Académique Documents

Professionnel Documents

Culture Documents

PCCPL May 2014 Update

Transféré par

Duby RexCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

PCCPL May 2014 Update

Transféré par

Duby RexDroits d'auteur :

Formats disponibles

3nity.in@gmail.

com

This is not a buy or sell recommendation. We are in the process of compiling data

sheets of companies that we track / own so that in future we may use these for buying /

selling stocks of such companies. Reason for sharing is hopefully somebody who has

more information / insight may get in touch with us or for a healthy debate.

Punjab Chemicals & Crop Protection Ltd

Date : 26-May-14

Traded In : BSE B (506618)

Face Value : 10

CMP : Rs 78.10

EPS (TTM) : 8.62

P/E : 9.06

Market Cap : 95.77 Cr

Enterprise Value : Rs 387.92 Cr

52 Week H/L : 86.4 / 29.15

Website : http://www.punjabchemicals.com/

The base report is available in

http://www.scribd.com/doc/216086492/Punjab-Chemicals-Apr-2014

1. Update about the pharma division: Frankly speaking there has been no update from

the company side. It is an update from my side or rather a lapse on my part to dig deep

and get some data about the pharma division of the company in the earlier analysis.

2. Pharma division of PCCPL

This division comprises the business of Chandigarh-based Alpha Drugs Ltd, which

PCCPL acquired in 2003 from DSM Fine Chemicals of the Netherlands for Rs 25 lakhs.

This was the first acquisition of the company and was merged with itself. The division is

into manufacturing of anti-bacterial bulk drugs and intermediates of penicillin-based

antibiotics, Trimethoprim, Gallic acid and its derivative products.

Trimethoprim, the flagship product of the company is a bacteriostatic antibiotic mainly

used in the prevention and treatment of urinary tract infections (Cystitis). The division

also undertakes contract manufacturing for GSK & Ranbaxy

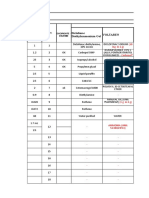

The financials of the pharma division are as below

3nity.in@gmail.com

It is seen that the division has done well in spite of the financial strain on the company

and with very inadequate capex

The product line is restricted to few bulk drugs, drug intermediates and specialty

chemicals. The division is growing slowly mainly due to lack of working capital. With

the introduction of another API, the number of products has increased. The CRAM

business in the division is giving good returns.

As we do not have a base to develop new products, we must remain dependent on

large companies which are organized to develop products and sell finished products

in the competitive market.

(Src: Annual Report 2013)

The contract manufacturing of few products has limited the Company's potential of

development. However, this helps to generate more revenue and utilisation of the

plants.

(Src: Annual Report 2012)

We would assume when (and if) PCCPL turns the corner and pumps in money into the

pharma division it would be a money spinner

3. CDR

When the company fell into hard times, it is evident that the company wanted to spin off

or sell the pharma division

This division contributed Rs 700 mn to FY10 consolidated revenues (12% of overall

revenues). Ernst & Young, appointed for valuing this business, has assigned an

enterprise value of Rs 800 mn. The dedicated debt for this division is worth Rs 200

mn. As per the management, the company is either planning to sell this division or

dedicate 80% of the plant to a US-based entity. If any of these plans materialise, the

company will be able to raise Rs 600 mn. Though we have not built in the sale of this

division into our earnings estimates, we believe that selling this division or dedicating

the plant to a US entity may not be difficult since the plant is a pioneer in the

manufacture of import substitute intermediates for semi-synthetic penicillin.

(Src: Independent Equity Research Crisil dated 2-Dec-2010)

It seems that the company has realized that the pharma division has good potential

Working Capital Demand Loan has been converted to Working Capital Term Loan

(WCTL) with following terms:-

Rs. 5,000 lacs carrying interest @ 8% p.a. and to be repaid in full till 30

September 2012 ,out of which the company has paid Rs. 2,044 lacs to the bankers.

The company is under discussion with the lender to renegotiate the terms of

repayment by offering certain alternative assets for disposal to repay all in lieu of

disposal of Pharmaceutical division as per CDR scheme. The Company is awaiting for

such approval based on which the Company will repay balance amount of Rs. 2,956

3nity.in@gmail.com

lacs of WCTL to the lenders as per the CDR scheme. Pending the approval from

lenders to disposal of alternate assets, the Company has executed "Power of

Attorney" in favour of lenders to dispose off the Pharmaceutical Division of the

company to repay the WCTL as per the CDR scheme

Repayment of remaining amount has been restructured over 40 quarterly

installments, commencing 30 September 2011. The interest rates have been

restructured @ 8% p.a. for the period ended 30 September 2012 and thereafter at

varying rates linked to Monitoring Institutions' base rate

(Src: Annual Report 2013)

Company has offered to sell other assets instead of the pharma division

4. Standalone financials of the pharma division

This is going to be a very basic and primitive calculation. The activity is to try to find the

approximate performance of the pharma division.

Extrapolating the nine months results, we get an annual turnover of Rs 75 crore and

segment results of Rs 6.48 Cr.

Assumptions , assumptions , assumptions : Let us assume the division has debt of

Rs 15 Crore to be paid in 5 years at an interest rate of 15%, we would assume the

interest per year would come to Rs 4 Crore

Now the PBT would be Rs 6.48 Cr Rs 4 Cr = Rs 2.48 Cr

Let us deduct 34% as tax, thus PAT would be Rs 2.48 Cr Rs Rs .84 Cr = Rs 1.64 Cr

This is a worst case scenario of Rs 15 Cr debt at 15% interest. If the division can make a

net profit in such a scenario think about how the division would perform with less debt

and a decent capex

Assumptions is the mother of all **** ups - Quote from the movie Under Siege Part 2.

Ah I had to introduce the quote because whenever I assume something immediately this

quote flashes through my mind

Synopsis

The pharma division would be an asset as and when the company turns around. In a

worst case scenario too, a demerger or sale of the pharma division will definitely benefit

PCCPL.

Have become pretty bullish on PCCPL (at least for the next 4 quarters).

References

1. www.bseindia.com

2. www.punjabchemicals.com

3. https://www.sbi.co.in/user.htm?action=viewsection&lang=0&id=0,17,389

3nity.in@gmail.com

Disclaimer

General: This report is not a buy / sell recommendation. Buying stocks must be done

after careful analysis and the above report can be used as a base for the analysis and

should not be used as sole basis.

Vested Interest: The author does have position in the above stock @ average price of

Rs 76.10. He may purchase / sell the same in the future in the short or long term based

on his conviction and his financial situation.

Data Validity: The data is collated from various sites in the internet. Even though we

have tried our best, there may be discrepancy due to human error while collating the

data. The author should not be held responsible for such mistakes. The data can be

looked up at various websites given in the reference section.

Valuation: The author is not an expert and his valuation may be off the mark.

Vous aimerez peut-être aussi

- Chapter 13 - Hypertensive Crisis - I Don't Really Need Those Pills Level IDocument6 pagesChapter 13 - Hypertensive Crisis - I Don't Really Need Those Pills Level IRichix K Yabe0% (1)

- ICORPFIN Executive Optical Business Plan - CARBONELLDocument10 pagesICORPFIN Executive Optical Business Plan - CARBONELLZhanika Marie CarbonellPas encore d'évaluation

- PCCL Jun 2014 UpdateDocument6 pagesPCCL Jun 2014 UpdateDuby RexPas encore d'évaluation

- Piramal Healthcare Ltd. 21/06/2010Document3 pagesPiramal Healthcare Ltd. 21/06/2010Mohit RathiPas encore d'évaluation

- Call On Cosmo Films PDFDocument2 pagesCall On Cosmo Films PDFSubham MazumdarPas encore d'évaluation

- Piramal Healthcare: Landmark DealDocument3 pagesPiramal Healthcare: Landmark DealjigarchhatrolaPas encore d'évaluation

- Capitalmind Financial Shenanigans Part 1Document17 pagesCapitalmind Financial Shenanigans Part 1abhinavnarayanPas encore d'évaluation

- NISM Case StudyDocument14 pagesNISM Case Studymissionupscias2016Pas encore d'évaluation

- A Rare Buying Opportunity in Two Smallcaps in The Market CorrectionDocument6 pagesA Rare Buying Opportunity in Two Smallcaps in The Market CorrectionPIYUSH GOPALPas encore d'évaluation

- Conviction Stocks 16 Mar 2022Document2 pagesConviction Stocks 16 Mar 2022John J EdisonPas encore d'évaluation

- 5 Companies Analysis of Financial StatementDocument11 pages5 Companies Analysis of Financial StatementNikhil GuptaPas encore d'évaluation

- IEA Report: 7th Dec, 2016Document19 pagesIEA Report: 7th Dec, 2016narnoliaPas encore d'évaluation

- Final Project On Engro FinalDocument27 pagesFinal Project On Engro FinalKamran GulPas encore d'évaluation

- Merger Valutation ReportDocument30 pagesMerger Valutation ReportpardeepjhaPas encore d'évaluation

- The Burden of Expectations: April 26, 2011Document10 pagesThe Burden of Expectations: April 26, 2011Karthikraja KPas encore d'évaluation

- ChatGPT Exercise 1 - Written CommunicationDocument5 pagesChatGPT Exercise 1 - Written CommunicationVipin KanojiaPas encore d'évaluation

- Final Liquidity and Cash Cycle AssignmentDocument7 pagesFinal Liquidity and Cash Cycle Assignmentaung linnPas encore d'évaluation

- SRCL Research NotesDocument5 pagesSRCL Research NotesMichael LoebPas encore d'évaluation

- Chestnut Foods: Case - 4Document8 pagesChestnut Foods: Case - 4KshitishPas encore d'évaluation

- High Conviction Basket: Consumption: Stock Name Weighatge RationaleDocument2 pagesHigh Conviction Basket: Consumption: Stock Name Weighatge RationaleShrikrushnaKawathePas encore d'évaluation

- VST Analysis 2Document21 pagesVST Analysis 2api-555390406Pas encore d'évaluation

- IB League 2019: HSBC STG BangaloreDocument13 pagesIB League 2019: HSBC STG BangaloreMayur AgrawalPas encore d'évaluation

- Capital Structure PlanningDocument5 pagesCapital Structure PlanningAlok Singh100% (1)

- Chapter 6 Prospective Analysis: ForecastingDocument10 pagesChapter 6 Prospective Analysis: ForecastingSheep ersPas encore d'évaluation

- A PROJECT REPORT On Ratio Analysis at Haripriya Organic Chemical PVT LTDDocument71 pagesA PROJECT REPORT On Ratio Analysis at Haripriya Organic Chemical PVT LTDBabasab Patil (Karrisatte)Pas encore d'évaluation

- Case Analysis - SMDocument4 pagesCase Analysis - SMMargarette RobiegoPas encore d'évaluation

- BBMF2023 Tutorial Group 3 Power Root BerhadDocument35 pagesBBMF2023 Tutorial Group 3 Power Root BerhadKar EngPas encore d'évaluation

- Calculate Self Sustainable Growth Rate (SSGR) of A CompanyDocument25 pagesCalculate Self Sustainable Growth Rate (SSGR) of A CompanymusiboyinaPas encore d'évaluation

- Maintain Buy' On M&M - TP Rs.800: Research Notes - Buy M&M, Aban Offshore, L&T, Hold DLF, Reduce Rpower (June 01, 2012)Document3 pagesMaintain Buy' On M&M - TP Rs.800: Research Notes - Buy M&M, Aban Offshore, L&T, Hold DLF, Reduce Rpower (June 01, 2012)Nas Mall RegisterPas encore d'évaluation

- Interactive Question 3 ICAEW Chapter 2 (Strategic Choices)Document2 pagesInteractive Question 3 ICAEW Chapter 2 (Strategic Choices)uzair aliPas encore d'évaluation

- Management Theory and PracticeDocument10 pagesManagement Theory and PracticeVidhath C GowdaPas encore d'évaluation

- Eric Khrom of Khrom Capital 2012 Q1 LetterDocument4 pagesEric Khrom of Khrom Capital 2012 Q1 Letterallaboutvalue100% (1)

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDocument4 pagesRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingPas encore d'évaluation

- Submitted by Ramesh Babu Sadda (2895538) : Word Count: 2800Document18 pagesSubmitted by Ramesh Babu Sadda (2895538) : Word Count: 2800Ramesh BabuPas encore d'évaluation

- Business Analysis ReportDocument23 pagesBusiness Analysis ReportDulon DuttaPas encore d'évaluation

- Engine Capital Letter To PDLI BoardDocument7 pagesEngine Capital Letter To PDLI BoardfilipandPas encore d'évaluation

- PadgettDocument15 pagesPadgettDonna RespondekPas encore d'évaluation

- CF Question Paper t2Document3 pagesCF Question Paper t2KUSHI JAINPas encore d'évaluation

- Flash Memory IncDocument3 pagesFlash Memory IncAhsan IqbalPas encore d'évaluation

- Corporate Finance - Project Report - Capital Structure TrendsDocument18 pagesCorporate Finance - Project Report - Capital Structure TrendsNikhil PathakPas encore d'évaluation

- Presented By:-: Pritpal Singh BhullarDocument26 pagesPresented By:-: Pritpal Singh BhullarTarun ChawlaPas encore d'évaluation

- CeraDocument32 pagesCeraRohit ThapliyalPas encore d'évaluation

- Market Outlook 12th March 2012Document4 pagesMarket Outlook 12th March 2012Angel BrokingPas encore d'évaluation

- Assignment On MoneybhaiDocument7 pagesAssignment On MoneybhaiKritibandhu SwainPas encore d'évaluation

- Burget Paints Financial Report Summary and InsightsDocument5 pagesBurget Paints Financial Report Summary and InsightscoolPas encore d'évaluation

- RC Capital Management - INA000004088: Is A SEBI Registered Investment Advisor Registration NumberDocument44 pagesRC Capital Management - INA000004088: Is A SEBI Registered Investment Advisor Registration NumberBhalani VijayPas encore d'évaluation

- Cera Sanitaryware Limited 1Document58 pagesCera Sanitaryware Limited 1Parul KatiyarPas encore d'évaluation

- Ester Report 1Document18 pagesEster Report 1api-555390406Pas encore d'évaluation

- Subject: Submission of Report On Corporate FinanceDocument24 pagesSubject: Submission of Report On Corporate FinanceMukit-Ul Hasan PromitPas encore d'évaluation

- The Best Stock To Add To Your Portfolio This Month Is Here!: Alembic PharmaDocument7 pagesThe Best Stock To Add To Your Portfolio This Month Is Here!: Alembic PharmagamesaalertsPas encore d'évaluation

- Market Outlook 14th March 2012Document3 pagesMarket Outlook 14th March 2012Angel BrokingPas encore d'évaluation

- ICICIdirect Fortis-Wockhardt DealDocument4 pagesICICIdirect Fortis-Wockhardt DealSiva VenkatPas encore d'évaluation

- Capital Market Operation: Submitted By: Submitted ToDocument8 pagesCapital Market Operation: Submitted By: Submitted ToSatyam SharmaPas encore d'évaluation

- FMA - Tute 10 - Dividend PolicyDocument3 pagesFMA - Tute 10 - Dividend PolicyPhuong VuongPas encore d'évaluation

- Future Plans: Get QuoteDocument6 pagesFuture Plans: Get Quoteprateeksomani9246Pas encore d'évaluation

- Guna Fibres Working CapitalDocument5 pagesGuna Fibres Working CapitalRahul KumarPas encore d'évaluation

- Idfc Grama Vidiyal M&aDocument11 pagesIdfc Grama Vidiyal M&ashubhamPas encore d'évaluation

- DR Lal Pathlabs LTD - Samplestudy - ElearnMarketDocument33 pagesDR Lal Pathlabs LTD - Samplestudy - ElearnMarketNarendraDugarPas encore d'évaluation

- A Complete Pest Control Business Plan: To Start with Little to No MoneyD'EverandA Complete Pest Control Business Plan: To Start with Little to No MoneyPas encore d'évaluation

- Drug Therapy in Pregnancy (Soal)Document6 pagesDrug Therapy in Pregnancy (Soal)Yola FebriyantiPas encore d'évaluation

- A Review of Modern Sample-Preparation Techniques For The Extraction and Analysis of Medicinal PlantsDocument8 pagesA Review of Modern Sample-Preparation Techniques For The Extraction and Analysis of Medicinal PlantsAhmad Abdullah Najjar100% (80)

- Sterility Test Failure Investigations: Peer Review: MicrobiologyDocument8 pagesSterility Test Failure Investigations: Peer Review: MicrobiologyAyman EshraPas encore d'évaluation

- Ranitidine 50mg - 2ml Solution For Injection and Infusion - (EMC) Print FriendlyDocument6 pagesRanitidine 50mg - 2ml Solution For Injection and Infusion - (EMC) Print FriendlyDewi Wara ShintaPas encore d'évaluation

- Chap 20 Reading WorksheetDocument4 pagesChap 20 Reading WorksheetSarahPas encore d'évaluation

- Generic Name TizanidineDocument3 pagesGeneric Name TizanidinemadamcloudninePas encore d'évaluation

- Olive Oil and Clove Oil Based Nanoemulsion For Topical Delivery of Terbinafine Hydrochloride in Vitro and Ex Vivo EvaluationDocument14 pagesOlive Oil and Clove Oil Based Nanoemulsion For Topical Delivery of Terbinafine Hydrochloride in Vitro and Ex Vivo EvaluationRaghavendra NaveenPas encore d'évaluation

- Pharmaceutical Lubricants Used in Equipments - Pharmaceutical GuidelinesDocument1 pagePharmaceutical Lubricants Used in Equipments - Pharmaceutical GuidelinesASHOK KUMAR LENKAPas encore d'évaluation

- Diclofenac GelDocument11 pagesDiclofenac GelEdgar Condori MendozaPas encore d'évaluation

- Ace 083Document1 pageAce 083amirdorianPas encore d'évaluation

- Memorandum and Article of Association BeximcoDocument5 pagesMemorandum and Article of Association BeximcoMd. Jakir HossainPas encore d'évaluation

- Interventional Pain Management in Elderly: Asep Nugraha HermawanDocument34 pagesInterventional Pain Management in Elderly: Asep Nugraha HermawanYobbi ArissaputraPas encore d'évaluation

- 1 EssentialsDocument4 pages1 EssentialsJoanna Carla Marmonejo Estorninos-WalkerPas encore d'évaluation

- Pharmaceutical Inorganic Chemistry QB Sem 1 B PharmDocument8 pagesPharmaceutical Inorganic Chemistry QB Sem 1 B PharmAshish SinghPas encore d'évaluation

- 8-Drugs Used in Anxiety and Panic Disprder (Edited)Document8 pages8-Drugs Used in Anxiety and Panic Disprder (Edited)himanshukumar839496Pas encore d'évaluation

- Dehradun: Veer Madho Singh Bhandari Uttarakhand Technological UniversityDocument6 pagesDehradun: Veer Madho Singh Bhandari Uttarakhand Technological UniversityArif BashirPas encore d'évaluation

- Bioorganic & Medicinal ChemistryDocument7 pagesBioorganic & Medicinal ChemistryIndah WulansariPas encore d'évaluation

- 09-092 CX Technology LehrichDocument3 pages09-092 CX Technology LehrichRaihan PervezPas encore d'évaluation

- PDFDocument444 pagesPDFOki NurpatriaPas encore d'évaluation

- Repositioning Dabur: Case Details: PriceDocument7 pagesRepositioning Dabur: Case Details: Pricechakri5555Pas encore d'évaluation

- Plants Used in Cosmetics PDFDocument14 pagesPlants Used in Cosmetics PDFAline CPas encore d'évaluation

- Chapter 056Document42 pagesChapter 056Adistri KimPas encore d'évaluation

- @MedicalBooksStore 2017 Pharmaceutical PDFDocument469 pages@MedicalBooksStore 2017 Pharmaceutical PDFeny88% (8)

- Patent Application Publication (10) Pub. No.: US 2010/01 12052 A1Document12 pagesPatent Application Publication (10) Pub. No.: US 2010/01 12052 A1iin eirkaPas encore d'évaluation

- Johnson and Johnson Iilm FinalDocument15 pagesJohnson and Johnson Iilm FinalAayushi Pandey100% (1)

- Vendedor de Goma Gum TechnologyDocument2 pagesVendedor de Goma Gum Technologyalicia_brisanPas encore d'évaluation

- International Journal of Pharmaceutics: Lipid-Based Formulations For Oral Administration of Poorly Water-Soluble DrugsDocument10 pagesInternational Journal of Pharmaceutics: Lipid-Based Formulations For Oral Administration of Poorly Water-Soluble DrugsAna KovačevićPas encore d'évaluation

- 3 RdeditonDocument387 pages3 RdeditonHamza shoaib100% (1)

- Epoprostenol Important Information About Change in Formulation of FlolanDocument5 pagesEpoprostenol Important Information About Change in Formulation of FlolanNur FitrianaPas encore d'évaluation