Académique Documents

Professionnel Documents

Culture Documents

Business Law Prac Module 2

Transféré par

Laura Noel0 évaluation0% ont trouvé ce document utile (0 vote)

143 vues190 pagesBusiness Law Practice Elective Reviewer for Ateneo Law School

Copyright

© © All Rights Reserved

Formats disponibles

DOC, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentBusiness Law Practice Elective Reviewer for Ateneo Law School

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOC, PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

143 vues190 pagesBusiness Law Prac Module 2

Transféré par

Laura NoelBusiness Law Practice Elective Reviewer for Ateneo Law School

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOC, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 190

Business Law Practice Noel | Pangcog

Atty. Jose Cochingyan III AY 2011-2012

MODULE 2: THE CORPORATION AND TAXES

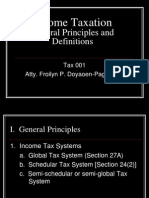

1. STATE POLICY & GENERAL PRINCIPLES OF INCOME TAXATION

RA 8424

Section 2. State Policy. - It is hereby declared the policy of

the State to promote sustainable economic growth through

the rationaliation of the Philippine internal re!enue ta"

system# including ta" administration$ to pro!ide# as much as

possible# an e%uitable relief to a greater number of ta"payers

in order to impro!e le!els of disposable income and increase

economic acti!ity$ and to create a robust en!ironment for

business to enable firms to compete better in the regional as

well as the global mar&et# at the same time that the State

ensures that 'o!ernment is able to pro!ide for the needs of

those under its (urisdiction and care.

)IR* +2,

S-*. 2,. 'eneral Principles of Income .a"ation in the

Philippines. - -"cept when otherwise pro!ided in this *ode/

0A1 A citien of the Philippines residing therein is ta"able on

all income deri!ed from sources within and without the

Philippines$

021 A nonresident citien is ta"able only on income deri!ed

from sources within the Philippines$

0*1 An indi!idual citien of the Philippines who is wor&ing

and deri!ing income from abroad as an o!erseas

contract wor&er is ta"able only on income deri!ed from

sources within the Philippines/ Pro!ided# .hat a seaman

who is a citien of the Philippines and who recei!es

compensation for ser!ices rendered abroad as a

member of the complement of a !essel engaged

e"clusi!ely in international trade shall be treated as an

o!erseas contract wor&er$

031 An alien indi!idual# whether a resident or not of the

Philippines# is ta"able only on income deri!ed from

sources within the Philippines$

0-1 A domestic corporation is ta"able on all income deri!ed

from sources within and without the Philippines$ and

041 A foreign corporation# whether engaged or not in trade or

business in the Philippines# is ta"able only on income

deri!ed from sources within the Philippines.

"------------------------------------"

2. IMPORTANT BASIC TERMS IN GENERAL (NIRC 22)

2.1 Taxa!" Y"a#

0P1 .he term 5ta"able year5 means the calendar year# or the

fiscal year ending during such calendar year# upon the

basis of which the net income is computed under this

.itle. 6.a"able year6 includes# in the case of a return

made for a fractional part of a year under the pro!isions

of this .itle or under rules and regulations prescribed by

the Secretary of 4inance# upon recommendation of the

commissioner# the period for which such return is made.

2.2 F$%&a! Y"a#

071 .he term 5fiscal year5 means an accounting period of

twel!e 0821 months ending on the last day of any month

other than 3ecember.

2.' S"&(#$)$"%

0.1 .he term 5securities5 means shares of stoc& in a

corporation and rights to subscribe for or to recei!e such

shares. .he term includes bonds# debentures# notes or

certificates# or other e!idence or indebtedness# issued

by any corporation# including those issued by a

go!ernment or political subdi!ision thereof# with interest

coupons or in registered form.

2.* O#+$,a#- I,&./"

091 .he term 5ordinary income5 includes any gain from the

sale or e"change of property which is not a capital asset

or property described in Section ,:0A1081. Any gain from

the sale or e"change of property which is treated or

considered# under other pro!isions of this .itle# as

6ordinary income6 shall be treated as gain from the sale

or e"change of property which is not a capital asset as

defined in Section ,:0A1081.

1

Business Law Practice Noel | Pangcog

Atty. Jose Cochingyan III AY 2011-2012

2.0 G#.%% I,&./" 1 22(A) & (E)(*)

S-*. 2;. Rates of Income ta" on 3omestic *orporations. -

0A1 In 'eneral. - -"cept as otherwise pro!ided in this *ode#

an income ta" of thirty-fi!e percent 0,<=1 is hereby

imposed upon the ta"able income deri!ed during each

ta"able year from all sources within and without the

Philippines by e!ery corporation# as defined in Section

22021 of this *ode and ta"able under this .itle as a

corporation# organied in# or e"isting under the laws of

the Philippines/ Pro!ided# .hat effecti!e >anuary 8#

8::8# the rate of income ta" shall be thirty-four percent

0,4=1$ effecti!e >anuary 8# 8:::# the rate shall be thirty-

three percent 0,,=1$ and effecti!e >anuary 8# 2??? and

thereafter# the rate shall be thirty-two percent 0,2=1.

In the case of corporations adopting the fiscal-year

accounting period# the ta"able income shall be

computed without regard to the specific date when

specific sales# purchases and other transactions occur.

.heir income and e"penses for the fiscal year shall be

deemed to ha!e been earned and spent e%ually for each

month of the period.

.he reduced corporate income ta" rates shall be applied

on the amount computed by multiplying the number of

months co!ered by the new rates within the fiscal year

by the ta"able income of the corporation for the period#

di!ided by twel!e.

Pro!ided# further# .hat the President# upon the

recommendation of the Secretary of 4inance# may

effecti!e >anuary 8# 2???# allow corporations the option

to be ta"ed at fifteen percent 08<=1 of gross income as

defined herein# after the following conditions ha!e been

satisfied/

081 A ta" effort ratio of twenty percent 02?=1 of 'ross

)ational Product 0')P1$

021 A ratio of forty percent 04?=1 of income ta" collection

to total ta" re!enues$

0,1 A @A. ta" effort of four percent 04=1 of ')P$ and

041 A ?.: percent 0?.:=1 ratio of the *onsolidated Public

Sector 4inancial Position 0*PS4P1 to ')P.

.he option to be ta"ed based on gross income shall be

a!ailable only to firms whose ratio of cost of sales to

gross sales or receipts from all sources does not e"ceed

fifty-fi!e percent 0<<=1.

.he election of the gross income ta" option by the

corporation shall be irre!ocable for three 0,1 consecuti!e

ta"able years during which the corporation is %ualified

under the scheme.

4or purposes of this Section# the term 6gross income6

deri!ed from business shall be e%ui!alent to gross sales

less sales returns# discounts and allowances and cost of

goods sold. 5*ost of goods sold5 shall include all

business e"penses directly incurred to produce the

merchandise to bring them to their present location and

use.

4or a trading or merchandising concern# 5cost of goods5

sold shall include the in!oice cost of the goods sold# plus

import duties# freight in transporting the goods to the

place where the goods are actually sold# including

insurance while the goods are in transit.

4or a manufacturing concern# 5cost of goods

manufactured and sold5 shall include all costs of

production of finished goods# such as raw materials

used# direct labor and manufacturing o!erhead# freight

cost# insurance premiums and other costs incurred to

bring the raw materials to the factory or warehouse.

In the case of ta"payers engaged in the sale of ser!ice#

6gross income6 means gross receipts less sales returns#

allowances and discounts.

A A A

2

Business Law Practice Noel | Pangcog

Atty. Jose Cochingyan III AY 2011-2012

0-1 Binimum *orporate Income .a" on 3omestic

*orporations. C

A A A

041 'ross Income 3efined. - 4or purposes of applying

the minimum corporate income ta" pro!ided under

Subsection 0-1 hereof# the term 6gross income6 shall

mean gross sales less sales returns# discounts and

allowances and cost of goods sold. 5*ost of goods sold6

shall include all business e"penses directly incurred to

produce the merchandise to bring them to their present

location and use.

4or a trading or merchandising concern# 5cost of goods

sold6 shall include the in!oice cost of the goods sold#

plus import duties# freight in transporting the goods to

the place where the goods are actually sold including

insurance while the goods are in transit.

4or a manufacturing concern# cost of 5goods

manufactured and sold5 shall include all costs of

production of finished goods# such as raw materials

used# direct labor and manufacturing o!erhead# freight

cost# insurance premiums and other costs incurred to

bring the raw materials to the factory or warehouse.

In the case of ta"payers engaged in the sale of ser!ice#

6gross income6 means gross receipts less sales returns#

allowances# discounts and cost of ser!ices. 5*ost of

ser!ices5 shall mean all direct costs and e"penses

necessarily incurred to pro!ide the ser!ices re%uired by

the customers and clients including 0A1 salaries and

employee benefits of personnel# consultants and

specialists directly rendering the ser!ice and 021 cost of

facilities directly utilied in pro!iding the ser!ice such as

depreciation or rental of e%uipment used and cost of

supplies/ Pro!ided# howe!er# .hat in the case of ban&s#

5cost of ser!ices5 shall include interest e"pense.

2.3 O#+$,a#- L.%%

091 D.he term 6ordinary loss6 includes any loss from the sale

or e"change of property which is not a capital asset. Any

loss from the sale or e"change of property which is

treated or considered# under other pro!isions of this

.itle# as 6ordinary loss6 shall be treated as loss from the

sale or e"change of property which is not a capital asset.

2.2 Ca4$)a! A%%")% 1 '5(A)(1)

S-*. ,:. *apital 'ains and Eosses. -

0A1 3efinitions. - As used in this .itle -

081 *apital Assets. - .he term 5capital assets5 means

property held by the ta"payer 0whether or not

connected with his trade or business1# but does not

include stoc& in trade of the ta"payer or other

property of a &ind which would properly be included

in the in!entory of the ta"payer if on hand at the

close of the ta"able year# or property held by the

ta"payer primarily for sale to customers in the

ordinary course of his trade or business# or property

used in the trade or business# of a character which is

sub(ect to the allowance for depreciation pro!ided in

Subsection 041 of Section ,4$ or real property used

in trade or business of the ta"payer.

2.6 Taxa!" I,&./" 1 '1

S-*. ,8. .a"able Income 3efined. - .he term ta"able

income means the pertinent items of gross income specified

in this *ode# less the deductions andFor personal and

additional e"emptions# if any# authoried for such types of

income by this *ode or other special laws.

2.5 7$)88.!+$,9 A9",)

0G1 .he term 5withholding agent5 means any person

re%uired to deduct and withhold any ta" under the

pro!isions of Section <;.

Business Law Practice Noel | Pangcog

Atty. Jose Cochingyan III AY 2011-2012

2.1: D$;;"#",)$a)" ")<"", Ca4$)a! A%%"% a,+ a, O#+$,a#-

A%%")

RR )o. ?;-?, 03ec. 2;# 2??21

S-*. ,. 'HI3-EI)-S I) 3-.-RBI)I)' IJ-.J-R A

PAR.I*HEAR R-AE PRKP-R.L IS A *API.AE ASS-. KR

KR3I)ARL ASS-.. C

a. .a"payers engaged in the real estate business. C Real

property shall be classified with respect to ta"payers

engaged in the real estate business as follows/

8. Real -state 3ealer. - All real properties ac%uired by

the real estate dealer shall be considered as

ordinary assets.

2. Real -state 3e!eloper. C All real properties ac%uired

by the real estate de!eloper# whether de!eloped or

unde!eloped as of the time of ac%uisition# and all

real properties which are held by the real estate

de!eloper primarily for sale or for lease to customers

in the ordinary course of his trade or business or

which would properly be included in the in!entory of

the ta"payer if on hand at the close of the ta"able

year and all real properties used in the trade or

business# whether in the form of land# building# or

other impro!ements# shall be considered as ordinary

assets.

,. Real -state Eessor. C All real properties of the real

estate lessor# whether land andFor impro!ements#

which are for leaseFrent or being offered for

leaseFrent# or otherwise for use or being used in the

trade or business shall li&ewise be considered as

ordinary assets.

4. .a"payers habitually engaged in the real estate

business. - All real properties ac%uired in the course

of trade or business by a ta"payer habitually

engaged in the sale of real estate shall be

considered as ordinary assets. Registration with the

JEHR2 or JH3** as a real estate dealer or

de!eloper shall be sufficient for a ta"payer to be

considered as habitually engaged in the sale of real

estate. If the ta"payer is not registered with the

JEHR2 or JH3** as a real estate dealer or

de!eloper# heFit may ne!ertheless be deemed to be

engaged in the real estate business through the

establishment of substantial rele!ant e!idence 0such

as consummation during the preceding year of at

least si" 0M1 ta"able real estate sale transactions#

regardless of amount$ registration as habitually

engaged in real estate business with the Eocal

'o!ernment Hnit or the 2ureau of Internal Re!enue#

etc.#1.

A property purchased for future use in the business#

e!en though this purpose is later thwarted by

circumstances beyond the ta"payerNs control# does not

lose its character as an ordinary asset. )or does a mere

discontinuance of the acti!e use of the property change

its character pre!iously established as a business

property.

b. .a"payer not engaged in the real estate business. - In

the case of a ta"payer not engaged in the real estate

business# real properties# whether land# building# or other

impro!ements# which are used or being used or ha!e

been pre!iously used in the trade or business of the

ta"payer shall be considered as ordinary assets. .hese

include buildings andFor impro!ements sub(ect to

depreciation and lands used in the trade or business of

the ta"payer.

A depreciable asset does not lose its character as an

ordinary asset# for purposes of the instant pro!ision#

e!en if it becomes fully depreciated# or there is failure to

ta&e depreciation during the period of ownership.

Bonetary consideration or the presence or absence of

profit in the operation of the property is not significant in

the characteriation of the property. So long as the

property is or has been used for business purposes#

whether for the benefit of the owner or any of its

members or stoc&holders# it shall still be considered as

an ordinary asset. Real property used by an e"empt

!

Business Law Practice Noel | Pangcog

Atty. Jose Cochingyan III AY 2011-2012

corporation in its e"empt operations# such as a

corporation included in the enumeration of Section ,? of

the *ode# shall not be considered used for business

purposes# and therefore# considered as capital asset

under these Regulations.

Real property# whether single detached$ townhouse$ or

condominium unit# not used in trade or business as

e!idenced by a certification from the 2arangay *hairman

or from the head of administration# in case of

condominium unit# townhouse or apartment# and as

!alidated from the e"isting a!ailable records of the

2ureau of Internal Re!enue# owned by an indi!idual

engaged in business# shall be treated as capital asset.

c. .a"payers changing business from real estate business

to non-real estate business. C In the case of a ta"payer

who changed its real estate business to a non-real

estate business# or who amended its Articles of

Incorporation from a real estate business to a non-real

estate business# such as a holding company#

manufacturing company# trading company# etc.# the

change of business or amendment of the primary

purpose of the business shall not result in the re-

classification of real property held by it from ordinary

asset to capital asset. 4or purposes of issuing the

certificate authoriing registration 0*AR1 or ta" clearance

certificate 0.*E1# as the case may be# the appropriate

officer of the 2IR shall at all times determine whether a

corporation purporting to be not engaged in the real

estate business has at any time amended its primary

purpose from a real estate business to a non-real estate

business.

d. .a"payers originally registered to be engaged in the real

estate business but failed to subse%uently operate. C In

the case of subse%uent non- operation by ta"payers

originally registered to be engaged in the real estate

business# all real properties originally ac%uired by it shall

continue to be treated as ordinary assets.

e. .reatment of abandoned and idle real properties. - Real

properties formerly forming part of the stoc& in trade of a

ta"payer engaged in the real estate business# or

formerly being used in the trade or business of a

ta"payer engaged or not engaged in the real estate

business# which were later on abandoned and became

idle# shall continue to be treated as ordinary assets. Real

property initially ac%uired by a ta"payer engaged in the

real estate business shall not result in its con!ersion into

a capital asset e!en if the same is subse%uently

abandoned or becomes idle.

Pro!ided howe!er# that properties classified as ordinary

assets for being used in business by a ta"payer

engaged in business other than real estate business as

defined in Section 2 0g1 hereof are automatically

con!erted into capital assets upon showing of proof that

the same ha!e not been used in business for more than

two 021 years prior to the consummation of the ta"able

transactions in!ol!ing said properties.

f. .reatment of real properties that ha!e been transferred

to a buyerFtransferee# whether the transfer is through

sale# barter or e"change# inheritance# donation or

declaration of property di!idends.

Real properties classified as capital or ordinary asset in

the hands of the sellerFtransferor may change their

character in the hands of the buyerFtransferee. .he

classification of such property in the hands of the

buyerFtransferee shall be determined in accordance with

the following rules/

8. Real property transferred through succession or

donation to the heir or donee who is not engaged in

the real estate business with respect to the real

property inherited or donated# and who does not

subse%uently use such property in trade or business#

shall be considered as a capital asset in the hands

of the heir or donee.

2. Real property recei!ed as di!idend by the

stoc&holders who are not engaged in the real estate

business and who do not subse%uently use such

real property in trade or business shall be treated as

"

Business Law Practice Noel | Pangcog

Atty. Jose Cochingyan III AY 2011-2012

capital assets in the hands of the recipients e!en if

the corporation which declared the real property

di!idend is engaged in real estate business.

,. .he real property recei!ed in an e"change shall be

treated as ordinary asset in the hands of the

transferee in the case of a ta"- free e"change by

ta"payer not engaged in real estate business to a

ta"payer who is engaged in real estate business# or

to a ta"payer who# e!en if not engaged in real estate

business# will use in business the property recei!ed

in the e"change.

g. .reatment of real property sub(ect of in!oluntary transfer.

- In the case of in!oluntary transfers of real properties#

including e"propriation or foreclosure sale# the

in!oluntariness of such sale shall ha!e no effect on the

classification of such real property in the hands of the

in!oluntary seller# either as capital asset or ordinary

asset# as the case may be.

4or e"ample# real properties forming part of the

in!entory of a real estate dealer# which are foreclosed#

shall# for purposes of determining the applicable ta" on

such foreclosure sale# be treated as ordinary assets. Kn

the other hand# the nature of such real property in the

hands of the foreclosure buyer shall be determined in

accordance with the rules stated in sub-paragraph 0f1

hereof.

"------------------------------------"

'. CORPORATIONS AND FOREIGN CORPORATIONS (NIRC 22)

'.1 P"#%.,

0A1 .he term 5person5 means an indi!idual# a trust# estate or

corporation.

'.2 C.#4.#a)$.,

021 .he term 5corporation5 shall include partnerships# no

matter how created or organied# (oint-stoc& companies#

(oint accounts 0cuentas en participacion1# association# or

insurance companies# but does not include general

professional partnerships and a (oint !enture or

consortium formed for the purpose of underta&ing

construction pro(ects or engaging in petroleum# coal#

geothermal and other energy operations pursuant to an

operating consortium agreement under a ser!ice

contract with the 'o!ernment. 5'eneral professional

partnerships5 are partnerships formed by persons for the

sole purpose of e"ercising their common profession# no

part of the income of which is deri!ed from engaging in

any trade or business.

'.' D./"%)$&

0*1 .he term 5domestic5# when applied to a corporation#

means created or organied in the Philippines or under

its laws.

'.* F.#"$9,

031 .he term 5foreign5# when applied to a corporation#

means a corporation which is not domestic.

'.0 R"%$+",) F.#"$9, C.#4.#a)$.,

0J1 .he term 5resident foreign corporation5 applies to a

foreign corporation engaged in trade or business within

the Philippines.

'.3 N.,1#"%$+",) F.#"$9, C.#4.#a)$.,

0I1 .he term 6nonresident foreign corporation6 applies to a

foreign corporation not engaged in trade or business

within the Philippines.

'.2 S8a#"8.!+"#

0B1 .he term 5shareholder5 shall include holders of a shareFs

of stoc&# warrantFs andFor optionFs to purchase shares of

#

Business Law Practice Noel | Pangcog

Atty. Jose Cochingyan III AY 2011-2012

stoc& of a corporation# as well as a holder of a unit of

participation in a partnership 0e"cept general

professional partnerships1 in a (oint stoc& company# a

(oint account# a ta"able (oint !enture# a member of an

association# recreation or amusement club 0such as golf#

polo or similar clubs1 and a holder of a mutual fund

certificate# a member in an association# (oint-stoc&

company# or insurance company.

'.6 Tax4a-"#

0)1 .he term 5ta"payer5 means any person sub(ect to ta"

imposed by this .itle.

'.5 R"9$.,a! .# A#"a H"a+=(a#)"#%

0331 .he term 5regional or area head%uarters5 shall mean a

branch established in the Philippines by multinational

companies and which head%uarters do not earn or

deri!e income from the Philippines and which act as

super!isory# communications and coordinating center for

their affiliates# subsidiaries# or branches in the Asia-

Pacific Region and other foreign mar&ets.

'.1: R"9$.,a! O4"#a)$., H"a+=(a#)"#%

0--1 .he term 5regional operating head%uarters5 shall mean

a branch established in the Philippines by multinational

companies which are engaged in any of the following

ser!ices/ general administration and planning$ business

planning and coordination$ sourcing and procurement of

raw materials and components$ corporate finance

ad!isory ser!ices$ mar&eting control and sales

promotion$ training and personnel management$ logistic

ser!ices$ research and de!elopment ser!ices and

product de!elopment$ technical support and

maintenance$ data processing and communications$ and

business de!elopment.

'.11 C./4a#" <$)8 >P8$!$44$," Na)$.,a!?

Foreign Investments Act of 1991 3(a)

.he term 5Philippine national5 shall mean a citien of the

Philippines$ of a domestic partnership or association wholly

owned by citiens of the Philippines$ or a corporation

organied under the laws of the Philippines of which at least

si"ty percent 0M?=1 of the capital stoc& outstanding and

entitled to !ote is owned and held by citiens of the

Philippines$ or a corporation organied abroad and

registered as doing business in the Philippines under the

*orporation *ode of which one hundred percent 08??=1 of

the capital stoc& outstanding and entitled to !ote is wholly

owned by 4ilipinos or a trustee of funds for pension or other

employee retirement or separation benefits# where the

trustee is a Philippine national and at least si"ty percent

0M?=1 of the fund will accrue to the benefit of Philippine

nationals/ Pro!ided# .hat where a corporation and its non-

4ilipino stoc&holders own stoc&s in a Securities and

-"change *ommission 0S-*1 registered enterprise# at least

si"ty percent 0M?=1 of the capital stoc& outstanding and

entitled to !ote of each of both corporations must be owned

and held by citiens of the Philippines and at least si"ty

percent 0M?=1 of the members of the 2oard of 3irectors of

each of both corporations must be citiens of the Philippines#

in order that the corporation# shall be considered a

5Philippine national.5

Implementing Rules and Regulations, Rule 1, 1(b)

5Philippine national5 shall mean a citien of the Philippines or

a domestic partnership or association wholly owned by the

citiens of the Philippines$ or a corporation organied under

the laws of the Philippines of which at least si"ty percent

OM?=P of the capital stoc& outstanding and entitled to !ote is

owned and held by citiens of the Philippines$ or a trustee of

funds for pension or other employee retirement or separation

benefits# where the trustee is a Philippine national and at

least si"ty percent OM?=P of the fund will accrue to the benefit

of the Philippine nationals$ Pro!ided# that where a

corporation its non-4ilipino stoc&holders own stoc&s in a

Securities and -"change *ommission OS-*P registered

enterprise# at least si"ty percent OM?=P of the capital stoc&

outstanding and entitled to !ote of both corporations must be

$

Business Law Practice Noel | Pangcog

Atty. Jose Cochingyan III AY 2011-2012

owned and held by citiens of the Philippines and at least

si"ty percent OM?=P of the members of the 2oard of 3irectors

of each of both corporation must be citiens of the

Philippines# in order that the corporation shall be considered

a Philippine national. .he control test shall be applied for this

purpose.

S! "pinion dated April 1#, 19$% (Supreme &ec'netronic !orp)

Are non-!oting shares e"cluded in the computation of the

M?F4?= 4ilipino-alien e%uity re%uirement under Section 2#

Article AII of the *onstitution of the PhilippinesQ Ihat is the

effect should non-!oting preferred shares issued to

foreigners e"ceed 4?= of the e%uity of the corporation.

Apropos of said issue# please be informed that the term

5capital5 is used synonymously with the term 5capital stoc&5

as meaning the amount subscribed and paid-in by the

shareholders# or secured to be paid in# and upon which the

corporation is to conduct its operation. 088 4letcher# *yc.

*orps.# 8:<8 Re!. @ol.# sec. <?8?# pp. 2?-281. Eegal

(urisprudence is replete with authorities to the effect that the

capital of a corporation is the fund or other property# actually

or potentially in its possession# deri!ed or to be deri!ed from

the sale by it of shares of its stoc& or his e"change by it for

property other than money. .hese funds comprise not only

money or other property recei!ed by the corporation for

shares of stoc& but all balances of purchases# money# or

installments# due the corporation for shares of stoc& sold by

it# and all unpaid subscriptions for shares. 0Iilliams !.

2rounstein# 8 42d 4;?# cited in 4letcher# Supra.1. .he capital

stoc& of a corporation is the amount paid in by its

stoc&holders in money# property# or ser!ices with which it is

to conduct its business# 5and it is immaterial how the stoc& is

classified5 0Jaggard !. Ee"ington Htilities *o.# 2M Gy 2<8# 84

SI 2d 84# citing 4letcher# *yc. *orps.# perm. ed.# sec.

<?:?1.

In !iew of the foregoing# it is opined that the term 5capital5

denotes the sum total of the shares subscribed and paid by

the shareholders# or secured to be paid# irrespecti!e of their

nomenclature to be issued by the corporation in the conduct

of its operation. Jence# non-!oting preferred shares are

considered in the computation of the M?-4?= 4ilipino-alien

e%uity re%uirement of certain economic acti!ities under the

*onstitution.

S! "pinion (o) 3*+,* (-"& .ease Finance /'ilippines)

.he term 5Philippine national5 shall mean a citien of the

Philippines$ of a domestic partnership or association wholly

owned by citiens of the Philippines$ or a corporation

organied under the laws of the Philippines of which at least

si"ty percent 0M?=1 of the capital stoc& outstanding and

entitled to !ote is owned and held by citiens of the

Philippines$ or a corporation organied abroad and

registered as doing business in the Philippines under the

*orporation *ode of which one hundred percent 08??=1 of

the capital stoc& outstanding and entitled to !ote is wholly

owned by 4ilipinos or a trustee of funds for pension or other

employee retirement or separation benefits# where the

trustee is a Philippine national and at least si"ty percent

0M?=1 of the fund will accrue to the benefit of Philippine

nationals/ Pro!ided# .hat where a corporation and its non-

4ilipino stoc&holders own stoc&s in a Securities and

-"change *ommission 0S-*1 registered enterprise# at least

si"ty percent 0M?=1 of the capital stoc& outstanding and

entitled to !ote of each of both corporations must be owned

and held by citiens of the Philippines and at least si"ty

percent 0M?=1 of the members of the 2oard of 3irectors of

each of both corporations must be citiens of the Philippines#

in order that the corporation# shall be considered a

5Philippine national.5

Applying the foregoing definition# a corporation with si"ty

percent 0M?=1 4ilipino and forty percent 04?=1 foreign e%uity

ownership is considered a Philippine national# for purposes

of in!estment. 4or as long as the percentage of 4ilipino

e%uity o!er the capital stoc& of all the corporate stoc&holders

is at least si"ty percent 0M?=1 thereof# the entire

stoc&holdings of the corporation shall be considered as of

Philippine nationality. *on!ersely# once the foreign e%uity

percentage participation increases beyond 04?=1# the

corporation shall no longer be a Philippine national under the

%

Business Law Practice Noel | Pangcog

Atty. Jose Cochingyan III AY 2011-2012

control test# but a foreign corporation co!ered by the 4oreign

In!estments Act 04IA1.

.he computation of the si"ty percent 0M?=1 4ilipino

ownership for purposes of determining whether or not a

corporation is a Philippine national is based on the total

number of outstanding capital stoc& entitled to !ote R

irrespecti!e of amount of the par !alue of the shares# < and

li&ewise regardless of whether or not such shares ha!e been

fully or partially paid

S! "pinion (o) ,9+1, (!redit 0# Finance !ompan1, Inc))

.o compute the re%uired percentage of 4ilipino ownership of

a corporation engaged in a particular industry# resort must

be had to the 8:8; *onstitution andFor the statutes enacted

by *ongress pursuant to its power to determine which areas

of in!estment may be opened to foreign participation and

which ones which should be completely reser!ed to 4ilipino

citiens# such as Republic Act )o. ;?42 or the 4oreign

In!estments Act 054IA51 including the applicable 4oreign

In!estment )egati!e Eist 054I)E51.

It is now well settled in this (urisdiction that the ownership of

the shares of stoc& of a corporation is based on the total

outstanding or subscribedFissued capital stoc& regardless of

whether they are classified as common !oting shares or

preferred shares without !oting rights. It is further said that

the test for compliance with the nationality re%uirement is

based on the total outstanding capital stoc& irrespecti!e of

the amount of the par !alue of shares# and li&ewise without

regard to whether or not such shares ha!e been fully or

partially paid. .his rule was applied in a )o!ember 2??;

opinion which e"plained that the term 5capital5 mentioned

without %ualification in Section 88# Article AII of the 8:8;

*onstitution 0which prescribes a specific e%uity

participationFstructure in a public utility1 should be interpreted

to refer to the sum total of the outstanding capital stoc&#

irrespecti!e of the nomenclature or classification as

common# preferred# !oting or non-!oting.

.he abo!e# howe!er# appears to be the general rule and is

not applicable to financing companies which are go!erned

by a more specific or special# if not stringent# re%uirement

under the 4*A. .he 4*A e"pressly mandates that the

nationality re%uirement applies only to !oting stoc&s# to wit/

5Sec. M. 4orm of organiation and capital re%uirements. R

4inancing companies shall be organied in the form of stoc&

corporations at least forty percent 04?=1 of the !oting stoc&

of which is owned by citiens of the Philippines and shall

ha!e a paid-up capital of not less than .en million pesos

0P8?#???#???1 in case the financing company is located in

Betro Banila and other first class cities# 4i!e million pesos

0P<#???#???1 in other classes of cities and .wo million fi!e

hundred thousand pesos 0P2#<??#???1 in municipalities$

Pro!ided# howe!er# .hat no foreign national may be allowed

to own stoc& in any financing company unless the country of

which he is a national accords the same reciprocal rights to

4ilipinos in the ownership of financing companies or their

counterpart entities in such a country. . . . .5

Hnder the doctrine of e%uality of shares# in the absence of

any pro!ision in the articles of incorporation and in the

certificates of stoc& to the contrary# all stoc&s# regardless of

their nomenclature# en(oy the same rights and pri!ileges#

including general !oting rights# and sub(ect to the same

liabilities. .hus# since you did not state the specific rights#

pri!ileges and liabilities# if any# that would attach to a

common share and to a preferred share under the proposed

reclassification# both classes of shares shall be considered

herein as !oting stoc&s.

S! "pinion (o) 3,+,# (2inos'ita /earls /'ilippines, Inc))

It is well-settled in this (urisdiction that the ownership of the

shares of a stoc& corporation is based on the total

outstanding or subscribedFissued capital stoc& regardless of

whether they are classified as common !oting shares or

preferred shares without !oting rights.

Kutstanding capital stoc& is defined as 5the total shares of

stoc& issued to subscribers or stoc&holders# whether or not

fully or partially paid 0as long as there is a binding

subscription agreement1 e"cept treasury shares. 0Sec. 8,;

&

Business Law Practice Noel | Pangcog

Atty. Jose Cochingyan III AY 2011-2012

of the *orporation *ode of the Philippines.1

Hnder the principle of e%uality of shares# regardless of the

classification of shares# each share is e%ual in all respects to

e!ery other share e"cept when otherwise pro!ided under the

articles of incorporation# and certificate of stoc&. .hus# the

total number of shares issued# whether !oting or non-!oting

which comprises the outstanding capital stoc& and accorded

e%ual stoc&holders rights# shall be considered in the

determination of the ownership of a corporation.

Accordingly# under the proposed increase GPPI cannot

maintain its current e%uity participation# if P;?B worth of

shares representing ;?= of the outstanding capital# as

increased# shall be subscribed by GP*E. Simply stated# the

foreign e%uity percentage participation shall be increased

from 4?= to ;?= rendering GPPI no longer a Philippine

national under the control test but a foreign corporation

co!ered by the 4oreign In!estment Act 04IA1.

S! "pinion (o) #9+,# (a 3Foundation4)

.he test for compliance with the nationality re%uirement is

based on the total outstanding capital stoc& irrespecti!e of

the amount of the par !alue of shares.

In determining the nationality of a non-stoc& corporation# the

*ommission said/

5. . . please be informed that the nationality of non-stoc&

corporation is computed on the basis of the nationality of its

members and not premised on the membership contribution.

0As aptly held in the case of Register of 3eeds !s. Hng Sui

.emple# :; Phil. p. M81

.he fact that the appellant religious corporation has no

capital stoc& does not suffice to escape the constitutional

inhibition# since it is admitted that the members are of foreign

nationality. .he purpose of the si"ty per centum re%uirement

is ob!iously to ensure that corporations or associations

allowed to ac%uire agricultural land to e"ploit natural

resources shall be controlled by 4ilipinos$ and the spirit of

the *onstitution demands that in absence of capital stoc&#

the controlling membership should be composed of 4ilipino

citiens.

Applying the afore%uoted ruling to the instant %uery# it may

be safely said that since *a!alry *hapel .raining *enter#

Inc.# is composed of fi!e members with 2 foreign and ,

4ilipino nationals# the M?= 4ilipino R 4?= foreign

membership re%uirement for ac%uisition of land in the

Philippines by a non-stoc& corporation is complied with. .he

rule therefore in this (urisdiction is that the nationality of a

non-stoc& corporation is determinable on the basis of its

membership and not on members6 contribution.5

S!+"5! "pinion (o) 1$+,% (A !onsortium for /SA.6)

.he legal capacity of the corporation to ac%uire franchise#

certificate or authority for the operation of a public utility is

regulated by the afore%uoted *onstitutional pro!ision# which

re%uires that at least si"ty per centum 0M?=1 of the capital of

such corporation be owned by citiens of the Philippines.

Jowe!er# such pro!ision does not %ualify whether the

re%uired ownership of 5capital5 shall be that of the !oting or

non-!oting# common or preferred. Jence# it should be

interpreted to refer to the sum total of the outstanding capital

stoc&# irrespecti!e of the nomenclature or classification as

common# preferred# !oting or non-!oting.

.he test for compliance with the nationality re%uirement is

based on the total outstanding capital stoc& irrespecti!e of

the amount of the par !alue of shares. 2 Stated otherwise#

once it is established that a company is at least M?= owned

by Philippine nationals# it is no longer necessary to conduct

any further in%uiry as to the owners of the shareholders

since the entire company is already considered a 4ilipino

entity.

S!+"5! "pinion (o) 1#+,$ (!ooperative for Assistance and

Relief)

.he instant %uery now centers on whether both !oting and

non-!oting shares are included in the computation of the

10

Business Law Practice Noel | Pangcog

Atty. Jose Cochingyan III AY 2011-2012

re%uired percentage of 4ilipino e%uity. As a rule# the 8:8;

*onstitution does not distinguish between !oting and non-

!oting shares with regard to the computation of the

percentage of interest by 4ilipinos and non-4ilipinos in a

company. In other words# non-!oting shares should be

included in the computation of the foreign ownership limit for

domestic corporations. .his was the rule that was applied

when this *ommission issued its opinion addressed to Bs.

Barlene *aluya of Ginoshita Pearls Philippines# Inc. It was

opined therein that the ownership of the shares of stoc& of a

corporation is based on the total outstanding or

subscribedFissued capital stoc& regardless of whether they

are classified as common !oting shares or preferred shares

without !oting rights. .his is in line with the policy of the

State to de!elop an independent national economy

effecti!ely controlled by 4ilipinos. .he *onstitution

encourages an independent and nationalist approach to

economic de!elopment. .hus# there is a need to stri&e a

balance between the encouragement of foreign in!estment

in the country and the 4ilipiniation of enterprises. .he said

rule# howe!er# is not applicable to financing companies

which are specifically go!erned by R.A. )o. <:8? as

amended. Hnder the said statute# it is e"pressly stated that

the nationality re%uirement applies only to !oting stoc&s# to

wit/

5Sec. M. 4orm of organiation and capital re%uirements. R

4inancing companies shall be organied in the form of stoc&

corporations at least forty percent 04?=1 of the !oting stoc&

of which is owned by citiens of the Philippines and shall

ha!e a paid-up capital of not less than .en million pesos

0P8?#???#???1 in case the financing company is located in

Betro Banila and other first class cities# 4i!e million pesos

0P<#???#???1 in other classes of cities and .wo million fi!e

hundred thousand pesos 0P2#<??#???1 in municipalities/

Pro!ided# howe!er# .hat no foreign national may be allowed

to own stoc& in any financing company unless the country of

which he is a national accords the same reciprocal rights to

4ilipinos in the ownership of financing companies or their

counterpart entities in such country . . .5

2ased on that# it can be said that the *ongress intends to

gi!e leeway for financing companies to increase or decrease

foreign ownership of shares for as long as the minimum

4ilipino ownership of !oting shares is complied with. .his

Kffice# thus# sees no legal obstacle in issuing all non-!oting

shares of a financing company to non-Philippine nationals

for as long as the minimum re%uirements enumerated in

Section M of R.A. )o. <:8? as amended are complied with.

In the case of *AR- Inc.# it is the opinion of this Kffice that it

can own one hundred percent 08??=1 of the non-!oting

shares of *AR- Philippines without !iolating the nationality

re%uirement as pro!ided for in the *onstitution and R.A. )o.

<:8? as amended.

S!+"5! "pinion (o) 31+1, (!o+" Small Scale 6iners

Association)

*ompliance with the re%uired 4ilipino ownership of a

corporation shall be determined on the basis of outstanding

capital stoc& whether fully paid or not# but only such stoc&s

which are generally entitled to !ote are considered.

4or stoc&s to be deemed owned and held by Philippine

citiens or Philippine nationals# mere legal title is not enough

to meet the re%uired 4ilipino e%uity. 4ull beneficial ownership

of the stoc&s# coupled with appropriate !oting rights is

essential. .hus# stoc&s# the !oting rights of which ha!e been

assigned or transferred to aliens cannot be considered held

by Philippine citiens or Philippine nationals.

Indi!iduals or (uridical entities not meeting the

aforementioned %ualifications are considered as non-

Philippine nationals.

Jowe!er# we now opine that the control test must not be

applied in determining if a corporation satisfies the

*onstitution6s citienship re%uirements in certain areas of

acti!ities. .he control test creates a legal fiction where if

M?= of the shares of an in!esting corporation are owned by

Philippine citiens then all of the shares or 8??= of that

corporation6s shares are considered 4ilipino owned for

purposes of determining the e"tent of foreign e%uity in an

in!estee corporation engaging in an acti!ity restricted to

11

Business Law Practice Noel | Pangcog

Atty. Jose Cochingyan III AY 2011-2012

Philippine citiens. In other words# Philippine citienship is

being unduly attributed to foreign indi!iduals who own the

rest of the shares in a M?= 4ilipino e%uity corporation

in!esting in another corporation. .hus# applying the control

test effecti!ely circum!ents the *onstitutional mandate that

corporations engaging in certain acti!ities must be M?=

owned by 4ilipino citiens. .he words of the *onstitution

clearly pro!ide that we must loo& at the citienship of the

indi!idualFnatural person who ultimately owns and controls

the shares of stoc&s of the corporation engaging in the

nationaliedFpartly-nationalied acti!ity. .his is what the

framers of the constitution intended. In fact# the Bining Act

strictly adheres to the te"t of the *onstitution and does not

pro!ide for the application of the control test. Indeed# the

application of the control test has no constitutional or

statutory basis. Its application is only by mere administrati!e

fiat.

Administrati!e interpretations can ne!er be allowed to

derogate from the te"t and clear intent of the *onstitution or

the statutes. An administrati!e practice that is contrary to the

constitutional and statutory pro!isions it implements does not

!est any right# and must be discontinued no matter how long

such practice has been pre!alent. .he practice of applying

the control test in determining the e"tent of foreign

participation in nationalied areas of acti!ities must be

discontinued since it actually allows corporations where the

le!el of 4ilipino ownership and control is effecti!ely less than

M?= to engage in acti!ities reser!ed by the *onstitution to

Philippine citiens or corporation that are M?= owned by

Philippine citiens. In other words# the control test effecti!ely

sanctions the circum!ention of the *onstitutional restriction.

In any case# we opine further that the *onstitution and the

statute re%uire that si"ty per cent 0M?=1 of the capital of a

mining corporation must be owned by Philippine 5citiens5

and not (ust Philippine 5nationals5 as used in other statutes

such as the 4IA. 82 In other words# the term 5Philippine

national5 as used in the 4IA is not synonymous or e%ui!alent

to the concept of 5Philippine citien5 as used in the

*onstitution and the Bining Act. .he term 5Philippine

national5 as defined under the 4IA and its implementing rules

is only applicable to entities that want to register and deri!e

benefits under the 4IA. It does not apply to entities engaging

in nationalied acti!ities or acti!ities in the so called

5negati!e lists.5

Ja!ing established that the application of the grandfather

rule# instead of the control test# is the standard consistent

with the pro!isions of the *onstitutional and the Bining Act

restricting foreign participation in a mineral production

sharing agreement# we now apply the grandfather rule to the

(oint mining !enture.

5amboa v) Finance Secretar1

'.12 C.#4.#a)$., @ C.#4.#a)$., C.+" 2

A corporation is an artificial being created by operation of

law# ha!ing the right of succession and the powers#

attributes and properties e"pressly authoried by law or

incident to its e"istence.

'.1' S).&A C.#4.#a)$., @ C.#4.#a)$., C.+" 12B 1'B 1*(6)

Stoc& corporations incorporated under this *ode shall not be

re%uired to ha!e any minimum authoried capital stoc&

e"cept as otherwise specifically pro!ided for by special law#

and sub(ect to the pro!isions of the following section.

At least twenty-fi!e percent 02<=1 of the authoried capital

stoc& as stated in the articles of incorporation must be

subscribed at the time of incorporation# and at least twenty-

fi!e 02<=1 per cent of the total subscription must be paid

upon subscription# the balance to be payable on a date or

dates fi"ed in the contract of subscription without need of

call# or in the absence of a fi"ed date or dates# upon call for

payment by the board of directors/ Pro!ided# howe!er# .hat

in no case shall the paid-up capital be less than fi!e

.housand 0P<#???.??1 pesos.

A A A

12

Business Law Practice Noel | Pangcog

Atty. Jose Cochingyan III AY 2011-2012

If it be a stoc& corporation# the amount of its authoried

capital stoc& in lawful money of the Philippines# the number

of shares into which it is di!ided# and in case the share are

par !alue shares# the par !alue of each# the names#

nationalities and residences of the original subscribers# and

the amount subscribed and paid by each on his subscription#

and if some or all of the shares are without par !alue# such

fact must be stated$

A A A

'.1* F.#"$9, C.#4.#a)$.,

!orporation !ode 103

4or the purposes of this *ode# a foreign corporation is one

formed# organied or e"isting under any laws other than

those of the Philippines and whose laws allow 4ilipino

citiens and corporations to do business in its own country or

state. It shall ha!e the right to transact business in the

Philippines after it shall ha!e obtained a license to transact

business in this country in accordance with this *ode and a

certificate of authority from the appropriate go!ernment

agency.

Implementing Rules and Regulations, Rule 1, 1(c), 1

st

7

54oreign corporation5 shall mean one which is formed#

organied or e"isting under laws other than those of the

Philippines.

'.10 B#a,&8 O;;$&"

Implementing Rules and Regulations, Rule 1, 1(c), 0

nd

7

2ranch office of a foreign company carries out the business

acti!ities of the head office and deri!es income from the host

country.

'.13 R"4#"%",)a)$C"DL$a$%., O;;$&"

Implementing Rules and Regulations, Rule 1, 1(c), 0

nd

7

Representati!e or liaison office deals directly# with the clients

of the parent company but does not deri!e income from the

host country and is fully subsidied by its head office. It

underta&es acti!ities such as but not limited to information

dissemination and promotion of the company6s products as

well as %uality control of products.

-IR Ruling 8A+393+,3 (International .egal Advocates)

It is represented that your client# Kbtech Asia Pacific Pte.

Etd. 05Kbtech51 is a foreign corporation organied and

e"isting under the laws of Singapore$ that by !irtue of S-*

Reg. )o. A 2??8;82?# the Securities and -"change

*ommission granted to your client a EI*-)S- .K

.RA)SA*. 2HSI)-SS in the Philippines in accordance

with the *orporation *ode 02atas Pambansa )o. M81 and

the 4oreign In!estment Act of 8::8 0Republic Act )o. ;?42$

that conse%uently# your client established a representati!e

office in the Philippines with address at 24th 4loor# Pacific

Star 2uilding# Ba&ati A!enue# Ba&ati *ity$ that said office

shall perform in particular acti!ities# which promote the

interests of its parent company$ that your client conducts/

81 conferences and dialogues for the purpose

disseminating information regarding the company

and its products$

21 promotion of the products and ser!ices of the

company# through the process of demonstrations$

and

,1 referral of orders and technical assistance to

persons or personnel who ha!e the re%uisite#

e"pertise and &nowledge of the products and

ser!ices.

In reply# please be informed that a representati!e office is a

non-resident foreign corporation not engaged in any income

generation business in the Philippines. As can be !iewed by

its licensed acti!ities# Kbtech is a representati!e office.

Accordingly# your client# Kbtech is not sub(ect to income ta".

1

Business Law Practice Noel | Pangcog

Atty. Jose Cochingyan III AY 2011-2012

Jence# it is e"empt from filing of the corporate income ta"

return.

A person is sub(ect to @A. if it renders ser!ice 5in the course

of trade or business5 0Section 8?<# 8::; .a" *ode1.

Inasmuch as the operation of the representati!e office is

similar to regional or area head%uarters of multinational

corporations which are e"empt from @A. under Section

8?:0p1 of the 8::; .a" *ode# representati!e offices are also

e"empt from @A.. Boreo!er# since Kbtech Banila Kffice

merely enables the o!erseas head office to maintain some

presence in the country# and is not engaged in any income-

generating acti!ity in the Philippines further %ualifies said

office for e"emption from @A.. Jowe!er# this e"emption

applies only to @A. directly due from representati!e offices.

Kn the other hand# please be ad!ised that if you will remit

technical ser!ice fees to your parent company# the said fees

are considered royalties 0Section 420A10410f1# 8::; .a"

*ode1. 2eing Philippine source income of a representati!e

office# the technical ser!ice fees are sub(ect to Philippine

corporate income ta" at the rate of ,2= 0Section 28021081#

Ibid1 which you will withhold as the payor-corporation and

paid in the same manner and sub(ect to the same conditions

as pro!ided in Section <: of the 8::; .a" *ode 0Section <8#

Ibid1 02IR Ruling )o. 8,M-8: dated >uly 4# 8:8:1.

'.12 M(!)$,a)$.,a! C./4a,- @ RA 6203 2(1)

Bultinational *ompany shall mean a foreign company or a

group of foreign companies with business establishments in

two or more countries.

'.16 R"9$.,a! .# A#"a H"a+=(a#)"#%

RA $%9* 0(0)

Regional or Area Jead%uarters 0RJ71 shall mean an office

whose purpose is to act as an administrati!e branch of a

multinational company engaged in international trade which

principally ser!es as a super!ision# communications and

coordination center for its subsidiaries# branches or affiliates

in the Asia-Pacific Region and other foreign mar&ets and

which does not earn or deri!e income in the Philippines.

(IR! 00(88)

.he term 5regional or area head%uarters5 shall mean a

branch established in the Philippines by multinational

companies and which head%uarters do not earn or deri!e

income from the Philippines and which act as super!isory#

communications and coordinating center for their affiliates#

subsidiaries# or branches in the Asia-Pacific Region and

other foreign mar&ets.

'.15 R"9$.,a! O4"#a)$,9 H"a+=(a#)"#%

RA $%9* 0(3), #

Regional Kperating Jead%uarters 0RKJ71 shall mean a

foreign business entity which is allowed to deri!e income in

the Philippines by performing %ualifying ser!ices to its

affiliates# subsidiaries or branches in the Philippines# in the

Asia-Pacific Region and in other foreign mar&ets.

Any foreign business entity formed# organied and e"isting

under any laws other than those of the Philippines may

establish a regional operating head%uarters in the

Philippines to ser!ice its own affiliates# subsidiaries or

branches in the Philippines# in the Asia-Pacific Region and

other foreign mar&ets. RKJ7s will be allowed to deri!e

income by performing the %ualifying ser!ices enumerated

under paragraph 0b1 8 hereunder. RKJ7s of non-ban&ing

and non-financial institutions are re%uired to secure a license

from the Securities and -"change *ommission# upon the

fa!orable recommendation of the 2oard of In!estments.

RKJ7s of ban&ing and financial institutions# on the other

hand# are re%uired to secure licenses from the Securities

and -"change *ommission and the 2ang&o Sentral ng

Pilipinas# upon the fa!orable recommendation of the 2oard

of In!estments.

.he following minimum re%uirements shall be complied with

by the said foreign entity/

1!

Business Law Practice Noel | Pangcog

Atty. Jose Cochingyan III AY 2011-2012

0a1 A certification from the Philippine *onsulateF -mbassy#

or a duly authenticated certification from the 3epartment

of .rade and Industry or its e%ui!alent in the foreign

firm6s home country that said foreign firm is an entity

engaged in international trade with affiliates# subsidiaries

or branch offices in the Asia-Pacific Region and other

foreign mar&ets.

0b1 A duly authenticated certification from the principal

officer of the foreign entity to the effect that the said

foreign entity has been authoried by its 2oard of

3irectors or go!erning body to establish its regional

operating head%uarters in the Philippines# specifying

that/

081 .he regional operating head%uarters may engage in

any of the following %ualifying ser!ices/

- 'eneral administration and planning$

- 2usiness planning and coordination$

- SourcingFprocurement of raw materials and

components$

- *orporate finance ad!isory ser!ices$

- Bar&eting control and sales promotion$

- .raining and personnel management$

- Eogistics ser!ices$

- Research and de!elopment ser!ices# and

product de!elopment$

- .echnical support and maintenance$

- 3ata processing and communication$ and

- 2usiness de!elopment.

RKJ7s are prohibited from offering %ualifying

ser!ices to entities other than their affiliates#

branches or subsidiaries# as declared in their

registration with the Securities and -"change

*ommission nor shall they be allowed to directly and

indirectly solicit or mar&et goods and ser!ices

whether on behalf of their mother company#

branches# affiliates# subsidiaries or any other

company.

021 .he regional operating head%uarters shall notify the

2oard of In!estments# the Securities and -"change

*ommission and the 2ang&o Sentral ng Pilipinas# as

the case may be# of any decision to close down or

suspend operations of its head%uarters at least

fifteen 08<1 days before the same is effected.

0c1 An underta&ing that the multinational company will

initially remit into the country such amount as may be

necessary to co!er its operations in the Philippines but

which amount will not be less than .wo hundred

thousand Hnited States dollars 0S2??#???1 or its

e%ui!alent in other foreign currencies.

Iithin thirty 0,?1 days from receipt of certificate of

registration# the multinational company will submit to the

Securities and -"change *ommission a certificate of

inward remittance from a local ban& showing that it has

remitted to the Philippines the amount of at least .wo

hundred thousand Hnited States dollars 0S2??#???1 or its

e%ui!alent in other foreign currencies and con!erted the

same to Philippine currency.

0d1 Any !iolation by the regional operating head%uarters of a

multinational company of the pro!isions of this *ode# or

its implementing rules and regulations# or other terms

and conditions of its registration# or any pro!ision of

e"isting laws# shall constitute a sufficient cause for the

cancellation of its license or registration.

(IR! 00()

.he term 5regional operating head%uarters5 shall mean a

branch established in the Philippines by multinational

companies which are engaged in any of the following

ser!ices/ general administration and planning$ business

planning and coordination$ sourcing and procurement of raw

materials and components$ corporate finance ad!isory

ser!ices$ mar&eting control and sales promotion$ training and

personnel management$ logistic ser!ices$ research and

de!elopment ser!ices and product de!elopment$ technical

1"

Business Law Practice Noel | Pangcog

Atty. Jose Cochingyan III AY 2011-2012

support and maintenance$ data processing and

communications$ and business de!elopment.

'.2: R"9$.,a! 7a#"8.(%" @ RA6203 2

Art. M8. 7ualifications. - A multinational company organied

and e"isting under any laws other than those of the

Philippines which is engaged in international trade and

supplies spare parts# components# semi-finished products

and raw materials to its distributors or mar&ets in the Asia-

Pacific area and other foreign areas and which has

established or will simultaneously establish a regional or

area head%uarters andFor regional operating head%uarters in

the Philippines in accordance with the pro!isions of 2oo& III

of this *ode and the rules and regulations implementing the

same may also establish a regional warehouse or

warehouses in ecoones in the Philippines# after securing a

license therefor from the Philippine -conomic 9one Authority

0P-9A1. Iith respect to regional warehouses located or will

locate in ecoones with special charters# such license shall

be secured from the concerned ecoone authorities. 4or

e"isting regional warehouses# said license shall be secured

from the 2oard of In!estments unless they choose to

relocate inside ecoones/ Pro!ided# .hat/

081 .he acti!ities of the regional warehouse shall be limited

to ser!ing as a supply depot for the storage# deposit#

safe&eeping of its spare parts# components# semi-

finished products and raw materials including the

pac&ing# co!ering# putting up# mar&ing# labelling and

cutting or altering to customer6s specification# mounting

andFor pac&aging into &its or mar&etable lots thereof# to

fill up transactions and sales made by its head offices or

parent companies and to ser!ing as a storage or

warehouse of goods purchased locally by the home

office of the multinational for e"port abroad. .he regional

warehouse shall not directly engage in trade nor directly

solicit business# promote any sale# nor enter into any

contract for the sale or disposition of goods in the

Philippines/ Pro!ided# .hat a regional warehouse may

be allowed to withdraw imported goods from said

warehouseFs for deli!ery to an authoried distributor in

the Philippines/ Pro!ided# howe!er# .hat the

corresponding ta"es# customs duties and charges under

the .ariff and *ustoms *ode ha!e been paid by the

head%uarters of the said multinational upon arri!al of

such goods/ Pro!ided# further# .hat the deli!ery of said

goods to the aforesaid distributor in the Philippines shall

be treated as a sale made by the head%uarters rather

than that of its head office# and shall be reflected in a

separate boo& of accounts# any representation as to who

is the seller to the contrary notwithstanding/ Pro!ided#

furthermore# .hat the aforementioned sale shall be

go!erned by the pro!isions on !alue-added ta" in

accordance with the )ational Internal Re!enue *ode# as

amended by Republic Act )o. 8424/ Pro!ided# finally#

.hat the income from the aforementioned sale to said

distributor shall be treated as income deri!ed by the said

head%uarters from sources within the Philippines and

shall be sub(ect to the corporate income ta" of a resident

foreign corporation under the )ational Internal Re!enue

*ode# as amended# the pro!ision of any law to the

contrary notwithstanding.

021 .he personnel of a regional warehouse will not

participate in any manner in the management of any

subsidiary# affiliate or branch office it might ha!e in the

Philippines other than the acti!ities allowed under this

Act.

0,1 .he personnel of the regional or area head%uarters or

regional operating head%uarters shall be responsible for

the operation of the regional warehouse sub(ect to the

pro!isions of this *ode.

041 .he multinational company shall pay the 2oard of

In!estments# the P-9A or concerned ecoone

authorities# as the case may be# and the appropriate

*ollector of *ustoms concerned the corresponding

license fees and storage fees to be determined by said

offices.

0<1 An application for the establishment of a regional

warehouse located outside an ecoone shall be made in

1#

Business Law Practice Noel | Pangcog

Atty. Jose Cochingyan III AY 2011-2012

writing to the 2oard of In!estments# to the P-9A# or to

concerned ecoone authorities in the case of regional

warehouses located in ecoones. .he application shall

describe the premises# the location and capacity of the

regional warehouse and the purpose for which the

building is to be used.

.he (urisdiction and responsibility of super!ising the regional

warehouses located outside ecoones shall be !ested on the

2ureau of *ustoms# and the 2oard of In!estments# or the

P-9A or concerned ecoone authorities for warehouses

within ecoones.

.he 2oard of In!estments# the P-9A or concerned ecoone

authorities# in consultation with the Regional 3irector of

*ustoms of the district where the warehouse will be situated

shall cause an e"amination of the premises to be made and

if found satisfactory# it may authorie its establishment

without complying with the re%uirements of any other

go!ernment body# sub(ect to the following conditions/

081 .hat the articles to be stored in the warehouse are spare

parts# components# semi-finished products and raw

materials of the multinational company operator for

distribution and supply to its Asia-Pacific and other

foreign mar&ets including pac&aging# co!erings# brands#

labels and warehouse e%uipment as pro!ided in Article

M:0a1 hereof$

021 .hat the entry or importation# storage or re-e"port of the

goods destined for or to be stored in the regional

warehouse will not in!ol!e any dollar outlay from

Philippine sources$

0,1 .hat they are of such character as to be readily

identifiable for re-e"port$ and in case of local distribution

they shall be sub(ect to Article M8081# Article M:

paragraph 0b1 and the guidelines implementing 2oo& I@

of this *ode$

041 .hat it shall file an ordinary warehousing bond in an

amount e%ual to one hundred percent 08??=1 of the

ascertained customs duties on the articles imported

without pre(udice to its filing a general warehousing bond

in lieu of the ordinary warehousing bond$

0<1 .he percentage of annual allowable withdrawal from

warehouses located outside ecoones for domestic use

shall be sub(ect to the appro!al of the 2oard of

In!estments# or of the P-9A or concerned ecoone

authorities with respect to warehouses located within the

ecoones of their (urisdiction/ Pro!ided# howe!er# .hat in

the case of e"isting warehouses# in no case shall their

withdrawals e"ceed thirty percent 0,?=1 of the !alue of

goods they ha!e brought in for any gi!en year and the

payment of the corresponding ta"es and duties shall

ha!e been made upon the arri!al of such goods

imported/ Pro!ided# further# .hat the P-9A or concerned

ecoone authorities may allow withdrawal e"ceeding

thirty percent 0,?=1 of the !alue of goods under such

terms and conditions the P-9A or concerned ecoone

authorities may impose.

Art. M:. .a" .reatment of Imported Articles in the Regional

Iarehouse. -

0a1 .a" Incenti!es for 7ualified 'oods 3estined for

Ree"portation to the Asia-Pacific and Kther 4oreign

Bar&ets. - -"cept as otherwise pro!ided in this *ode#

imported spare parts# components# semi-finished

products# raw materials and other items including any

pac&ages# co!erings# brands and labels and warehouse

e%uipment as may be allowed by the 2oard of

In!estments# the P-9A or concerned ecoone

authorities# as the case may be# for use e"clusi!ely on

the goods stored# e"cept those prohibited by law#

brought into the regional warehouse from abroad to be

&ept# stored andFor deposited or used therein and re-

e"ported directly therefrom under the super!ision of the

*ollector of *ustoms concerned for distribution to its

Asia-Pacific and other foreign mar&ets in accordance

with the guidelines implementing 2oo& I@ of this *ode

including to a bonded manufacturing warehouse in the

Philippines and e!entually re-e"ported shall not be

1$

Business Law Practice Noel | Pangcog

Atty. Jose Cochingyan III AY 2011-2012

sub(ect to customs duty# internal re!enue ta"# e"port ta"

nor to local ta"es# the pro!isions of law to the contrary

notwithstanding.

0b1 Payment of Applicable 3uties and .a"es on 7ualified

'oods Sub(ect to Eaws and Regulations *o!ering

Imported Berchandise if 3estined for the Eocal Bar&et. -

Any spare parts# components# semi-finished products#

raw materials and other items sent# deli!ered# released

or ta&en from the regional warehouse to the local mar&et

in accordance with the guidelines implementing 2oo& I@

of this *ode shall be sub(ect to the payment of income

ta"es# customs duties# ta"es and other charges pro!ided

for under Section M8 hereof and for which purpose# the

proper commercial in!oice of the head offices or parent

companies shall be submitted to the *ollector of

*ustoms concerned$ and shall be sub(ect to laws and

regulations go!erning imported merchandise/ Pro!ided#

.hat in case any of the foregoing items are sold#

bartered# hired or used for purposes other than they

were intended for without prior compliance with the

guidelines implementing 2oo& I@ of this *ode and

without prior payment of the duty# ta" or other charges

which would ha!e been due and payable at the time of

entry if the articles had been entered without the benefit

of this Krder# shall be sub(ect to forfeiture and the

importation shall constitute a fraudulent practice against

customs re!enue punishable under Section ,M?2# as

amended# of the .ariff and *ustoms *ode of the

Philippines/ Pro!ided# further# .hat a sale pursuant to a

(udicial order shall not be sub(ect to the preceding

pro!iso without pre(udice to the payment of duties# ta"es

and other charges.

Art. ;?. -"emption 4rom the Ba"imum Storage Period

Hnder the .ariff and *ustoms *ode$ Period of Storage in the

Regional Iarehouse. - .he pro!ision of the law in Section

8:?8 of the .ariff and *ustoms *ode of the Philippines# as

amended# to the contrary notwithstanding# articles duly

entered for warehousing may remain in the regional

warehouses for a period of two 021 years from the time of

their transfer to the regional warehouse# which period may

be e"tended with the appro!al of the 2oard of In!estments

for an additional period of one 081 year upon payment of the

corresponding storage fee on the une"ported articles# as

pro!ided for under Article M8041 for each e"tension until they

are re-e"ported in accordance with the guidelines

implementing 2oo& I@ of this *ode. Any articles withdrawn#

released or remo!ed contrary to the pro!isions of said

guidelines shall be forfeited pursuant to the pro!isions of

Article M:# paragraph 0b1 hereof.

Art. ;8. Rules and Regulations on the >urisdiction# Kperation

and *ontrol K!er 7ualified 'oods in the Regional

Iarehouse. - .he 2oard of In!estments# the P-9A#

concerned ecoone authorities and the 2ureau of *ustoms

shall (ointly issue special rules and regulations on the

recei!ing# handling# custody# entry# e"amination#

classifications# deli!ery# storage# warehousing# manipulation

and pac&aging# release for ree"portation or for importation

and deli!ery to a Philippine distributor and for the

safe&eeping# recording# in!entory and li%uidation of said

%ualified goods# any e"isting law notwithstanding. Such rules

and regulations shall be formulated in consultation with the

applicantsFoperators of regional warehouses.

Art. ;2. *ancellation of Eicense or Registration. - Any willful

!iolation by the regional or area head%uarters or regional

operating head%uarters of a multinational company which

has established a regional warehouse or warehouses

contrary to or in !iolation of the pro!isions of e"isting laws

and the implementing guidelines of 2oo& I@ of this *ode

shall constitute a sufficient cause for the cancellation of its

license or registration in addition to the penalties

hereinabo!e pro!ided in Article M:# paragraph 0b1 hereof.

.he 2oard# the P-9A or concerned ecoone authorities# as

the case may be# shall ha!e the authority to impose such

fines in amounts that are (ust and reasonable in cases of late

submission or non-compliance on the part of registered

enterprises# with reporting and other re%uirements under this

*ode and its implementing rules and regulations.

'.21 D./"%)$& Ma#A") E,)"#4#$%"

1%

Business Law Practice Noel | Pangcog

Atty. Jose Cochingyan III AY 2011-2012

Foreign Investments Act 3(f)

.he term 5domestic mar&et enterprise5 shall mean an

enterprise which produces goods for sale# or renders

ser!ices to the domestic mar&et entirely or if e"porting a

portion of its output fails to consistency e"port at least si"ty

percent 0M?=1 thereof.

'.22 I,C"%)/",)

Foreign Investments Act 3(b)

.he term 5in!estment5 shall mean e%uity participation in any

enterprise organied or e"isting under the laws of the

Philippines.

Implementing Rules and Regulations, Rule 1, 1(d)

In!estment shall mean e%uity participation in any enterprise

organied or e"isting under the laws of the Philippines. It

includes both original and additional in!estments# whether

made directly as in stoc& subscription# or indirectly through

the transfer of e%uity from one in!estor to another as in stoc&

purchase. Kwnership of bonds Oincluding income bondsP#

debentures# notes or other e!idences of indebtedness does

not %ualify as in!estments.

.he purchase of stoc& options or stoc& warrants is not an

in!estment until the holder thereof e"ercises his option and

actually ac%uires stoc& from the corporation.

'.2' F.#"$9, I,C"%)/",)

Foreign Investments Act 3(c)

.he term 5foreign in!estment5 shall mean an e%uity

in!estment made by non-Philippine national in the form of