.7% 7.8% 8.1% 2.0%

4 7.7% 10.8% 13.7% 5.9% 6.8% 6.5% 7.5% 4.1% 3.8%

5 10.4% 12.0% 6.2% 6.5% 4.9% 4.3% 11.5% 7.5% 6.4%

Average 11.8% 10.8% 10.4% 9.1% 7.9% 6.6% 6.2% 6.4% 4.2%

Broker data by itself doesnt convey much about the entities who have dominated trading as their buying and

selling is likely to be spread across a range of brokers. Moreover, while a substantial amount of broker trading

shows buying matched more or less by selling, the reality is that brokers are generally buying for some entities

while selling for others making it difficult to assess their impact on the market.

A prominent market share by one or more brokers has often provided a foil for other brokers to come in and

be leading net buyers or net sellers of stock even though their market shares have been relatively minor. Also,

there is no guarantee that the entities responsible for net sales havent actually re-purchased the shares

through other brokers, and similarly, there are no guarantees that entities responsible for net purchases

havent actually sold a similar number of shares through other brokers. The monitoring of such trading activity

is extremely difficult because of the netting of trades and the concealment of broker identities through the

settlement and registration of trades when it comes to institutional dealings. Complicating the issue further is

the camouflage offered to entities responsible for trades but who happen to operate within the nominee

structure of an institutional account or even worse, through the nominee accounts of multiple institutions.

The leading net buyers and the leading net sellers across the 5 periods of trading are summarized below.

Brokers who have been influential as a net buyer or as a net seller but who have had only a minor market

share of all trading are highlighted. The NET % column shows the proportion of net selling or net buying the

broker has been responsible for during the period.

For example, during Period 2, Citigroup with an overall market share of 16.3% (refer above) were responsible

for 40.7% of all net buying that took place. It reveals a very major influence over trading particularly as CITI

has been a consistent buyer over an extended period in a falling market. The real issue however in terms of

being able to reconcile trading and being able to judge whether trading was fair and reasonable, is to be able

to identify who the sellers were and what relationship they had, if any, with the Citigroup client or clients who

accumulated the shares. An absence of changes to beneficial ownership would ring alarm bells and it is the

sort of regulatory issue that only audits could clarify.

Period Broker Sells Buys Net Net %

Period Broker Sells Buys Net Net %

2 CITI 51,573,003 60,085,548 8,512,545 40.7%

3 CSUI 23,512,098 13,172,638 -10,339,460 40.2%

1 MACQ 10,703,331 14,387,987 3,684,656 37.6%

1 GS 14,954,878 11,820,195 -3,134,683 32.%

1 DMG 10,646,509 13,402,793 2,756,284 28.2%

4 DMG 16,405,774 7,060,536 -9,345,238 28.5%

3 COMM 17,691,686 24,631,403 6,939,717 27.%

3 MSDW 19,174,337 12,467,211 -6,707,126 26.1%

4 ORDS 1,064,960 9,515,000 8,450,040 25.8%

5 UBS 98,276,918 81,429,403 -16,847,515 23.7%

5 COMM 76,869,618 94,419,007 17,549,389 24.7%

5 MSDW 52,967,801 39,533,919 -13,433,882 18.9%

2 MACQ 23,393,895 27,735,489 4,341,594 20.8%

1 EVAN 1,982,130 172,912 -1,809,218 18.5%

15

Period Broker Sells Buys Net Net %

Period Broker Sells Buys Net Net %

4 COMM 16,025,081 22,499,918 6,474,837 19.8%

2 NAL 16,671,409 13,218,162 -3,453,247 16.5%

5 CSUI 23,545,757 37,085,365 13,539,608 19.%

3 JPM 6,189,096 1,979,071 -4,210,025 16.4%

1 MERL 1,241,882 2,449,920 1,208,038 12.3%

4 CSUI 14,787,234 9,605,237 -5,181,997 15.8%

3 ORDS 580,949 3,717,800 3,136,851 12.2%

2 DAIW 3,647,270 683,439 -2,963,831 14.2%

3 MACQ 13,371,030 16,342,374 2,971,344 11.6%

4 CIMB 7,201,414 2,680,452 -4,520,962 13.8%

5 BELL 5,766,353 12,485,129 6,718,776 9.4%

2 UBS 42,070,934 39,319,180 -2,751,754 13.2%

2 ITG 1,802,351 3,705,415 1,903,064 9.1%

2 MERL 12,137,831 9,505,113 -2,632,718 12.6%

4 ETRD 3,821,812 6,591,428 2,769,616 8.5%

5 GS 46,829,463 38,069,757 -8,759,706 12.3%

5 ETRD 24,329,361 30,294,443 5,965,082 8.4%

4 CLSA 4,585,102 605,173 -3,979,929 12.1%

3 AIEX 2,686,530 4,645,977 1,959,447 7.6%

2 GS 48,213,527 45,914,219 -2,299,308 11.%

5 AIEX 11,744,519 16,859,773 5,115,254 7.2%

5 CITI 77,935,701 71,146,862 -6,788,839 9.5%

5 DMG 43,756,636 48,799,422 5,042,786 7.1%

3 ITG 3,426,630 1,109,941 -2,316,689 9.0%

4 GS 28,480,063 30,804,010 2,323,947 7.1%

1 TAYL 872,428 33,848 -838,580 8.6%

4 UBS 19,535,069 21,868,594 2,333,525 7.1%

4 MERL 7,413,673 4,647,923 -2,765,750 8.4%

1 UBS 13,113,894 13,783,151 669,257 6.8%

5 MERL 17,565,804 11,595,150 -5,970,654 8.4%

2 INST 5,452,161 6,825,157 1,372,996 6.6%

1 CSUI 8,028,627 7,310,811 -717,816 7.3%

3 ETRD 2,816,399 4,488,320 1,671,921 6.5%

1 CITI 10,520,097 9,834,198 -685,899 7.0%

4 AIEX 3,675,670 5,562,856 1,887,186 5.8%

2 DMG 35,888,353 34,599,898 -1,288,455 6.2%

2 CSUI 23,479,068 24,663,126 1,184,058 5.7%

2 JPM 13,042,342 11,870,653 -1,171,689 5.6%

5 NATO 4,749,965 8,766,014 4,016,049 5.6%

1 MSDW 7,847,056 7,316,612 -530,444 5.4%

4 BELL 3,212,647 4,914,665 1,702,018 5.2%

2 EVAN 1,338,251 302,397 -1,035,854 5.0%

3 MACP 1,635,073 2,944,439 1,309,366 5.1%

5 CIMB 4,021,857 760,148 -3,261,709 4.6%

5 PETRA 1,600,000 5,005,000 3,405,000 4.8%

1 MACP 559,194 124,898 -434,296 4.4%

4 JPM 5,070,023 6,540,312 1,470,289 4.5%

3 DAIW 1,083,000 25,000 -1,058,000 4.1%

3 CITI 25,585,522 26,691,802 1,106,280 4.3%

5 BBY 17,964,088 15,143,359 -2,820,729 4.0.%

5 TIMR 2,599,225 5,683,177 3,083,952 4.3%

2 NDAL 643,558 5,008 -638,550 3.1%

1 COMM 1,833,118 2,222,581 389,463 4.0%

4 CITI 14,449,455 13,470,782 -978,673 3.0%

1 ITG 288,171 620,059 331,888 3.4%

4 BTIG 1,819,575 861,174 -958,401 2.9%

2 AUST 145,478 799,825 654,347 3.1%

1 JPM 6,005,706 5,728,559 -277,147 2.8%

3 CIMB 2,575,290 3,382,376 807,086 3.1%

4 MACQ 14,095,150 13,193,618 -901,532 2.8%

1 MOELIS 0 290,000 290,000 3.0%

5 MACQ 35,436,929 33,571,824 -1,865,105 2.6%

2 MSDW 20,799,499 21,410,282 610,783 2.9%

4 INST 2,349,085 1,516,183 -832,902 2.5%

2 MOELIS 120,000 711,055 591,055 2.8%

2 RBSM 1,955,751 1,428,576 -527,175 2.5%

3 SBAR 216,447 894,022 677,575 2.6%

4 MOELIS 877,700 100,089 -777,611 2.4%

2 MFGBL 184,095 714,876 530,781 2.5%

5 ORDS 5,054,101 3,378,869 -1,675,232 2.4%

4 CCZ 32,917 760,000 727,083 2.2%

1 SHAW 234,210 16,220 -217,990 2.2%

1 PSL 25,982 154,043 128,061 1.3%

5 VIRT 8,760,871 7,181,438 -1,579,433 2.2%

Surprisingly, the Annual Reports for 2010, 2011 and 2012 reveal that institutional ownership as a group has

actually been maintained at comparatively high levels. A seemingly stable register has emerged,

despite all of the buying and selling taking place much of it surrounded by panic;

despite all of the negativity flowing from chronic earnings disappointments;

despite all of the negative press;

despite a substantial capital raising that caused massive dilution of the register, and;

despite two failed takeover attempts by TPG.

The table summarizes 3 years of registry activity and represents a very substantial amount of trading. In fact

from mid-August 2009 to mid-August 2012 which spans the trading summarized in the 3 Annual Reports,

around 1.596 billion shares were bought and sold.

REGISTRY STATISTICS 2010 2011 2012

Full Register 253,122,552 254,037,587 478,944,292

Top 20 Totals 211,866,229 215,946,007 378,035,048

% of Register 83.7% 85.0% 78.9%

Institutional Holdings 158,682,997 170,438,879 295,202,229

% of Register 62.6% 67.1% 63.2%

% of Top 20 74.9% 78.9% 78.1%

Institutional holdings even allowing for

the 6 for 7 entitlement offer have

averaged around 64% of the register

despite the 1.6 billion shares that have

traded. It represents an inordinate

amount of churning of holdings.

16

Institutional holdings have averaged 64.3% of the entire register across the 3 Annual Reports and have

averaged 77.3% of the registers Top 20. It demonstrates that trading churn has run at high levels with

institutions generally engaging in a pass the parcel exercise between themselves irrespective of how the

trading algorithms of multiple brokers have processed the transactions perhaps to confuse the issue. While

individual holdings have varied, ownership as a group has actually been maintained.

The year by year changes to the holdings of the major institutional shareholders are summarized below.

2010 2011 2012

Entity

Holding % of Register Holding % of Register Holding % of Register

HSBC Nominees 43,256,012 17.1% 34,089,046 13.4% 53,123,837 11.1%

J P Morgan Nominees 39,070,171 15.4% 50,222,395 19.8% 88,155,051 18.4%

National Nominees 32,984,219 13.0% 49,032,954 19.3% 65,405,980 13.7%

Citicorp Nominees 27,792,512 11.0% 23,836,134 9.4% 59,076,243 12.3%

The changes are not major but in any case they are difficult to interpret because of the impact that securities

lending has on portfolios. Where there have been reductions for example, the changes in holdings may in part

be due to the selling down of the holding but it may also be due to shares that have been lent out to other

entities and then short sold into the market.

In fact short selling alone could be responsible for say the decrease by HSBC between 2010 and 2011 (i.e.; a fall

of 9.2 million shares) and at the same time part of the increase by National Nominees during the same period

(i.e.; an increase of 16 million shares). The changes certainly need to be weighed against the fact that open

short positions increased from 7.3 million shares to 22.1 million shares in the period (i.e.; between the 2010

and the 2011 Annual Reports. Shares lent out do undergo changes of ownership with the lender showing a

reduction in holding and the purchaser showing an increase.

Given an absence of genuine selling as revealed by the register, short selling has very likely played a pivotal role

in share price declines. However the practice is wide open to abuse under current arrangements that sanction

its use. Profits from short selling have come at the expense of those whose shares have been lent out, and in

the main it is the investors who have shares controlled by institutional fund managers.

Time and time again over the 5 periods reviewed it has been the portfolios of those with funds under

management who have facilitated the short selling. In return they would have received marginal fees for the

use of their shares and they would also have received massive losses to the value of their portfolios because of

the short selling. Billabong investors with funds under management would have good reason to question the

motives of those who have continuously sacrificed their holdings for the benefit of other institutions who have

positioned themselves to rake in profits from shorting. Allegiances between fund managers and preparedness

by some to sacrifice client funds for the benefit of fellow professionals, perhaps for the return of a similar

favour at a future time, may explain a substantial portion of the churn trading that has taken place in Billabong

and for that matter right across the ASX.

The pattern of BBG share price declines but with the register showing that institutions as a group have retained

their holdings (at least up to the time of the 2012 Annual Report) points towards either collusion by brokers or

collusion by entities acting through multiple brokers. Tranches of shares appear to be passed around in such a

way that delivers gains through short selling but at the same time control over the shares sold short is

maintained within institutional ranks. Such an arrangement would help explain how open short positions

appear to have been conveniently managed.

17

Essentially, the purchasers of shares sold short appear to be more than willing to make them available to ease

the short position exposures undertaken by their industry affiliates. With cooperation, the covering of short

positions could easily be achieved with stock supplied to the market just as brokers are looking to buy back the

shares short sold. Covering could also occur on mutually acceptable terms either through off-market dealings or

through Dark Pools where fair price discovery is avoided. The issue of collusion is not new and there was a

precedent cited in Research Paper 7.1 (Pg. 71) involving TPG attempting to secure the assets of targeted

companies cheaply through unfair means.

Certainly the covering of shorts in BBG doesnt seem to have resulted in any share price appreciation while on

the other hand the building of positions on market has severely depressed prices.

18

7.3.1.4 TIMELINE OF SIGNIFICANT EVENTS: Oct 2011 through to April 2013

The trading in Billabong from October 2011 through to the end of April 2013 day has been characterized by

several key events. All events have had ramifications for the Billabong share price. They are listed as follows:

AGM 2011 - Earnings Outlook

Price Slump Nov 24, 2011 (An ASX Price Query followed on Nov 25)

Trading Update Dec 19, 2011

Capital Structure Review, Nixon JV, Half Year Accounts Feb 17, 2012

TPG Offer Received ($3 per share) Feb 20, 2012

TPG Update: Feb 27

TPG Update: Feb 28 (TPG bid rejected)

Cash Raising - Jun 21, 2012

TPG Second Bid Received ($1.45) July 24, 2012

TPG Granted Due Diligence authority - July 27, 2012

Additional BID Received (Bain Capital) Sept 6, 2012

Second BID Withdrawn - Sept 20, 2012

Press Announces TPG will not proceed refuted by BBG - Oct 4, 2012

ASX Price Query Oct 4

TPG Withdraws Oct 12, 2012

Chairman Ted Kunkel Retires Nov 11, 2012

BBG Director Paul Naude steps down to prepare a further bid for control of BBG Nov 19, 2012

Paul Naude $1.10 Bid Received (Sycamore partners) Dec 19, 2012

Paul Naude Bid Re-affirmed but without confidentiality provisions Dec 19, 2012

BBG, Chief Financial Officer, Craig White, steps down Dec 20, 2012

Paul Naude Granted authority to conduct Due Diligence Dec 24, 2012

Receipt of Altamont /VF Consortium BID Jan 14, 2013 also pitched at $1.10 per share

Press Reports that Both Bids could be reduced or withdrawn March 21, 2013 (Refuted by the

company)

Trading Halt & Suspension for Sycamore to finalize a 60 cent offer April 9, 2013

Extension of time granted to Paul Naude/Sycamore consortium to finalize their 60 cent bid April 24

Trading Halt & Suspension Further discussions with all interested parties May 9, 2013

The events portray a deteriorating outlook for Billabong with agreement failing to be reached with 4 different

consortiums and with offers retreating from $3.30, to $1.45 to $1.10 to 60 cents none of which ever became

conditional. Along with the diminishing bids for the company has been an exodus of key personnel and a

deterioration in the outlook for the company perhaps presciently alluded to by Ted Kunkel in his address at the

2011 AGM on Oct 25 when he stated:

It will be no surprise to anyone in this room when I say that the 2010-11 financial year was extremely difficult

for the Billabong Group. It was a year of great economic uncertainty around the world; a year of very

significant foreign exchange rate fluctuations; and a year in which natural disasters struck multiple countries

in the Groups highest margin territory of Australasia. These events further eroded what was already fragile

consumer confidence, in particular in Australia and, late in the year, Europe, which ultimately impacted

wholesale and retail sales. Added to this, the Group faced a year when the cost of raw materials such as

cotton reached all-time highs and significant wage cost pressures emerged in the China supply chain, with

little or no ability to recover these costs in competitive, price-sensitive markets. All of these factors combined

to reduce the Groups overall profitability.

19

There can be no doubt that the underlying factor behind share price falls has been a deteriorating earnings

outlook for the company, but the situation has been seized upon by:

Interests looking to bid for the company;

Billabongs financiers who have been heavily exposed to the company, and;

Market participants who have profited through various trading strategies some of which carry the

stigma of possible share price manipulation given the anomalies associated with substantial volumes of

trading data.

The positioning of TPG is reflected in the deal they struck with Colonial First State and Perennial Value

Management to take over their holdings should TGPs $1.45 bid be approved. The trading by those two

groups therefore comes under scrutiny as well. They were active in selling down the share price following the

Dec 19, 2011 earnings down grade but they were also able to accumulate substantial holdings throughout the

market turmoil that ensued. (Refer Research Paper 7.1 Sections 7.1.3.8.1.11, and 7.1.3.9.1 through to 9.4)

The TPG move in relation to Colonial First State and Perennial Value Management also raises queries about

what influences they may have had behind the scenes and if the trading that led to lower prices was in any

way connected to them or their associates.

The malaise of Billabong through tough trading conditions and a deteriorating earnings outlook must not take

away from any unfair trading tactics employed to profit through dubious short selling and through managing

the market in ways that may not meet with approval if properly investigated. Certainly, collusive trading by

entities acting through multiple brokers is the scenario that best fits trading data as detailed in the following

sections. The circumstances surrounding BBGs demise with negative news about the companys earnings

problems and balance sheet may simply have allowed dubious trading behaviours to pass unnoticed.

7.3.1.5 THE BBG SHARE PRICE CORRESPONDING TO SIGNIFICANT EVENTS:

$0.00

$0.50

$1.00

$1.50

$2.00

$2.50

$3.00

$3.50

$4.00

$4.50

$5.00

AGM Address

Oct 25,2011

Price Query

Earnings Update

TGP BID

Revised TGP BID Rejected

Bain Capital BID (withdrawn 14 days later)

Paul Naude and

Altimont BIDS at $1.10

Press Reports Re TPG withdrawing

TPG officially withdraws

Revised Offer of 60 cents

Capital Raising announcement

2011 2012 2013 2013

Oct 1 Apr 30

SHARE PRICE CHART SHOWING SIGNIFCANT EVENTS

Press Reports about

problems with the BIDS

20

7.3.1.6 SHARE PRICE MANIPULATION ISSUES

The research that follows looks at the trading activity accompanying all of the key events that have been

itemized in the timeline of Section 7.3.1.4 and highlighted in the previous chart. However, in assessing trading

trends, it needs to be borne in mind that market manipulation can and does occur even though it mostly

passes under the radar of regulators because of flexibilities that exist in current regulatory frameworks.

As pointed out in Research Paper 7.1 Section 7.1.3.6 (Pg. 35) and again repeated herewith, share price

manipulation manifests in a variety of ways where fund managers acting through groups of brokers and

where brokers and entities acting in their own right can exercise control over the market through:

The use of proprietary trading programs that deliver control over pricing levels through the forcing of

Down Ticks through various crossing strategies and through sales between groups of brokers all of which

appear to be coordinated by algorithms;

Control (again via trading algorithms) over the setting of prices during auctions;

The selling of shares by entities back and forth to themselves (i.e. trading churn) with orders distributed

amongst a large number of brokers to camouflage the activity;

The re-balancing of holdings without price discovery through extensive off-market transfers and through

trades executed in dark pool venues;

The implementation of particular trading agendas through designated brokers but with trading put

through other brokers designed to facilitate the particular trading agenda, (e.g.; buying or selling through

one or more brokers but churning stock through others in an attempt to control/manage the market)

Using the system of short selling as a manipulative trading tool whereby downward pressure on the share

prices occurs through short selling in the market and where adjustments to short exposures are done off-

market to avoid fair price discovery. The activity suggests collusion by those with short exposure and

those who are willing to supply shares off-market to reduce those exposures;

Wrong footing and panicking retail investors through tactics such as deliberately selling down

announcements that herald major developments for the company. A disappointing share price reaction

invariably takes away from the significance of an announcement and leads to investor angst;

Registering substantial holdings across multiple nominee accounts within an institution or across multiple

accounts with multiple institutions thus providing the substantial holder with various options to deliver

buying and/or selling orders to assist with trading agendas;

Panicking investors by using large buy bids to support the price and then suddenly selling into the bids to

give the appearance of price weakness but where the buying and selling has been between related

entities;

Capitalizing on trading volatility by entities engineering price falls in trading between themselves that

lead to the margin limits of exposed investors being triggered and to irrational panic amongst retail

investors thereby accelerating price falls;

Camouflaging extensive levels of what might be considered wash trades (i.e. no changes to beneficial

ownership) by putting many of the trades through brokers with large numbers of retail clients and then

settling on the net positions at the close of trading;

Taking advantage of a settlement system where the brokers used for high volumes of dubious

institutional trades are not identified on the register, thus further camouflaging the trading activity;

Taking advantage of unreliable reporting systems to disguise trading activity as evidenced by substantial

changes in short positions not being matched by corresponding changes in stock lending & stock

borrowing data, and where for example a large increase in open positions is usually not reflected on the

register by corresponding falls in the lenders holding.

The deliberate selling down of a holding to create volatility only to re-purchase shares as investors panic;

The leaking of information to the media by company insiders where the news items so generated are

used to justify specific trading agendas.

All of the above needs to be taken into account in assessing the trading associated with the significant events

related to the affairs of Billabong Corporation.

21

Section 7.3.1.7

BBG TRADING ACCOMPANYING SIGNIFICANT EVENTS

The research that follows focusses on the broker trading accompanying the significant events detailed in the

timeline of Section 7.3.1.4 and the chart of Section 7.3.1.5 and where the trading behaviours itemized in

Section 7.3.1.6 have all come to the fore.

Trading data draws attention to the brokers who have played leading roles in trading anomalies but only some

of the volumes would have related to their own house trading activities. The majority of share flows are

associated with the dealings of sophisticated investors and generally their activities are invisible to the

market. The invisibility arises due to:

Most trading avoids substantial shareholder reporting requirements, and;

The system of trading and settlements is opaque as far as sophisticated traders are concerned.

Being able to reconcile trading activity of brokers and the impact that their clients have on the register is an

exceedingly laborious and occasionally futile undertaking. For example, in the extreme case of entities trading

through multiple brokers as a nominee account that sits on the register within a nominee account or multiple

nominee accounts of one or more investment banks and where the legal ownership of the entity is lodged in a

foreign jurisdiction, shows how difficult it can be to track the trading of some sophisticated investors.

Such a system means that regulators appear to accept all trading at face value, knowing that the flexibilities

within the system and the difficulties in reconciling trading would make any attempt to prosecute for wrong

doing arduous and problematical at best. The fact that successful prosecutions for market manipulation are a

rarity and that the usual approach is to fine transgressors for any misdemeanours with a no guilt clause

signed off on payment of the fine, show what a protected species that entities responsible for chronic trading

anomalies can be.

However the fact that such a system is allowed to prevail by regulators and by default Treasury, and the fact

that regulation is funded by tax payer money where their ought to be a degree of accountability for the role

they have been entrusted to perform, is of cold comfort to genuine investors who have lost considerable nest

eggs in the market. The losses have arisen through diminished superannuation returns and through trading

losses on their own account, precipitated no doubt by difficult economic conditions, but exacerbated by

unfairly controlled and/or manipulated markets as suggested by research into trading data.

Meanwhile sophisticated investors will no doubt continue to take advantage of a non-transparent poorly

audited system at the expense of those unable to compete in an un-level playing field, of those with funds

under dubious management practices especially as related to short selling and the possible over-trading of

accounts to generate commissions and fees, and at the expense of those unable to access the privileges

afforded to sophisticated investors. Regulators will probably continue to look sideways given the difficulties in

reconciling trading and in establishing wrong doing in ways that are prosecutable given the opportunity for

unfair trading made possible by current trading guidelines.

The trading of Billabong brought to notice in the following sections needs to be considered in the light of the

above and the reality that there are gross deficiencies in the way that markets are allowed to function;

deficiencies likely to be made worse now that trading algorithms have been given the green light by ASIC.

22

7.3.1.7.1.1 TRADING LEADING UP TO THE PRICE SLUMP ON DEC 19, 2011: The price query on Nov 25, 2011

The price query was prompted by a share price slump on Nov 24 where the share price fell from $4.16 as per

the previous days close, to $3.57 before recovering to close at $3.64. The response to the price query by the

company (LINK) referred to the comments made by the CEO at the AGM several weeks prior on Oct 25, 2011,

where both the Chairman and the CEO addressed the challenges faced by the company.

Yet the advice delivered to the market on Oct 25, 2011 actually resulted in a share price increase in the days

and weeks that followed as highlighted in the chart below.

The explanation provided by the company and the share price reaction to news released at the AGM a month

earlier suggests that the slump on Nov 24 was more likely to be the result of insider activity than a delayed

response to the AGM news; particularly as 3.3 million short positions were added by the time the price peak

was reached on Nov 14, 2011. The leading brokers up until the price peaked on Nov 14, are summarized in the

table below.

LEADING BROKERS Oct 21 to Nov 14, 2011 LEADING BROKERS BY NET BUYING & NET SELLING

BROKER SELLS BUYS NET SHARE % BROKER SELLS BUYS NET BUYS NET %

CITI 11,280,711 10,447,715 -832,996 27.0% MERL 2,095,682 5,185,157 3,089,475 45.2%

DMG 7,179,112 5,258,731 -1,920,381 14.9% COMM 991,647 1,959,525 967,878 14.2%

MSDW 3,940,648 3,613,777 -326,871 9.2% UBS 2,356,734 2,889,408 532,674 7.8%

MERL 2,095,682 5,185,157 3,089,475 8.7% GS 1,283,483 1,740,139 456,656 6.7%

UBS 2,356,734 2,889,408 532,674 6.3% SBAR 92,543 488,285 395,742 5.8%

CSUI 3,640,386 1,695,755 -1,944,631 6.3% ITG 10,679 365,710 355,031 5.2%

GS 1,283,483 1,740,139 456,656 3.6% JPM 137,294 415,562 278,268 4.1%

COMM 991,647 1,959,525 967,878 3.6% INST 971,853 1,137,060 165,207 2.4%

MACQ 1,288,964 1,420,284 131,320 3.3% MACQ 1,288,964 1,420,284 131,320 1.9%

INST 971,853 1,137,060 165,207 2.5% Other 1,366,616 1,832,899 466,283 6.8%

SUSQ 918,908 890,782 -28,126 2.2%

Total 6,838,534

NAL 535,025 458,187 -76,838 1.2%

Net Selling

BBY 493,246 477,958 -15,288 1.2% BROKER SELLS BUYS NET SELLS NET %

DAIW 1,080,000 0 -1,080,000 1.1% CSUI 3,640,386 1,695,755 -1,944,631 28.4%

CLSA 419,937 429,169 9,232 1.0% DMG 7,179,112 5,258,731 -1,920,381 28.1%

ETRD 395,345 299,363 -95,982 0.8% DAIW 1,080,000 0 -1,080,000 15.8%

AIEX 371,730 237,961 -133,769 0.7% CITI 11,280,711 10,447,715 -832,996 12.2%

SBAR 92,543 488,285 395,742 0.7% MSDW 3,940,648 3,613,777 -326,871 4.8%

JPM 137,294 415,562 278,268 0.7% AIEX 371,730 237,961 -133,769 2.0%

MACP 240,436 256,692 16,256 0.6% SHAW 122,851 3,700 -119,151 1.7%

CIMB 212,528 270,776 58,248 0.6% ETRD 395,345 299,363 -95,982 1.4%

ITG 10,679 365,710 355,031 0.4% ORDS 123,361 32,995 -90,366 1.3%

SOSL 172,511 166,511 -6,000 0.4% NAL 535,025 458,187 -76,838 1.1%

Other 1,163,974 1,168,869 4,895 2.8% Other 2,008,712 1,791,163 -217,549 3.2%

Totals 41,273,376 41,273,376 0 100%

Total -6,838,534

$3.45

$3.65

$3.85

$4.05

$4.25

$4.45

$4.65

Oct

21

Oct

25

Oct

27

Oct

31

Nov

2

Nov

4

Nov

8

Nov

10

Nov

14

Nov

16

Nov

18

Nov

22

Nov

24

AGM Oct 25

A share price rise of 24% from

the day prior to the AGM

A fall of 52 cents on

Nov 24, 2011

Nov 14

Nov 24

Open Short Positions

Oct 24: 25.0 million

Nov 14: 28.3 million

Oct 24

Substantial rise

following the AGM

23

Broker Citigroup was the leading broker by market share in trading following the AGM with both Credit Suisse

and Deutsche Bank prominent net sellers. Merrill Lynch was the leading net buyer. The Citigroup activity as

the leading broker by market shares is difficult to comprehend given their average selling price for the period

was $4.29 yet their average buying price was marginally higher at $4.295.

The leading brokers associated with price declines from Nov 15 to Nov 24 are also listed below.

Citigroup were replaced by Deutsche Bank as the leading broker by market share with total volumes traded

(22.7 million) only around half of that for the previous period (41.3 million).

LEADING BROKERS Nov 15 to Nov 24, 2011 LEADING BROKERS BY NET BUYING & NET SELLING

BROKER SELLS BUYS NET SHARE % BROKER SELLS BUYS NET BUYS NET %

DMG 5,482,668 6,111,247 628,579 26.3% UBS 1,907,613 2,899,629 992,016 17.1%

CITI 3,018,416 3,618,091 599,675 14.6% MACQ 1,148,280 1,940,459 792,179 13.6%

UBS 1,907,613 2,899,629 992,016 10.5% DMG 5,482,668 6,111,247 628,579 10.8%

GS 3,721,138 988,657 -2,732,481 9.9% CITI 3,018,416 3,618,091 599,675 10.3%

MSDW 3,063,157 1,019,042 -2,044,115 8.6% CIMB 61,718 586,718 525,000 9.0%

MACQ 1,148,280 1,940,459 792,179 6.7% ORDS 16,408 455,625 439,217 7.6%

CSUI 905,175 676,969 -228,206 3.5% MERL 276,574 706,694 430,120 7.4%

SUSQ 547,306 574,177 26,871 2.5% BBY 210,551 624,594 414,043 7.1%

MERL 276,574 706,694 430,120 2.2% COMM 310,291 601,779 291,488 5.0%

INST 554,000 349,282 -204,718 2.0% Other 747,996 1,443,350 695,354 12.0%

COMM 310,291 601,779 291,488 2.0%

Total 5,807,671

BBY 210,551 624,594 414,043 1.9%

Net Selling

CIMB 61,718 586,718 525,000 1.3% BROKER SELLS BUYS NET SELLS NET %

MACP 403,309 77,336 -325,973 1.1% GS 3,721,138 988,657 -2,732,481 47.0%

ORDS 16,408 455,625 439,217 1.1% MSDW 3,063,157 1,019,042 -2,044,115 35.2%

TIMR 212,250 209,611 -2,639 0.9% MACP 403,309 77,336 -325,973 5.6%

SBAR 62,572 276,750 214,178 0.8% CSUI 905,175 676,969 -228,206 3.9%

ITG 218,071 109,571 -108,500 0.8% INST 554,000 349,282 -204,718 3.5%

BTIG 0 200,000 200,000 0.4% ITG 218,071 109,571 -108,500 1.9%

JPM 69,354 88,605 19,251 0.4% WILS 79,695 31,435 -48,260 0.8%

AIEX 94,597 71,002 -23,595 0.4% AIEX 94,597 71,002 -23,595 0.4%

ETRD 86,797 73,828 -12,969 0.3% TPPM 60,434 38,297 -22,137 0.4%

NAL 4,769 131,194 126,425 0.3% SHAW 20,000 0 -20,000 0.3%

Other 385,584 369,738 -15,846 3.2% Other 460,507 410,821 -49,686 0.9%

Totals 22,760,598 22,760,598 0 100%

Total -5,807,671

Interestingly, CITI and DMG simply changed roles with their dominance over trading between the two periods.

CITI went from a market share of 27.0% to 14.5% while DMG went from 14.9% in the previous period to

26.3% in the period where price declines occurred.

UBS and Macquarie were the leading net buyers from a number of brokers accumulating stock, while

Goldman and Morgan Stanley were the two main net sellers of stock.

Research has shown that broker data alone, or even when combined with registry data, doesnt provide

clarity about what has actually occurred with trading. For example short positions put on by entities acting

through say Goldman Sachs and/or Morgan Stanley, who both net sold in the run up to Nov 14, could have

been covered through different brokers during the price declines that followed.

While short selling strategies are legitimate, what isnt legitimate is any associated buying and selling put

through other brokers designed to facilitate those trading strategies. The potential for such collusive activity is

precisely why clearer accounting procedures for all trading should be in place and why audits should be

mandatory in guaranteeing that price discovery is fair and that trading is genuine.

The net selling by GS & MSDW across both periods was relentless in disposing of 9.4 million shares between them, with a

number of brokers as net buyers including UBS, MACQ, DMG & CITI doesnt make logical sense. Simply because the

brokers represent sophisticated investors with the most informed view of the companys prospects which is also likely to

be a shared view. More likely, the trading patterns represent corporate agendas manifesting through multiple brokers.

24

7.3.1.7.1.2 FURTHER TRADING LEADING TO DEC 19, 2011

Open short positions were maintained at around 28 million shares from Nov 25 up until the Dec 19, 2011

earnings upgrade. Trading during that time is summarized below with Macquarie by far the most prominent

broker by market share. Credit Suisse stepped up as a net buyer with all other net buying and net selling

somewhat subdued.

LEADING BROKERS Nov 25, 2011 to Friday Dec 16, 2011 LEADING BROKERS BY NET BUYING & NET SELLING

BROKER SELLS BUYS NET SHARE % BROKER SELLS BUYS NET BUYS NET %

MACQ 7,597,854 7,617,808 19,954 20.1% CSUI 1,695,749 3,565,688 1,869,939 35.0%

CITI 4,279,507 5,350,409 1,070,902 12.6% CITI 4,279,507 5,350,409 1,070,902 20.0%

UBS 3,848,706 2,770,308 -1,078,398 8.7% DMG 2,767,453 3,347,769 580,316 10.9%

DMG 2,767,453 3,347,769 580,316 8.1% BELL 12,255 511,695 499,440 9.3%

MSDW 3,530,389 2,468,838 -1,061,551 7.9% PSL 6,591 306,500 299,909 5.6%

CSUI 1,695,749 3,565,688 1,869,939 6.8% CLSA 27,308 221,890 194,582 3.6%

GS 2,458,189 2,542,889 84,700 6.7% CIMB 1,598,309 1,750,732 152,423 2.9%

CIMB 1,598,309 1,750,732 152,423 4.3% INST 886,787 1,029,358 142,571 2.7%

COMM 2,006,682 847,969 -1,158,713 3.8% HART 0 122,500 122,500 2.3%

JPM 1,218,883 1,075,512 -143,371 3.1% Other 11,550,162 11,963,571 413,409 7.7%

INST 886,787 1,029,358 142,571 2.5%

Total 5,345,991

MERL 1,352,538 537,293 -815,245 2.5%

Net Selling

ITG 932,613 637,165 -295,448 2.0% BROKER SELLS BUYS NET SELLS NET %

NAL 598,434 569,732 -28,702 1.5% COMM 2,006,682 847,969 -1,158,713 22.1%

SUSQ 540,307 515,656 -24,651 1.4% UBS 3,848,706 2,770,308 -1,078,398 20.5%

BBY 326,184 399,866 73,682 0.9% MSDW 3,530,389 2,468,838 -1,061,551 20.2%

BTIG 308,000 338,441 30,441 0.8% MERL 1,352,538 537,293 -815,245 15.5%

BELL 12,255 511,695 499,440 0.7% RBSM 466,649 5,000 -461,649 8.8%

AIEX 238,603 249,242 10,639 0.6% ITG 932,613 637,165 -295,448 5.6%

RBSM 466,649 5,000 -461,649 0.6% JPM 1,218,883 1,075,512 -143,371 2.7%

ETRD 184,252 206,647 22,395 0.5% ORDS 173,845 98,760 -75,085 1.4%

PSL 6,591 306,500 299,909 0.4% CMCS 102,693 28,723 -73,970 1.4%

MACP 162,637 127,284 -35,353 0.4% MOELIS 50,000 0 -50,000 0.9%

Other 920,388 1,166,158 245,770 3.2% Other 1,430,840 1,298,279 -132,561 2.5%