Académique Documents

Professionnel Documents

Culture Documents

Trends in Packaging R&D in The US

Transféré par

Siddu09549Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Trends in Packaging R&D in The US

Transféré par

Siddu09549Droits d'auteur :

Formats disponibles

Trends and O pportunities

in Packaging R&D in the US

Trends and O pportunities

in Packaging R&D in the US

Hauffe Niels

Technology Review 213/2007

Technology Review 213/2007

Further information:

Tekes

Anna Alasmaa

+358 10 60 25748

anna.alasmaa@tekes.fi

The Finnish Funding Agency for Technology and Innovation

Kyllikinportti 2, P.O. Box 69, FIN-00101 Helsinki, Finland

Tel. +358 1060 55000, Fax +358 9 694 9196, E-mail: tekes@tekes.fi

www.tekes.fi

August 2007

ISSN 1239-758X

ISBN 978-952-457-379-5

Trends and Opportunities

in Packaging R&D in the US

Niels Hauffe

NWV Market Discovery, Inc.

Technology Review 213/2007

Helsinki 2007

Tekes, the Finnish Funding Agency for Technology and Innovation

Tekes is the main public funding organisation for research and development

(R&D) in Finland. Tekes funds industrial projects as well as projects in re-

search organisations, and especially promotes innovative, risk-intensive

projects. Tekes offers partners fromabroad a gateway to the key technology

players in Finland.

Technology programmes Tekes choices for the greatest impact

of R&D funding

Tekes uses technology programmes to allocate its financing, networking

and expert services to areas that are important for business and society.

Programmes are launched in areas of application and technology that are in

line with the focus areas in Tekes strategy. Tekes allocates about half the fi-

nancing granted to companies, universities and research institutes through

technology programmes. Tekes technology programmes have been con-

tributing to changes in the Finnish innovation environment for twenty years.

Copyright Tekes 2007. All rights reserved.

This publication includes materials protected under copyright law, the copy-

right for which is held by Tekes or a third party. The materials appearing in

publications may not be used for commercial purposes. The contents of

publications are the opinion of the writers and do not represent the official

position of Tekes. Tekes bears no responsibility for any possible damages

arising fromtheir use. The original source must be mentioned when quoting

from the materials.

ISSN 1239-758-X

ISBN 978-952-457-379-5

Cover picture: Kylmankka design, Anton Kalland

Page layout: DTPage Oy

Foreword

Tekes has been preparing a technology programme around the theme of packaging during the year

2007 under the name Pakkaus 2015 Packaging 2015. This report of the trends and opportunities

in packaging R&D in the USA has been done as a part of the preparation of this technology

programme.

The use and the role of the packages in a whole value chain are very regionally and culturally ori-

ented. As USAoffers significant market potential and is also very much consumer oriented society,

it is very interesting object for a consumer packaging market study.

This report concerns three packaging sectors: pharmaceutical, retail food and electronics packag-

ing. It also includes the driving forces that are influencing packaging decisions made in the US to-

day. These include e.g. retailers and consumers viewpoint as well as information about consumer

studies and universal design.

Tekes would like to thank Niels Hauffe, NWV Market Discovery Inc. for conducting this survey.

We hope that this report will generate new ideas and thoughts for the Finnish packaging value

chain.

Helsinki, July 2007

Tekes The Finnish Funding Agency for Technology and Innovation

Table of Contents

Foreword

Executive Summary . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

Introduction . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

Selected Industry Statistics. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

Overview of Packaging R&D New Trends/Issues/Hot Topics . . . . . . . . . . . . 4

Pharmaceuticals Packaging . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

Retail Food Packaging . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

Electronics Packaging. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

Driving Forces from Retailers and Consumers Viewpoint . . . . . . . . . . . . . . . . 6

Retailer and Consumer Packaging Issues . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

Sustainable Packaging . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

Recycling. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

Universal Design . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

Smart (Intelligent) Packaging. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

E-Commerce . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

Consumer Studies . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

Retail Driven Change: How and Why Retailers Influence Packaging Decisions. . . . . . . . . . . . . 14

Pharmaceutical Packaging Objectives . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

The Market for Sustainable Packaging Materials . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

The Influence of Packaging on Purchasing Decisions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

Prominent Trends Affecting Food Packaging . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

Private-Label Packaging . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

Research and Development . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

Research Schools . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

Key Players . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18

Associations/Councils/Institutes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18

Appendices

Appendix A Packaging Associations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21

Appendix B Sustainable Packaging Resource Guide. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 31

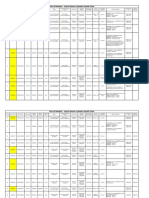

Appendix C Green Report How to Comply with Wal-Marts Scorecard . . . . . . . . . . . . . . . . 39

Appendix D Food and Drug Administration Guidance for Industry Bar Code Label

Requirements. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 45

Appendix E Glossary of Food Packaging Terms . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 52

Tekes Technology Reviews in English. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 55

Executive Summary

The packaging industry on a worldwide basis is estimated

at about $460 billion, with the US accounting for about

$127 billion or 28% of the global market.

There are many issues affecting packaging research and

development in the US, including:

Sustainable packaging;

Recycling regulations, legislation, and/or voluntary

agreements;

Consumer dynamics;

Universal design;

Smart packaging; and

E-commerce.

This report takes a preliminary look at these issues with par-

ticular emphasis on three sectors: pharmaceuticals packag-

ing, retail food packaging, and electronics packaging.

Important issues affecting pharmaceutical packaging in-

clude:

Bar coding new US Food and Drug Administration

(FDA) rules for drugs for hospital use

Anticounterfeiting RFID technologies

Encouraging compliance noncompliance with drug

regimens is an important issue throughout the healthcare

system

Cost control the rising cost of oil-based plastics is

leading to the use of new materials and packaging sys-

tems

Senior-friendly packaging rapid growth in the el-

derly population and the aging of the baby-boomgenera-

tion is increasing the importance of bringing se-

nior-friendly solutions to market.

For retail food packaging, the important issues include:

Convenience the emphasis on convenience drives

many food packaging decisions today, and is likely to

have more influence on packaging in the future than any

other factor

Intelligent packaging smart packaging provides

differentiation and added value

Environmental awareness using renewable re-

sources for packaging and reducing its environmental

impact are issues of increasing importance

Aseptic packaging long a staple in Europe, aseptic

packaging is gaining ground in the US

Case-ready packaging case-ready packaging of meat

is growing in the US and there is the opportunity here to

look for sustainable packaging options.

In the case of electronics packaging, one of the most impor-

tant issues is packaging for electrostatic discharge (ESD)

sensitive components.

Driving forces that are influencing packaging decisions in

the US today include:

Age currently, two of the most influential age groups

are tweens boys or girls between 8 and 12 and baby

boomers

Sex women make the majority of purchase decisions,

especially for a household

Ethnicity in 2007, Hispanics are expected to control

more disposable personal income than any other minor-

ity group in the US

Hard-to-open packaging in many cases, consumers

end up with what has come to be known as wrap rage

after enduring the physical and emotional struggle of

trying to separate their purchase from its plastic clam-

shell

Sustainable packaging although sustainable packag-

ing is a fairly new concept in the US, it will likely have a

substantial impact on the packaging industry. Note that

Wal-Mart, a retailer with enormous market pull, has a

sustainability initiative scheduled to begin in 2008

Recycling municipal solid waste recycling is now a

mainstream waste management tool with over 9,000

curbside programs, almost 4,000 composting facilities,

and many thousands of drop-off and buy-back centers

Universal design the integration of universal design

into packaging in the US is still relatively new; however,

the potential market is huge the 2000 Census counted

49.7 million people with some type of long-lasting con-

dition or disability

Smart (intelligent) packaging the competitive retail

climate and the rise of private labels are two reasons

leading consumer packaged goods companies to con-

sider new technologies as a way to differentiate their

products

E-commerce a survey by Strategic Analysis, forecasts

that e-commerce will grow between 16-20% per year in

the US.

There have been numerous consumer and retailer studies

regarding packaging. Of particular interest is a study enti-

tled: Retail Driven Change: How and Why Retailers In-

fluence Packaging Decisions. One of the key findings of

this study was that the most significant drivers that influ-

ence consumers are lifestyle trends of health and wellness,

convenience, and sustainability.

1

Introduction

The International Association of Packaging Research Insti-

tutes (IAPR) provides a good introduction to packaging re-

search today:

Packaging technology has gone through a fast and signifi-

cant development in recent decades; however the smartest

developments are yet to be seen. Todays modern society

depends to a large extend on the availability and use of

modern packaging technology, comprising a vast variety

of modern materials, high tech applications, and smart op-

erations. Modern packaging technology aims to meet a vast

range of requirements from providing food safety, via

low-cost storage and distribution, self-selling marketing,

and convenient consumer use to responsible waste man-

agement practices.

Good packaging facilitates a subtle cooperation between

product, packaging process, and material with the objec-

tive of fulfilling needs of all stakeholders along the supply

chain including the post-consumer waste manager.

Value chain management, product stewardship, and life

cycle management are considered key attributes that will

drive the development of future, sustainable packaging

systems. Such systems will need to go far beyond the cur-

rent waste minimization driven principles of reduce,

re-use, recycle, and recovery the 4-R waste management

hierarchy. Packaging systems that will minimize impact on

the environment, will seamlessly meet social requirements

and expectations, and will be economically effective are

the business winners of the future.

There are many issues affecting packaging research and

development in the US, including:

Sustainable packaging;

Recycling regulations, legislation, and/or voluntary

agreements;

Consumer dynamics;

Universal design;

Smart packaging; and

E-commerce.

This report will take a preliminary look at these issues with

particular emphasis on three sectors: pharmaceuticals

packaging, retail food packaging, and electronics packag-

ing.

(Note: Aglossary of food packaging terms is shown in Ap-

pendix E.)

Selected Industry Statistics

The packaging industry on a worldwide basis is esti-

mated at about $460 billion, with the US accounting for

about $127 billion or 28% of the global market.

The Flexible Packing Association, in its 2006 State of

the Flexible Packaging Industry Report, reports annual

sales in the US at $21.8 billion of which $10.6 billion is

for the retail food segment, $1.6 billion for the medical

and pharmaceutical segment, and $2.1 billion for the

consumer products segment. In terms of packaging ma-

terials, plastics (plastic resins and film and sheet) ac-

count for 69% of materials used, paper about 8%, and

foil about 4%.

A market research report by the Freedonia Group esti-

mates that domestic plastic-film demand will increase

2.6% per year to 15.2 billion pounds in 2010. Low-den-

sity polyethylene (LDPE) will remain the leading film,

accounting for 64% of the US total. Packaging made up

nearly three quarters of plastic filmuse in 2005. The best

growth is expected in secondary packaging applications

such as stretch and shrink wrap, and retail bags. Food

packaging will grow at above average rates, pushed by

continued expansion in fresh produce, confectionery,

and frozen foods.

The Freedonia Group also reports that demand for both

stand-up pouches (SUPs) and flat pouches will increase

at 6.3% per year through 2010 with sales increasing

from $4.8 billion in 2006 to $6.5 billion in 2010. Hot

end-use markets for SUPs include cheese, processed

foods, and consumer products. For flat pouches, growth

will come in such fields as fresh produce, medical and

pharmaceutical items, and consumer products.

2

The corrugated packaging industry reports that about

400 billion square feet of corrugated board a combina-

tion of at least 3 sheets of paper, collectively called

containerboard is produced annually (valued at about

$21 billion) of which the packaged food and beverages

segment accounts for about 28%.

The Paperboard Packaging Council estimates 2006 US

folding carton sales at $9.6 billion. There are approxi-

mately 300 companies whose primary business is fold-

ing cartons, but the top 5 companies account for 54% of

industry sales. The top ranked company for the last 4

years is Graphic Packaging Corporation, headquartered

in Marietta, Georgia.

According to market research by the Freedonia Group,

total US corrugated and paperboard box demand will in-

crease at 2.1% per year reaching nearly $35 billion in

2009. Retail food will remain the largest market end-

user accounting for about 40% of the total. The fastest

growing market for corrugated cases will be retail ship-

ping as the popularity of Internet shopping continues to

expand.

The US Census reports that nearly 34 billion glass con-

tainers were produced in 2005. The breakdown by end

use was: food 17%, beverages 9%, beer 55%, liquor 3%,

wine 5%, and other 11%.

3

Overview of Packaging R&D

New Trends/Issues/Hot Topics

Pharmaceuticals Packaging

There a number of important issues and trends in pharma-

ceutical packaging, including:

Bar Coding: According to the US Food and Drug Ad-

ministration (FDA) rules, Bar Code Label Require-

ments, Questions and Answers, drugs manufactured on

or after April 26, 2006 for hospital use must bear a bar

code. FDA is not recalling any drugs packaged and la-

beled without bar codes before April 26, 2006 that are

distributed and sold after April 26, 2006. All packages,

even small ones, must comply. While linear bar codes

encoded with the National Drug Code (NDC) must be

present on most prescription drug products and certain

OTCdrug products, other technologies to encode lot and

expiry-date codes may be used, too. Rule revisions may

involve newautomatic identification technologies, FDA

says. Bar coding pharmaceutical packages on the pack-

aging lineperhaps the most efficient and practical

means of adding bar codes to the unit doseremains a

challenge for some firms. (Note: FDA Guidance for In-

dustry Bar Code Label Requirements is shown in Ap-

pendix D.)

Anticounterfeiting: Pharmaceutical and Medical Pack-

aging News writes that when it comes to automatic

identification technologies, RFID has been the headline

maker in 2006. FDA has driven interest with its belief

that RFID can be used to fight counterfeiting and diver-

sion through electronic pedigrees. In addition, a spokes-

man for Cardinal Health says that anticounterfeiting

and RFID gained a lot of coverage as pedigree legisla-

tion is making its way through multiple state govern-

ments.

Encouraging Compliance: Noncompliance with drug

regimens is an issue throughout the healthcare system.

One expert says that research conducted shows wide-

spread noncompliance with prescription regimens re-

sulting in billions of dollars in unnecessary healthcare

costs. Retail pharmacies are reportedly investigating

the role unit-dose packaging can play in compliance.

Harmonizing Medical Packaging: After years of de-

bate, ISO 11607 has finally been revised. The revision is

significant for a number of reasons. Because it harmo-

nizes ISO 11607 with EN-868, Part 1, the CEN standard

for sterile medical packaging, global medical device

manufacturers will be able to follow one standard to

meet US and European laws.

Cost Control: The rising cost of oil-based plastic mate-

rials is a large concern. One expert expects to see new

materials and packaging systems that significantly de-

crease manufacturing costs. These innovations will be

driven by cooperative agreements between Medical De-

vice Manufacturers, converters, and raw material pro-

ducers. And another expert predicts that well proba-

bly start to see a shift to other-than-oil-based plastics and

paper materials.

Senior-Friendly Packaging: The need for senior- friendly

packaging that is also child-resistant has been discussed for

many years. Nowthat the over-85 group is the most rapidly

growing segment of the population in many countries, and

members of the baby-boom generation are reaching their

sixties, the issue of bringing senior-friendly solutions to

market is of increasing importance.

Retail Food Packaging

Retail food packaging has evolved considerably in recent

decades both aesthetically and functionally. Innovation in

food packaging is driven by a number of factors, including:

Convenience: The emphasis on convenience drives

many food packaging decisions today, and is likely to

have more influence on packaging in the future than any

other factor. Consumers are attracted by features like

easy-to-open/easy-to-close packaging or packaging suit-

able for direct use in ovens and microwaves. Following

are two examples of new convenience packaging:

Chicken of the Sea International is marketing shelf-

stable, retorted peel-and-eat cups of tuna and salmon.

Consumers believe cups are even more convenient

and on-the-go than retorted pouches, and this opens

up a whole new usage occasion for tuna and salmon

as eat-it-anywhere snacks.

Food packages that self-vent in the microwave are an-

other convenience-driven packaging format that is

gaining in popularity. For example, General Mills is

nowpackaging several varieties of Green Giant brand

frozen vegetables in a Simple Steam pack that has a

self-venting feature. (Note: In February 2007, the

Foodservice & Packaging Institute issued a revised

Standard Test Method to Qualify Disposables for

Use in Microwave Ovens. The full document is

available in PDF format from their website,

www.fpi.org.)

4

Intelligent packaging: Examples include packaging

that is capable of absorbing oxygen and water or indicat-

ing temperature. Innovations such as these provide

packaging with both differentiation and added value.

Environmental awareness: Two examples are packag-

ing that promotes the use of renewable resources or

packaging that reduces environmental impact by de-

creasing the thickness of materials.

Aseptic packaging: The aseptic package, long a staple

in Europe, is still little understood in the United States.

But that is changing. In 1996, the aseptic carton won the

Presidential Award for Sustainable Development, the

only package ever to receive this environmental prize. In

the US, aseptically packaged products now include

milks, juices, tomatoes, soups, broths, tofu, soy bever-

ages, wines, liquid eggs, whipping cream, and teas. In

describing their preference for aseptic packaging, Amer-

ican consumers often point to the safety, nutrition, and

ease of handling of the packages. Others prefer the asep-

tic carton because it is shatter-proof and tamper-evident.

Case-ready packaging: Case-ready packaging of fresh

meat continues to grow in the US. Vacuum packaging is

part of the mix, though it may never be popular with beef

because it deprives beef of oxygen and causes it to turn

very dark red, almost purple. The two packaging formats

that are most popular with beef are called Modified At-

mosphere Packaging (MAP) Barrier Tray and Back-

flushed Barrier Masterbag. Both provide a refrigerated

shelf life of about 10 days. In MAP Barrier Tray, a deep

drawn barrier tray is backflushed with gases that help

prolong shelf life, and the tray is then hermetically

sealed with a heat-sealed barrier lidstock. In Back-

flushed Barrier Masterbag, a large barrier bag contains

multiple units of meat in conventional foam trays and

clear film overwrap; the masterbag is backflushed and

hermetically closed, and once its opened, the individual

units have a three-day shelf life. Some retailers like the

MAP Barrier Tray approach because they dont have to

worry about the three-day shelf life of the individual

packs once the Masterbag is open. Other retailers like

the Masterbag approach because some consumers prefer

the more conventional appearance of the unit packs.

One case-ready format popular in the UK but almost

never seen in the US is a back-flushed deep-drawn alu-

minum tray with a clear barrier film heat-sealed to the

trays smooth flange. Convenience-driven, it lets con-

sumers put fresh chicken, beef, pork, or even fish in the

oven in a cooking container that can be discarded rather

than washed.

Considering how much emphasis has been placed lately

on sustainable packaging, any new technologies for

case-ready meats that can bring about source reduction

and better cube efficiencies throughout the supply chain

could be worth examining.

Electronics Packaging

One of the most important issues with electronics packag-

ing is the issue of electrostatic discharge (ESD). According

to one ESD technical consultant, improper packaging of

ESDsensitive (ESDS) components, assemblies, and equip-

ment resulting in hard and soft failures has cost both manu-

facturers and users millions of dollars, maybe even bil-

lions.

User requirements for ESD packaging include:

That it retain its ESD protective properties over a speci-

fied period of time in order to be reusable.

That it is recyclable after the useful life period ends.

That it allows for reading the assembly, circuit pack, or

plug-in bar code without having to open the container.

That is does not include over-packs for shipping unless

absolutely necessary.

That all packaging has an ESD label and a seal.

That packing containers are stackable.

Examples of available packaging include:

Corrugated containers

Plastic bags

Thermoformed plastic clamshell.

Some pros and cons associated with these types of packag-

ing include:

A corrugated container with a removable window fits

most of the user requirements. It can also have a metal

layer in the corrugation for shielding if required.

A plastic bag or clamshell will always need an over-

pack, and a paper label adhered to the bag will make it

unrecyclable.

Bar codes are often difficult to read through a thermo-

formed plastic clamshell and impossible to read through

a static shielding bag.

Bags are often not reusable because the bag is punctured

by the sharp component leads protruding from the as-

sembly solder side.

The clamshell is reusable assuming that its static

dissipative properties can be maintained. Clamshells can

be designed to be stackable, but bags are not.

A plastic bag can be designed to be a moisture barrier,

but corrugated packaging always contains some mois-

ture.

5

Driving Forces From Retailers and

Consumers Viewpoint

Retailer and Consumer Packaging Issues

Demographics have a large influence on the needs and

preferences of consumers and retailers.

Age: Some markets to consider here are:

Tweens boys or girls between the ages of 8 and 12

affect the spending of billions of dollars each year.

According to one source, tweens spend $51 billion

each year of their own money and influence about

$170 billion spent on them. Packaging is a big

differentiator between products for teens and adults

and those aimed at tweens. For example, lip gloss co-

mes in a mock plastic cell phone and bright eye shad-

ows and shimmer powders come in multi-compart-

ment packages that double as purses. According to

the president of The Consumer Network, to be ap-

pealing to this market, packaging has to be cool.

This of course presents endless packaging possibili-

ties and may require a lot of experimentation with

materials, shapes, colors, and labels. Apparently, one

key factor recently has been portability. Tweens pre-

fer products they can throw in their backpacks or

pockets to show off to friends.

Baby boomers represent about 78 million Americans

one of the largest buying groups in the US and

some $46 billion in sales. This growing senior popu-

lation doesnt think old; they think young. However,

there are realities, such as diminishing eyesight that

need to be addressed by packaging. Certain package

characteristics cater to this group. Ergonomic design

and easy-open closures help those with decreased

hand strength, and larger print on labels is inherently

inviting to this audience.

Sex: Women make the majority of purchase decisions,

especially for a household. According to one source,

women are expected to control 60% of US private

wealth by 2010. The most highly rated packaging char-

acteristics for women are convenience, ease of storage,

and female-friendly elements such as size of the package

and handles for carrying

Ethnicity: The 2006 Minority Buying Power Report

forecasts that Hispanic buying power will exceed $863

billion in 2007. And at the same time, Hispanics are ex-

pected to control more disposable personal income than

any other minority group in the US. The difficulty in

marketing to this group is that they are frommany differ-

ent countries, each with its own interest and preferences.

The president of Creative Packaging Solutions suggests

that successful packaging requires tailoring themto each

sub-population and then distributing them geographi-

cally. For example, on the west coast the predominant

population is Mexican; whereas in south Florida, its

Cuban and Columbian, and in New York, its Puerto Ri-

can and Dominican. Bilingual packages are a necessity,

and its essential to have a correct translation.

Another major issue with consumers is

Hard-to-open packaging: In many cases, consumers

end up with what has come to be known as wrap rage

after enduring the physical and emotional struggle of

trying to separate their purchase from its plastic clam-

shell. The main reasons for this type of packaging are to

prevent shoplifting, protect the product, and keep chil-

dren out. According to Consumer Reports, the worst of-

fenders for hard-to-open packaging in 2006 were

The clamshell,

Toy packaging that features excessive plastic and

wire restraints,

CD packaging with its unfriendly tape seal, and

Blister packs for pills.

Approaches to solve this problem include:

The Nestl company initiative to make its products

easier to open that includes both easy-open features

and on-pack text or pictograms to illustrate their use.

For some products, Costco has switched from clam-

shells to a new theft-resistant, easier-to-open form of

packaging a coated paperboard called Natralock

thats sealed to a plastic bubble.

For pharmaceutical companies, the problem is to

make child-resistant packages that are easy to open

for seniors. Research by Cardinal Health has shown

that kids will use anything available to open pack-

ages, including their teeth, and that children can be as

strong as seniors. However, children typically lack an

adults dexterity and the ability to perform a two-

handed opening action. So the companys senior-

friendly, child-resistant blister packs incorporate

multiple-action opening features. To use the Cardinal

Health Pill Calendar, for example, the consumer

slides a release mechanism with one hand and pushes

the tablet through the foil backing with the other

hand.

6

Sustainable Packaging

Although sustainable packaging is a fairly new concept in

the US, it good well have a substantial impact on the pack-

aging industry. It is especially noteworthy that Wal-Mart, a

retailer with enormous market pull, has a sustainability ini-

tiative scheduled to begin in 2008 (see below).

The Sustainable Packaging Coalition (SPC) is an indus-

try working group inspired by cradle-to-cradle principles

and dedicated to creating a more robust environmental vi-

sion for packaging. Through informed design practice,

supply chain collaboration, education, and innovation, the

coalition strives to transform packaging into a system that

encourages an economically prosperous and sustainable

flow of materials, creating lasting value for present and fu-

ture generations.

The Sustainable Packaging Coalition envisions a world

where all packaging is sourced responsibly, designed to be

effective and safe throughout its life cycle, meets market

criteria for performance and cost, is made entirely using re-

newable energy and, once used, is recycled efficiently to

provide a valuable resource for subsequent generations. In

summary: a true cradle-to-cradle systemfor all packaging.

The SPC mission is to advocate and communicate a posi-

tive, robust environmental vision for packaging and to sup-

port innovative, functional packaging materials and sys-

tems that promote economic and environmental health

through supply chain collaboration.

In 2005, the SPCcompleted version 1.0 of the Definition of

Sustainable Packaging. This definition represents an im-

portant first step in articulating a common understanding of

the term sustainable packaging. It provides a common

vision and a framework for understanding activities di-

rected toward improving packaging and continues to in-

form the future vision of the coalition and its individual

member-companies. Sustainable packaging:

Is beneficial, safe & healthy for individuals and

communities throughout its life cycle;

Meets market criteria for performance and cost;

Is sourced, manufactured, transported, and recycled

using renewable energy;

Maximizes the use of renewable or recycled source

materials;

Is manufactured using clean production technologies

and best practices;

Is made from materials healthy in all probable end of

life scenarios;

Is physically designed to optimize materials and energy;

and

Is effectively recovered and utilized in biological and/or

industrial cradle-to-cradle cycles.

Cradle-to-Cradle Packaging: Cradle-to-cradle design

means literally designing waste right out of the lifecycle of

the package. Mimicking nature, a package is designed to be

either a technical nutrient that can be reused, or truly recy-

cled in a tight, closed-loop process with zero loss in mate-

rial performance, or a biological nutrient that can safely

break down into the soil.

By contrast, traditional cradle-to-grave design practically

guarantees a product or package will end up as unwanted

waste that must be dealt with at some cost to the end user.

Plus, the manufacturer loses the economic value of reusing

the material.

The originators of this cradle-to-cradle concept, architect

William McDonough and chemist Michael Braungart, re-

cently published a book on the subject called Cradle to

Cradle: Remaking the Way We Make Things. Packaging is

an area thats well suited to the cradle-to-cradle design con-

cept, the authors say. They contend that cradle-to-cradle

design has the potential to expand, not reduce, the choices

of materials available to package designers. They say pack-

aging can be designed to be an asset after use, rather than a

liability, for customers. Finally, they argue that cradle-to-

cradle packaging can cost the same or less than the packag-

ing it replaces.

Instead of focusing on the moral argument, which tradi-

tionally pits environmentalism against business interests,

the authors have made a compelling business argument for

ecologically intelligent products and packaging that are

also good for the bottom line. For most packaging users,

suppliers, and consumers, cost outweighs the environment

as a purchasing factor. But the authors insist eco-effective

packaging can be the same or cheaper compared to tradi-

tional packaging. That is one of the most important argu-

ments, yet its the hardest one to prove, because the idea is

still so new. And it runs contrary to the industrys experi-

ence with most new forms of, say, biodegradable packag-

ing, which typically cost more, not less, than traditional

materials.

Wal-Marts Sustainability Initiative (the following is

taken from Wal-Marts website):

September 22, 2006 Wal-Mart Stores, Inc. today an-

nounced plans to measure its 60,000 worldwide suppliers

on their ability to develop packaging and conserve natural

resources. This initiative, scheduled to begin in 2008, is

projected to reduce overall packaging by five percent. The

announcement came at the conclusion of the Clinton

Global Initiative in New York City.

In addition to preventing millions of pounds of trash from

reaching landfills, the initiative is projected to save

667,000 metric tons of carbon dioxide fromentering the at-

mosphere. This is equal to taking 213,000 trucks off the

road annually, and saving 323,800 tons of coal and 66.7

million gallons of diesel fuel from being burned. This ini-

tiative will also create $10.98 billion in savings, just froma

7

5 percent reduction in 10 percent of the global packaging

industry. Wal-Mart alone is poised to save $3.4 billion.

Packaging is where consumers and suppliers come to-

gether and can have a real impact both on business effi-

ciency and environmental stewardship, said Wal-Mart

CEO H. Lee Scott. Even small changes to packaging have

a significant ripple effect. Improved packaging means less

waste, fewer materials used, and savings on transportation,

manufacturing, shipping and storage.

On November 1, 2006, Wal-Mart will introduce a packag-

ing scorecard to more than 2,000 private label suppliers.

This is a tool that will allow Wal-Mart buyers to have all

the information about packaging alternatives or more sus-

tainable packaging materials in one place, allowing them

to make better purchasing decisions.

On February 1, 2007, tools and processes will be made

available to all of the companys global suppliers. For 12

months, these suppliers will learn and share results within

this process. And beginning in 2008, Wal-Mart will mea-

sure and recognize the entire worldwide supply base for us-

ing less packaging, utilizing more effective materials in

packaging, and sourcing these materials more efficiently

through a packaging scorecard.

Wal-Mart Sustainable Packaging Value Network, a group

of 200 leaders in the global packaging industry, is leading

the project. This group includes representatives from gov-

ernment, NGOs, academia and industry.

(Note: See Appendix C: Green ReportHow to Comply

with Wal-Marts Scorecard.)

HP focuses on materials innovation and design for

recyclability (the following is excerpted from an article in

Packaging World Magazine, May 2007):

Early in February, Hewlett-Packard Companys Imaging

and Printing Supplies business made an announcement that

would be the envy of any organization committed to both

sustainable practices and a healthy bottom line.

The company said its redesigned ink and toner supplies

packaging will:

Eliminate the use of nearly 15 million pounds of materi-

als, including 3 million pounds of corrugated board in

2007

Eliminate the use of more than 6.8 million pounds of

PVC through material reduction and substitution of re-

cycled content, both paperboard and plastic

Reduce overall package weight for inkjet cartridge

multi-packs by 80 percent and quadruple the number of

packages that can be carried per truckload

In club stores, tri-packs will be stacked three high versus

two high for the current generation, and the number of

packages per foot of retail shelf space will increase as

well

Reduce LaserJet toner packaging 45 percent by weight

and improve by 30 percent the number of toner packages

per pallet

Corresponding savings in shelf space will be 30 percent

The redesigned packaging is not only about being green,

but at the same time, and justifiably so, about benefits to

the bottom line. Just think of all that material HP doesnt

have to buy, process, and transport, not to mention increas-

ing the number of products per foot of retail and club store

shelf space. Scott Canonico, manager, Environmental Pol-

icy and Strategy for HPs printing and supplies business,

put these developments into context. There are three areas

of priority focus across HP in terms of sustainable prac-

ticesenergy efficiency, materials innovation, and design

for recyclability.

In terms of materials innovation and recyclability, Ca-

nonico said the company is moving away froma number of

packaging materials, including PVC, and discovering

greater uses for recycled content. He says, We are looking

to find ways to do more, or the same, with less. When we

reduce the size and weight of packaging, we take positive

steps forward.

Jill Wollam, who holds a packaging degree from Michigan

State University and a packaging professional certification

from the IOPP, is a packaging engineer and new product

planner for HPs LaserJet supplies business. She advises

packaging organizations to begin the sustainable process

by benchmarking where the organization is today in terms

of materials, package size, and recyclability. Wollam sug-

gests packaging teams first of all work to improve bench-

mark scores on new packages:

Increasing the content of recycled materials

Designing smaller and lighter packaging that adequately

protects the product, while decreasing transportation im-

pacts and improving customer usability

Creating greater end-of-life recyclability.

Wollam adds that while size reduction is a straightforward

concept, its implementation can be complex. You have to

achieve balance in size reduction, ensuring that smaller

packaging meets product protection, transportation, retail

handling, marketing, customer usability, and customer dis-

posal or return standards, she says. You cant solve one

problemsizeand then create other problems. Wollam

said that one of the keys to size reduction is working with

suppliers to identify new alternatives in cushioning.

(Note: See Appendix B: Sustainable Packaging Resource

Guide.)

8

Recycling

According to a 2004 report by the Waste Policy Center,

America has made great strides in dealing with municipal

solid waste (MSW, trash, garbage) in the last 10-15 years.

Major accomplishments include:

Attainment of EPAs national recycling goal of 25%

Development of stringent regulations for landfills and

municipal solid waste combustors

Significant reduction in the weight of packaging and

products (e.g., 2-liter PET bottles have reduced in

weight from 65g in 1980 to 47g in 2002 and glass soda

bottles have reduced from 255g to 165g over the same

period).

MSW recycling is now a mainstream waste management

tool with over 9,000 curbside programs, almost 4,000 com-

posting facilities, and many thousands of drop-off and

buy-back centers, material recovery facilities, and scrap

dealers. The percentage of certain packaging materials that

are recycled (for 2002) is as follows:

Corrugated boxes: 70%

Steel cans: 59%

Aluminum cans: 47%.

Many residential recycling programs can only accept PET

and HDPE beverage containers frozen food trays, marga-

rine tubs and other food containers come in too many col-

ors to be cost effectively collected in most communities.

The recycling symbol incorporated into the plastic resin

identification codes is only meant to help consumers and

recyclers sort plastic containers. It does not mean all local

recycling programs collect each type of container. There

may not be markets close enough to be cost-efficient.

Resin codes are shown below:

PET Polyethylene Terephthalate two-liter bev-

erage bottles, mouthwash bottles, boil-in- bag

pouches.

HDPE High Density Polyethylene milk jugs,

trash bags, detergent bottles.

PVC Polyvinyl Chloride cooking oil bottles,

packaging around meat.

LDPE Low Density Polyethylene grocery

bags, produce bags, food wrap, bread bags.

PP Polypropylene yogurt containers, shampoo

bottles, straws, margarine tubs, diapers.

PS Polystyrene hot beverage cups, take-home

boxes, egg cartons, meat trays, cd cases.

OTHER all other types of plastics or packaging

made from more than one type of plastic.

Government Accountability Office (GAO)

Study: Although recycling can generate environmental and

economic benefits, the national recycling rate has in-

creased only slightly since 2000, according to the Environ-

mental Protection Agency (EPA). While local govern-

ments have the primary role in operating recycling pro-

grams, EPA and the Department of Commerce (Com-

merce) have some legal responsibilities for encouraging re-

cycling. GAO was asked to (1) identify key practices cities

are using to increase recycling, (2) describe what EPA and

Commerce are doing to encourage recycling, and (3) iden-

tify federal policy options that could help increase recy-

cling. GAO interviewed recycling coordinators in 11 large

cities about key practices and 13 additional recycling

stakeholders about policy options.

Key findings from the report release in December 2006 in-

cluded:

Recycling coordinators with whom GAO spoke in se-

lected cities across the country identified several key

practices they are using to increase recycling in their cit-

ies. The three practices they cited most frequently were

(1) making recycling convenient and easy for their resi-

dents, (2) offering financial incentives for recycling,

such as allowing residents who produce less waste

through recycling to use smaller garbage cans and pay

lower fees, and (3) conducting public education and out-

reach. In addition, both recycling coordinators and the

recycling literature identified other ways to increase re-

cycling, such as targeting a wide range of materials for

recycling and extending recycling programs to the com-

mercial sector.

The recycling stakeholders GAO interviewed identified

various federal policy options that they believe could

help municipalities increase their recycling rates. The

three federal policy options cited most frequently were

to (1) establish a nationwide campaign to educate the

public about recycling, (2) enact a national bottle bill

in which beverage containers may be returned for

money, and (3) require manufacturers to establish sys-

tems that consumers can use to recycle their products.

Other identified policy options included facilitating the

sharing of recycling best practices among municipali-

ties, expanding EPA research on the economic and envi-

ronmental benefits of recycling, and providing addi-

tional grant money for recycling projects.

Bottle Bills: The term bottle bill is actually another way

of saying container deposit law. A container deposit law

requires a minimum refundable deposit on beer, soft drink,

and other beverage containers in order to ensure a high rate

of recycling or reuse.

9

1

2

3

4

5

6

7

Today, 11 states have a deposit law requiring refundable

deposits on certain beverage containers California, Con-

necticut, Delaware, Hawaii, Iowa, Maine, Massachusetts,

Michigan, New York, Oregon, and Vermont. No state de-

posit lawhas ever been repealed. In fact, several states have

expanded their laws to cover beverages such as juice and

sports drinks, teas, and bottled water beverages that did

not exist when most bottle bills were passed.

Seven states report a reduction of beverage container litter

ranging from70-83%, and a reduction in total litter ranging

from30-47%after implementation of a bottle bill. High re-

cycling rates were also achieved.

As examples, the at-a-glance versions of the bottle bills

in California and Massachusetts are shown below:

Packaging environmental efficiency study: A 56-page

study that takes a careful, measured look at environmental

efficiency for various formats was released earlier this

year.

The study comprises a look at 52 of the highest-volume

product categories from four types of retailers: supermar-

kets, mass/general merchandise, drug/health & beauty aid,

and club stores. The formula used in the study to determine

packaging efficiency is:

Amount of packaging per equivalent unit of product - (mi-

nus) Amount diverted by recycling or use of post-con-

sumer recycled materials (whichever is greater) = Amount

landfilled (or Net discards).

Major findings

The best way to reduce net discards is through the use of

flexible packaging.

While not as significant a factor as source reduction, re-

cycling can play a prominent role in reducing discards.

Larger sizes are significantly more efficient than their

smaller counterparts, regardless of material type.

Products to which water is added at the point of use, or

removed at the point of manufacture, are significantly

more efficient than similar products that are purchased

in liquid or moist form.

10

California

Law: California Beverage Container Recycling and Litter

Reduction Act (AB 2020)

Purpose: To encourage recycling and reduce litter

Enacted: Legislative process, September 29, 1986.

Implemented: September 1, 1987; Expanded in 2000 to

include all non-carbonated, non-alcoholic beverages,

except milk. Updated in 2006 to increase deposit value

Beverage container material types in the program:

Aluminum, glass, plastic, and bi-metal.

Beverages covered: Beer and other malt beverages, soft

drinks, wine and distilled spirit coolers, carbonated mineral

water, soda water, noncarbonated water, fruit drinks, some

vegetable juices, coffee and tea beverages, and sport drinks.

Amount of deposit: 5 under 24 oz., 10 over 24 oz.

Unredeemed Deposits: returned to a state-managed fund

Unique features:

Containers are returned to redemption centers instead of

retailers.

Unclaimed redemption payments go towards program ad-

ministration, grants to nonprofits and other organizations,

recycling and education programs, and reimbursement to

municipal governments curbside programs for the contain-

ers they collect.

Refillable containers are exempt.

State government, not private industry, oversees the

Program and controls the operating funds.

Beverage manufacturers pay Processing Fees to offset

recyclers costs when the cost of recycling exceeds the

value of material.

Glass container manufacturers must use a minimumamount

of recycled glass to produce new containers.

Administering agency: Department of Conservation

Massachusetts

Law: Beverage Container Recovery Law

Purpose: To provide an economic incentive for consumers

to return used beverage containers and encourage conserva-

tion of materials and energy through recycling and reuse

Enacted: Became law by legislative override of the gover-

nors veto in 1981. Survived repeal by referendum effort in

1982 by a 60% to 40% vote.

Implemented: January 1983

Containers covered: Beer, soft drink, and carbonated water

Amount of deposit: 5 cents

Handling fee: 2.25 cents per container (originally 1 cent)

Unique features:

Wholesalers are required to file monthly reports with the

Department of Revenue regarding deposits received and re-

funds given.

The escheat amendment passed in 1989 (implemented in

1990) made all unredeemed deposits the property of the

state of 1990. Originally, escheats were earmarked for

MSW-related education only. Escheats were changed to the

general fund in 2003.

Administering agency: Department of Environmental

Protection (DEP)

While there may be value in the use of materials made

fromrenewable resources, it is not apparent when exam-

ining packaging from an efficiency standpoint.

The rise of single-serve items, especially for snack

foods, has the potential to increase waste.

Some major conclusions

Reducing packaging weight continues to offer signifi-

cant opportunities to minimize net discards, regardless

of the materials.

Product-to-package weight ratio is an excellent indicator

to using when making topline decisions about packaging

efficiencies.

Consumer goods marketers should be encouraged to de-

velop and aggressively promote flexible packaging, con-

centrates and refills, dry mixes, and larger sizes for ap-

propriate applications.

Universal Design

The term universal design was first coined in 1985 by

Ron Mace, an American architect and designer. Mace de-

fined the concept as the design of all products and envi-

ronments to be usable by people to the greatest extent pos-

sible without the need for adaptation or specialized de-

sign. Products that are designed universally reach the

largest possible audience by going beyond the needs and

abilities of average, healthy adults to include seniors,

children, and those with motor and sensory disabilities.

The integration of universal design into packaging in the

US is still relatively new; however, the potential market is

huge. It is estimated that in the US 8.6 million people over

the age of 6 have difficulty with one or more of the activi-

ties of daily life and 4.1 million people need some kind of

personal assistance. The 2000 Census counted 49.7 million

people with some type of long-lasting condition or disabil-

ity representing almost 20%of the people who are aged 5

or over in the civilian, non-institutionalized population.

Some current examples of universal design include:

Duracell recently commissioned a packaging and prod-

uct design and development agency to redesign its hear-

ing aid battery package. The existing package presented

such difficulty for some users that they were reportedly

saving their hearing aids for special occasions to pro-

long the charge and avoid struggling with the packaging

to change the battery. The solution was the Duracell

EasyTab, a design with an easy-to-open, resealable

package and individual tabs with a grippable surface that

transforms them into a tool to place the battery easily

into the hearing aid. The designer said the package em-

powered users to change their batteries by themselves

rather than asking for help. The end result for users was

having usable hearing aids; the result for Duracell was

increased battery sales. The design was specifically

aimed at the elderly, but sacrificed no convenience for

other users, making the new package handier for con-

sumers of all ages and abilities.

Proctor & Gamble has its Folgers AromaSeal coffee

canister in the market, featuring an easy-grip molded

handle (and a seal that acknowledges approval of the

American Arthritis Foundation), and a full line of Pam-

pers Kandoo childrens bath products designed to

make themaccessible to childrens small hands. Kandoo

Foaming Body Wash and Instant Foam Shampoo have a

broad base, and Airsprays wide and easy-to-use pump

top that dispenses instant foam, helping to empower kids

and make bath time easy and fun.

The Principles of Universal Design: The Center for Uni-

versal Design at North Carolina State University identi-

fies seven principles of Universal Design:

Equitable useappeals to all users

Flexibility in useaccommodates a range of individual

preferences

Simple and intuitive designeliminates complexity for

users of varying abilities

Perceptible informationconveys messages regardless

of user abilities

Tolerance for errorminimizes hazards from unin-

tended actions

Low physical effortprevents user fatigue

Size and space for approach and useaccommodates

size/mobility issues

The Center for Universal Design is a national research, in-

formation, and technical assistance center that evaluates,

develops, and promotes accessible and universal design in

housing, buildings, outdoor and urban environments and

related products. The Centers work manifests the belief

that all new environments and products, to the greatest ex-

tent possible, should be usable by everyone regardless of

their age, ability, or circumstance. Part of the College of

Design at North Carolina State University (NCSU), Ra-

leigh, NC, the Center promotes the concept of universal de-

sign in all design, construction, and manufacturing disci-

plines through research, design assistance, and training.

Activities

The Center conducts original research to learn what design

solutions are appropriate for the widest diversity of users

and what tools are most useful to practitioners wishing to

successfully practice universal design. The Center collabo-

rates with builders and manufacturers on the development

of new design solutions. It also develops publications and

instructional materials, and provides information, referrals

and technical assistance to individuals with disabilities,

families, and professionals nationwide and internationally.

11

Research

Activities include applied research studies on human fac-

tors and user needs, usability of accessible and universally

designed products and environments, and the impact of

universal design.

The Center:

Advances knowledge of universal design principles

Identifies user needs

Conducts design and market research

Evaluates universal design solutions

Contact

Nilda Cosco

Director

nilda_cosco@ncsu.edu

Design

The center finds solutions to specific accessibility needs at

various levels of design e.g., whole houses, buildings,

spaces or products and provides design development ser-

vices for universally usable products, building components

and spaces.

The Center:

Provides concept development for new products

Conducts architectural and product evaluations

Plan Consultation

Provides design and marketing assistance to business

and industry

Contact

Leslie Young

Director of Design

leslie_young@ncsu.edu

Staff

Nilda Cosco, PhD, Director

e-mail: nilda_cosco@ncsu.edu

Nilda Cosco holds a degree in Educational Psychology,

Universidad del Salvador, Buenos Aires, and a Ph.D. in

Landscape Architecture, Heriot Watt University, Scotland.

She has an interest on the impact of outdoor environments

on health outcomes such as obesity, sedentary lifestyles, at-

tention functioning, and well-being. Her current research is

supported by the National Institute of Environmental

Health (NIEHS), the National Science Foundation (NSF),

and the Buffalo Hospital Foundation.

Mailing Address

The Center for Universal Design

College of Design

North Carolina State University

Campus Box 8613

Raleigh, NC 27695-8613

Telephone Numbers

CUD office hours are 9am - 5pm EST, Monday-Friday.

The office is closed Saturday and Sunday.

Telephone: (919) 515-3082

Fax: (919) 515-8951

Info Line: (800) 647-6777

Smart (Intelligent) Packaging

There doesnt appear to be a consensus on what actually

constitutes smart packaging. However, by one defini-

tion, it is the chemical, biological, mechanical, electrical,

and electronic technologies that make a package interact in

some way.

The competitive retail climate and the rise of private labels are

two reasons leading consumer packaged goods companies

(CPGs) to consider newtechnologies as a way to differentiate

their products. Examples of smart packaging include:

RFID: The use of RFID in packaging is still in its in-

fancy, although some major companies such as Wal-

Mart are mandating manufacturers and other suppliers to

use it to track inventory. However, there is concern that,

for now, there is no business case for manufacturers to

implement the technology: tags run from seven cents to

20 cents depending on quantities used and their reliabil-

ity is still somewhat in question.

The exception to this is the pharmaceutical industry.

There are 2 main reasons for this:

It is much easier to determine the value of RFID to

consumers in the healthcare industry, and

Compliance is a key objective for smart packaging in

healthcare.

For example:

In 2006, Pfizer was among the first to implement

RFID on a broad basis, using passive tags on cases

and retail packages of Viagra, which is widely coun-

terfeited, to enable wholesalers and pharmacies to au-

thenticate the drug.

Pharmacies serving the Department of Veteran Af-

fairs are also using RFID, but as part of a ScripTalk

system that makes prescription labels talk when vi-

sually impaired patients scan them with a reader. The

system reduces the chances of mix-ups by letting pa-

tients know which drug they are holding, how much

to take, and how often.

Other uses for smart packaging include:

Smart packaging, specifically smart labels, can help

brands arm consumers with valuable information.

Food and beverage manufacturers, for instance, can

benefit by providing customers details about fresh-

ness, nutrition, and shelf life.

Another application in the food industry is packaging

materials that alert consumers to the presence of

pathogens. This technology could have avoided the

recent (2006) outbreak of E. coli in bagged spinach.

12

E-Commerce

A survey by Strategic Analysis, forecasts that e-commerce

Internet and mail-order sales will grow between

16-20% per year. This will principally benefit 2 types of

flex-pack materials:

Shrink sleeves, and

Packaging mail bags/padded envelopes/bubble wrap,

etc.

As one example of this growth, in 2005, sales of prescrip-

tion drugs rose 6% overall, but mail-order prescriptions

rose 18%.

EPA Initiative: As part of an initiative to investigate inno-

vative solutions and strategies to eliminate or reduce waste,

the U.S. Environmental Protection Agency (EPA), in part-

nership with McDonough Braungart Design Chemistry

(MBDC), issued a design challenge. One of the intentions

of the design challenge is to encourage a more integrated

and comprehensive approach to the design of packaging

for e-commerce. The goal is to develop more sustainable

packaging services through the design of environmentally

preferable packaging and the complementary systems

needed for value recovery using cradle-to-cradle princi-

ples.

As background, EPA notes that Internet-based companies

ship millions of books, CDs, DVDs, and videos each year.

A large percentage of the shipping packaging associated

with these purchases, primarily corrugated paperboard and

plastic, ends up in landfills. E-commerce presents an ideal

opportunity for system-wide implementation of innovative

packaging solutions due to its dependence on highly inte-

grated technology for product distribution and returns.

One of the winning designs was:

The Bevelope: The key feature in the design of the

Bevelope is the bevels that help the package expand to

accommodate products with different thicknesses. The

adaptability of the Bevelope starts with just a few clev-

erly placed scores, creating bevels that make it possible

to adjust the Bevelopes thickness to accommodate the

slimmest paperback book, a molded DVDcase, or a very

thick manual. The bevels also help hold the products

within the center of the packages, providing a protective

cushion around the edges of the items during transit.

Its easy to use, re-use, and recycle and very cost ef-

fective.

It protects and accommodates a variety of individual

and multiple types of products.

It has unique, adaptable design features to meet vari-

ous client, shipper, and customer needs.

Content loading operations can be automated or man-

ual.

It can be printed with environmental markings, client

and manufacturing information, as well as other cus-

tomer related messaging.

The materials used contain post-consumer recycled

content and are easily recycled at end of useful life.

It uses minimal materials, is lightweight, and reduces

transportation energy and related handling costs.

Space-saving, the Bevelope arrives preconstructed

and flat and requires no additional filler materials

when packing, thereby reducing assembly time.

Once loaded, it has a unique appearance that in-

creases customer interest in the package and ensures

satisfaction through safe delivery.

13

Consumer Studies

Retail Driven Change:

How and Why Retailers Influence

Packaging Decisions

This is a 2006 market research report commissioned by the

Flexible Packaging Association. (Note: the cost of the re-

port to non-members is $3,500.) The Executive Summary

highlights some of the reports findings, which include:

Packaging is no longer just about cost. Retailers are

looking for value-added packaging solutions that attract

customers.

The retailer has become the ultimate product marketer at

the expense of the national brand owner. Now, 80% of

consumer purchase decisions are made in the store.

Packaging is more important than ever, as more retailers

understand the importance of shelf impact in selling

products.

The most significant drivers that influence consumers

are lifestyle trends of health and wellness, convenience,

and sustainability.

Due to their size and purchasing power, mass merchan-

disers and club stores have more influence than tradi-

tional grocery and drug stores when it comes to packag-

ing development.

Nearly one out of every four products purchased from a

US retail channel mass merchandiser, drug chain, or

supermarket is a Private Label Product controlled by a

retailer.

Retailers exert a growing influence on packaging that is

increasing the complexity of consumer packaged goods

companies (CPGs) supply chain and packaging opera-

tions.

Packaging manufacturers provide the R&D and invest-

ment for packaging innovation as well as influence

end-user consumption and retailers operational effi-

ciency through packaging designs.

Pharmaceutical Packaging Objectives

The Pharmaceutical and Medical Packaging News 2006

Healthcare Packaging Trends Survey rated the importance

of objectives to pharmaceutical packaging on a scale of 1 to

5 (1 = not-at-all important and 5 = very important). The fol-

lowing list is in order of importance with the rating shown

in parenthesis.

Product Integrity (4.7)

Protection against Tampering (4.3)

Cost-Effectiveness (4.3)

Ease of Manufacturing or Packaging (4.3)

Product Authentication (4.2)

Patient Compliance (4.1)

Ease of Use for Patient (4.0)

Protection against Counterfeiting (4.0)

Labeling Space for Bar Coding (3.9)

Protection against Diversion (3.9)

Labeling Space for Patient Instructions (3.9)

Child Resistance (3.7)

Brand Promotion (3.7)

Ease of Use for Pharmacist (3.4)

RFID Implementation (3.2)

The Market for Sustainable

Packaging Materials

Based on an annual tracking study of 2,000+ US house-

holds by the Natural Marketing Institute, approximately

16% (48 million) of the 300 million US consumers may be

LOHAS those with Lifestyles of Health and Sustain-

ability. These individuals are dedicated to personal and

planetary health they buy green products and support

advocacy programs. According to the study:

More than 50%of these LOHAS consumers list recycla-

ble packaging, eco-friendly packaging, and biodegrad-

able packaging as very important traits for their food

and beverage products.

Approximately 65% of this segment is willing to spend

20% more for products made in an eco-friendly and sus-

tainable way, while only 9%say they make purchase de-

cisions based solely on price.

The Influence of Packaging

on Purchasing Decisions

A survey of consumers by Food & Drug Packaging maga-

zine was designed to rate the influence of packaging rela-

tive to the influence of price, brand, freshness, and specific

item preferences on their buying decisions. The survey

covered 25 product categories ranging from candy, soft

drinks, cereals, and whole fruits and vegetables, to first aid

and pills and tablets.

Consumers were asked to rate each influencer using a

5-point scale ranging from1 as No influence on purchase

decision to 5 as Great influence. The results were calcu-

lated as percentages to reflect the average rating given to

each influence. Each specific influence (packaging, price,

brand, freshness and specific item preferences) was

14

counted as one fifth of the overall purchasing decision,

with the influences adding up to roughly 100%.

The findings showed that:

Consumers are acknowledging the influence of packag-

ing on their purchases.

Packagings influence exceeded brands influence

in three categories, including pills/tablets.

Packaging was rated as more influential than specific

product preference in seven categories.

Across all categories, the median rating for the influence

of packaging was 17.7%.

Interestingly, packaging was rated more influential by

younger respondents than by older respondents even

though older respondents, especially those 75+, are more

likely to have trouble with the physical aspects of packag-

ing (e.g., opening, reclosing, and pouring).

Considering the ratio of money spent on advertising to the

money spent on packaging, the findings of this survey,

showing that overall the ratings for packaging influence

and brand influence were very close median ratings of

17.7% and 18.8% respectively suggest that spending on

packaging may have a higher, long-term return.

Prominent Trends Affecting

Food Packaging

Recent surveys and studies have shown howseveral promi-

nent trends are affecting the food packaging industry, in-

cluding:

Organics/Naturals: Sales of organic food products

reached $14 billion in 2005, representing 2.5% of all re-

tail food sales, according to the Organic Trade Associa-

tion. And the category has been growing at 15%per year

for the last 10 years. The trend in packaging for these

products is towards bio-based plastics. As an example,

Wal-Mart is using clear thermoformed containers made

of biodegradable plastic for fresh fruit, herbs, strawber-

ries, and Brussels sprouts.

Obesity: Obesity rates in the US have soared from 27%

in 1991 to 61% in 2001; but according to a Food Mar-

keting Institute survey, consumers are trying to do some-

thing about it 59% of shoppers said they were trying to

eat a healthier diet in 2005, and the desire to loose weight

influences the buying decisions of 42% of those shop-

pers. The role of packaging in this obesity-related trend

is in portion control. Several companies have come out

with repackaged versions of mainstream items that con-

tain only 100 calories. Launches of 100-calorie products

increased from 9 in 2003 to 33 in 2005, according to

Datamonitor, a product research company. Packaged

goods companies are apparently finding that consumers

would rather buy regular products in smaller portions

than products that have been altered to achieve a lower

calorie count.

Convenience: Convenience continues to be a driving

force in food product packaging. This trend has recently

taken several forms, for example:

Sliced luncheon meat (and other refrigerated items) in

completely reusable plastic tubs that is, tubs with

paper labeling that can be removed to leave a blank,

generic tub.

Single-serve packaging for many items including

fruits.

Packages that save time and effort. For example,

General Mills shake n pour version of pancake

batter. The mix is in a large plastic bottle with a

molded handle simply add water, shake, and pour

out the batter. And a dessert bar mix, a no-bake prod-

uct that comes with its own paperboard pan.

Private-Label Packaging

A 2006 survey commissioned by the Private Label Manu-

facturers Association found that the steady growth of re-

tailer-brand (private label) products in food and beverage is

spilling over into non-grocery categories. Private-label

products are gaining market share in areas such as health

and beauty, home office supplies, and household goods.

Results of the survey include:

57% of respondents said packaging for private-label

grocery brands is as good as the packaging for national

brands.

On average, 32% of their product selections were pri-

vate-label brands.

41% of shoppers identified themselves as frequent buy-

ers of retailer brands compared to 36% when the survey

was last conducted in 2001.

Middle- and higher-income consumers are significantly

more likely to increase their purchases of private-label

brands in 2007 than low-income shoppers.

15

Research and Development

Research Schools

Indiana Packaging Research and Development Center

Myers Technology Building

Terre Haute, IN 47809

Tel: 812-237-8740

Fax: 812-237-3902

E-mail: mdschafer@indstate.edu

Website: http://www.indstate.edu/imt/packaginglab.html

The Indiana Packaging Research and Development Center

was formed to provide a variety of services to meet the

packaging design, testing, and troubleshooting needs of

business and industry. Services provided by the Center

comply with all recognized standards using state-of-the-art

and certified equipment. Center personnel are experienced