Académique Documents

Professionnel Documents

Culture Documents

Salary Exchange... A Tax Efficient Way To Boost Your Plans For The Future

Transféré par

Standard Life UK0 évaluation0% ont trouvé ce document utile (0 vote)

43 vues4 pagesWith salary exchange you could have the chance to increase your net take home pay while the payments into your pension stay at exactly the same level.

Titre original

Salary exchange... a tax efficient way to boost your plans for the future

Copyright

© © All Rights Reserved

Formats disponibles

PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentWith salary exchange you could have the chance to increase your net take home pay while the payments into your pension stay at exactly the same level.

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

43 vues4 pagesSalary Exchange... A Tax Efficient Way To Boost Your Plans For The Future

Transféré par

Standard Life UKWith salary exchange you could have the chance to increase your net take home pay while the payments into your pension stay at exactly the same level.

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 4

Your guide to salary exchange

Increase your net take home pay

Your guide to salary exchange 01/04

Salary exchange a tax efficient way to boost

your plans for the future

With salary exchange you could have the chance to increase your

net take home pay while the payments into your pension stay at

exactly the same level.

Salary exchange allows you to give up an amount of your gross

(before tax) salary. Your employer then pays that amount straight

into your pension plan on your behalf. So if you exchange 1,250 of

your salary, your employer pays 1,250 into your pension.

As youre exchanging a portion of your gross salary, you wont

pay Income Tax or National Insurance Contributions (NICs) on that

amount. How much you save depends on how much you currently

earn and how much you reduce your monthly pay.

Your employer may make NIC savings and choose to pay a

proportion of this saving into your pension plan, giving your

payments a further boost.

02/04 Your guide to salary exchange

How salary exchange works and how you

could benefit

Pay exactly the same amount into your pension plan and

increase your net take home pay as youll be paying reduced NICs

Lets assume your current salary is 25,000 each year and you

pay 5% of your salary to a personal pension 1,250. However,

instead of paying your 1,250 pension payment you exchange

1,250 of your gross salary.

For tax year 2013/14

Your net take home pay goes up, in this example, by 150, as you

pay less tax and NICs on your reduced salary.

These figures are for illustration only. All figures are based on

annual tax allowances, NIC threshold limits and a single persons tax

allowance for the tax year 2013/14. These may be affected by future

changes in tax, National Insurance Contributions, and legislation or

by an individuals particular circumstance.

Before exchange

Basic salary 25,000

Deductions

Tax

NIC

Pension

3,112

2,069

1,000

(paid from salary after deductions)

Net take home pay 18,819

Gross pension payment 1,250

(1,000 pension payment from salary after deductions +

20% relief of 250)

After exchange

Basic salary 23,750

(25,000 salary 1,250 pension payment at source)

Deductions

Tax

NIC

Pension

2,862

1,919

0

(pension payment already deducted by employer at source)

Net take home pay 18,969

Gross pension payment 1,250

(plus any employer NIC saving reinvested into your pension)

Your guide to salary exchange 03/04

Other things you should consider include:

A reduction in your taxable salary may reduce your entitlement

to certain state benefits, such as tax credits, statutory sick pay,

maternity pay and the second state pension, as these are linked

to your total gross earnings.

Due to a change in your taxable salary, other company benefits

and the amount you can borrow may be affected.

There are no NIC savings if you earn less than the earnings

threshold, as there are no NICs to pay on earnings below this level.

Salary exchange is not suitable if your salary is reduced below

the national minimum wage as a result of joining.

Your employer may limit the number of times you can make

changes and these changes may incur a charge.

Salary exchange should not reduce your salary to the lower

earnings limit, as you would not accrue any basic state pension

for that year.

Laws and tax rules may change in the future. The information

here is based on our understanding in July 2013. Your personal

circumstances also have an impact on tax treatment.

Salary exchange: the benefits

You can use it to boost your net take home pay, while payments

to your pension stay the same.

If you earn less than the upper earnings limit, you could save

12% National Insurance on the amount you exchange.

You can exchange a portion of your salary that would ordinarily

be taxed into pension payments that are not taxed.

Your company pension is already a tax efficient way to save

for your retirement with salary exchange you can boost your

payments and benefit even more from the tax relief.

Higher and additional-rate taxpayers receive higher-rate tax

relief immediately on a personal pension rather than claiming

the further tax relief separately.

04/04

Win-Win

Salary exchange provides a simple way to boost

your pension and makes your money work harder

as you benefit from valuable tax advantages.

Its easy to arrange. Speak to your employer for

further information.

If youre not sure whether salary exchange is right for

you, you should speak to your employer or a financial

adviser. There may be a cost associated to seeking

advice from a financial adviser.

GEN753AA5 0813 2013 Standard Life

Standard Life Assurance Limited is registered in Scotland (SC286833) at Standard Life

House, 30 Lothian Road, Edinburgh EH1 2DH. Standard Life Assurance Limited is

authorised by the Prudential Regulation Authority and regulated by the Financial Conduct

Authority and the Prudential Regulation Authority. www.standardlife.co.uk

Vous aimerez peut-être aussi

- Calculate SalaryDocument15 pagesCalculate SalaryShahjahan MohammedPas encore d'évaluation

- Redundancy Payments Are TaxedDocument2 pagesRedundancy Payments Are TaxedVivian KongPas encore d'évaluation

- Year-End Tax Guide 2015/16Document10 pagesYear-End Tax Guide 2015/16api-311814387Pas encore d'évaluation

- Maximizing Your Wealth: A Comprehensive Guide to Understanding Gross and Net SalaryD'EverandMaximizing Your Wealth: A Comprehensive Guide to Understanding Gross and Net SalaryPas encore d'évaluation

- Hilton Sharp Clarke Financial Services Money Talk Winter 2014Document4 pagesHilton Sharp Clarke Financial Services Money Talk Winter 2014nathan8848Pas encore d'évaluation

- SIPP GUIDE - EVERYTHING YOU NEED TO KNOW ABOUT SELF-INVESTED PERSONAL PENSIONSDocument20 pagesSIPP GUIDE - EVERYTHING YOU NEED TO KNOW ABOUT SELF-INVESTED PERSONAL PENSIONSStephenAshtonPas encore d'évaluation

- Guide To Save Tax in UKDocument8 pagesGuide To Save Tax in UKCyrus KhanPas encore d'évaluation

- Sipp Guide UkDocument20 pagesSipp Guide UkRobertPas encore d'évaluation

- Retirement Strategies For Millennials: A Simple and Practical Plan for Retiring EarlyD'EverandRetirement Strategies For Millennials: A Simple and Practical Plan for Retiring EarlyPas encore d'évaluation

- Preparing For EOFY June 2011Document2 pagesPreparing For EOFY June 2011nsfpPas encore d'évaluation

- Landlord Tax Planning StrategiesD'EverandLandlord Tax Planning StrategiesPas encore d'évaluation

- Print Tax on savings interest_ How much tax you pay - GOV.UKDocument5 pagesPrint Tax on savings interest_ How much tax you pay - GOV.UKscribd.peworPas encore d'évaluation

- F 1040 EsDocument12 pagesF 1040 EsEndu EnduroPas encore d'évaluation

- Build Tax-Free Wealth: How to Permanently Lower Your Taxes and Build More WealthD'EverandBuild Tax-Free Wealth: How to Permanently Lower Your Taxes and Build More WealthPas encore d'évaluation

- Small Business Taxes: Putting More Money Back in Your PocketD'EverandSmall Business Taxes: Putting More Money Back in Your PocketPas encore d'évaluation

- The Income Tax 2024: A Complete Guide to Permanently Reducing Your Taxes: Step-by-Step StrategiesD'EverandThe Income Tax 2024: A Complete Guide to Permanently Reducing Your Taxes: Step-by-Step StrategiesPas encore d'évaluation

- DeductionDocument1 pageDeductionQueenie AndayaPas encore d'évaluation

- Bpen 376 ADocument16 pagesBpen 376 AJohnyMacaroniPas encore d'évaluation

- Surviving the New Tax Landscape: Smart Savings, Investment and Estate Planning StrategiesD'EverandSurviving the New Tax Landscape: Smart Savings, Investment and Estate Planning StrategiesPas encore d'évaluation

- Form 1040-ES: Purpose of This PackageDocument12 pagesForm 1040-ES: Purpose of This PackageCaliCain MendezPas encore d'évaluation

- 401(k) Plans Made Easy: Understanding Your 401(k) PlanD'Everand401(k) Plans Made Easy: Understanding Your 401(k) PlanPas encore d'évaluation

- Strategies To Pay Less TaxDocument4 pagesStrategies To Pay Less TaxblkdwgPas encore d'évaluation

- Next Level Tax Course: The only book a newbie needs for a foundation of the tax industryD'EverandNext Level Tax Course: The only book a newbie needs for a foundation of the tax industryPas encore d'évaluation

- Quick Notes on “The Trump Tax Cut: Your Personal Guide to the New Tax Law by Eva Rosenberg”D'EverandQuick Notes on “The Trump Tax Cut: Your Personal Guide to the New Tax Law by Eva Rosenberg”Pas encore d'évaluation

- En 05 10022Document2 pagesEn 05 10022Jeremy WebbPas encore d'évaluation

- Pension reforms allow over-55s full access to savingsDocument7 pagesPension reforms allow over-55s full access to savingsPriyalPatelPas encore d'évaluation

- Hilton Sharp Clarke Taking Account Spring 2014Document8 pagesHilton Sharp Clarke Taking Account Spring 2014nathan8848Pas encore d'évaluation

- 16 Don'T-Miss Tax DeductionsDocument4 pages16 Don'T-Miss Tax DeductionsGon FloPas encore d'évaluation

- Explanation of The Medical Tax CreditsDocument2 pagesExplanation of The Medical Tax CreditspttaPas encore d'évaluation

- How To Get The Most Out of Your Pension and Secure The Retirement That You Deserve2Document5 pagesHow To Get The Most Out of Your Pension and Secure The Retirement That You Deserve2Jack JamalPas encore d'évaluation

- Centorbi - AE Taxes White Paper - DL - GGDocument8 pagesCentorbi - AE Taxes White Paper - DL - GGchad centorbiPas encore d'évaluation

- US Individual RegulationDocument3 pagesUS Individual RegulationDarab AkhtarPas encore d'évaluation

- 2014 IRS Form 1040-ES Guide for Estimated Tax PaymentsDocument12 pages2014 IRS Form 1040-ES Guide for Estimated Tax PaymentsClaudia MaldonadoPas encore d'évaluation

- Year-Round Tax Saving Tips: Vow To Be More EfficientDocument4 pagesYear-Round Tax Saving Tips: Vow To Be More EfficientSrinivas ThoutaPas encore d'évaluation

- 1040 Exam Prep Module VI: Standard and Itemized DeductionsD'Everand1040 Exam Prep Module VI: Standard and Itemized DeductionsPas encore d'évaluation

- 7 Reasons to Become an Income Investor: Financial Freedom, #214D'Everand7 Reasons to Become an Income Investor: Financial Freedom, #214Pas encore d'évaluation

- A Guide To 2013 Tax Changes (And More)Document15 pagesA Guide To 2013 Tax Changes (And More)Doug PotashPas encore d'évaluation

- Make Taxes Great Again: The Good, the Bad and the Ugly About Tax ReformD'EverandMake Taxes Great Again: The Good, the Bad and the Ugly About Tax ReformPas encore d'évaluation

- Windes 2021 Year End Year Round Tax Planning GuideDocument20 pagesWindes 2021 Year End Year Round Tax Planning GuideBrian SneePas encore d'évaluation

- Viewpoint: The Value of Income ProtectionDocument8 pagesViewpoint: The Value of Income ProtectionSenecaReidPas encore d'évaluation

- National Insurance UK How-ToDocument5 pagesNational Insurance UK How-ToÁdám T. BogárPas encore d'évaluation

- 2011 Form 1040-ES (NR) Estimated Tax GuideDocument9 pages2011 Form 1040-ES (NR) Estimated Tax GuideBrokerAPas encore d'évaluation

- Money Saving Tips - A White Paper: Techniques I've Actually Used: Thinking About Money, #2D'EverandMoney Saving Tips - A White Paper: Techniques I've Actually Used: Thinking About Money, #2Pas encore d'évaluation

- KEY Tax Points From George'S Summer Budget: Owner Managed BusinessesDocument8 pagesKEY Tax Points From George'S Summer Budget: Owner Managed Businessesapi-281744226Pas encore d'évaluation

- Report Income TaxDocument6 pagesReport Income TaxLudmila DorojanPas encore d'évaluation

- Tax Planning 0611Document2 pagesTax Planning 0611GLSTaxAdviceUKPas encore d'évaluation

- Guide to Auto-Enrolment PensionsDocument5 pagesGuide to Auto-Enrolment PensionsnikPas encore d'évaluation

- Ways To Wealth - in Your 60'S Start Ensuring That Your Money Lasts Longer!Document6 pagesWays To Wealth - in Your 60'S Start Ensuring That Your Money Lasts Longer!LandaLeighPas encore d'évaluation

- Pivotal Planning Autumn EditionDocument9 pagesPivotal Planning Autumn EditionAnthony WrightPas encore d'évaluation

- Superannuation and Retirement Planning AdviceDocument16 pagesSuperannuation and Retirement Planning Adviceapi-337581948Pas encore d'évaluation

- Your RRSP Contribution LimitDocument15 pagesYour RRSP Contribution LimitMadia AbdelrahmanPas encore d'évaluation

- (Insert Your Firm's Name Here) : Guide FromDocument5 pages(Insert Your Firm's Name Here) : Guide FromHussein SeetalPas encore d'évaluation

- RRSP Quick Tips: Quick Tip #1 - Contribute Early To Maximize Your RRSPDocument2 pagesRRSP Quick Tips: Quick Tip #1 - Contribute Early To Maximize Your RRSPapi-117755361Pas encore d'évaluation

- Alliance Trust Full SIPP HandbookDocument14 pagesAlliance Trust Full SIPP Handbookrohit1000Pas encore d'évaluation

- Differentiation: Vehicle Network SolutionsDocument1 pageDifferentiation: Vehicle Network SolutionsДрагиша Небитни ТрифуновићPas encore d'évaluation

- Cs On RH IncompatibilityDocument17 pagesCs On RH IncompatibilityRupali Arora100% (2)

- 26th April 2021 ES Submission - CloudKitchens - ProfessorSriramDocument16 pages26th April 2021 ES Submission - CloudKitchens - ProfessorSriramSamarth LahotiPas encore d'évaluation

- Dwarf Boas of The Caribbean PDFDocument5 pagesDwarf Boas of The Caribbean PDFJohn GamesbyPas encore d'évaluation

- Ds 3805Document4 pagesDs 3805sparky2017Pas encore d'évaluation

- Table of Contents and Executive SummaryDocument38 pagesTable of Contents and Executive SummarySourav Ojha0% (1)

- Offshore Wind Turbine 6mw Robust Simple EfficientDocument4 pagesOffshore Wind Turbine 6mw Robust Simple EfficientCristian Jhair PerezPas encore d'évaluation

- ĐỀ CƯƠNG ANH 9 - CK2 (23-24)Document7 pagesĐỀ CƯƠNG ANH 9 - CK2 (23-24)thuyhagl2710Pas encore d'évaluation

- Expected OutcomesDocument4 pagesExpected OutcomesPankaj MahantaPas encore d'évaluation

- Marketing of Agriculture InputsDocument18 pagesMarketing of Agriculture InputsChanakyaPas encore d'évaluation

- Government of The Punjab Primary & Secondary Healthcare DepartmentDocument3 pagesGovernment of The Punjab Primary & Secondary Healthcare DepartmentYasir GhafoorPas encore d'évaluation

- WCM - March 2017-Final Version PDF - 4731677 - 01Document211 pagesWCM - March 2017-Final Version PDF - 4731677 - 01Antonio VargasPas encore d'évaluation

- Complex Numbers GuideDocument17 pagesComplex Numbers GuideGus EdiPas encore d'évaluation

- Sci7 Q1 Wk-5 Module-5Document15 pagesSci7 Q1 Wk-5 Module-5Lester Noel RosalesPas encore d'évaluation

- Capex Vs RescoDocument1 pageCapex Vs Rescosingla.nishant1245Pas encore d'évaluation

- Chapter 1Document2 pagesChapter 1Nor-man KusainPas encore d'évaluation

- Describing An Object - PPTDocument17 pagesDescribing An Object - PPThanzqanif azqaPas encore d'évaluation

- Lignan & NeolignanDocument12 pagesLignan & NeolignanUle UlePas encore d'évaluation

- 7 React Redux React Router Es6 m7 SlidesDocument19 pages7 React Redux React Router Es6 m7 Slidesaishas11Pas encore d'évaluation

- Rivalry and Central PlanningDocument109 pagesRivalry and Central PlanningElias GarciaPas encore d'évaluation

- Sceduling and Maintenance MTP ShutdownDocument18 pagesSceduling and Maintenance MTP ShutdownAnonymous yODS5VPas encore d'évaluation

- Cypress Enable Basic Rer Erence ManualDocument2 pagesCypress Enable Basic Rer Erence ManualCarlos RodasPas encore d'évaluation

- AWK and SED Command Examples in LinuxDocument2 pagesAWK and SED Command Examples in Linuximranpathan22Pas encore d'évaluation

- Product Data: T T 13 SEER Single - Packaged Heat Pump R (R - 410A) RefrigerantDocument36 pagesProduct Data: T T 13 SEER Single - Packaged Heat Pump R (R - 410A) RefrigerantJesus CantuPas encore d'évaluation

- 1 20《经济学家》读译参考Document62 pages1 20《经济学家》读译参考xinying94Pas encore d'évaluation

- Plumbing Arithmetic RefresherDocument80 pagesPlumbing Arithmetic RefresherGigi AguasPas encore d'évaluation

- Checklist For Mold RemediationDocument2 pagesChecklist For Mold Remediation631052Pas encore d'évaluation

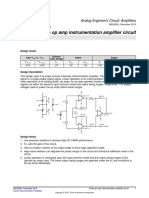

- Opamp TIDocument5 pagesOpamp TIAmogh Gajaré100% (1)

- Where Are The Women in The Water Pipeline? Wading Out of The Shallows - Women and Water Leadership in GeorgiaDocument7 pagesWhere Are The Women in The Water Pipeline? Wading Out of The Shallows - Women and Water Leadership in GeorgiaADBGADPas encore d'évaluation

- Gavrila Eduard 2Document6 pagesGavrila Eduard 2Eduard Gabriel GavrilăPas encore d'évaluation