Académique Documents

Professionnel Documents

Culture Documents

Micro Finance in Action - A Business Process

Transféré par

Mohd Fahad IfazTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Micro Finance in Action - A Business Process

Transféré par

Mohd Fahad IfazDroits d'auteur :

Formats disponibles

Fairfeld University

DigitalCommons@Fairfeld

Business Faculty Publications Charles F. Dolan School of Business

1-1-2006

Microfnance in Action: A Business Process

Analysis of an Operation in Nicaragua

Julio Martinez

Winston Tellis

Fairfeld University, winston@fairfeld.edu

Tis article, published by the International Association for Computer Information Systems, is freely

available at htp://iacis.org/iis/2006/Martinez_Tellis.pdf

Peer Reviewed

Published Citation

Martinez, Julio; Tellis, Winston M.. 'Microfnance in Action: A Business Process Analysis of an Operation in Nicaragua.' Issues in

Information Systems, v.7, 2 (2006): 105-109

Tis Article is brought to you for free and open access by the Charles F. Dolan School of Business at DigitalCommons@Fairfeld. It has been accepted

for inclusion in Business Faculty Publications by an authorized administrator of DigitalCommons@Fairfeld. For more information, please contact

digitalcommons@fairfeld.edu.

Repository Citation

Martinez, Julio and Tellis, Winston, "Microfnance in Action: A Business Process Analysis of an Operation in Nicaragua" (2006).

Business Faculty Publications. Paper 36.

htp://digitalcommons.fairfeld.edu/business-facultypubs/36

Volume VII, No. 2, 2006 105 Issues in Information Systems

MICROFINANCE IN ACTION:

A BUSINESS PROCESS ANALYSIS OF AN OPERATION IN NICARAGUA

Julio Martinez, Fairfield University,07_jmartinez3@stagweb.fairfield.edu

Winston Tellis, Fairfield University, Winston@mail.fairfield.edu

ABSTRACT

This paper is a business process analysis of an

existing and successful microfinance institution in

Nicaragua. The authors visited the main office and

branch offices to determine the data flow and process

relationships between the main office and the

branches. For U.S. based organizations, the cultural

differences and resource constraints could be

informative. As globalization expands, the need to

prepare students for assignments in developing

countries is one of the goals of this project.

Keywords: Business Process, Database, Data Flow,

Nicaragua, Developing Country.

INTRODUCTION

The Local Development Fund [FDL) was formally

created in May 5, 1997 as a non-profit organization,

and the National Assembly approved its legal status

nearly a year later. However, it initially began its

financial activities in 1993 as part of Nitlapn, the

Research and Development institution of Universidad

CentroAmericana [UCA) located in Managua,

Nicaragua. Its mission statement follows: The Local

Development Fund [FDL) is a micro-financing

institution specializing in financial services, mainly

to the rural sector. The target sector for the credit

services includes micro, small, and medium-sized

businesses of production, commerce and services that

are economically viable but have no access to the

formal banking sector. FDL also works in urban

contexts, which allows it to diversify the credit risk

and financial flow.[1]

Since it was founded in 1990, Nitlapns primary

objective has been to find effective methods to

guarantee the sustainability and independence of

local rural development programs. By 1992, it began

managing circulating funds to help address problems

that were primarily occurring in the rural sector [2].

In 1993, it began its second project by creating the

Local Development Bank that was structured to

finance to rural producers. The Local Development

Bank was supported by a self-administration model

and was governed by local organizations cooperating

with one another.

Between 1994 and 1996 the program enforced

administrative control over local banks in an effort to

prevent the abuse of power, encourage accountability

and regain the lenders confidence. However, the new

changes did not contribute too much improvement for

a couple of reasons: 1) Local directors refused to

abide by the credit rules and policies and 2) the

expansion of credit services was very limited [2]. In

addition, the increasing lack of liquidity in the rural

sector contributed to the closings of the some

regulated banks. As a result, Nitlapn decided to

organize a completely new local institution that

would have a new administration.

By 1997, the new models first strategic plan got

underway with the launching of the Local

Development Fund. It entailed conducting a process

of specialized financial services with a strategy

oriented to seeking sustainability and a legal

separation from Nitlapn. The first plan was executed

between 1998 and 2002. During its second strategic

plan between 2003 and 2007, the program plans to

obtain long-term credit lines with appropriate interest

rates that will allow it to offer investment credits [2].

It hopes to meet its objective of providing financial

assistance that will support the capitalization of small

and medium rural businesses.

Staffing

FDL currently operates through twelve branches and

sixteen satellite offices which are located throughout

the country. Since 2002, the staff has grown

approximately 13% each year. As of December 2005,

the staff was composed of 351 people [2].

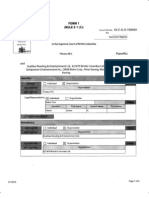

Table 1. Increases in FDL Staff

Staff

12/31/02

12/21/03 12/31/03 12/31/05

Total 237 286 324 351

Credit

Officers

74 90 110 124

Others 163 196 214 227

Microfinance in Action: A Business Process Analysis of an Operation in Nicaragua

Volume VII, No. 2, 2006 106 Issues in Information Systems

Credit Officer

Credit officers account for almost half of the FDL

entire staff. Under the supervision of a branch

director, credit officers are the most active members

at FDL. FDL gives each credit officer a motorcycle

and computer to complete the daily tasks. Credit

officers promote and market FDLs financial services

to the local citizens. They also visit existing clients,

sometimes at the clients home, regarding the loan.

They also process new credit requests [4].

Figure 1. Organization Chart of FDL [2]

Table 2. Increases in FDL Clients [2]

Clients

12/31/02

12/31/03

12/31/04

Number of active borrowers 21,306 25,106 33,676

Average loan balance per borrower $587.00 $659.00 $666.00

Woman borrower 51.8% 51.0% 56.0%

Male borrower 48.2% 49.0% 44.0%

FDL provides their clients financial services through

individual and group lending methodology. Only

clients with well established credit history are able to

receive individual loans. Besides financial services,

FDL also provides their clients with training and

technical assistance. In agreement with Nitlapn,

FDL provides training and assistance to small and

medium businesses and agricultural producers. In

2004, FDL provided training for 1,972 small and

medium urban and rural businesses. The training

included Basic Accounting, Marketing, Finance and

other business related courses [2].

Microfinance in Action: A Business Process Analysis of an Operation in Nicaragua

Volume VII, No. 2, 2006 107 Issues in Information Systems

Use Case for the Allocation of a Normal Individual

Credit [4]

Primary Actor: Client

Scope: Microfinance Bank

Level: Summary

Stakeholders and Interests:

Client- wants to take out a loan

Credit Officer- wants to verify that client is worthy of

credit approval

Office Manager- to see that all guidelines are

followed

Preconditions: Money is needed to run their

business

Trigger: Client initiates credit request

Minimal Guarantee: Client will know whether the

credit request has been approved or declined

Success Guarantee: Client has been granted total

amount of credit requested

Use Case for the Allocation of an Urban Solidarity

Credit [4]

Primary Actor: Client

Scope: Microfinance Bank

Level: Summary

Stakeholders and Interests:

Client- wants to take out a loan

Guarantor- to assure clients in their group make their

payments on time

Credit Officer- wants to verify that client is worthy of

credit approval

Office Manager- to see that all guidelines are

followed

Preconditions: Money is needed to run their

business

Trigger: Client initiates credit request

Minimal Guarantee: Client will know whether the

credit request has been approved or declined

Success Guarantee: Client has been granted total

amount of credit requested. Group agrees on terms

and conditions and signs the contract

Use Case for the Allocation of a Rural Solidarity

Credit

Primary Actor: Client

Scope: Microfinance Bank

Level: Summary

Stakeholders and Interests:

Client- wants to take out a loan

Guarantor- to assure clients in their group make their

payments on time

Credit Officer- wants to verify that client is worthy of

credit approval

Office Manager- to see that all guidelines are

followed

Preconditions: Money is needed to run their

business

Trigger: Client initiates credit request

Minimal Guarantee: Client will know whether the

credit request has been approved or declined

Success Guarantee: Client has been granted total

amount of credit requested. Group agrees on terms

and conditions and signs the contract

Systems

After a client completes a credit request application,

the credit official then determines how much credit

should be approved. If the client is new, the credit

officer must first obtain a credit history for that

person before making any computations [4]. They

could obtain the credit report of any new client

through www.siuriesgo.com.ni, a website that records

any loan activity in Nicaragua. After the credit report

has been obtained, the credit officer uses an Excel

Worksheet, and the clients information provided in

the application, to determine the total amount for

which he or she is qualified. After the loan amount is

determined, the credit officer inputs all of the clients

information to a software program MeraKERP[3].

MeraKERP is a management information system

with a platform that manages SQL server databases

integrated with accountancy. The system also has the

capability to send data from one branch to another

directly through e-mail. Branches with satellites

receive their data from satellite offices through

floppy discs. Each month, every FDL branch sends

portfolio and accountancy updates to the

headquarters. Each clients information and other

financial data are saved and secured at the

headquarters in Managua [4].

Microfinance in Action: A Business Process Analysis of an Operation in Nicaragua

Volume VII, No. 2, 2006 108 Issues in Information Systems

NO

YES

Figure 2. Business ProcessFlowchart for the Allocation of an Urban Solidarity Credit

CONCLUSIONS

The Microfinance market has been growing rapidly

in many developing countries. Bolivia, Peru, Brazil,

Indonesia [5], Sri Lanka [6], the Philippines [8], and

several African countries have made great strides in

poverty alleviation by using microfinance to provide

credit to the working poor. In some cases, there is

significant government involvement, as in Sri Lanka

and Indonesia, not always with positive results. In

other cases, non-governmental organizations

provided the leadership in moving forward with this

well-respected form of poverty alleviation. In all

cases, however, there is no substitute for professional

financial management of the operation. Too often this

aspect has not been carefully addressed.

START

END

Clients receive

promotional

discussion in the

camps

Quality control

[Before Committee)

Input of credit request in the system

and committee resolution

Social Investigation

Information process

Client signs the proof

of check or debit and

receives the loan

The members

register their groups

and the corporate

papers are signed They are

transferred to

the area of cash

balance for

their respective

disbursement

Clients receive

verbal information in

regional offices

Presentation of case in

the credit committee

Allow credit

Registration of the decisions taken in

committee[s) of credit

Approval and explanation of the

terms conditions of the loans

Elaboration of the disbursement page

and shipment to accounting

Programming of disbursements and

notices to client of the decisions taken

by the committee

Explanation of disbursement order,

contract and payment plans.

Everything is signed and approved by

the manager

Discuss the proof of

legalization of the

contract.

Clients sign

the contract

Initial selection of

client and revision of

management of the

branch office

Visits to investigate the

business of each member

in the group

Discuss the

disbursements to the

group Explain the

terms and conditions

of the contract.

They are transferred

to the area of cash

balance for their

respective

disbursement

Microfinance in Action: A Business Process Analysis of an Operation in Nicaragua

Volume VII, No. 2, 2006 109 Issues in Information Systems

FDL is clearly a model operation both in Nicaragua

and for the rest of Central America. This paper has

identified the transparency with which the MFI is

operated. The researchers have observed that those

organizations that operate openly and whose Board of

Directors are responsible and honest individuals are

likely to continue to operate successfully, whereas

the failure rate of improperly run MFIs grows each

day.

As The Grameen Bank [7] demonstrated, innovation

is an important aspect of MFIs. FDL has attempted to

do this by loaning equipment to farmers in order to

get them started. As in most cases, the repayment rate

is above 95%, and FDL is well within those

parameters.

REFERENCES

1. FDL Annual Memory for 2004. FDL publication.

2. FDL Website, http://www.fdl.org.ni

3. The MIX Market Microfinance,

http://www.mixmarket.org/en/demand/demand.s

how.profile.asp?ett=1064

4. Personal Interviews on site.

5. Afwan, I. & Charitonenko, S. (November, 2003).

Commercialization of Microfinance: Indonesia.

Manila, Philippines: Asian Development Bank.

6. Charitonenko, S. & de Silva, D. (May 2002).

Commercialization of Microfinance: Sri Lanka.

Manila, Philippines: Asian Development Bank.

7. Grameen Bank. (2004). http://www.grameen-

info.org/

8. Charitonenko, S. (May 2002).

Commercialization of Microfinance: The

Philippines. Manila, Philippines: Asian

Development Bank.

Vous aimerez peut-être aussi

- Business Plan Template for Online Micro-Credit OrganizationDocument22 pagesBusiness Plan Template for Online Micro-Credit OrganizationAngshuman DasPas encore d'évaluation

- Defining completion of construction worksDocument20 pagesDefining completion of construction worksHicham Fares100% (1)

- The Functional Microfinance Bank: Strategies for SurvivalD'EverandThe Functional Microfinance Bank: Strategies for SurvivalPas encore d'évaluation

- GuarantyDocument4 pagesGuarantyNN DDL100% (2)

- The Company Secretary's Handbook: A Guide To Duties and ResponsibilitiesDocument179 pagesThe Company Secretary's Handbook: A Guide To Duties and ResponsibilitiesAhmad Munir HossainPas encore d'évaluation

- Microcredit Business Plan For CooperativesDocument21 pagesMicrocredit Business Plan For Cooperativescarlos-tulali-130990% (10)

- SAN BEDA COLLEGE OF LAW GUIDEDocument10 pagesSAN BEDA COLLEGE OF LAW GUIDEPamela DenisePas encore d'évaluation

- Effects of Inflation On Performance Microfinance InstitutionsDocument33 pagesEffects of Inflation On Performance Microfinance InstitutionsHissan Zia Khan100% (2)

- Banks' Lending Functions and Loan ProductsDocument26 pagesBanks' Lending Functions and Loan ProductsAshish Gupta100% (1)

- Sample Business Proposal - Impact of Microfinance in KenyaDocument61 pagesSample Business Proposal - Impact of Microfinance in KenyaKennedy Nyabwala100% (15)

- Microfinance Bank Proposal AjiboyeDocument12 pagesMicrofinance Bank Proposal AjiboyeYkeOluyomi Olojo81% (16)

- 08-11-24 Credit Scoring For SME LendingDocument36 pages08-11-24 Credit Scoring For SME LendingSimon MutekePas encore d'évaluation

- Financial Service Promotional (Strategy Icici Bank)Document51 pagesFinancial Service Promotional (Strategy Icici Bank)goodwynj100% (2)

- Credit TransactionsDocument29 pagesCredit TransactionsGabrielle Louise de Peralta0% (1)

- Digest 5 Spouses Benatiro vs. Heirs of CuyosDocument2 pagesDigest 5 Spouses Benatiro vs. Heirs of Cuyossimon gibalay100% (1)

- Cassava Trade Information BriefDocument75 pagesCassava Trade Information BriefMohd Fahad IfazPas encore d'évaluation

- Criminal Law Elements Guide: Parricide, Murder, Homicide and MoreDocument24 pagesCriminal Law Elements Guide: Parricide, Murder, Homicide and Morejag murilloPas encore d'évaluation

- SBLC Format HSBC HKDocument2 pagesSBLC Format HSBC HKWinengku50% (8)

- Chapter One: 1.1. Back Ground of The StudyDocument18 pagesChapter One: 1.1. Back Ground of The StudyReta TolesaPas encore d'évaluation

- Microfinance Philippines ThesisDocument5 pagesMicrofinance Philippines Thesisfjm38xf3100% (2)

- Impact of Microfinance on Business in NepalDocument14 pagesImpact of Microfinance on Business in NepalBharat Ram DhunganaPas encore d'évaluation

- Kenya Digital RegsDocument6 pagesKenya Digital RegsThanasis DimasPas encore d'évaluation

- Manuscript Final ThesisDocument60 pagesManuscript Final ThesisEya VillapuzPas encore d'évaluation

- Microfinance Industry Challenges in the PhilippinesDocument25 pagesMicrofinance Industry Challenges in the PhilippinesCarlos105Pas encore d'évaluation

- Repoprt On Loans & Advances PDFDocument66 pagesRepoprt On Loans & Advances PDFTitas Manower50% (4)

- Micro FinanceDocument64 pagesMicro Financewarezisgr8Pas encore d'évaluation

- Dissertation Report On Issue and Success Factors in Micro FinancingDocument71 pagesDissertation Report On Issue and Success Factors in Micro FinancingMohd KabeerPas encore d'évaluation

- Best Management Practices in The BankingDocument14 pagesBest Management Practices in The Bankingmanique_abeyrat2469Pas encore d'évaluation

- Factors Affecting Loan Repayment of Ethiopia's Development BankDocument35 pagesFactors Affecting Loan Repayment of Ethiopia's Development Bankabraham admassiePas encore d'évaluation

- Edited ProjectDocument40 pagesEdited ProjectZakariyya Musa YakubuPas encore d'évaluation

- TriView - Key FactorsDocument4 pagesTriView - Key FactorsVikash KumarPas encore d'évaluation

- Introducing Rural FinanceDocument37 pagesIntroducing Rural FinanceanuyadaPas encore d'évaluation

- FIN 354 Ca2Document13 pagesFIN 354 Ca2Jashim AhammedPas encore d'évaluation

- The Role of Microfinance Bank On Small Scale EnterpriseDocument5 pagesThe Role of Microfinance Bank On Small Scale EnterpriseKingsley OpeyemiPas encore d'évaluation

- Micro FinanceDocument30 pagesMicro FinanceSakshi BhaskarPas encore d'évaluation

- ACC223 Case Study: Impact of COVID-19 on Village Financial ServicesDocument16 pagesACC223 Case Study: Impact of COVID-19 on Village Financial Servicesfatoumata coulibalyPas encore d'évaluation

- Market Research On Cause of Client DropoutDocument25 pagesMarket Research On Cause of Client Dropouthailu letaPas encore d'évaluation

- RishabhDocument38 pagesRishabhpooja rodePas encore d'évaluation

- Assessment of Loan RepaymentDocument81 pagesAssessment of Loan Repaymentzachariah z. sowionPas encore d'évaluation

- Accounting and Auditing Update October 2014Document32 pagesAccounting and Auditing Update October 2014bhatepoonamPas encore d'évaluation

- Chapter - 1Document53 pagesChapter - 1Divya RatnagiriPas encore d'évaluation

- Synopsis Complete 17 11 2023Document12 pagesSynopsis Complete 17 11 2023D-Park Software Solutions And ConsultancyPas encore d'évaluation

- The Problem and Its SettingsDocument5 pagesThe Problem and Its SettingsHi JezPas encore d'évaluation

- Session: 2011-13: Contemporary Issue On Seminar Micro Finance-Financial Product For Bottom of Pyramid Market"Document35 pagesSession: 2011-13: Contemporary Issue On Seminar Micro Finance-Financial Product For Bottom of Pyramid Market"Ram SharmaPas encore d'évaluation

- Take Home Final DEV572 Fall07Document2 pagesTake Home Final DEV572 Fall07api-3733468Pas encore d'évaluation

- Spoorthi BennurDocument58 pagesSpoorthi BennurSarva ShivaPas encore d'évaluation

- Commercial Banks and Microfinance: July 2007Document54 pagesCommercial Banks and Microfinance: July 2007AlmaPas encore d'évaluation

- Rich ProposalDocument29 pagesRich ProposalecomujPas encore d'évaluation

- Research Paper On Microfinance InstitutionsDocument4 pagesResearch Paper On Microfinance Institutionsngqcodbkf100% (1)

- CLAFNet Credit Operational SystemDocument24 pagesCLAFNet Credit Operational SystemRanjith SamarasinghePas encore d'évaluation

- Challenges and Prospects of Microfinance Banks in Financing Small BusinessesDocument37 pagesChallenges and Prospects of Microfinance Banks in Financing Small BusinessesZakariyya Musa YakubuPas encore d'évaluation

- Microfinance Thesis in GhanaDocument9 pagesMicrofinance Thesis in GhanaCheapPaperWritingServicesMobile100% (2)

- Term PaperDocument8 pagesTerm PaperAce Hulsey TevesPas encore d'évaluation

- Islami BankDocument36 pagesIslami Bankmoin06Pas encore d'évaluation

- Va Sudha ProjectDocument28 pagesVa Sudha ProjectPranjal SrivastavaPas encore d'évaluation

- An Overview of Microfinance Service Practices in Nepal: Puspa Raj Sharma, PHDDocument16 pagesAn Overview of Microfinance Service Practices in Nepal: Puspa Raj Sharma, PHDRamdeo YadavPas encore d'évaluation

- Makerere University Business SchoolDocument5 pagesMakerere University Business SchoolCeacer Julio SsekatawaPas encore d'évaluation

- Statement of PurposeDocument5 pagesStatement of PurposeShalini SinghPas encore d'évaluation

- A Study On Role and Effects of Microfinance Banks in Rural Areas in India 1Document63 pagesA Study On Role and Effects of Microfinance Banks in Rural Areas in India 1Rohit KumarPas encore d'évaluation

- Grassroot MFB RatingDocument13 pagesGrassroot MFB Rating9415351296Pas encore d'évaluation

- The Effect of Loan Appraisal Process ManDocument7 pagesThe Effect of Loan Appraisal Process ManFel Salazar JapsPas encore d'évaluation

- The Means by Which Poor People Convert Small Sums of Money Into Large Lump Sums (Rutherford 1999)Document7 pagesThe Means by Which Poor People Convert Small Sums of Money Into Large Lump Sums (Rutherford 1999)Ramachandra ReddyPas encore d'évaluation

- Impact of Commercial Bank Credits on SME Performance in NigeriaDocument28 pagesImpact of Commercial Bank Credits on SME Performance in NigeriaIzzy ConceptsPas encore d'évaluation

- Effect of Microfinance Bank Loan On Small and Medium Scale EnterprisesDocument9 pagesEffect of Microfinance Bank Loan On Small and Medium Scale EnterprisesAkinmejiwa OlakunlePas encore d'évaluation

- MFG en Paper Micro Lending As A Model For Efficient Commercial Small Scale Lending and Its Application in Banks 2000 - 0Document18 pagesMFG en Paper Micro Lending As A Model For Efficient Commercial Small Scale Lending and Its Application in Banks 2000 - 0Jamey DAVIDSONPas encore d'évaluation

- Effects of Bayanihan Act To Microfinance OrganizationDocument8 pagesEffects of Bayanihan Act To Microfinance OrganizationJay ArPas encore d'évaluation

- A Study On Role and Effects of Microfinance Banks in Rural Areas in India 2Document55 pagesA Study On Role and Effects of Microfinance Banks in Rural Areas in India 2Rohit KumarPas encore d'évaluation

- Credit Scoring For Microfinance Using Behavioral Data in Emerging MarketsDocument25 pagesCredit Scoring For Microfinance Using Behavioral Data in Emerging MarketsCésar Anderson HNPas encore d'évaluation

- Unlocking Financial Opportunities: A Comprehensive Guide on How to Establish Business CreditD'EverandUnlocking Financial Opportunities: A Comprehensive Guide on How to Establish Business CreditPas encore d'évaluation

- Consult EDGEDocument10 pagesConsult EDGEMohd Fahad IfazPas encore d'évaluation

- Annual Report of PKSFDocument32 pagesAnnual Report of PKSFMohd Fahad IfazPas encore d'évaluation

- The Bottom of The Pyramid Strategy For Reducing Poverty: A Failed PromiseDocument14 pagesThe Bottom of The Pyramid Strategy For Reducing Poverty: A Failed PromiseDibyendu MishraPas encore d'évaluation

- Big Data For Better Performance - Further ReadingDocument2 pagesBig Data For Better Performance - Further ReadingMohd Fahad IfazPas encore d'évaluation

- Chapter One Extinction of ObligationsDocument46 pagesChapter One Extinction of ObligationsHemen zinahbizuPas encore d'évaluation

- PAYMENT or PERFORMANCEDocument57 pagesPAYMENT or PERFORMANCEEJ HipolitoPas encore d'évaluation

- 16 Contingent Liability - Schedule 12Document62 pages16 Contingent Liability - Schedule 12SudhansuSekharPas encore d'évaluation

- Succession Agreement DisputeDocument45 pagesSuccession Agreement DisputeRio AborkaPas encore d'évaluation

- Prudential V AnscorDocument11 pagesPrudential V Anscorfjl_302711Pas encore d'évaluation

- Contract Ii Model Answer PaperDocument34 pagesContract Ii Model Answer PaperShubham PandeyPas encore d'évaluation

- Digest Feb 1Document6 pagesDigest Feb 1johnkylePas encore d'évaluation

- Gateway Electronics vs. AsianbankDocument26 pagesGateway Electronics vs. Asianbankpoiuytrewq911550% (2)

- Payment Services Regulations 2019Document48 pagesPayment Services Regulations 2019asdPas encore d'évaluation

- Fritaco NV Vs XcaliburDocument6 pagesFritaco NV Vs Xcaliburgord_a_campbellPas encore d'évaluation

- OooDocument6 pagesOoojoy benedictoPas encore d'évaluation

- Revised PSE Listing RulesDocument68 pagesRevised PSE Listing RulesEric Dykimching100% (1)

- Obligations and Contracts Module 3 Different Kinds of ObligationsDocument13 pagesObligations and Contracts Module 3 Different Kinds of ObligationsFeler Ed SisonPas encore d'évaluation

- Ia Chapter 4 Valix 2019Document5 pagesIa Chapter 4 Valix 2019M100% (1)

- Sat SahebDocument7 pagesSat SahebAMIT JHAPas encore d'évaluation

- BLRRRRRDocument28 pagesBLRRRRRSherri BonquinPas encore d'évaluation

- BailmentDocument6 pagesBailmentNimmi GopinathPas encore d'évaluation

- Law of ContractDocument4 pagesLaw of ContractTannu SinghPas encore d'évaluation

- Important Circular Sub: Crop Loans Against Assigned / DKT / Dot Lands - Renewal of Loans OnDocument10 pagesImportant Circular Sub: Crop Loans Against Assigned / DKT / Dot Lands - Renewal of Loans OnDCCB VZMPas encore d'évaluation

- Limited Liability Companies Act Chapter 151 of The Revised Laws of Saint Vincent and The Grenadines, 2009Document63 pagesLimited Liability Companies Act Chapter 151 of The Revised Laws of Saint Vincent and The Grenadines, 2009Logan's LtdPas encore d'évaluation

- 1st Draft Personal Guarantee (Tenancy Agreement)Document4 pages1st Draft Personal Guarantee (Tenancy Agreement)amanichesemanPas encore d'évaluation