Académique Documents

Professionnel Documents

Culture Documents

Report

Transféré par

zazazzzz0 évaluation0% ont trouvé ce document utile (0 vote)

13 vues11 pagestropicana

Copyright

© © All Rights Reserved

Formats disponibles

DOCX, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documenttropicana

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

13 vues11 pagesReport

Transféré par

zazazzzztropicana

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 11

1

1.0 ISSUES: TROPICANA SELL LAND TO ECO WORLD

According the article by Ng Bei Jaya, The Star Malaysia, 20 March 2014,

Tropicana Corp Bhd is selling 128ha near Kota Kemuning, Selangor to Eco World

Development Group Bhd for RM470.67 million in cash. The land is part of the 474ha

Tropicana Aman and also known as Canal City land which Tropicana acquired from the

Selangor state government in April 2013. The sale and purchase agreement is expected

to generate a net gain of about RM170 million for the group.

Base on the expected net profit RM170 million or RM12.64 per sq ft, the

Tropicana expected that effective cost for the parcel is RM22.36 per sq ft. The exercise

translates into a profit of 56.5% is not too bad as a return considering the purchase was

done less than a year ago. Base on this article, Tropicana said the sale would enhance

its net earnings per share by 12 sen for the financial year ending Dec 31.

2

2.0 INTRODUCTION

2.1 BACKGROUND OF TROPICANA CORPORATION BHD

Tropicana Corporation Bhd is the first to introduce resort-style living into

residential property developments under the name of Tropicana, which has since

become the benchmark for the category. This corporation subsequent development

proudly carried the Tropicana brand in their names, and the Tropicana DNA in their

concepts. Tropicana Corporation Bhd will continue to focus on cutting edge concepts for

our ever-growing portfolio of residential, office and retail developments. Tropicana will

expand their horizons to include property investment, management, land trading,

hospitality and education.

Tropicana has built a reputation for creating homes and offices that surpass

expectations in terms of practicality in design, quality of construction, lush landscaping

and strategic location that generates high appreciation value. Across Malaysia, they

developments encompass new homes, contemporary urban apartments and innovative

mixed use schemes - all guaranteed to express the essential Tropicana values.

Many of Tropicana developments combine leading edge design whilst maintaining the

key elements from our architectural heritage. From highly complex developments, that

combine residential, retail and leisure facilities, to urban apartments or the

condominiums - Tropicana continues to provide quality, style and sustainability.

3

2.2 BACKGROUND OF ECO WORLD DEVELOPMENT GROUP BHD

Eco World Development Group Berhad, an investment holding company, is

engaged in the investment and development of properties in Malaysia. It develops

residential, commercial, and industrial and recreational properties. The company was

formerly known as Focal Aims Holdings Berhad and changed its name to Eco World

Development Group Berhad in December 2013. Eco World Development Group Berhad

is based in Johor Bahru, Malaysia.

Eco World Development aspires to build a future where homes are not just well-

built and beautifully-designed, but are habitats for sustainable green communities. Such

great aspiration requires talented and creative revolutionists with a fiery passion not

only for property development but for building a greener future as well.

4

3.0 REASON WHY TROPICANA WANT TO SELL THEIR LAND TO ECO WORLD

The main reason why Tropicana want to sell part of its land in Canal City,

Selangor to Eco World is because of their debt position problem. From our analysis,

Tropicana face the series debt position that increase slightly from 2008 until 2012

because Tropicana spend too much on acquiring new land and properties project.

Figure 3.1 Debt Ratio of Tropicana (2008-2012)

Base on the graph above, we can see that the percentage of debt of Tropicana

increase slightly and on 2012 the debt that Tropicana facing are seriously because it

has been exceeding 40% ( health debt position benchmark) because of Tropicana

spend too much on acquiring new land and properties projects, thus, Tropicana needs

to reduce its land holding cost. As at end of the fourth quarter in 2013, the company

expected gearing was 0.55 times where this is high for a property company. So, the sell

of the land to Eco World generally view that the Tropicana have lowering its debt

position. The sell and purchase agreement is expected to generate a net gain of about

RM170 million for Tropicana. Tropicana still need to meet a cash commitment of about

RM500mil for acquiring its various pieces of land in Johor in the past if the expected

gearing would stay at the 0.55 times.

57%

68%

64%

72%

80%

2008 2009 2010 2011 2012

Debt Ratio of Tropicana Development from 2008-2012

source from Annual Report Tropicana Corporation Bhd (2008-2012)

5

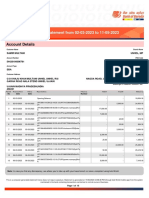

Figure 3.2 Debt Ratio of Eco World (2009-2013)

The graph above shows that the debt ratio of Eco World from 2009 until 2013

continually decreases year to year. It is also show that Eco World have better debt

position compare to the Tropicana because it generates profit from year to year so it

can recover their debt. So, it has no problem with the buying of the new land from

Tropicana, also the buy is based on cash basis. The sale of the Tropicana land to Eco

World allows Tropicana to leverage on Eco Worlds strong branding and benefit from

the spillover effects of being a premium developers neighbor. The emergence of Eco

World as its neighbor and development partner will raise the profile of the Tropicana

project. In other word, Tropicana try to stable their reputation through selling the land to

Eco World and it is also help Tropicana to increase their net earnings per share by 12

sen.

87%

80%

72%

60%

54%

2009 2010 2011 2012 2013

Debt Ratio of Eco World Development from

2009-2013

source from Annual Report Eco World (2009-2013)

6

4.0 REASON WHY ECO WORLD BUY LAND FROM TROPICANA

The reason why Eco World wants to buy the Canal City from the Tropicana is

because the Eco World wants to expand their profit. With strong profitable, Eco World

can reduce their debt position thus, it can stand longer in this sector (property

development).

Figure 4.1 Profit of Eco World (2009-2013)

Based on the graph, it show that the Eco World generate a profit from year to

year. Although 2009, 2010, and 2011 there is negative number for the profit but starting

from year 2012 the figure start to become positive and raise drastictily until year 2013.

Because of this high profit, Eco World wants to buy a land from Tropicana so they can

generate a new project that will increase their profit for next year.

-10000

-5000

0

5000

10000

15000

20000

25000

30000

2009 2010 2011 2012 2013

Profit of Eco World ('000)

source from Annual Report of Eco World (2009-2013)

7

Figure 4.2 Profit of Tropicana (2008-2012)

Based on the bar chart above, we can see that Tropicanas profit has been

decreasing gradually. This is most likely because the company have experiencing a

high debt position lately. Due to that, Tropicana have decided to sell one of its land to

Eco World.

RM 171057

RM 77013

RM 43252

RM 50512

RM 34436

2008 2009 2010 2011 2012

Profit of Tropicana ('000)

source from Annual Report of Tropicana (2008-2012)

8

Figure 4.3 Earning per share of Eco World

Based on the earning per share also we can see that the Eco World has good

number earning per share especially on the year 2013. So with this buying of new land

for Tropicana it is expected that EPS will increase for next 8 years.

2009 2010 2011 2012 2013

Earning Per Share -3.29 -2.2 -0.82 2.84 9.85

-4

-2

0

2

4

6

8

10

12

Earning Per Share of Eco World

9

Figure 4.4 Earning Per Share of Tropicana (2008-2012)

Although Tropicana is experiencing a decreasing in profit, it still manages to

declare positive earnings per share annually. However, due to lower profit for certain

year, the EPS also showing some upside down trend.

2008 2009 2010 2011 2012

Earning per Share of Tropicana 32.48 16.42 9.5 18.8 13.3

0

5

10

15

20

25

30

35

Earning Per Share of Tropicana

10

5.0 CONCLUSION & RECOMENDATION

As a conclusion, the action of selling land to Eco World is a smart move by

Tropicana Corporation Berhad. Besides securing its debt position, the business dealing

with company like Eco World puts a good record in Tropicanas portfolio as Eco World is

one of the companies that have a very good future prospect.

11

6.0 REFERENCES

1. Annual Report of Tropicana Corporation Berhad

2. Annual report of Eco World Development Bhd

3. http://ecoworldgroup.com.my/home/

4. http://investing.businessweek.com/research/stocks/snapshot/snapshot.as

p?ticker=ECW:MK

5. http://www.tropicanacorp.com.my/home/index.php

6. http://www.thestar.com.my/

Vous aimerez peut-être aussi

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Latif Khan PDFDocument2 pagesLatif Khan PDFGaurav AroraPas encore d'évaluation

- PT RulesDocument47 pagesPT RulesdewanibipinPas encore d'évaluation

- E Payment SystemDocument47 pagesE Payment SystemNamrata KshirsagarPas encore d'évaluation

- Transferable Letters of CreditDocument12 pagesTransferable Letters of CreditSudershan ThaibaPas encore d'évaluation

- International Business The New Realities 4th Edition Cavusgil Test BankDocument26 pagesInternational Business The New Realities 4th Edition Cavusgil Test BankMichaelSmithspqn100% (54)

- 06 Task Performance 1Document1 page06 Task Performance 1Richmon RabePas encore d'évaluation

- Strengths and Weakness of Airborne FedexDocument2 pagesStrengths and Weakness of Airborne FedexSrilakshmi ShunmugarajPas encore d'évaluation

- Professional Photographer Bank StatementDocument6 pagesProfessional Photographer Bank StatementDhiraj Kumar PradhanPas encore d'évaluation

- Bodhanwala, R. J. (2014) - Testing The Efficiency of Price-Earnings Ratio in Constructing Portfolio. IUP Journal of Applied Finance, 20 (3), 111-118.Document9 pagesBodhanwala, R. J. (2014) - Testing The Efficiency of Price-Earnings Ratio in Constructing Portfolio. IUP Journal of Applied Finance, 20 (3), 111-118.firebirdshockwavePas encore d'évaluation

- Globalization - Definition: According To Ritzer (2011)Document5 pagesGlobalization - Definition: According To Ritzer (2011)ARNOLD II A. TORRESPas encore d'évaluation

- Advanced Financial Accounting & Reporting February 9, 2020Document8 pagesAdvanced Financial Accounting & Reporting February 9, 2020Ric John Naquila CabilanPas encore d'évaluation

- Unemployment Newspaper ArticleDocument3 pagesUnemployment Newspaper ArticleWwil DuPas encore d'évaluation

- LDYKhE9pQcmnLVhrrdpW Solve Earth Intro Course 4.0Document14 pagesLDYKhE9pQcmnLVhrrdpW Solve Earth Intro Course 4.0Jose M TousPas encore d'évaluation

- Enron Weather Derivatives Assignment AnswerkeyDocument2 pagesEnron Weather Derivatives Assignment AnswerkeyValeria Natasha67% (3)

- TQM Implementation Issues Review and Case StudyDocument14 pagesTQM Implementation Issues Review and Case StudyTharundevasiaPas encore d'évaluation

- Module 12 - Financial StatementsDocument3 pagesModule 12 - Financial StatementsGeneen LouisePas encore d'évaluation

- XXXXXXXXXX6781 - 20230615160830874376 (1) - UnlockedDocument16 pagesXXXXXXXXXX6781 - 20230615160830874376 (1) - UnlockedRajendra SharmaPas encore d'évaluation

- FPA Candidate HandbookDocument32 pagesFPA Candidate HandbookFreddy - Marc NadjéPas encore d'évaluation

- 2018 - GAR Annual ReportDocument211 pages2018 - GAR Annual ReportKirstie ImeldaPas encore d'évaluation

- Bond, Undertaking & Indemnity (CCE)Document4 pagesBond, Undertaking & Indemnity (CCE)Rahul Kumar100% (1)

- 1030120969session 2015-16 Class Xi Accountancy Study Material PDFDocument189 pages1030120969session 2015-16 Class Xi Accountancy Study Material PDFharshika chachan100% (1)

- The Gold Standard Journal 12Document13 pagesThe Gold Standard Journal 12ulfheidner9103Pas encore d'évaluation

- Maybank Market Strategy For InvestmentsDocument9 pagesMaybank Market Strategy For InvestmentsjasbonPas encore d'évaluation

- Usa Policy y GlobalizationDocument11 pagesUsa Policy y GlobalizationmayuPas encore d'évaluation

- Why Did Subhiksha FailedDocument11 pagesWhy Did Subhiksha Failedpujil2009Pas encore d'évaluation

- Biniam TassewDocument74 pagesBiniam Tassewabel debebePas encore d'évaluation

- Kakasuleff, Chris - Predicting Market Trends Using The Square of 9Document4 pagesKakasuleff, Chris - Predicting Market Trends Using The Square of 9Mohamed ElAgamy100% (4)

- Entreprunership Chapter 3Document12 pagesEntreprunership Chapter 3fitsumPas encore d'évaluation

- Fast Retailing Sustainability Report 2019Document20 pagesFast Retailing Sustainability Report 2019Mahmudul HaquePas encore d'évaluation

- The Banking and Financial Institutions (Disclosure) Regulation 2014Document12 pagesThe Banking and Financial Institutions (Disclosure) Regulation 2014Michael MwambangaPas encore d'évaluation