Académique Documents

Professionnel Documents

Culture Documents

Economic Design Criteria

Transféré par

Sidharth Razdan0 évaluation0% ont trouvé ce document utile (0 vote)

51 vues10 pagesECONOMIC DESIGN CRITERIA ChE 4253 - Design I (chapter 4253) - design i) total capital investment, TCI or I (total capital investment)=(Fixed capital Investment)+ (working capital) Fixed capital Investment, FCI or I F FCI = (Direct Costs) + (indirect costs) working capital, WC or I W Cash, raw materials, stock, etc. About 10-20% of TCI.

Description originale:

Copyright

© © All Rights Reserved

Formats disponibles

PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentECONOMIC DESIGN CRITERIA ChE 4253 - Design I (chapter 4253) - design i) total capital investment, TCI or I (total capital investment)=(Fixed capital Investment)+ (working capital) Fixed capital Investment, FCI or I F FCI = (Direct Costs) + (indirect costs) working capital, WC or I W Cash, raw materials, stock, etc. About 10-20% of TCI.

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

51 vues10 pagesEconomic Design Criteria

Transféré par

Sidharth RazdanECONOMIC DESIGN CRITERIA ChE 4253 - Design I (chapter 4253) - design i) total capital investment, TCI or I (total capital investment)=(Fixed capital Investment)+ (working capital) Fixed capital Investment, FCI or I F FCI = (Direct Costs) + (indirect costs) working capital, WC or I W Cash, raw materials, stock, etc. About 10-20% of TCI.

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 10

ECONOMIC DESIGN CRITERIA

BASIC ECONOMIC TERMS

Total Capital Investment, TCI or I

(Total Capital Investment)=(Fixed Capital Investment)+

(Working Capital)

TCI = FCI + WC

Fixed Capital Investment, FCI or I

F

FCI = (Direct Costs) + (Indirect Costs)

Working Capital, WC or I

W

Cash, raw materials, stock, etc. About 10-20% of TCI.

ChE 4253 - Design I ChE 4253 - Design I

BASIC ECONOMIC TERMS

Product Cost, C

C=C

I

+C

Q

+C

O

+C

G

Fixed Charges, C

I

Do not depend on production level (insurance,

property taxes, depreciation, rent etc.)

Direct Production Cost, C

Q

Labor, utilities, raw materials, maintenance,

supplies, royalties etc.

Plant Overhead, C

O

Recreation, employee facilities, packaging etc.

General Expenses, C

G

Administration, marketing, R&D, distribution.

ChE 4253 - Design I ChE 4253 - Design I

BASIC ECONOMIC TERMS

Income from Sales, S in ($/yr)

Gross Earnings, R in ($/yr)

R = S - C

Net Earnings, P in ($/yr)

P = R - eI

F

- (R - d I

F

) t

(Net Profit) = (Gross) - (Amortization) - (Taxes)

Depreciation rate

Recovery of Investment, e

Taxation purposes, d

Straight line depreciation, e=1/n

Depreciation with capital reinvestment

(sinking fund method, i is interest)

( ) 1 1 +

=

n

i

i

e

ChE 4253 - Design I ChE 4253 - Design I

BASIC ECONOMIC TERMS (break-even chart)

ChE 4253 - Design I ChE 4253 - Design I

BASIC ECONOMIC TERMS

Salvage Value

Net cash obtainable from the sale of used property (above

charges for removal and sale)

Scrap value: Salvage value after dismantling a unit.

Present Value

Book Value : (Total Capital Investment) - (All Depreciation)

Market Value : Cash obtainable from selling the unit.

Replacement Value : Cost of obtaining the same property.

ChE 4253 - Design I ChE 4253 - Design I

BASIC ECONOMIC TERMS

Depreciation

Reduction in value due to any causes.

Example: Pump

Cost : C

V

= $12,000

Scrap value : V

S

= $2,000

Depreciation : C

V

- V

S

= $10,000

For engineers, depreciation is considered as a cost for

using the equipment.

ChE 4253 - Design I ChE 4253 - Design I

DEPRECIATION

Types Of Depreciation

Physical: Wear and Tear, corrosion, accidents,

age deterioration.

Functional: All other causes.

Obsolescence:Due to technological advances.

Depletion: Loss due to materials consumed. Applicable to

Natural Resources (timber, mineral, oil deposits)

IRS: A reasonable allowance for the exhaustion, wear and tear

of property used in the trade or business including a reasonable

allowance for obsolescence

ChE 4253 - Design I ChE 4253 - Design I

BASIC ECONOMIC TERMS

Service Life

The IRS has determined various values

(See Peters et al., 2003, for complete list).

Group 1: General Business Assets. (Office furniture,

Land, Buildings, etc)

Group 2: Non-manufacturing activities: (Agriculture,

Fishing, Mining, etc.)

Group 3: Manufacturing, e.g. Petroleum Refining: 16

years. Chemicals 11 years.

Group 4: Transportation, Communication and Public

Utilities: (Electrical, Gas, Motor transport, Radio and TV

broadcasting, railroad, etc.)

ChE 4253 - Design I ChE 4253 - Design I

BASIC ECONOMIC TERMS

Total Capital

Investment, TCI

CD

Direct

Costs

CI

Indirect

Costs

WC

Working

Capital

S, Income from sales

R

C

Product

Cost

(R-d I

F

) t

Taxes

D=e I

F

Depreciation

P, Net Earnings

FCI

CF

ChE 4253 - Design I ChE 4253 - Design I

BASIC ECONOMIC TERMS

Cumulative Cash Position (Figs 9.12, 10.1)

time

(yrs)

$

n

0

Construction

Period

Land

FCI

WC

TCI

Net

profit

over n

Annual net

profit

Economic Life of Project

Land, salvage,

and WC

Annual

depreciation

Cumulative cash position=

Net profit + depreciation - TCI

Land, salvage,

and WC

ChE 4253 - Design I ChE 4253 - Design I

Vous aimerez peut-être aussi

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Chapter 3.6part3Document14 pagesChapter 3.6part3Sidharth RazdanPas encore d'évaluation

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

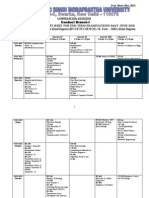

- Friday - Gta Assessment Schedule G8 HHS G9 HSS 103 HSS 104 HSSDocument4 pagesFriday - Gta Assessment Schedule G8 HHS G9 HSS 103 HSS 104 HSSSidharth RazdanPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5795)

- NPTEL - Gas SeparationDocument48 pagesNPTEL - Gas SeparationEaswaran NampoothiriPas encore d'évaluation

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Example: Adsorption and Heterogeneous ReactionsDocument10 pagesExample: Adsorption and Heterogeneous ReactionsSidharth RazdanPas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Basic Template For The TOEFL ESSAY: Write Your IntroductionDocument2 pagesBasic Template For The TOEFL ESSAY: Write Your IntroductionSidharth RazdanPas encore d'évaluation

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Profitabilty. AnalysisDocument35 pagesProfitabilty. AnalysisSidharth RazdanPas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- MinerJobs Student Guide 2011Document2 pagesMinerJobs Student Guide 2011Sidharth RazdanPas encore d'évaluation

- Top Chemical Engg Colleges in UsaDocument2 pagesTop Chemical Engg Colleges in UsaSidharth RazdanPas encore d'évaluation

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Btech. BT CT It Cse Ece UssDocument5 pagesBtech. BT CT It Cse Ece UssSidharth RazdanPas encore d'évaluation

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Treatment. Current Industrial Practice Places More Emphasis On Abatement (Also KnownDocument3 pagesTreatment. Current Industrial Practice Places More Emphasis On Abatement (Also KnownSidharth RazdanPas encore d'évaluation

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- MutualfundsDocument26 pagesMutualfundsrohith surukutlaPas encore d'évaluation

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- Order in The Matter of Capacious Farming Private LimitedDocument20 pagesOrder in The Matter of Capacious Farming Private LimitedShyam SunderPas encore d'évaluation

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Historic Returns - Large Cap Fund, Large Cap Fund Performance Tracker Mutual Funds With Highest ReturnsDocument3 pagesHistoric Returns - Large Cap Fund, Large Cap Fund Performance Tracker Mutual Funds With Highest ReturnsArsh AgarwalPas encore d'évaluation

- Madoff Trustee Vs Enrica Cotellessa-PitzDocument43 pagesMadoff Trustee Vs Enrica Cotellessa-Pitzjpeppard0% (1)

- Facts and Fantasies About Commodity Futures Ten Years LaterDocument31 pagesFacts and Fantasies About Commodity Futures Ten Years LaterSoren K. GroupPas encore d'évaluation

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Cornerstones of Financial Accounting Canadian 1st Edition Rich Test BankDocument72 pagesCornerstones of Financial Accounting Canadian 1st Edition Rich Test Banktaradavisszgmptyfkq100% (13)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- All Job OrderDocument11 pagesAll Job OrderBPH MaramagPas encore d'évaluation

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- 001 - Sah Mill DPRDocument23 pages001 - Sah Mill DPRsatyamyadav44uPas encore d'évaluation

- Solutions - Income Tax Divyastra CH 7 - PGBPDocument26 pagesSolutions - Income Tax Divyastra CH 7 - PGBPArjun ThawaniPas encore d'évaluation

- Krugman - Chap 1Document22 pagesKrugman - Chap 1Lodhi Ismail0% (1)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- COP44A - Apply For Help With Court of Protection FeesDocument4 pagesCOP44A - Apply For Help With Court of Protection FeesIvicore MusicPas encore d'évaluation

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1091)

- Trading Flag PatternDocument27 pagesTrading Flag Patternsudeshjha100% (1)

- UntitledDocument2 pagesUntitledNur AsnadirahPas encore d'évaluation

- Audit of Cash and Cash Equivalents: Problem No. 20Document6 pagesAudit of Cash and Cash Equivalents: Problem No. 20Robel MurilloPas encore d'évaluation

- 3Document1 page3Magsaysay SouthPas encore d'évaluation

- Audit Assignment For Harvey NormanDocument14 pagesAudit Assignment For Harvey Normancchiu429Pas encore d'évaluation

- Job Description IRRBBDocument2 pagesJob Description IRRBBbarmanarijit4321Pas encore d'évaluation

- Group Assignment FAR Semester 2 2020Document4 pagesGroup Assignment FAR Semester 2 2020Shamimi ShahPas encore d'évaluation

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Financial Aid: Chanell Thomas, M.Ed. Associate Director, Financial Aid and Scholarships Vanderbilt UniversityDocument31 pagesFinancial Aid: Chanell Thomas, M.Ed. Associate Director, Financial Aid and Scholarships Vanderbilt UniversityindiraPas encore d'évaluation

- Terms & Conditions: Citi Rewards Credit CardDocument3 pagesTerms & Conditions: Citi Rewards Credit CardAmarendra SinghaPas encore d'évaluation

- Fundamental AnalysisDocument73 pagesFundamental AnalysisAashutosh SinghPas encore d'évaluation

- Loan and LeasingDocument18 pagesLoan and LeasingaliffiaPas encore d'évaluation

- TVM QuestionsDocument2 pagesTVM QuestionsMuhammed RafiudeenPas encore d'évaluation

- BKM 10e Chap003 SM SelectedDocument6 pagesBKM 10e Chap003 SM SelectedahmedPas encore d'évaluation

- St. Marry Inter CollegeDocument15 pagesSt. Marry Inter CollegeSTAR PRINTINGPas encore d'évaluation

- Types of TaxesDocument58 pagesTypes of TaxesJuniorJayBPas encore d'évaluation

- Midterm Exam Portfoliomanagement Fall 2019Document3 pagesMidterm Exam Portfoliomanagement Fall 2019eya feguiriPas encore d'évaluation

- Stock PitchDocument4 pagesStock PitchthatbassdudePas encore d'évaluation

- E3 - Depreciation of Non-Current AssetsDocument35 pagesE3 - Depreciation of Non-Current Assetsanson100% (1)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- PL AA S17 Exam PaperDocument7 pagesPL AA S17 Exam PaperIsavic Alsina100% (1)