Académique Documents

Professionnel Documents

Culture Documents

Banking Licenses

Transféré par

Just ChillCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Banking Licenses

Transféré par

Just ChillDroits d'auteur :

Formats disponibles

The Reserve Bank of India (RBI) has decided today to grant in-principle approval to

two applicants viz. I!"# $i%ited and Bandhan "inancial &ervices 'rivate $i%ited to set

(p )anks (nder the *(idelines on $icensing of +ew Banks in the 'rivate &ector iss(ed

on "e)r(ary ,, ,-./ (Guidelines). These two applicants were also reco%%ended as

s(ita)le for grant of in-principle approval )y the 0igh $evel 1dvisory #o%%ittee

(0$1#) set (p )y the RBI. The 0$1# had also reco%%ended that in the case of

!epart%ent of 'osts which has applied for licence it wo(ld )e desira)le for the RBI to

consider the application separately in cons(ltation with the *overn%ent of India. The

RBI has accepted the reco%%endation of the 0$1#.

The in-principle approval granted will )e valid for a period of .2 %onths d(ring which

the applicants have to co%ply with the re3(ire%ents (nder the *(idelines and f(lfil the

other conditions as %ay )e stip(lated )y the RBI. 4n )eing satisfied that the applicants

have co%plied with the re3(isite conditions laid down )y the RBI as part of in-principle

approval they wo(ld )e considered for grant of a licence for co%%ence%ent of )anking

)(siness (nder &ection ,,(.) of the Banking Reg(lation 1ct .565. 7ntil a reg(lar

licence is iss(ed the applicants wo(ld )e )arred fro% doing )anking )(siness.

Backgro(nd

In the )(dget speech of the 7nion "inance 8inister for the year ,-.--.. it was

anno(nced inter alia that there was a need to e9tend the geographic coverage of )anks

and i%prove access to )anking services and that RBI was considering giving so%e

additional )anking licences to private sector players. &()se3(ently RBI iss(ed

*(idelines for licensing of new )anks on "e)r(ary ,, ,-./.

1fter withdrawal )y two applicants ,: applications have )een considered. "ollowing the

*(idelines a 0$1# was set (p on 4cto)er /- ,-./ chaired )y for%er RBI *overnor

!r. Bi%al ;alan and co%prising three %e%)ers (viz. &hri #.B. Bhave for%er #hair%an

&<BI= &%t. 7sha Thorat for%er !ep(ty *overnor RBI= and &hri +achiket 8or !irector

RBI #entral Board) to screen the applications and to reco%%end licences only to those

applicants who co%ply with the *(idelines.

In the first stage the applications were scr(tinised )y RBI to ens(re eligi)ility of the

applicants (nder the *(idelines. Thereafter the applications were referred to the 0$1#.

The 0$1# s()%itted its reco%%endations to RBI on "e)r(ary ,: ,-.6 for its

consideration.

The RBI assessed the 3(antitative and 3(alitative aspects of the applicants as per the

criteria laid down in the *(idelines. This incl(ded analysis of the financial state%ents of

the key entities in the gro(p .- year track record of r(nning their )(sinesses proposed

)(siness %odel for the )ank as well as the applicants> de%onstrated capa)ilities for

r(nning a )ank plan for e9panding incl(sion and c(lt(re of co%pliance and integrity

de%onstrated )y the applicant in its past activities. Based on all this the RBI took a view

of the fit and proper stat(s of the applicant.

The decision to grant in-principle approval has )een taken after cons(lting the <lection

#o%%ission given that the #ode of #ond(ct for the co%ing elections is in force.

RBI>s approach in this ro(nd of )ank licences co(ld well )e categorised as conservative.

1t a ti%e when there is p()lic concern a)o(t governance and when it co%es to licences

for entities that are inti%ately tr(sted )y the Indian p()lic this %ay well )e the %ost

appropriate stance. *oing forward RBI intends to (se the learning fro% this licensing

e9ercise to revise the *(idelines appropriately and %ove to give licences %ore reg(larly

that is virt(ally on tap. It will also fra%e categories of differentiated )ank licences

)(ilding on its prior disc(ssion paper and this will allow a wider pool of entrants into

)anking. RBI )elieves that so%e of those entities who did not 3(alify in this ro(nd for a

f(ll-fledged )anking licence co(ld well apply in f(t(re ro(nds or co(ld apply for

differentiated licences (nder the proposed fra%ework.

The RBI in its first )i-%onthly 8onetary 'olicy &tate%ent for "?.: also said that after

this ro(nd of licensing it wo(ld grad(ate to a syste% of on-tap licences that will also

incl(de differentiated )ank licences. #(rrently all )anks in India have to follow the sa%e

(niversal %odel of )eing a )anker to every inco%e or interest gro(p which %akes setting

(p a )ank a costly affair.

1fter weeks of de)ate the <lection #o%%ission has given the go ahead. @The

co%%ission is of the view that the Reserve Bank of India %ay take necessary action as

dee%ed appropriate )y the Bank as per%issi)le (nder provisions of the RBI 1ct .5/6

Banking Reg(ration 1ct .565 and or any other relevant law(s)@ the <# said .

RBI will )e granting new licences after %ore than a decade since it handed o(t licences

to YES Bank in ,--/ and Kotak Mahindra to convert itself into a )ank fro% a non-)anking

finance co%pany. The central )ank has i%posed strict capital re3(ire%ents s(ch as Rs

:-- crore capital and p(t a lot of restrictions on how other gro(p activities co(ld )e

cond(cted. @Ae are on a path where the )anking space is set to get lot %ore

co%petitive.

#leary this %ay res(lt in press(re on %argins and pricing which wo(ld )enefit

c(sto%ers@ said &(nil Ba(shal regional #<4 for India and &o(th 1sia. This %ay also

)e the final one where )anking licences )eca%e s(ch a to(gh iss(e as the

*overnor Raghuram Rajan plans to iss(e licences on tap and also for differentiated

)anking.

@Ae sho(ld not )e giving licences every .- years@ RaCan told reporters on T(esday. @&o

I think that there is scope for having people with partial licences for pay%ents or only for

lending to co%e into the syste%.

This will allow people to develop )anking capa)ilities with relatively s%all size of

operations which will then allow the% to apply for f(ll )anking licences down the line@

he said RaCan also defended his decision to cons(lt the <# even tho(gh the finance

%inister ' #hida%)ara% had opined that RBI co(ld have gone ahead )y itself even

tho(gh the code of cond(ct was in place d(e to election anno(nce%ents.

@The idea to seek per%ission or C(st to %ake s(re the election co%%ission was on )oard

was pri%arily to shield the anno(nce%ent fro% controversy so that the new licensees

donDt get dragged into the political process which co(ld happen 3(ite easily@ said

RaCan. @It is perhaps a)(ndant ca(tion@ he added.

Guidelines for Licensing of New Banks in the Private Sector

Bey feat(res of the g(idelines areE

(i) <ligi)le 'ro%otersE <ntities F gro(ps in the private sector entities in p()lic sector and

+on-Banking "inancial #o%panies (+B"#s) shall )e eligi)le to set (p a )ank thro(gh a

wholly-owned +on-4perative "inancial 0olding #o%pany (+4"0#).

(ii) G"it and 'roper> criteriaE <ntities F gro(ps sho(ld have a past record of so(nd

credentials and integrity )e financially so(nd with a s(ccessf(l track record of .- years.

"or this p(rpose RBI %ay seek feed)ack fro% other reg(lators and enforce%ent and

investigative agencies.

(iii) #orporate str(ct(re of the +4"0#E The +4"0# shall )e wholly owned )y the

'ro%oter F 'ro%oter *ro(p. The +4"0# shall hold the )ank as well as all the other

financial services entities of the gro(p.

(iv) 8ini%(% voting e3(ity capital re3(ire%ents for )anks and shareholding )y

+4"0#E The initial %ini%(% paid-(p voting e3(ity capital for a )ank shall )e H: )illion.

The +4"0# shall initially hold a %ini%(% of 6- per cent of the paid-(p voting e3(ity

capital of the )ank which shall )e locked in for a period of five years and which shall )e

)ro(ght down to .: per cent within ., years. The )ank shall get its shares listed on the

stock e9changes within three years of the co%%ence%ent of )(siness )y the )ank.

(v) Reg(latory fra%eworkE The )ank will )e governed )y the provisions of the relevant

1cts relevant &tat(tes and the !irectives 'r(dential reg(lations and other

*(idelinesFInstr(ctions iss(ed )y RBI and other reg(lators. The +4"0# shall )e

registered as a non-)anking finance co%pany (+B"#) with the RBI and will )e governed

)y a separate set of directions iss(ed )y RBI.

(vi) "oreign shareholding in the )ankE The aggregate non-resident shareholding in the

new )ank shall not e9ceed 65I for the first : years after which it will )e as per the

e9tant policy.

(vii) #orporate governance of +4"0#E 1t least :-I of the !irectors of the +4"0#

sho(ld )e independent directors. The corporate str(ct(re sho(ld not i%pede effective

s(pervision of the )ank and the +4"0# on a consolidated )asis )y RBI.

(viii) 'r(dential nor%s for the +4"0#E The pr(dential nor%s will )e applied to +4"0#

)oth on stand-alone as well as on a consolidated )asis and the nor%s wo(ld )e on

si%ilar lines as that of the )ank.

(i9) <9pos(re nor%sE The +4"0# and the )ank shall not have any e9pos(re to the

'ro%oter *ro(p. The )ank shall not invest in the e3(ity F de)t capital instr(%ents of any

financial entities held )y the +4"0#.

(9) B(siness 'lan for the )ankE The )(siness plan sho(ld )e realistic and via)le and

sho(ld address how the )ank proposes to achieve financial incl(sion.

(9i) 4ther conditions for the )ank E

The Board of the )ank sho(ld have a %aCority of independent !irectors.

The )ank shall open at least ,: per cent of its )ranches in (n)anked r(ral

centres (pop(lation (pto 5555 as per the latest cens(s)

The )ank shall co%ply with the priority sector lending targets and s()-targets as

applica)le to the e9isting do%estic )anks.

Banks pro%oted )y gro(ps having 6- per cent or %ore assetsFinco%e fro% non-

financial )(siness will re3(ire RBI>s prior approval for raising paid-(p voting

e3(ity capital )eyond H.- )illion for every )lock of H: )illion.

1ny non-co%pliance of ter%s and conditions will attract penal %eas(res incl(ding

cancellation of licence of the )ank.

(9ii) 1dditional conditions for +B"#s pro%oting F converting into a )ank E <9isting

+B"#s if considered eligi)le %ay )e per%itted to pro%ote a new )ank or convert

the%selves into )anks.

'roced(re for applicationE

In ter%s of R(le .. of the Banking Reg(lation (#o%panies) R(les .565 applications

shall )e s()%itted in the prescri)ed for% ("or% III). The eligi)le pro%oters can send

their applications for setting (p of new )anks along with other details %entioned in

1nne9 II to the *(idelines to the #hief *eneral 8anger-in-#harge !epart%ent of

Banking 4perations and !evelop%ent Reserve Bank of India #entral 4ffice .,th

"loor #entral 4ffice B(ilding 8(%)ai J 6-- --. on or )efore ;(ly . ,-./.

'roced(re for RBI decisionsE

1t the first stage the applications will )e screened )y the Reserve Bank.

Thereafter the applications will )e referred to a 0igh $evel 1dvisory #o%%ittee

the constit(tion of which will )e anno(nced shortly.

The #o%%ittee will s()%it its reco%%endations to the Reserve Bank. The

decision to iss(e an in-principle approval for setting (p of a )ank will )e taken )y

the Reserve Bank.

The validity of the in-principle approval iss(ed )y the Reserve Bank will )e one

year.

In order to ens(re transparency the na%es of the applicants will )e placed on the

Reserve Bank we)site after the last date of receipt of applications.

Backgro(nd

It %ay )e recalled that after the anno(nce%ent %ade )y the 0on>)le "inance 8inister in

his B(dget &peech for the year ,-.--.. the Reserve Bank had p(t o(t a !isc(ssion

'aper on its we)site on 1(g(st .. ,-.- inviting feed)ack and co%%ents. Thereafter

the draft g(idelines on the licensing of new )anks were released on the Reserve Bank

we)site on 1(g(st ,5 ,-.. inviting views and co%%ents. #o%%ents and s(ggestions

received on the draft g(idelines were e9a%ined and so%e of the s(ggestions were

accepted. 1fter the vital a%end%ents to the Banking Reg(lation 1ct .565 were carried

o(t in !ece%)er ,-., and after cons(lting with the *overn%ent of India the g(idelines

for $icensing of +ew Banks in the 'rivate &ector have now )een finalised.

Financial Inclusion:-

The new )anking licences iss(ed to I!"# and Bandhan "inancial &ervices 'rivate

$i%ited and the Reserve Bank>s intention to consider the application of !epart%ent of

'osts separately in cons(ltation with the #entral *overn%ent are likely to widen the

scope for financial incl(sion.

It was a long process and the RBI has done a caref(l eval(ation (sing all filters

3(antitative and 3(alitative while selecting the entities for )anking licences said

&hashwat &har%a 'artner-"inancial &ervices B'8* in India. The RBI was convinced

that these entities wo(ld )e a)le to do C(stice to the central )ank>s declared slogan

Gfinancial incl(sion> he pointed o(t.

Ahile the RBI has )een conservative in granting in-principle approval to only two

applicants in this ro(nd what is very heartening to note is the stated o(tlook to review

the g(idelines and %ake this a reg(lar process %oving towards an Gon-tap> policy

incl(ding differentiated licences said 8r. &har%a.

The new )anks added in .55/-56 were only o)ligated to open )ranches in r(ral areas.

The )anks added s()se3(ently in ,--/--6 were re3(ired to have ,: per cent )ranches

in se%i-(r)an and r(ral locations. The c(rrent g(idelines re3(ire new )anks to set (p ,:

per cent )ranches in (n-)anked r(ral locations with pop(lation (p to 5555. If we

caref(lly look at the develop%ents in the two decades this clearly indicates the foc(s

RBI is having towards incl(sive growth and financial incl(sion said Rishi *(pta #44 K

<! "I+4 'ayTech the largest )(siness correspondent in India offering a )o(3(et of

financial services.

Bandhan is well-esta)lished in r(ral parts of <astern India. It essentially caters to the

entreprene(rial F )anka)le %asses )y e9tending the% credit via Coint lia)ility gro(p

(;$*) %odel. Ahereas other typical corporate )anks find it diffic(lt to %ake r(ral

)ranches profita)le Bandhan sho(ld )e a)le to leverage its r(ral presence effectively

said 8r. *(pta. Ahat needs to )e seen is how it is a)le to cater to the )anking needs of

the B'$ sections of r(ral India he added.

Emerging cometition

Ae )elieve new entrants will take ti%e to scale (p their )ranch and lia)ility networks

and will not pose significant threat to the strong depositFretail franchises created )y other

larger )anks said 0ati% Broachwala 1nalyst Barvy &tock Broking while talking on

newly e%erging co%petition in the sector.

The RBI has also reiterated that the new )ank licences will )e an on-tap process fro%

here on. and g(idelines for the sa%e will )e iss(ed soon. 8r. Broachwala said that the

process of grad(al entry of )anks over a period of ti%e wo(ld s%oothen o(t f(t(re

co%petition in the sector and also red(ce risks of fail(re of new )anks.

Ae have a strong starting position in corporate )anking. 1s a )ank we will )e a)le to

deliver to o(r e9isting clients wider array of prod(cts. That sho(ld red(ce o(r

dependency on ter% loans and allows (s to )roaden o(r reven(e )ase fro% corporate

)anking. In parallel it is o(r goal to )(ild a depository franchise which we intend also to

enter the space of retail )ankingL to reach the goal of an (niversal )ank said RaCiv B.

$all <9ec(tive #hair%an I!"#. Ae will also have a partic(lar foc(s on )(ilding (p

)anking footprints in BharatL.going to s%aller towns and reach the (n-)anked 8r. $all

added

List of comanies that had alied:-

IDFC

Bandhan Micro Finance

* Aditya Birla Nuvo, part of the Aditya Birla conglomerate, which includes Idea

Cellularand Hindalco Industries.

* Bajaj Finance, part of the Bajaj Group, which includes motorbike maker Bajaj Auto.

* Edelweiss Financial Services, a diversified financial services firm.

* IFCIa financial consultancy and advisory company.

* Indiabulls Housing Finance Ltd, part of the Indiabulls group conglomerate.

* India Post, part of the ministry of communications and information technology.

Indian post offices offer savings schemes and sell insurance and mutual funds.

* India Infoline, part of the IIFL group, which has interests in brokerage, wealth

management, insurance and consumer loans.

* INMACS Management Services Ltd, which provides management consultancy,

corporate finance, audit, tax and legal advisory services.

* Janalakshmi Financial Services, a microfinance company.

* JM Financial. Former CitigroupCEO Vikram Pandit would become non-executive

chairman of JM's banking arm if it wins a license.

* LIC Housing Finance, a unit of Life Insurance Corp of India, the country's largest

insurer.

* L&T Finance Holdings(, part of India's largest engineering conglomerate, Larsen &

Toubro.

* Magma Fincorp, a finance company that gives loans for vehicles, gold and small

enterprises.

* Muthoot Financegives loans against gold.

* Reliance Capital, controlled by billionaire Anil Ambani. Japan's Sumitomo Mitsui

Trust Bank and Nippon Life Insurance of Japan would each own stakes of between 4

and 5 percent in the proposed bank.

* Religare Enterprises, a financial services firm controlled by the Singh brothers who

also control Fortis HealthcareU.S.-based bank Customers Bancorp Inc(CUBI.O) will

invest $51 million in the bank if the group gets a licence.

* Shriram Capital, part of the Shriram Group, which includes truck financier Shriram

Transport(SRTR.NS).

* Smart Global Ventures.

* SREI Infrastructure Finance, which mainly finances infrastructure projects.

* Suryamani Financing Co Ltd, a financial services provider.

* Tourism Finance Corp of Indiawhich provides financial services for tourism-related

activities.

* UAE Exchange India, a remittance and foreign exchange services firm.

Vous aimerez peut-être aussi

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5795)

- First Morning Technical Call 3rd February 2015Document5 pagesFirst Morning Technical Call 3rd February 2015Just ChillPas encore d'évaluation

- India Morning Bell 5th December 2014Document18 pagesIndia Morning Bell 5th December 2014Just ChillPas encore d'évaluation

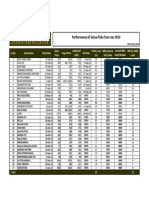

- Performance of Value Pick Since 2014-2Document1 pagePerformance of Value Pick Since 2014-2Just ChillPas encore d'évaluation

- India Morning Bell 4th December 2014Document14 pagesIndia Morning Bell 4th December 2014Just ChillPas encore d'évaluation

- Links SlideshareDocument4 pagesLinks SlideshareJust ChillPas encore d'évaluation

- Gopeekrishnan Pillai Retail ManagementDocument1 pageGopeekrishnan Pillai Retail ManagementJust ChillPas encore d'évaluation

- 1600 Amphitheatre Parkway Mountain View California: Google IncDocument7 pages1600 Amphitheatre Parkway Mountain View California: Google IncJust ChillPas encore d'évaluation

- Problems Faced by Agriculture in IndiaDocument5 pagesProblems Faced by Agriculture in IndiaJust ChillPas encore d'évaluation

- BimaruDocument2 pagesBimaruJust ChillPas encore d'évaluation

- Presentation Title Impact Assessment Of: 1. Sports Education 2. Jan Jagruti Aabhiyan 3. Project With Magic BusDocument16 pagesPresentation Title Impact Assessment Of: 1. Sports Education 2. Jan Jagruti Aabhiyan 3. Project With Magic BusJust ChillPas encore d'évaluation

- Marginal Cost Analysis: Short-Run Alternative Choice DecisionsDocument21 pagesMarginal Cost Analysis: Short-Run Alternative Choice DecisionsJust ChillPas encore d'évaluation

- Privatization of Coal Mines in IndiaDocument2 pagesPrivatization of Coal Mines in IndiaJust ChillPas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- POLS 1503 - Review QuizDocument12 pagesPOLS 1503 - Review QuizDanielle FavreauPas encore d'évaluation

- Grandparents 2Document13 pagesGrandparents 2api-288503311Pas encore d'évaluation

- DZone ScyllaDB Database Systems Trend ReportDocument49 pagesDZone ScyllaDB Database Systems Trend ReportSidharth PallaiPas encore d'évaluation

- Petersen S 4 Wheel Off Road December 2015Document248 pagesPetersen S 4 Wheel Off Road December 20154lexx100% (1)

- Chapter 3Document56 pagesChapter 3percepshanPas encore d'évaluation

- FY2011 Sked CDocument291 pagesFY2011 Sked CSunnyside PostPas encore d'évaluation

- ЛексикологіяDocument2 pagesЛексикологіяQwerty1488 No namePas encore d'évaluation

- Kansai Survival Manual CH 15Document2 pagesKansai Survival Manual CH 15Marcela SuárezPas encore d'évaluation

- Commercial Banks in IndiaDocument14 pagesCommercial Banks in IndiaAnonymous UwYpudZrAPas encore d'évaluation

- University of Lagos: Akoka Yaba School of Postgraduate Studies PART TIME 2017/2018 SESSIONDocument5 pagesUniversity of Lagos: Akoka Yaba School of Postgraduate Studies PART TIME 2017/2018 SESSIONDavid OparindePas encore d'évaluation

- Principles of PR Measurement 0 PDFDocument15 pagesPrinciples of PR Measurement 0 PDFVisai_kitasPas encore d'évaluation

- Guilatco Vs City of Dagupan Case DigestDocument1 pageGuilatco Vs City of Dagupan Case DigestYrna Caña100% (1)

- SahilDocument4 pagesSahilayushpundri914Pas encore d'évaluation

- Mastery Problem (L04, 5, 6), 27: 2,500 500 0 200 100 1,300 1,500 (Expense) 2,000 0 200 100 1,300 1,000Document2 pagesMastery Problem (L04, 5, 6), 27: 2,500 500 0 200 100 1,300 1,500 (Expense) 2,000 0 200 100 1,300 1,000Paulina OlivaresPas encore d'évaluation

- Trade Infrastructure (Maharashtra)Document5 pagesTrade Infrastructure (Maharashtra)RayPas encore d'évaluation

- SCDL Strategic ManagementDocument6 pagesSCDL Strategic ManagementMicky StarPas encore d'évaluation

- Week 5 6 Diass 3.0Document7 pagesWeek 5 6 Diass 3.0Jonathan ReyesPas encore d'évaluation

- HirarchaddonDocument5 pagesHirarchaddonawe_emPas encore d'évaluation

- TrerwtsdsDocument167 pagesTrerwtsdsvinicius gomes duartePas encore d'évaluation

- Soal Asking and Giving OpinionDocument2 pagesSoal Asking and Giving OpinionfitriaPas encore d'évaluation

- Section 6 in The Hindu Succession Act, 1956Document2 pagesSection 6 in The Hindu Succession Act, 1956Sathish KumarPas encore d'évaluation

- DigestDocument9 pagesDigestOliveros DMPas encore d'évaluation

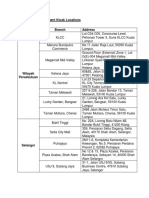

- Debit Card Replacement Kiosk Locations v2Document3 pagesDebit Card Replacement Kiosk Locations v2aiaiyaya33% (3)

- Internship Final Students CircularDocument1 pageInternship Final Students CircularAdi TyaPas encore d'évaluation

- Property Tables AnnexDocument3 pagesProperty Tables AnnexkdescallarPas encore d'évaluation

- Roman Catholic Archbishop of Manila Vs CADocument5 pagesRoman Catholic Archbishop of Manila Vs CALiaa AquinoPas encore d'évaluation

- Sunbeam Model - Fpsbcmm901Document10 pagesSunbeam Model - Fpsbcmm901Andreah YoungPas encore d'évaluation

- Aud Prob Compilation 1Document31 pagesAud Prob Compilation 1Chammy TeyPas encore d'évaluation

- UNCLOS - Salient Features, Objectives, Maritime Zones, Passages and DutiesDocument14 pagesUNCLOS - Salient Features, Objectives, Maritime Zones, Passages and DutiesGiorgi KandelakiPas encore d'évaluation

- Biomes of The WorldDocument12 pagesBiomes of The WorldOmaya Tariq100% (1)